Global Bread Crumbs Market Size, Share, Growth Analysis By Product (Dry, Fresh, Panko, Others), By Seasoning (Unflavored, Italian, French, Cheese, Paprika, Garlic), By End-use (Frozen Food Items, Dessert, Fresh Food Items, Pet Treats, Others), By Distribution Channel (Hypermarkets/Supermarkets, Wholesale Stores, Online, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157263

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

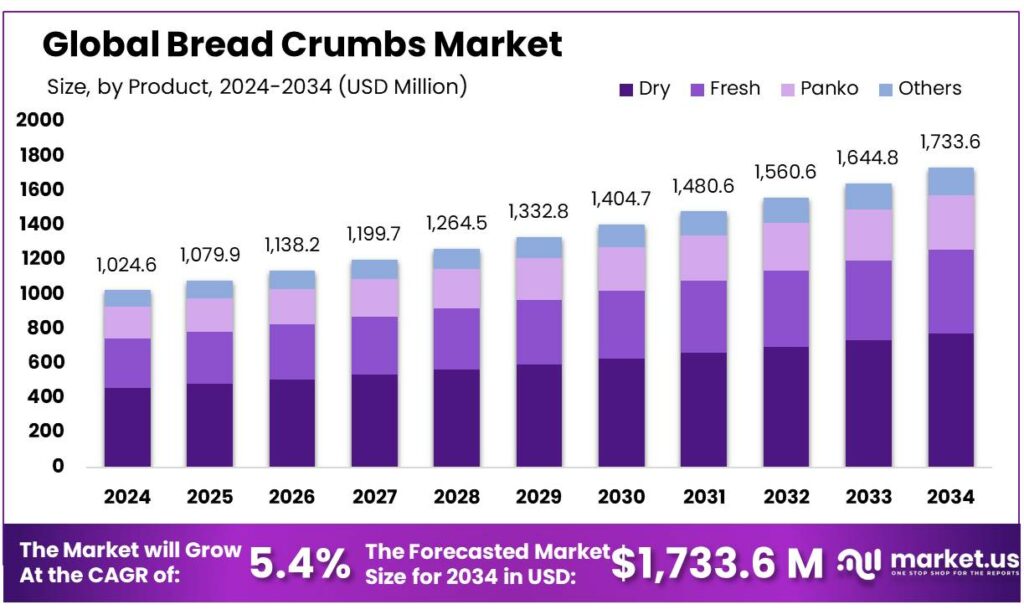

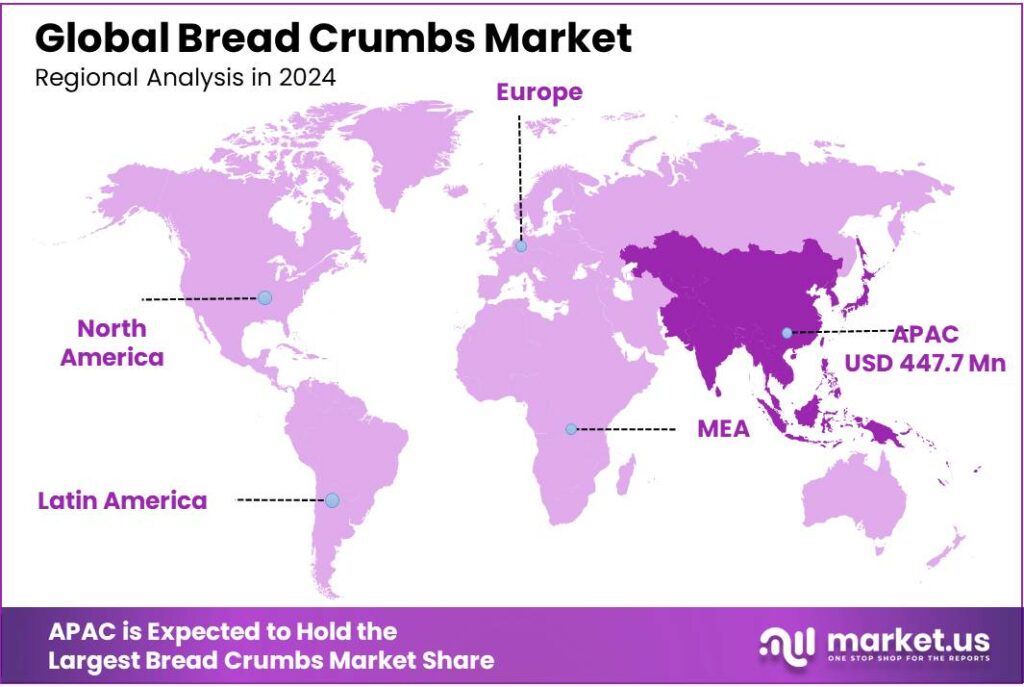

The Global Bread Crumbs Market size is expected to be worth around USD 1733.6 Million by 2034, from USD 1024.6 Million in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.70% share, holding USD 447.7 Million in revenue.

The bread crumbs industry sits at the intersection of wheat milling, bakery processing, and value-added coatings used by foodservice and packaged foods. Supply is closely tied to grain dynamics: the FAO projects 2024 global wheat output at about 787 million tonnes, a scale that underpins flour availability for crumb manufacturers and bakery by-product streams used for crumb recovery. In major consuming markets, per-capita flour availability metrics from USDA’s ERS indicate stable, long-run demand for wheat-based foods, supporting steady throughput for crumb suppliers serving snacks, frozen meats, and ready meals.

In the EU, Commission Regulation (EU) 2017/2158 requires mitigation measures and sets benchmark levels to reduce acrylamide—a heat-formed process contaminant—across bakery categories; operators must monitor and apply recipes and time/temperature controls to keep levels as low as reasonably achievable.

Demand drivers include convenience foods, coating innovations, and health reformulation. On sodium, the U.S. FDA’s updated (Aug 2024) voluntary reduction goals set measurable 2.5-year targets across processed categories, building toward ~20% population-level intake reduction; crumb makers supplying QSR and retail private label are reformulating seasonings and base crumbs accordingly.

Waste-to-value is another structural driver: UNEP’s Food Waste Index 2024 reports 1.05 billion tonnes of food waste in 2022 (132 kg per capita), with households at 60%, foodservice 28%, and retail 12%. This scale strengthens the economics of upcycling surplus bread into industrial crumbs and rusk meal, reducing disposal costs while creating inputs for breaded proteins and vegetables.

Public programs are expanding processing capacity, especially among MSMEs. India’s PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme provides credit-linked subsidies (typically 60:40 Centre–State cost share; 90:10 in NE/Himalayan States) and targets support to 200,000 micro units, including bakery and crumb lines; recent government communications confirm ongoing budgetary backing and rollout. For investors, this translates into capex support for ovens, dryers, grinders/sievers, and packaging that meet national standards.

Key Takeaways

- Bread Crumbs Market size is expected to be worth around USD 1733.6 Million by 2034, from USD 1024.6 Million in 2024, growing at a CAGR of 5.4%.

- Dry held a dominant market position, capturing more than a 44.8% share in the global bread crumbs market.

- Unflavored held a dominant market position, capturing more than a 56.4% share in the global bread crumbs market.

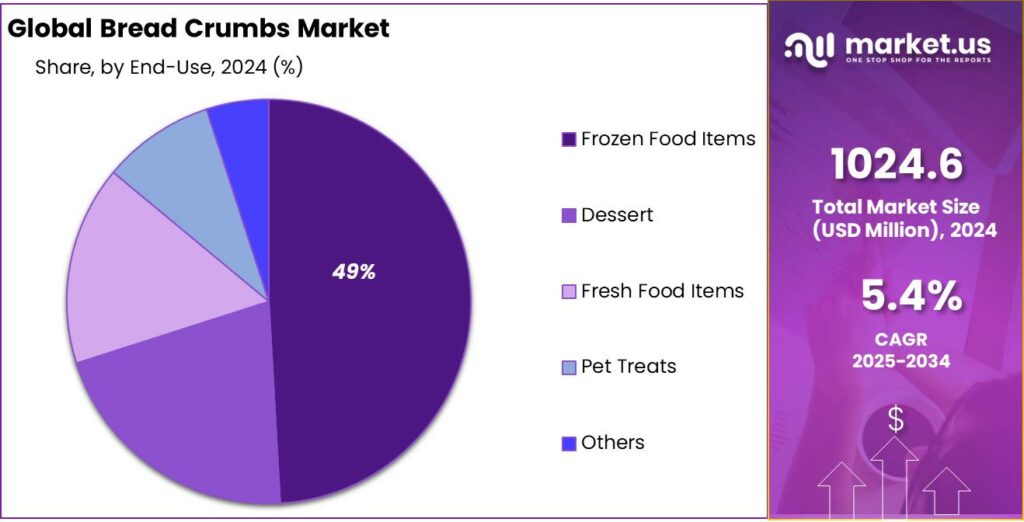

- Frozen Food Items held a dominant market position, capturing more than a 49.2% share in the global bread crumbs market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 49.1% share of the global bread crumbs market.

- Asia Pacific held a dominant position in the global bread crumbs market, capturing a substantial 43.70% market share, valued at approximately USD 447.7 million.

By Product Analysis

Dry Bread Crumbs dominate with 44.8% due to longer shelf life and versatility in cooking

In 2024, Dry held a dominant market position, capturing more than a 44.8% share in the global bread crumbs market. This strong lead can be attributed to dry bread crumbs’ extended shelf life, ease of storage, and adaptability across a wide range of culinary applications. Unlike fresh or semi-dry variants, dry bread crumbs are highly preferred by both commercial kitchens and household consumers for their crunch and longer usability.

Additionally, as frozen and ready-to-cook food categories expand, dry bread crumbs continue to see integration into these value-added products. Their stable nature also makes them an ideal choice for export markets. As convenience food trends grow and consumers seek products with longer pantry life, dry bread crumbs are expected to maintain their leadership in the product segment.

By Seasoning Analysis

Unflavored Bread Crumbs lead with 56.4% for their cooking flexibility and neutrality

In 2024, Unflavored held a dominant market position, capturing more than a 56.4% share in the global bread crumbs market. This clear preference stems from their wide usage across both household kitchens and food processing industries. Unflavored bread crumbs offer a neutral base that adapts well to a variety of recipes, whether it’s coating cutlets, thickening soups, or binding ingredients in patties and meatballs. Their versatility makes them a staple ingredient for chefs who prefer to season dishes independently.

Food manufacturers also favor unflavored crumbs for industrial use because they blend seamlessly with regional or brand-specific flavor profiles. The segment continues to grow in tandem with rising frozen food and ready-meal applications where neutral coating agents are needed. As health-conscious consumers also look to avoid excess sodium or artificial flavorings, unflavored bread crumbs offer a clean-label appeal that keeps them in the lead.

By End-use Analysis

Frozen Food Items dominate with 49.2% share due to rising convenience eating habits

In 2024, Frozen Food Items held a dominant market position, capturing more than a 49.2% share in the global bread crumbs market. This segment’s strength lies in the growing popularity of frozen ready-to-cook products like chicken nuggets, fish sticks, patties, and breaded vegetables, where bread crumbs play a crucial role in texture and appearance. The crispy exterior provided by breading enhances both taste and shelf appeal, making them a favorite in quick-service restaurants and home freezers alike.

Bread crumbs not only improve the mouthfeel but also help seal in moisture during freezing and reheating, ensuring quality consistency across frozen meals. Manufacturers are also exploring innovative bread crumb variants that maintain crunchiness even after microwave reheating, further driving adoption in this segment. Overall, the high utility of bread crumbs in preserving and elevating frozen food quality makes this segment a key contributor to market expansion.

By Distribution Channel Analysis

Hypermarkets/Supermarkets dominate with 49.1% share due to broad product visibility and easy access

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 49.1% share of the global bread crumbs market. These large-format retail stores remain the go-to destinations for household grocery shopping due to their vast selection, organized shelf display, and promotional offers. The visual appeal of different bread crumb varieties—from fine to coarse, plain to seasoned—encourages impulse purchases and brand exploration among consumers.

Supermarkets often stock both private-label and premium options, catering to a broad income range. The easy accessibility of bread crumbs in bakery or snack aisles adds to their frequent inclusion in shopping baskets, especially by consumers looking to prepare quick, crispy home meals. Moreover, as supermarket chains expand into tier-2 and tier-3 cities globally, the reach of bread crumbs through this channel is widening, thereby reinforcing its dominance in the market.

Key Market Segments

By Product

- Dry

- Fresh

- Panko

- Others

By Seasoning

- Unflavored

- Italian

- French

- Cheese

- Paprika

- Garlic

By End-use

- Frozen Food Items

- Dessert

- Fresh Food Items

- Pet Treats

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Wholesale Stores

- Online

- Others

Emerging Trends

Surge in Demand for Gluten-Free and Allergen-Free Breadcrumbs

In recent years, the bread crumbs industry has experienced a notable shift towards healthier and more inclusive options. Consumers are increasingly seeking gluten-free and allergen-free products, driven by health concerns, dietary restrictions, and lifestyle choices. This trend is reshaping the market dynamics, prompting manufacturers to innovate and cater to the evolving preferences of health-conscious consumers.

The increasing prevalence of gluten intolerance and celiac disease has heightened awareness about the importance of gluten-free diets. According to the Centers for Disease Control and Prevention (CDC), about 1 in 133 people in the U.S. have celiac disease, an autoimmune disorder triggered by gluten. This has led to a surge in demand for gluten-free food products, including bread crumbs. Additionally, the broader trend towards plant-based and allergen-free diets is contributing to the popularity of gluten-free bread crumbs.

In response to this growing demand, manufacturers are investing in research and development to create gluten-free and allergen-free bread crumbs that meet consumer expectations for taste, texture, and nutritional value. For instance, companies are exploring the use of alternative flours and grains to produce bread crumbs that cater to various dietary needs. These innovations not only address health concerns but also enhance the culinary versatility of bread crumbs in diverse cuisines.

Drivers

Rising Demand for Health-Conscious and Gluten-Free Options

The bread crumbs market is experiencing significant growth, driven by a notable shift in consumer preferences towards healthier and dietary-specific products. This transformation is not just a passing trend but a reflection of a broader societal movement towards better nutrition and lifestyle choices.

Consumers today are more informed and selective about their food choices. There’s a growing inclination towards products that align with health-conscious diets, such as gluten-free, organic, and whole-grain options. This shift is evident in the bread crumbs market, where traditional products are being replaced or supplemented by alternatives that cater to specific dietary needs. For instance, gluten-free bread crumbs are gaining popularity among individuals with celiac disease or gluten sensitivity, as well as those opting for gluten-free diets for health reasons.

Governments worldwide are recognizing the importance of promoting healthier food options and are implementing policies to support this shift. In India, for example, the Food Safety and Standards Authority of India (FSSAI) has been actively working towards improving food safety standards and promoting the availability of nutritious food products. Such initiatives create a conducive environment for the growth of health-oriented food products, including specialized bread crumbs.

In response to this demand, manufacturers are innovating and diversifying their product offerings. Companies are introducing a variety of bread crumbs made from alternative grains like rice, quinoa, and corn, catering to gluten-free and allergen-free diets. Additionally, there’s an emphasis on clean-label products, which are free from artificial additives and preservatives, further appealing to health-conscious consumers.

Restraints

High Production Costs and Limited Consumer Accessibility

The bread crumbs market faces significant challenges stemming from high production costs and limited consumer accessibility, particularly concerning gluten-free variants. These issues not only affect manufacturers but also impact consumers, especially those with dietary restrictions.

The production of gluten-free bread crumbs involves specialized ingredients such as rice flour, chickpea flour, and quinoa flour. These ingredients are often more expensive than traditional wheat flour. Additionally, to prevent cross-contamination, dedicated production lines and stringent quality control measures are necessary, further increasing costs. For instance, a study by Coeliac UK in 2024 indicated that a weekly gluten-free food shop can be up to 35% more expensive than a regular one

The higher production costs often translate to higher retail prices, making gluten-free bread crumbs less accessible to a broader consumer base. This limited accessibility is particularly challenging for individuals with gluten intolerance or celiac disease, who rely on such products for their daily meals. The disparity in pricing between gluten-free and regular products can lead to economic strain for these consumers.

To address these challenges, some manufacturers are exploring cost-effective production methods and sourcing alternative ingredients that can reduce costs without compromising quality. Additionally, increasing consumer demand for gluten-free products has encouraged more retailers to stock these items, improving accessibility. However, achieving significant price reductions and widespread availability remains a complex issue that requires coordinated efforts across the industry.

Opportunity

Government Initiatives Supporting Gluten-Free Bread Crumbs

The growing demand for gluten-free bread crumbs presents a significant opportunity for market expansion. This demand is not only driven by consumer preferences but also by supportive government initiatives aimed at improving access to gluten-free foods.

In the United States, the Food and Drug Administration (FDA) has established clear guidelines for labeling gluten-free products, ensuring that consumers can make informed choices. This regulation provides a standardized tool for managing health and dietary intake, especially for individuals with celiac disease, an autoimmune disorder triggered by gluten consumption

Similarly, in Wales, the government has introduced a prepaid subsidy card scheme to assist individuals with coeliac disease and gluten intolerance in accessing gluten-free foods. This initiative aims to reduce reliance on NHS prescriptions and promote more efficient use of healthcare resources. The scheme is expected to alleviate the financial burden on patients, making gluten-free products more accessible

Regional Insights

In 2024, Asia Pacific held a dominant position in the global bread crumbs market, capturing a substantial 43.70% market share, valued at approximately USD 447.7 million. The region’s leadership is driven by a strong cultural inclination toward fried and breaded foods, especially in countries like Japan, China, South Korea, India, and Southeast Asian nations.

Japan remains one of the largest consumers and exporters of panko-style bread crumbs, which are widely used in dishes such as tonkatsu and tempura. According to the Japanese External Trade Organization (JETRO), Japan exported over 8,200 metric tons of panko crumbs in 2023, showcasing the country’s leadership in product innovation and international distribution.

In India, the rapid expansion of quick-service restaurants (QSRs), frozen food brands, and snack manufacturers has significantly contributed to bread crumb consumption. Urbanization and changing dietary habits are pushing the demand for convenient, ready-to-cook food items like cutlets, patties, and nuggets—where bread crumbs are a key ingredient.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kikkoman Corporation, a global leader in food seasonings, is widely known for its soy sauce but also maintains a strong presence in the bread crumbs market, particularly with its Panko-style offerings. Headquartered in Japan, Kikkoman caters to both food service and retail sectors, promoting premium quality and innovation. Their Panko breadcrumbs are popular in Asian and Western cuisines, especially for deep-fried dishes. The company continues expanding globally with a focus on high-quality, low-oil absorption breadcrumb varieties.

Gonnella Baking Company, based in the United States, is a longstanding name in traditional and artisanal baking. With over a century in the baking industry, Gonnella produces fresh and dried bread crumbs from its own premium baked bread, ensuring consistent quality. The company supplies to restaurants, food manufacturers, and institutional kitchens. Gonnella’s commitment to old-world baking techniques combined with modern food safety practices has positioned it as a trusted player in the U.S. breadcrumbs segment.

4C Foods Corporation, a family-owned American company, has been a major name in the breadcrumbs segment for decades. Known for its signature Seasoned, Plain, and Panko Bread Crumbs, 4C emphasizes traditional recipes and high-quality ingredients. Its products are widely available in supermarkets and are a staple in home kitchens and professional cooking environments. 4C also focuses on kosher-certified and non-GMO products, responding to growing consumer demand for transparency and food safety in everyday pantry staples.

Top Key Players Outlook

- Kikkoman Corporation

- Gonnella Baking Company

- DeLallo

- 4C Foods

- Vigo Importing Co

- General Mills

- Edward & Sons Trading Co.

- Aleia’s Gluten Free Foods Inc.

Recent Industry Developments

DeLallo’s products, such as the 24 oz Plain Breadcrumbs priced at $3.95 and the 12 oz Panko Breadcrumbs at $4.95, cater to both retail and foodservice sectors, emphasizing quality and versatility.

In 2024 Vigo Importing Co, reported an import turnover ranging between $180,000 and $630,000, indicating a stable presence in the import sector.

Report Scope

Report Features Description Market Value (2024) USD 1024.6 Mn Forecast Revenue (2034) USD 1733.6 Mn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dry, Fresh, Panko, Others), By Seasoning (Unflavored, Italian, French, Cheese, Paprika, Garlic), By End-use (Frozen Food Items, Dessert, Fresh Food Items, Pet Treats, Others), By Distribution Channel (Hypermarkets/Supermarkets, Wholesale Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kikkoman Corporation, Gonnella Baking Company, DeLallo, 4C Foods, Vigo Importing Co, General Mills, Edward & Sons Trading Co., Aleia’s Gluten Free Foods Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kikkoman Corporation

- Gonnella Baking Company

- DeLallo

- 4C Foods

- Vigo Importing Co

- General Mills

- Edward & Sons Trading Co.

- Aleia’s Gluten Free Foods Inc.