Global Brake Pads and Shoes Market Market Size, Share, Growth Analysis By Type (Brake System Hoses, Power Steering System Hoses, Cooling System Hoses, Fuel System Hoses, Others), By Application (Automotive OEM Market, Automotive Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166768

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

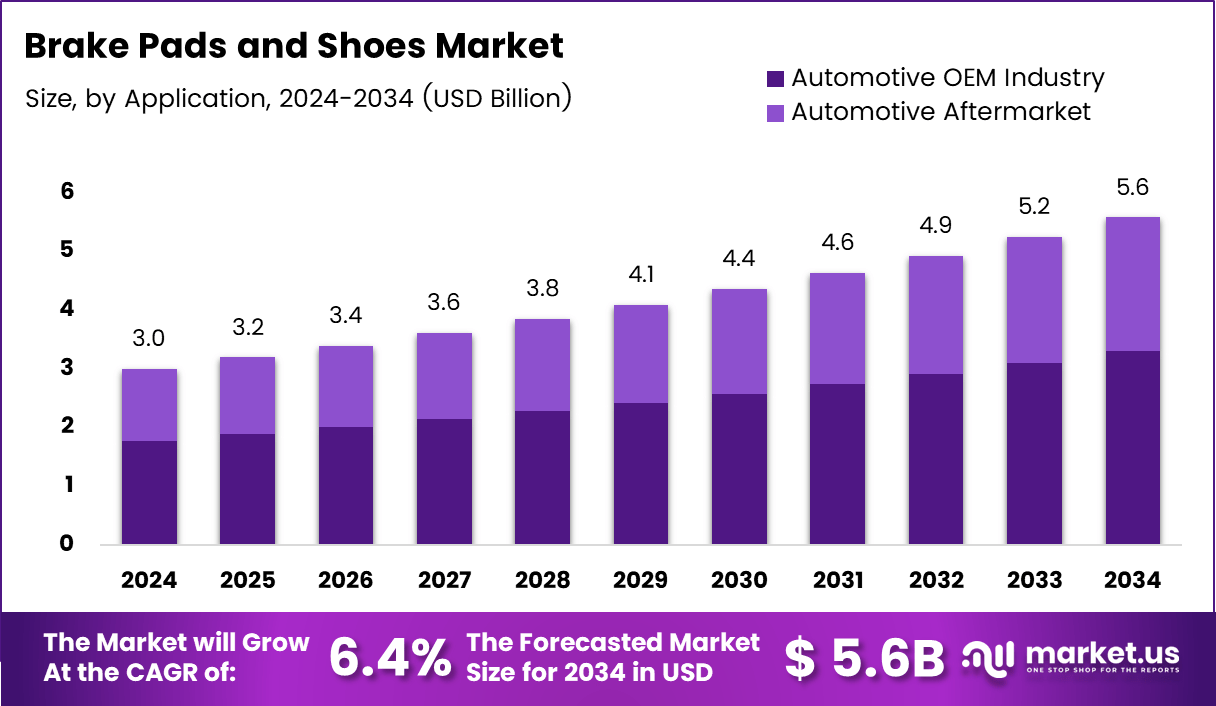

The Global Brake Pads and Shoes Market size is expected to be worth around USD 5.6 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Brake Pads and Shoes Market represents a critical component category that ensures reliable stopping performance for passenger cars, commercial fleets, and two-wheelers. The market continues expanding as rising mobility, higher vehicle parc, and stricter road-safety frameworks drive consistent replacement requirements. Steady consumer demand, fleet aging, and aftermarket expansions sustain its relevance globally.

Moving further, the market experiences solid growth because urban driving density increases brake wear frequency, creating recurring demand for Automotive brake pads and shoe replacements. Additionally, the shift toward premium braking materials, enhanced friction formulations, and longer-lasting components encourages upgrades in both OEM and aftermarket channels, strengthening transaction volumes across developed and emerging regions.

In addition, government investments in road safety initiatives accelerate structured maintenance behavior. Regulatory bodies increasingly emphasize brake-system efficiency to reduce collision risks, encouraging timely inspections and replacement cycles. Meanwhile, greater attention on compliance, performance certification, and friction-material regulation supports technology upgrades, fostering opportunities for producers delivering environmentally aligned, copper-free braking solutions and heat-resistant formulations suited for modern vehicle architectures.

Furthermore, broader opportunities emerge as commercial transportation expands across logistics, e-commerce, and last-mile delivery. Heavy-duty vehicles generate higher brake-wear rates, supporting consistent aftermarket demand. Electrification trends also introduce regenerative-braking dynamics that shift friction-material needs but maintain a stable replacement market, particularly in hybrid and non-regenerative segments requiring enhanced thermal management.

However, consumer maintenance behavior continues influencing market performance. According to The Motor Ombudsman (UK), 39% of workshops reported that consumers delay replacing brake pads, indicating a major challenge for early-stage demand. Additionally, according to Brakes UK vehicle-maintenance survey of 2,019 drivers, a significant share of cars showed dangerous MOT defects, reflecting broader maintenance neglect that directly impacts brake-system servicing frequency.

This pattern underscores strong transactional potential in the Brake Pads and Shoes Market as stricter enforcement, education campaigns, and digital-service reminders encourage timely replacements. Growing adoption of safety-inspection programs, increasing awareness of braking performance, and rising miles travelled continue pushing aftermarket revenue forward, securing long-term demand for high-quality brake pads and shoes across global mobility ecosystems.

Key Takeaways

- Global Automotive Operating System Market expected to reach USD XXX Billion by 2034 from USD 16.9 Billion in 2024 at a 11.2% CAGR.

- Android leads the OS type segment with a 34.8% market share.

- Passenger Cars dominate the vehicle type segment with 73.7% share.

- Infotainment System is the largest application segment at 28.2%.

- North America holds the highest regional share at 38.9%, valued at USD 6.5 Billion.

By Type Analysis

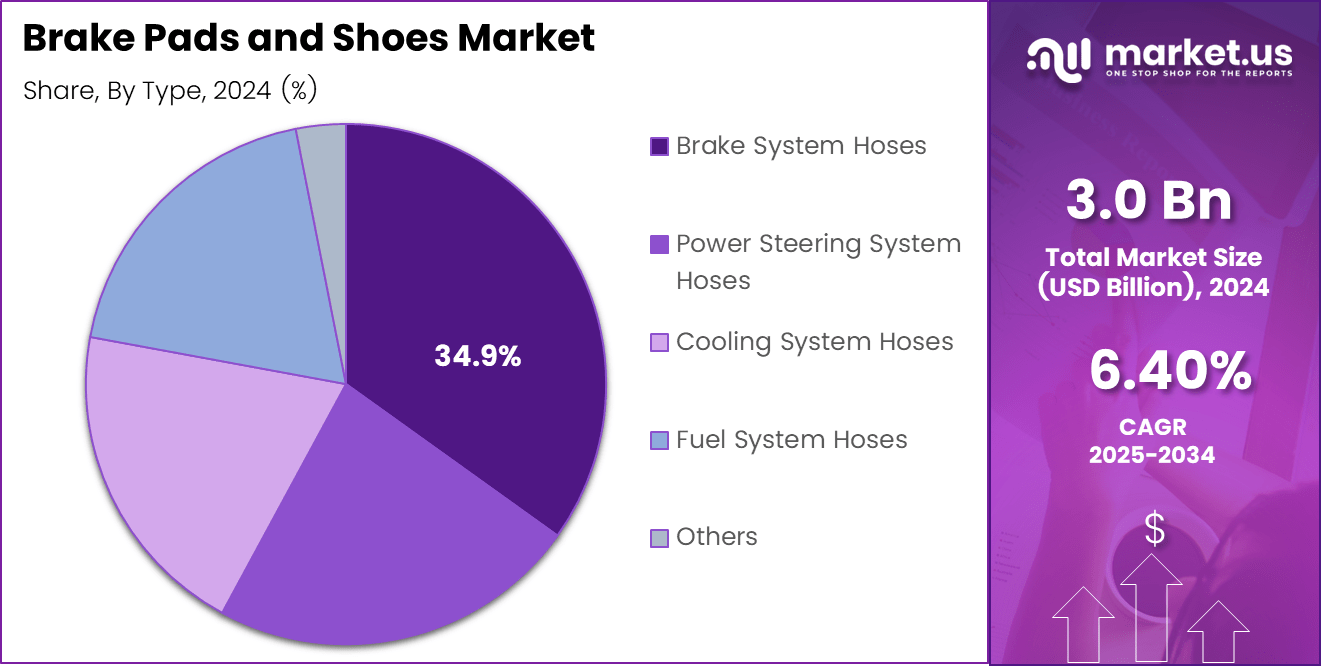

Brake System Hoses dominate with 34.9% due to their high replacement frequency and essential role in braking safety.

In 2024, Brake System Hoses held a dominant market position in the By Type segment of the Brake Pads and Shoes Market, with a 34.9% share. Their constant exposure to pressure cycles, heat, and fluid corrosion drives steady replacements, strengthening overall demand across OEM and aftermarket channels.

Power Steering System Hoses contributed progressively as vehicle manufacturers continued adopting hydraulic steering architectures. These hoses support consistent steering response and durability, prompting routine inspection and replacement cycles. Their role in ensuring reliable maneuverability enhances market relevance across a broad range of passenger and commercial vehicles globally.

Cooling System Hoses showed stable adoption as efficient thermal management remains crucial for engine longevity. These hoses ensure optimal coolant circulation under varying load conditions, reinforcing replacement demand due to wear, cracking, and thermal fatigue. Their necessity across combustion and hybrid vehicles supports sustained aftermarket contribution.

Fuel System Hoses maintained consistent demand, driven by their importance in minimizing fuel leakage, vapor emissions, and performance inefficiencies. Regulatory pressures on emission control further encourage timely replacement, strengthening long-term market acceptance. Their reliability directly influences combustion efficiency and operational safety.

Others captured a smaller share but continued gaining traction through vehicle-specific hose needs such as vacuum, air-intake, and breather hoses. These components experience varying stress levels based on driving conditions, supporting periodic replacements and contributing modestly to the overall segment performance.

By Application Analysis

The automotive OEM Market dominates with 59.2% due to strong installation demand during vehicle manufacturing.

In 2024, the Automotive OEM Market held a dominant market position in the By Application segment of the Brake Pads and Shoes Market, with a 59.2% share. Strong vehicle production volumes and stricter factory-level safety integration strengthened OEM demand for brake hoses installed during assembly.

The Automotive Aftermarket segment followed with growing replacement-driven consumption. Brake hoses undergo wear from pressure cycles, terrain variations, and heat exposure, creating recurring service demand. Rising vehicle parc, longer ownership cycles, and expanding workshop networks continue supporting substantial aftermarket sales across global transportation ecosystems.

Key Market Segments

By Type

- Brake System Hoses

- Power Steering System Hoses

- Cooling System Hoses

- Fuel System Hoses

- Others

By Application

- Automotive OEM Market

- Automotive Aftermarket

Drivers

Rising Emphasis on Precision Braking Performance Drives Market Growth

The Brake Pads and Shoes Market continues gaining momentum as vehicle operators place a stronger emphasis on precision braking performance, especially in high-load applications. Trucks, buses, and commercial fleets require consistent stopping power, pushing manufacturers to design friction materials that deliver a stable response under heat, pressure, and prolonged usage conditions.

Growing demand for long-life friction materials further accelerates market expansion. Fleet operators increasingly prefer brake pads and shoes that reduce downtime, limit frequent replacements, and support predictable maintenance cycles. This shift encourages the adoption of advanced composite materials designed for durability, heat resistance, and improved performance over extended driving distances.

Additionally, government vehicle inspection programs are expanding across several regions, raising replacement rates for worn-out brake components. Mandatory safety checks highlight issues such as thinning pads, friction wear, and structural imbalance, prompting timely servicing. These regulatory interventions support a healthier aftermarket ecosystem and help reduce accident risks associated with delayed brake maintenance.

Together, these factors build strong momentum for the Brake Pads and Shoes Market. Increased focus on safety, operational efficiency, and regulatory compliance continues to strengthen demand, ensuring consistent growth across OEM and aftermarket channels as vehicle fleets expand and maintenance standards evolve.

Restraints

Fluctuating Availability of Raw Materials Restrains Market Expansion

The Brake Pads and Shoes Market faces notable restraints as the availability of raw materials used in friction linings remains inconsistent. Materials such as rubber, resins, fibers, and metal composites experience periodic supply disruptions, creating manufacturing delays and pushing production costs higher, especially for mid-range braking products.

Higher durability of premium brake systems also softens replacement frequency. Advanced ceramic, metallic, and hybrid friction materials last longer than traditional formulations, reducing the number of service cycles. While beneficial for consumers, this trend slows aftermarket turnover, affecting sales volumes for standard brake pads and shoes across several vehicle categories.

Furthermore, limited technical workforce availability in remote and underserved regions restricts proper brake system servicing. Many rural workshops lack trained technicians capable of identifying critical wear patterns, heat scoring, or friction imbalance, leading to delayed replacements. This gap impacts both road safety and the overall braking components demand curve.

Together, these restraints create structural challenges for the Brake Pads and Shoes Market Market. Supply volatility, reduced replacement intervals, and workforce shortages collectively temper growth, urging manufacturers and service networks to adopt stronger sourcing strategies, technician training programs, and adaptive production planning.

Growth Factors

Development of Lightweight Composite Brake Shoes Creates Strong Growth Opportunities

The Brake Pads and Shoes Market is witnessing new opportunities as manufacturers work on lightweight composite brake shoes for next-generation vehicles. These materials improve braking response, reduce heat buildup, and lower vehicle weight, making them attractive for modern mobility platforms focused on efficiency and performance.

Increasing partnerships between OEMs and friction-material innovators further strengthen the markets growth potential. Automakers are collaborating with technology developers to create advanced formulations that enhance durability and noise control. These alliances accelerate product testing, standardization, and large-scale adoption, building a more competitive and innovation-driven ecosystem.

Rising demand for brake upgrades in commercial EV conversions also expands the opportunity. Many electric fleets require enhanced braking components due to regenerative-braking load variations and higher vehicle weight. This shift opens a new segment for specialized pads and shoes designed for thermal stability and consistent performance in electric mobility frameworks.

Additionally, the expansion of digital platforms for aftermarket brake component distribution is reshaping accessibility and customer engagement. Online retailers and service marketplaces enable faster procurement, transparent pricing, and wider product availability. This digital shift supports higher aftermarket penetration and strengthens customer trust through reliable purchase channels and simplified servicing options.

Emerging Trends

Growing Interest in Pre-Assembled Brake Shoe Kits Drives Market Trends

The Brake Pads and Shoes Market is experiencing notable trending shifts as more workshops and fleet operators prefer pre-assembled brake shoe kits for faster installation. These kits reduce downtime, simplify servicing, and ensure consistent performance, making them highly attractive for high-utilisation vehicles and time-sensitive maintenance operations.

The adoption of embedded wear-sensing indicators in drum brake shoes is also rising steadily. These indicators help technicians identify wear levels early, improving safety and reducing unexpected failures. Their increasing use reflects a broader industry push toward smarter, more predictive maintenance solutions across both consumer and commercial vehicle segments.

Another key trend includes the rising shift toward noise-optimised friction formulations. Manufacturers are engineering materials that minimise vibration and brake squeal, improving driving comfort. This trend aligns with consumer expectations for quieter vehicles and supports stronger demand for premium low-noise brake pads and shoes across multiple applications.

Additionally, increasing standardisation of brake shoe dimensions for cross-model compatibility is reshaping product design strategies. Standardisation simplifies inventory management, enhances workshop efficiency, and expands interchangeability across vehicle platforms. This trend strengthens aftermarket accessibility and encourages broader adoption of universally compatible braking components.

Regional Analysis

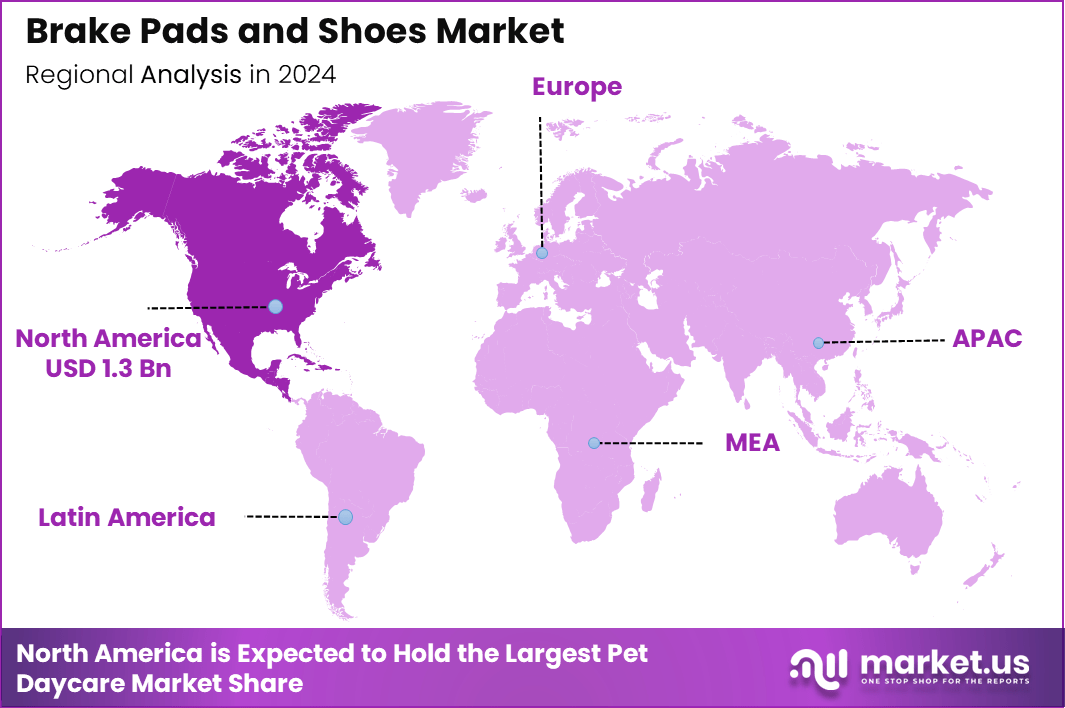

North America Dominates the Brake Pads and Shoes Market with a Market Share of 44.2%, Valued at USD 1.3 Billion

North America remained the leading regional market in 2024, supported by strong vehicle ownership rates, strict safety inspection protocols, and a mature aftermarket servicing structure. The region accounted for 44.2% of the total market share, generating revenues worth USD 1.3 billion. High replacement frequency and consumer focus on reliable braking systems strengthened overall market performance.

Europe Brake Pads and Shoes Market Trends

Europe showed steady growth driven by stringent road safety regulations, mandatory vehicle inspections, and rising adoption of low-noise friction materials. Strong demand from passenger cars and commercial fleets sustained replacement activities. Increasing focus on eco-friendly brake components continued shaping regional innovation and aftermarket dynamics.

Asia Pacific Brake Pads and Shoes Market Trends

Asia Pacific observed expanding demand due to rapid vehicle production, urbanization, and a growing consumer base. Cost-effective aftermarket services and rising fleet utilization supported recurring brake component replacements. Additionally, increasing adoption of electric and hybrid vehicles encouraged the development of advanced friction materials suited for high-temperature operating conditions.

Middle East and Africa Brake Pads and Shoes Market Trends

Middle East and Africa experienced moderate growth supported by expanding road networks and rising commercial vehicle usage. Harsh climatic conditions increased brake wear rates, boosting aftermarket demand. Growth in logistics and construction activities further strengthened the need for durable, heat-resistant braking components across key markets.

Latin America Brake Pads and Shoes Market Trends

Latin America continued witnessing stable demand driven by an aging vehicle fleet and rising dependence on aftermarket repair services. Economic recovery efforts supported mobility growth, while fluctuating road conditions contributed to higher brake wear. Regional workshops increasingly adopted standardized brake components to streamline servicing efficiency.

U.S. Brake Pads and Shoes Market Trends

The U.S. represented a major contributor within North America, driven by high vehicle miles traveled, strict safety norms, and a well-established service ecosystem. Strong fleet operations and consistent road usage supported sustained replacement cycles. Increasing interest in premium friction materials further improved product penetration across the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Brake Pads and Shoes Market Company Insights

Continental continued shaping the global Brake Pads and Shoes market in 2024 through steady advancements in braking technologies and material engineering. The company maintained strong engagement in enhancing braking efficiency, thermal stability, and wear resistance, supporting consistent adoption across multiple vehicle categories and strengthening its influence in both OEM and aftermarket ecosystems.

Hwaseung demonstrated meaningful progress by focusing on durable and cost-effective braking components suited for diverse driving environments. Its emphasis on reliability and standardized production allowed the company to address rising demand in emerging markets. Hwaseungs growing presence in high-volume segments supported steady market penetration during the year.

SamcoSport played an important role by emphasizing performance-oriented braking solutions designed for demanding applications. Its specialty in high-strength materials and reinforced friction designs appealed to users requiring enhanced control and braking stability. This positioning helped the brand strengthen its visibility in performance and utility vehicle categories.

Vibrant Performance contributed to the market through precision-engineered components targeted at specialized vehicular setups. The companys focus on quality, customization, and installation compatibility supported its expansion in enthusiast and professional maintenance channels. Its consistent product availability allowed it to serve a niche yet growing segment effectively.

Top Key Players in the Market

- Continental

- Hwaseung

- SamcoSport

- Vibrant Performance

- Summit Racing

- Dayco

- Grainger

- Manuli

- Parker Hannifin

- Gates Corporation

Recent Developments

- In Jan 2025, RealTruck, Inc. entered a strategic agreement to acquire Vehicle Accessories Group, strengthening its position in the global automotive accessories market. This move expands RealTruck’s product portfolio and enhances its manufacturing and distribution capabilities across key vehicle accessory categories.

- In Feb 2024, Rane Group announced the merger of Rane Brake Lining Ltd. and Rane Engine Valve Ltd. into Rane (Madras) Ltd., consolidating its automotive component operations. The merger aims to improve operational efficiency, streamline governance, and create a stronger unified platform for long-term growth.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Brake System Hoses, Power Steering System Hoses, Cooling System Hoses, Fuel System Hoses, Others),

By Application (Automotive OEM Market, Automotive Aftermarket)Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Continental, Hwaseung, SamcoSport, Vibrant Performance, Summit Racing, Dayco, Grainger, Manuli, Parker Hannifin, Gates Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brake Pads and Shoes MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Brake Pads and Shoes MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental

- Hwaseung

- SamcoSport

- Vibrant Performance

- Summit Racing

- Dayco

- Grainger

- Manuli

- Parker Hannifin

- Gates Corporation