Global BPO Business Analytics Market Size, Share Analaysis Report By Component (Software, Services), By Deployment (Cloud-based, On-premises), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Function (Finance & Accounting, Human Resources, Knowledge Process Outsourcing, Procurement & Supply Chain, Customer Services, Others), By Industry Vertical (BFSI, IT and Telecom, Healthcare, Manufacturing, Retail, Transportation and Logistics, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 110848

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

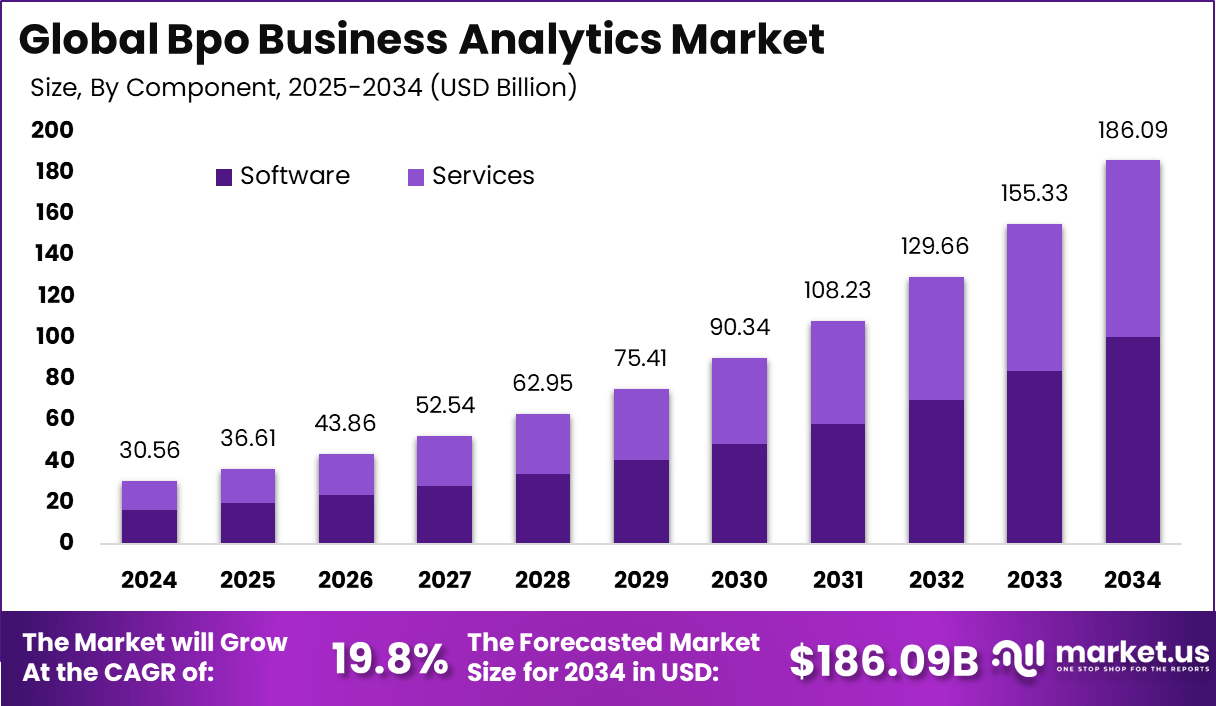

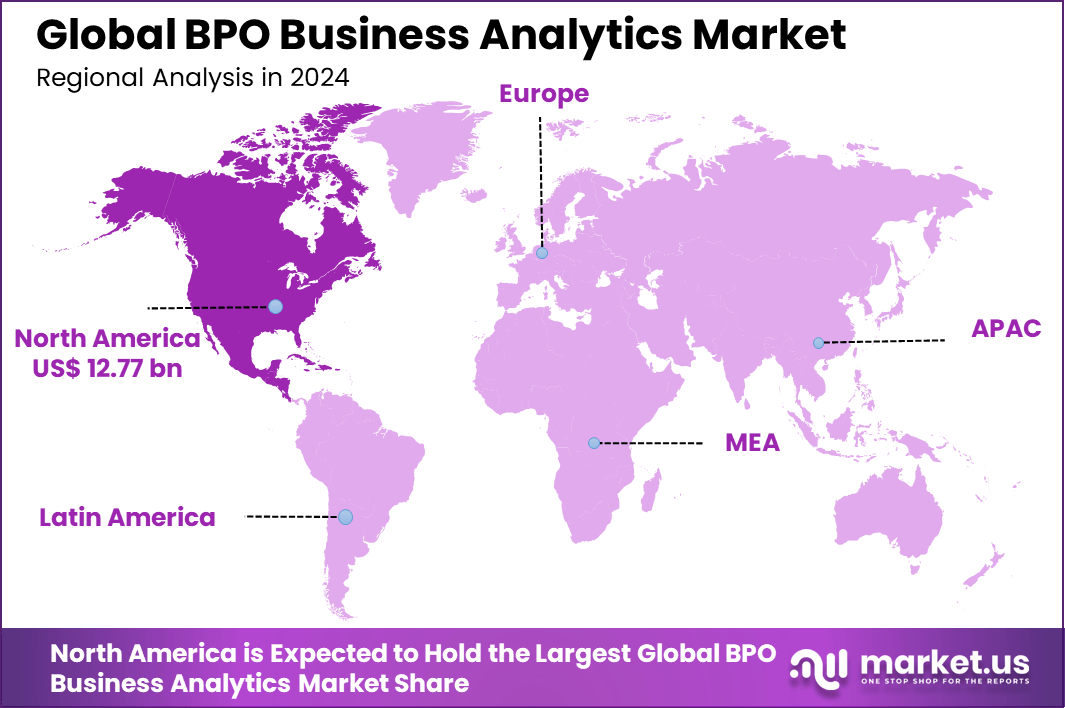

The Global BPO Business Analytics Market size is expected to be worth around USD 186.09 Billion By 2034, from USD 30.56 billion in 2024, growing at a CAGR of 19.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.8% share, holding USD 12.77 Billion revenue.

The BPO Business Analytics Market encompasses services supplied by outsourcing firms that process and analyze business process data on behalf of clients. These services include statistical analysis, predictive modelling, customer insights, and operational reporting across domains such as finance, human resources, CRM, supply chain, and back‑office operations. Analytics delivered via outsourcing enables organizations to leverage external expertise and scalable infrastructure without building internal capabilities.

The growth of this market can be attributed to the accelerating need for data‑driven decision making. Organizations increasingly rely on analytics to optimise operations and improve competitive positioning. Technological progress in cloud computing, machine learning, artificial intelligence and RPA has heightened the value proposition of BPO analytics services. The cloud enables scalable and flexible deployment while reducing upfront investments.

For instance, in April 2025, IBM completed the acquisition of Hakkoda Inc., a data consultancy specializing in AI and machine learning solutions. This acquisition expands IBM’s data and analytics expertise, allowing the company to enhance its capabilities in helping clients accelerate AI-driven transformations. This move underscores the growing trend of integrating AI and analytics in BPO services to drive operational efficiency and innovation across industries.

Demand for BPO business analytics is rising steadily. Businesses across industries experience a surge in data from digital channels, IoT devices, and customer interactions. Companies are seeking analytics partners who can deliver real-time and predictive insights, helping them react to market changes instantly and tailor services to individual customer needs. The finance, healthcare, and retail sectors, in particular, display elevated interest as they balance innovation with stringent industry regulations and security demands.

Key Insights

- The market is projected to grow from USD 30.56 billion in 2024 to around USD 186.09 billion by 2034, advancing at a robust CAGR of 19.8%.

- North America led the global market with a 41.8% share, generating approximately USD 12.77 billion in revenue in 2024.

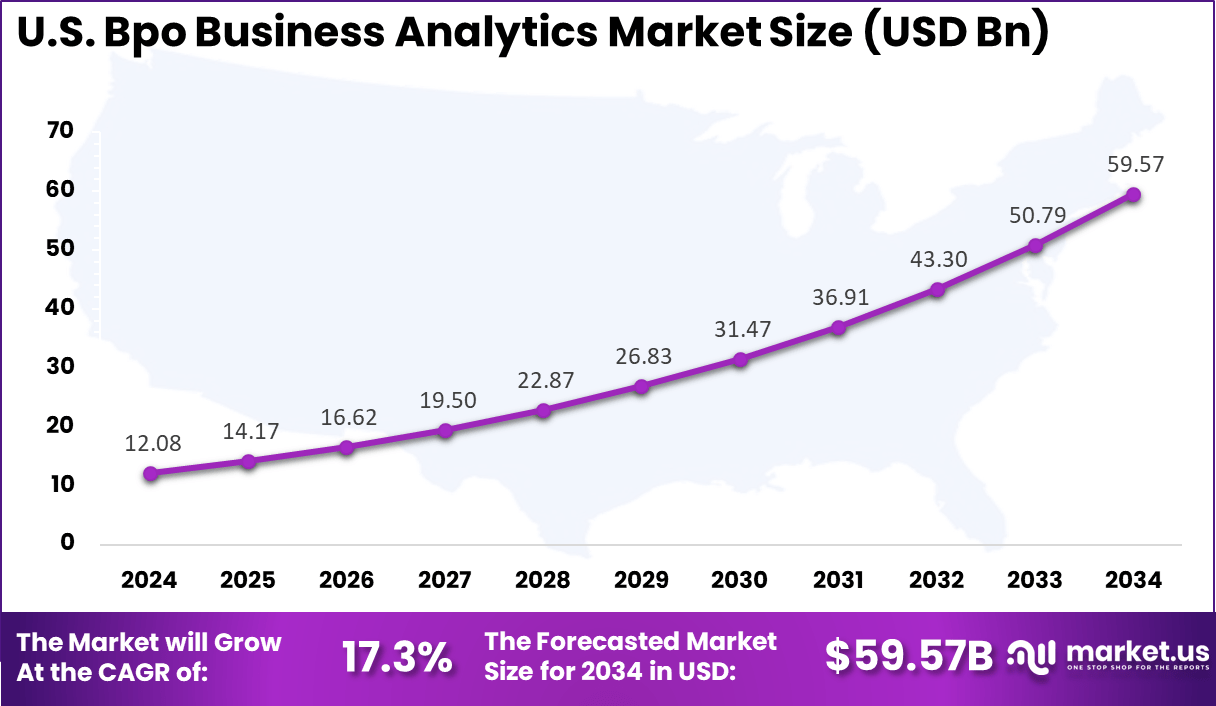

- The United States alone contributed USD 12.08 billion, with a steady CAGR of 17.3%, reflecting strong demand for data-driven outsourcing solutions.

- Software dominated the component segment, accounting for 54%, as analytics platforms become central to BPO decision-making.

- The cloud-based deployment model held a 65.2% share, offering scalability, reduced infrastructure costs, and real-time data access.

- Large enterprises made up 72.5% of the market, due to their higher outsourcing volumes and analytics needs.

- Finance & Accounting was the top functional area, representing 30%, as firms seek better financial visibility and performance tracking.

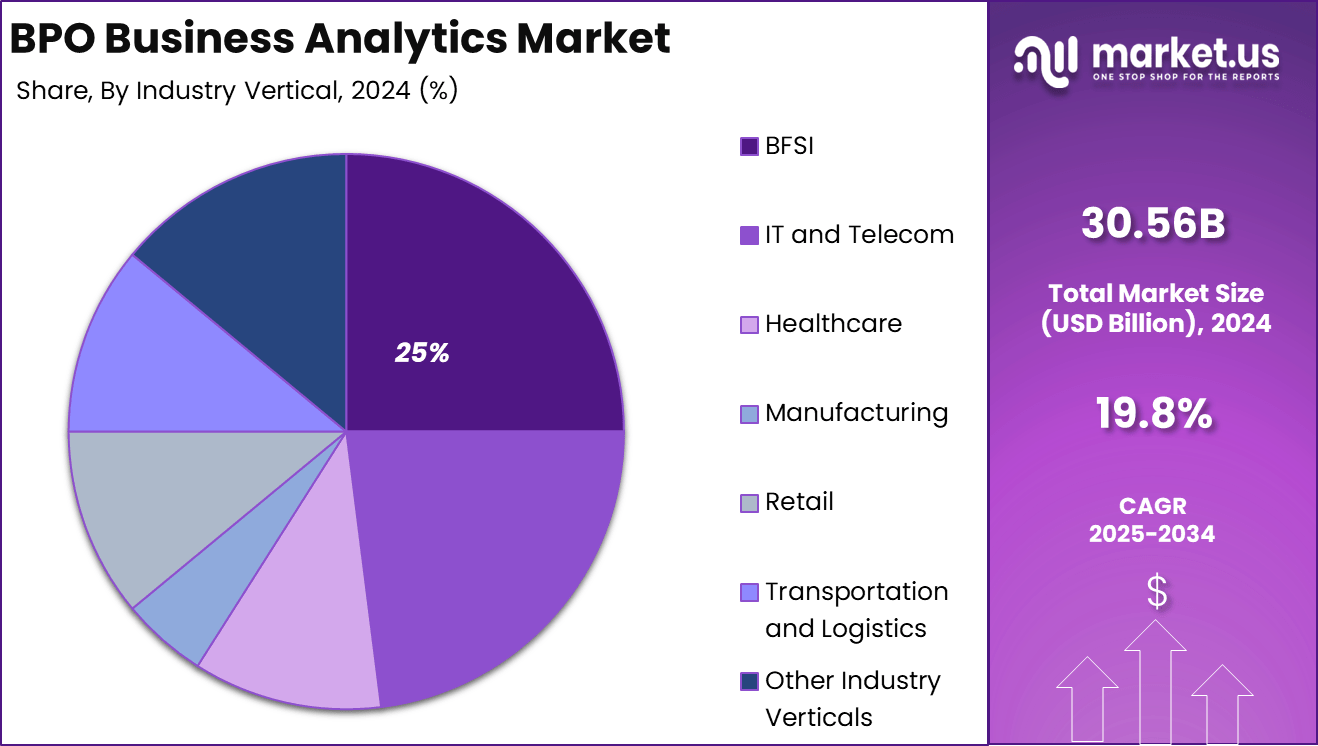

- The BFSI sector accounted for 25%, relying on analytics for customer insights, compliance, and operational efficiency.

U.S. Market Valuation

The market for BPO Business Analytics within the U.S. is growing tremendously and is currently valued at USD 12.08 billion, the market has a projected CAGR of 17.3%. The market is expanding rapidly, fueled by strong digital transformation initiatives, robust data infrastructure, and growing demand for customer-focused, insight-led operations.

Companies across sectors like finance, healthcare, retail, and manufacturing are increasingly adopting AI, cloud analytics, and automation to enhance efficiency and decision-making. The surge in customer and operational data, along with strict regulatory requirements, is driving organizations to outsource analytics to expert providers. This enables greater agility, cost efficiency, and competitive advantage in today’s fast-paced, data-driven business environment.

For instance, in February 2024, Acquire BPO launched Acquire.AI, a platform designed to accelerate business growth through AI-powered analytics solutions. This launch reflects the growing dominance of the U.S. in the BPO Business Analytics market, as companies increasingly adopt advanced technologies like AI and machine learning to optimize customer experience and operational efficiency.

In 2024, North America held a dominant market position in the Global BPO Business Analytics Market, capturing more than a 41.8% share, holding USD 12.77 billion in revenue. North America held a dominant position in this market due to its early adoption of advanced technologies such as AI, cloud computing, and big data analytics.

The region benefits from a mature IT infrastructure, a high concentration of analytics-driven enterprises, and strong demand across key sectors like finance, healthcare, and retail. Additionally, regulatory compliance pressures and the need for operational efficiency have accelerated outsourcing to specialized analytics providers, reinforcing North America’s leadership in delivering high-value, insight-based business solutions.

For instance, in June 2025, Accenture announced its acquisition of Maryville Consulting Group, a U.S.-based firm specializing in technology strategy and transformation. This acquisition enhances Accenture’s ability to help North American clients align IT strategy with business objectives through advanced analytics and digital execution. It underscores the region’s dominance in the BPO Business Analytics market, where demand for strategic, insight-led outsourcing continues to grow.

Component Analysis

In 2024, the Software segment held a dominant market position, capturing a 54% share of the Global BPO Business Analytics Market. This dominance is due to the growing reliance on advanced analytics platforms that enable real-time data processing, predictive modeling, and AI integration.

As organizations prioritize data-driven decision-making, demand for scalable, cloud-based software solutions has surged. These platforms enhance operational efficiency, support multichannel analytics, and offer flexible deployment, making them essential for BPO providers delivering value-added, insight-rich services across industries.

For Instance, in March 2025, Genpact reinvented itself for the Services-as-Software era, emphasizing the integration of advanced automation, AI, and analytics into scalable, subscription-based service models. This shift enables Genpact to offer data-driven, software-powered solutions that drive business process innovation and efficiency.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 65.2% share of the Global BPO Business Analytics Market. The dominance is due to the rising need for scalable, flexible, and cost-effective analytics solutions. Cloud deployment supports real-time data access, easy integration across operations, and fast adoption of AI and machine learning technologies.

It also minimizes capital investment by reducing reliance on physical infrastructure while maintaining strong security and compliance. As digital transformation accelerates, more organizations are turning to cloud-based analytics to gain timely, data-driven insights and respond effectively to evolving market demands.

For instance, in November 2024, NTT DATA expanded its partnership with Google Cloud to drive the adoption of data analytics and generative AI solutions. This collaboration focuses on enhancing cloud-based analytics capabilities within the BPO Business Analytics sector, enabling businesses to leverage real-time insights and AI-driven decision-making.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 72.5% share of the Global BPO Business Analytics Market. This dominance is due to their substantial investment capacity, complex operational structures, and higher demand for advanced analytics to drive strategic decision-making.

Large organizations are increasingly seeking external assistance for analytics to improve their work processes, manage massive data volumes, and gather valuable information to stay ahead of the market on a global scale. Their emphasis on digital transformation and extensive use of AI solutions helps them maintain their position as the top user for BPO analytics services.

For Instance, in July 2025, Capgemini announced its acquisition of WNS Global Services for $3.3 billion, marking a significant move in the BPO Business Analytics market. This acquisition aims to integrate WNS’s deep domain expertise and strong presence in the U.S. and U.K. with Capgemini’s advanced AI capabilities, enhancing their ability to offer intelligent, data-driven business process services.

Function Analysis

In 2024, the Finance & Accounting segment held a dominant market position, capturing a 30% share of the Global BPO Business Analytics Market. The dominance is driven by the high demand for accurate financial reporting, regulatory compliance, and cost optimization.

Organizations increasingly rely on analytics to streamline processes such as forecasting, budgeting, risk management, and regulatory reporting. Outsourcing these functions enables access to advanced analytical tools and expertise, helping enterprises improve financial decision-making, enhance transparency, and maintain strong governance in an increasingly complex regulatory environment.

Industry Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 25% share of the Global BPO Business Analytics Market. This dominance is due to the BFSI sector’s heavy reliance on data for functions such as risk assessment, compliance, fraud detection, and customer analytics.

Financial institutions are increasingly outsourcing analytics to gain real-time operational insights, improve customer engagement, and support strategic decisions. The industry’s large and complex data volumes require sophisticated tools for credit analysis, forecasting, and personalized services. With growing demand for AI-powered predictive analytics, the BFSI sector continues to lead in adopting BPO analytics solutions to enhance efficiency and competitiveness.

For Instance, in November 2024, Emirates NBD partnered with McKinsey & Company to accelerate AI and advanced analytics adoption across its operations. The collaboration aims to enhance customer experience, improve risk management, and optimize decision-making. This partnership underscores the growing demand for BPO Business Analytics in the BFSI sector, as financial institutions leverage AI and analytics to stay competitive and deliver personalized services.

Growth Factors

Key Factors Description Rising Demand for Data-Driven Decision Making Organizations increasingly leverage business analytics BPO for actionable insights to improve competitive advantage and operational performance. Cost Efficiency and Operational Optimization Outsourcing analytics to specialized providers offers economies of scale, reduces costs, and enhances resource utilization for clients. Digital Transformation and Advanced Technologies Accelerating adoption of digital tools, AI, ML, and automation in analytics boosts efficiency and supports real-time data interpretation. Cloud-Based Solution Adoption Cloud analytics platforms bring scalability, accessibility, and lower upfront investment, expanding market reach across organizations of all sizes. Increasing Outsourcing Trends Across Industries BFSI, healthcare, retail, IT, and especially SMEs are outsourcing analytics to gain expertise rapidly, improve customer experiences, and focus on core business. Emering Trends

Key Trends Description Integration of AI, ML & Automation BPO analytics firms infuse AI, ML, and automation for predictive analytics, fraud detection, and process automation, delivering deeper insights and enhanced efficiency. Real-Time Analytics & Actionability Demand is growing for real-time, actionable insights to allow organizations to make quicker and smarter business decisions. Expansion of Cloud and SaaS Models Cloud-based analytics (SaaS) enable flexible deployment, faster scaling, and seamless integration across global teams. Industry and SME-Focused Solutions Customized analytics solutions targeting niche industry needs and SME-specific challenges drive adoption and innovation. Enhanced Security & Data Governance Heightened awareness around data privacy, compliance, and secure analytics processes, especially for sensitive verticals like healthcare and finance.< Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud-based

- On-premises

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Function

- Finance & Accounting

- Human Resources

- Knowledge Process Outsourcing

- Procurement & Supply Chain

- Customer Services

- Others

By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Manufacturing

- Retail

- Transportation and Logistics

- Other Industry Verticals

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Real-Time and Data-Driven Decision-Making

Enterprises are increasingly leveraging data analytics to drive faster, smarter decisions. The importance of data analysis stems from the need to improve customer experience, streamline operations, and adapt to changing market conditions.

The requirement for businesses that offer business process outsourcing (BPO) services is to provide not only cost-saving solutions but also important insights. The increasing importance of data analysis in planning has led to the creation of BPO solutions that allow for flexible, competitive, and customer-focused approaches, regardless of industry or location.

For instance, In July 2025, Accenture acquired SYSTEMA, a specialist in manufacturing IT and automation, to strengthen its services for semiconductor clients. The move supports growing demand for real-time, data-driven decision-making in BPO business analytics by enhancing operational efficiency and analytics-driven process optimization.

Restraint

Lack of Skilled Analytics Professionals

Despite robust market demand, the shortage of skilled analytics professionals poses a significant constraint on growth. BPO providers often struggle to recruit and retain talent with expertise in data science, AI, and advanced analytics.

This talent gap limits the scalability of high-value services and increases operational risk. Without sufficient human capital to interpret complex data, even advanced platforms can fall short in delivering client ROI. Bridging this skills gap is essential for sustainable BPO analytics expansion.

For instance, in November 2024, Investigo expanded its operations to the Netherlands to address the growing demand for skilled data analytics professionals. This expansion reflects the ongoing shortage of qualified analytics talent, which is limiting the ability of many organizations to harness the full potential of their data.

Opportunities

Expansion in Emerging Markets

BPO analytics offers significant opportunities in emerging markets such as Asia Pacific, the Middle East, and Africa. Driven by digital transformation initiatives, increased cloud adoption, and favorable outsourcing economics, these markets are rapidly becoming analytics hubs.

Enterprises across sectors are outsourcing decision-support functions to specialized providers, seeking agility and cost efficiency. BPO firms that localize offerings, ensure compliance, and invest in workforce development in these regions stand to capture a significant share in the evolving global landscape.

For instance, in October 2024, iSON Xperiences partnered with FICO to introduce AI-powered customer management technology across Africa. This expansion aims to improve customer experience and operational efficiency by leveraging advanced analytics and AI. The partnership enhances iSON’s BPO services, driving the adoption of BPO Business Analytics in emerging markets with growing demand for digital transformation.

Challenges

Rapid Technology Evolution

Companies that offer analytics services for business process outsourcing face a significant challenge in keeping up with the changing technology landscape. The rapid advancement of artificial intelligence, machine learning, and data management systems necessitates that these companies keep spending money on tools, skilled workers, or supporting systems.

If they can’t adopt the latest analytics solutions, they may lose out on competitive advantages. To remain relevant and expand their services to meet the constantly evolving needs of both consumers and businesses, companies must maintain flexibility and adaptability in this area.

For instance, in March 2025, Wipro announced a strategic reshaping of its global business lines to better align with evolving market demands. The company is focusing on enhancing its capabilities in AI, cloud services, and business process outsourcing (BPO), integrating advanced analytics to drive smarter, data-driven solutions.

Key Players Analysis

Accenture and IBM have emerged as dominant players in the BPO Business Analytics Market due to their extensive global presence and investments in AI-powered platforms. Accenture’s focus on industry-specific analytics and real-time decision-making tools has strengthened its position. IBM leverages its advanced data capabilities, including Watson AI, to deliver tailored business insights.

Genpact and WNS Global Services have gained attention for delivering end-to-end analytics solutions across finance, insurance, and healthcare sectors. These companies are actively expanding their service offerings through strategic partnerships and digital transformation initiatives. Tata Consultancy Services (TCS), Infosys, and Wipro have shown strong capabilities in integrating business analytics with IT infrastructure and cloud-based platforms.

Cognizant and Capgemini are also key contributors, with Cognizant focusing on predictive analytics and Capgemini on data monetization strategies. EXL Service has built a reputation in healthcare and BFSI analytics, offering data-driven process optimization tools that are well-integrated into business process workflows.

HCL Technologies, NTT DATA, and Firstsource Solutions are expanding their analytics capabilities through automation, cognitive tools, and customer intelligence platforms. Conduent and Sutherland Global provide analytics-as-a-service models tailored for client-specific needs. Teleperformance and Sitel Group are enhancing customer experience analytics to support contact center transformation. Wunderman Thompson, with its blend of marketing analytics and business intelligence, also plays a significant role.

Top Key Players

- Accenture

- IBM

- Genpact

- WNS Global Services

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Cognizant

- Capgemini

- EXL Service

- Firstsource Solutions

- HCL Technologies

- NTT DATA

- Conduent

- Sutherland Global

- Teleperformance

- Sitel Group

- Wunderman Thompson

- Other Key Players

Recent Developments

- May 2024: Global investment firm KKR acquired a significant minority stake in Infinx Healthcare, a healthcare-focused business analytics provider. This move signals investor confidence in healthcare analytics outsourcing as demand for advanced analytics surges in sectors like medical billing and patient engagement.

- February 2024: Acquire BPO, a major player in customer service outsourcing, launched its new division Acquire AI. This division provides AI consulting and business analytics tailored to BPO clients. The aim is clear – helping businesses adopt AI-powered analytics for smarter decision-making and operational efficiency at scale in outsourcing arrangements.

Report Scope

Report Features Description Market Value (2024) USD 30.56Bn Forecast Revenue (2034) USD 186.09 Bn CAGR (2025-2034) 19.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (Cloud-based, On-premises), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Function (Finance & Accounting, Human Resources, Knowledge Process Outsourcing, Procurement & Supply Chain, Customer Services, Others), By Industry Vertical (BFSI, IT and Telecom, Healthcare, Manufacturing, Retail, Transportation and Logistics, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, IBM, Genpact, WNS Global Services, Tata Consultancy Services (TCS), Infosys, Wipro, Cognizant, Capgemini, EXL Service, Firstsource Solutions, HCL Technologies, NTT DATA, Conduent, Sutherland Global, Teleperformance, Sitel Group, Wunderman Thompson, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  BPO Business Analytics MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

BPO Business Analytics MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- IBM

- Genpact

- WNS Global Services

- Tata Consultancy Services (TCS)

- Infosys

- Wipro

- Cognizant

- Capgemini

- EXL Service

- Firstsource Solutions

- HCL Technologies

- NTT DATA

- Conduent

- Sutherland Global

- Teleperformance

- Sitel Group

- Wunderman Thompson

- Other Key Players