Global Bottom Discharge Valve Market Size, Share, Growth Analysis By Valve Type (Flush Bottom Valves, Tank Bottom Ball Valves, Tank Bottom Diaphragm Valves, Others), By End Use (Pharmaceutical Manufacturing, Fine & Specialty Chemicals, Food Processing, Petrochemicals, Battery Materials, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175384

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

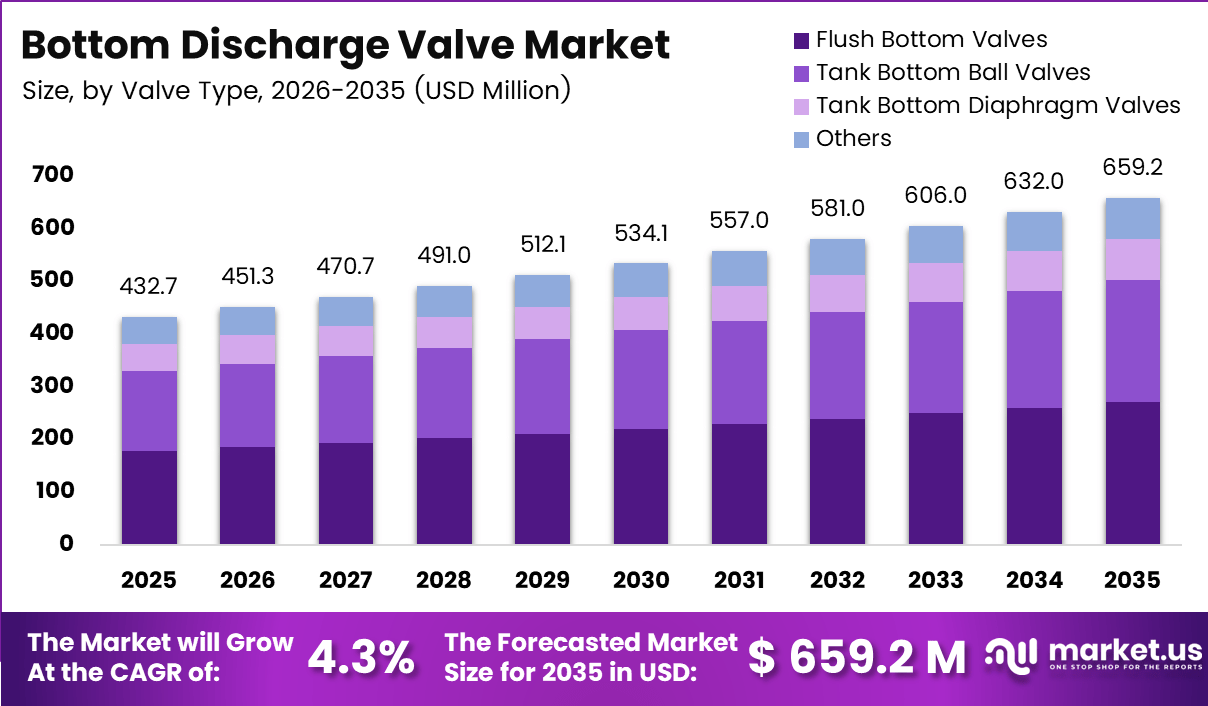

The Global Bottom Discharge Valve Market size is expected to be worth around USD 659.2 million by 2035, from USD 432.7 Million in 2025, growing at a CAGR of 4.3% during the forecast period from 2026 to 2035.

The Bottom Discharge Valve as a critical flow-control solution used in tanks, reactors, and transport vessels. It enables controlled emptying, minimizes residue, and improves safety. Consequently, industries handling viscous or hazardous fluids increasingly rely on bottom discharge valve systems.

The Bottom Discharge Valve supports hygienic and efficient discharge across chemical, pharmaceutical, and food processing applications. Moreover, it integrates smoothly with automated production lines. As industries pursue higher efficiency and compliance, demand grows for reliable bottom outlet valves with precision control and long service life.

Transitioning to the Bottom Discharge Valve Market, growth remains consistent due to expanding industrial infrastructure and stricter process regulations. Governments continue investing in chemical manufacturing zones, pharmaceutical facilities, and bulk liquid logistics. As a result, capital expenditure on tanks and reactors directly supports market expansion opportunities.

In parallel, regulatory bodies emphasize leakage prevention, environmental protection, and operator safety. Therefore, industries increasingly replace conventional outlet valves with bottom discharge configurations. This shift creates opportunities in both retrofit projects and greenfield installations, while sustainability initiatives further supporting efficient fluid recovery and waste reduction.

From a technical perspective, evolving design standards strengthen market adoption. According to ISO tank equipment guidelines, foot valves commonly operate at 45° or 30°, while road tankers and offshore tanks typically use 90° angles. Additionally, oilfield equipment manuals note intermediary valves displacing nearly 10% of pumped fluid into the annulus.

Furthermore, according to industrial pump application datasheets, insert pump compatibility includes tubing sizes of 60.325mm and 73.025mm, with cages designed for 1 1/4” and 1 1/2”, equivalent to 31.75mm and 38.1mm. These standardized dimensions simplify integration and reduce installation complexity.

Key Takeaways

- The global Bottom Discharge Valve Market is projected to reach USD 659.2 million by 2035, growing from USD 432.7 million in 2025.

- The market is expected to expand at a steady CAGR of 4.3% during the forecast period from 2026 to 2035.

- Flush Bottom Valves lead the valve type segment with a dominant share of 41.2%, driven by efficient and residue-free discharge.

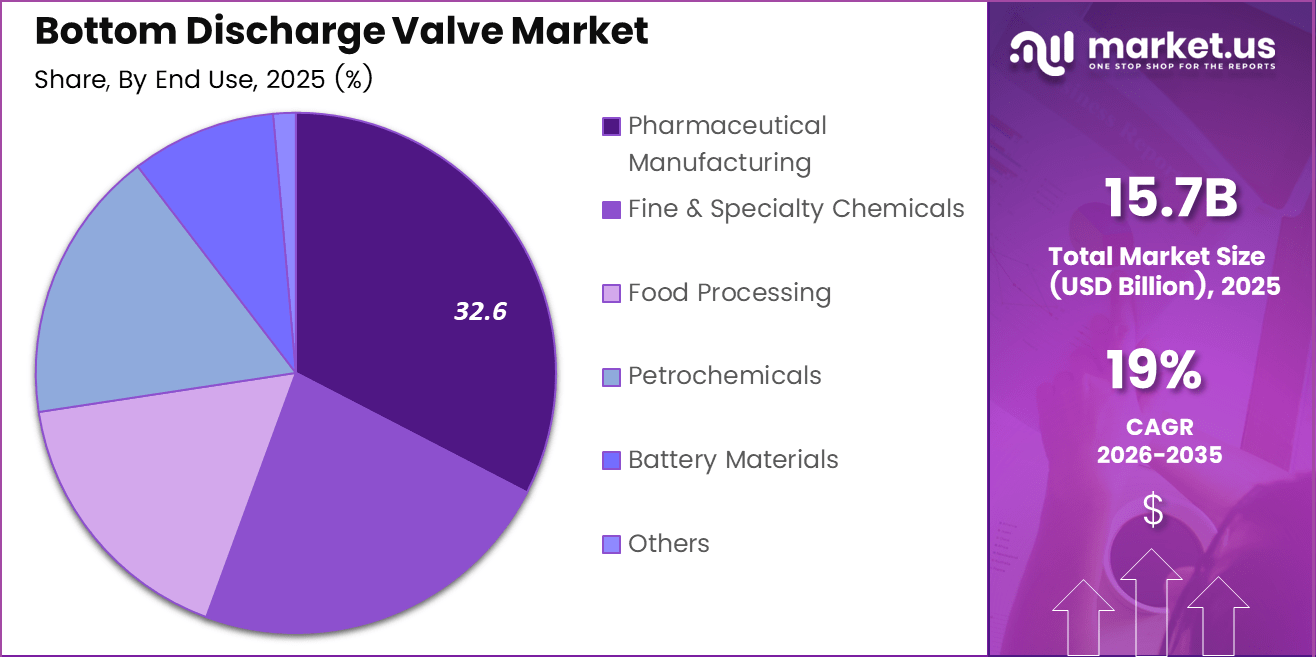

- Pharmaceutical Manufacturing dominates the end-use segment, accounting for a market share of 32.6% due to strict hygiene requirements.

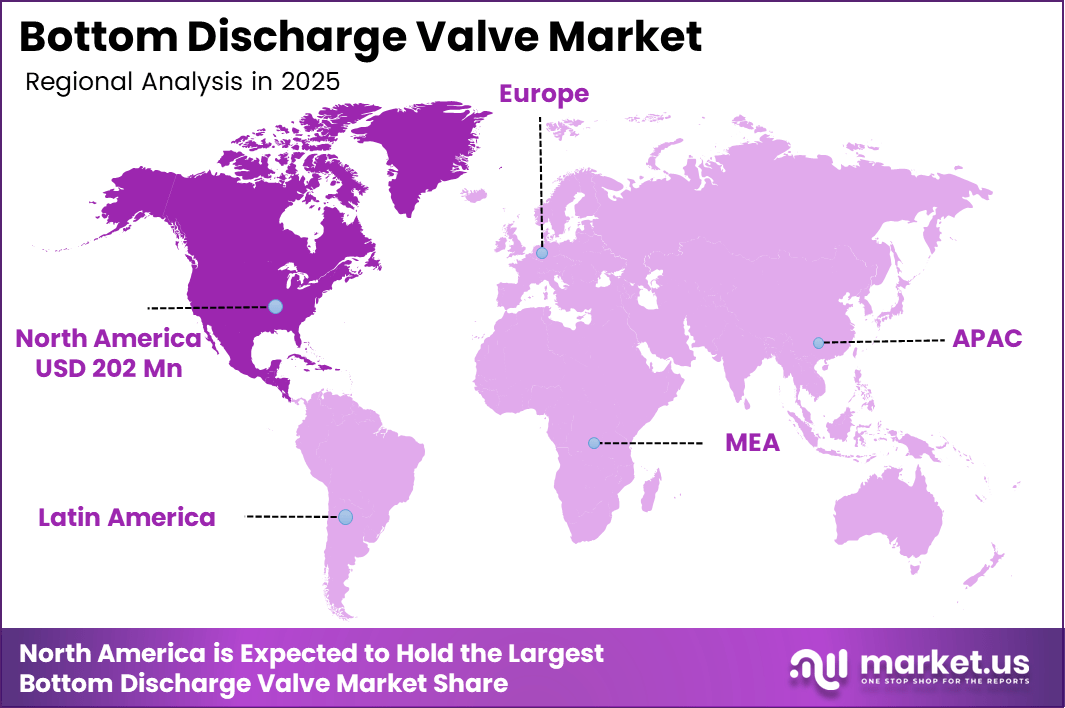

- North America is the leading regional market, holding 46.7% share and valued at USD 202.0 Million.

- Asia Pacific represents a high-growth region, supported by expanding industrial and manufacturing activities.

- Europe remains a mature market, driven by regulatory compliance and strong process safety standards.

Valve Type Analysis

Flush Bottom Valves dominate with 41.2% due to superior discharge efficiency and minimal residue retention.

In 2025, Flush Bottom Valves held a dominant market position in the By Main Segment Analysis segment of Bottom Discharge Valve Market, with a 41.2% share. This dominance is driven by clean discharge, reduced dead space, and suitability for hygienic operations. Consequently, process industries favor flush designs for safety and efficiency.

Tank Bottom Ball Valves follow as a reliable alternative, offering robust sealing and straightforward operation. These valves are widely adopted in applications requiring quick shut-off and durability. Moreover, their simple mechanical structure supports ease of maintenance, making them suitable for general industrial tanks and moderate-pressure environments.

Tank Bottom Diaphragm Valves gain traction where contamination control is critical. These valves use flexible diaphragms to isolate media from moving parts. As a result, they are preferred in corrosive and slurry-based processes. Additionally, they support precise flow control while reducing leakage risks.

Other valve types include customized and application-specific designs addressing niche requirements. These valves serve specialized tanks, extreme temperatures, or unique media characteristics. Although adoption remains selective, innovation and customization continue expanding their relevance across emerging industrial processes.

End Use Analysis

Pharmaceutical Manufacturing dominates with 32.6% driven by strict hygiene standards and high-value fluid handling.

In 2025, Pharmaceutical Manufacturing held a dominant market position in the By Main Segment Analysis segment of Bottom Discharge Valve Market, with a 32.6% share. Growth is supported by stringent regulatory compliance, sterile processing needs, and rising drug production. Therefore, bottom discharge valves are essential for contamination-free operations.

Fine and Specialty Chemicals represent a significant end-use segment due to complex formulations and sensitive reactions. These processes require precise discharge and minimal residue. Consequently, manufacturers adopt advanced valve designs to ensure safety, product consistency, and efficient batch processing.

Food Processing increasingly uses bottom discharge valves to meet hygiene and cleaning requirements. These valves enable complete emptying and support clean-in-place systems. As food safety regulations tighten, processors prefer solutions that reduce waste and improve operational reliability.

Petrochemicals, battery materials, and other industries adopt bottom discharge valves for handling viscous, hazardous, or high-temperature fluids. While demand varies, ongoing investments in energy storage, refining, and specialty materials steadily support market penetration across these applications.

Key Market Segments

By Valve Type

- Flush Bottom Valves

- Tank Bottom Ball Valves

- Tank Bottom Diaphragm Valves

- Others

By End Use

- Pharmaceutical Manufacturing

- Fine & Specialty Chemicals

- Food Processing

- Petrochemicals

- Battery Materials

- Others

Drivers

Increasing Adoption in Bulk Material Handling Industries Drives Market Growth

As an analyst, I observe that bulk material handling industries increasingly rely on bottom discharge valves for safe and complete material discharge. These industries handle powders, slurries, and viscous fluids that require controlled flow. Therefore, bottom discharge valves help reduce residue and material loss.

Moreover, automated valve systems improve operational efficiency by reducing manual intervention. Plants benefit from faster discharge cycles and consistent flow control. As automation expands, valves compatible with control systems gain preference. This trend supports productivity improvements across industrial operations.

In addition, rising demand for corrosion-resistant materials supports market growth. Chemical exposure and harsh operating conditions require valves made from durable alloys or coated surfaces. Consequently, longer service life and lower replacement frequency encourage adoption.

Furthermore, growth in chemical and pharmaceutical manufacturing strengthens demand. These sectors need hygienic, leak-proof discharge solutions. Bottom discharge valves meet strict safety and quality standards, making them essential components in modern processing facilities.

Restraints

High Initial Capital Investment Limits Wider Market Adoption

One key restraint in the bottom discharge valve market is the high initial investment required for advanced valve systems. Automated and specialized valves involve higher purchase and installation costs. As a result, budget constraints impact buying decisions.

Small and medium-scale industries often hesitate to invest due to limited capital availability. These users may prefer simpler valve alternatives despite lower efficiency. Therefore, cost sensitivity slows adoption in certain market segments.

Additionally, complex maintenance requirements act as a barrier. Advanced valves require skilled technicians for servicing and calibration. This increases operational expenses over time.

Consequently, organizations lacking technical expertise may delay upgrades. Until maintenance becomes simpler and more affordable, adoption among smaller operators may remain limited.

Growth Factors

Expansion in Food and Beverage Processing Creates New Opportunities

From a growth perspective, food and beverage processing offers strong opportunities for bottom discharge valves. These facilities require hygienic and residue-free discharge systems. As food safety standards tighten, demand for reliable valves increases.

Integration with IoT and smart factory automation further expands opportunities. Valves equipped with sensors enable real-time monitoring and predictive maintenance. Therefore, manufacturers benefit from improved efficiency and reduced downtime.

Additionally, development of energy-efficient and eco-friendly valve designs attracts sustainability-focused industries. Reduced leakage and optimized flow support environmental goals.

Rising demand in water treatment and waste management also supports growth. These applications require durable and efficient discharge solutions for sludge and treated fluids.

Emerging Trends

Use of Advanced Materials Enhances Product Innovation Trends

Trending factors indicate growing use of advanced alloys and composite materials. These materials improve durability and resistance to wear, corrosion, and chemicals. As a result, valve lifespan increases across demanding applications.

Another trend is the adoption of remote monitoring and control features. Digital connectivity allows operators to track performance and detect issues early. This improves reliability and operational transparency.

Customization for extreme temperature and pressure conditions is also increasing. Industries handling high-risk fluids require tailored valve designs for safety and compliance.

Finally, manufacturers are shifting toward compact and space-saving valve designs. These designs support modern plant layouts where space efficiency is increasingly important.

Regional Analysis

North America Dominates the Bottom Discharge Valve Market with a Market Share of 46.7%, Valued at USD 202.0 Million

North America leads the Bottom Discharge Valve Market due to strong industrial infrastructure and early adoption of advanced flow-control technologies. In this region, the market accounts for a dominant 46.7% share, valued at USD 202.0 Million, supported by investments in pharmaceuticals, chemicals, and bulk liquid transportation. Strict safety and environmental regulations further drive consistent demand.

Europe Bottom Discharge Valve Market Trends

Europe represents a mature market, driven by stringent regulatory compliance and a strong focus on process safety. Industries across chemicals, food processing, and specialty materials emphasize efficient discharge solutions. Additionally, sustainability initiatives encourage the adoption of valves that reduce leakage and product waste across industrial facilities.

Asia Pacific Bottom Discharge Valve Market Outlook

Asia Pacific shows high growth potential due to rapid industrialization and expanding manufacturing capacity. Rising investments in chemical production, pharmaceuticals, and battery materials increase the need for reliable bottom discharge solutions. Moreover, infrastructure development and cost-effective manufacturing support long-term market expansion.

Middle East and Africa Bottom Discharge Valve Market Overview

The Middle East and Africa market is driven by oil, gas, and petrochemical activities, where safe fluid handling is critical. Growing investments in refining and chemical processing plants support gradual adoption. However, market growth remains moderate due to varying levels of industrial development across countries.

Latin America Bottom Discharge Valve Market Insights

Latin America demonstrates steady demand supported by food processing, chemicals, and resource-based industries. Improving industrial standards and modernization of processing facilities encourage valve upgrades. While adoption remains selective, increasing focus on efficiency and safety creates opportunities for gradual market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bottom Discharge Valve Company Insights

De Dietrich Process Systems continues to leverage its deep expertise in high-purity and customized valve solutions for pharmaceutical and fine chemical industries, enhancing reliability and contamination control. Its emphasis on modular and serviceable designs is expected to sustain its competitive edge in markets requiring stringent process integrity.

GEMÜ is poised to expand its footprint through tailored valve technologies that address diverse fluid handling challenges. Known for precision and adaptability, GEMÜ’s focus on digital integration and smart valve systems is aligning with broader Industry 4.0 trends, enabling real-time performance monitoring and predictive maintenance for operators.

GEA, continues to capitalize on its global scale and comprehensive process expertise to deliver robust bottom discharge valves for food, beverage, and industrial applications. GEA’s strong R&D pipeline and commitment to energy-efficient solutions support its positioning as a preferred partner for large industrial clients seeking long-term operational savings.

Spirax Sarco rounds out this group with its strong emphasis on steam and thermal fluid system optimization, where specialized bottom discharge valves play a crucial role. Spirax Sarco’s solutions are increasingly valued for their ability to improve system responsiveness and reduce downtime, particularly in energy-intensive sectors focused on sustainability.

Collectively, these players are driving technological refinement and application-specific innovation in the Bottom Discharge Valve market, responding to evolving regulatory demands and industry digitization trends.

Top Key Players in the Market

- De Dietrich Process Systems

- GEMÜ

- GEA

- Spirax Sarco

- Crane

- IMI

- Bürkert

- Alfa Laval

- Valmet

- Flowserve

Recent Developments

- In November 2024, KI launched a new tank bottom ball valve product. This bottom discharge valve is designed for efficient and complete tank drainage, suitable for various industrial applications including chemical and pharmaceutical storage tanks.

Report Scope

Report Features Description Market Value (2025) USD 432.7 Million Forecast Revenue (2035) USD 659.2 million CAGR (2026-2035) 4.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Valve Type (Flush Bottom Valves, Tank Bottom Ball Valves, Tank Bottom Diaphragm Valves, Others), By End Use (Pharmaceutical Manufacturing, Fine & Specialty Chemicals, Food Processing, Petrochemicals, Battery Materials, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape De Dietrich Process Systems, GEMÜ, GEA, Spirax Sarco, Crane, IMI, Bürkert, Alfa Laval, Valmet, Flowserve Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bottom Discharge Valve MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Bottom Discharge Valve MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- De Dietrich Process Systems

- GEMÜ

- GEA

- Spirax Sarco

- Crane

- IMI

- Bürkert

- Alfa Laval

- Valmet

- Flowserve