Global Bot Security Market Size, Share, Trend Analysis Report By Component (Solution, Services), By Security Type (Web Security, API Security, Mobile Security), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-Commerce, Healthcare, Travel and Tourism, Media and Entertainment, Government and Defense, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 131197

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

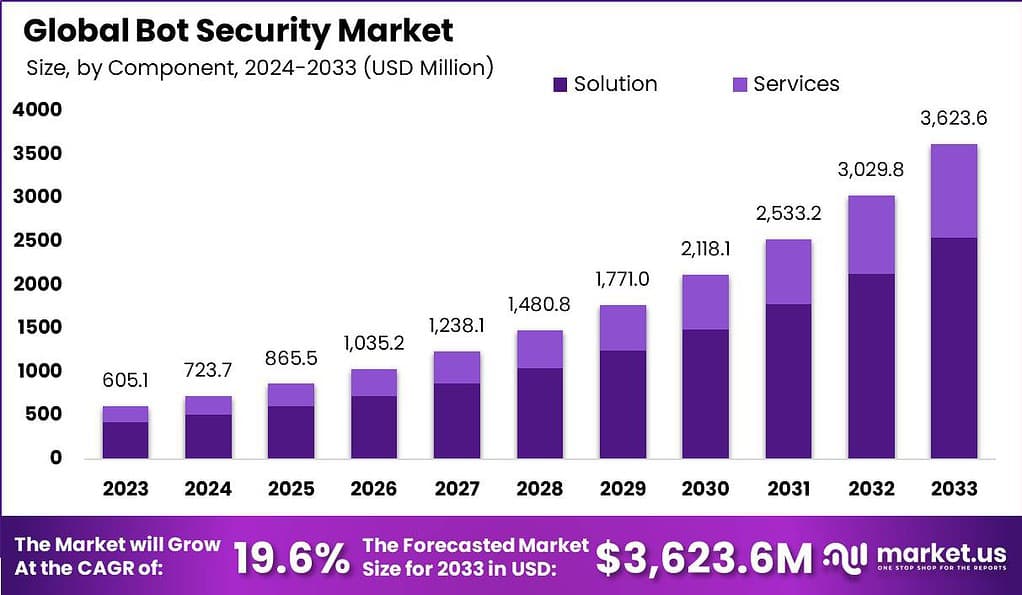

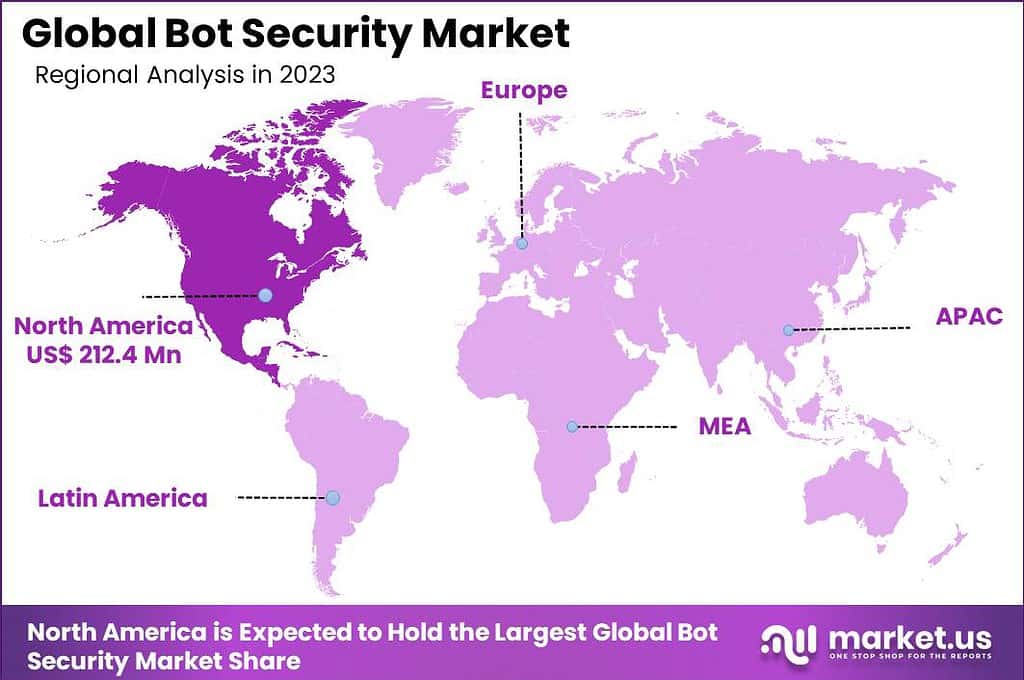

The Global Bot Security Market size is expected to be worth around USD 3,623.6 Million By 2033, from USD 605.1 Million in 2023, growing at a CAGR of 19.60% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.1% share, holding USD 212.4 Million revenue.

Bot security refers to the measures and technologies used to protect against malicious automated attacks on websites, apps, and APIs. These attacks are often carried out by bots, which are software applications programmed to perform tasks. Bot security is crucial because it helps to safeguard sensitive information, maintain website functionality, and ensure a good user experience by preventing slowdowns or downtime caused by bot traffic.

The bot security market is experiencing significant growth due to the increasing prevalence of cyber threats and the expansion of e-commerce and digital services. As businesses seek to protect their online platforms from automated attacks, the demand for sophisticated bot management solutions is rising. This market encompasses a range of solutions, including standalone security platforms and services integrated into broader cybersecurity frameworks.

The growth of the bot security market is driven by several key factors. The surge in online transactions and digital interactions has made businesses more vulnerable to bot-driven attacks, heightening the need for effective security solutions. Additionally, regulatory requirements for data protection and privacy force companies to invest in robust security measures, including bot management.

The sophistication of attacks, such as credential stuffing and DDoS attacks, also compels organizations to enhance their defenses, contributing to market growth. Current trends in the bot security market include the integration of artificial intelligence to improve threat detection and response capabilities. There’s a noticeable shift towards cloud-based bot management services, which offer scalability and ease of integration with existing IT infrastructure.

The benefits of investing in bot security are substantial. For businesses, it means safeguarding against financial losses from fraud and enhancing customer trust through secure interactions. Effective bot management also helps maintain service availability, preventing downtime caused by bot-driven traffic spikes. Moreover, compliance with global data protection regulations protects businesses from potential legal and reputational risks associated with data breaches.

Demand in the bot security market is bolstered by the increasing number of digital platforms and the volume of sensitive user data they handle. As businesses expand their online presence, the need to ensure secure customer interactions and protect against data breaches has never been more critical. This demand is widespread across industries, including finance, retail, healthcare, and media, where customer data security is paramount.

The bot security market presents numerous opportunities, particularly in developing customized solutions for different industry needs. There’s potential for growth in emerging markets where digital transformation is accelerating. Additionally, as new forms of bots continue to evolve, there will be ongoing opportunities for innovation in detection and mitigation technologies.

As reported by DataDome, an alarming 65% of businesses are still vulnerable to basic bot attacks, with only 8% of companies being fully protected. The most concerning industries are e-commerce and healthcare, where over 70% of websites fail to implement adequate protection measures. This data highlights the ongoing risk faced by organizations as bot-driven threats continue to rise.

According to Thales, a leading cybersecurity firm, bots accounted for 49.6% of all internet traffic in 2023, marking a 2% increase over the previous year. This is the highest level reported by Imperva since they began tracking automated traffic in 2013. The growth of automated threats corresponds with the rising adoption of generative AI and large language models, which contributed to the rise in simple bots. The volume of these simple bots grew to 39.6% in 2023, up from 33.4% in 2022.

Additionally, account takeover (ATO) attacks surged by 10% in 2023 compared to the prior year, with a significant portion targeting API endpoints. In 2023, 44% of ATO attacks were aimed at APIs, up from 35% in 2022. This growing trend underscores the increasing risk to API security, with 11% of all login attempts being associated with account takeover efforts.

Industries most affected by ATO attacks in 2023 were Financial Services (36.8%), Travel (11.5%), and Business Services (8%). Countries like Ireland (71%), Germany (67.5%), and Mexico (42.8%) experienced the highest levels of bad bot traffic. Meanwhile, the US saw its bad bot traffic rise to 35.4%, slightly higher than the 32.1% recorded in 2022. This global spread of bot attacks highlights the need for stronger defenses across industries and regions

Key Takeaways

- The Global Bot Security Market is projected to grow from USD 605.1 million in 2023 to USD 3,623.6 million by 2033, at a CAGR of 19.60% during the forecast period from 2024 to 2033.

- In 2023, the Solution segment held a dominant market position, capturing over 70.3% of the Bot Security market share.

- The Web Security segment maintained a leading position in the Bot Security Market in 2023, with more than a 38.5% market share.

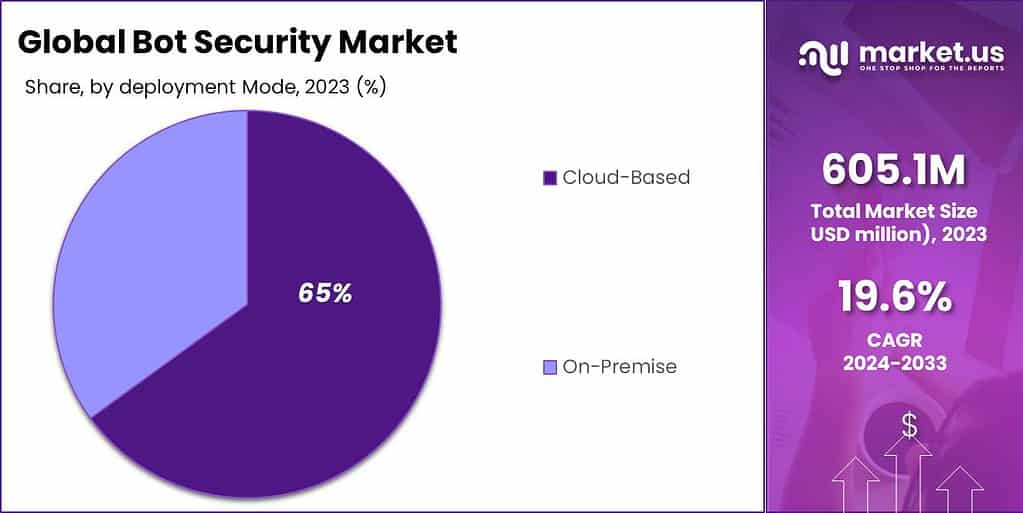

- The Cloud-Based segment dominated the Bot Security Market in 2023, holding over 65.0% of the market share.

- In 2023, the Large Enterprises segment held a dominant position in the Bot Security Market, capturing more than 60.8% of the market share.

- The Retail and E-Commerce segment held a significant position in the Bot Security Market in 2023, with more than a 22.6% share.

- In 2023, North America was the leading region in the Bot Security Market, holding over 35.1% of the market share, equivalent to USD 212.4 million in revenue.

Component Analysis

In 2023, the Solution segment held a dominant market position in the bot security market, capturing more than a 70.3% share. This significant market share underscores the critical role that specialized security solutions play in combating the sophisticated threats posed by malicious bots. Businesses and organizations increasingly recognize the need for robust, integrated solutions that can effectively detect, analyze, and mitigate potential bot threats in real-time.

The leading position of the Solution segment can be attributed to its ability to provide comprehensive protection mechanisms tailored to diverse digital environments. These solutions often combine advanced machine learning algorithms, user behavior analytics, and signature-based detection methods to identify and block harmful bot activities. By integrating these technologies, bot security solutions can adapt to new threats more quickly than traditional security measures, ensuring that they remain effective as bot strategies evolve.

Moreover, the demand for bot security solutions is fueled by their scalability and ease of integration with existing cybersecurity infrastructures. As organizations expand their digital footprints, the ability to seamlessly scale security solutions without compromising performance or protection is invaluable. This scalability is particularly crucial in handling large volumes of data and high traffic volumes, common challenges for e-commerce platforms, financial services, and social media networks.

Lastly, the push towards digital transformation across all sectors has made automated defenses a priority for ensuring secure customer interactions and protecting sensitive data. The Solution segment’s comprehensive offerings help organizations maintain compliance with stringent data protection regulations, further cementing its leadership in the bot security market. These factors collectively drive the dominant market share of the Solution segment, highlighting its essential role in the broader cybersecurity ecosystem.

Security Type Analysis

In 2023, the Web Security segment held a dominant market position in the bot security market, capturing more than a 38.5% share. This leadership is primarily due to the critical need for securing websites against increasingly sophisticated bot attacks that target online platforms.

Websites, as the most common point of interaction between businesses and customers, are frequent targets for credential stuffing, DDoS attacks, and data scraping bots. Effective web security measures are essential to safeguard these digital gateways, protect customer data, and ensure business continuity.

The predominance of the Web Security segment also stems from its comprehensive coverage against a broad range of threats. Solutions in this segment are designed to detect and mitigate threats before they can exploit vulnerabilities in the web infrastructure. By using advanced algorithms and pattern recognition techniques, web security systems can distinguish between legitimate users and malicious bot traffic, effectively blocking harmful interactions.

This capability is crucial for maintaining the integrity and performance of web services, which directly impacts user experience and trust. Furthermore, the shift towards online transactions and digital interactions across sectors such as retail, banking, and services has made web security a top priority for businesses aiming to protect their operations from the financial and reputational damage caused by bot attacks.

The growth of e-commerce, particularly, has driven demand for robust web security solutions as businesses seek to prevent losses related to fraud and data breaches. Lastly, regulatory compliance has played a significant role in boosting the web security segment. With regulations like GDPR and CCPA imposing strict penalties for data breaches, companies are investing more in web security solutions to comply with legal requirements.

This not only helps in avoiding financial penalties but also reinforces customer confidence in the company’s commitment to protecting their data. The combination of increasing online threats, regulatory requirements, and the critical role of websites in business operations highlights why the Web Security segment is leading in the bot security market.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position in the bot security market, capturing more than a 65% share. This substantial market share is primarily due to the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer.

As businesses of all sizes continue to move their operations online, the demand for cloud-based security solutions that can be easily integrated and scaled according to the needs of the business has surged. The leadership of the Cloud-Based segment can also be attributed to the ongoing digital transformation initiatives across various industries.

With the rapid deployment of digital technologies, organizations are seeking security solutions that can be swiftly implemented and managed. Cloud-based bot security services meet these requirements by offering real-time updates and protections without the need for extensive onsite hardware installations, which can be both costly and time-consuming.

Moreover, cloud-based solutions are favored for their ability to provide comprehensive and updated defenses against the latest threats. These solutions leverage global threat intelligence and continuous learning algorithms to enhance their effectiveness against new and evolving bot attacks. This proactive approach is crucial for maintaining security in an environment where threats are constantly changing.

Finally, the preference for cloud-based bot security solutions is bolstered by their ability to integrate with other cloud services. This integration allows for seamless security management across multiple platforms, reducing the complexity and increasing the efficiency of security protocols. The operational simplicity and robust protection provided by cloud-based solutions significantly contribute to their dominance in the bot security market.

Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the bot security market, capturing more than a 60.8% share. This significant share reflects the higher risk and larger attack surface that large enterprises face due to their extensive digital footprints.

These organizations typically manage vast amounts of sensitive data and conduct numerous online transactions, making them prime targets for sophisticated bot attacks. As a result, there is a heightened demand for robust bot security solutions that can protect against a wide array of threats.

The predominance of the Large Enterprises segment is also driven by their capacity to invest in advanced security solutions. Unlike smaller businesses, large enterprises often have the financial resources to allocate towards comprehensive security infrastructure. This includes not only purchasing the solutions but also investing in ongoing updates and the integration of cutting-edge technologies like artificial intelligence and machine learning to enhance their bot detection and mitigation capabilities.

Furthermore, large enterprises tend to be more heavily regulated and must comply with a variety of data protection and privacy regulations across different regions. This regulatory pressure compels them to maintain stringent security measures, which in turn drives the adoption of sophisticated bot management tools. By implementing top-tier security solutions, large enterprises can avoid the hefty fines and reputational damage associated with data breaches.

Finally, the need for customized bot security solutions that can be integrated with existing corporate IT infrastructures also favors large enterprises in the bot security market. Vendors often tailor their offerings to meet the specific needs of these organizations, providing them with scalable and flexible solutions that safeguard their extensive digital environments. This level of customization and integration ensures that large enterprises can maintain a secure and resilient online presence, further solidifying their leading position in the bot security market.

Industry Vertical Analysis

In 2023, the Retail and E-Commerce segment held a dominant market position in the bot security market, capturing more than a 22.6% share. This leading position can be attributed to the critical need for robust bot management systems in an industry that relies heavily on online customer interactions and transactions.

Retailers and e-commerce platforms are frequent targets for bots that carry out price scraping, inventory hoarding, and account takeover attacks. These activities can disrupt business operations, manipulate product pricing, and degrade customer trust and satisfaction.

The significance of bot security in the Retail and E-Commerce sector is also heightened by the competitive nature of the industry. As businesses strive to offer seamless and secure shopping experiences to gain and retain customers, investing in effective bot mitigation tools becomes essential. These tools help ensure that genuine customers can access promotions and make purchases without interference from malicious bots, thus maintaining the integrity of online sales operations.

Moreover, the Retail and E-Commerce segment’s emphasis on bot security is further supported by the need to protect against data breaches. With vast amounts of sensitive customer data being processed daily, retailers must safeguard this information to comply with data protection regulations and to prevent financial loss and reputational damage from potential security incidents.

Lastly, the adoption of bot security solutions in the Retail and E-Commerce sector is driven by the ongoing evolution of both threat landscapes and retail technologies. As retailers innovate and integrate more advanced technologies into their platforms, the complexity of security challenges increases.

Bot security solutions that can adapt to these changes and offer proactive defense mechanisms are therefore crucial for maintaining a secure and reliable online retail environment. This continuous need for advanced and adaptable security solutions explains why the Retail and E-Commerce segment commands a significant share of the bot security market.

Key Market Segments

By Component

- Solution

- Services

By Security Type

- Web Security

- API Security

- Mobile Security

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail and E-Commerce

- Healthcare

- Travel and Tourism

- Media and Entertainment

- Government and Defense

- Other Industry Verticals

Driver

Increasing Automation in Security Systems

One of the key drivers in the Bot Security Market is the increasing integration of automation in security systems. With organizations worldwide adopting more automated processes to enhance efficiency and productivity, the demand for bot security solutions is rising rapidly.

Automated systems enable businesses to handle repetitive tasks without human intervention, freeing up resources for more strategic activities. A compromised bot could lead to unauthorized access to sensitive data, system disruptions, or even complete takeovers of key infrastructure. As a result, the market for bot security solutions is expanding, driven by the need to safeguard these automated systems from cyber threats.

Restraint

High Implementation Costs

One significant restraint in the Bot Security Market is the high cost associated with implementing advanced security solutions. Bot security requires specialized tools and technologies that can monitor, detect, and mitigate threats in real time. These solutions often come with substantial price tags, which can be prohibitive for small and medium-sized enterprises (SMEs) or startups.

Additionally, continuous updates, patches, and monitoring are required to keep security systems up to date with the latest threats. This ongoing need for maintenance and updates adds to the operational costs for businesses. For companies operating on tight budgets, these expenses can deter them from adopting robust bot security solutions, opting instead for basic or even insufficient security measures.

Opportunity

Growing Demand for Cloud-Based Security Solutions

The increasing reliance on cloud computing provides a significant opportunity for the Bot Security Market. As more businesses migrate their operations to the cloud, they also introduce new security risks associated with cloud infrastructure.

Cloud-based bot security solutions have the ability to deploy security measures quickly across different geographic locations. With remote work becoming more common, businesses are increasingly seeking security solutions that can be implemented globally without the need for on-site IT teams. Cloud-based security offers this agility, making it easier to secure bots operating in different regions and across various cloud platforms.

Challenge

Evolving Nature of Cyber Threats

The constantly evolving landscape of cyber threats presents a significant challenge for the Bot Security Market. Cybercriminals are continually developing new techniques to exploit vulnerabilities in bot systems, making it difficult for security solutions to keep up. Bots, due to their automated nature, are often targeted for a range of malicious activities, including data theft, fraud, and distributed denial of service (DDoS) attacks.

One of the primary challenges is that bots can be both a tool and a target for cybercriminals. Malicious bots are often used to carry out attacks on legitimate bot systems, making it difficult to differentiate between normal bot activity and potentially harmful behavior.

Emerging Trends

Bot security is evolving rapidly as cyber threats become more sophisticated. One major trend is the rise of AI-powered bots that can bypass traditional security systems. Malicious bots are getting smarter, using machine learning to mimic human behavior, making it harder for conventional security tools to detect them.

These bots are now capable of automating large-scale attacks, such as Distributed Denial of Service (DDoS) and credential stuffing, often leading to severe disruptions for businesses. To counter this, security solutions are also getting smarter, with AI and machine learning being employed to detect and mitigate bot threats in real-time.

Another trend is the increasing use of multi-layered security approaches. Companies are no longer relying solely on firewalls or single-point solutions. Instead, they are integrating various security measures, such as bot management platforms, web application firewalls (WAF), and user behavior analytics. This multi-layered defense strategy provides more comprehensive protection against advanced bot attacks.

Bot security is also seeing a shift toward API security. Bots increasingly target APIs as they are the backbone of many modern applications. Securing APIs has become a priority, with developers focusing on enhancing API security by implementing better authentication, encryption, and monitoring solutions.

Business Benefits

Investing in bot security offers numerous business benefits, especially as the threat landscape continues to evolve. One of the key advantages is the protection of sensitive data. Many bot attacks aim to steal personal information, credit card details, or login credentials. With robust bot security in place, businesses can significantly reduce the risk of data breaches, protecting both themselves and their customers.

Bot security also helps in preventing financial losses. Bots are often used to automate fraudulent transactions, manipulate prices, or engage in inventory hoarding, especially in e-commerce and online service platforms. By deploying advanced bot management systems, businesses can detect and block these fraudulent activities before they cause significant damage.

Another critical benefit is the enhancement of competitive advantage. Companies that can efficiently manage bot threats and secure their digital assets are more likely to gain an edge over competitors. Customers are more likely to trust secure platforms, leading to higher conversion rates and brand loyalty.

Regional Analysis

In 2023, North America held a dominant market position in the bot security market, capturing more than a 35.1% share, equivalent to USD 212.4 million in revenue. This leadership is attributed to several key factors that position North America at the forefront of the bot security industry.

The presence of major technology firms and advanced IT infrastructure significantly contributes to North America’s leading position. The region is home to some of the world’s largest technology companies, including key players in the bot security market such as Imperva Inc. and Cloudflare Inc. which mitigate solutions that address the evolving security needs of modern businesses.

North America shows a high level of awareness and adoption of cybersecurity solutions due to the increasing incidence of cyber threats, including those perpetrated by sophisticated botnets. Regulatory frameworks and compliance standards in the U.S. and Canada also drive businesses to invest in robust cybersecurity measures, further boosting the bot security market.

Additionally, the technological readiness of organizations in North America to adopt cloud-based security solutions contributes to the region’s dominance. Cloud deployment offers scalability and flexibility in security operations, which is essential for effective bot management. This is complemented by the increasing shift of traffic from web to mobile platforms, where North American companies are leading in developing mobile-specific security solutions to thwart bot attacks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Bot security is becoming increasingly critical as automated threats evolve. Several key players in this space offer innovative solutions to protect organizations from malicious bot activity.

F5, Inc. stands out as a leading player in the bot security market, primarily due to its advanced security solutions that protect against automated threats and bot attacks. The company has been instrumental in developing security frameworks that not only detect and mitigate bots but also ensure compliance with evolving regulatory standards.

Akamai Technologies, Inc. is another key player in the bot security arena, known for its robust cloud security solutions. Akamai helps businesses protect their websites and mobile applications from bot-driven attacks, such as credential abuse and DDoS attacks, through its comprehensive cloud security platforms. The company’s strength lies in its vast global server network, which enables distributed security measures.

Cloudflare, Inc. is renowned for its efficiency in enhancing internet security and performance. In the bot security market, Cloudflare offers solutions that excel in preventing malicious bot traffic from affecting user experiences and compromising data. Their security products are designed to automatically recognize and block potential threats before they reach the client’s networks.

Top Key Players in the Market

- F5, Inc.

- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Imperva

- Sophos Ltd.

- Radware Ltd.

- Fastly, Inc.

- DataDome

- Kasada

- Reblaze Technologies Ltd.

- Other Key Players

Recent Developments

- In August 2024, F5, Inc. was recognized as a strong performer in the Forrester Wave report for Bot Management. F5’s SaaS-based bot defense platform is noted for its ease of use and strong reporting capabilities, designed to protect against sophisticated bot attacks in real-time.

- In August 2024, DataDome was named a leader in the Forrester Wave for bot management, praised for its AI-powered protection that processes over 5 trillion data signals daily. DataDome also won the Fortress Cybersecurity Award for Application Security and ranked highly in the G2 Grid® report for bot detection.

- In October 2023, Imperva responded to a critical vulnerability affecting F5’s BIG-IP solution (CVE-2023-46747), ensuring its customers using Cloud WAF and WAF Gateway were protected. This was part of their ongoing efforts to mitigate emerging threats.

- In April 2024, Fastly, Inc. launched its Bot Management Solution on. This solution is designed to help organizations combat automated attacks at the network edge, significantly reducing the risk of fraud, DDoS attacks, and account takeovers. It leverages Fastly’s Edge Cloud Platform, providing a multi-layered approach to stop malicious bots.

- In September 2024, Radware expanded its Cloud Security Offering by introducing a new Threat Intelligence Service. This service enhances Radware’s ability to protect against botnet and other cyber threats. Additionally, Radware has been actively involved in extending Hybrid DDoS Protection for major European stock exchanges.

Report Scope

Report Features Description Market Value (2023) USD 605.1 Mn Forecast Revenue (2033) USD 3,623.6 Mn CAGR (2024-2033) 19.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Security Type (Web Security, API Security, Mobile Security), By Deployment Mode (Cloud-Based,On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail and E-Commerce, Healthcare,Travel and Tourism, Media and Entertainment, Government and Defense, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F5, Inc., Akamai Technologies, Inc., Cloudflare, Inc., Imperva, Sophos Ltd., Radware Ltd., Fastly, Inc., DataDome, Kasada, Reblaze Technologies Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- F5, Inc.

- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Imperva

- Sophos Ltd.

- Radware Ltd.

- Fastly, Inc.

- DataDome

- Kasada

- Reblaze Technologies Ltd.

- Other Key Players