Global Boric Acid Market By Purity Grade ( < 99% and ≥ 99%) By Grade (Industrial Grade and Pharmaceutical Grade) By End-Use (Glass, Ceramic, Agriculture, Medical and Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 38458

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

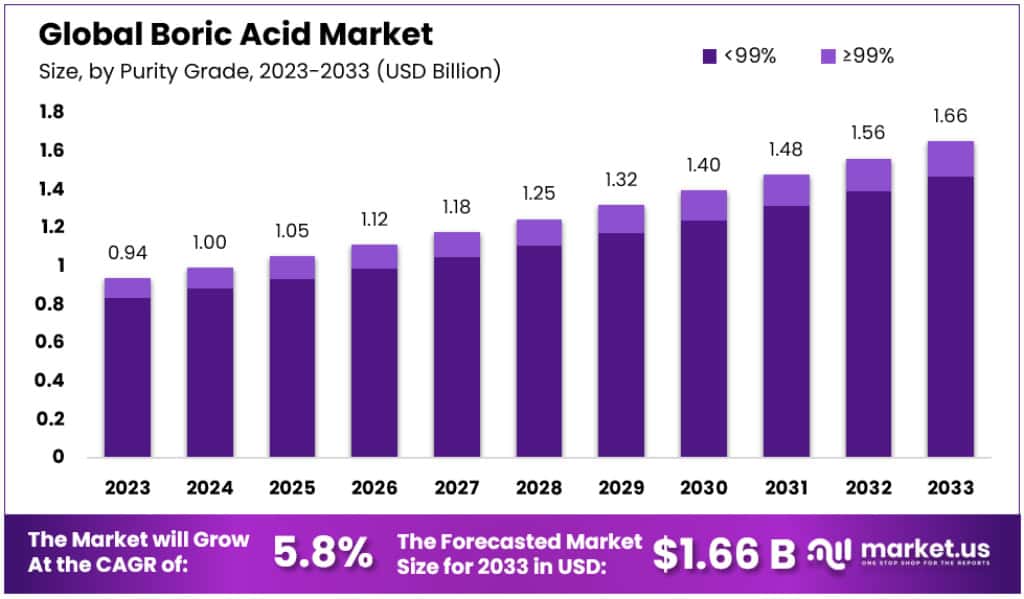

The Global Boric Acid Market size is expected to be worth around USD 1.66 Billion by 2033, from USD 0.94 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

Boric acid (H3BO3) is a boron compound which is a colorless, water-soluble, salt-like white powder. It is also known as boracic acid, hydrogen borate, and orthoboric acid. Boric acid is a low-toxic, non-volatile mineral with insecticidal, fungicidal, and herbicidal properties. It is widely used as an antiseptic, flame retardant, insecticide, lubricant, neutron absorber, or precursor to other chemical compounds. It is used as a liquid (applied as a spray or aerosol), wettable powder, emulsifiable concentrate, granule, powders, dust, pellets, tablets, paste, bait, or crystalline rod depending upon the circumstances and target pest.

Increasing demand for boric acid in glass and ceramics is a key factor driving growth of the global boric acid market, owing to its usage in various end-use industries. Boric acid is widely used in the manufacturing of monofilament fiberglass, usually known as textile fiberglass to reinforce plastics in various applications such as boats, industrial piping, computer circuit boards, etc. It is also used in the production of the glass made for LCD flat panel displays. Boric acid is used in medicine as an antiseptic for minor cuts or burns and is sometimes used in dressings and salves, such as boracic lint.

It is also used as an eyewash in a very dilute solution. Additionally, it can be used as an antibacterial compound for acne treatment and prevention of athlete’s foot. This is another factor expected to augment growth of the target market in the near future.

Boric acid acts as a “stomach poison” for certain pests such as cockroaches, ants, and termites. As an insecticide, it is usually applied in bait form or used as a dry powder in which contains a feeding attractant and then added into crevices and creaks so that it forms a layer of dust. So boric acid adheres to their legs when the insects move across the powder. In addition, boric acid is used as a food preservative in some foods and food products to preserve meats, meat products, caviar, and dairy products. This is because boric acid can inhibit the growth of microorganisms, which helps to preserve the food. These are some of the other factors proliferating the growth of the target market.

Purity Grade Analysis

In 2023, the boric acid market was distinctly segmented by purity grades, with <99% purity holding a dominant market position, capturing a significant 88.9% share. This segment’s substantial portion can be attributed to its widespread use in various industrial applications where ultra-high purity is not a critical requirement. Its utilization spans a range of sectors, including agriculture for pest control, ceramics for improving durability, and the pharmaceutical industry for various medicinal preparations. Despite its lower purity, this segment benefits from its broad application spectrum and cost-effectiveness, making it a preferred choice for many businesses seeking economical yet effective solutions.

On the other hand, the ≥99% purity grade of boric acid dominates the market in terms of high-tech applications and value-added products. The report highlights that the ≥99% segment, while not as voluminous in share as its counterpart, represented the largest segment in terms of strategic importance and growth potential. This higher purity boric acid is crucial in industries that require utmost precision and quality, such as electronics and semiconductors, where it plays an indispensable role in boron doping processes critical for enhancing semiconductor performance. Additionally, its application in the aerospace and defense sectors for the development of advanced materials demonstrates its vital role in supporting innovative technologies and sophisticated industrial applications. The demand for ≥99% purity boric acid is driven by its unparalleled efficacy and essential role in cutting-edge applications, ensuring its continued market dominance and growth trajectory.

Grade Analysis

In 2023, the boric acid market was distinctly categorized by grade, with Industrial Grade seizing a commanding market position by capturing more than a significant 87.2% share. This dominant stance stems from the escalating demand for industrial-grade boric acid across a spectrum of sectors. Predominantly used in glass manufacturing, textile production, and construction activities, this grade’s versatility and efficacy make it indispensable in industrial applications. The robust growth of these sectors, coupled with the continuous need for high-quality industrial chemicals, has significantly contributed to the dominance of this segment. The industrial grade’s substantial market share reflects its foundational role in diverse industrial processes, where it enhances product quality and manufacturing efficiency.

Conversely, the Pharmaceutical Grade boric acid, while smaller in market share, is poised for rapid growth, expected to expand at a substantial CAGR during the forecast period. The increasing recognition of its therapeutic properties and its widening applications in medical and healthcare products underpin this segment’s growth trajectory. As a mild antiseptic and a constituent in various ointments and eyewash solutions, pharmaceutical-grade boric acid is gaining prominence for its efficacy and safety. The rising focus on healthcare, coupled with growing investments in medical research and pharmaceutical manufacturing, is set to drive the demand for this grade, marking its critical role in the medical sector globally.

End-Use Analysis

In 2023, the Glass category in the boric acid market held a dominant position, capturing more than a significant 39.4% share. This commanding presence is primarily attributed to the extensive use of boric acid in the glass industry, where it’s utilized as a raw material to enhance durability and resistance in products like fiberglass and borosilicate glass. The demand within this segment is driven by its critical role in improving the thermal and chemical stability of glass products, making it indispensable in sectors ranging from construction to consumer goods.

The Ceramic category is also set to expand at a significant CAGR during the forecast period. Boric acid’s role in ceramic production is vital, contributing to the improved strength, thermal resistance, and aesthetic quality of ceramic goods. As the construction and home décor industries grow, so does the demand for high-quality ceramic products, thereby boosting the boric acid market in this segment.

In Agriculture, boric acid is utilized for its nutrient properties in plant growth and as a pest control agent. Its effectiveness in managing soil boron levels and protecting crops against a range of pests underscores its importance in the agricultural sector. With the global focus on increasing agricultural productivity and sustainable practices, the demand for boric acid in this segment is expected to remain steady.

The Medical category, particularly post-pandemic, has seen an uptick in the usage of boric acid. Its antiseptic and antifungal properties make it a valuable component in various pharmaceutical products and medical applications. The market growth in this segment is further supported by the rising healthcare standards and an increased focus on hygiene and patient care globally.

Other categories, including cosmetics, textiles, and fire safety, contribute to the diverse application spectrum of boric acid. Its role in reducing CO2 emissions in fire stations and its use as a preservative in the food industry due to its antimicrobial properties highlight the versatility of boric acid. The continuous innovation in manufacturing and application methods, such as new vacuum technology, further supports the market’s expansion across these varied sectors.

Key Market Segments

Purity Grade

- <99%

- ≥99%

Grade

- Industrial Grade

- Pharmaceutical Grade

End-Use

- Glass

- Ceramic

- Agriculture

- Medical

- Others

Drivers

- Diverse Industrial Demand: Boric acid’s role in agriculture as a micronutrient is particularly impactful, significantly benefiting crops like fruits and vegetables. In the glass industry, over 55% of the world’s borates, which are integral to producing borosilicate and fiberglass, rely on boric acid. A staggering 211,000 Mt of boric acid is required to meet this demand, highlighting its critical role in various sectors.

- Building and Construction Growth: The demand in the construction sector is underscored by the fact that a considerable portion of borates (used in producing glass and insulation materials) supports this industry’s growth. The fiberglass market, a key application of boric acid, is witnessing an upswing with the rise in energy-efficient building practices.

- Insulation Material Demand: Boric acid derivatives are crucial in creating borosilicate glass fibers, a high-performance insulating material. With the trade in borax pentahydrate and decahydrate, closely related to boric acid, increasing by 40% from 2020 to 2022, the demand for these advanced insulating materials is evident.

Restraints

- Competition and Alternatives: While boric acid is essential in many applications, it faces competition from substitutes. For instance, in the glass industry, alternative fluxing agents can sometimes be used, posing a challenge to boric acid’s market share.

- Environmental and Health Regulations: The safe use of boric acid is critical due to potential environmental and health impacts. With strict regulations in place, manufacturers must navigate these constraints carefully, which can sometimes hinder market growth.

Opportunities

- Sustainable Agriculture Focus: As the agricultural sector increasingly adopts sustainable practices, boric acid’s role as a micronutrient and pest control agent grows. This trend is supported by the broader movement towards organic farming, where boric acid’s benefits are especially valued.

- Emerging Markets and Applications: New technologies and applications present opportunities for boric acid. For example, its use in advanced materials and energy storage signifies potential growth areas, especially as industries look for eco-friendly and efficient solutions.

Challenges

- Limited Raw Material Supply: The availability of boron minerals is a significant concern. With more than 60% of the world’s borates consumed in Asia alone, the competition for these resources can affect market stability and prices.

- Fluctuating Mineral Prices: The cost of boron minerals, crucial for boric acid production, can vary widely. For instance, the extensive use of borates in glass and ceramics influences the demand and price of these minerals, impacting the overall market for boric acid.

Trends

- Alternative Flame Retardants: Boric acid’s use as a flame retardant in construction is increasing, partly due to its presence in over 55% of borates used in glass production, which is essential for building materials.

- Natural Personal Care Products: The incorporation of boric acid into natural and organic personal care products is rising, reflecting a consumer shift towards safer, eco-friendly options. This trend aligns with the increasing awareness and demand for sustainable products.

- Sustainable Agriculture Practices: The growing demand for boric acid-based fertilizers and pesticides is indicative of the shift towards sustainable agriculture practices, where boric acid’s role as a micronutrient is crucial.

- Technological Advancements: Ongoing advancements in boric acid applications, such as its role in ceramics, where it’s becoming a necessary component due to its longevity and quality enhancement properties, indicate a market responsive to innovation and efficiency.

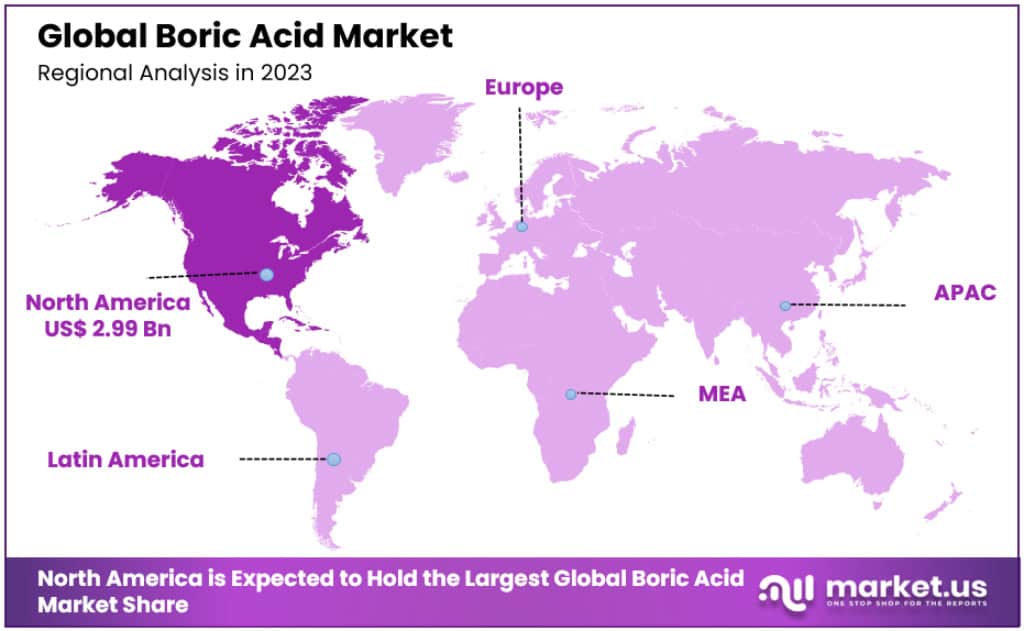

Regional Analysis

In the boric acid market, North America stands out with a dominant 32.4% share, boasting a market value of USD 2.99 Billion in 2023. This region’s rapid urban growth and a spike in construction demand, especially for materials like textile fiberglass that rely on boric acid, fuel its leading position. The agricultural sector’s need for boric acid further solidifies this dominance, with expectations to maintain its lead through 2030.

Europe follows as the second-largest market, driven by technological advancements and a booming automotive sector. Germany leads in market share within Europe, while the UK is catching up fast, showing the quickest growth in the region. Europe’s stake in the global market is significant, with boric acid’s widespread use in fiberglass production and agriculture, contributing to a notable ~10% of the global market.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Big companies are investing a lot in research and development to add more products and help the Boric Acid market grow. They’re launching new products, joining forces with other companies, and making smart investments.

One strategy companies use is making products locally to cut down on expenses. This helps them serve their customers better and grow their part of the market. The Boric Acid industry has seen some big benefits recently, and major players like 3M are working hard to keep the demand high by putting money into research and development.

3M, a big American company, makes over 60,000 products in different areas like healthcare and consumer goods. It’s based in Minnesota and is always creating new things. For example, in 2019, it planned to buy Acelity Inc. and its KCI subsidiaries for about $6.7 billion.

FMC Corporation is another big name, focusing on helping farmers grow better crops and dealing with climate change. They have solutions for crop protection and have about 6,400 employees worldwide. In 2022, FMC India added three new products to help Indian farmers.

3M makes a special kind of boric acid that can be used in different nuclear applications. Borax has a modern facility in India that is self-sufficient and makes high-quality boric acid. Gujarat Boron Derivatives, with facilities in Gujarat, India, sells its products all over the world and is known for its high-quality boric acid.

Key Market Players

- Rio Tinto (U.S. Borax Inc.)

- 3M

- EtiMaden

- Nirma Limited (Searles Valley Minerals Inc.)

- NIPPON DENKO CO.LTD

- Promega Corporation

- Southern Agricultural Insecticides Inc.

- Quiborax

- American Borate Company

- Minera Santa Rita S.R.L. (MSR)

Recent Developments

Acquisitions

- December 2023: The world’s largest boric acid producer, Rio Tinto Minerals, announced plans to acquire a majority stake in Turkish boric acid manufacturer Eti Maden Borax Isletmeleri (ETMIB). This acquisition will further solidify Rio Tinto’s dominance in the global boric acid market and is expected to close in the first half of 2024.

New Trends

- Growing Demand for Sustainable Borax Production: Concerns about the environmental impact of traditional borax mining are driving demand for sustainable alternatives. Companies like Anatolia Minerals are exploring more environmentally friendly production methods, such as using geothermal energy to power borax processing facilities.

- Increased Application in Green Technologies: Boric acid is finding new applications in green technologies, such as solar panels, wind turbines, and electric vehicles. This rise in demand is expected to boost the boric acid market in the coming years.

Company News

- Boric Acid Prices Fluctuate: Boric acid prices experienced fluctuations in December 2023 due to ongoing supply chain disruptions and rising energy costs. However, analysts predict a steady increase in prices throughout 2024 due to the aforementioned factors, particularly the growing demand for green technologies.

Report Scope

Report Features Description Market Value (2023) USD 0.94 Billion Forecast Revenue (2033) USD 1.66 Billion CAGR (2023-2033) 5.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Grade (<99% and ≥99%) By Grade (Industrial Grade and Pharmaceutical Grade) By End-Use (Glass, Ceramic, Agriculture, Medical and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Borax, 3M, NIPPON DENKO CO. LTD, Minera Santa Rita S.R.L. (MSR), Southern Agricultural Insecticides Inc., Nirma Limited, Promega Corporation, Rio Tinto Group, EtiMaden, Others. and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rio Tinto (U.S. Borax Inc.)

- 3M

- EtiMaden

- Nirma Limited (Searles Valley Minerals Inc.)

- NIPPON DENKO CO.LTD

- Promega Corporation

- Southern Agricultural Insecticides Inc

- Quiborax

- American Borate Company

- Minera Santa Rita S.R.L. (MSR)