Global Network Surveillance Cameras Market Size, Share, Industry Analysis Report By Component (Hardware, Services), By Product Type (Fixed, Pan-Tilt-Zoom (PTZ), Infrared), By Connection Type (Consolidated, Distributed, By End-use (Residential, Commercial [BFSI, Education, Healthcare, Real Estate, Retail, Transportation & Logistics, Others], Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169673

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

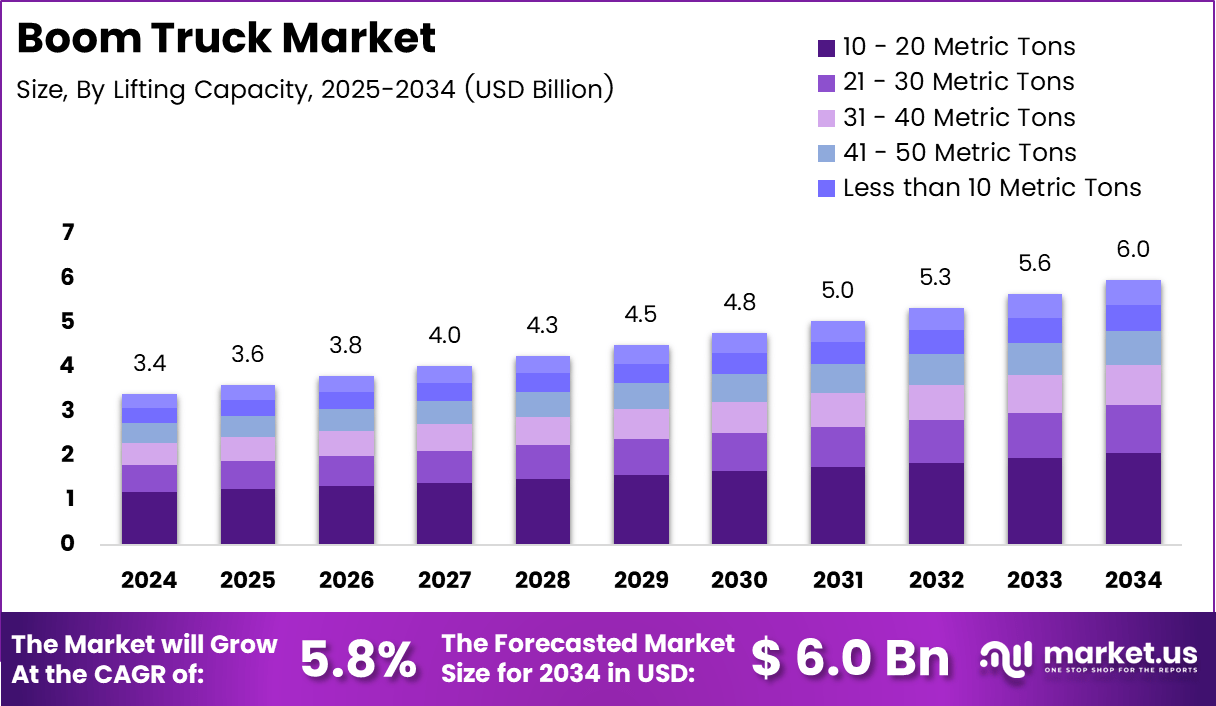

The Global Boom Truck Market size is expected to be worth around USD 6 billion by 2034, from USD 3.4 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

A boom truck market represents a specialized segment of lifting equipment integrated onto commercial truck chassis, enabling efficient material handling across construction, utilities, telecom, and infrastructure sectors. This market focuses on mobility, faster setup, reduced operating time, and flexible lifting ranges suitable for urban and industrial project environments.

Growing demand accelerates as construction activity expands, utilities modernize networks, and municipalities adopt fleet upgrades for safer and faster lifting operations. Rising infrastructure spending further strengthens the adoption curve, supporting broader deployment across highway development, grid maintenance, and commercial project timelines where mobile lifting solutions become operationally practical.

Opportunities emerge from technological innovation and regulatory tightening that encourage equipment modernization. Increasing adoption of Automotive telematics, load-monitoring systems, and operator-assist technologies enhances safety and compliance. Government investment in smart cities, renewable energy installation, and transmission-line expansion continues to reinforce new procurement pipelines for advanced boom truck solutions.

Regulations focusing on operator safety, outrigger deployment, permissible load standards, and emissions compliance reshape purchase decisions. Manufacturers increasingly integrate improved outriggers, lightweight booms, and automated controls to align with evolving standards. Markets benefit from rising equipment rental penetration, where contractors favor cost-effective access to high-reach lifting systems without long-term ownership burdens.

According to survey, the 65-ton model features a 155-foot main boom, a 32- to 50-foot jib, and a 215-foot maximum sheave height supported by smart swing-out outriggers with four deployment positions. These advances improve stability and operational reach across multi-stage construction and industrial lifting tasks in the boom truck market.

Similarly, the 40-ton crane incorporates a 142-foot boom, a 55-foot jib, and a 207-foot tip height using an out-and-down outrigger system, according to manufacturer specifications. New truck-mounted cranes offering 80-foot five-section booms and modern U-shaped boom designs with 142-foot reach enhance lifting performance and reduce structural stress.

According to industry production insights, custom crane manufacturing scales to nearly 2,000 units annually for tailored applications, supporting rapid market diversification. These advancements collectively reinforce strong demand drivers, with boom trucks becoming essential for material handling, utility operations, and infrastructure upgrades across global markets.

Key Takeaways

- The Global Boom Truck Market is projected to reach USD 6 billion by 2034, expanding from USD 3.4 billion in 2024.

- The market grows at a steady rate with a projected CAGR of 5.8% between 2025–2034.

- The Boom Length segment is led by the 20–30m category, accounting for a 48.9% share.

- Behind the Cab Mount dominates the Mount segment with a 59.5% market share in 2024.

- The Lifting Capacity segment is led by the 10–20 Metric Tons range, capturing 34.7% of total demand.

- North America is the leading regional market with a 38.9% share, valued at USD 1.3 billion in 2024.

Boom Length Analysis

20 – 30m dominates the Boom Length segment with a 48.9% share due to its balanced reach and operational flexibility.

20 – 30m held a dominant market position in the Boom Length Analysis segment of the Boom Truck Market, with a 48.9% share. This range supports versatile lifting tasks, enabling efficient construction operations. Additionally, its flexibility strengthens adoption across utilities, infrastructure monitoring, and maintenance projects worldwide.

Less than 20m contributed steadily to the Boom Length segment as operators pursued compact, maneuverable units for urban sites. This configuration suits light-duty lifting, sign installation, and municipal works. Moreover, the shorter reach enables cost-effective deployment, appealing to small contractors and fleet owners targeting routine elevation tasks.

31 – 40m remained an essential category within the Boom Length segment as infrastructure projects required higher working heights. This configuration enhances operational capability for multi-story construction. Furthermore, its extended reach improves efficiency in telecom, bridge maintenance, and industrial applications demanding elevated and stable lifting performance.

More than 40m supported high-reach operations across complex industrial environments. This configuration is increasingly adopted in energy, large construction sites, and specialized maintenance tasks. Similarly, its capability to tackle challenging heights enhances safety and reduces equipment switching, creating operational benefits for contractors handling advanced elevation requirements.

Mount Type Analysis

Behind the Cab Mount dominates the Mount segment with a 59.5% share, owing to its stability and improved load handling.

Behind the Cab Mount held a dominant market position in the By Mount Analysis segment of the Boom Truck Market, with a 59.5% share. This configuration enhances weight distribution and operator visibility. Additionally, it supports higher lifting performance, boosting adoption across construction, utility maintenance, and logistics operations.

Rear Mount gained traction among users seeking enhanced operational flexibility. This configuration allows operators to position the boom closer to job site edges, improving reach and workflow efficiency. Furthermore, it supports better maneuvering during confined-space lifting, strengthening its use in roadwork, landscaping, and municipal utility applications.

Swing Seat configurations addressed applications requiring precise boom control. This seating design enhances operator comfort and visibility, enabling smoother operation during elevated tasks. Moreover, its ergonomic control arrangement reduces fatigue during extended shifts, supporting higher productivity in projects demanding repetitive lifting or accurate placement activities.

Lifting Capacity Analysis

10 – 20 Metric Tons dominates the Lifting Capacity segment with a 34.7% share due to its strong suitability for mid-range lifting operations.

10 – 20 Metric Tons held a dominant market position in the By Lifting Capacity Analysis segment of the Boom Truck Market, with a 34.7% share. This range addresses mainstream construction and maintenance tasks. Additionally, its balance of power and mobility improves utility for contractors pursuing efficient jobsite performance.

Less than 10 Metric Tons served light-duty lifting across municipal, commercial, and utility maintenance work. This capacity benefits operators seeking compact equipment for tight spaces. Moreover, its cost-effectiveness and ease of operation continue to support adoption among small service providers targeting routine lifting needs.

21 – 30 Metric Tons supported medium-heavy applications as contractors expanded activity in the infrastructure and industrial sectors. This range enhances load stability at extended heights, improving safety during demanding lifts. Furthermore, its capability enables efficient handling of structural components, machinery placement, and energy-sector maintenance.

31 – 40 Metric Tons provided robust performance for heavy construction. This category strengthens utility in bridge work, commercial building erection, and plant maintenance. Additionally, its enhanced lifting strength helps decrease downtime by minimizing the need for multiple equipment setups during large-scale structural operations.

41 – 50 Metric Tons addressed specialized lifting operations involving heavy components. This capacity proved valuable across Drill bit, industrial fabrication, and transportation infrastructure. Likewise, its improved load-bearing potential increases operational efficiency for contractors handling high-precision elevation tasks requiring strong stability and reach.

More than 50 Metric Tons contributed to ultra-heavy lifting requirements across energy, petrochemical, and large infrastructure developments. This segment supports demanding industrial operations, enabling safer handling of oversized loads. Moreover, its advanced structural performance assists contractors engaged in high-complexity elevation tasks requiring exceptional lifting capability.

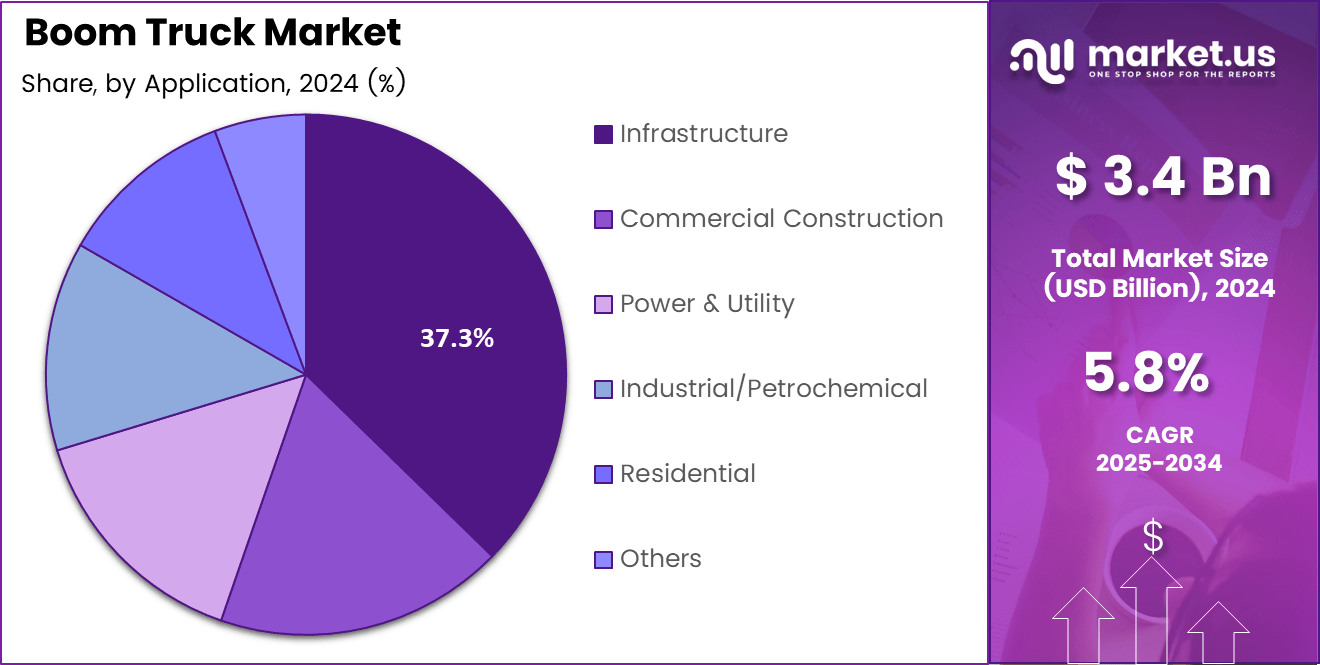

By Application Analysis

Infrastructure dominates with 37.3% due to extensive use in roadwork, public utilities, and structural development.

Infrastructure held a dominant market position in the By Application Analysis segment of the Boom Truck Market, with a 37.3% share. This segment grows steadily as governments expand road networks and bridges. Additionally, infrastructure upgrades require reliable lifting systems, strengthening boom truck adoption for heavy and mid-range elevation tasks across public projects.

Commercial Construction contributed significantly to the Boom Truck Market as developers pursued faster building cycles. This segment benefits from the need to lift materials to elevated floors. Furthermore, rising commercial real estate development encourages contractors to deploy mobile lifting equipment, improving workflow efficiency and reducing operational downtime during project execution.

Power & Utility applications expanded steadily as grid modernization and energy distribution upgrades advanced. This segment requires safe elevation for pole installation, transformer handling, and maintenance tasks. Moreover, the growing shift toward renewable energy infrastructures increases the use of boom trucks for panel placement and system repairs, ensuring operational continuity.

Industrial/Petrochemical projects maintained a consistent demand for boom trucks due to complex facility maintenance activities. This segment depends on stable lifting for pipelines, machinery shifts, and refinery upkeep. Additionally, industrial safety standards promote equipment with improved control and reach, reinforcing boom truck usage in hazardous and constrained work environments.

Residential applications supported moderate market activity as housing development expanded across urban and semi-urban regions. This segment uses boom trucks for roofing, material shifting, and repair workflows. Furthermore, compact boom models enhance accessibility in tight neighborhoods, helping contractors improve efficiency during small-scale elevation tasks.

Other applications such as telecom, landscaping, and municipal operations, continued to expand their use of boom trucks. These tasks require precise elevation for signage installation, tower maintenance, and tree trimming. Additionally, growing municipal infrastructure programs encourage the use of versatile lifting systems to support daily operational requirements across various service sectors.

Key Market Segments

By Boom Length

- Less than 20m

- 20 – 30m

- 31 – 40m

- More than 40m

By Mount

- Behind the Cab Mount

- Rear Mount

- Swing Seat

By Lifting Capacity

- Less than 10 Metric Tons

- 10 – 20 Metric Tons

- 21 – 30 Metric Tons

- 31 – 40 Metric Tons

- 41 – 50 Metric Tons

- More than 50 Metric Tons

By Application

- Infrastructure

- Commercial Construction

- Power & Utility

- Industrial/Petrochemical

- Residential

- Others

Drivers

Rising Adoption of Boom Trucks for Modular Infrastructure Drives Market Growth

Rising adoption of boom trucks for modular infrastructure and prefabricated construction handling accelerates overall market demand. These vehicles support quick lifting, precise placement, and safer workflows, enabling contractors to manage heavy components effectively. Further, modular building methods expand rapidly, creating a consistent need for versatile lifting solutions.

Increasing deployment in utility maintenance and telecom tower installation also strengthens market momentum. Boom trucks help technicians access elevated points quickly, improving repair efficiency and reducing downtime. Growing investments in telecom upgrades, fiber rollouts, and grid modernization contribute to steady equipment utilization across service providers.

Growing demand for efficient lifting equipment across oilfield support operations adds another layer of opportunity. The sector relies heavily on dependable lifting systems to handle drilling materials and maintenance tasks safely. Boom trucks offer reliability and flexible mobility, making them essential in remote oilfield environments where operational stability matters most.

Expansion of fleet modernization programs among rental service providers further boosts market growth. Rental companies increasingly replace older units with advanced boom trucks that deliver improved safety features, fuel efficiency, and better control. This modernization trend supports broader customer adoption, especially among contractors preferring rental over ownership.

Restraints

High Upfront Procurement Cost Limits Wider Equipment Adoption

High upfront procurement cost, limiting adoption among small contractors, remains a major restraint. Many small firms struggle to justify investment in advanced boom trucks due to financial constraints, prompting a preference for rentals instead of ownership. This slows market penetration in cost-sensitive regions.

Operational restrictions in densely populated urban zones also challenge market expansion. Tight streets, traffic rules, and limited maneuvering space make large lifting equipment difficult to operate. These barriers reduce deployment frequency in crowded cities where regulatory approvals and safety requirements create operational hurdles.

Skilled operator shortages affecting safe and efficient equipment handling add further pressure. Boom trucks require trained professionals to manage complex lifting tasks securely. The lack of certified operators increases operational risks and limits utilization, particularly for companies expanding into new project categories.

Additional compliance requirements related to safety inspections and licensing also impact adoption. These obligations increase operational overhead and prolong deployment timelines, discouraging smaller enterprises from investing in such equipment. As a result, regional adoption varies based on workforce readiness and regulatory clarity.

Growth Factors

Development of Hybrid and Electric Boom Truck Platforms Creates New Growth Space

The development of hybrid and electric boom truck platforms for cleaner operations offers strong opportunities. Companies increasingly seek low-emission lifting solutions to meet environmental regulations and sustainability commitments. Electric boom trucks reduce fuel expenses, improve worksite air quality, and support operations in emission-sensitive zones.

Integration of remote diagnostics and telematics for predictive maintenance strengthens long-term fleet efficiency. These technologies help operators track performance, detect issues early, and minimize breakdowns. Predictive insights reduce maintenance costs and extend vehicle life, making advanced boom trucks more attractive for fleet owners.

Growing investments in smart construction technologies further accelerate telematics adoption. Contractors use digital tools to optimize fleet scheduling, load monitoring, and operator performance. These improvements enhance productivity and support wider acceptance of data-enabled boom trucks across key industries.

The increasing shift toward automated maintenance planning also unlocks new services for manufacturers and rental providers. Digital platforms allow companies to offer proactive support, boosting customer satisfaction and equipment reliability. This ecosystem encourages modernization and boosts the market’s overall growth potential.

Emerging Trends

Shift Toward Lightweight High-Strength Steel Designs, Shapes, Market Trends

Shift toward lightweight high-strength steel booms for extended reach reflects a key industry trend. These materials improve lifting capacity without increasing vehicle weight, enabling safer and more efficient operations. Manufacturers adopt advanced metallurgy to deliver stronger and longer booms for complex job requirements.

Increased customization of boom trucks for sector-specific applications further shapes demand patterns. Industries require tailored configurations for utilities, oilfields, construction, and forestry. Custom platforms improve work efficiency and broaden usage scenarios, supporting wider application diversity across markets.

Rising acceptance of intelligent outrigger control and stability monitoring systems enhances overall equipment safety. Advanced sensors help operators maintain reliable ground stability, especially in uneven terrains. These technologies reduce operational risks and support compliance with evolving safety standards.

Growing adoption of automation features and control enhancements further strengthens system performance. Intelligent interfaces offer smoother operations and reduce operator fatigue. As digital capabilities expand, boom trucks become more predictable, safer, and aligned with modern jobsite expectations.

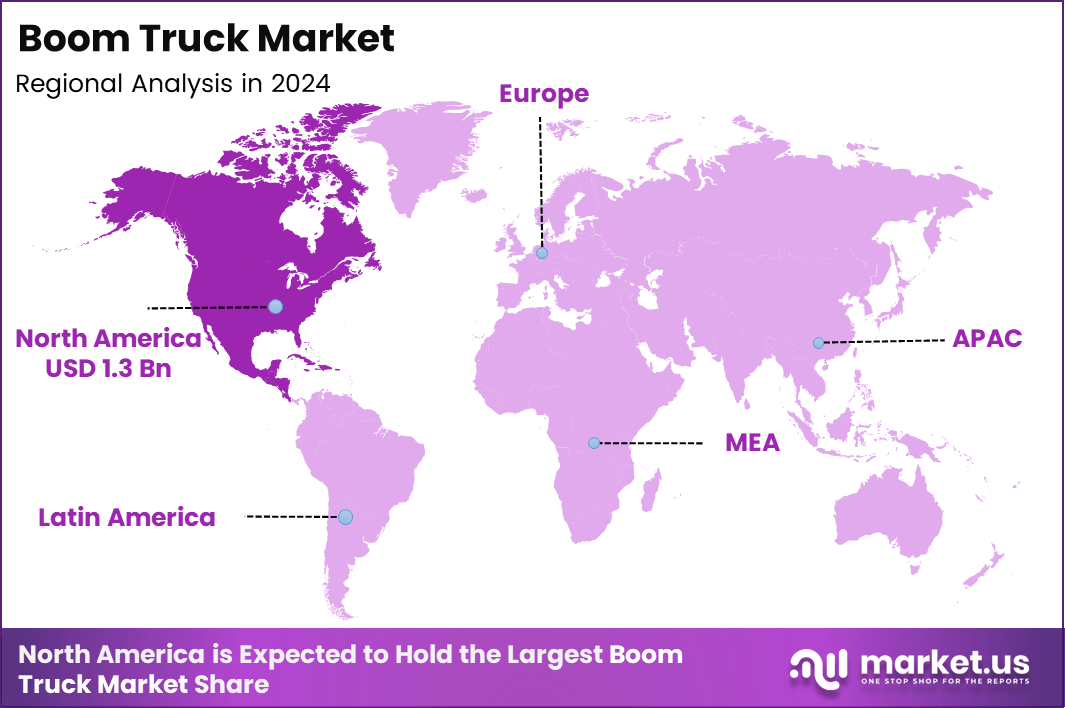

Regional Analysis

North America Dominates the Boom Truck Market with a Market Share of 38.9%, Valued at USD 1.3 Billion

North America holds the leading position in the Boom Truck Market, supported by strong construction spending, utility grid upgrades, and rising telecom tower maintenance activities. The region’s 38.9% share and valuation of USD 1.3 billion reflect the rapid integration of advanced lifting technologies, fleet modernization, and higher rental penetration across industrial and municipal applications. Ongoing infrastructure renewal programs further accelerate equipment adoption.

Europe Boom Truck Market Trends

Europe shows stable growth driven by cross-border transport development, energy transition projects, and increased deployment in wind farm installations requiring precise lifting capabilities. Regulatory emphasis on worksite safety encourages fleet upgrades, while urban redevelopment initiatives enhance equipment usage. Demand continues rising across Germany, France, and the Nordics due to strong public infrastructure commitments.

Asia Pacific Boom Truck Market Trends

Asia Pacific demonstrates fast-growing adoption due to expanding construction pipelines, smart city rollouts, and rapid telecom infrastructure expansion. Countries across Southeast Asia, India, and China prioritize high-reach equipment for modular building, heavy lifting, and power distribution maintenance. Growing investments in industrial facilities and logistics hubs also stimulate consistent market demand.

Middle East and Africa Boom Truck Market Trends

The Middle East and Africa experience increasing deployment of boom trucks, supported by oil and gas expansion, mega infrastructure programs, and rising utility network development. GCC nations adopt advanced lifting equipment for large-scale construction and refinery projects, while African economies gradually expand usage through urban infrastructure and mining-related applications.

Latin America Boom Truck Market Trends

Latin America shows a steady expansion pattern driven by construction sector recovery, renewable energy investments, and enhanced utility maintenance requirements. Brazil, Mexico, and Chile exhibit rising demand for mid- and long-boom configurations to support telecom upgrades and industrial operations. Government-driven transport corridor improvements further encourage equipment utilization.

United States Boom Truck Market Trends

The US represents the strongest national market due to consistent federal infrastructure funding, rapid 5G tower deployment, and high replacement rates among rental fleets. Demand remains strong across construction, utilities, energy, and municipal maintenance workflows. Increasing adoption of higher-capacity and longer-boom models reinforces the country’s significant contribution to overall market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Boom Truck Company Insights

The Manitowoc Company, Inc. strengthened its position in the boom truck market through continuous engineering improvements and operator-focused design enhancements. The company’s strategic emphasis on higher lifting efficiency and reliable field performance supports growing adoption across construction and utility sectors. Its broad product capabilities help address diverse lifting requirements globally.

Fassi Gru S.p.A. maintained steady market influence by expanding its technologically advanced crane solutions known for precision, stability, and versatile configurations. The company’s investments in lightweight materials and enhanced safety systems align well with industry demand for efficient, durable lifting platforms. Its reputation for customization supports strong engagement across industrial users.

Elliott Equipment Company continued gaining traction through purpose-built boom truck designs optimized for utility, telecom, and infrastructure applications. The company’s focus on high-reach performance, ergonomic controls, and reliability resonates with operators seeking durable solutions for daily field tasks. Its customer-centric engineering approach enhances long-term equipment value.

Altec Industries demonstrated a strong market presence driven by its engineering expertise and integrated lifting technologies that support a wide range of utility and construction operations. The company’s emphasis on safety, innovation, and fleet optimization positions it well for ongoing market expansion. Its diversified boom truck offerings align effectively with rising infrastructure and maintenance needs.

Top Key Players in the Market

- The Manitowoc Company, Inc.

- Fassi Gru S.p.A.

- Elliott Equipment Company

- Altec Industries

- Manitex International, Inc.

- Terex

- Able Rigging Contractors Inc.

- Aspen Equipment LLC

- Dur A Lift Inc.

- Interlake Crane Inc.

Recent Developments

- In Dec 2025, Miller Industries, Inc., the world’s largest manufacturer of towing and recovery equipment, completed the acquisition of Omars S.p.A. in an all cash transaction valued at approximately €17.5 million (about $20.3 million).The acquisition expands Miller Industries’ European manufacturing footprint and strengthens its global portfolio of towing and recovery vehicles.

- In Jan 2024, Barnhart Crane and Rigging purchased White Crane, a South Carolina based crane service provider, marking its second branch in the state.This acquisition supports Barnhart’s regional expansion strategy and enhances lifting, rigging, and heavy transport service coverage across the Southeastern US.

Report Scope

Report Features Description Market Value (2024) USD 3.4 billion Forecast Revenue (2034) USD 6 billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Boom Length (Less than 20m, 20 – 30m, 31 – 40m, More than 40m), By Mount (Behind the Cab Mount, Rear Mount, Swing Seat), By Lifting Capacity (Less than 10 Metric Tons, 10 – 20 Metric Tons, 21 – 30 Metric Tons, 31 – 40 Metric Tons, 41 – 50 Metric Tons, More than 50 Metric Tons), By Application (Infrastructure, Commercial Construction, Power & Utility, Industrial/Petrochemical, Residential, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Manitowoc Company, Inc., Fassi Gru S.p.A., Elliott Equipment Company, Altec Industries, Manitex International, Inc., Terex, Able Rigging Contractors Inc., Aspen Equipment LLC, Dur A Lift Inc., Interlake Crane Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Manitowoc Company, Inc.

- Fassi Gru S.p.A.

- Elliott Equipment Company

- Altec Industries

- Manitex International, Inc.

- Terex

- Able Rigging Contractors Inc.

- Aspen Equipment LLC

- Dur A Lift Inc.

- Interlake Crane Inc.