Global Boat Rental Market Size, Share, Growth Analysis By Boat Type (Motorboat, Yacht, Sailing Boat, Catamaran, Inflatable/RIB), By Boat Size (Between 30 and 79 ft, Less than 30 ft, Greater than 79 ft), By Power Source (IC Engine, Hybrid, Full-Electric), By Activity Type (Leisure Sailing/Cruising, Fishing, Watersports (towing, diving, etc.), Sight-seeing/Day-cruise), By Rental Duration (Hourly, Half-Day, Full-Day, Multi-Day/Weekly), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171182

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

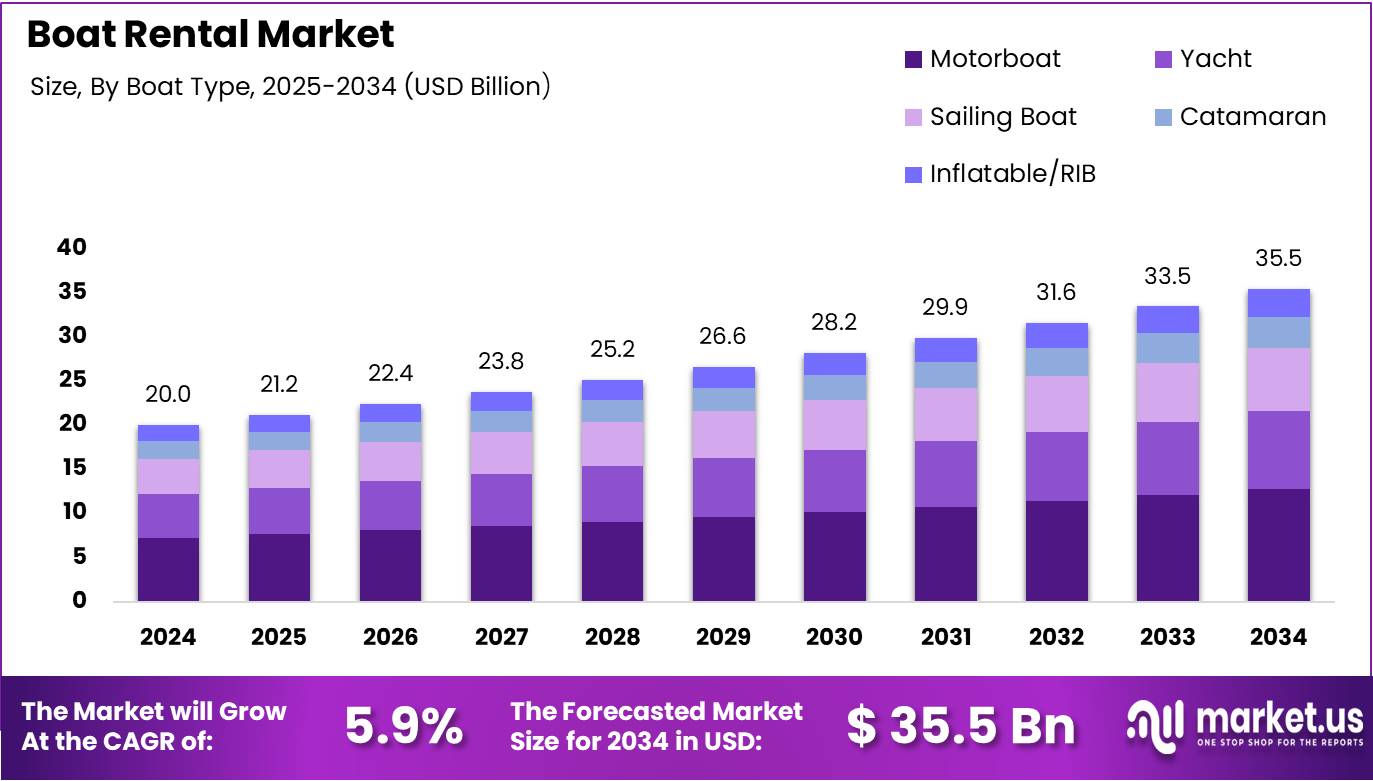

The Global Boat Rental Market size is expected to be worth around USD 35.5 Billion by 2034, from USD 20 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Boat Rental Market represents a dynamic segment within the recreational tourism industry, facilitating temporary vessel access for leisure activities. This market encompasses various watercraft types, from basic kayaks to luxury yachts, serving diverse customer needs. Subsequently, operators generate revenue through hourly, daily, or weekly rental arrangements across coastal regions, lakes, and inland waterways globally.

Market growth demonstrates robust momentum as consumer preferences shift toward experience-based recreation rather than ownership commitments. Millennials and Gen Z particularly favor rental models, avoiding maintenance costs and storage challenges. Consequently, the industry attracts entrepreneurs recognizing accessible entry points and scalable business opportunities within tourism ecosystems.

Profitability metrics reveal attractive margins for operators, with typical profit margins ranging from 20% to 40% across rental operations. This financial performance reflects relatively low operational overhead compared to capital-intensive marine businesses. Furthermore, established operators benefit from repeat customers and seasonal demand patterns that optimize revenue generation throughout peak periods.

Government investment in waterway infrastructure and marina development significantly enhances market accessibility. Regulatory frameworks ensure safety standards, licensing requirements, and environmental protections that professionalize the industry. Meanwhile, authorities balance conservation objectives with economic development goals, creating structured operating environments for rental businesses.

The fishing boat rental segment commands premium pricing, typically ranging from $330 to $750 per day, reflecting specialized equipment needs. Remarkably, 16% of the U.S. population engages with motorboats for recreation, including rental usage, demonstrating substantial market penetration. This participation rate underscores increasing consumer willingness to experience watercraft without ownership commitments.

Pricing strategies vary considerably across vessel categories, enabling operators to target multiple customer segments simultaneously. Daily rental rates span diverse tiers, smaller vessels like kayaks cost $30–$100, mid-sized boats including jet skis and pontoons range $200–$800, sailboats command $300–$700, while luxury yachts reach $10,000 per day. These diversified price points maximize market reach and revenue optimization across different demographic groups effectively.

Key Takeaways

- Global Boat Rental Market is expected to reach USD 35.5 Billion by 2034, growing from USD 20 Billion in 2024 at a CAGR of 5.9%.

- Motorboat dominates by boat type with a 36.8% share.

- Boats sized Between 30 and 79 ft lead the market with a 45.2% share.

- IC Engine is the primary power source with a 76.4% share.

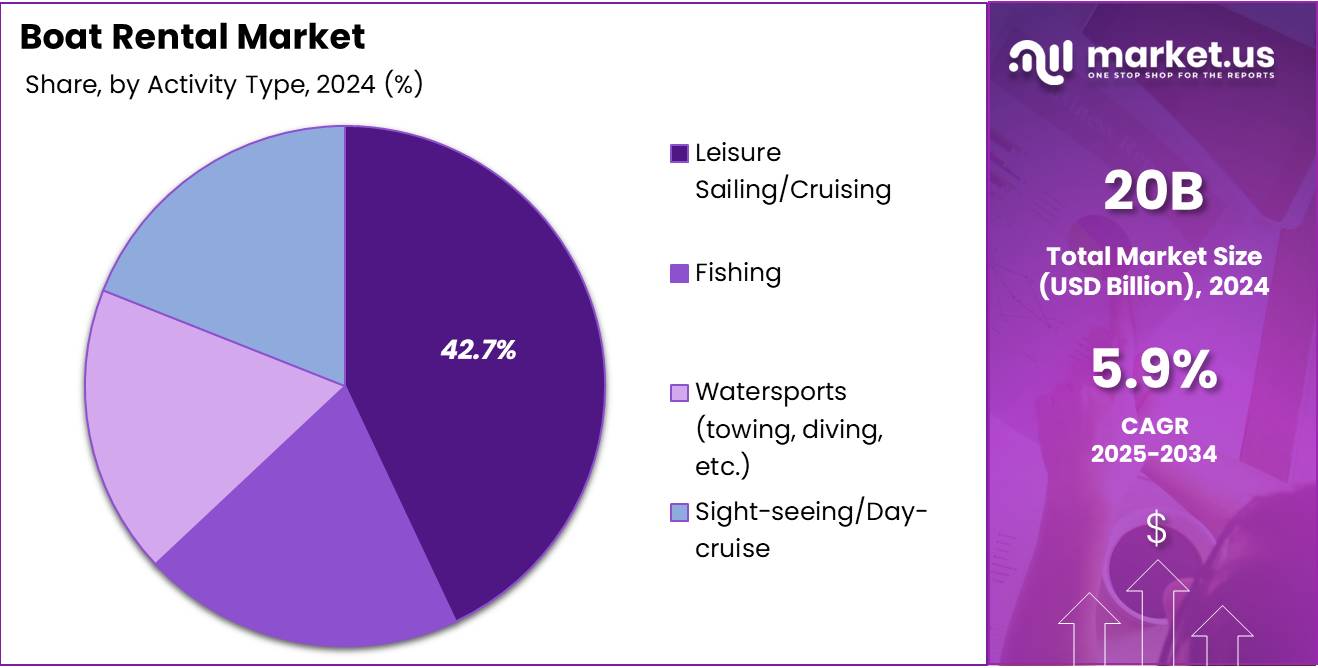

- Leisure Sailing/Cruising is the leading activity type with 42.7% share.

- Hourly rentals dominate by rental duration with 31.9% share.

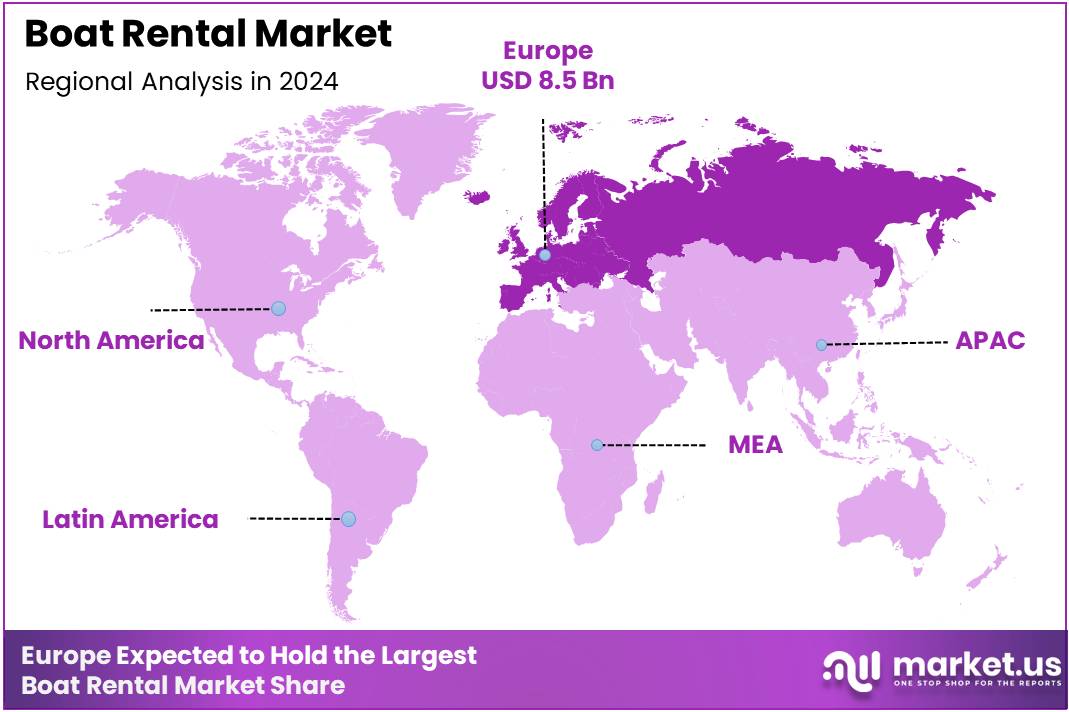

- Europe is the largest regional market with a 42.8% share, valued at USD 8.5 Billion.

By Boat Type Analysis

Motorboat dominates with 36.8% due to its versatility, speed, and suitability for short-distance recreational trips.

In 2024, Motorboat held a dominant market position in the By Boat Type Analysis segment of Boat Rental Market, with a 36.8% share. Motorboats remain highly preferred for casual day trips, coastal cruising, and recreational water activities. Their ease of handling, speed, and adaptability make them suitable for both experienced and novice boaters. This flexibility also supports high turnover rentals, making them a staple in busy coastal and urban water destinations.

Yachts are increasingly sought for premium experiences, private charters, and luxury cruising. They attract high-net-worth tourists who value privacy, onboard amenities, and exclusive services. Although rental frequency is lower than motorboats, yachts contribute disproportionately to revenue due to higher pricing. Their appeal extends to corporate events, celebrations, and multi-day cruises, making them a significant segment in high-end boating markets.

Sailing boats maintain steady demand among eco-conscious and adventure-focused users. Driven by wind power, these vessels appeal to travelers seeking immersive experiences and sustainability. They are ideal for longer leisure voyages and skill-based sailing trips. Popular in regions with sailing cultures and clubs, they also attract international tourists and boating enthusiasts seeking authentic nautical experiences.

Catamarans are increasingly popular due to stability, comfort, and spacious layouts. They are ideal for family outings, group cruises, and multi-day trips. Their dual-hull design reduces motion discomfort and improves safety, making them a preferred choice for longer tours or sightseeing activities. Operators also benefit from reduced maintenance compared to other multi-hull vessels.

Inflatable/RIB boats are preferred for short trips, adventure sports, and utility purposes. Lightweight and portable, they are suitable for diving support, island hopping, and quick excursions. Affordable and easy to handle, they attract first-time renters and budget-conscious users. Their versatility allows operators to deploy them for seasonal peaks and on-demand rentals, increasing fleet efficiency.

By Boat Size Analysis

Between 30 and 79 ft dominates with 45.2% driven by balanced capacity, comfort, and operational flexibility.

In 2024, Between 30 and 79 ft held a dominant market position in the By Boat Size Analysis segment of Boat Rental Market, with a 45.2% share. This size provides an ideal balance between onboard space, comfort, and operational manageability. It supports both leisure cruising and group travel, catering to families, tourists, and recreational clubs while remaining cost-efficient for operators.

Less than 30 ft boats are widely adopted for short-duration rentals and recreational trips. Compact size and simple handling appeal to beginners and casual boaters. They are popular for fishing, sightseeing, and short coastal cruises. This category ensures accessible, low-risk experiences and encourages first-time users to engage in water activities.

Greater than 79 ft boats primarily serve luxury tourism, private charters, and long-distance voyages. These boats attract high-net-worth individuals and corporate clients seeking comfort, privacy, and exclusive amenities. Despite lower rental frequency, they generate significant revenue, offering premium onboard facilities and multi-day itineraries. This size segment strengthens the high-end boating market.

By Power Source Analysis

IC Engine dominates with 76.4% supported by established infrastructure and long-range reliability.

In 2024, IC Engine held a dominant market position in the By Power Source Analysis segment of Boat Rental Market, with a 76.4% share. Internal combustion engines remain reliable and versatile for various boat sizes and activities. Their fuel availability, long-range capability, and performance under different weather conditions ensure they remain the default choice for most operators and tourists.

Hybrid boats are gradually adopted for environmentally conscious and performance-focused operations. They combine fuel and electric power, reducing emissions while maintaining operational efficiency. Hybrid boats attract renters and operators seeking sustainability without sacrificing range or convenience. Their adoption is increasing in areas with stricter environmental regulations and growing demand for green tourism.

Full-electric boats are emerging as a sustainable alternative, suitable for short-range and inland operations. Electric propulsion offers quiet, eco-friendly travel, appealing to environmentally-conscious tourists. While range limitations exist, increased interest in green boating and urban waterway policies drives adoption. Operators are incorporating electric fleets for sightseeing tours, leisure trips, and eco-tourism experiences.

By Activity Type Analysis

Leisure Sailing/Cruising dominates with 42.7% due to strong tourism-driven demand and experiential preferences.

In 2024, Leisure Sailing/Cruising held a dominant market position in the By Activity Type Analysis segment of Boat Rental Market, with a 42.7% share. This segment thrives on tourism growth and the demand for experiential travel. Leisure sailing encompasses both short trips and multi-day cruises, offering scenic exploration, relaxation, and recreational engagement. It appeals to families, couples, and solo travelers seeking a personalized nautical experience.

Fishing rentals maintain consistent demand across coastal and inland waters. Attracting both casual and semi-professional anglers, this segment benefits from seasonal peaks and specialized equipment. Boats are designed to provide safety, convenience, and enhanced fishing experiences. Operators gain repeat business from loyal customers and seasonal enthusiasts, ensuring stable revenue streams.

Watersports rentals, including towing, diving, and adventure sports, are increasingly popular among younger demographics. These activities complement motorboat usage and often come in bundled packages. Seasonal demand peaks during holidays and vacations, providing operators with opportunities to upsell additional services. The segment encourages frequent rentals and short-duration engagements.

Sight-seeing and day-cruise rentals focus on guided experiences, group travel, and scenic exploration. Operators utilize predictable routes, incorporating natural, cultural, and historical attractions. High passenger turnover ensures stable utilization, supporting operator profitability. This segment is a key revenue driver in tourist-heavy destinations and urban waterfronts.

By Rental Duration Analysis

Hourly dominates with 31.9% driven by affordability, flexibility, and spontaneous usage.

In 2024, Hourly held a dominant market position in the By Rental Duration Analysis segment of Boat Rental Market, with a 31.9% share. Hourly rentals appeal to spontaneous tourists and locals seeking flexible, cost-effective experiences. They are ideal for sightseeing, short recreational trips, and leisure outings, promoting frequent usage and high turnover.

Half-day rentals are suitable for renters wanting extended experiences without overnight stays. Balancing cost with satisfaction, this duration supports sightseeing, leisure cruising, and casual fishing. Half-day options encourage semi-spontaneous trips and are popular in dense tourism areas, offering moderate revenue potential.

Full-day rentals provide immersive experiences for families, groups, and tourists. They allow exploration of distant destinations, multiple activities, and extended leisure. These rentals attract medium-duration travelers, enhancing customer satisfaction and repeat business. Operators often bundle amenities or guided services to increase value.

Multi-day and weekly rentals cater to destination-based tourism and extended leisure trips. Supporting long-distance cruising, vacation travel, and experiential tourism, these rentals enhance engagement and loyalty. Operators provide inclusive services, itineraries, and premium offerings, strengthening the market’s high-value and luxury segments.

Key Market Segments

By Boat Type

- Motorboat

- Yacht

- Sailing Boat

- Catamaran

- Inflatable/RIB

By Boat Size

- Between 30 and 79 ft

- Less than 30 ft

- Greater than 79 ft

By Power Source

- IC Engine

- Hybrid

- Full-Electric

By Activity Type

- Leisure Sailing/Cruising

- Fishing

- Watersports (towing, diving, etc.)

- Sight-seeing/Day-cruise

By Rental Duration

- Hourly

- Half-Day

- Full-Day

- Multi-Day/Weekly

Drivers

Rising Popularity of Marine Tourism Boosts Boat Rental Market

The growing interest in marine tourism and water-based recreational activities is a key driver of the boat rental market. Increasing numbers of people are seeking unique experiences on rivers, lakes, and coastal areas. From weekend getaways to adventure trips, this trend is particularly strong among young travelers and adventure enthusiasts, leading to higher demand for short-term boat rentals.

Another important factor is the shift in consumer preference from owning assets like private boats to opting for experiential leisure. Renting a boat provides the freedom to enjoy water-based activities without the high costs, maintenance, and responsibilities associated with ownership. This change in lifestyle and spending habits is encouraging more service providers to expand their fleet and rental options to meet growing demand.

Technological advancements in online booking platforms are also playing a significant role in market growth. These platforms allow customers to book boats easily, compare rental prices, and select services tailored to their needs. The convenience and global accessibility provided by digital booking solutions are helping rental companies reach a wider audience and improve overall customer experience.

The combination of rising marine tourism, preference for experience-based leisure over ownership, and enhanced digital booking platforms is fueling steady growth in the boat rental market. These drivers are expected to sustain demand and attract more service providers, making the market increasingly competitive and dynamic.

Restraints

Challenges in Skilled Workforce and Weather Conditions Restrain Boat Rental Market

One of the main restraints in the boat rental market is the limited availability of skilled crew and certified operators, especially during peak seasons. High demand periods often coincide with vacations and holiday seasons, making it difficult for rental companies to find trained personnel. This shortage can affect service quality and limit the number of boats available for rent.

Weather dependency also plays a significant role in restricting the market. Unfavorable conditions such as storms, heavy rainfall, or high winds can lead to cancellations and reduce rental frequency. Customers often postpone or avoid bookings due to safety concerns, directly impacting revenue for service providers.

Safety is another critical concern for both operators and renters. Boats require proper maintenance, and inexperienced handling can lead to accidents or damage. Ensuring compliance with safety standards adds operational challenges and costs, further restraining market growth.

These factors combined—shortage of skilled operators, weather dependency, and safety concerns—create uncertainties in market operations. Companies must carefully plan staffing, maintenance, and scheduling to manage these risks and maintain customer trust, which can limit rapid expansion in the boat rental sector.

Growth Factors

Expansion into Emerging Markets and Sustainable Practices Create Growth Opportunities in Boat Rental Market

The boat rental market has significant growth potential through expansion into emerging markets with untapped coastal and inland water resources. Many regions remain underdeveloped in terms of recreational boating, presenting opportunities for companies to attract new customers and develop fresh rental offerings.

Adoption of eco-friendly electric and hybrid boats is another opportunity driving growth. Customers are increasingly seeking sustainable leisure options, and companies that invest in low-emission and energy-efficient boats can meet this demand while supporting environmental responsibility.

Partnerships with travel agencies and tourism boards offer additional growth avenues. Bundled experiential packages combining boat rentals with local tours, accommodations, or adventure activities create a more attractive proposition for travelers. Such collaborations help companies enhance customer experience, increase bookings, and improve brand visibility in competitive markets.

Focusing on these opportunities enables boat rental providers to diversify their services, expand their geographic reach, and align with evolving consumer preferences. Strategic investments in emerging regions, sustainability initiatives, and collaborations can drive long-term market growth and strengthen the sector’s overall performance.

Emerging Trends

Digital Platforms and Technological Integration Drive Trends in Boat Rental Market

The rapid rise of peer-to-peer (P2P) digital rental platforms is transforming how consumers access boats. These platforms allow individuals to rent boats directly from owners, improving convenience, reducing costs, and expanding market reach to a wider audience. This model also encourages more people to participate in boating without the need for ownership, increasing overall market activity.

Increasing integration of AI and IoT technologies is shaping personalized booking and fleet management. Companies can now offer tailored recommendations based on user preferences, optimize rental schedules, and monitor boat performance in real time. These technologies also enhance safety by tracking conditions and usage patterns, allowing operators to respond proactively to potential issues.

There is also a noticeable shift toward short-term and flexible rental models, particularly among younger demographics. Travelers now prefer on-demand, customizable experiences over long-term commitments. This trend encourages rental companies to introduce hourly, daily, and seasonal packages that cater to changing customer expectations and lifestyle preferences.

The combination of P2P platforms, AI and IoT integration, and flexible rental models is redefining the boat rental market. Companies that embrace these technological and consumer-driven trends can increase efficiency, improve customer experience, and attract a larger, more diverse clientele, positioning themselves for sustained growth in an evolving industry.

Regional Analysis

Europe Dominates the Boat Rental Market with a Market Share of 42.8%, Valued at USD 8.5 Billion

Europe continues to lead the global boat rental market with a strong 42.8% share and a market value of USD 8.5 Billion. Its dominance is driven by extensive coastlines, well-established marine tourism infrastructure, and high consumer spending on leisure activities. Western and Northern European countries are witnessing robust demand for luxury yachts, leisure boats, and charter services. Seasonal tourism peaks, combined with investments in modern marinas and waterfront facilities, are supporting steady growth and encouraging new operators to enter the market.

North America Boat Rental Market Trends

North America maintains a strong position in the boat rental market due to its rich boating culture, diverse inland waterways, and expansive coastlines. The region is increasingly adopting eco-friendly and hybrid boats to meet sustainability demands. Partnerships with tourism boards and bundled boating experiences are gaining traction, while digital platforms are making rentals more convenient. Seasonal tourism and recreational activities along the coasts continue to drive revenue, reinforcing North America as a significant contributor to global market growth.

Asia Pacific Boat Rental Market Trends

Asia Pacific is emerging as one of the fastest-growing markets for boat rentals. Rising disposable incomes, increased tourism investments, and untapped coastal and inland water resources are driving demand. Southeast Asia, the Pacific Islands, and South Asia are seeing a surge in marine leisure activities, including yacht charters, river cruises, and experiential tourism. Growing awareness of sustainable boating options and digital rental platforms is attracting younger and tech-savvy consumers, providing strong growth potential in the region.

Middle East and Africa Boat Rental Market Trends

The Middle East and Africa market is gradually expanding, driven by luxury tourism, waterfront development, and high-net-worth consumer demand. Investments in marinas, leisure destinations, and boating infrastructure are improving accessibility and service quality. Seasonal tourism peaks in warmer months influence rental frequency, while premium boating experiences, including luxury yachts and private charters, are enhancing the overall market appeal and attracting affluent travelers across the region.

Latin America Boat Rental Market Trends

Latin America is witnessing steady growth in the boat rental sector, supported by emerging coastal tourism hubs and inland river activities. Countries such as Brazil and Argentina are seeing increased domestic and international demand for short-term and leisure boat rentals. Development of marina infrastructure, adoption of online rental platforms, and tourism promotion initiatives are helping the region enhance accessibility and attract more recreational boating enthusiasts over time.

U.S. Boat Rental Market Trends

The U.S. remains a mature and active market, supported by a strong recreational boating culture and well-developed coastal and inland infrastructure. Adoption of sustainable and hybrid boats is increasing, while integrated tourism packages and digital booking platforms are enhancing consumer convenience. Seasonal boating peaks, along with diverse offerings such as yacht charters and river cruises, continue to drive stable growth and maintain the U.S. as a key market globally.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Boat Rental Company Insights

Boatsetter Inc. remains a pivotal player, leveraging its peer‑to‑peer marketplace model to connect boat owners with renters efficiently. The company’s emphasis on insurance coverage and user verification has strengthened trust, driving higher adoption in North America and select international markets. Its integrated booking infrastructure and scalable operations also support partnerships with local marinas, boosting supply diversity.

GetMyBoat has solidified its position through extensive global reach and a broad inventory that spans small recreational vessels to luxury charters. The platform’s robust mobile experience and multi‑lingual support facilitate easy discovery and booking, particularly among millennial and Gen Z travelers. Strategic focus on community engagement and reviews enhances transparency, which is critical in reducing friction in the sharing economy and fostering repeat usage.

ClickandBoat continues to harness its European stronghold by emphasizing localized service offerings and curated experiences. Its platform integrates charter and skippered options, catering to both novice renters and experienced sailors. ClickandBoat’s efforts in expanding partnerships with professional fleets have augmented its reliability and seasonal availability, positioning it as a go‑to solution for Mediterranean and coastal tourism markets.

Nautal differentiates through a strong emphasis on professional fleet listings and comprehensive customer support. By focusing on quality assurance and tailored trip planning, Nautal appeals to travelers seeking premium and bespoke boating experiences. Its strategic investments in digital tools for fleet operators improve operational efficiency, fostering loyalty among service partners.

Top Key Players in the Market

- Boatsetter Inc.

- GetMyBoat

- ClickandBoat

- Nautal

- Sailo Inc.

- SamBoat

- Boat Jump

- Globe Sailor

- Le Boat

- Dream Yacht Charter

- Freedom Boat Club

Recent Developments

- In December 2025, Boatsetter and GetMyBoat announced a merger to form a combined global boat rental marketplace. This strategic move aims to enhance inventory, technology, and worldwide booking capabilities.

- In September 2025, yacht rental platform Boatscribe secured a six-figure pre-seed investment. The funding is intended to scale its yacht rental metasearch technology and attract new travelers to the platform.

- In January 2024, GetMyBoat and Your Boat Club launched a strategic partnership. This collaboration expanded boat rental and club fleet availability on the GetMyBoat platform, improving access for renters and members.

- In July 2024, Baglietto yacht rental opened bookings for the AKULA, a 52-meter luxury charter yacht. The yacht features a specialized toy garage, catering to water sports enthusiasts with premium amenities.

Report Scope

Report Features Description Market Value (2024) USD 20 Billion Forecast Revenue (2034) USD 35.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Boat Type (Motorboat, Yacht, Sailing Boat, Catamaran, Inflatable/RIB), By Boat Size (Between 30 and 79 ft, Less than 30 ft, Greater than 79 ft), By Power Source (IC Engine, Hybrid, Full-Electric), By Activity Type (Leisure Sailing/Cruising, Fishing, Watersports (towing, diving, etc.), Sight-seeing/Day-cruise), By Rental Duration (Hourly, Half-Day, Full-Day, Multi-Day/Weekly) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Boatsetter Inc., GetMyBoat, ClickandBoat, Nautal, Sailo Inc., SamBoat, Boat Jump, Globe Sailor, Le Boat, Dream Yacht Charter, Freedom Boat Club Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Boatsetter Inc.

- GetMyBoat

- ClickandBoat

- Nautal

- Sailo Inc.

- SamBoat

- Boat Jump

- Globe Sailor

- Le Boat

- Dream Yacht Charter

- Freedom Boat Club