Global Blood Glucose Meters Market By Type (Electrode Type Blood Glucose Meter, and Photoelectric Blood Glucose Meter), By Application (Home Care, and Hospitals), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 52815

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

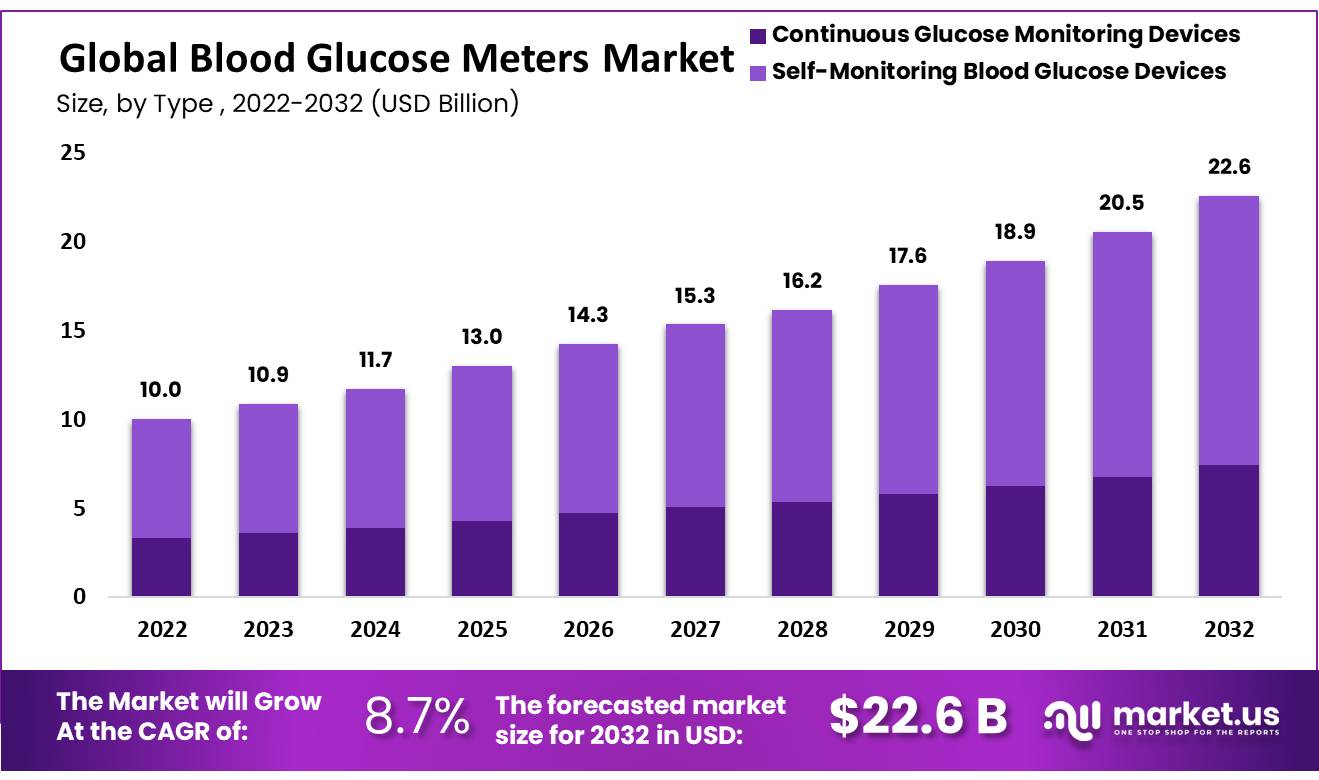

The Global Blood Glucose Meters Market size is expected to be worth around USD 22.6 Billion by 2032 from USD 10 Billion in 2022, growing at a CAGR of 8.7% during the forecast period from 2022 to 2032.

A glucose meter is also called a ‘glucometer.’ It is a medical device used to measure and display the approximate amount of glucose in the blood. With the help of this device, a patient who is suffering from diabetes mellitus or hypoglycemia can be able to do Home Blood Glucose Monitoring (HBGM). Healthcare professionals have advised patients of diabetes mellitus to appropriate monitoring. In addition, blood Glucose Meters should meet the accuracy standards set by the International Organization for Standardization (ISO).

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Diabetes Epidemic: Global prevalence of type 2 diabetes has seen exponential increases over the past decades and this epidemic is driving increased use of blood glucose meters as it’s vital for managing this form of the illness. Regular monitoring is required in order to manage effectively diabetes management.

- Variety of Products: The market offers an assortment of blood glucose meters with different features and capabilities, such as traditional fingerstick meters, continuous glucose monitoring systems (CGMs), smart glucose meters that connect directly with smartphones or other devices and traditional fingerstick meters that dispense blood by needle.

- Accuracy and Precision: Accuracy and precision are at the core of blood glucose monitoring. Manufacturers strive continuously to enhance the accuracy of their meters for proper diabetes management, with precise measurements essential.

- Convenience and Portability: Modern blood glucose meters have become compact and portable, enabling users to conveniently monitor their glucose levels both at home and while on-the-go, making diabetes management even simpler and more manageable. Their portability enhances convenience in diabetes treatment.

- Technological Advances: Blood glucose meters have witnessed many technological developments over time. These advancements include Bluetooth connectivity, mobile apps, cloud storage capabilities and integration with insulin pumps. Furthermore, continuous glucose monitoring systems offer real-time data collection instead of frequent fingerstick tests.

Type Analysis

Based on type, the segments in the market for blood glucose meter is Continuous glucose monitoring devices and Self-Monitoring Blood Glucose System. These glucose meters measure blood sugar levels which play an essential role in the treatment of diabetes. Accordingly, the market is characterized as invasive as well as non-invasive.

The type in the global market segment includes wearable and non-wearable. The wearable type is expected to register a comparatively higher CAGR during the forecast period.

As a result, the global blood glucose market will grow from US$ 15.62 billion in 2022 to US$ 16.94 billion in 2023 at a Compound Annual Growth Rate (CAGR) of 8.4%. Its market size is predicted to grow to US$ 22.39 billion in 2027 at a CAGR of 7.1%.

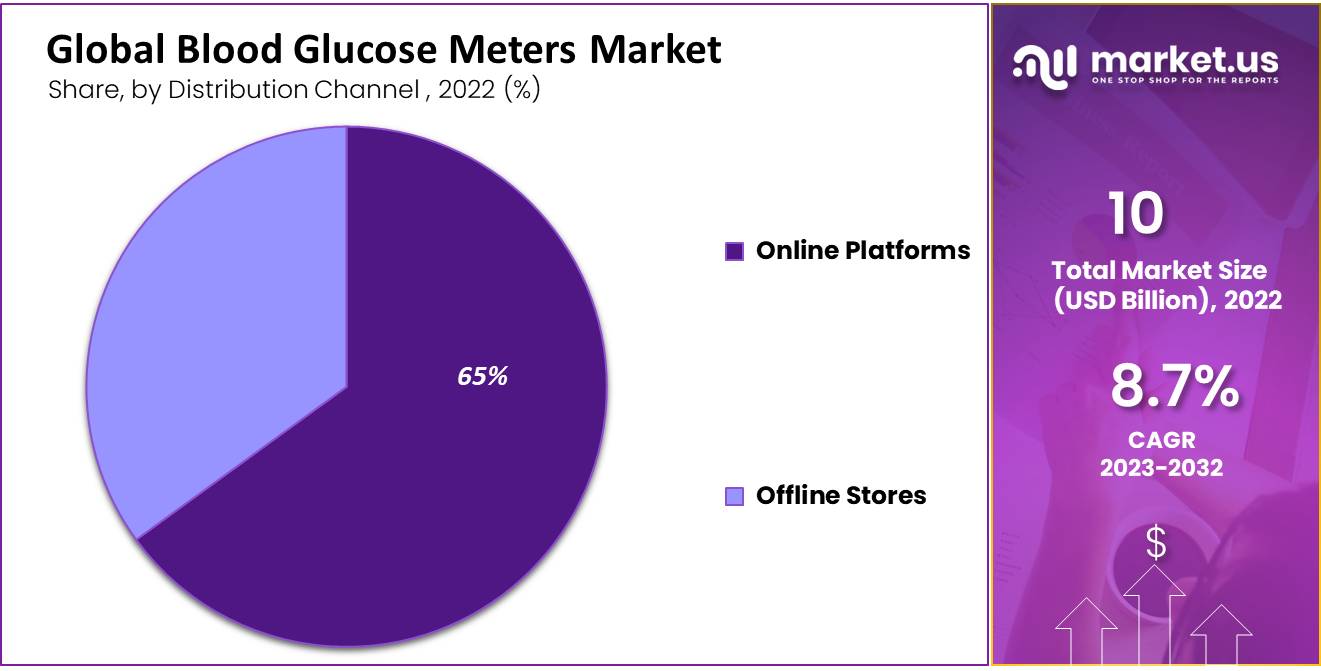

Distribution Channel Analysis

According to the distribution channel, the segment in the market is offline stores as well as online platforms. In developing countries, because of the gradual shift towards self-blood glucose meter devices, there is growth in the online platforms segment as compared to offline stores.

It results in a comparatively higher CAGR of online platforms than offline stores during 2019-2026. It will increase the blood glucose market demands.

End-User Analysis

According to the reports, the hospital segment seizes the most significant revenue shares of 40% of 2021. As a result, it anticipates the lead market over the forecast period because of the developing infrastructure and booming healthcare in the hospitals.

It is expected to register that the home care segment will show the fastest growth rate during the forecast period. The HBGM is the most comprehensive use method of short-term glucose monitoring worldwide. Similarly, through SMBG, people with or without diabetes can check their blood glucose levels at home.

Key Market Segments

Based on Type

- Continuous Glucose Monitoring Devices

- Self-Monitoring Blood Glucose Devices

Based on Distribution Channel

- Offline Stores

- Online Platforms

Based on End-User

- Healthcare

- Pharmacies

- Home Care

- Diagnostic Centres

Drivers

Factors that drive the market

For regular monitoring of blood glucose levels, Blood glucose monitoring devices are beneficial for patients who are suffering from diabetes. These devices allow patients and clinicians to analyze their blood glucose levels, allowing therapy modifications and protecting patients from confirming diabetes. In addition, it will ensure patient safety.

The technology makes it easier for the patient for diabetes management and also assists people in developing healthy habits. All these factors drive the market. The BGM devices are readily available at multiple prices, sizes, testing times, and ease of use.

Increasing Cases of Diabetes

The key drivers of the market are the increasing cases of diabetes and the geriatric population, which is prone to diabetes. In addition, the rising alertness further drives the growth of the market regarding diabetes preventive care and the launches of new products.

Diabetes is a serious and growing problem around the globe, where; the lack of efficiency of the pancreas results in the production of insulin, and due to this increase in blood glucose levels takes place.

According to the reports of the International Diabetes Federation, in 2021, diabetes was diagnosed in around 537 million people. This number will increase to 643 million by 2030 and 783 million by 2045.

Restraints

A large number of undiagnosed diabetes population

A large number of undiagnosed diabetes populations results in less adoption of blood glucose monitoring systems, especially in developing countries. As a result, the frequency of delayed analysis is more among countries such as China, South Africa, India, Brazil, and others. Another reason is the lack of awareness and Health care facilities among ordinary people regarding chronic diseases such as diabetes mellitus.

In 2021, according to the report published by International Diabetes Federation in Africa, it was noticed that almost 1 in 2 patients remain undiagnosed, and in Asia Pacific countries such as India, Indonesia, and China, the population of undiagnosed patients is around 55%.

Thus, the lack of a refund plan for CGM and SMBG systems and the above factors are the reason for lower diagnosis and treatment rates.

Opportunity

Surging Geriatric Populations

The Global Blood Glucose Meters Market is boosted because of the rising number of older people at risk for disease. The rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and spiking awareness among individuals are driving the Key factor that enhances the BGM Market in developing countries.

International Diabetes Federation (IDF) estimated that in 2021 around 537 million adults had diabetes; by 2045, the number will be around 783 million. With the increasing prevalence of diabetes patients globally, there will be a hike in the global blood glucose devices market.

Trends

Real-time monitoring feature for insulin-dependent patients

The real-time monitoring feature for insulin-dependent patients has been enabled with the introduction of advanced technologies such as CBM in the market. Compared to Self-Monitoring Blood Glucose System (SMBG), Continuous Blood Glucose Monitoring (CBM) offers several advantages, such as real-time monitoring, less pain, rapid and precise, and minimally invasive. SMBG revolutionizes home-based glucose monitoring, and it is the most widely used method.

CBGM is an essential tool for patients with type 1 diabetes for diabetes care. According to the data published by Abbott, the number of FreeStyle Libre users increased globally from 3.0 million in 2020 to 4.0 million in 2021.

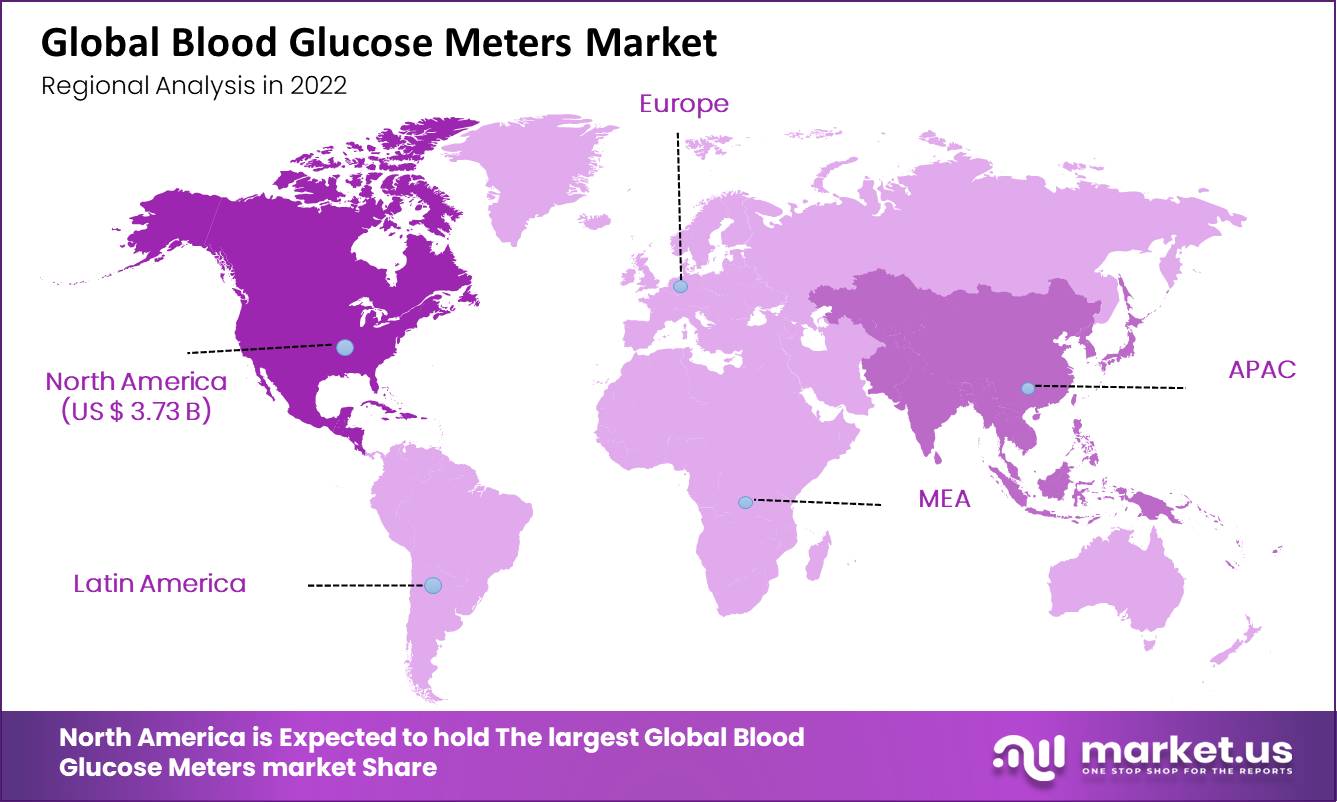

Regional Analysis

North America accounted for the largest Revenue Share in this market.

The North American market shared revenue of over 35.0% in 2022. It held the largest share of the market. The blood Glucose Monitoring System reached up to US$ 3.73 billion in 2022.

The increasing number of patients suffering from obesity and other factors, such as the high cost of treatment, new product launches, and technological advancements, are expected to drive the regional market.

The Europe market is estimated to capture the revenue share in the forecast period due to increased gestational diabetes. Furthermore, due to the implementation of advanced medical products and healthcare sector improvements, the demand for BGMs will increase in the region.

Asia Pacific is expected to be a lucrative region over the forecast period. Because of the rise in the geriatric population and the rising prevalence of insulin-dependent diabetes, this region is anticipated to register a substantial CAGR.

Due to its sizeable diabetic population and rapid economic growth, China headed the APAC region in 2021. Also, patients with diabetes in the countries such as Australia and Japan are actively interested in timely and regular monitoring of their blood glucose levels.

The Middle East & Africa, and Latin America are the major regions estimated to register moderate CAGR during the forecast period. It is because of a need for more awareness among general people about the disease.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Major players focus on government approvals, new product launches, advancement in existing technologies and products, acquisitions, and other strategies to strengthen their presence and expand their business portfolio. For example, in May 2021, Roche collaborated with Elli Lilli and the company to improve insulin pen therapy management.

Due to the collaboration, Roche follows its dream to create an open ecosystem of its own and partner devices, services, and solutions to give proper care to patients who have diabetes. Some of the major companies in the blood glucose market are B. Braun Melsungen AG, F. Hoffmann-La Roche, Medtronic plc, B. Braun, Terumo Corporation, Agamatrix Inc., and other key players.

Below are some of the most prominent global blood glucose monitoring devices market players’ company profiles.

Market Key Players

- Abbott Laboratories

- Asensia Diabetes Care

- Medtronic plc

- Dexcom Inc.

- Hoffmann-La Roche Ltd.

- Sanofi

- Insulet Corporation

- Novo Nordisk

- Glysens Incorporated

- B. Braun

- Ypsomed Holdings

- Other Key Players

Key Industry Developments

- In March 2021, F. Hoffmann-La Roche Ltd. launched the Accu-Chek Instant system so that it can connect directly with the mySugr app and provide real-time blood glucose level data.

- In February 2021, Ascensia Diabetes Care Holdings Ag took over the distribution of EVERSENSE XL of Sensonics, Inc. in countries like Switzerland, Germany, Poland, Netherlands, Spain, and Italy so that the demand from customers in the European market will be fulfilled.

Report Scope

Report Features Description Market Value (2022) USD 10 Billion Forecast Revenue (2032) USD 22.6 Billion CAGR (2023-2032) 8.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Continuous Glucose Monitoring Devices and Self-Monitoring Blood Glucose Devices; By Distribution Channel- Offline Stores and Online Platforms; and By End Users- Healthcare, Pharmacies, Home Care, and Diagnostic Centres. Regional Analysis North America – The US, Canada, and Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA. Competitive Landscape Abbott Laboratories, Asensia Diabetes Care, Medtronic plc, Dexcom Inc., Hoffmann-La Roche Ltd., Sanofi, Insulet Corporation, Novo Nordisk, Glysens Incorporated, B. Braun, Ypsomed Holdings, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Blood Glucose Meters Market?The global Blood Glucose Meters Market size was estimated at USD 11 bn in 2023 and is expected to reach USD 24.69 bn in 2032.

Who are the key players in the Blood Glucose Meters Market?Some key players operating in the Blood Glucose Meters Market include Abbott Laboratories Asensia Diabetes Care Medtronic plc Dexcom Inc. Hoffmann-La Roche Ltd. Sanofi Insulet Corporation Novo Nordisk Glysens Incorporated B. Braun Ypsomed Holdings Other Key Players

What segments are covered in the Blood Glucose Meter Market Report?The Global Blood Glucose Meter Market is segmented based on Type, Distribution Channel, End-User.

Blood Glucose Meters MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Blood Glucose Meters MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Asensia Diabetes Care

- Medtronic plc

- Dexcom Inc.

- Hoffmann-La Roche Ltd.

- Sanofi

- Insulet Corporation

- Novo Nordisk

- Glysens Incorporated

- B. Braun

- Ypsomed Holdings

- Other Key Players