Global Blank Apparel Market Size, Share, Growth Analysis Type (T-Shirts & Tanks, Hoodies/Sweatshirts, Shirts, Bottoms, Others), Distribution Channel (Business to Business (B2B), Business to Consumers (B2C)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177157

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

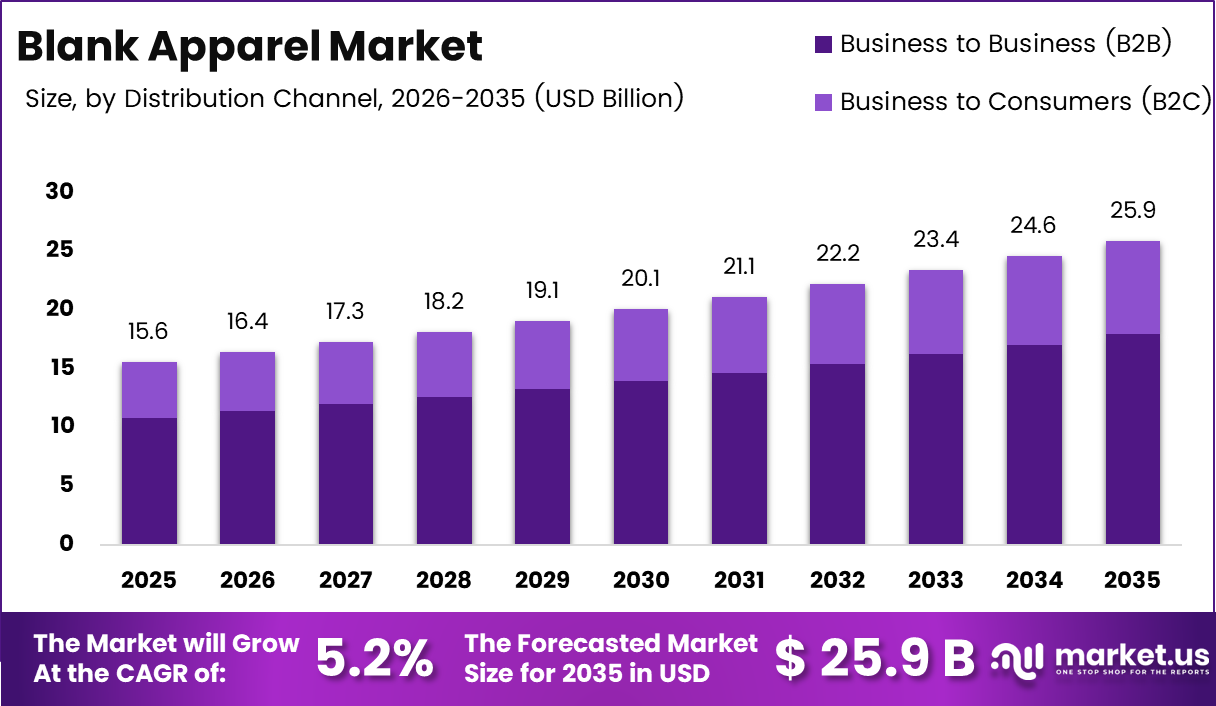

Global Blank Apparel Market size is expected to be worth around USD 25.9 Billion by 2035 from USD 15.6 Billion in 2025, growing at a CAGR of 5.2% during the forecast period 2026 to 2035.

Blank apparel refers to unbranded, plain garments manufactured without logos, prints, or decorative elements. These products serve as base materials for customization, decoration, and branding across various applications. Moreover, they represent essential inventory for businesses engaged in screen printing, embroidery, and heat transfer operations.

The market encompasses essential clothing items including t-shirts, hoodies and sweatshirts, and bottoms. These garments are produced using diverse fabric compositions ranging from pure cotton to polyester blends. Additionally, manufacturers focus on delivering consistent quality, sizing accuracy, and color options to meet commercial decoration requirements.

Blank apparel serves multiple end-use applications across promotional merchandise, corporate uniforms, and custom fashion brands. Print-on-demand businesses rely heavily on these products for personalized merchandise creation. Furthermore, educational institutions, sports teams, and event organizers utilize blank garments for branded apparel programs.

The industry experiences robust growth driven by expanding e-commerce platforms and direct-to-consumer sales channels. Digital printing technology advancements enable faster customization processes and lower minimum order quantities. Consequently, small businesses and independent creators access professional-quality blank apparel more efficiently than traditional manufacturing routes.

Government initiatives supporting textile manufacturing and sustainable fashion practices influence market dynamics. Environmental regulations encourage adoption of organic fabrics and eco-friendly production methods. Therefore, manufacturers increasingly invest in sustainable sourcing and transparent supply chain management to comply with evolving standards.

According to Graphics Pro, Chief Value Cotton comprising 60% cotton and 40% polyester is growing in popularity for its versatility and affordability. This blend offers comfort, durability, and resistance to shrinking and wrinkling. However, classic 100% cotton remains the top textile choice, especially in streetwear, lifestyle merchandise, and fashion basics.

The market benefits from rising demand for premium-quality, heavyweight, and oversized blank garments across fashion segments. Royal Apparel highlights unique offerings including 100% polyester sublimation tees, union-made recycled jersey tees, and certified organic apparel. Additionally, wholesale suppliers provide diverse products including raglan baseball shirts, fleece hoodies, and infant clothing to meet varied customer requirements.

Key Takeaways

- Global Blank Apparel Market valued at USD 15.6 Billion in 2025, projected to reach USD 25.9 Billion by 2035

- Market growing at CAGR of 5.2% during forecast period 2026-2035

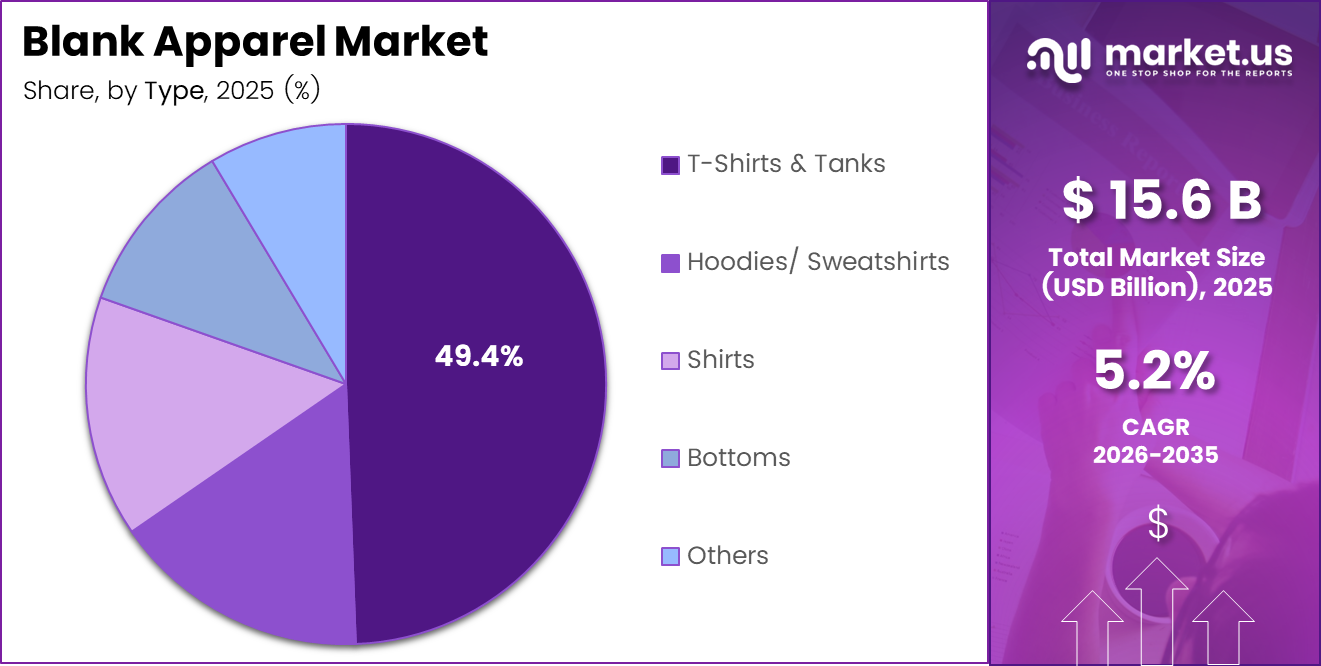

- T-Shirts & Tanks segment dominates by Type with 49.4% market share in 2025

- Business to Business (B2B) distribution channel holds 69.3% market share in 2025

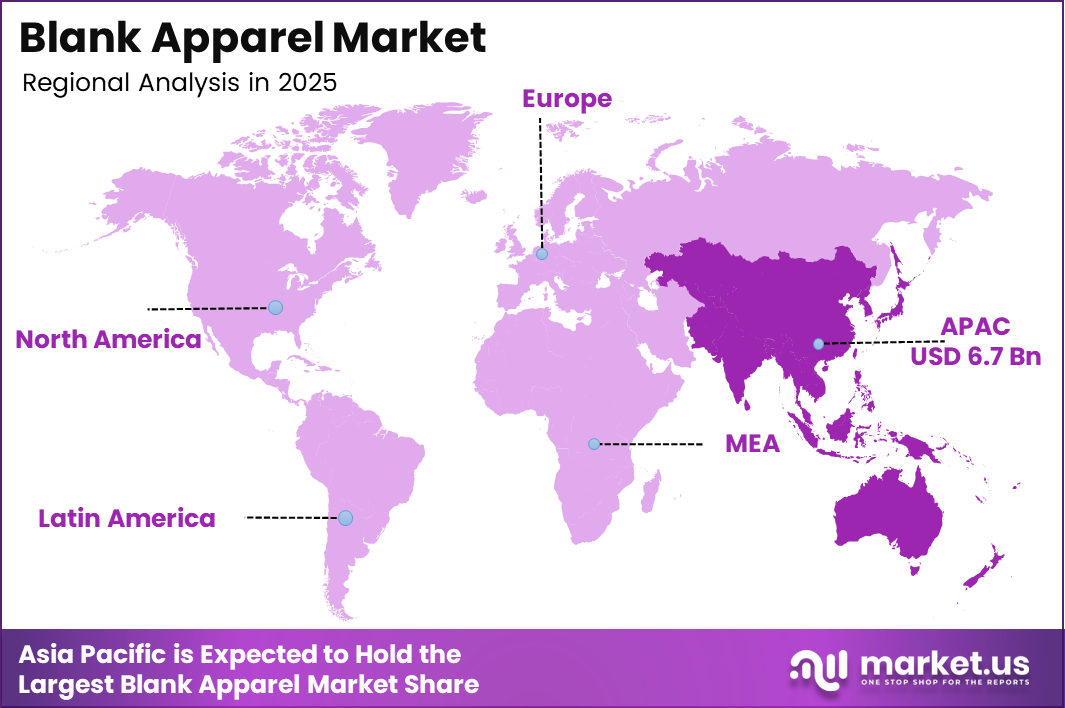

- Asia Pacific region leads with 43.20% market share, valued at USD 6.7 Billion

- Rising demand from print-on-demand and custom merchandising brands drives market expansion

- Sustainable and organic fabric blank apparel gaining significant traction globally

- E-commerce platforms enabling direct-to-consumer sales growth across all regions

Type Analysis

T-Shirts & Tanks dominates with 49.4% due to high-volume everyday wear demand and customization suitability.

T-Shirts & Tanks accounted for a segment value of 49.4% in the Blank Apparel Market, reflecting their position as the leading product type due to high-volume everyday wear demand and strong customization suitability across promotional, casual, and private-label applications.

T-Shirts & Tanks held a strong market position in the Blank Apparel Market. This leadership reflects broad adoption across promotional, casual, and private-label uses, supported by affordability, seasonal relevance, and wide fabric and fit availability across global distribution channels.

Hoodies/ Sweatshirts maintained a significant presence in the Blank Apparel Market. Growth remained steady as demand benefited from athleisure trends, colder-climate consumption, and increasing preference for layering garments suitable for branding, retail resale, and corporate merchandising programs.

Shirts continued to play an important role in the Blank Apparel Market. This segment remained relevant through workplace casualization, hospitality uniforms, and customization demand, supported by consistent fabric quality, standardized sizing, and compatibility with embroidery and screen-printing processes.

Bottoms showed consistent demand within the Blank Apparel Market. Growth was driven by coordinated apparel sets, fitness wear expansion, and increasing use in promotional kits, though momentum remained moderate compared to upper-body garment categories.

Others represented a niche yet stable category in the Blank Apparel Market. This segment includes items such as caps and outerwear, supported by event-based demand, seasonal promotions, and limited-edition branding applications across diverse end-user industries.

Distribution Channel Analysis

Business to Business (B2B) dominates with 69.3% due to bulk purchasing by decorators, promotional product distributors, and institutional buyers requiring consistent inventory.

In 2025, Business to Business (B2B) held a dominant market position in the Distribution Channel segment of Blank Apparel Market, with a 69.3% share. Screen printers, embroidery shops, and promotional product companies constitute primary B2B customers purchasing large quantities regularly. Consequently, these businesses demand reliable supply chains, competitive wholesale pricing, and standardized quality specifications for successful decoration operations.

Business to Consumers (B2C) distribution channels are expanding rapidly through online marketplaces and direct manufacturer websites. Individual creators, small-batch fashion designers, and personal customization enthusiasts access blank apparel without minimum order requirements. Therefore, B2C platforms enable product experimentation, style testing, and niche market exploration for entrepreneurs entering custom apparel industries with limited capital investment.

Key Market Segments

By Type

- T-Shirts & Tanks

- Hoodies/Sweatshirts

- Shirts

- Bottoms

- Others

By Distribution Channel

- Business to Business (B2B)

- Business to Consumers (B2C)

Drivers

Rising Demand from Print-on-Demand and Custom Merchandising Drives Market Expansion

Print-on-demand platforms revolutionize custom apparel production by eliminating inventory risks and upfront manufacturing costs. Entrepreneurs launch branded merchandise stores without capital-intensive blank apparel stockpiling requirements. Moreover, digital fulfillment services connect independent creators directly with wholesale blank suppliers, streamlining order processing and reducing delivery timelines significantly across global markets.

E-commerce marketplaces enable direct-to-consumer blank apparel sales, bypassing traditional distribution intermediaries and reducing customer acquisition costs. Online platforms provide detailed product specifications, size charts, and fabric composition information for informed purchasing decisions. Additionally, bulk pricing transparency and automated reordering systems help businesses maintain consistent inventory levels while optimizing working capital allocation.

Corporate uniform buyers, promotional merchandise distributors, and institutional purchasers represent substantial B2B demand drivers. Organizations require branded apparel for employee identification, marketing campaigns, and event sponsorships. Furthermore, educational institutions and sports teams order customized garments regularly, creating predictable revenue streams for blank apparel manufacturers and wholesale distributors throughout annual procurement cycles.

Restraints

Price Competition and Raw Material Volatility Limit Market Profitability

Intense price competition from low-cost manufacturers in developing markets pressures profit margins across the blank apparel industry. Businesses face constant pressure to reduce wholesale pricing while maintaining quality standards and service levels. Consequently, manufacturers implement cost-cutting measures that may compromise fabric quality, construction durability, or ethical labor practices to remain competitive.

Cotton and synthetic fiber raw material prices fluctuate significantly due to weather conditions, global trade policies, and supply chain disruptions. These cost variations create forecasting challenges for manufacturers and wholesalers attempting to maintain stable pricing structures. Moreover, unexpected price increases force difficult decisions between absorbing costs, passing increases to customers, or seeking alternative fabric sources.

Small and medium-sized blank apparel suppliers struggle to compete against vertically integrated manufacturers with economies of scale advantages. Large corporations negotiate favorable raw material contracts, optimize production efficiency, and leverage distribution networks more effectively. Therefore, independent manufacturers face market share erosion despite offering specialized products or superior customer service to niche market segments.

Growth Factors

Sustainable Materials and Emerging Markets Accelerate Industry Growth

Surging demand for sustainable, organic, and recycled fabric blank apparel reflects growing environmental consciousness among consumers and businesses. Brands prioritize eco-friendly materials to align with corporate social responsibility commitments and appeal to environmentally aware customers. Additionally, certifications like GOTS organic and recycled polyester content provide competitive differentiation in crowded marketplace environments.

Influencer-led apparel brands require high-quality blank garments for limited edition merchandise drops and exclusive fan collections. Social media personalities leverage engaged audiences to sell customized products without establishing traditional manufacturing infrastructure. Furthermore, these creators demand premium fabric quality, unique silhouettes, and rapid fulfillment capabilities to maintain brand reputation and customer satisfaction.

Emerging markets across Asia, Africa, and Latin America present untapped demand opportunities for blank apparel suppliers. Rising middle-class populations, urbanization trends, and entrepreneurial activity drive custom apparel business formation. Moreover, local startups seek affordable blank inventory to launch promotional merchandise services, corporate uniform programs, and personalized fashion brands within developing economies.

Emerging Trends

Premium Quality and Ethical Manufacturing Reshape Industry Standards

Preference for premium-quality, heavyweight, and oversized blank garments reflects evolving fashion aesthetics and consumer quality expectations. Customers increasingly value substantial fabric weight, reinforced stitching, and superior construction over budget-oriented options. Consequently, manufacturers invest in upgraded materials and production processes to meet demand for durable, long-lasting apparel suitable for repeated decoration.

Rising popularity of minimalist, logo-free fashion aesthetics drives demand for clean, unbranded garments across streetwear and contemporary fashion segments. Consumers appreciate versatile wardrobe staples without visible branding that enable personal style expression through fit and silhouette. Therefore, blank apparel manufacturers position products as foundational pieces for capsule wardrobes and sustainable fashion consumption patterns.

Increased focus on ethical manufacturing and transparent supply chains responds to consumer scrutiny of labor practices and production conditions. Brands publicize factory certifications, fair wage commitments, and social compliance audits to differentiate from competitors. Additionally, blockchain technology and digital tracking systems enable customers to verify garment origins, manufacturing processes, and environmental impact claims throughout product lifecycles.

Regional Analysis

Asia Pacific Dominates the Blank Apparel Market with a Market Share of 43.20%, Valued at USD 6.7 Billion

Asia Pacific leads global blank apparel production and consumption due to established textile manufacturing infrastructure and cost-competitive labor markets. Countries including China, India, Bangladesh, and Vietnam operate extensive garment factories supplying international brands and domestic markets. Moreover, the region’s 43.20% market share, valued at USD 6.7 Billion, reflects strong B2B demand from decoration businesses and growing B2C e-commerce adoption across urban populations.

North America Blank Apparel Market Trends

North America maintains significant market presence driven by robust print-on-demand platforms, promotional merchandise industries, and corporate uniform programs. United States and Canada host numerous screen printing businesses, embroidery shops, and custom apparel startups requiring reliable blank inventory. Additionally, consumers prioritize domestically manufactured options and sustainable fabric choices, creating premium product segment opportunities.

Europe Blank Apparel Market Trends

Europe demonstrates strong demand for organic cotton, recycled fabrics, and ethically manufactured blank apparel aligned with sustainability regulations. Germany, France, and United Kingdom lead regional consumption through established fashion industries and environmental consciousness. Furthermore, strict labor standards and quality certifications influence purchasing decisions among European decorators and brand owners.

Latin America Blank Apparel Market Trends

Latin America experiences growing blank apparel demand from expanding middle-class populations and entrepreneurial custom apparel ventures. Brazil and Mexico represent primary regional markets with increasing e-commerce penetration and promotional merchandise adoption. Moreover, local manufacturers compete with imported products while addressing regional sizing preferences and climate-appropriate fabric requirements.

Middle East & Africa Blank Apparel Market Trends

Middle East & Africa shows emerging potential driven by urbanization, corporate sector expansion, and event merchandising requirements. GCC countries demonstrate premium product preferences for corporate uniforms and promotional campaigns. Additionally, South Africa’s established textile industry supports regional blank apparel supply while addressing growing demand from custom decoration businesses.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

BELLA+CANVAS leads premium blank apparel innovation through superior fabric quality, modern fits, and ethical manufacturing commitments. The company emphasizes sustainable production practices, including water conservation and renewable energy utilization at manufacturing facilities. Moreover, BELLA+CANVAS offers extensive color ranges, fashion-forward silhouettes, and retail-quality construction that appeal to discerning decorators and fashion brands seeking elevated blank garment options for custom merchandise programs.

Gildan operates as one of the world’s largest vertically integrated apparel manufacturers, controlling production from yarn spinning through finished garment assembly. This integration enables competitive pricing, consistent quality standards, and reliable supply chain management across global markets. Additionally, Gildan’s recent $2.2 billion acquisition of HanesBrands in August 2025 significantly expands market presence and product portfolio within the blank apparel industry.

SpectraUSA focuses on wholesale distribution and custom decoration services for businesses, organizations, and events requiring branded apparel solutions. The company announced expansion of market positioning as a provider of wholesale bags, apparel, and headwear in January 2026. Furthermore, SpectraUSA emphasizes customer service excellence, rapid fulfillment capabilities, and comprehensive product selection to support screen printers and promotional merchandise distributors.

Los Angeles Apparel Inc. manufactures blank garments domestically in California, emphasizing ethical labor practices, fair wages, and American-made product positioning. The company targets customers prioritizing local manufacturing, superior fabric quality, and socially responsible production methods. Consequently, Los Angeles Apparel commands premium pricing while serving fashion brands, boutique retailers, and conscious consumers seeking alternatives to imported blank apparel options.

Key Players

- BELLA+CANVAS

- SpectraUSA

- Gildan

- Soffe Apparel, Inc.

- Los Angeles Apparel Inc.

- LANE SEVEN APPAREL

- AS Colour

- Independent Trading Company

- Stanley/Stella

- Next Level Apparel

Recent Developments

- August 2025 – Gildan Activewear announced a $2.2 billion acquisition of HanesBrands, including the takeover of its $2 billion debt, representing one of the largest apparel mergers in recent history and significantly consolidating market presence.

- January 2026 – SpectraUSA, a leading wholesale supplier of promotional merchandise, announced an expansion of its market positioning as a provider of wholesale and custom bags, apparel, and headwear for businesses, organizations, and events.

- June 2025 – Strends Print Limited, owners of DynasTees, announced acquisition by Blanks, strengthening the company’s manufacturing capabilities and expanding distribution networks across key regional markets for custom blank apparel products.

Report Scope

Report Features Description Market Value (2025) USD 15.6 Billion Forecast Revenue (2035) USD 25.9 Billion CAGR (2026-2035) 5.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (T-Shirts & Tanks, Hoodies/Sweatshirts, Shirts, Bottoms, Others), Distribution Channel (Business to Business (B2B), Business to Consumers (B2C)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BELLA+CANVAS, SpectraUSA, Gildan, Soffe Apparel, Inc., Los Angeles Apparel Inc., LANE SEVEN APPAREL, AS Colour, Independent Trading Company, Stanley/Stella, Next Level Apparel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BELLA+CANVAS

- SpectraUSA

- Gildan

- Soffe Apparel, Inc.

- Los Angeles Apparel Inc.

- LANE SEVEN APPAREL

- AS Colour

- Independent Trading Company

- Stanley/Stella

- Next Level Apparel