Global Bladeless Wind Energy Market By Turbine Type(EWICON Bladeless Wind Turbine, Vortex Bladeless Wind Turbine, PowerPod, Solid-state Wind-Energy Transformer, Others), By Size(Small-Scale (< 100 kW), Medium-Scale (100 kW - 1 MW), Large-Scale (> 1 MW)), By Application(Commercial & Industrial, Residential, Agricultural, Off-Grid Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123066

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

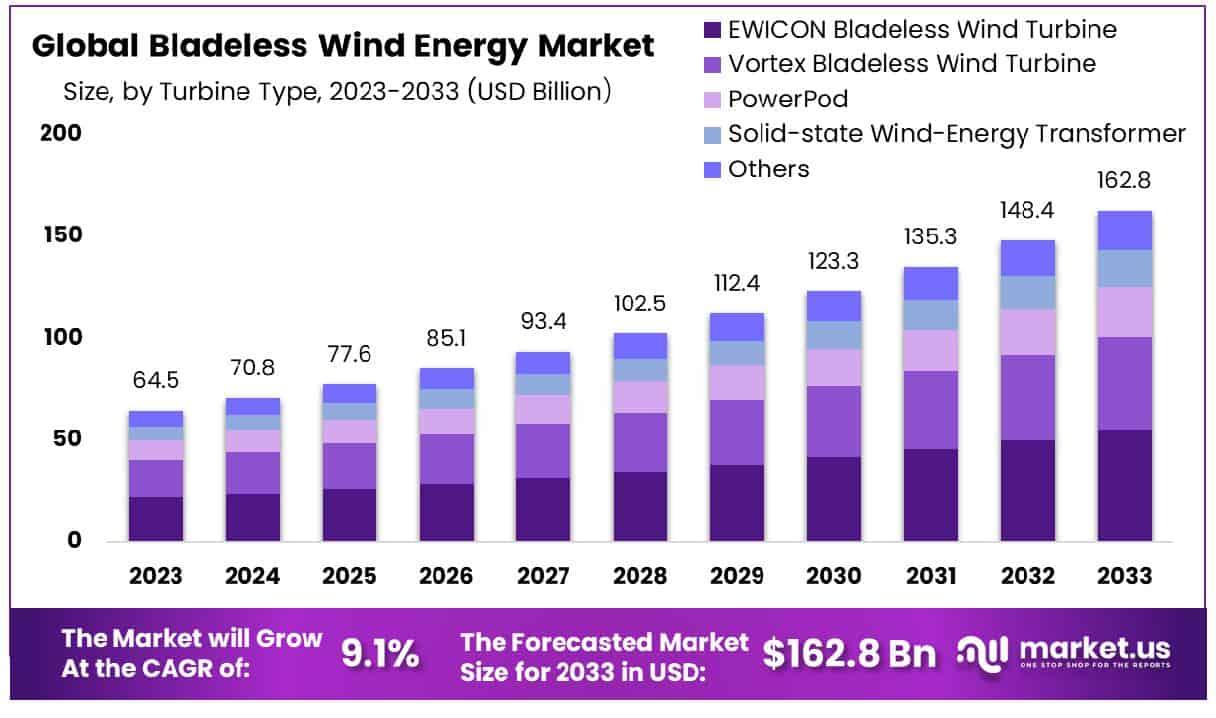

The Global Bladeless Wind Energy Market size is expected to be worth around USD 162.8 Billion by 2033, From USD 64.5 Billion by 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

The bladeless wind energy market comprises technologies engineered to generate electricity through the oscillation of structures, rather than conventional rotary blades. This emerging sector offers a distinct value proposition: minimized mechanical parts reduce maintenance costs and environmental impact, enhancing operational longevity.

Key innovations in this market leverage aerodynamic instabilities to harness wind energy, offering a compact, noise-reduced alternative to traditional turbines. As these technologies mature, they present significant investment opportunities, particularly attractive to executives and product managers aiming to lead in sustainable innovation and capitalize on the shift towards more environmentally friendly energy solutions.

The bladeless wind energy sector is poised to carve a niche within the broader wind power market, which has demonstrated robust growth dynamics as evidenced by recent data. In 2023, the global wind power capacity surged to an unprecedented 1,047 GW, bolstered by the addition of 116 GW of new capacity. This represents a significant year-on-year growth of 12.5%. Notably, China has emerged as the predominant contributor, accounting for approximately two-thirds of the new global capacity with around 75 GW installed.

In the United States, wind energy contributed about 10% of the total utility-scale electricity, amounting to 425 billion kWh in 2023. Key states such as Texas, Iowa, Oklahoma, Kansas, and Illinois were instrumental, collectively generating 59% of the nation’s total wind output. Furthermore, the offshore wind sector in the U.S. is on an upward trajectory, with more than 5,251 MW capacity currently under various phases of planning and development, predominantly off the East Coast.

Bladeless wind turbines, characterized by their innovative design that eliminates mechanical moving parts traditionally used in wind capture, offer a transformative approach to harnessing wind energy. This technology not only reduces maintenance and operational costs but also minimizes noise and wildlife disruption, aligning with increasing environmental and sustainability mandates.

Key Takeaways

- The Bladeless Wind Energy Market is projected to grow from USD 64.5 billion in 2023 to USD 162.8 billion by 2033, at a CAGR of 9.1%.

- North America holds 39.5% of the bladeless wind energy market, valued at USD 25.4 billion.

- Vortex Bladeless Wind Turbine captures 33.6% of the market share.

- Small-scale turbines under 100 kW dominate the sector’s growth.

- Commercial & Industrial applications lead with 41.3% market penetration.

Driving Factors

Rising Global Demand for Renewable Energy Sources

The escalation in the global appetite for renewable energy sources significantly propels the bladeless wind energy market. As nations and corporations intensify their efforts to meet sustainability goals and reduce carbon footprints, alternative energy forms such as bladeless wind turbines gain traction. These turbines, which leverage vibration and oscillation principles to generate power without traditional spinning blades, offer an innovative solution in the renewable sector.

The increasing emphasis on reducing greenhouse gas emissions and transitioning away from fossil fuels contributes directly to the growth of this market. As per industry estimates, renewable energy’s share of power generation is expected to increase from 29% in 2020 to over 60% by 2050, underscoring a robust growth trajectory for technologies like bladeless wind turbines.

Technological Advancements in Bladeless Wind Turbine Designs

Technological innovations are critical in driving the adoption and efficiency of bladeless wind turbines. Recent advancements have focused on enhancing the material science aspects to improve durability and energy conversion efficiencies, while also reducing manufacturing costs.

Innovations such as the use of advanced aerodynamic modeling and materials like carbon fiber have allowed these turbines to become more competitive with traditional wind turbines. These technological enhancements not only make bladeless turbines a viable alternative but also increase their attractiveness to potential investors and adopters within the energy sector.

Supportive Government Policies and Incentives for Green Energy

Governmental support plays a pivotal role in the proliferation of bladeless wind energy solutions. Many countries have implemented policies and incentives such as tax rebates, subsidies, and grants to encourage the adoption of renewable energy technologies. For example, the European Union’s Green Deal and the United States’ renewable energy tax credits significantly lower the entry barriers for new technologies in the renewable sector.

These supportive measures not only reduce the initial capital expenditure required for adopting bladeless wind technologies but also foster a conducive environment for continuous research and development. Such policies are instrumental in catalyzing market growth, attracting investments, and facilitating the broader deployment of innovative energy solutions like bladeless wind turbines.

Restraining Factors

High Initial Deployment Costs: Stifling Market Expansion

The growth of the bladeless wind energy market is significantly restrained by high initial deployment costs. These costs encompass the development, manufacturing, and installation of bladeless wind turbines, which often incorporate advanced materials and novel engineering solutions to generate energy without traditional mechanical blades.

The financial barrier is particularly daunting for new entrants and smaller players who may struggle to secure funding for such innovative technologies. This financial hurdle not only slows down the adoption rate but also limits market penetration in regions with lower investment capabilities. Without economies of scale or substantial financial incentives, the cost-benefit ratio remains unfavorable, thereby impeding rapid market growth.

Limited Awareness and Skepticism Regarding Bladeless Technology Effectiveness: Hindering Market Acceptance

Awareness and perception issues form another critical restraint on the bladeless wind energy market. Despite the potential benefits of bladeless wind turbines, such as reduced mechanical wear and lower maintenance costs, there remains a significant degree of skepticism regarding their efficiency and overall effectiveness. The absence of visible, moving parts can lead skeptical stakeholders to question their functionality and output capabilities.

This skepticism is compounded by limited awareness among potential users and investors, who are often unfamiliar with the operational principles and advantages of bladeless technology. The combination of these factors leads to slower adoption rates, as potential adopters opt for more traditional and familiar technologies. Collectively, these perceptual barriers delay the establishment of bladeless turbines as a mainstream alternative, curbing their potential market growth.

By Turbine Type Analysis

Vortex Bladeless Wind Turbine accounts for 33.6% of the market share.

In 2023, the Vortex Bladeless Wind Turbine held a dominant market position in the “By Turbine Type” segment of the Bladeless Wind Energy Market, capturing more than a 33.6% share. This segment’s landscape also features other key technologies, including EWICON Bladeless Wind Turbine, PowerPod, Solid-state Wind-Energy Transformer, and others, each contributing to the diversification and technological innovation within the market.

The substantial market share held by Vortex Bladeless Wind Turbine can be attributed to its innovative design, which eliminates the need for mechanical moving parts, thus reducing maintenance costs and increasing the turbine’s lifespan. Its unique technology harnesses vorticity, an aerodynamic effect that produces a pattern of spinning vortices. Compared to traditional turbines, this model significantly reduces noise, a critical factor in residential and urban installations.

The EWICON (Electrostatic Wind Energy Converter) Bladeless Wind Turbine, another significant player, utilizes a different approach by converting wind energy into electricity using charged water droplets. This method presents a novel way to generate wind energy without physical rotation, appealing to markets focused on reducing mechanical wear and environmental impact.

Emerging technologies like the PowerPod and Solid-state Wind-Energy Transformer are also gaining traction. These innovations cater to a growing demand for sustainable and efficient energy solutions. The PowerPod, for instance, focuses on optimizing aerodynamic efficiency through a compact design suitable for small-scale applications.

By Size Analysis

Small-scale turbines, defined as less than 100 kW, dominate this market segment.

In 2023, the Small-Scale (<100 kW) segment held a dominant market position in the “By Size” category of the Bladeless Wind Energy Market. This segment’s prominence is primarily attributed to its widespread adoption in residential and small-scale commercial applications, where space constraints and aesthetic considerations play crucial roles. The small-scale bladeless wind turbines, celebrated for their compact design and lower noise levels compared to traditional turbines, have garnered significant interest among environmentally conscious consumers seeking sustainable energy solutions without the spatial and visual impact of conventional wind turbines.By Application Analysis

Commercial & industrial uses capture 41.3% of the application market for these turbines.

In 2023, Commercial & Industrial applications held a dominant market position in the “By Application” segment of the Bladeless Wind Energy Market, capturing more than a 41.3% share. This substantial market share is attributed to increasing adoption within sectors seeking to reduce their carbon footprint while achieving energy autonomy. Commercial buildings and industrial facilities have integrated bladeless wind turbines to complement their existing energy systems, driven by their efficiency, lower operational noise, and minimal environmental impact compared to traditional wind turbines.

The Residential segment also showed significant growth, propelled by the rising consumer awareness and the shift towards sustainable living. Homeowners are adopting these innovative energy solutions to decrease reliance on grid electricity and reduce household carbon emissions, further supported by governmental incentives and decreasing installation costs.

In the Agricultural sector, bladeless wind turbines are increasingly used for powering irrigation systems and other farm operations, marking a shift towards renewable sources that are less dependent on grid connectivity and fossil fuels. This trend is expected to continue as technology costs decrease and awareness of sustainable farming practices increases.

The Off-Grid Power Generation segment is benefiting from the deployment of bladeless wind turbines in remote areas where traditional power grid connectivity is either unreliable or nonexistent. This application is crucial for enhancing energy access in underserved regions, thus driving the segment’s growth.

Key Market Segments

By Turbine Type

- EWICON Bladeless Wind Turbine

- Vortex Bladeless Wind Turbine

- PowerPod

- Solid-state Wind-Energy Transformer

- Others

By Size

- Small-Scale (< 100 kW)

- Medium-Scale (100 kW – 1 MW)

- Large-Scale (> 1 MW)

By Application

- Commercial & Industrial

- Residential

- Agricultural

- Off-Grid Power Generation

- Others

Growth Opportunities

Expansion into Emerging Markets: Capitalizing on Untapped Potential

The global bladeless wind energy market is poised to capitalize significantly on expansion into emerging markets in 2023. These regions, characterized by abundant untapped wind resources, represent a fertile ground for deploying innovative energy solutions. Countries in Africa, Asia, and Latin America, where traditional energy infrastructure may be underdeveloped or absent, offer vast opportunities for the establishment of bladeless wind turbines.

The minimal environmental impact and reduced mechanical complexity of bladeless turbines make them particularly appealing in these areas, as they can be deployed rapidly and with less ecological disruption compared to traditional wind turbines. This strategic expansion not only diversifies the geographic footprint of the bladeless wind energy market but also enhances its resilience by tapping into new consumer bases that are progressively more receptive to renewable energy technologies.

Integration with Smart Grid Technologies: Enhancing Efficiency and Reliability

In 2023, integrating bladeless wind energy solutions with smart grid technologies presents a substantial growth opportunity. Smart grids, which use digital communication technology to monitor and manage electricity flow, can significantly enhance the operational efficiency and energy distribution capabilities of bladeless turbines. This integration allows for more precise energy management and better alignment with demand patterns, thereby increasing the overall reliability and attractiveness of bladeless wind energy systems.

As the grid becomes smarter and more integrated, the role of bladeless turbines could shift from merely being an alternative energy source to becoming a pivotal component in the next-generation energy systems. This synergy not only boosts the market growth potential of bladeless turbines but also supports the broader transition towards more sustainable and efficient energy networks globally.

Latest Trends

Adoption of Artificial Intelligence for Operational Efficiency

The bladeless wind energy market is witnessing a transformative trend with the increasing adoption of artificial intelligence (AI) to enhance operational efficiency. In 2023, AI technologies are being integrated into bladeless wind energy systems to optimize energy capture, predict maintenance needs, and enhance overall turbine performance. By leveraging AI-driven algorithms, bladeless turbines can automatically adjust to changes in wind patterns and atmospheric conditions, maximizing energy output with minimal human intervention.

This technological advancement not only improves the economic viability of bladeless turbines but also positions them as a competitive alternative to traditional wind energy solutions. The trend toward AI adoption underscores the market’s shift towards smarter, more autonomous renewable energy systems that promise higher efficiency and lower operational costs.

Collaborative Ventures between Tech Companies and Renewable Energy Firms

A key trend shaping the bladeless wind energy market in 2023 is the increase in collaborative ventures between tech companies and renewable energy firms. These partnerships are driving innovation and accelerating the commercialization of bladeless wind technologies. Tech companies bring cutting-edge technologies and substantial R&D capabilities, while renewable energy firms offer industry-specific expertise and market access.

Such collaborations are resulting in the development of more advanced, reliable, and cost-effective bladeless wind turbines. These partnerships not only foster technological innovation but also enhance the scalability of bladeless wind solutions, facilitating wider adoption across global markets. This trend reflects a broader movement toward interdisciplinary cooperation, crucial for addressing complex challenges in the renewable energy sector.

Regional Analysis

The North American bladeless wind energy market holds a 39.5% share, valued at USD 25.4 billion.

The global bladeless wind energy market exhibits distinct regional dynamics characterized by varied growth trajectories and market penetration across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America emerges as the dominating region, commanding a substantial 39.5% market share with a valuation of USD 25.4 billion. This leadership is driven by robust investments in renewable technologies, supportive government policies, and a high degree of technological adoption among the energy sector stakeholders in the region.

In contrast, Europe follows closely, leveraging its strong regulatory frameworks that favor green energy and innovation. The European market is spurred by aggressive carbon reduction targets and the integration of renewable energy sources into the regional grid, which enhances the adoption of innovative technologies like bladeless wind turbines.

Asia Pacific is witnessing rapid growth due to expanding energy needs and increasing environmental awareness. Countries like China and India are pivotal, with their governments promoting renewable energy through incentives and subsidies, thus catalyzing the regional bladeless wind energy sector.

The Middle East & Africa, though still nascent in the bladeless wind energy market, are beginning to recognize the potential of renewable sources to meet their expanding energy requirements and diversify their energy portfolios away from hydrocarbon dependence.

Lastly, Latin America shows promising growth potential, fueled by its vast natural resources and escalating energy demands. The region is gradually shifting towards renewable energy sources, with bladeless wind energy poised to play a significant role in its sustainable energy landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the bladeless wind energy market continues to evolve, driven by a dynamic array of key players that are innovating and expanding the technological frontiers of renewable energy. Among these, several companies stand out due to their strategic initiatives and contributions to market growth.

Enercon and GE Renewable Energy remain prominent players, capitalizing on their extensive expertise and global reach to innovate and implement bladeless technologies alongside traditional offerings. Goldwind and Mitsubishi Heavy Industries have been pivotal in integrating bladeless designs with existing turbine technologies, enhancing efficiency and reducing operational costs.

Nordex and Senvion, along with Siemens, continue to push the boundaries of bladeless wind technology through significant R&D investments and partnerships with technology innovators. Suzlon and Envision are exploring new markets and applications for bladeless turbines, particularly in regions with complex terrain where traditional turbines are less effective.

Vestas and General Electric have focused on incorporating advanced materials and aerodynamic designs to optimize the performance and durability of bladeless systems. Meanwhile, Altair Engineering Inc. and Nord-Lock International AB have been instrumental in enhancing the structural integrity and safety features of bladeless turbines.

Emerging companies like Aeromine Technologies and Vortex Bladeless are noteworthy for their revolutionary approaches to design and functionality, which challenge conventional wind energy paradigms. eWind Solutions Inc. is making strides in the small-scale and residential market segments, indicating the broadening appeal of bladeless wind solutions.

Market Key Players

- Enercon

- GE Renewable Energy

- Goldwind

- Mitsubishi Heavy Industries

- Nordex

- Senvion

- Siemens

- Suzlon and Envision

- Vestas General Electric

- Altair Engineering Inc.

- Nord-Lock International AB

- Aeromine Technologies

- Vortex Bladeless

- eWind Solutions Inc

Recent Development

- In 2023, GE Vernova’s agreement with Pattern Energy to install 674 of their 3.6-154 turbines for the SunZia project in New Mexico, marking a significant order received in the fourth quarter of 2023.

- In 2023, MHI has a long-standing presence in the renewable energy sector, particularly in wind turbine production, having supplied over 4,200 units globally.

Report Scope

Report Features Description Market Value (2023) USD 64.5 Billion Forecast Revenue (2033) USD 162.8 Billion CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Turbine Type(EWICON Bladeless Wind Turbine, Vortex Bladeless Wind Turbine, PowerPod, Solid-state Wind-Energy Transformer, Others), By Size(Small-Scale (< 100 kW), Medium-Scale (100 kW – 1 MW), Large-Scale (> 1 MW)), By Application(Commercial & Industrial, Residential, Agricultural, Off-Grid Power Generation, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Enercon, GE Renewable Energy, Goldwind, Mitsubishi Heavy Industries, Nordex, Senvion, Siemens, Suzlon and Envision, Vestas General Electric, Altair Engineering Inc., Nord-Lock International AB, Aeromine Technologies, Vortex Bladeless, eWind Solutions Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Bladeless Wind Energy Market Size in 2023?The Global Bladeless Wind Energy Market Size is USD 64.5 Billion in 2023.

What is the projected CAGR at which the Global Bladeless Wind Energy Market is expected to grow at?The Global Bladeless Wind Energy Market is expected to grow at a CAGR of 9.1% (2024-2033).

List the segments encompassed in this report on the Global Bladeless Wind Energy Market?Market.US has segmented the Global Bladeless Wind Energy Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Turbine Type(EWICON Bladeless Wind Turbine, Vortex Bladeless Wind Turbine, PowerPod, Solid-state Wind-Energy Transformer, Others), By Size(Small-Scale (< 100 kW), Medium-Scale (100 kW - 1 MW), Large-Scale (> 1 MW)), By Application(Commercial & Industrial, Residential, Agricultural, Off-Grid Power Generation, Others)

List the key industry players of the Global Bladeless Wind Energy Market?Enercon, GE Renewable Energy, Goldwind, Mitsubishi Heavy Industries, Nordex, Senvion, Siemens, Suzlon and Envision, Vestas General Electric, Altair Engineering Inc., Nord-Lock International AB, Aeromine Technologies , Vortex Bladeless, eWind Solutions Inc

Name the key areas of business for Global Bladeless Wind Energy Market?The US, Canada, Mexico are leading key areas of operation for Global Bladeless Wind Energy Market.

Bladeless Wind Energy MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Bladeless Wind Energy MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Enercon

- GE Renewable Energy

- Goldwind

- Mitsubishi Heavy Industries

- Nordex

- Senvion

- Siemens

- Suzlon and Envision

- Vestas General Electric

- Altair Engineering Inc.

- Nord-Lock International AB

- Aeromine Technologies

- Vortex Bladeless

- eWind Solutions Inc