Global Biotechnology And Pharmaceutical Services Outsourcing Market By Service(Consulting, Regulatory Affairs, Product Design & Development, Auditing and Assessment, Product Maintenance, Training & Education, Others) By Company Size(Large Enterprises, Small and Medium Enterprises (SMEs)) By End-User(Pharmaceutical Companies, Biotech Companies, Research Institutions) By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156453

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

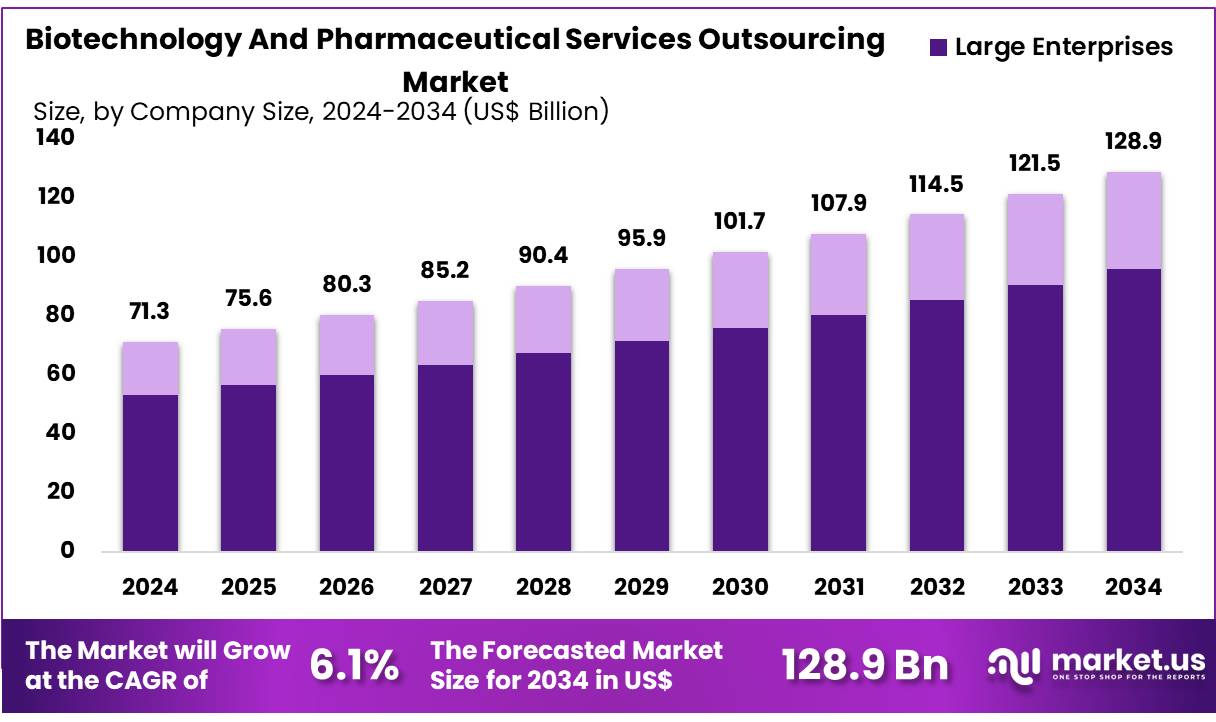

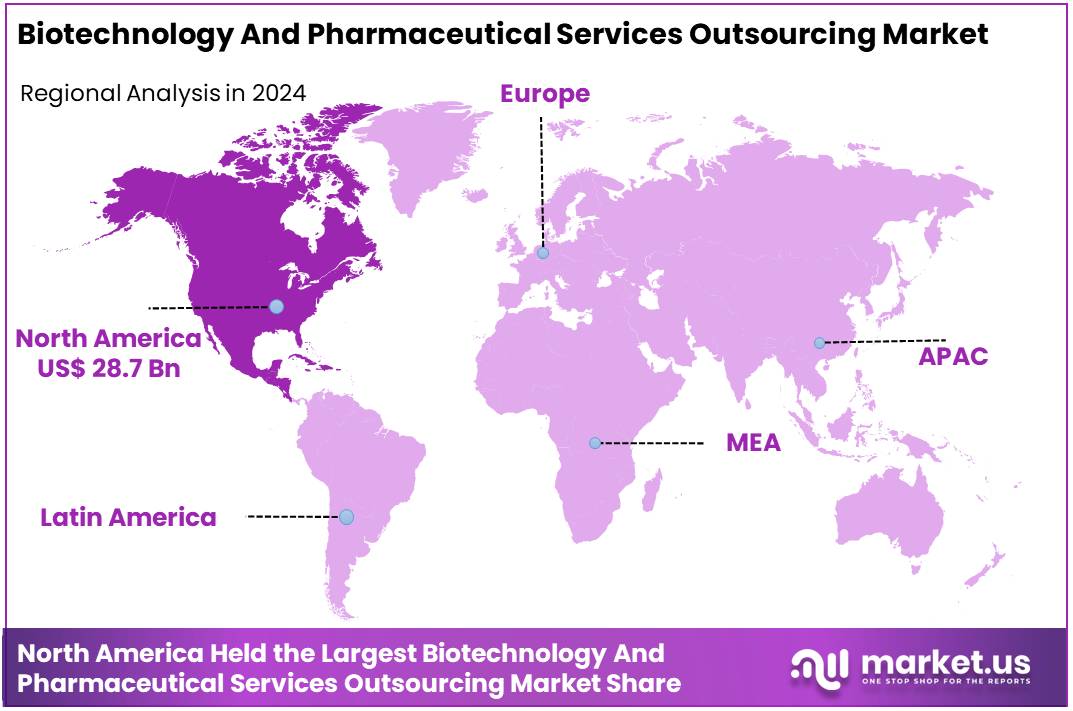

Global Biotechnology And Pharmaceutical Services Outsourcing Market size is expected to be worth around US$ 128.9 Billion by 2034 from US$ 71.3 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 28.7 Billion.

The healthcare Market is undergoing rapid transformation as biotechnology and pharmaceutical companies increasingly adopt outsourcing strategies to enhance efficiency and accelerate innovation. The outsourcing of services such as clinical research, regulatory compliance, drug development support, and manufacturing has become an essential practice to meet the growing complexity of healthcare demands.

Healthcare providers and life sciences organizations face rising pressure to deliver innovative therapies at a faster pace while maintaining compliance with stringent global regulations. Outsourcing has emerged as a solution, allowing companies to collaborate with specialized partners who bring technical expertise, cost advantages, and advanced infrastructure. This enables organizations to focus on core competencies such as research and patient care, while ensuring streamlined operations across the value chain.

The healthcare sector benefits significantly from this model. Contract service providers contribute to the successful execution of clinical trials, patient recruitment, pharmacovigilance, and regulatory submissions. These partnerships are accelerating the availability of critical treatments, including advanced biologics, vaccines, and personalized medicines. Additionally, outsourcing supports digital adoption in healthcare by integrating data management, artificial intelligence, and real-world evidence analysis into clinical processes.

As global health systems continue to evolve, biotechnology and pharmaceutical services outsourcing is expected to remain a vital strategy. The model not only reduces costs but also fosters innovation and patient-centric outcomes, reinforcing its role as a cornerstone of modern healthcare advancement.

Key Takeaways

- Market Size: Global Biotechnology And Pharmaceutical Services Outsourcing Market size is expected to be worth around US$ 128.9 Billion by 2034 from US$ 71.3 Billion in 2024.

- Market Growth: The market growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 28.7 Billion.

- Service Analysis Analysis: consulting services dominate the market with a 26.5% share in 2024.

- Company Size Analysis: The Biotechnology and Pharmaceutical Services Outsourcing Market in 2024 is predominantly led by Large Enterprises, which account for 74.6% of the total market share.

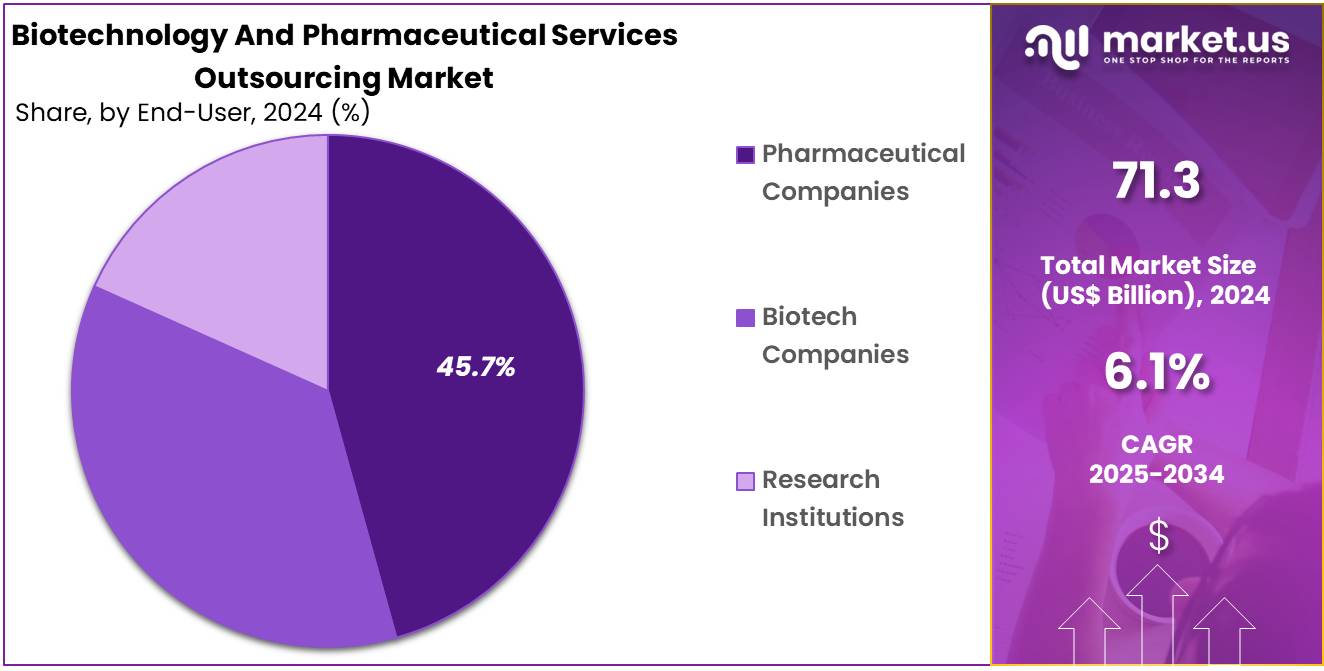

- End-Use Analysis: The Biotechnology and Pharmaceutical Services Outsourcing Market is primarily dominated by Pharmaceutical Companies, which hold a 45.7% share.

- Regional Analysis: In 2024, North America held a dominant market position, capturing more than a 40.3% share and holding a market value of US$ 28.7 billion for the year.

Service Analysis

The biotechnology and pharmaceutical services outsourcing market in 2024 is segmented into consulting, regulatory affairs, product design and development, auditing and assessment, product maintenance, training and education, and other services. Among these, consulting services dominate the market with a 26.5% share in 2024, reflecting the strong reliance of pharmaceutical and biotechnology companies on external expertise to address complex challenges in strategy, commercialization, and clinical development. The growth of consulting is being driven by the rising demand for cost optimization, risk management, and market access strategies.

Regulatory affairs services constitute a critical segment, as companies increasingly outsource compliance and submission activities to navigate stringent regulatory frameworks across multiple geographies. Product design and development services are also witnessing significant adoption, particularly due to the rising complexity of biologics and biosimilars requiring specialized expertise. Auditing and assessment services remain essential for ensuring quality management and adherence to global standards, while product maintenance services provide long-term support across the product lifecycle.

Additionally, training and education services are gaining traction as companies prioritize workforce skill development in advanced therapies and digital solutions. The others category includes niche offerings such as pharmacovigilance and post-market surveillance, which are expanding steadily with the growing emphasis on patient safety.

Company Size Analysis

The Biotechnology and Pharmaceutical Services Outsourcing Market in 2024 is predominantly led by Large Enterprises, which account for 74.6% of the total market share. This dominance is driven by their substantial financial resources, advanced infrastructure, and established global presence, which enable them to outsource services at scale to optimize costs, accelerate drug development, and maintain compliance with evolving regulatory frameworks.

Large enterprises are increasingly leveraging outsourcing partners to enhance research and development efficiency, streamline manufacturing, and expand into emerging markets. Their strategic alliances with contract research organizations (CROs) and contract manufacturing organizations (CMOs) contribute significantly to sustaining market leadership.

In contrast, Small and Medium Enterprises (SMEs), while representing a comparatively smaller share of the market, are expected to exhibit higher growth potential over the forecast period. Limited internal resources and budget constraints encourage SMEs to rely on outsourcing for critical functions such as clinical trials, regulatory support, and data management.

Outsourcing enables these companies to remain competitive, reduce operational risks, and focus on innovation without the burden of large-scale infrastructure investments. As biopharmaceutical innovations increasingly emerge from smaller players, SMEs are likely to strengthen their role in shaping market dynamics, albeit from a lower base compared to large enterprises.

End-User Analysis

The Biotechnology and Pharmaceutical Services Outsourcing Market is primarily dominated by Pharmaceutical Companies, which hold a 45.7% share. Their dominance is attributed to extensive drug development pipelines, high R&D expenditure, and the pressing need to reduce time-to-market for new therapies. Outsourcing allows pharmaceutical firms to optimize costs, access specialized expertise, and meet stringent regulatory requirements efficiently.

Partnerships with contract research organizations (CROs) and contract manufacturing organizations (CMOs) are increasingly adopted to manage large-scale clinical trials, complex biologics manufacturing, and global regulatory compliance. The ability of pharmaceutical companies to engage multiple outsourcing partners across geographies reinforces their leadership position in this segment.

Biotechnology Companies represent the second key segment and are anticipated to expand at a robust pace. These firms, often innovation-driven but resource-constrained, leverage outsourcing to access advanced technologies, specialized capabilities, and clinical trial expertise without incurring significant capital investments. Their growing focus on niche therapies, biologics, and cell and gene therapies is expected to drive demand for outsourcing services.

Research Institutions, though smaller in market share, contribute significantly to pre-clinical research and collaborative projects with industry players. Outsourcing supports these institutions in advancing early-stage discoveries and translating them into potential commercial applications, strengthening the overall innovation ecosystem.

Key Market Segments

By Service

- Consulting

- Regulatory Consulting

- Clinical Development Consulting

- Strategic Planning & Business Development Consulting

- Quality Management Systems Consulting

- Others

- Regulatory Affairs

- Legal Representation

- Regulatory Writing & Publishing

- Product Registration & Clinical Trial Applications

- Regulatory Submissions

- Regulatory Operations

- Others

- Product Design & Development

- Research, Strategy, & Concept Generation

- Concept & Requirements Development

- Detailed Design & Process Development

- Design Verification & Validation

- Process Validation & Manufacturing Transfer

- Production & Commercial Support

- Auditing and Assessment

- Product Maintenance

- Training & Education

- Others

By Company Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User

- Pharmaceutical Companies

- Biotech Companies

- Research Institutions

Drivering Factors

The growing emphasis on domestic manufacturing and strengthening supply chain resilience has become a significant driver for the biotechnology and pharmaceutical services outsourcing market. The COVID-19 pandemic revealed vulnerabilities arising from heavy reliance on foreign suppliers, particularly from China and India, which created disruptions in drug availability and delayed clinical programs.

As a result, pharmaceutical companies and investors are prioritizing the development of more robust and geographically diversified supply chains. Contract manufacturing organizations (CMOs) have become critical partners in this shift, offering flexible infrastructure and technical expertise to meet rising demand. Substantial private equity investments in leading players such as PCI Pharma Services and Catalent demonstrate long-term confidence in the growth of outsourced production services.

Trending Factors

India has emerged as a key growth center shaping the global outsourcing landscape, with government initiatives providing strong policy and financial support. The Indian government has allocated more than USD 2.86 billion to strengthen its biotechnology sector, reflecting its ambition to establish a globally competitive pharmaceutical ecosystem.

One major policy initiative is the proposal to establish centralized Contract Research, Development, and Manufacturing Organization (CRDMO) parks designed to streamline operations, lower costs, and attract foreign investment. These reforms are aimed at enhancing efficiency, addressing regulatory delays, and reducing dependence on Chinese supply chains. With favorable demographics, a skilled workforce, and rising infrastructure, India is positioning itself as a major outsourcing hub for biotechnology and pharmaceutical services.

Restraining Factors

A key restraint affecting the biotechnology and pharmaceutical services outsourcing market is the rising geopolitical tension and evolving regulatory frameworks in major markets. The United States, for instance, has introduced legislation such as the Biosecure Act, which discourages partnerships with Chinese contract research organizations (CROs) and biotechs, particularly for projects linked to federal research or sensitive supply chains.

While these measures aim to safeguard national security and data integrity, they simultaneously increase operational complexity for pharmaceutical companies. Firms are now compelled to reevaluate supply partners, diversify sourcing, and invest in alternative geographies, often at higher costs. This reshaping of global outsourcing relationships can lead to longer timelines, added compliance burdens, and greater unpredictability in drug development pipelines.

Opportunity

The rapid expansion of cross-border licensing and development agreements presents a major opportunity for biotechnology and pharmaceutical services outsourcing. Chinese biotechnology companies have become increasingly central to global innovation, particularly in oncology and biologics. In 2025, Chinese firms accounted for nearly one-third of the total value of global licensing deals, underscoring their growing importance.

Notable agreements include Pfizer’s USD 6 billion licensing partnership for cancer therapies and AstraZeneca’s cumulative licensing value of USD 13.6 billion with Chinese firms. These collaborations highlight both the scientific progress in China’s biopharma sector and the willingness of global firms to engage in joint development. For outsourcing providers, this creates opportunities in clinical research, manufacturing, and early-stage drug development partnerships across borders.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 40.3% share and holding a market value of US$ 28.7 billion for the year. The strong market position can be attributed to advanced healthcare infrastructure. The presence of well-established pharmaceutical companies has further supported demand for outsourcing services. Clinical trial activity in the United States and Canada has remained high, which has strengthened the need for contract research and development services.

Regulatory frameworks in the region are considered favorable. The U.S. Food and Drug Administration (FDA) plays a critical role in setting global benchmarks for clinical trials and drug approvals. This has encouraged global pharmaceutical companies to choose North America as a prime outsourcing destination.

Technological advancements have also contributed to the region’s leadership. The adoption of artificial intelligence, big data analytics, and cloud-based platforms has improved efficiency in drug discovery and clinical trial management. This has allowed service providers to deliver faster and more reliable outcomes.

The growing demand for personalized medicine is another factor boosting outsourcing activities. Pharmaceutical and biotechnology firms in the region are increasingly relying on specialized contract services to reduce costs and accelerate product pipelines.

In summary, North America’s dominance in the biotechnology and pharmaceutical services outsourcing market is underpinned by advanced infrastructure, regulatory strength, innovation, and sustained investment in research and development. The region is expected to retain its leadership position during the forecast period, supported by continued technological integration and high outsourcing demand.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The biotechnology and pharmaceutical services outsourcing market is characterized by the presence of a diverse group of global and regional providers. Market participants focus on expanding service portfolios that include clinical research, regulatory support, pharmacovigilance, and manufacturing solutions. Strong emphasis is placed on advanced technologies such as artificial intelligence, real-world evidence analytics, and automation to enhance operational efficiency. Players actively invest in strategic partnerships, mergers, and acquisitions to strengthen their global footprint and meet rising demand for specialized services.

Cost optimization and accelerated drug development timelines remain central drivers for outsourcing decisions, shaping competitive strategies. In addition, growing demand for personalized medicine and biologics has encouraged service providers to expand capabilities in niche therapeutic areas. The competitive environment is moderately consolidated, with leading providers holding significant market share, while smaller firms focus on innovation and customized offerings to capture specific segments and maintain competitiveness.

Market Key Players

- Parexel International Corporation

- LabCorp

- IQVIA

- Lonza

- Concept Heidelberg GmbH

- Samsung Biologics

- Charles River Laboratories

- ICON plc.

- Syneos Health

- Lachman Consultant Services, Inc.

- Catalent Inc.

- GMP Pharmaceuticals Pty Ltd.

- The Quantic Group

Recent Developments

- Parexel International Corporation: In April 2025, Parexel announced its acquisition of functional-service provider ExecuPharm Inc., strengthening its functional service provider (FSP) capabilities across Phases I–IV clinical studies.

- LabCorp: In March 2025, LabCorp acquired select Oncology and related clinical testing services assets from BioReference Health. In early 2025, it also completed acquisitions of Lab Works (Birmingham) and Ballad Health outreach services, with a collaboration announced with Inspira Health.

- IQVIA: In June 2025, IQVIA completed a merger/acquisition with Medicines Evaluation Unit. In Q2 2025, it also repurchased $607 million of common stock, reaching $1.032 billion in the first half of the year.

- Lonza: In October 2024, Lonza finalized the acquisition of Genentech’s large-scale biologics manufacturing site in Vacaville, California, for USD 1.2 billion. In May 2025, it reaffirmed 2025 outlook: CDMO CER sales growth approaching 20% and CORE EBITDA margin nearing 30%.

Report Scope

Report Features Description Market Value (2024) US$ 71.3 Billion Forecast Revenue (2034) US$ 128.9 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service(Consulting(Regulatory Consulting, Clinical Development Consulting, Strategic Planning & Business Development Consulting, Quality Management Systems Consulting, Others)Regulatory Affairs(Legal Representation, Regulatory Writing & Publishing, Product Registration & Clinical Trial Applications, Regulatory Submissions, Regulatory Operations, Others) Product Design & Development(Research, Strategy, & Concept Generation, Concept & Requirements Development, Detailed Design & Process Development, Design Verification & Validation, Process Validation & Manufacturing Transfer , Production & Commercial Support) Auditing and Assessment, Product Maintenance, Training & Education, Others) By Company Size(Large Enterprises, Small and Medium Enterprises (SMEs)) By End-User(Pharmaceutical Companies, Biotech Companies, Research Institutions) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Parexel International Corporation, LabCorp, IQVIA, Lonza, Concept Heidelberg GmbH, Samsung Biologics, Charles River Laboratories, ICON plc., Syneos Health, Lachman Consultant Services, Inc., Catalent Inc., GMP Pharmaceuticals Pty Ltd., The Quantic Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biotechnology And Pharmaceutical Services Outsourcing MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Biotechnology And Pharmaceutical Services Outsourcing MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Parexel International Corporation

- LabCorp

- IQVIA

- Lonza

- Concept Heidelberg GmbH

- Samsung Biologics

- Charles River Laboratories

- ICON plc.

- Syneos Health

- Lachman Consultant Services, Inc.

- Catalent Inc.

- GMP Pharmaceuticals Pty Ltd.

- The Quantic Group