Bioreactors Market By Product Type (Single Use and Reusable), By Cell (Mammalian Cells, Yeast Cells, Bacterial Cells, and Others), By Molecule (Vaccines, Monoclonal Antibodies, Recombinant Proteins, Gene Therapy, Stem Cells, and Others), By Usage (Preclinical & Clinical, Developmental, and Commercial Production), By End-Use (Research & Development Organizations, Biopharmaceutical Manufacturers, and Contract Manufacturing Organizations), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130548

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Cell Analysis

- Molecule Analysis

- Usage Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

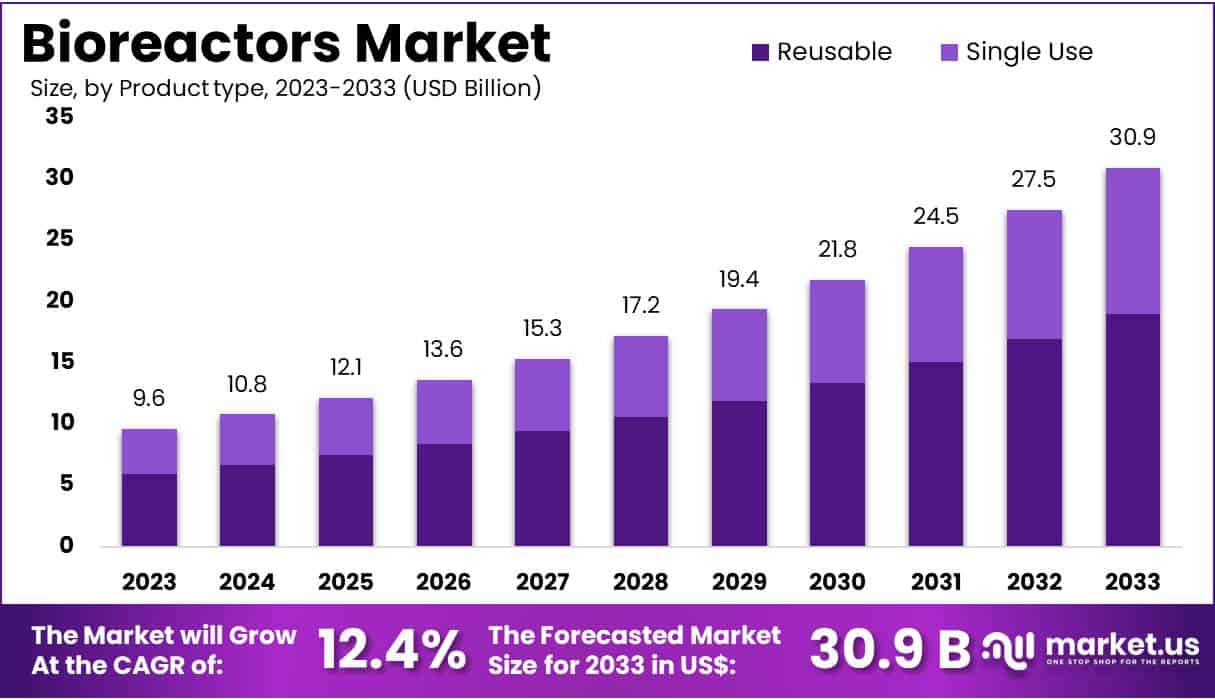

The Bioreactors Market size is expected to be worth around US$ 30.9 billion by 2033 from US$ 9.6 billion in 2023, growing at a CAGR of 12.4% during the forecast period 2024 to 2033.

Growing interest in sustainable production methods drives significant advancements in the bioreactors market, particularly in applications such as biopharmaceutical manufacturing, cell culture, and tissue engineering. Bioreactors play a critical role in the cultivation of cells and microorganisms for the production of therapeutic proteins, vaccines, and other biologics, addressing the rising demand for effective healthcare solutions.

Recent trends indicate a shift towards using bioreactors for cellular agriculture, where companies aim to produce animal products like meat and milk proteins directly from animal and microbial cells. In October 2022, Getinge AB announced that its bioreactors would support the Dutch government’s initiative to promote such sustainable practices, demonstrating a commitment to innovative food production technologies. Additionally, the bioreactor market benefits from ongoing advancements in automation and process control, which enhance efficiency and scalability in production.

The integration of artificial intelligence and machine learning further optimizes bioprocessing, enabling more precise monitoring and control of various parameters. As regulatory frameworks evolve to support these innovative approaches, the market will likely see increased investment and interest from both established and emerging players. Furthermore, the growing focus on personalized medicine and biologics opens new opportunities for bioreactor applications, as developers seek to create customized therapies tailored to individual patient needs.

Key Takeaways

- In 2023, the market for Bioreactors generated a revenue of US$ 6 billion, with a CAGR of 12.4%, and is expected to reach US$ 30.9 billion by the year 2033.

- The product type segment is divided into single use and reusable, with reusable taking the lead in 2023 with a market share of 61.5%.

- Considering cell, the market is divided into mammalian cells, yeast cells, bacterial cells, and others. Among these, mammalian cells held a significant share of 47.9%.

- Concerning the molecule segment, the vaccines sector stands out as the dominant player, holding the largest revenue share of 42.6% in the Bioreactors market.

- The usage segment is segregated into preclinical & clinical, developmental, and commercial production, with the preclinical & clinical segment leading the market, holding a revenue share of 50.3%.

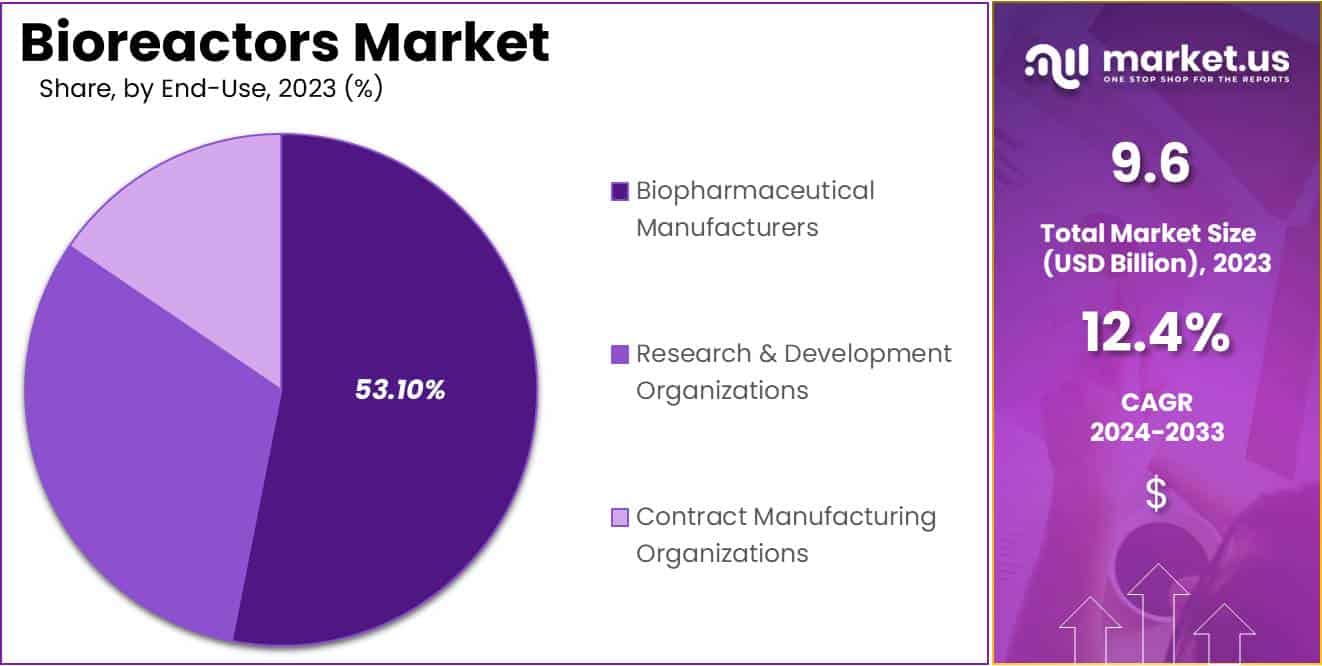

- Considering end-use, the market is divided into research & development organizations, biopharmaceutical manufacturers, and contract manufacturing organizations. Among these, biopharmaceutical manufacturers held a significant share of 53.1%.

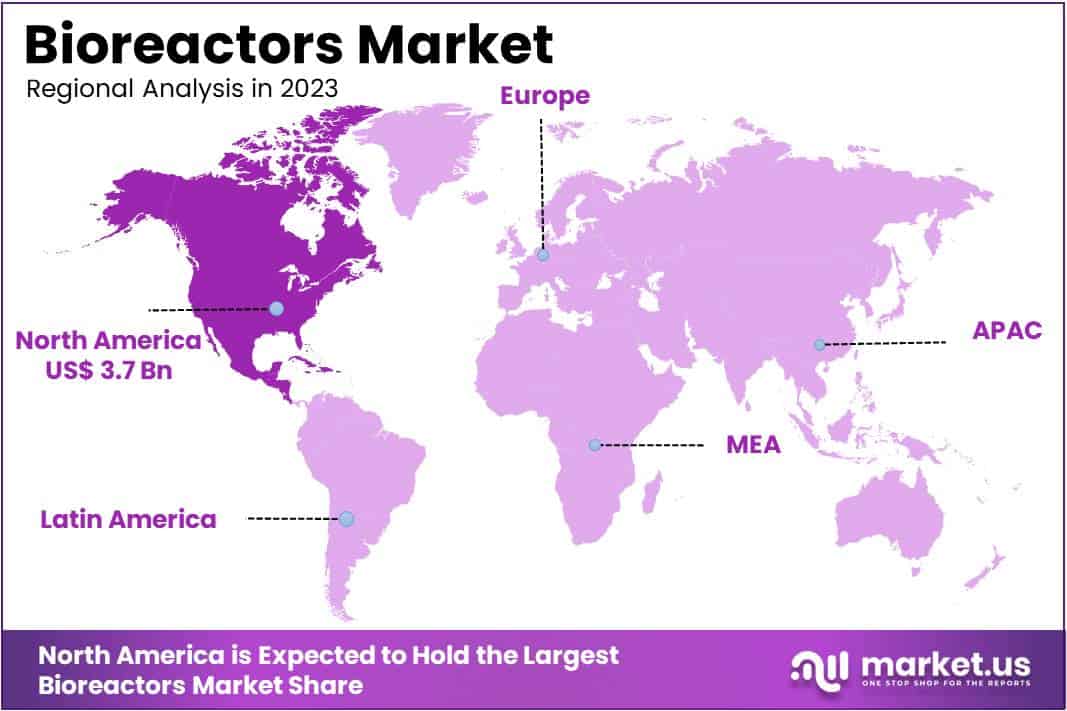

- North America led the market by securing a market share of 38.4% in 2023.

Product Type Analysis

The reusable segment led in 2023, claiming a market share of 61.5% owing to increasing demand for cost-effective and sustainable manufacturing processes. As biopharmaceutical companies seek to minimize production costs, the advantages of reusable systems become evident, particularly in reducing waste and enhancing efficiency.

The anticipated advancements in cleaning and sterilization technologies are likely to facilitate the effective reuse of these devices, further appealing to manufacturers focused on sustainability. Additionally, regulatory support for environmentally friendly practices is projected to enhance the adoption of reusable bioreactors. As companies strive to optimize production workflows and maintain product quality, the reusable segment is likely to solidify its position as a preferred choice in the market.

Cell Analysis

The mammalian cells held a significant share of 47.9% due to the increasing use of mammalian cells in the production of biologics, including therapeutic proteins and monoclonal antibodies. The superior ability of these cells to perform post-translational modifications makes them essential for developing complex biopharmaceuticals that require human-like glycosylation patterns. As the demand for more effective and targeted therapies continues to rise, the preference for mammalian cell systems is likely to increase.

Furthermore, ongoing innovations in cell culture technologies are expected to enhance productivity and scalability, thereby driving market growth. The increasing focus on personalized medicine and the development of advanced cell lines are anticipated to further boost the mammalian cells segment, positioning it as a key player in the evolving landscape of biomanufacturing.

Molecule Analysis

The vaccines segment had a tremendous growth rate, with a revenue share of 42.6% owing to the global emphasis on vaccine development and production in response to emerging infectious diseases. The increasing incidence of viral outbreaks, coupled with the need for rapid vaccine production, is expected to propel the demand for efficient bioprocessing solutions.

Innovations in vaccine formulation and delivery technologies, along with advancements in recombinant DNA technology, are likely to enhance the efficacy of vaccine candidates. Additionally, the ongoing research and development in mRNA and vector-based vaccines are projected to stimulate the growth of this segment. As public health initiatives prioritize immunization against a wider array of diseases, the vaccines segment is poised to play a crucial role in the future of biopharmaceutical manufacturing.

Usage Analysis

The preclinical & clinical segment grew at a substantial rate, generating a revenue portion of 50.3% due to the increasing number of biopharmaceutical products undergoing trials. The demand for scalable and adaptable bioreactor systems in early-stage research is expected to rise, as developers seek to optimize production processes before moving to commercial phases.

Regulatory agencies are likely to emphasize the importance of robust preclinical and clinical data, driving the need for sophisticated bioprocessing solutions that support the development of new therapeutics. Furthermore, the growing investment in biotechnology research and development is anticipated to lead to more preclinical and clinical studies, ultimately enhancing the demand for bioreactor systems. As organizations focus on accelerating the development timeline of new drugs, this segment is expected to see substantial growth, reflecting the critical role of bioreactors in the drug development pipeline.

End-Use Analysis

The biopharmaceutical manufacturers segment grew at a substantial rate, generating a revenue portion of 53.1% due to the increasing demand for biologics and advanced therapeutics. As the focus on personalized medicine intensifies, biopharmaceutical manufacturers are likely to invest in advanced bioprocessing technologies to meet the unique production requirements of these complex products.

The rising incidence of chronic diseases and the need for effective treatment options are projected to boost the demand for biopharmaceuticals, further enhancing this segment’s growth. Additionally, collaborations between manufacturers and research organizations are expected to foster innovation and efficiency in bioprocessing.

The ongoing trend towards contract manufacturing partnerships is likely to support biopharmaceutical manufacturers in scaling up production capabilities, solidifying their importance in the bioreactor market. As the industry evolves, this segment will play a critical role in advancing therapeutic development and improving patient outcomes.

Key Market Segments

By Product Type

- Single Use

- Reusable

By Cell

- Mammalian Cells

- Yeast Cells

- Bacterial Cells

- Others

By Molecule

- Vaccines

- Monoclonal Antibodies

- Recombinant Proteins

- Gene Therapy

- Stem Cells

- Others

By Usage

- Preclinical & Clinical

- Developmental

- Commercial Production

By End-Use

- Research & Development Organizations

- Biopharmaceutical Manufacturers

- Contract Manufacturing Organizations

Drivers

Growing Demand for Disposable Bioreactor Systems

Increasing demand for disposable bioreactor systems significantly drives the bioreactors market. The shift towards single-use technologies reflects the industry’s focus on minimizing contamination risks and enhancing production efficiency. In December 2023, Cellexus Bioreactor Systems showcased their innovative airlift single-use disposable bioreactor systems at CPHI Barcelona 2023, demonstrating their commitment to advancing this technology.

The growing preference for these systems stems from their ability to streamline processes and reduce operational costs associated with cleaning and sterilization. As biopharmaceutical companies increasingly adopt disposable systems for cell culture and fermentation, the market is expected to experience robust growth. This demand highlights the industry’s transition toward more flexible and efficient production methodologies, driving further investment in disposable technologies.

Restraints

Low Capacity of Bioreactors

High levels of low capacity in bioreactor systems restrain the growth of the bioreactors market. Many traditional bioreactors may not accommodate the increasing scale of production needed to meet the rising demand for biopharmaceuticals. Limited capacity often necessitates the installation of multiple units, which can complicate production processes and increase operational costs.

Additionally, manufacturers may encounter challenges in scaling up their processes effectively, leading to inefficiencies and potential supply chain disruptions. These constraints are expected to impede the market’s overall expansion, particularly as companies seek to maximize productivity while minimizing costs. Consequently, the need for larger-capacity bioreactors becomes critical as the industry evolves to meet increasing therapeutic demands.

Opportunities

Rise in Technological Advancements

Rising technological advancements present significant opportunities for the bioreactors market. Innovations in bioreactor design and functionality enable more efficient and effective production processes. For instance, in October 2021, Thermo Fisher Scientific collaborated with 3M to enhance process efficiency and versatility in commercial therapeutic manufacturing. This partnership combined Thermo Scientific’s HyPerforma Single-Use Bioreactor Systems with 3M’s Harvest RC Chromatographic Clarifier, improving the overall performance of therapeutic production.

As technology continues to evolve, manufacturers are likely to introduce advanced bioreactor solutions that integrate automation, real-time monitoring, and data analytics. These advancements are anticipated to increase productivity, reduce costs, and improve the quality of biopharmaceutical products, thereby driving significant growth in the bioreactors market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the market for biological production systems. Economic downturns often lead to budget cuts in research and development, impacting investment in new technologies and facilities. Inflationary pressures can increase raw material costs, driving up the overall price of production equipment. Geopolitical tensions may disrupt global supply chains, affecting the availability of essential components needed for bioreactor manufacturing.

However, the growing demand for biologics and biopharmaceuticals offers significant growth opportunities. Increased focus on healthcare infrastructure and advancements in biotechnology further fuel market expansion. Additionally, rising investments in sustainable and efficient production processes encourage innovation. Despite the challenges posed by economic fluctuations and geopolitical dynamics, the commitment to enhancing bioprocessing technologies presents a positive outlook for the industry.

Trends

Impact of Acquisitions and Mergers on the Bioreactors Market

Rising activity in acquisitions and mergers is expected to drive substantial growth in the market for biological production systems. Companies pursue strategic partnerships to enhance their technological capabilities and market reach. This trend allows firms to integrate complementary technologies, resulting in innovative solutions that improve production efficiency.

For instance, in December 2022, Merck acquired Erbi Biosystems, a company specializing in a 2 ml continuous perfusion cell culture platform technology. This acquisition enables scalable perfusion processes ranging from 2 ml to 2,000 L, facilitating rapid development of lab-scale processes. As the market witnesses an increase in such strategic moves, industry players are likely to enhance their product offerings and operational efficiencies. This ongoing consolidation trend promises to improve capabilities and expand options for biopharmaceutical production, benefiting both manufacturers and end-users alike.

Regional Analysis

North America is leading the Bioreactors Market

North America dominated the market with the highest revenue share of 38.4% owing to multiple factors that underscore the increasing demand for biotechnological applications. The rising prevalence of chronic diseases and the need for personalized medicine have heightened the demand for cell and gene therapies, which rely heavily on bioreactor technologies.

Moreover, advancements in bioprocessing technologies have enhanced production efficiency and scalability, allowing for more effective manufacturing of biologics. In October 2023, researchers at Washington State University unveiled a compact bioreactor, the size of a minifridge, which can produce T cells at 95% of their maximum growth rate—approximately 30% faster than existing technologies.

This innovative development reflects the ongoing trend towards optimizing bioprocessing methods. Furthermore, increased investment in biotechnology research and development has spurred innovation, expanding the application scope of bioreactors across various sectors. Collectively, these factors have fostered a robust growth environment for the bioreactors market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the bioreactors market is expected to see significant growth during the forecast period. The increasing focus on biopharmaceutical manufacturing, driven by rising healthcare needs and expanding access to advanced treatments, is anticipated to propel demand for effective bioreactor solutions.

Countries such as China and India are likely to enhance their investments in biotechnology and pharmaceutical sectors, promoting the development and deployment of innovative technologies. In April 2023, Cytiva launched X-platform bioreactors available in 50 and 200-liter sizes, designed to enhance process efficiency through ergonomic improvements. Such innovations are projected to streamline production processes, making biopharmaceutical manufacturing more effective.

Additionally, the growing prevalence of infectious diseases and a rising emphasis on vaccine production will further drive the need for bioreactor technologies in the region. As healthcare infrastructure improves and regulatory environments become more supportive, the market for bioreactors in Asia Pacific is likely to flourish, fueled by both innovation and increasing demand for biotechnological advancements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Bioreactors market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the bioreactors market pursue growth by emphasizing innovation and technological advancements to meet increasing demand for biopharmaceutical production.

They invest significantly in research and development to create next-generation systems that enhance efficiency and scalability, such as single-use and continuous-flow bioreactors. Collaborating with biotechnology firms and research institutions allows them to stay at the forefront of industry trends and integrate new technologies into their offerings.

Companies also focus on expanding their global presence through strategic partnerships and distribution networks, particularly in emerging markets where biomanufacturing is on the rise. Additionally, they enhance customer support and training programs to ensure effective implementation and operation of their products, fostering long-term relationships with clients.

Recent Developments

- In April 2023: BioMADE announced the initiation of five new projects aimed at creating more efficient, cost-effective, flexible, and re-deployable bioreactors to support the advancement of the U.S. bioeconomy and biomanufacturing objectives. This focus on innovative bioreactor designs is expected to drive growth in the bioreactors market by enhancing production capabilities and reducing operational costs for various biomanufacturing processes.

- In May 2022: Pall Corporation unveiled its ICELL, a nano bioreactor that assisted the Institute of Biomedicine of Seville (IBIS) in developing viral vectors for CAR-T therapy. The introduction of such advanced bioreactor technologies not only demonstrates the increasing complexity of biomanufacturing needs but also highlights the critical role bioreactors play in the production of cutting-edge therapies. This trend contributes to the expansion of the bioreactors market as the demand for sophisticated manufacturing solutions continues to rise in the biopharmaceutical industry.

Top Key Players in the Bioreactors Market

- GE Healthcare

- Merck KGaA

- Eppendorf AG

- Sartorius AG

- Thermo Fisher Scientific Inc.

- BBI-Biotech GmbH

- Bioengineering AG

- Danaher Corporation

- BioMADE

- Pall Corporation

Report Scope

Report Features Description Market Value (2023) US$ 9.6 billion Forecast Revenue (2033) US$ 30.9 billion CAGR (2024-2033) 12.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Use and Reusable), By Cell (Mammalian Cells, Yeast Cells, Bacterial Cells, and Others), By Molecule (Vaccines, Monoclonal Antibodies, Recombinant Proteins, Gene Therapy, Stem Cells, and Others), By Usage (Preclinical & Clinical, Developmental, and Commercial Production), By End-Use (Research & Development Organizations, Biopharmaceutical Manufacturers, and Contract Manufacturing Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Merck KGaA, Eppendorf AG, Sartorius AG, Thermo Fisher Scientific Inc., BBI-Biotech GmbH, Bioengineering AG, Danaher Corporation, BioMADE , and Pall Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GE Healthcare

- Merck KGaA

- Eppendorf AG

- Sartorius AG

- Thermo Fisher Scientific Inc.

- BBI-Biotech GmbH

- Bioengineering AG

- Danaher Corporation

- BioMADE

- Pall Corporation