Global Biometrics As A Service In Healthcare Market Analysis By Type (Multimodal, Unimodal), By Application (Site Access Control, Time Recording, Mobile Application, Web and Workplace), By Scanner Type (Fingerprint Recognition, Iris Recognition, Palm Recognition, Facial Recognition, Voice Recognition, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155041

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

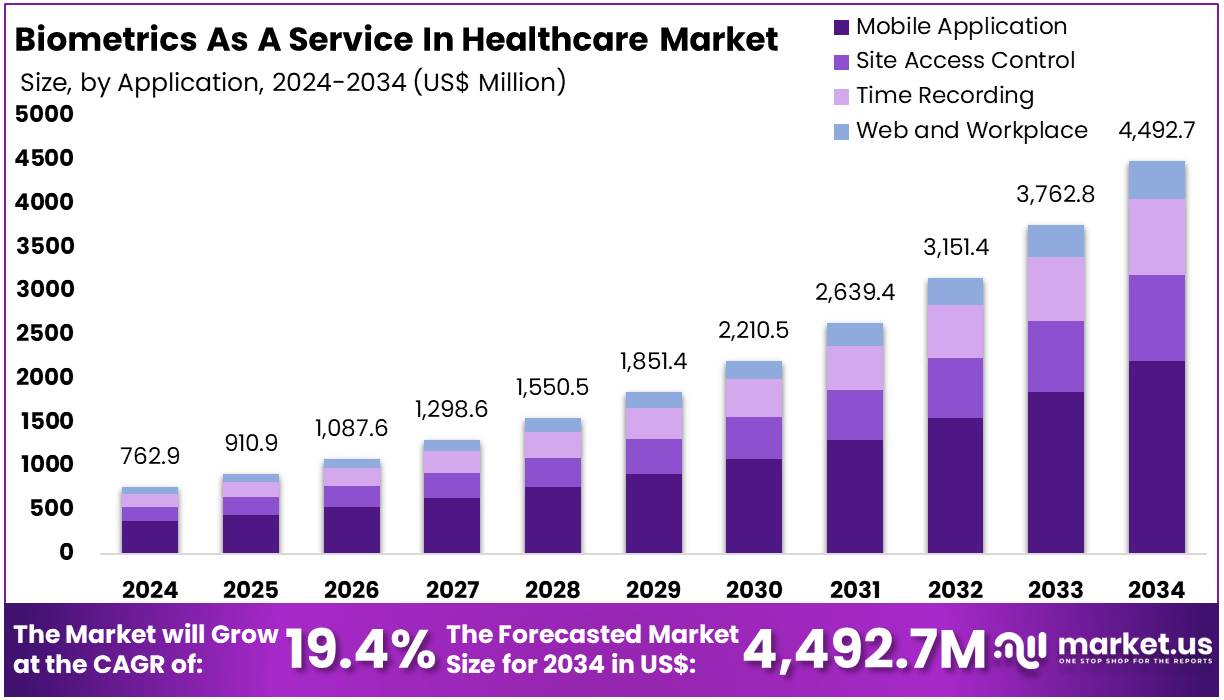

The Global Biometrics As A Service In Healthcare Market size is expected to be worth around US$ 4492.7 Million by 2034, from US$ 762.9 Million in 2024, growing at a CAGR of 19.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 47.1% share and holds US$ 359.3 Million market value for the year.

Biometrics as a Service (BaaS) in healthcare refers to the cloud-based integration of biometric technologies such as fingerprint scanning, facial recognition, iris scanning, and voice identification into medical systems. This model allows healthcare providers to authenticate patient identities and protect access to electronic health records (EHRs). According to global health authorities, over 850 million people worldwide lack reliable medical identity, which affects continuity of care. BaaS enables secure access without large-scale infrastructure investments.

Market growth is being driven by the rapid digital transformation of healthcare systems. The increasing adoption of telemedicine, mobile health apps, and e-prescriptions has created a demand for real-time, secure patient verification. For example, biometric tools are now used to expedite telehealth check-ins and ensure safe medication access. Federal oversight reports confirm that these technologies reduce medical errors and improve treatment safety. Additionally, they protect sensitive health data and combat medical identity fraud.

Government policy frameworks are accelerating BaaS adoption. For instance, India’s Ayushman Bharat Digital Mission (ABDM) has issued over 71.16 crore ABHA (Ayushman Bharat Health Account) IDs by December 2024. The initiative also linked 46 crore health records and onboarded over 9 lakh healthcare facilities and professionals. According to the program, biometric verification supports secure access, record matching, and improves service continuity. In the U.S., regulations like HIPAA encourage hospitals to adopt biometric safeguards to comply with privacy and safety standards.

Public sector initiatives are also pushing the use of biometric identity systems. A study by international organizations revealed that over 1.2 billion people in low- and middle-income countries have been enrolled in biometric identification programs. For example, South Africa uses these systems to reduce fraud in social assistance and health services. In the U.S., the National Health Care Anti-Fraud Association (NHCAA) estimates that healthcare fraud results in losses of up to $300 billion annually, or 3–10% of total expenditure.

While BaaS offers clear advantages, challenges remain. Concerns around privacy, algorithmic bias, and limited technical training are prominent. A federal oversight body has recommended policy actions including privacy legislation, better training, and stronger risk-based regulatory frameworks. Addressing these challenges is key to ensuring equitable and efficient deployment of biometric systems across healthcare networks.

Private sector players are actively supporting the BaaS ecosystem. For instance, Eka Care has digitized over 110 million health records and serves more than 50 million users through ABHA-linked AI tools. These innovations align with public initiatives and demonstrate the scalability of biometric integration. As healthcare shifts further toward digital models, the BaaS market is expected to grow significantly, driven by rising data privacy concerns, policy incentives, and cloud-based deployment capabilities.

Key Takeaways

- The global Biometrics as a Service in Healthcare market is projected to reach US$ 4,492.7 million by 2034, growing at a CAGR of 19.4%.

- In 2024, the Multimodal type dominated the market segment, securing over 54.2% share due to its enhanced accuracy and layered authentication capabilities.

- Mobile Application emerged as the leading application segment in 2024, accounting for more than 41.6% share, driven by remote healthcare and mHealth expansion.

- Fingerprint Recognition led the scanner type segment in 2024 with a 48.3% share, due to its cost-efficiency, ease of use, and widespread deployment.

- North America dominated the regional landscape in 2024, holding over 47.1% market share with a total value of US$ 359.3 million.

Type Analysis

In 2024, the Multimodal section held a dominant market position in the Type Segment of Biometrics As A Service In Healthcare Market, and captured more than a 54.2% share. This leadership was due to its ability to deliver higher accuracy and security in identity verification. Multimodal systems use two or more biometric traits, such as face, fingerprint, or voice. Their combination helps reduce the chances of errors, making them more dependable for critical healthcare workflows.

Experts observed that hospitals and clinics increasingly adopted multimodal biometrics to enhance patient safety and data protection. These systems proved effective in managing secure access, verifying identities, and supporting telehealth services. With rising digitalization, healthcare providers required more robust solutions. Multimodal biometrics met these needs better than single-mode systems. Their ability to provide contactless identification also made them suitable for infection control and post-pandemic health protocols.

In contrast, the Unimodal section captured a smaller share of the market. It remained relevant in budget-limited settings due to lower costs and ease of deployment. However, unimodal systems face technical challenges. They are more likely to experience false matches and are easier to spoof. These drawbacks limit their suitability in highly regulated or sensitive healthcare environments.

Regulatory compliance and data privacy needs are expected to drive further adoption of multimodal biometrics. As healthcare systems move toward secure and integrated digital platforms, the demand for advanced identification methods will rise. Multimodal solutions offer the reliability needed to meet both patient safety goals and strict legal standards. This ongoing shift will likely expand their market share in the coming years.

Application Analysis

In 2024, the Mobile Application section held a dominant market position in the Application Segment of Biometrics As A Service In Healthcare Market, and captured more than a 41.6% share. This growth was driven by the increasing use of smartphones in healthcare. Mobile apps now support biometric logins for patient portals and telemedicine tools. These apps allow patients and doctors to securely access medical data from anywhere. The convenience and speed of mobile platforms have made them the preferred choice for many users.

Site Access Control followed closely in terms of market share. Hospitals and clinics are using biometric systems to enhance physical security. These systems help control who can enter restricted areas like operating rooms or data centers. Biometric authentication reduces the risk of unauthorized access. Healthcare providers are focusing more on safety and compliance. This growing need for advanced security measures has made biometric access control a reliable and effective solution.

Time Recording applications also showed a notable rise in adoption. Many healthcare facilities have integrated biometric systems to monitor staff attendance. These tools ensure accurate time tracking for shift-based workers. They also help reduce manual errors and time fraud. By automating attendance processes, hospitals can better manage workforce efficiency. The demand for reliable staff monitoring tools continues to grow across large hospital networks.

Web and Workplace applications are gaining steady momentum. Web-based biometric tools are used for logging into cloud platforms and health record systems. These applications offer secure access and improve data privacy. In the workplace, biometrics streamline employee access to internal systems. They support payroll, performance tracking, and workflow management. As hospitals embrace digital transformation, both segments are expected to show consistent growth in the coming years.

Scanner Type Analysis

In 2024, the Fingerprint Recognition section held a dominant market position in the Scanner Type segment of the Biometrics As A Service in Healthcare market, and captured more than a 48.3% share. This dominance was largely due to its broad use in healthcare facilities for secure access, patient verification, and attendance systems. The technology is reliable and cost-effective. It also integrates easily with electronic health records and hospital systems. Many clinics in low-resource settings favor it for its simplicity and affordability.

Facial recognition emerged as the second-leading segment in this market. Healthcare providers increasingly adopted it for contactless access and identity verification. This trend accelerated during the COVID-19 pandemic, where reducing physical touchpoints became a priority. The system is being used in outpatient check-ins and telemedicine sessions. It helps streamline workflows and enhances patient experience. Despite higher costs, facial biometrics are gaining popularity due to their speed and non-intrusiveness.

Other scanner types such as iris, palm, and voice recognition showed steady growth. These technologies are mainly used in specialized areas like research centers and remote consultations. Voice recognition, in particular, has been effective in virtual care. It supports hands-free access and patient authentication. Emerging types like vein pattern and behavioral biometrics are still in early use but are expected to gain traction in coming years.

Key Market Segments

By Type

- Multimodal

- Unimodal

By Application

- Site Access Control

- Time Recording

- Mobile Application

- Web and Workplace

By Scanner Type

- Fingerprint Recognition

- Iris Recognition

- Palm Recognition

- Facial Recognition

- Voice Recognition

- Others

Drivers

Rising Demand for Secure Patient Identification Amidst Healthcare Digitalization

The rapid digitalization of healthcare systems has intensified the need for secure and accurate patient identification. As telemedicine, electronic health records (EHRs), and cloud-based platforms expand, healthcare providers face heightened pressure to ensure data integrity and patient safety. Biometric authentication—such as fingerprint and facial recognition—plays a critical role in minimizing identity fraud and enabling seamless access to clinical data. In countries like the United States and India, national digital health initiatives are reinforcing the demand for reliable identity verification mechanisms.

In the United States, certified EHR adoption has reached near-universal levels, with 96% of non-federal acute care hospitals implementing ONC-certified systems as of 2021. Similarly, 78% of office-based physicians had adopted certified EHRs, reflecting significant growth over the past decade. These platforms demand secure authentication for accessing sensitive patient data. Regulatory frameworks like HIPAA further mandate compliance, making biometric solutions an integral part of secure healthcare infrastructure.

Interoperability has also become a critical focus. By 2023, 70% of U.S. hospitals engaged in all four domains of interoperability: sending, receiving, querying, and integrating electronic health data. High engagement levels—92% for sending and 87% for receiving—highlight the volume and complexity of health data exchange. This environment requires foolproof identity verification to avoid mismatched records and data breaches, positioning biometric-as-a-service (BaaS) as a strategic enabler of secure healthcare communications.

Restraints

Heightened Privacy Concerns and Absence of Biometric-Specific Legal Frameworks

The adoption of Biometrics as a Service (BaaS) in healthcare is hindered by rising privacy concerns linked to data sensitivity. Although biometric authentication offers strong security, the permanent nature of biometric identifiers—such as fingerprints and facial scans—raises irreversible risks. Once compromised, these identifiers cannot be replaced, unlike passwords. This immutability deters healthcare providers and patients alike. The absence of clear, unified legal safeguards exacerbates this challenge, creating regulatory ambiguity across jurisdictions and delaying wider adoption of BaaS platforms in clinical settings.

Healthcare continues to face an alarming number of large-scale data breaches. In 2024, the U.S. witnessed 734 incidents involving over 500 records each. While this marked a 1.74% decline from the previous year, the severity increased drastically. The total number of compromised healthcare records surged by 64.1%, reaching 276.8 million. This number equates to 81.4% of the U.S. population. These statistics underscore the increasing vulnerability of sensitive healthcare data, especially when biometric identifiers are involved in system integrations.

Financial implications further intensify these concerns. As of early 2025, the global average cost of a healthcare data breach reached US $7.42 million—the highest among all industries. This includes costs associated with breach resolution, legal actions, and reputational damage. The high cost burden places significant pressure on healthcare organizations considering BaaS solutions. For institutions with limited resources, the financial risk outweighs the potential security benefit, slowing the adoption of biometric technologies despite their authentication advantages.

Third-party involvement adds another layer of risk. In 2024, external vendors and business associates were responsible for nearly 40% of all large healthcare data breaches, affecting 17.5 million individuals. BaaS platforms typically involve cloud-based vendors or external providers, making data sharing with third parties inevitable. This dependency magnifies privacy concerns, particularly when accountability and transparency are unclear. As long as legal safeguards remain fragmented and vendor oversight is weak, healthcare stakeholders will remain cautious about adopting biometric cloud services at scale.

Opportunities

Integration of Biometrics‑as‑a‑Service with National Digital Health ID Systems

The expanding digital health infrastructure in India presents a significant opportunity for Biometrics‑as‑a‑Service (BaaS) in healthcare. Government-led programs such as the Ayushman Bharat Digital Mission (ABDM) have already assigned over 73.98 crore Ayushman Bharat Health Accounts (ABHA) as of February 2025. These accounts are foundational for linking biometric identifiers to unique health IDs. With 49.06 crore health records integrated, the ecosystem now supports real-time access to care. This environment creates a scalable platform for biometric verification across both rural and urban healthcare services.

Widespread infrastructure underpins this opportunity. The ecosystem includes 1.24 billion Aadhaar digital IDs and supports over 10 billion monthly eKYC transactions. These components make it feasible to embed biometric verification into every layer of the digital health system. Notably, over 1.59 lakh health facilities have adopted ABDM‑enabled software. Moreover, more than 5.64 lakh healthcare professionals have been digitally registered. This broad adoption paves the way for BaaS integration, driving efficiency and secure identification in clinical workflows.

Biometrics such as facial recognition, iris scans, and fingerprint authentication are already integral to ABDM workflows. They enable precise patient identification, support fraud prevention, and enhance administrative accuracy. Tools like “Scan & Share” QR-based registration in OPDs simplify patient onboarding. This eliminates paperwork and long wait times. When integrated with cloud-based BaaS solutions, such features can be deployed remotely, allowing for scalable use in resource-limited healthcare settings across India.

Trends

Rising Integration of Multimodal Biometric Authentication in Mobile-First Healthcare Platforms

The adoption of multimodal biometric authentication is emerging as a defining trend in the Biometrics as a Service (BaaS) in Healthcare market. Healthcare providers are shifting from single-mode systems to advanced multimodal solutions, combining fingerprint, facial, and sometimes voice recognition. This transformation enhances patient identity verification, reduces fraud, and strengthens data security. The growing reliance on accurate and layered identity authentication aligns with increasing patient expectations for secure and seamless digital healthcare access. This trend is particularly prominent in mobile-first environments.

Multimodal biometrics are being embedded into healthcare mobile applications. These include platforms for teleconsultation, e-prescriptions, and remote health monitoring. The shift is driven by the need for real-time, secure access to personal health information without compromising privacy. Patients can now verify identity quickly using facial or fingerprint scans, enhancing trust in digital health services. As more health providers adopt mobile-first strategies, integration of such technology is becoming essential rather than optional for digital healthcare transformation.

This trend also reflects broader policy and industry movements toward data protection and interoperability. Healthcare systems are under pressure to improve identity management in compliance with privacy regulations such as HIPAA. Multimodal biometric authentication minimizes the risk of unauthorized access. Additionally, it supports the expansion of telehealth and connected health ecosystems. This move helps bridge gaps in care delivery, especially in regions with large rural populations or limited physical healthcare infrastructure.

Overall, the integration of multimodal authentication into BaaS healthcare platforms represents a convergence of security, user convenience, and digital health growth. It reflects a larger industry trend toward patient-centric care, where technology simplifies and secures access to health services. As biometric accuracy and device interoperability continue to improve, multimodal solutions will become the standard for digital identity verification in healthcare systems worldwide.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 47.1% share and holds US$ 359.3 million market value for the year. This leadership is largely credited to the growing use of biometric technologies within healthcare environments. Healthcare facilities across the region are adopting these tools for identity management and access control. A strong emphasis on data protection and patient security has further supported this expansion. These factors continue to reinforce North America’s early adoption advantage.

The United States plays a key role in this dominance. Healthcare institutions are increasingly implementing fingerprint and facial recognition technologies. These are used for secure patient verification and facility access. Compliance with the Health Insurance Portability and Accountability Act (HIPAA) has heightened the demand for secure digital identity systems. Additionally, national efforts to digitalize healthcare infrastructure have encouraged the integration of biometric platforms across various medical services.

Canada also contributes to regional growth, mainly through its telemedicine and eHealth development. Biometric tools are being used in remote patient monitoring and electronic health record systems. These tools ensure identity verification in digital healthcare interactions. Government programs supporting interoperability and patient safety have led to wider use. As a result, Canada’s healthcare sector is experiencing increased biometric adoption in both public and private settings.

Overall, North America’s continued investment in cybersecurity and healthcare modernization supports its leading status. Hospitals and clinics are prioritizing secure, cloud-based biometric services. This ensures efficiency in operations and protection of patient data. With ongoing government backing and technological readiness, the region is likely to retain its leadership in the Biometrics as a Service in Healthcare market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Biometrics-as-a-Service (BaaS) market in healthcare is evolving rapidly. Key players are delivering scalable and secure solutions tailored for healthcare environments. Aratek focuses on multi-modal biometric devices such as fingerprint and facial recognition. Its solutions enable streamlined patient identification and access control. The firm emphasizes cloud-based deployment, supporting scalability with minimal infrastructure. Aratek has strong market visibility in Asia and emerging regions, where healthcare facilities are increasingly adopting biometric platforms for enhanced efficiency, data protection, and compliance with digital health regulations.

Aware Inc. provides modular biometric platforms with fingerprint, facial, and iris recognition technologies. These are widely applied in telemedicine, patient access, and secure data workflows. The solutions can be integrated into cloud-based or on-premise environments. Their strength lies in compliance with healthcare data regulations and system interoperability. This allows healthcare organizations to deploy BaaS solutions without altering their core IT infrastructure. The company’s focus on secure identity verification processes makes it a preferred choice in clinical and remote care applications.

BIO-key International and Cognitec Systems GmbH further strengthen the market. BIO-key specializes in fingerprint authentication used in EHR access, staff login, and medication distribution. It supports cloud and on-premise models with a subscription-based pricing structure aligned with the BaaS framework. Cognitec, known for facial recognition, is active in hospital lobbies and emergency units. Its systems are optimized for speed and accuracy, even in high-traffic healthcare settings. Both companies provide essential capabilities for identity assurance and operational efficiency in modern healthcare ecosystems.

Market Key Players

- Aratek

- Aware Inc.

- BIO-key International

- Cognitec Systems GmbH

- Fujitsu

- HID Global Corporation

- Hitachi Ltd.

- IDEX Biometrics ASA

- Imprivata Inc.

- NEC Corporation

- Suprema Inc.

- Thales

- Voice Biometric Group

Recent Developments

- In June 2024: HID Global announced a strategic collaboration whereby its U.ARE.U Camera Identification System was integrated with Amazon Rekognition, Amazon Web Services’ managed computer vision service. This integration enhances facial analysis and verification capabilities—such as face detection, face comparison, face indexing, and search—within self‑service and point‑of‑service environments, including healthcare settings. The combined solution improves performance in challenging lighting and diverse environments, while enabling liveness detection and on‑device processing.

- In October 2023: Hitachi Ltd. announced the transfer of its Healthcare Business Division to Hitachi High‑Tech Corporation, a wholly owned subsidiary. This corporate restructuring, executed via an absorption‑type company split effective April 1, 2024, is intended to reinforce the healthcare business under the strategic framework of “Diagnosis × Treatment × Digital”, fostering innovation across diagnostics, treatment technologies, and digital healthcare services.

- In February 2023: Aratek’s fingerprint devices—including the A400 and A600 scanners and sensor modules—were officially confirmed to have met the MOSIP (Modular Open Source Identity Platform) compliance standards for biometric components. These products were incorporated into MOSIP’s certified marketplace, enhancing their integration potential within large-scale digital identity initiatives such as national ID systems.

- In October 2022: During the fourth quarter of 2022, Aware introduced AwareID, a cloud-native, multi‑modal SaaS authentication platform showcased at Money2020 in Las Vegas. This launch marks a pivotal step in the company’s transformation toward recurring‑revenue models and broadens its capabilities in biometric identity solutions.

Report Scope

Report Features Description Market Value (2024) US$ 762.9 Million Forecast Revenue (2034) US$ 4492.7 Million CAGR (2025-2034) 19.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Multimodal, Unimodal), By Application (Site Access Control, Time Recording, Mobile Application, Web and Workplace), By Scanner Type (Fingerprint Recognition, Iris Recognition, Palm Recognition, Facial Recognition, Voice Recognition, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aratek, Aware Inc., BIO-key International, Cognitec Systems GmbH, Fujitsu, HID Global Corporation, Hitachi Ltd., IDEX Biometrics ASA, Imprivata Inc., NEC Corporation, Suprema Inc., Thales, Voice Biometric Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biometrics As A Service In Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Biometrics As A Service In Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aratek

- Aware Inc.

- BIO-key International

- Cognitec Systems GmbH

- Fujitsu

- HID Global Corporation

- Hitachi Ltd.

- IDEX Biometrics ASA

- Imprivata Inc.

- NEC Corporation

- Suprema Inc.

- Thales

- Voice Biometric Group