Global Biological Seed Treatment Market Seed Type(Botanicals, Microbials, Others), Function(Crop Protection, Soil Enhancement, Others), Crop Type(Cereals & Grains, Oilseeds, Fruits & Vegetables, Ornamentals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116739

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

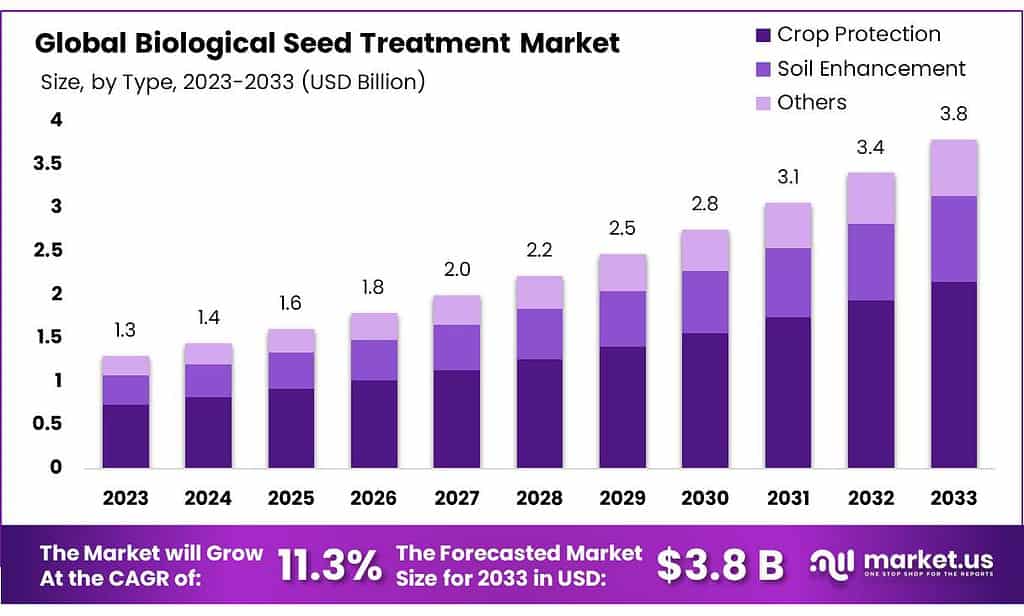

The global Biological Seed Treatment Market size is expected to be worth around USD 3.8 billion by 2033, from USD 1.3 billion in 2023, growing at a CAGR of 11.3% during the forecast period from 2023 to 2033.

The Biological Seed Treatment Market encompasses a sector within agriculture dedicated to improving seed quality, plant health, and crop yield through the use of biological agents. These agents typically consist of beneficial microorganisms, such as bacteria and fungi, as well as natural compounds derived from plants. Applied to seeds before planting, biological seed treatments serve multiple purposes, including enhancing seed germination, promoting root development, and providing protection against pests and diseases.

By harnessing the power of nature’s defenses, biological seed treatments offer a sustainable and environmentally friendly approach to crop protection and enhancement. This market represents an important component of modern agricultural practices, aiming to increase crop productivity while minimizing reliance on synthetic chemicals and reducing environmental impacts.

Key Takeaways

- Market Growth: Expected worth of USD 3.8 billion by 2033, with a CAGR of 11.3% from 2023.

- Dominant Seed Type: Microbials hold over 58.9% market share in 2023.

- Botanical Alternatives: Chemical-free botanical treatments enhance seed germination and plant vigor.

- Functional Focus: Crop protection dominates with over 56.8% market share in 2023.

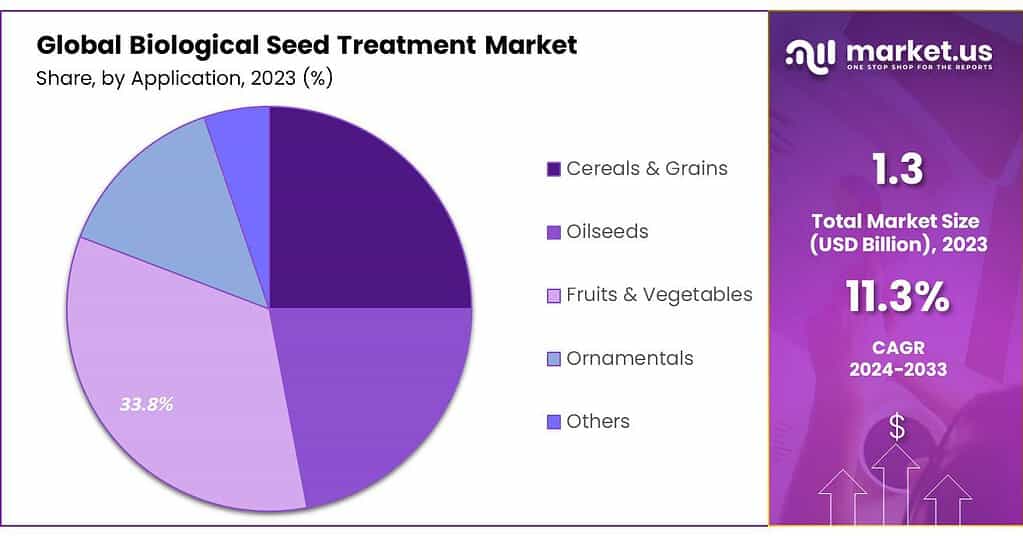

- Crop Type Dynamics: Fruits & Vegetables lead with over 33.8% market share in 2023.

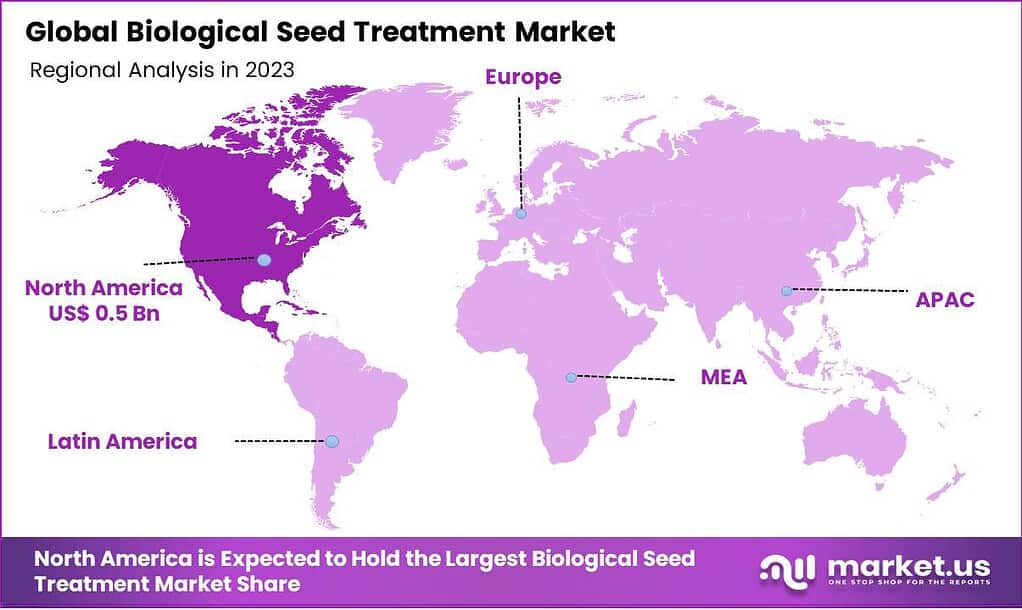

- Regional Insights: North America commands a 38.5% market share; Asia Pacific shows high growth potential.

- As of 2023, there are over 200 registered biological seed treatment products available globally.

- In 2023, a biological seed treatment containing Bacillus subtilis was reported to reduce Fusarium root rot in soybeans by up to 50%.

- Biological seed treatments can improve nutrient uptake and availability for plants, with some products increasing nitrogen fixation by up to 25%.

- In 2024, the United States Environmental Protection Agency (EPA) approved the registration of five new biological seed treatment products for use in various crops.

Seed Type

In 2023, Microbials held a dominant market position, capturing more than a 58.9% share. Microbials refer to beneficial microorganisms applied to seeds to promote plant health and protect against diseases. These microorganisms include bacteria, fungi, and other microscopic organisms known for their ability to enhance soil fertility, nutrient uptake, and disease resistance in plants.

They work symbiotically with the plant’s root system, forming a protective barrier against harmful pathogens and pests while stimulating growth-promoting hormones. Microbial seed treatments are favored for their eco-friendly nature and sustainable approach to agriculture.

Botanicals represent another significant segment in the biological seed treatment market, comprising plant-derived extracts, oils, and compounds. Botanical seed treatments utilize natural substances with pesticidal properties to protect seeds and young plants from pests and diseases.

These botanical extracts often contain compounds that repel or deter harmful insects and pathogens, providing a chemical-free alternative to synthetic pesticides. Additionally, botanicals can enhance seed germination, root development, and overall plant vigor, contributing to improved crop yields and sustainability in agriculture.

The “Others” category in the biological seed treatment market encompasses various seed treatment options beyond microbials and botanicals. This segment may include bio-stimulants, enzymes, and other innovative formulations designed to enhance seed performance and crop productivity.

Bio-stimulants, for example, contain organic compounds that stimulate plant growth and resilience, improving nutrient uptake and stress tolerance. Enzyme-based seed treatments aid in seed germination and nutrient mobilization, optimizing plant health and vigor. The diversity within the “Others” category reflects ongoing research and development efforts to explore new avenues for sustainable seed treatment solutions.

By Function

In 2023, Crop Protection held a dominant market position, capturing more than a 56.8% share. Crop protection in the biological seed treatment market involves utilizing treatments to shield plants from pests, diseases, and environmental stresses. These treatments bolster plant immunity, thwarting the harmful effects of pathogens and pests, thus ensuring healthier yields for farmers.

Soil enhancement, another crucial function, focuses on improving soil health and fertility to support robust plant growth. By enriching the soil with essential nutrients and beneficial microorganisms, soil enhancement treatments contribute to enhanced nutrient uptake and overall plant vigor. The “Others” category within the biological seed treatment market encompasses a range of additional functions beyond crop protection and soil enhancement.

These may include seed priming for improved germination, seed coating for enhanced seedling establishment, and seed inoculation for increased nutrient availability. Each function within the biological seed treatment market serves a unique purpose in optimizing plant health and promoting sustainable agriculture practices.

Crop Type

In 2023, Crop Fruits & Vegetables held a dominant market position, capturing more than a 33.8% share. Biological seed treatments tailored for fruits and vegetables play a crucial role in safeguarding these crops from pests, diseases, and environmental stresses. These treatments are designed to enhance plant health and improve yield quality, ensuring the production of high-quality fruits and vegetables for consumers. Additionally, biological seed treatments for fruits and vegetables contribute to sustainable agriculture practices by reducing the reliance on chemical pesticides and promoting eco-friendly farming methods.

Cereals & Grains represent another significant segment in the biological seed treatment market, accounting for a considerable share of global seed treatment activities. Seed treatments for cereals and grains aim to protect these staple crops from common pests and diseases, ensuring optimal yield and quality. By applying biological seed treatments, farmers can mitigate the risk of crop loss due to pests and diseases while minimizing environmental impact and preserving soil health.

Oilseeds, including crops such as soybeans, canola, and sunflower, also benefit from biological seed treatments tailored to their specific needs. These treatments enhance seed germination, root development, and plant vigor, leading to improved crop establishment and yield. By incorporating biological seed treatments into their cultivation practices, oilseed producers can optimize crop performance and profitability while reducing reliance on synthetic chemicals.

The “Others” category within the biological seed treatment market encompasses a diverse range of crop types beyond fruits & vegetables, cereals & grains, and oilseeds. This segment may include ornamental plants, specialty crops, and niche agricultural products, each with unique requirements and challenges.

Biological seed treatments for ornamentals, for example, focus on enhancing aesthetics, disease resistance, and longevity, catering to the needs of landscapers, nurseries, and gardeners. Overall, the biological seed treatment market offers tailored solutions for various crop types, promoting sustainable agriculture practices and ensuring global food security.

Market Key Segments

Seed Type

- Botanicals

- Microbials

- Others

Function

- Crop Protection

- Soil Enhancement

- Others

Crop Type

- Cereals & Grains

- Oilseeds

- Fruits & Vegetables

- Ornamentals

- Others

Drivers

Increasing Demand for Sustainable Agriculture

- With growing concerns about environmental sustainability, there’s a rising demand for sustainable agricultural practices.

- Biological seed treatments offer an eco-friendly alternative to chemical pesticides, aligning with consumer preferences for sustainable food production.

- Government initiatives promoting sustainable agriculture further drive the adoption of biological seed treatments.

Regulatory Support and Restrictions on Chemical Pesticides:

- Regulatory bodies are imposing stricter regulations on chemical pesticides, leading to a shift towards biological alternatives.

- Governments incentivize the use of biological seed treatments through subsidies and support programs, encouraging their adoption.

- Restrictions on genetically modified organisms (GMOs) also contribute to the demand for biological seed treatments as safer alternatives.

Advancements in Biotechnology and Microbial Research:

- Ongoing advancements in biotechnology and microbial research lead to the development of more effective biological seed treatments.

- Scientists are discovering new strains of beneficial microorganisms with enhanced capabilities for pest and disease management.

- Innovations in formulation technologies improve the efficacy, shelf-life, and application methods of biological seed treatments, driving market growth.

Restraints

Limited Efficacy and Consistency:

- Biological seed treatments may exhibit variable efficacy and consistency compared to chemical pesticides.

- Factors such as environmental conditions, soil health, and crop genetics can impact the performance of biological seed treatments, posing challenges to widespread adoption.

- Farmers may experience inconsistent results with biological treatments, leading to skepticism and reluctance to fully transition from conventional chemical pesticides.

High Initial Investment and Adoption Costs:

- The initial investment required for research, development, and production of biological seed treatments can be substantial.

- Farmers may face challenges in adopting biological seed treatments due to higher upfront costs compared to conventional chemical treatments.

- Limited access to affordable biological seed treatments and associated application equipment further impedes adoption rates, particularly among small-scale farmers in developing regions.

Lack of Awareness and Education:

- A lack of awareness and education among farmers about the benefits and proper application of biological seed treatments hinders market growth.

- Many farmers are unfamiliar with biological seed treatments or perceive them as less effective than chemical pesticides.

- Educational initiatives and extension services are needed to increase awareness, build trust, and promote the adoption of biological seed treatments among farmers.

Opportunity

Expansion into Emerging Markets:

- Emerging economies with increasing agricultural activities present untapped opportunities for the biological seed treatment market.

- Rising population, urbanization, and disposable incomes drive demand for higher-quality crops, creating a favorable environment for the adoption of biological seed treatments.

- Government support for sustainable agriculture and food security initiatives further accelerates market growth in emerging markets.

Product Innovation and Customization:

- Continuous innovation in biological seed treatments, including novel formulations and application methods, opens up opportunities for market expansion.

- Customized solutions tailored to specific crops, regions, and environmental conditions address the diverse needs of farmers and drive adoption rates.

- Investment in research and development fosters the development of advanced biological seed treatments with enhanced efficacy, safety, and environmental sustainability.

Strategic Partnerships and Collaborations:

- Strategic partnerships and collaborations between seed companies, biotechnology firms, research institutions, and agricultural organizations drive innovation and market penetration.

- Joint ventures and licensing agreements enable companies to access new technologies, expand their product portfolios, and enter new geographical markets.

- Collaboration with government agencies and non-profit organizations facilitates market access, regulatory compliance, and sustainable agricultural development initiatives.

Trends

Rise in Organic Farming Practices:

- The increasing consumer demand for organic produce drives the adoption of biological seed treatments in organic farming.

- Organic farmers prioritize natural and eco-friendly solutions, creating a favorable market for biological seed treatments.

- Governments and certification bodies promote organic farming practices, further fueling the trend towards biological seed treatments.

Technological Advancements in Seed Coating and Encapsulation:

- Technological advancements in seed coating and encapsulation techniques enhance the delivery and performance of biological seed treatments.

- Encapsulation technologies protect microorganisms from environmental stresses and improve their survival rates upon seed germination.

- Seed coating innovations enable the incorporation of multiple biological agents, nutrients, and additives, offering multifunctional solutions for crop protection and enhancement.

Increasing Collaboration and Partnerships in Research and Development:

- Collaboration between seed companies, biotechnology firms, research institutions, and agricultural organizations accelerates innovation in biological seed treatments.

- Public-private partnerships facilitate the exchange of knowledge, resources, and expertise, driving research and development efforts in the field.

- Joint ventures and licensing agreements enable companies to access new technologies and expand their product portfolios, fostering market growth.

Regional Analysis

North America emerges as a frontrunner in the global biological seed treatment market, securing a substantial market share of 38.5%. The region’s dominance is primarily attributed to its robust aerospace and defense sectors, led by industry giants like Boeing and Lockheed Martin. These entities drive significant investments in unmanned systems, bolstering demand for advanced composite materials in North America.

The application of biological seed treatments extends beyond aerospace and defense, encompassing industries such as agriculture, surveying, and photography, where commercial drones play a pivotal role. This diversification contributes to the market’s growth in North America, reflecting a burgeoning demand for innovative agricultural solutions.

Meanwhile, the Asia Pacific region exhibits remarkable growth potential, poised to witness the highest growth rate. This accelerated expansion is propelled by intensified research and development initiatives, particularly in countries like China and India. The region’s focus on enhancing agricultural technologies and applications, including biological seed treatments, fuels optimism for substantial market growth in the Asia Pacific during the forecast period.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the realm of the biological seed treatment market, several key players stand out for their significant contributions and innovative offerings.

BASF SE, a frontrunner in this arena, spearheads the market with its diverse range of cutting-edge solutions. Meanwhile, Bayer CropScience AG solidifies its presence through a comprehensive portfolio tailored to various crop types and regions. Syngenta AG also commands attention, leveraging sustainable agricultural practices and robust research initiatives to develop tailored biological seed treatments.

Маrkеt Кеу Рlауеrѕ

- BASF SE

- Bayer AG

- Syngenta AG

- INCOTEC Group BV

- Nufarm

- Chemtura Corporation

- The Monsanto Company

- Novozymes A/S

- Corteva, Inc.

- Sumitomo Chemical Co., Ltd.

- Arysta LifeScience Corporation

- Plant Health Care

- Valent Biosciences Corporation

- Verdesian Life Sciences

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc.

- Bioworks Inc.

- Others

Recent Development

- BASF SE (2024): Collaborated with agricultural research institutes to conduct field trials for its new biological seed treatment products, demonstrating improved crop yields and disease resistance.

- Bayer AG (2024): Invested in the development of precision application technologies for biological seed treatments, enabling more efficient and targeted delivery on a large scale.

- Syngenta AG (2024): Formed strategic partnerships with seed companies to integrate its biological seed treatment solutions into their breeding programs, facilitating the development of improved crop varieties.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Bn Forecast Revenue (2033) USD 5591.1 Mn CAGR (2024-2033) 11.30% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Seed Type(Botanicals, Microbials, Others), Function(Crop Protection, Soil Enhancement, Others), Crop Type(Cereals & Grains, Oilseeds, Fruits & Vegetables, Ornamentals, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Bayer AG, Syngenta AG, INCOTEC Group BV, Nufarm, Chemtura Corporation, The Monsanto Company, Novozymes A/S, Corteva, Inc., Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Plant Health Care, Valent Biosciences Corporation, Verdesian Life Sciences, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc., Bioworks Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Biological Seed Treatment Market?BASF SE, Bayer AG, Syngenta AG, INCOTEC Group BV, Nufarm, Chemtura Corporation, The Monsanto Company, Novozymes A/S, Corteva, Inc., Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, Plant Health Care, Valent Biosciences Corporation, Verdesian Life Sciences, Adama Agricultural Solutions Ltd, Advanced Biological Marketing Inc., Bioworks Inc., Others

What is the CAGR for the Biological Seed Treatment Market?The Biological Seed Treatment Market expected to grow at a CAGR of 11.30% during 2023-2032.What is the size of Biological Seed Treatment Market?Biological Seed Treatment Market size is expected to be worth around USD 3.8 billion by 2033, from USD 1.3 billion in 2023

Biological Seed Treatment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Biological Seed Treatment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Bayer AG

- Syngenta AG

- INCOTEC Group BV

- Nufarm

- Chemtura Corporation

- The Monsanto Company

- Novozymes A/S

- Corteva, Inc.

- Sumitomo Chemical Co., Ltd.

- Arysta LifeScience Corporation

- Plant Health Care

- Valent Biosciences Corporation

- Verdesian Life Sciences

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc.

- Bioworks Inc.

- Others