Global Biological PCR Technology Market By Product Type (Reagents and Consumables), By Application (Diagnostic Laboratories and Molecular Testing Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152043

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

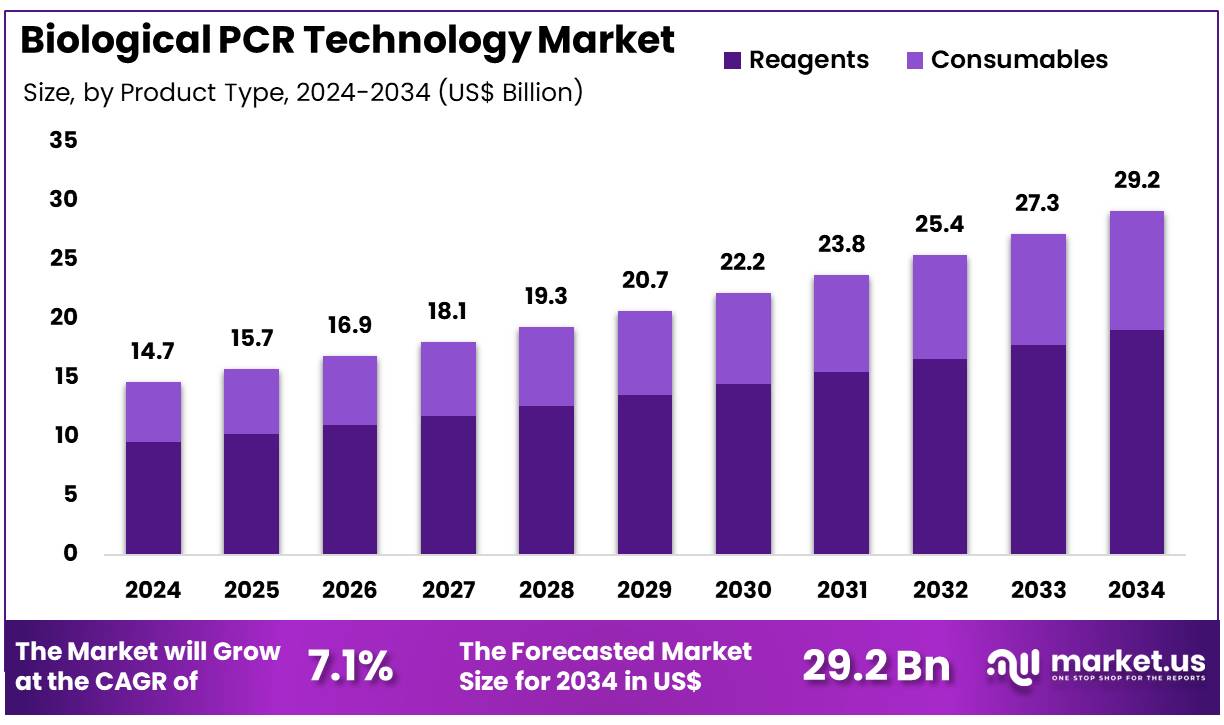

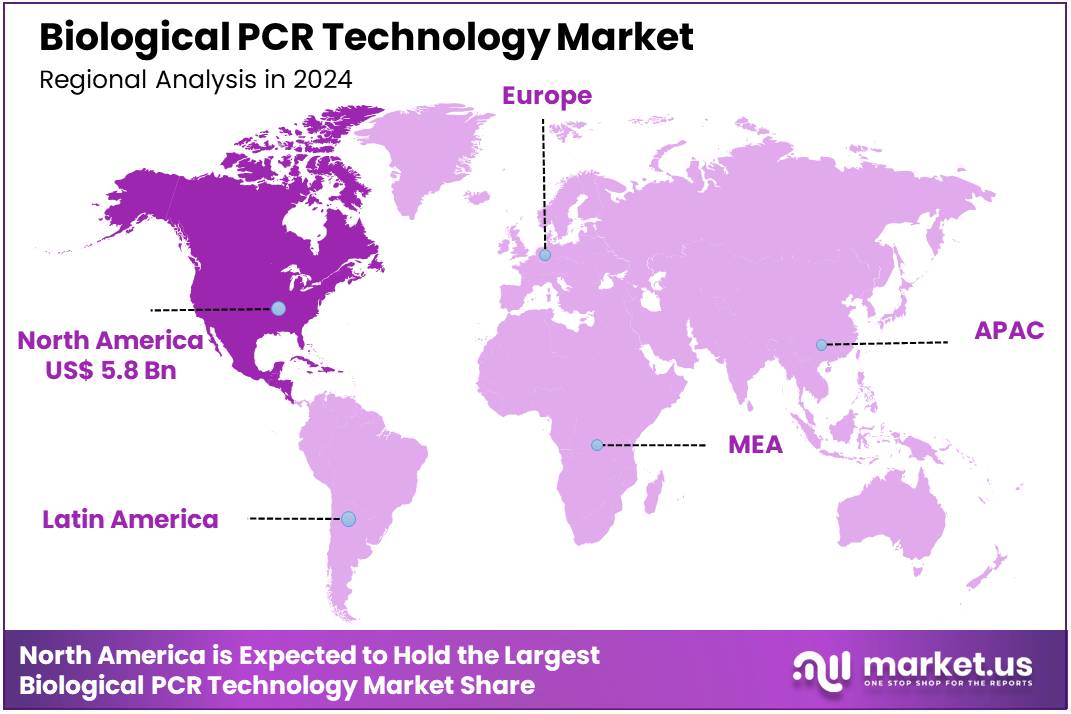

Global Biological PCR Technology Market size is expected to be worth around US$ 29.2 Billion by 2034 from US$ 14.7 Billion in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 5.8 Billion.

Growing demand for advanced molecular diagnostics and increasing applications of genetic research are driving the expansion of the biological PCR technology market. Polymerase chain reaction (PCR) technology, particularly real-time quantitative PCR (qPCR), plays a pivotal role in amplifying DNA or RNA sequences, allowing for precise analysis of gene expression, mutation detection, and pathogen identification.

The market benefits from qPCR’s versatility in applications ranging from cancer research to infectious disease diagnosis, making it an indispensable tool in clinical and research settings. Recent advancements in PCR technology, including high-throughput capabilities and automation, have further enhanced its efficiency and accessibility.

The growing emphasis on personalized medicine and the rising prevalence of genetic disorders create significant opportunities for PCR-based technologies. In April 2023, Promega Corporation announced US$15,000 grants to researchers utilizing real-time qPCR, alongside providing VIP technical assistance and personalized training. This initiative supports the widespread adoption and application of qPCR techniques, which are essential for molecular research and clinical diagnostics. As the demand for rapid, accurate, and non-invasive diagnostic tools rises, biological PCR technology is poised for continued growth, providing key advancements in healthcare and research applications.

Key Takeaways

- In 2024, the market for Biological PCR Technology generated a revenue of US$ 14.7 Billion, with a CAGR of 7.1%, and is expected to reach US$ 29.2 Billion by the year 2034.

- The product type segment is divided into reagents and consumables, with reagents taking the lead in 2024 with a market share of 65.3%.

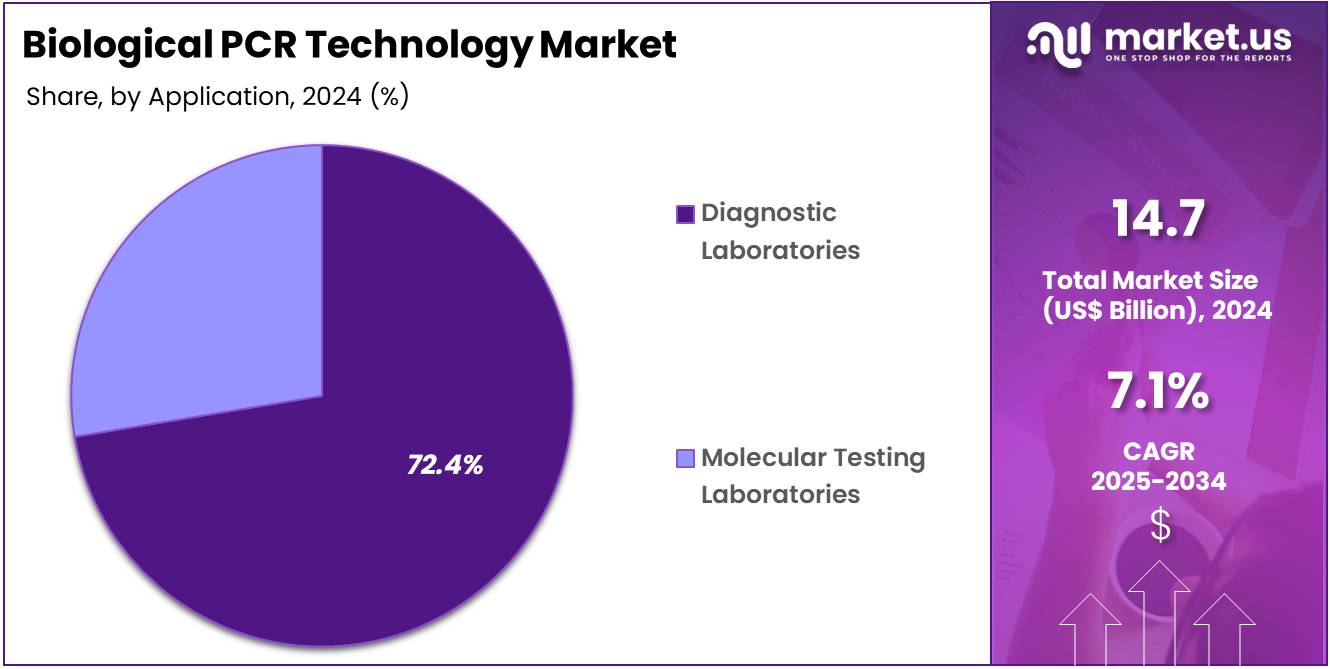

- Considering application, the market is divided into diagnostic laboratories and molecular testing laboratories. Among these, diagnostic laboratories held a significant share of 72.4%.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

Reagents are expected to dominate the biological PCR technology market, accounting for 65.3% of the market share. These reagents are critical in the execution of PCR-based techniques, particularly in real-time quantitative PCR (qPCR) and other molecular diagnostic applications. The demand for reagents is projected to increase as molecular diagnostics become more widespread, especially for applications in infectious disease detection, genetic testing, and cancer research.

The growing need for accurate, sensitive, and rapid diagnostic results is likely to drive the growth of this segment. As PCR technology continues to evolve with advancements in reagent formulations, offering improved efficiency and specificity, the reagents segment is expected to remain a key driver in the market, bolstered by the increasing adoption of PCR in both research and clinical settings.

Application Analysis

Diagnostic laboratories are projected to be the largest end-users in the biological PCR technology market, comprising 72.4% of the market share. These laboratories are central to the implementation of PCR-based testing for a wide range of applications, including genetic testing, disease diagnostics, and research. The growing demand for personalized medicine, as well as the rising incidence of infectious diseases and genetic disorders, is anticipated to drive the demand for PCR technology in diagnostic laboratories.

The increasing automation in PCR systems, allowing for faster and more efficient testing, is expected to further fuel market growth in this segment. Additionally, as the healthcare sector continues to prioritize precision medicine, diagnostic laboratories are likely to continue their leading role in the adoption and utilization of PCR technologies.

Key Market Segments

By Product Type

- Reagents

- Consumables

By Application

- Diagnostic Laboratories

- Molecular Testing Laboratories

Drivers

Increasing Prevalence of Infectious Diseases is Driving the Market

The rising global burden of infectious diseases, including newly emerging pathogens and persistent endemic diseases, fundamentally drives demand for biological PCR technology. Polymerase Chain Reaction (PCR) remains a cornerstone in molecular diagnostics due to its high sensitivity and specificity in detecting genetic material from various pathogens, enabling rapid and accurate diagnosis.

The U.S. Centers for Disease Control and Prevention (CDC) continuously monitors and reports on the prevalence of infectious diseases; for instance, their “Notifiable Diseases and Mortality Tables” updated weekly, consistently show thousands of new cases of various infectious diseases across the US from 2022 to 2024, emphasizing the ongoing need for robust diagnostic tools. This sustained and often urgent need for precise pathogen identification in clinical, public health, and research settings fuels the continuous adoption and innovation within the PCR market.

Restraints

High Cost of Advanced PCR Systems and Reagent Sensitivity are Restraining the Market

The biological PCR technology market faces significant restraint due to the substantial initial investment required for advanced PCR instruments and the inherent sensitivity of PCR reagents to environmental conditions and contamination. High-throughput real-time PCR and digital PCR systems, while offering superior performance, represent a significant capital expenditure for many laboratories, particularly in developing regions or smaller healthcare facilities.

A scholarly article discussing “Polymerase Chain Reaction Chips for Biomarker Discovery and Validation,” published in MDPI in March 2024, implicitly highlights the complexity and specialized nature of these technologies, which contribute to their cost. Furthermore, the sensitivity of PCR reagents to degradation, contamination, and proper storage necessitates stringent laboratory practices and quality control, which can increase operational costs and the risk of false results if not meticulously managed. These factors can limit widespread accessibility and adoption, particularly in resource-constrained environments.

Opportunities

Integration with Automation and Microfluidics Creates Growth Opportunities

The increasing integration of biological PCR technology with automation platforms and microfluidic systems presents significant growth opportunities in the market. Automation streamlines the PCR workflow, from sample preparation to data analysis, reducing manual errors, increasing throughput, and improving reproducibility, which is critical for large-scale diagnostic and research applications.

A scholarly article published in MDPI in January 2025, titled “Present and Future Applications of Digital PCR in Infectious Diseases Diagnosis,” discusses how advancements in dPCR allow for higher accuracy and sensitivity, and implies the increasing automation that makes such precision possible.

Microfluidic-based PCR devices enable portable, rapid, and low-sample volume testing, opening new avenues for point-of-care diagnostics and field-based applications. These advancements overcome traditional bottlenecks, making PCR more efficient, accessible, and suitable for diverse settings, from centralized labs to remote clinics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the biological PCR technology market, primarily through their impact on healthcare budgets, research funding, and the overall economic health of countries. Robust economic periods generally lead to increased investment in healthcare infrastructure, diagnostic capabilities, and biotechnology research and development, directly benefiting the adoption of advanced PCR systems.

Conversely, economic downturns or high inflation rates can result in budget cuts for healthcare and research institutions, potentially delaying equipment upgrades or limiting the purchase of expensive reagents, thereby slowing market growth. The International Monetary Fund (IMF) projects global growth to remain stable at around 3.1% in 2024, which, while not a rapid acceleration, provides a stable environment for continued investment in healthcare technologies.

Geopolitical factors, such as trade policies affecting the import and export of laboratory equipment and reagents, and the stability of global supply chains for critical components like specialized enzymes and plastics, also play a crucial role. Political instability or trade disputes, as highlighted by a March 2025 article on geopolitical risks in logistics, can disrupt supply chains, increase manufacturing costs, and create uncertainty for international collaborations, affecting the timely availability and pricing of PCR products.

However, the indispensable role of PCR in disease surveillance, outbreak response, and fundamental biological research ensures that governments and key players prioritize this technology, fostering its continued development and market expansion even amidst economic and political fluctuations.

Current US tariff policies can directly impact the biological PCR technology market by altering the cost of imported specialized enzymes, nucleotides, plastics for reaction vessels, and sophisticated instrumentation. Given the globalized nature of biotechnology manufacturing, many critical components and finished PCR systems are sourced from international suppliers.

The U.S. Census Bureau’s foreign trade data for 2023 and 2024 shows substantial US imports of laboratory equipment and chemical reagents, indicating the significant exposure of this sector to potential tariff impacts. Any new tariffs imposed on these categories could directly increase the operational costs for US-based manufacturers of PCR instruments and reagents, as well as for laboratories and hospitals purchasing these products. This could translate to higher prices for PCR tests or reduced profit margins for companies, potentially affecting patient access or the financial viability of commercialization.

An AAMC news article from May 2025 specifically mentioned that new tariffs on medical supplies, including those used in diagnostics, could have “significant implications for healthcare.” Conversely, these tariff policies can act as a powerful incentive for manufacturers to invest in expanding or establishing domestic production capabilities for PCR-related consumables and instruments within the US. This strategic shift towards localized manufacturing aims to create a more secure and resilient supply chain for essential molecular diagnostic tools, reducing dependence on potentially volatile international sources and enhancing national biosecurity, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Growing Adoption of Digital PCR (dPCR) for Absolute Quantification is a Recent Trend

A prominent recent trend in the biological PCR technology market is the accelerating adoption of digital PCR (dPCR) for absolute quantification of nucleic acids. Digital PCR partitions a sample into thousands or millions of individual reactions, allowing for highly precise and sensitive detection and quantification of target DNA or RNA molecules without the need for standard curves.

A scholarly article discussing “Impact of Multiplex PCR on Diagnosis of Bacterial and Fungal Infections,” published by PMC in May 2024, explicitly explores recent innovations in multiplex PCR, such as digital PCR and portable devices. This technology is gaining traction in applications requiring ultra-high sensitivity, such as cancer liquid biopsy, pathogen detection in low-concentration samples, and gene therapy monitoring. The ability of dPCR to provide absolute counts of nucleic acid targets offers a significant advantage over traditional real-time PCR, driving its increasing preference in advanced research and clinical diagnostics.

Regional Analysis

North America is leading the Biological PCR Technology Market

North America dominated the market with the highest revenue share of 39.6% owing to sustained demand for rapid and accurate diagnostics, ongoing advancements in molecular biology research, and continued public health preparedness initiatives. While specific, dedicated NIH funding for PCR research is integrated into broader biomedical budgets, the overall National Institutes of Health budget was approximately US$47.311 billion in fiscal year 2024, a substantial portion of which supports molecular diagnostic research and development.

This continuous governmental investment in scientific inquiry underpins the innovation in PCR technologies. Major players in the diagnostic industry reported robust revenues, reflecting the widespread adoption of these technologies. For instance, Thermo Fisher Scientific, a leading provider of life science solutions, reported annual revenue of US$42.88 billion in 2024, with its Life Sciences Solutions segment heavily involved in PCR instruments and reagents.

Abbott Laboratories’ Diagnostics segment, which includes molecular diagnostics, reported total sales of US$9.341 billion for the full year 2024, underscoring the strong commercial performance of these essential diagnostic tools in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare infrastructure development, a rising burden of infectious and chronic diseases, and escalating government and private sector investments in advanced diagnostic capabilities. Governments across the region are prioritizing the enhancement of diagnostic networks; for example, India’s Department of Health Research (DHR) implemented a Central Sector Scheme to establish 163 Viral Research & Diagnostic Laboratories (VRDLs) for epidemic management from fiscal year 2021-22 to 2025-26, directly increasing the capacity for PCR testing.

Similarly, China’s government continues to invest heavily in medical device research, including molecular diagnostics, with significant support for domestic manufacturers. Major diagnostic companies are expanding their presence in this dynamic region; Bio-Rad Laboratories reported that Asia Pacific contributed 20.3% to its total sales in 2024, with growth in its Clinical Diagnostics business being broad-based across all regions, including Asia Pacific. This expanding diagnostic infrastructure and commercial focus are anticipated to drive the widespread adoption of molecular technologies for various applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biological polymerase chain reaction (PCR) technology market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel assays, reagents, and instruments tailored for specific applications, such as diagnostics, research, and therapeutics. Companies invest in automation and high-throughput technologies to enhance scalability and reproducibility in PCR processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new technologies into clinical and research settings. Additionally, players aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for PCR-based solutions.

Thermo Fisher Scientific Inc. is a prominent player in the biological PCR technology market. Headquartered in Waltham, Massachusetts, Thermo Fisher specializes in providing a comprehensive range of products and services, including PCR instruments, reagents, consumables, and software for various applications such as genomics, infectious disease detection, and research.

The company emphasizes innovation and quality, offering solutions that enable researchers and healthcare professionals to perform accurate and efficient analyses. Thermo Fisher’s global presence and commitment to customer support position it as a key contributor to the advancement of PCR technologies. The company’s strategic mergers and acquisitions further enhance its capabilities and market reach, solidifying its leadership in the industry.

Top Key Players

- Takara Bio Inc

- QIAGEN

- Promega Corporation

- Merck KGAA

- Hoffmann-La Roche Ltd

- Eppendorf S

- Bioneer Corporation

- ABBOTT

Recent Developments

- In November 2023, F. Hoffmann-La Roche Ltd launched the next-generation qPCR system, the Light Cycler PRO System, designed to enhance the efficiency of molecular diagnostics and meet evolving clinical demands. The introduction of this advanced system is poised to accelerate the photomedicine and molecular diagnostics markets by offering improved accuracy and speed in clinical diagnostics, which are crucial for early disease detection and precision medicine.

- In April 2023, Gabriela Saldanha, product marketing manager at Promega Corporation, highlighted that the grants awarded by Promega would assist researchers in leveraging the powerful molecular biology tool, qPCR. By connecting with young researchers and students globally, Promega is fostering the development of innovative projects in the molecular diagnostics space. This initiative is expected to further expand the photomedicine market, as it encourages the adoption of qPCR for a wide range of diagnostic and therapeutic applications.

Report Scope

Report Features Description Market Value (2024) US$ 14.7 Billion Forecast Revenue (2034) US$ 29.2 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents and Consumables), By Application (Diagnostic Laboratories and Molecular Testing Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takara Bio Inc, QIAGEN, Promega Corporation, Merck KGAA, F. Hoffmann-La Roche Ltd , Eppendorf S, Bioneer Corporation, ABBOTT. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biological PCR Technology MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Biological PCR Technology MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Takara Bio Inc

- QIAGEN

- Promega Corporation

- Merck KGAA

- Hoffmann-La Roche Ltd

- Eppendorf S

- Bioneer Corporation

- ABBOTT