Global Biofertilizer Market Size, Share Analysis Report By Type (Nitrogen-fixing Biofertilizers, Phosphate Solubilizing and Mobilizing Biofertilizers, Potassium Solubilizing and Mobilizing Biofertilizers, Others), By Form (Liquid, Carrier- based), Ву Сгор Туре (Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By Mode of Application (Soil Treatment, Seed Treatment, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155066

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

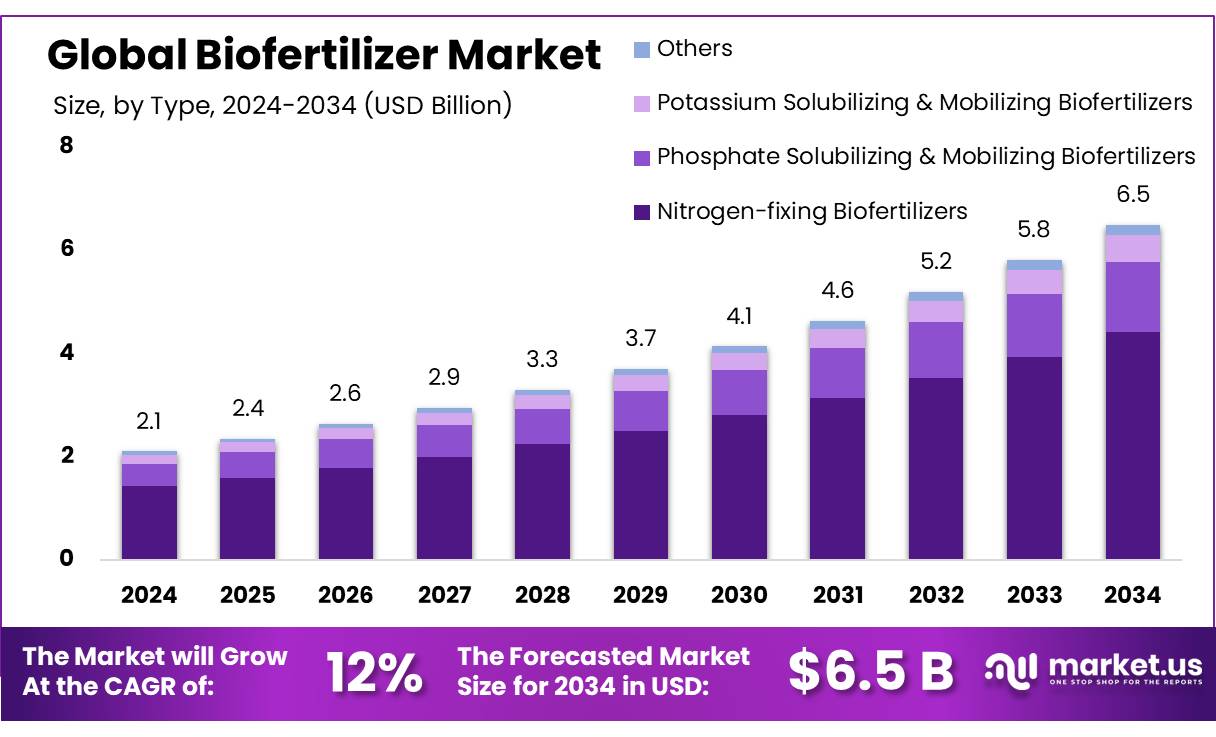

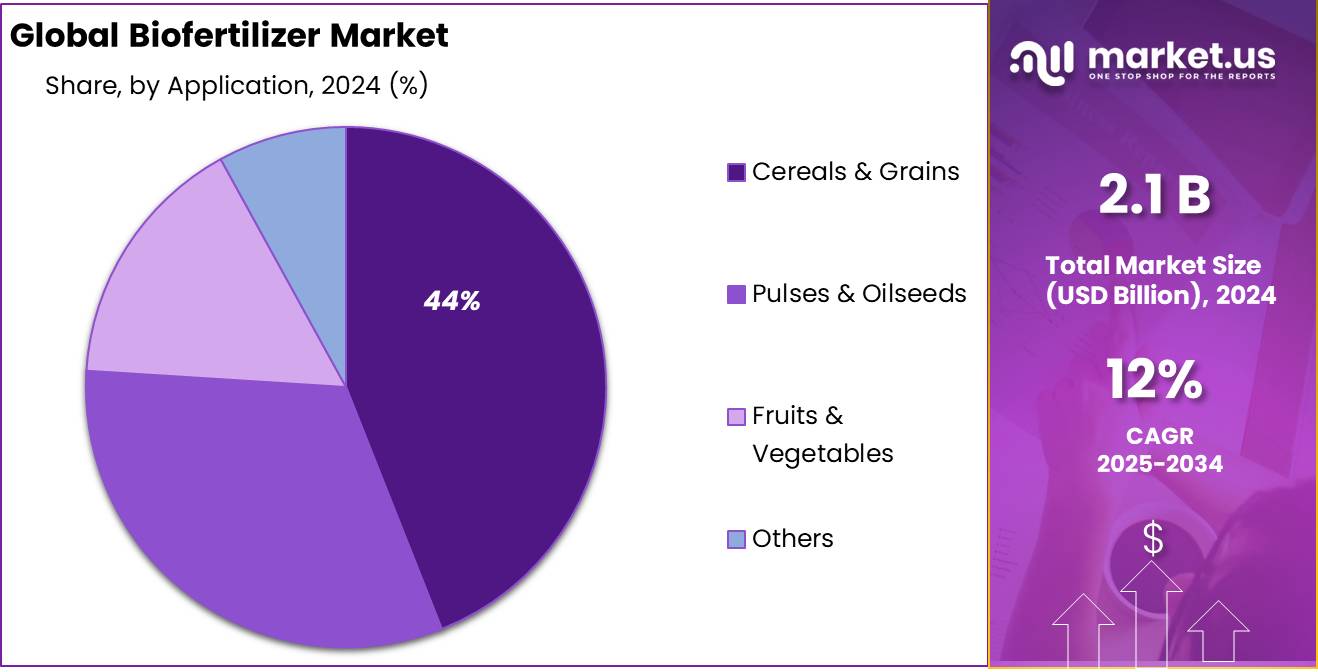

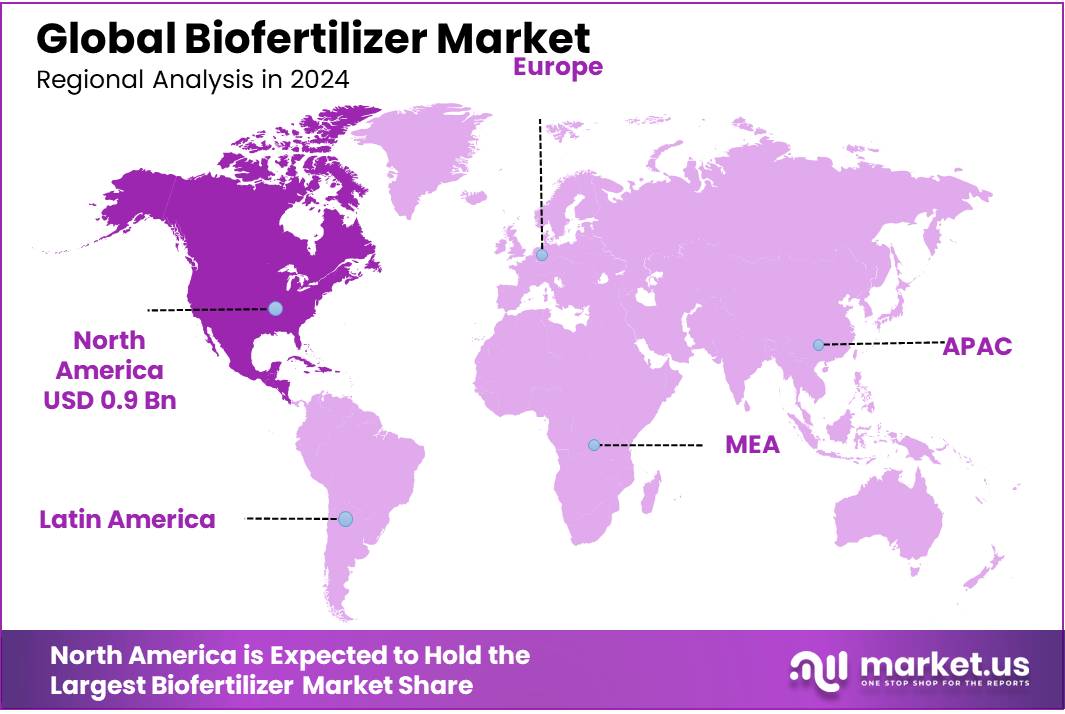

The Global Biofertilizer Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 12.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 44.2% share, holding USD 0.9 Billion revenue.

The biofertilizer concentrates industry in India is experiencing significant growth, driven by increasing awareness of sustainable agriculture practices, government support, and advancements in biotechnology. Biofertilizers, which are substances containing living microorganisms that promote plant growth by enhancing nutrient availability, are gaining popularity as eco-friendly alternatives to chemical fertilizers.

The Government of India has implemented several initiatives to promote the use of biofertilizers. The Indian Council of Agricultural Research (ICAR) has developed liquid biofertilizer technologies with enhanced shelf life and improved strains specific to various crops and soil types. Additionally, the government provides 100% financial assistance up to INR 160 lakh for setting up state-of-the-art biofertilizer units.

Government support plays a pivotal role in this growth. Under the Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North Eastern Region (MOVCDNER), farmers receive financial assistance of ₹15,000 per hectare for three years through Direct Benefit Transfer (DBT) to purchase organic inputs, including biofertilizers. Additionally, the Indian Council of Agricultural Research (ICAR) has developed liquid biofertilizer technologies with enhanced shelf life and improved strains tailored for various crops and soil types.

The market dynamics are further influenced by the increasing demand for organic produce, which is reshaping farming practices. India, with approximately 1.3 million certified organic producers, leads globally in the number of organic farmers, though the proportion of land under organic farming remains relatively small. This shift towards organic farming is complemented by the government’s launch of the Prime Minister Dhan-Dhaanya Krishi Yojana in July 2025, a six-year initiative with an annual outlay of ₹24,000 crore, aimed at boosting crop yields and farmers’ income in 100 low-performing districts.

Key Takeaways

- Biofertilizer Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 12.0%.

- Nitrogen-fixing Biofertilizers held a dominant market position, capturing more than a 74.2% share.

- Liquid biofertilizers held a dominant market position, capturing more than a 61.2% share.

- Cereals & grains segment held a dominant market position, capturing more than a 44.3% share.

- Soil treatment held a dominant market position in the biofertilizer sector, capturing more than a 56.4% share.

- North America was the dominant region in the biofertilizer market, accounting for 44.2% of global revenue—about USD 0.9 billion.

By Type Analysis

Nitrogen-Fixing Biofertilizers Lead Market with 74.2% Share in 2024

In 2024, Nitrogen-fixing Biofertilizers held a dominant market position, capturing more than a 74.2% share. This segment’s leadership is attributed to its essential role in enhancing soil fertility by converting atmospheric nitrogen into a form that plants can absorb and utilize. Nitrogen is a vital nutrient for plant growth, and its availability is crucial for achieving high agricultural yields. The widespread adoption of nitrogen-fixing biofertilizers is particularly evident in the cultivation of cereals and grains, which are nitrogen-intensive crops.

These biofertilizers contribute to sustainable farming practices by reducing the reliance on synthetic nitrogen fertilizers, thereby promoting environmental Tsustainability. The continued dominance of this segment is expected as farmers increasingly recognize the benefits of incorporating nitrogen-fixing biofertilizers into their agricultural practices.

By Form Analysis

Liquid Biofertilizers Capture 61.2% Market Share in 2024

In 2024, liquid biofertilizers held a dominant market position, capturing more than a 61.2% share. This significant share underscores the growing preference for liquid formulations among farmers and agricultural professionals. Liquid biofertilizers offer several advantages, including ease of application, compatibility with various irrigation systems, and uniform distribution of microbial inoculants. These benefits make them particularly suitable for large-scale farming operations and precision agriculture practices. The adoption of liquid biofertilizers is further supported by advancements in formulation technologies that enhance product stability and shelf life. As the demand for sustainable and efficient agricultural inputs continues to rise, liquid biofertilizers are expected to maintain their leading position in the market. Their ability to integrate seamlessly into modern farming practices positions them as a key component in the future of sustainable agriculture.

By Сгор Туре Analysis

Cereals & Grains Dominate Biofertilizer Market with 44.3% Share in 2024

In 2024, the cereals & grains segment held a dominant market position, capturing more than a 44.3% share. This significant share reflects the extensive cultivation of staple crops such as rice, wheat, and maize, which are highly responsive to biofertilizer applications. The adoption of biofertilizers in these crops enhances soil fertility, promotes sustainable farming practices, and reduces dependency on chemical fertilizers. Government initiatives and subsidies further encourage the use of biofertilizers among farmers, contributing to the growth of this segment. As the demand for organic and eco-friendly agricultural inputs increases, the cereals & grains segment is expected to maintain its leading position in the biofertilizer market.

By Mode of Application

Soil Treatment Dominates Biofertilizer Application with 56.4% Share in 2024

In 2024, soil treatment held a dominant market position in the biofertilizer sector, capturing more than a 56.4% share. This method involves applying biofertilizers directly to the soil, facilitating the colonization of beneficial microorganisms in the rhizosphere. These microorganisms enhance nutrient availability, improve soil structure, and promote plant growth. The widespread adoption of soil treatment is driven by its effectiveness in improving soil health and fertility, which are critical for sustainable agriculture. Additionally, soil treatment allows for broader microbial interaction within the soil, leading to more uniform nutrient distribution and better plant establishment. As the agricultural industry continues to focus on sustainable practices, soil treatment is expected to maintain its leading position in the biofertilizer application market.

Key Market Segments

By Type

- Nitrogen-fixing Biofertilizers

- Phosphate Solubilizing & Mobilizing Biofertilizers

- Potassium Solubilizing & Mobilizing Biofertilizers

- Others

By Form

- Liquid

- Carrier- based

Ву Сгор Туре

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

- Others

By Mode of Application

- Soil Treatment

- Seed Treatment

- Others

Emerging Trends

Policy-backed shift to biofertilizers in climate-smart and organic farming

A powerful, current trend in biofertilizers is the way governments are pulling them into the center of climate-smart and organic farming programs. This isn’t abstract policy talk—it’s backed by money, targets, and growing certified acreage. In the United States, USDA’s Partnerships for Climate-Smart Commodities is investing about $3.1 billion across 141 projects that pay producers to adopt practices like biological nutrient management—an umbrella that helps biofertilizers move from trials to routine use.

In India, the new PM-PRANAM scheme rewards states that cut chemical fertilizer use, letting them keep 50% of the subsidy savings to reinvest in alternatives such as biofertilizers and compost. That creates direct, state-level incentives to switch inputs at scale. In Europe, the Farm to Fork Strategy sets a headline goal to reduce fertilizer use by at least 20% by 2030, pushing farmers toward balanced nutrition and microbial solutions to maintain yields while trimming losses.

These policy moves meet farmers where they are: under pressure to stabilize input costs and meet buyers’ sustainability rules. The organic market shows the demand-side pull. In 2023, organic farmland reached 98.9 million hectares, managed by ~4.3 million producers, with retail sales exceeding €136 billion—all strong signals that low-residue, soil-friendly inputs like biofertilizers have a durable market.

Research continues to validate why: microbial inoculants improve nutrient availability and soil structure and reduce dependence on chemical fertilizers and pesticides, helping farms hit both yield and environmental targets. Beyond the U.S., EU, and India, countries such as Brazil have national bio-inputs programs that fund biofactories, training, and innovation—another tailwind for local manufacturing and access.

Drivers

Government Support and Financial Incentives

A significant driver for the adoption of biofertilizers in India is the robust support provided by the government through various schemes and financial incentives. These initiatives aim to promote sustainable agricultural practices, reduce dependency on chemical fertilizers, and enhance soil health across the country.

The Paramparagat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development for North Eastern Region (MOVCDNER) are two pivotal schemes in this regard. Under PKVY, farmers receive financial assistance of ₹15,000 per hectare for three years through Direct Benefit Transfer (DBT) for both on-farm and off-farm organic inputs, including biofertilizers. Similarly, MOVCDNER provides ₹32,500 per hectare over three years, covering organic inputs and planting materials. Collectively, these schemes have disbursed ₹930.08 crore to farmers in the last five years to support organic farming practices.

Additionally, the government has introduced the Market Development Assistance (MDA) program, offering ₹1,500 per metric ton to promote organic fertilizers like Fermented Organic Manure (FOM), Liquid FOM, and Phosphate Rich Organic Manure (PROM). This initiative is part of the GOBARdhan scheme, which has an outlay of ₹1,451.84 crore from FY 2023-24 to 2025-26, including ₹360 crore earmarked for research and development .

These government-backed programs not only provide financial support but also offer training and capacity-building opportunities to farmers. Institutions like the National Centre of Organic and Natural Farming (NCONF) and its regional centers conduct various training sessions and awareness programs on organic farming and the use of biofertilizers.

Restraints

Limited Awareness and Technical Expertise

One of the primary challenges hindering the widespread adoption of biofertilizers among Indian farmers is the limited awareness and technical expertise regarding their use. Despite the government’s efforts to promote sustainable agricultural practices, many farmers, especially in rural areas, lack comprehensive knowledge about the benefits and proper application of biofertilizers.

A study published in the Journal of Extension and Rural Development highlights that farmers often face difficulties in adopting biofertilizer technologies due to inadequate training and demonstrations. The absence of field-level advice and guidance further exacerbates this issue, leading to skepticism about the efficacy of biofertilizers.

Additionally, the inconsistent quality and availability of biofertilizer products in the market contribute to farmers’ reluctance to embrace these alternatives. The study emphasizes the need for extensive awareness programs and capacity-building initiatives to bridge this knowledge gap and encourage the sustainable adoption of biofertilizers.

Furthermore, the government’s subsidy structure, which predominantly favors chemical fertilizers, poses a significant barrier. For every $1,000 invested in sustainable farming, approximately $100,000 is allocated for chemical fertilizer subsidies, while the total allocation for organic inputs, including biofertilizers, is only about $0.17 billion. This disparity discourages farmers from transitioning to biofertilizers, as the financial incentives for chemical fertilizers are substantially higher.

Opportunity

Strengthening Food Security through Biofertilizer Adoption

One powerful avenue for growth in the biofertilizer industry lies in its critical role in enhancing global food security. The United Nations’ Food and Agriculture Organization (FAO) forecasts that by 2030, the demand for agricultural crops is expected to increase by up to 60% as the global population rises and pressure on food systems intensifies. Biofertilizers, with their ability to bolster soil fertility, improve nutrient uptake, and reduce reliance on chemical fertilizers, offer a sustainable and effective solution to help meet that growing demand while preserving soil health.

In practical terms, biofertilizers harness natural processes such as nitrogen fixation and phosphorus solubilization—anabaena, for example, associated with the water fern Azolla, can contribute up to 60 kg of nitrogen per hectare per season. This benefit is not just ecological—it translates into tangible yield increases, often ranging between 20% and 40%, owing to improved protein content, vital nutrients, and overall plant health.

On the policy front, the Government of India is actively promoting biofertilizer uptake through targeted schemes like Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development for North Eastern Region (MOVCDNER). Under these programs, farmers receive financial support of ₹15,000 per hectare for three years through direct benefit transfers, which can be used for biofertilizers and other organic inputs. Over the past five years, a total of ₹693.30 crore under PKVY and ₹236.78 crore under MOVCDNER have been transferred to farmers’ accounts for input support including biofertilizers.

This convergence of increasing food demand, environmental incentive, and structured policy support creates a rich stage for biofertilizer growth. It’s not just about protecting the planet—it’s about ensuring that people everywhere can access the food they need. As more farmers adopt biofertilizers—supported by both government funding and practical benefits—the industry is poised to witness uplift not just in sales but also in lasting impact on food security and farming resilience.

Regional Insights

North America Leads Global Biofertilizer Market with 44.2% Share in 2024

In 2024, North America was the dominant region in the biofertilizer market, accounting for 44.2% of global revenue—about USD 0.9 billion—on the back of large-scale row-crop cultivation and rapid adoption in specialty crops. The U.S. contributed the bulk of regional sales (≈80–85%), with Canada adding a further 12–15% and Mexico the balance, reflecting deeper distribution networks and faster product registrations. Demand was strongest for nitrogen-fixing inoculants used in corn, soybeans, and pulses, which together represented roughly two-thirds of North American biofertilizer value in 2024.

Adoption benefited from growers targeting 3–7% yield stabilization and input cost hedging after synthetic fertilizer price swings since 2022, while tightening water-quality and soil-health programs in key states accelerated on-farm trials.

Distribution expanded through ag-retailers and co-ops, lifting the weighted average treated acreage in the U.S. Midwest and Canadian Prairies; California and the Pacific Northwest saw faster gains in high-value fruits and vegetables where residue limits and export standards favor biological inputs. Canada’s regulatory clarity and on-farm carbon programs supported double-digit uptake in cereals and oilseeds, and Mexico’s horticulture clusters added steady volume in microbial consortia for fertigation.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Novozymes, headquartered in Denmark, is a global leader in biotechnology, specializing in industrial enzymes and microorganisms. In 2024, Novozymes merged with Chr. Hansen to form Novonesis, creating a powerhouse in biosolutions. The company operates in over 130 countries, offering sustainable solutions across various industries, including agriculture, food, and pharmaceuticals. Their agricultural division focuses on enhancing soil health and crop productivity through innovative biological products.

AgriLife, based in Hyderabad, India, is a prominent agri-biotech company specializing in biofertilizers, biopesticides, and bio-stimulants. Established in 1993, AgriLife is part of SOM Phytopharma (India) Limited and operates as a debt-free enterprise. The company focuses on research-based production and offers a wide range of products, including nitrogen-fixing biofertilizers and phosphorus-solubilizing bacteria, aimed at enhancing soil fertility and promoting sustainable agriculture.

Biomax, founded in 1998 and based in Mumbai, India, is a biotechnology company dedicated to providing innovative solutions in agriculture. The company focuses on developing products that enhance soil health and crop productivity. Biomax’s offerings include biofertilizers that help in reducing fertilizer costs and promoting sustainable farming practices.

Symborg, located in Murcia, Spain, is an agricultural biotechnology company specializing in the development and commercialization of biostimulants and biofertilizers. The company focuses on enhancing crop yields and quality through innovative biological solutions. Symborg’s products are designed to improve nutrient use efficiency, stress tolerance, and overall plant health, contributing to more sustainable agricultural practices.

Top Key Players Outlook

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- AgriLife

- Biomax

- Symborg S.L

- Antibiotice S.A

- Lallemand Inc.

- Sigma Agri-Science, LLC

- Kiwa Bio-Tech Products Group Corporation

Recent Industry Developments

In 2024, Novozymes A/S, prior to its merger to form Novonesis, remained a trusted name in agricultural biosolutions, offering advanced enzyme and microbial-based products to boost plant health and soil fertility—particularly in the biofertilizer space. The company’s legacy results show a steady organic sales growth of 6% in Q4 and 5% overall in 2023, reflecting its strong market presence and innovation drive.

In 2024, Antibiotice S.A., a renowned Romanian pharma company, continued its broader operations by including biofertilizer production among its diverse offerings. While specific numbers tied solely to biofertilizers are not disclosed, the company reported total revenues of 692.98 million lei for the year—an 8 % increase over 2023—and a strong EBITDA of 152.45 million lei, up 23 % year-over-year.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 6.5 Bn CAGR (2025-2034) 12.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Nitrogen-fixing Biofertilizers, Phosphate Solubilizing and Mobilizing Biofertilizers, Potassium Solubilizing and Mobilizing Biofertilizers, Others), By Form (Liquid, Carrier- based), Ву Сгор Туре (Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By Mode of Application (Soil Treatment, Seed Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CBF China Bio-Fertilizer AG, Novozymes A/S, AgriLife, Biomax, Symborg S.L, Antibiotice S.A, Lallemand Inc., Sigma Agri-Science, LLC, Kiwa Bio-Tech Products Group Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- AgriLife

- Biomax

- Symborg S.L

- Antibiotice S.A

- Lallemand Inc.

- Sigma Agri-Science, LLC

- Kiwa Bio-Tech Products Group Corporation