Electroceuticals/Bioelectric Medicine Market By Product Type (Cardiac Pacemakers, Retinal Implants, Neuromodulators, Implantable Cardioverter Defibrillators, Cochlear Implants), By Application (Arrhythmia, Parkinson’s Disease, Depression, Chronic Pain Management, Others), By Device Type (Implantable, Non-Invasive), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 101011

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

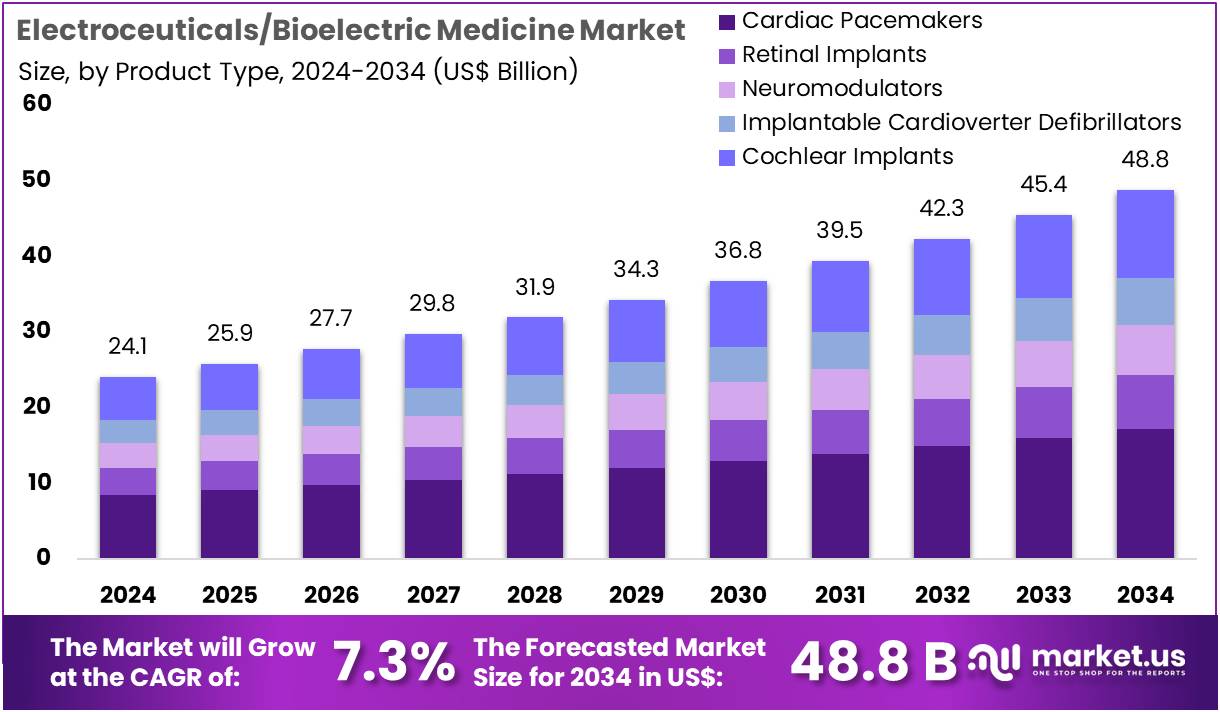

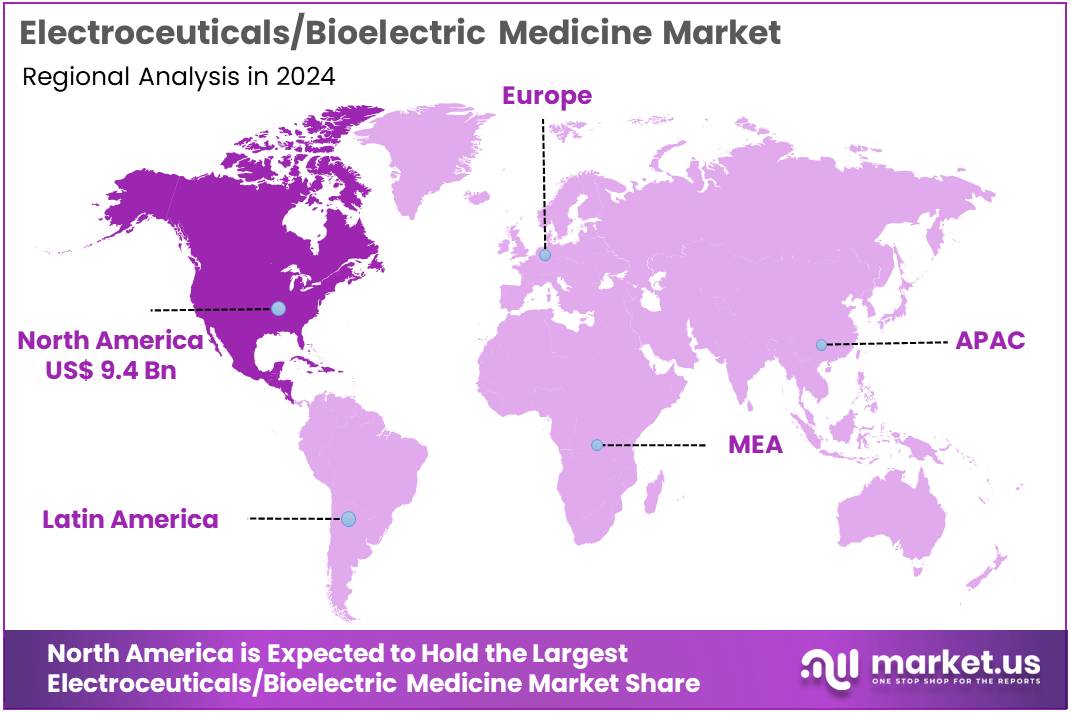

The Electroceuticals/Bioelectric Medicine Market size is expected to be worth around US$ 48.8 billion by 2034 from US$ 24.1 billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.8% share and holds US$ 9.4 Billion market value for the year.

Increasing innovation in device technologies and a shift towards value-based care are major drivers of the electroceuticals market. Modern devices now feature closed-loop sensing, miniaturized hardware, and onboard AI, allowing them to fine-tune stimulation dozens of times per second for conditions like complex neurological and cardiovascular disorders. This technological differentiation is now more crucial for competitive positioning than production scale.

Regulatory agencies are also facilitating this growth by streamlining breakthrough-device pathways, accelerating time-to-market for novel platforms. Payers are also shifting toward value-based reimbursement, which favors therapies that can document superior outcomes and lower lifetime treatment costs compared to long-term drug regimens.

Growing clinical applications and regulatory approvals are expanding the market for electroceuticals, showcasing their effectiveness as non-pharmaceutical solutions. In November 2024, the FDA approved the VARIPULSE catheter-ablation platform, with 74.4% of patients with paroxysmal atrial fibrillation remaining arrhythmia-free after 12 months. This landmark approval highlights the growing potential of bioelectric medicine in cardiac care.

Similarly, in August 2024, the FDA approved the Altius direct electrical nerve-stimulation system for phantom-limb pain, demonstrating over 50% relief in pivotal trials. These breakthroughs provide significant advancements in managing chronic pain and cardiovascular conditions, positioning electroceuticals as a key player in the future of medicine.

Rising investment and strategic partnerships are further cementing the market’s growth trajectory. For instance, the National Institutes of Health (NIH) has been a significant funder of research into bioelectric medicine, with recent initiatives focusing on mapping the nervous system to better understand how electrical signals can be used to treat various diseases. This investment, coupled with expedited regulatory pathways, is shortening the development cycle for new electroceutical therapies.

The FDA’s Breakthrough Devices Program, for instance, has granted over 1,000 devices this designation, with a significant portion of these being therapeutic devices intended to treat life-threatening or irreversibly debilitating conditions. This trend of collaboration between public funding, regulatory bodies, and private sector innovation ensures the market for electroceuticals will remain dynamic and highly competitive.

Key Takeaways

- In 2024, the market for electroceuticals/bioelectric medicine generated a revenue of US$ 24.1 billion, with a CAGR of 7.3%, and is expected to reach US$ 48.8 billion by the year 2034.

- The product type segment is divided into cardiac pacemakers, retinal implants, neuromodulators, implantable cardioverter defibrillators, cochlear implants, with cardiac pacemakers taking the lead in 2024 with a market share of 35.2%.

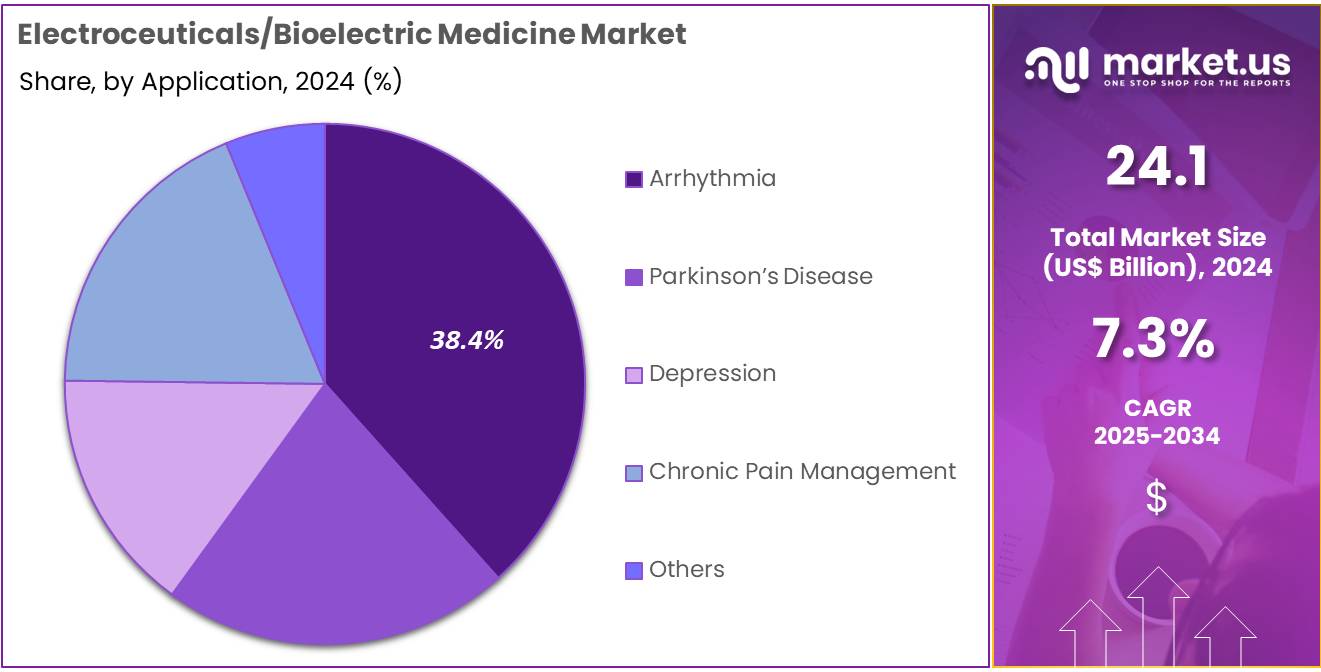

- Considering application, the market is divided into arrhythmia, parkinson’s disease, depression, chronic pain management, others. Among these, arrhythmia held a significant share of 38.4%.

- Furthermore, concerning the device type segment, the market is segregated into implantable, non-invasive. The implantable sector stands out as the dominant player, holding the largest revenue share of 61.7% in the electroceuticals/bioelectric medicine market.

- North America led the market by securing a market share of 38.8% in 2024.

Product Type Analysis

Cardiac pacemakers hold 35.2% of the product type segment in the electroceuticals/bioelectric medicine market. This segment’s growth is expected to continue as cardiac pacemakers are crucial for managing arrhythmias, a condition that affects millions of individuals worldwide. The global aging population and the increasing prevalence of heart-related diseases, such as heart failure and atrial fibrillation, are major drivers of demand for pacemakers. These devices help regulate heart rhythm and are considered life-saving for patients with heart conditions.

Technological advancements in pacemaker design, such as smaller sizes, longer battery life, and wireless communication capabilities, are expected to further enhance their adoption. Moreover, as healthcare systems emphasize early intervention and preventive measures, pacemakers are likely to become a more prominent treatment option. The increasing awareness of heart disease and the availability of advanced cardiac care are also contributing factors to the sustained growth of this segment.

Application Analysis

Arrhythmia accounts for 38.4% of the application segment in the electroceuticals/bioelectric medicine market. This growth is expected to continue as the prevalence of arrhythmias increases globally, driven by lifestyle factors such as stress, poor diet, and the aging population. Arrhythmias, including atrial fibrillation, ventricular fibrillation, and bradycardia, are serious conditions that require timely and effective treatment, with pacemakers and implantable defibrillators being some of the most common therapeutic options.

The growing demand for non-invasive and minimally invasive treatments for arrhythmia, such as the use of bioelectric devices for regulating heart rhythms, is anticipated to further drive the growth of this segment. Technological advancements in devices for arrhythmia treatment, such as improved monitoring and automatic adjustment capabilities, are likely to contribute to better patient outcomes and increased adoption. As healthcare providers continue to prioritize the management of cardiovascular diseases, the demand for electroceuticals targeting arrhythmia is expected to remain strong.

Device Type Analysis

Implantable devices represent 61.7% of the device type segment in the electroceuticals/bioelectric medicine market. This dominance is expected to persist as implantable devices, such as pacemakers, implantable cardioverter defibrillators (ICDs), and cochlear implants, provide long-term and effective solutions for various conditions. Implantable devices offer several advantages, including continuous monitoring and the ability to deliver therapy directly to the target area, which is especially critical in conditions like arrhythmia, chronic pain, and Parkinson’s disease.

The increasing need for long-term, reliable treatment options for chronic diseases, coupled with advancements in implantable device technology, is likely to drive the growth of this segment. As patients demand more durable, efficient, and minimally invasive treatment options, the adoption of implantable electroceuticals is expected to grow steadily. Additionally, the ability to integrate implantable devices with remote monitoring systems, enabling healthcare providers to track patients’ conditions in real-time, will further drive the growth of implantable devices in the electroceuticals market.

Key Market Segments

By Product Type

- Cardiac Pacemakers

- Retinal Implants

- Neuromodulators

- Implantable Cardioverter Defibrillators

- Cochlear Implants

By Application

- Arrhythmia

- Parkinson’s Disease

- Depression

- Chronic Pain Management

- Others

By Device Type

- Implantable

- Non-Invasive

Drivers

The growing burden of chronic neurological and cardiovascular diseases is driving the market

The electroceuticals market is expanding rapidly due to the rising global prevalence of chronic neurological and cardiovascular conditions, which often prove resistant to traditional pharmaceutical treatments. The worsening prevalence of refractory epilepsy, Parkinson’s disease, and heart rhythm disorders is pushing clinicians toward bioelectric interventions that can bypass pharmacological limitations. These advanced therapies offer a precise, targeted approach to managing symptoms. According to the Centers for Disease Control and Prevention (CDC), over 795,000 people in the United States have a stroke each year, and about 87% of all strokes are ischemic strokes, which can lead to long-term neurological damage.

Furthermore, data from the American Heart Association indicates that age-adjusted mortality for arrhythmias increased by 450% between 1970 and 2022. As developed-market populations age, patients with multi-morbid conditions increasingly seek therapies with lower systemic side-effect profiles compared to medication. This trend reinforces demand for a range of bioelectric therapies, from implantable devices for epilepsy and cardiac arrhythmias to non-invasive stimulators for chronic pain, driving the adoption of these technologies across both hospital and outpatient settings.

Restraints

The high cost of devices and complex reimbursement policies are restraining the market

A significant restraint on the bioelectric medicine market is the high initial cost of advanced devices and the complex, often unpredictable, reimbursement landscape. Many bioelectric therapies, particularly implantable neurostimulators and pacemakers, represent a substantial capital expenditure for healthcare providers and a significant financial burden for patients. The cost of a single implantable spinal cord stimulator system can range from tens of thousands of dollars, making it an inaccessible option for many without robust insurance coverage. Compounding this issue are the intricate and often lengthy processes for securing reimbursement from public and private payers.

The Centers for Medicare & Medicaid Services (CMS) and other private insurers require extensive clinical data and evidence of efficacy to establish coverage and set payment rates for new technologies. A 2024 CMS document on new medical device reimbursement demonstrated the significant challenges and lengthy timelines for obtaining a permanent reimbursement code. This lack of standardized reimbursement policies creates financial uncertainty for both manufacturers and healthcare providers, delaying the adoption of innovative devices. Consequently, these financial and administrative barriers hinder widespread market penetration despite the clear clinical benefits of the technologies.

Opportunities

Continuous technological innovations in implantable and non-invasive devices are creating growth opportunities

The electroceuticals market is presented with significant opportunities due to continuous technological innovations that are enhancing device capabilities, improving patient outcomes, and expanding the range of treatable conditions. The latest generation of neurostimulators can now adjust their output hundreds of times per second, moving therapy from reactive to proactive care. For instance, Medtronic’s Inceptiv closed-loop spinal cord stimulator received FDA clearance in April 2024, demonstrating its ability to deliver superior outcomes through automatic dose optimization based on real-time neural feedback.

Miniaturization breakthroughs have yielded implantable devices that are far less invasive, such as leadless pacemakers that are 93% smaller than conventional ones, as highlighted in a 2024 Medtronic report on miniaturized health tech. Innovations in non-invasive platforms, such as transcutaneous and focused ultrasound devices, now offer near-implant precision without the need for surgery, broadening eligibility to patients previously unwilling or unable to undergo invasive procedures. These continuous advancements improve the efficacy, safety, and patient experience, thereby increasing clinical adoption and unlocking significant growth potential.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the operational landscape for manufacturers and suppliers in the electroceuticals market. Rising global inflation has driven up the costs of essential materials, including specialized microchips and high-performance batteries, which are vital for advanced devices. For instance, a 2024 semiconductor supply chain report noted a 19% projected increase in global chip revenues, alongside a sharp rise in industry R&D spending, estimated to hit 52% of EBIT.

Additionally, geopolitical instability in key manufacturing regions has led to disruptions in global supply chains, causing volatility and potential shortages of critical components. The semiconductor sector is responding to these challenges by prioritizing operational efficiency and diversifying its supplier network, aiming to build a more resilient and stable manufacturing environment. A 2024 study further highlighted that US private sector investment in wafer fabrication is expected to make up 28% of global capital expenditures between 2024 and 2032, up significantly from previous levels.

Meanwhile, US tariffs are creating an added layer of complexity for the supply chain. New import duties on medical devices and electronic components from major trading partners have escalated the cost of these goods. According to a 2025 report from the Harmonized Tariff Schedule of the United States (HTS), certain medical instruments and electronics now face duties as high as 25% or more, depending on their classification and origin. This tariff structure has increased costs for manufacturers and, in turn, for healthcare providers.

In 2024, the US imported over $75 billion worth of medical devices and supplies, a sector heavily impacted by these trade barriers. However, the tariffs have also created an advantage for domestic manufacturers, who are not subject to these import duties. As a result, some healthcare providers are shifting their purchasing to locally produced goods, fostering a shift toward domestic manufacturing and encouraging investment in local production capabilities to reduce reliance on imports. This trend supports a more stable supply chain and offers a promising outlook for US-based manufacturers in the long term.

Latest Trends

Expansion of clinical indications across multiple therapeutic areas is creating growth opportunities

A significant trend observed in 2024 and 2025 is the expansion of bioelectric therapies beyond their traditional applications, with new clinical evidence supporting their use in oncology, metabolic, and autoimmune disorders. This diversification into new therapeutic areas is a key growth driver, as it broadens the patient population and reduces reliance on any single indication. In oncology, for example, Tumor Treating Fields (TTF) have shown remarkable potential.

A 2023 study published in Neuro-Oncology Advances corroborated that TTFields, when combined with standard chemotherapy, significantly prolonged median overall survival in patients with glioblastoma. In gastroenterology, targeted vagal nerve stimulation is emerging as a promising therapy for inflammatory bowel disease, with clinical data showing that it can modulate the immune response and reduce inflammation.

Furthermore, psychiatric care is a fast-emerging frontier, with transcutaneous auricular vagus nerve stimulation being evaluated in clinical trials, such as an ongoing study registered with ClinicalTrials.gov in June 2023, to ease symptoms of borderline personality disorder. This strategic expansion into diverse clinical indications creates a more robust and resilient market, shielding manufacturers from reimbursement headwinds in any single area and establishing a broad foundation for future growth.

Factor Impact on Market Growth Key Regions Affected Relevant Market Segment(s) Growing Burden of Chronic Neurological & Cardiovascular Diseases Increasing prevalence of neurological disorders like Parkinson’s, Alzheimer’s, and cardiovascular diseases leads to higher demand for bioelectric treatments like neuromodulation and deep brain stimulation. North America, Europe, Asia-Pacific Neurological Disease Treatment, Cardiovascular Disease Treatment Continuous Technological Innovations in Implantable & Non-Invasive Devices Advancements in implantable devices (e.g., pacemakers, cochlear implants) and non-invasive devices (e.g., transcranial magnetic stimulation, electrotherapy) are making treatments more effective and accessible. North America, Europe, Asia-Pacific Implantable Devices, Non-Invasive Therapies Rising Healthcare Expenditure & Favorable Government Initiatives Increasing healthcare funding, coupled with government support and favorable reimbursement policies, is accelerating the adoption of electroceutical therapies. North America, Europe, Asia-Pacific, Middle East Healthcare Providers, Government Support for Electroceuticals Expansion of Clinical Indications Across Multiple Therapeutic Areas Expanding clinical applications for electroceuticals in areas such as mental health, diabetes, and chronic pain is driving market growth and broadening treatment options. North America, Europe, Asia-Pacific Pain Management, Mental Health, Diabetes Regional Analysis

North America is leading the Electroceuticals/Bioelectric Medicine Market

The electroceuticals/bioelectric medicine market in North America held a commanding 38.8% share of the global market in 2024. This leadership is a result of the region’s well-developed healthcare infrastructure, high prevalence of chronic and neurological disorders, and a strong culture of innovation. The demand for electroceutical devices, such as cardiac pacemakers and neuromodulators, is driven by the significant burden of chronic diseases.

For instance, the Centers for Disease Control and Prevention (CDC) reports that approximately 610,000 people die of heart disease in the US every year, underscoring the critical need for advanced cardiac rhythm management solutions. This is further supported by the high prevalence of neurological conditions; the CDC also reports that an estimated 5.7 million adults in the US have heart failure, with an aging population particularly susceptible to these conditions.

The market’s growth is also a result of supportive government policies and the significant investments made by major medical device companies. For example, the US Food and Drug Administration (FDA) is actively facilitating the development and approval of these devices, with a growing number of approvals for new-generation, minimally invasive, and non-invasive electroceutical products.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market for electroceuticals/bioelectric medicine is anticipated to grow at the fastest rate during the forecast period. This growth is a result of a rapidly expanding healthcare sector, increasing government investments in medical technology, and a large and aging population. The World Health Organization (WHO) projects that the number of people aged 60 and over in the Asia Pacific region is expected to surpass 1.4 billion by 2030, which will significantly increase the patient pool for age-related conditions like cardiovascular and neurological disorders.

Furthermore, countries across the region are focusing on improving their healthcare infrastructure and adopting advanced medical technologies. China, for instance, is making substantial investments in its healthcare and pharmaceutical industries, and these initiatives are likely to create a favorable environment for the expansion of bioelectric medicine.

The market’s expansion in Asia Pacific is also propelled by rising awareness of non-pharmacological treatment options and the high prevalence of chronic diseases. The International Diabetes Federation (IDF) projects that the number of people with diabetes in the Asia Pacific region is expected to reach 589 million by 2050, highlighting a substantial need for innovative disease management solutions.

Governments are also implementing policies to promote the use of advanced medical devices. For example, some regulatory bodies in the region are working to streamline approval processes for medical devices, which is expected to facilitate market entry for new electroceutical products. These combined factors indicate that the Asia Pacific region is projected to become a key growth engine for the global electroceuticals/bioelectric medicine market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the electroceuticals/bioelectric medicine market drive growth by focusing on technological innovation, strategic collaborations, and global market expansion. They heavily invest in developing sophisticated, miniaturized devices that provide targeted therapy for chronic conditions and neurological disorders.

Companies form strategic partnerships with healthcare systems and research institutions to accelerate product development, expand clinical applications, and ensure regulatory compliance. They also strategically acquire smaller firms to diversify their portfolios and gain a foothold in emerging markets. Furthermore, these companies prioritize solutions that offer long-term cost savings and improved patient outcomes over traditional pharmaceutical treatments, reinforcing their value proposition to both providers and payers.

Medtronic stands as a preeminent global leader in the electroceuticals/bioelectric medicine market, renowned for its extensive portfolio of neurostimulation and cardiac rhythm management devices. The company’s core strategy revolves around continuous research and development, which has resulted in innovations such as advanced pacemakers, spinal cord stimulators, and deep brain stimulation systems.

Through a strong commitment to clinical research and strategic acquisitions, Medtronic expands its technological capabilities and broadens its global reach. This approach allows the company to provide comprehensive, data-driven solutions that address a wide array of chronic diseases, solidifying its position as an industry pioneer.

Top Key Players in the Electroceuticals/Bioelectric Medicine Market

- Stimwave LLC

- Sonova Holding AG

- Nevro Corp.

- NeuroPace, Inc.

- Medtronic plc

- LivaNova PLC

- electroCore, Inc.

- Cochlear Ltd.

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- Axonics Modulation Technologies, Inc.

- Abbott Laboratories

Recent Developments

- In April 2025: Epiminder received FDA approval for Minder, the first implantable continuous EEG monitor authorized under the De Novo pathway. This groundbreaking technology marks a significant milestone in neurostimulation, offering new possibilities for managing neurological conditions through continuous monitoring, thereby advancing the electroceuticals and bioelectric medicine market by providing more effective and accessible patient care solutions.

- In February 2025: Globus Medical completed its USD 250 million acquisition of Nevro Corp, significantly enhancing its neuromodulation portfolio for chronic pain. This acquisition strengthens Globus Medical’s position in the growing electroceuticals market, expanding its capabilities in advanced pain management technologies and further advancing the development of non-invasive therapeutic options through bioelectric solutions.

- In February 2025: Medtronic gained FDA clearance for the BrainSense Adaptive DBS system, marking a milestone as the first deep-brain stimulator to adjust therapy based on real-time neural feedback. This innovation represents a significant leap in the electroceuticals market, enhancing the precision and personalization of treatment for neurological disorders and driving the adoption of advanced neurostimulation technologies.

Report Scope

Report Features Description Market Value (2024) US$ 24.1 billion Forecast Revenue (2034) US$ 48.8 billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cardiac Pacemakers, Retinal Implants, Neuromodulators, Implantable Cardioverter Defibrillators, Cochlear Implants), By Application (Arrhythmia, Parkinson’s Disease, Depression, Chronic Pain Management, Others), By Device Type (Implantable, Non-Invasive) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stimwave LLC, Sonova Holding AG, Nevro Corp., NeuroPace, Inc., Medtronic plc, LivaNova PLC, electroCore, Inc., Cochlear Ltd., Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Axonics Modulation Technologies, Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electroceuticals/Bioelectric Medicine MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Electroceuticals/Bioelectric Medicine MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Stimwave LLC

- Sonova Holding AG

- Nevro Corp.

- NeuroPace, Inc.

- Medtronic plc

- LivaNova PLC

- electroCore, Inc.

- Cochlear Ltd.

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- Axonics Modulation Technologies, Inc.

- Abbott Laboratories