Global Biochar Fertilizer Market By Nature(Organic, Inorganic, Compound), By Technology(Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others), By Crop Type(Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application(Animal Feed, Agriculture, Fish Farming, Power Generation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132286

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

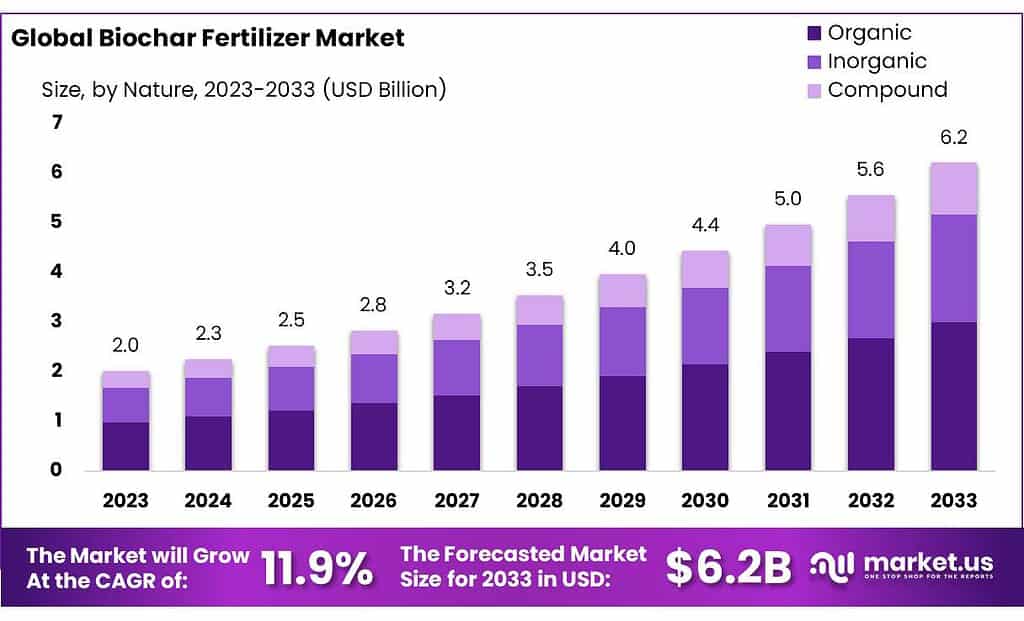

The Global Biochar Fertilizer Market size is expected to be worth around USD 6.2 Bn by 2033, from USD 2.2 Bn in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

Enriched biochar, a soil amendment that merges biochar with essential nutrients, is gaining traction in sustainable farming practices. Biochar, a stable form of charcoal derived from the pyrolysis of biomass, has long been recognized for its benefits in improving soil health.

This technique, which dates back to ancient Amazonian agriculture (terra preta), has re-emerged as a modern solution for enhancing soil fertility, increasing crop yields, and supporting sustainable farming. Its high carbon content and porous structure not only improve water retention and soil aeration but also provide an optimal environment for beneficial microorganisms.

In China, the integration of biochar as part of broader negative emission technologies (NETs) is pivotal to meeting its carbon reduction targets. A significant opportunity lies in converting agricultural residues into biochar. If 75% of agricultural waste is transformed, it could result in a reduction of up to 8,620 Mt CO2-equivalent emissions by 2050. This demonstrates biochar’s dual role in improving soil productivity while contributing to climate mitigation strategies.

The market is also witnessing technological advancements. Applied Carbon, a U.S.-based tech company, has secured $21.5 million to scale its biochar production technology. The company is deploying automated biochar machines across various states, enabling on-site conversion of agricultural waste into biochar. This innovation not only enhances soil health but also aids in long-term carbon sequestration.

Meanwhile, Argo Living Soils Corp., a Canadian firm, has invested C$100,000 in a strategic partnership with Connective Global to advance biochar research in Southeast Asia. The collaboration focuses on applying biochar in arid regions to improve soil quality, highlighting the global potential of this technology in diverse climatic conditions.

Key Takeaways

- Biochar Fertilizer Market size is expected to be worth around USD 6.2 Bn by 2033, from USD 2.2 Bn in 2023, growing at a CAGR of 11.9%.

- Organic biochar fertilizers held a dominant market position, capturing more than a 48.3% share.

- Slow Pyrolysis held a dominant market position in the biochar fertilizer sector, capturing more than a 38.7% share.

- Cereals & Grains held a dominant market position in the biochar fertilizer sector, capturing more than a 47.6% share.

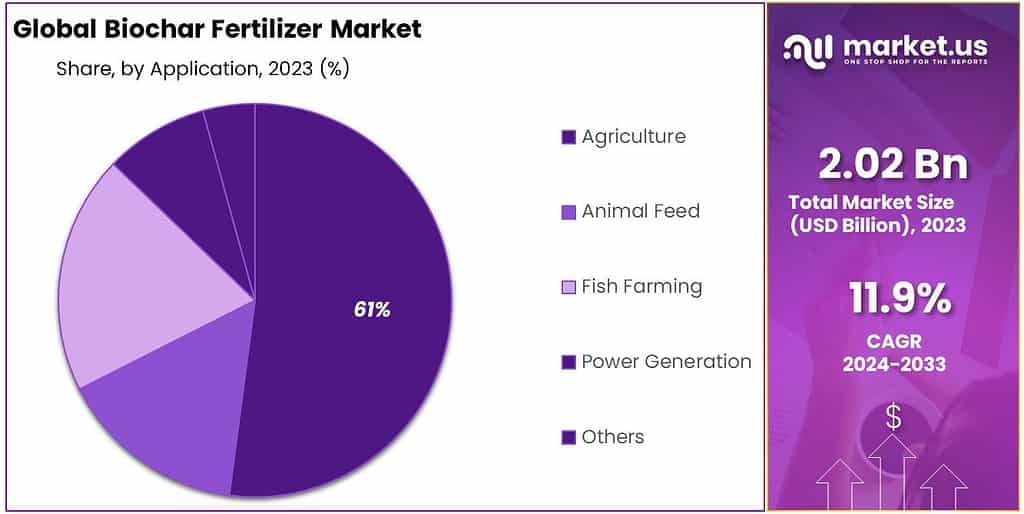

- Agriculture held a dominant market position in the biochar fertilizer sector, capturing more than a 61.2% share.

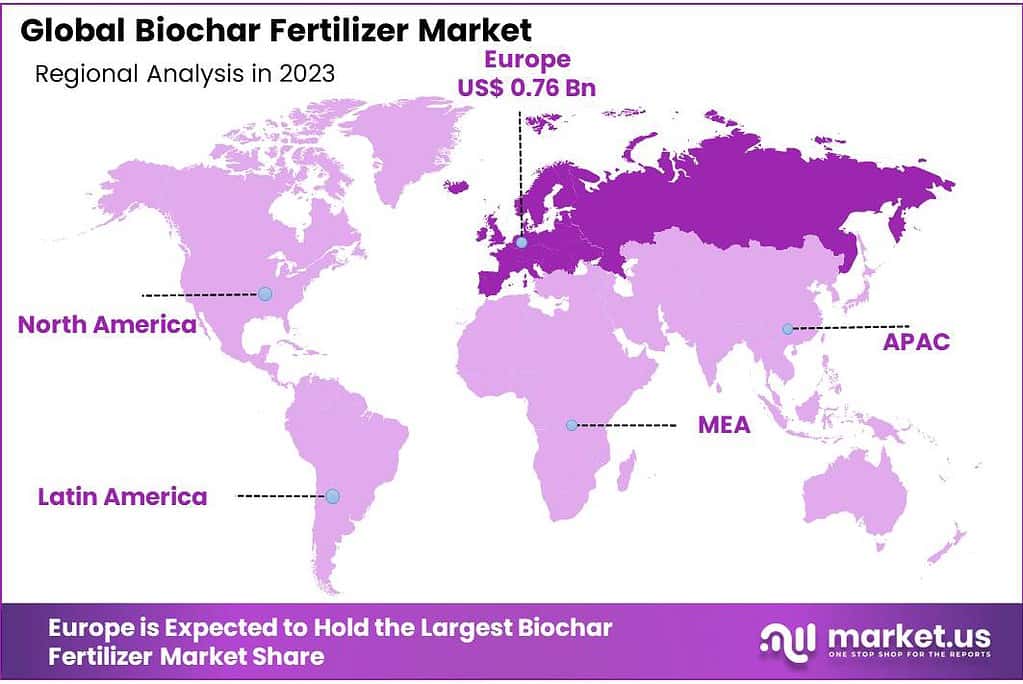

- Europe stands out as the dominant region, commanding a 37.8% market share with revenues reaching USD 0.76 billion.

By Nature

In 2023, Organic biochar fertilizers held a dominant market position, capturing more than a 48.3% share. This segment benefits significantly from the growing consumer demand for sustainable and environmentally friendly farming practices. Organic biochar is prized for its ability to improve soil fertility naturally, enhance plant growth, and reduce the reliance on synthetic chemical fertilizers.

The conventional biochar fertilizer segment also plays a crucial role in the market, catering to traditional agricultural practices that require cost-effective soil amendments. These fertilizers are valued for their ability to improve soil pH balance, moisture retention, and nutrient efficiency, making them a favored choice in both commercial and small-scale agriculture.

Specialty biochar fertilizers, tailored for specific crop types or soil conditions, are emerging as a key segment. These products are designed to address unique agricultural needs, such as enhancing yield for nutrient-intensive crops or revitalizing depleted soils, thereby attracting attention from specialized farming operations that focus on maximizing crop output and sustainability.

By Technology

In 2023, Slow Pyrolysis held a dominant market position in the biochar fertilizer sector, capturing more than a 38.7% share. This technology is favored for its ability to produce high-quality biochar, which enhances soil fertility and carbon sequestration. Slow pyrolysis operates at lower temperatures, which allows for better control over the char properties, making the end product highly beneficial for agricultural uses.

Fast Pyrolysis also plays a significant role in the market, noted for its efficiency in converting biomass into biochar in a shorter time frame. This method appeals to producers looking for quicker turnaround times and is effective in retaining a substantial amount of the original energy from the biomass in the char.

Gasification is another key technology used in the production of biochar fertilizer. It converts biomass into biochar at high temperatures with a controlled amount of oxygen, which is ideal for producing a porous char with a high surface area, enhancing its ability to absorb nutrients and water when applied to soil.

Hydrothermal Carbonization (HTC) offers a unique approach by processing biomass in water at elevated temperatures, creating a type of biochar that is rich in nutrients and particularly suited for wetter soils.

By Crop Type

In 2023, Cereals & Grains held a dominant market position in the biochar fertilizer sector, capturing more than a 47.6% share. This segment benefits from the widespread application of biochar fertilizers to enhance yield and soil fertility for staple crops such as wheat, rice, and corn. The ability of biochar to improve water retention and nutrient availability in soil makes it particularly valuable for these crop types, which are fundamental to global food security.

Fruits & Vegetables also make significant use of biochar fertilizers, leveraging their capacity to improve the quality and health of the soil, which in turn supports the growth of nutrient-rich produce. This segment values biochar for its ability to increase plant resilience against diseases and pests while boosting the overall yield.

Oilseeds & Pulses represent another important segment, utilizing biochar to improve nitrogen retention in the soil, which is crucial for the growth of leguminous crops. The application of biochar in these fields helps to reduce fertilizer leaching, thus enhancing soil productivity and sustainability.

By Application

In 2023, Agriculture held a dominant market position in the biochar fertilizer sector, capturing more than a 61.2% share. This segment benefits extensively from biochar’s ability to enhance soil fertility and increase crop productivity. Farmers value biochar for its effectiveness in improving soil structure, enhancing water retention, and increasing nutrient uptake by plants. These attributes make biochar an integral part of sustainable agricultural practices aimed at boosting yields while reducing chemical inputs.

Animal Feed is another significant application for biochar, where it is used as a feed additive to improve the health and productivity of livestock. In this segment, biochar helps in reducing toxins in the feed, aiding digestion, and enhancing nutrient absorption, which contributes to healthier animals and potentially higher meat and dairy production.

Fish Farming utilizes biochar to improve water quality and reduce pollutants in aquaculture systems. Biochar’s properties help absorb toxins and reduce nitrogen levels in water, providing a healthier environment for aquatic life and improving the sustainability of fish farms.

Power Generation also sees the application of biochar, primarily through its role in biomass energy production. Biochar can be used as a renewable fuel source, contributing to energy generation while capturing carbon, thus aiding in carbon sequestration efforts.

Key Market Segments

By Nature

- Organic

- Inorganic

- Compound

By Technology

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

By Application

- Animal Feed

- Agriculture

- Fish Farming

- Power Generation

- Others

Driving Factors

Increasing Demand for Organic Food Production

The surge in demand for organic food products is significantly influencing the growth of the biochar fertilizer market. Biochar’s ability to enhance soil fertility naturally without the need for chemical fertilizers aligns well with the organic farming sector’s goals. This is particularly evident in regions like North America and Europe, where there is a strong movement towards sustainable agricultural practices

Environmental Regulations and Carbon Sequestration

Governments globally are implementing stricter environmental regulations that encourage practices reducing carbon footprints. Biochar’s capacity for high carbon sequestration makes it an attractive option for achieving these regulatory goals. It helps in lowering greenhouse gas emissions from agricultural activities, which is a significant driver for its adoption in regions actively fighting climate change

Soil Fertility and Productivity Enhancement

Biochar is recognized for its remarkable ability to improve soil health by increasing nutrient retention and water-holding capacity. This makes it invaluable for enhancing crop yields, particularly in areas suffering from soil degradation and nutrient depletion. The Asia Pacific region, which includes leading producers like China, has been particularly quick to adopt biochar for these purposes, leveraging local agricultural waste to produce biochar and combat soil health issues

Restraining Factors

High Production Costs

The production of biochar through pyrolysis or gasification technologies is energy-intensive and requires substantial upfront investments in equipment and technology. These costs can be prohibitively high, particularly for operations in developing countries where access to such technologies and capital is limited.

Supply Chain and Logistics Challenges

Efficiently distributing biochar, especially in regions lacking in infrastructure, poses significant logistical challenges. This can increase the cost and reduce the availability of biochar to end-users, particularly smallholder farmers who might benefit most from its application

Regulatory and Standardization Issues

The biochar industry faces a lack of standardized regulations which affects the consistency of product quality across different producers. This variability can undermine consumer trust and acceptance, especially in regions with stringent environmental regulations

Growth Opportunity

Expansion in Sustainable Agriculture

The increasing global emphasis on sustainable agricultural practices presents a significant growth opportunity for the biochar fertilizer market. Biochar’s ability to improve soil health, enhance water retention, and reduce reliance on chemical fertilizers aligns well with the move towards organic farming. This trend is particularly strong in regions like Asia-Pacific, where the market size is expected to continue expanding significantly due to the large agricultural base and escalating environmental concerns

Regulatory Support and Environmental Benefits

Governments worldwide are implementing stricter environmental regulations which promote practices that reduce carbon footprints and improve soil management. Biochar’s carbon sequestration capabilities make it a favored option for meeting these regulatory standards. The material’s benefits in reducing pollution and enhancing soil fertility make it appealing in both developed and emerging markets, further spurred by governmental incentives

Technological Advancements in Production

Innovations in biochar production technologies are lowering costs and improving accessibility. The development of more efficient production methods that can handle a variety of biomass types broadens the potential applications of biochar. These advancements are crucial for scaling the market to meet the growing demand across diverse agricultural and environmental applications

Latest Trends

Increased Use in Organic Farming

The demand for organic food continues to rise sharply, fueling the need for sustainable soil amendments like biochar. Biochar’s capacity to enhance soil fertility and its environmentally friendly profile make it increasingly popular among organic farmers. This trend is supported by growing consumer health consciousness and a shift towards natural agricultural products

Technological Innovations in Biochar Production

There has been significant technological advancement in biochar production, particularly through methods like pyrolysis and gasification, which dominate the sector. Innovations aim to increase the yield and quality of biochar, making these technologies more effective and economically viable for large-scale use. Such advancements ensure higher carbon content and stability in the produced biochar, essential for agricultural effectiveness

Regulatory Support and Carbon Sequestration

Governments are increasingly supporting the use of biochar through environmental regulations that encourage its role in carbon sequestration and soil health improvement. This regulatory environment is promoting wider adoption of biochar, particularly in efforts to combat soil degradation and enhance carbon capture capabilities within agricultural practices

Regional Analysis

Europe stands out as the dominant region, commanding a 37.8% market share with revenues reaching USD 0.76 billion. Europe’s market leadership is driven by stringent environmental regulations, robust government support for sustainable agricultural practices, and high consumer preference for organic products. The region’s advanced agricultural technologies and substantial investments in biochar research further consolidate its market position.

North America follows closely, characterized by a well-established biochar production infrastructure and increasing adoption among large-scale and organic farmers. The market in this region benefits from governmental incentives promoting sustainable farming and carbon sequestration efforts, aiming to mitigate climate change impacts through innovative agricultural inputs.

Asia Pacific is marked by rapid growth, spurred by the expanding agricultural sector in countries like China and India. The region’s market expansion is supported by rising awareness about the benefits of biochar in soil enhancement and crop yield improvement, coupled with growing environmental concerns that drive the demand for sustainable agricultural inputs.

Middle East & Africa and Latin America are emerging markets, with growing recognition of biochar’s benefits in improving soil fertility and water retention in arid and semi-arid climates. These regions are increasingly exploring biochar as a key tool for enhancing agricultural productivity and sustainability amidst challenging environmental conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The biochar fertilizer market is shaped by a variety of key players, each contributing unique technologies and products that enhance soil fertility and contribute to sustainable agriculture. Among these, 3R Enviro Tech Group, American Biochar Company, and Biochar Supreme stand out for their innovative approaches to biochar production and application. These companies focus on creating high-quality biochar that improves water retention and nutrient availability in soils, which is crucial for enhancing crop yields and reducing the reliance on chemical fertilizers.

Carbonis GmbH & Co. KG and Pacific Pyrolysis Pty Ltd. are noted for their advanced pyrolysis technologies that convert organic materials into biochar, aiming to optimize energy use and minimize waste. Similarly, Terra Humana Ltd and Green Charcoal International emphasize eco-friendly production methods and have established significant market presence in Europe and Asia, respectively, catering to both small-scale farmers and large agricultural operations.

In North America, companies like Biochar Products Inc. and CharGrow focus on localized production and supply chains to serve the burgeoning organic farming sector. Cool Planet and Diacarbon Energy Inc. have expanded their reach by developing proprietary technologies that not only produce biochar but also integrate it into broader carbon sequestration and energy production systems. Together, these companies are spearheading efforts to meet the growing global demand for sustainable agricultural inputs and are at the forefront of the biochar fertilizer industry’s expansion.

Top Key Players in the Market

- 3R Enviro Tech Group

- Agri-Tech Producers LLC

- American Biochar Company

- Biochar Products Inc.

- Biochar Supreme

- BSEI

- Carbonis GmbH & Co. KG

- CharGrow

- Cool Planet

- Diacarbon Energy Inc.

- ECOSUS

- Farm2Energy

- Full Circle Biochar

- Green Charcoal International

- Green Man Char

- Oregon Biochar Solutions

- Pacific Pyrolysis Pty Ltd.

- Terra Humana Ltd

- TerraChar

- Tolero Energy LLC

- Vega Biofuels Inc.

Recent Developments

In 2023, ATP’s biochar production capacity reached up to 500 tons per year, reflecting their commitment to advancing biochar technology and its applications in agriculture.

In 2023 3R technology converts agricultural and forestry residues into high-quality biochar, enhancing soil fertility and promoting sustainable agriculture

Report Scope

Report Features Description Market Value (2023) USD 2.0 Bn Forecast Revenue (2033) USD 6.2 Bn CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature(Organic, Inorganic, Compound), By Technology(Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others), By Crop Type(Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Application(Animal Feed, Agriculture, Fish Farming, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3R Enviro Tech Group, Agri-Tech Producers LLC, American Biochar Company, Biochar Products Inc., Biochar Supreme, BSEI, Carbonis GmbH & Co. KG, CharGrow, Cool Planet, Diacarbon Energy Inc., ECOSUS, Farm2Energy, Full Circle Biochar, Green Charcoal International, Green Man Char, Oregon Biochar Solutions, Pacific Pyrolysis Pty Ltd., Terra Humana Ltd, TerraChar, Tolero Energy LLC, Vega Biofuels Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3R Enviro Tech Group

- Agri-Tech Producers LLC

- American Biochar Company

- Biochar Products Inc.

- Biochar Supreme

- BSEI

- Carbonis GmbH & Co. KG

- CharGrow

- Cool Planet

- Diacarbon Energy Inc.

- ECOSUS

- Farm2Energy

- Full Circle Biochar

- Green Charcoal International

- Green Man Char

- Oregon Biochar Solutions

- Pacific Pyrolysis Pty Ltd.

- Terra Humana Ltd

- TerraChar

- Tolero Energy LLC

- Vega Biofuels Inc.