Global Bicycle Tire Market Size, Share, Growth Analysis By Product Type (Tubeless Tire, Tube Tire, Solid Tire), By Bicycle Type (Mountain, Hybrid, Electric, Comfort, Youth, Cruiser, Road), By Tire Size (12–22 inches, Up to 12 inches, Above 22 inches), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161619

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Bicycle Type Analysis

- By Tire Size Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Bicycle Tire Company Insights

- By Product Type Analysis

- By Bicycle Type Analysis

- By Tire Size Analysis

- By Sales Channel Analysis

- Recent Developments

- Report Scope

Report Overview

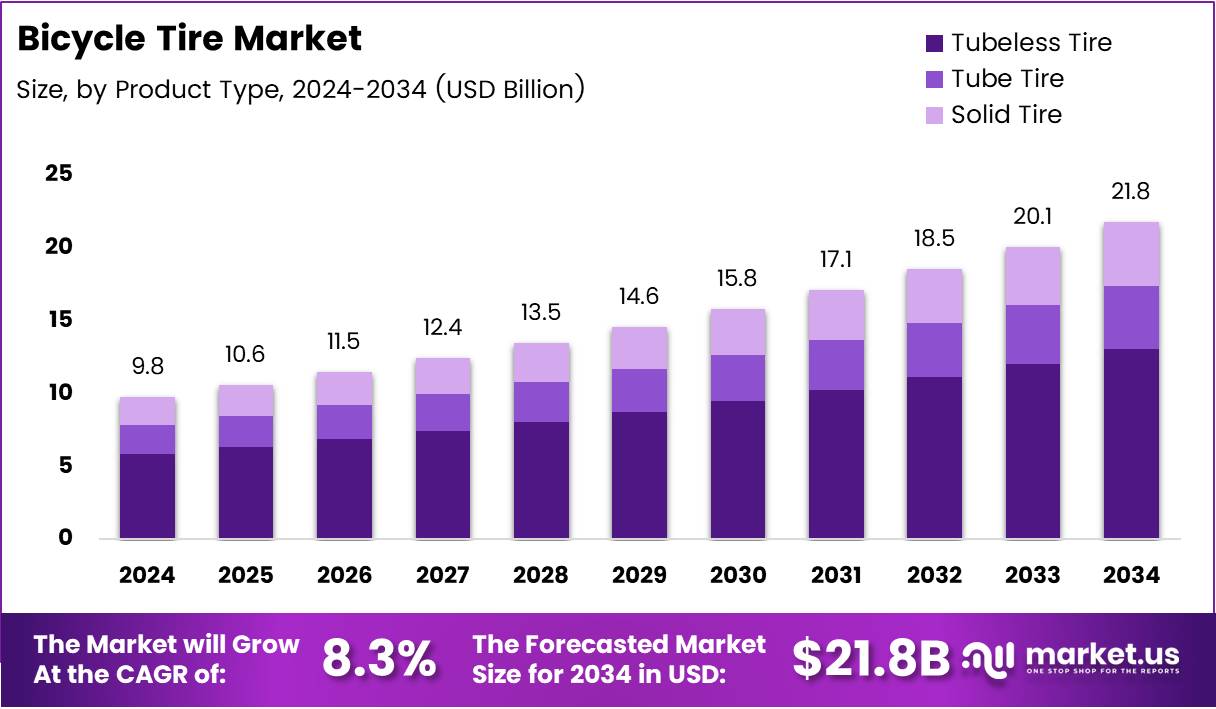

The Global Bicycle Tire Market size is expected to be worth around USD 21.8 Billion by 2034, from USD 9.8 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The Bicycle Tire Market represents a crucial segment within the global cycling industry, driven by rising health consciousness, eco-friendly mobility, and urban commuting trends. These tires ensure durability, traction, and performance across road, mountain, and hybrid bicycles. Increasing participation in recreational and competitive cycling continues to enhance product innovation and global demand.

Moreover, manufacturers are integrating lightweight materials, puncture-resistant technology, and sustainable compounds to meet evolving consumer expectations. Electric bicycles (e-bikes) have further boosted tire demand, as they require enhanced load-bearing and performance capabilities. This trend is reshaping the supply chain, pushing producers toward specialized tire models for different terrains and user needs.

Additionally, government initiatives promoting cycling infrastructure play a vital role. Countries across Europe and North America are investing heavily in bike lanes and shared mobility programs. These developments not only encourage daily commuting by bicycles but also support steady tire replacement cycles, creating consistent aftermarket opportunities for manufacturers and suppliers.

Furthermore, emerging economies in Asia-Pacific are witnessing rapid urbanization, encouraging low-cost, eco-friendly transport options like bicycles. Increased government investment in public cycling infrastructure—especially in China and Japan—is amplifying market potential. Rising consumer preference for performance-oriented tires in adventure and sports categories also strengthens global growth prospects.

According to the International Energy Agency (IEA), cycling usage surged by 40% in major European cities post-pandemic, driving aftermarket tire sales significantly. Similarly, the European Cyclists’ Federation reported USD 25 billion annual investment in bicycle infrastructure between 2020 and 2024. In addition, global bicycle production reached 150 million units in 2023, according to the World Bicycle Industry Association (WBIA), indicating robust demand for high-quality tires.

Key Takeaways

- The Global Bicycle Tire Market is projected to reach USD 21.8 Billion by 2034, growing from USD 9.8 Billion in 2024 at a CAGR of 8.3% (2025–2034).

- Tubeless Tires dominated the By Product Type segment in 2024 with a 47.8% market share, driven by better traction, comfort, and low maintenance.

- Mountain Bicycles led the By Bicycle Type segment in 2024 with a 31.2% share, fueled by demand for durable tires for off-road and outdoor cycling.

- 12–22 Inches Tires held a 67.1% share in the By Tire Size segment in 2024, owing to their versatility and adaptability across bicycle types.

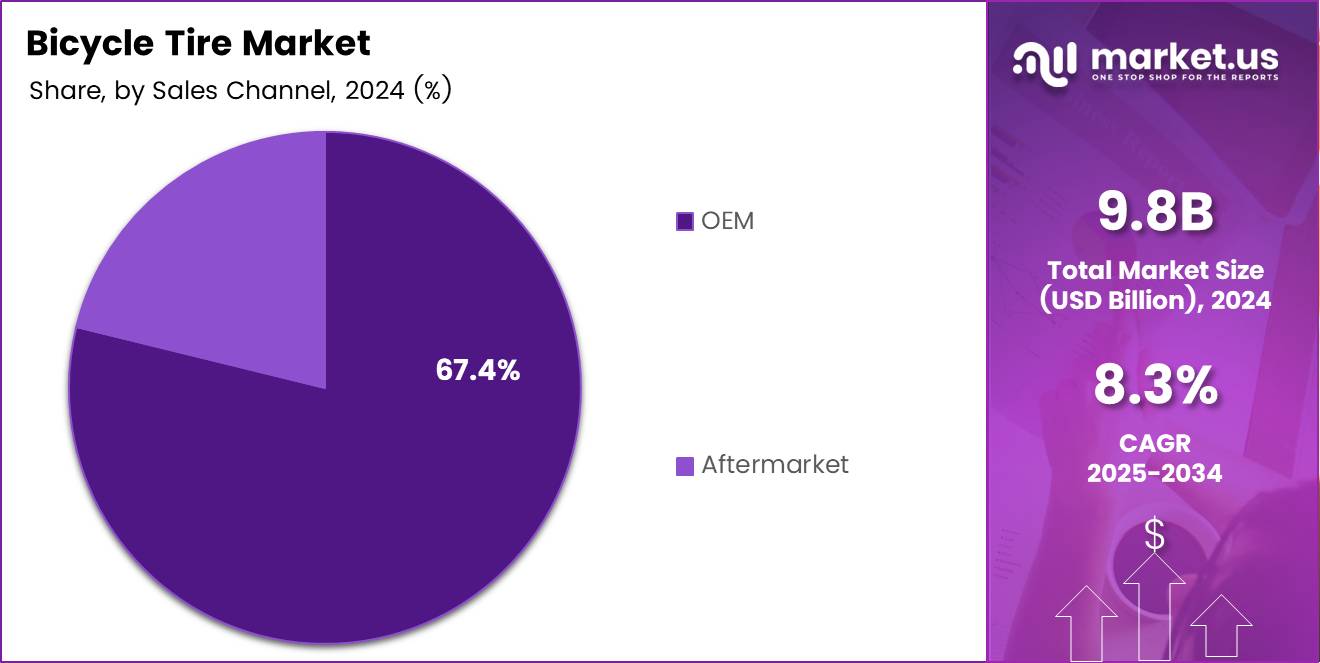

- OEM Sales Channel captured a 67.4% market share in 2024, supported by direct supply to bicycle manufacturers and emphasis on quality assurance.

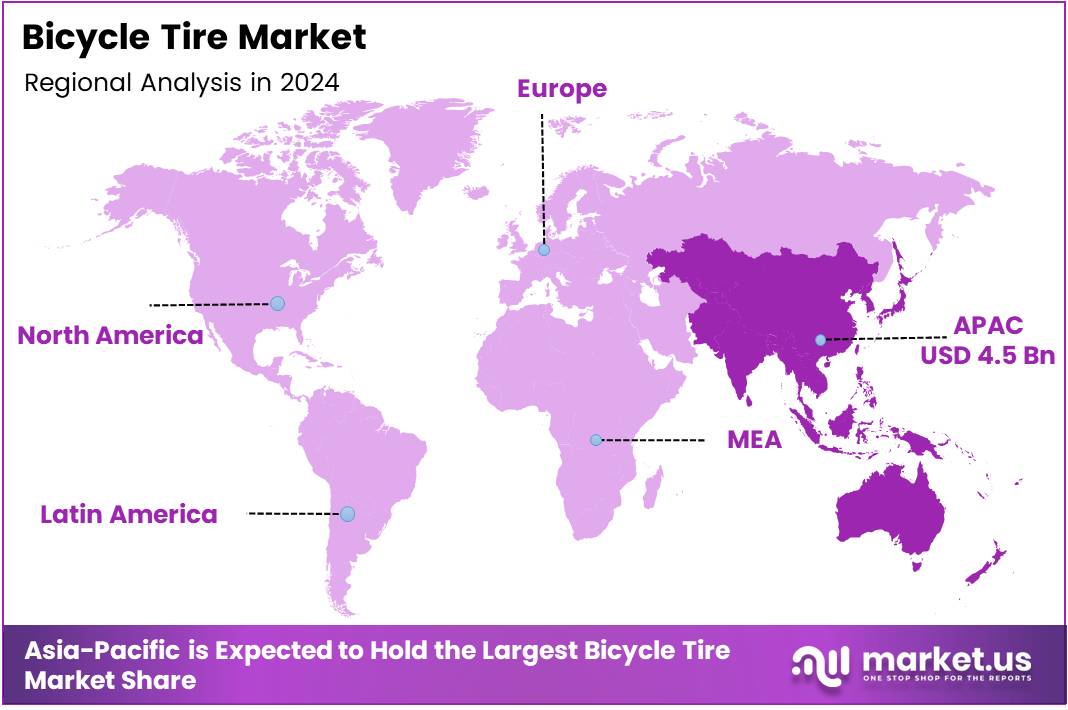

- Asia-Pacific dominated the regional market with a 46.8% share worth USD 4.5 Billion in 2024, driven by cycling adoption, strong manufacturing, and infrastructure growth.

By Product Type Analysis

Tubeless Tire dominates with 47.8% due to its superior performance and reduced puncture risk.

In 2024, Tubeless Tire held a dominant market position in the By Product Type segment of the Bicycle Tire Market, with a 47.8% share. This dominance is driven by their ability to operate at lower air pressure, offering better traction and comfort. Additionally, the growing preference among professional and recreational cyclists for enhanced durability and reduced maintenance further strengthens their demand.

Tube Tire continues to hold a considerable share in the market owing to its affordability and easy replacement features. These tires are widely used in entry-level and traditional bicycles, particularly in developing regions. Their availability across various bicycle models and compatibility with existing rims help sustain their market presence despite competition from advanced tire technologies.

Solid Tire is gaining attention for its puncture-proof design and low maintenance. It is increasingly used in rental and shared bicycles where durability and minimal upkeep are crucial. However, limited comfort and higher rolling resistance compared to pneumatic tires have slightly restricted their widespread adoption, though ongoing material innovations could enhance their performance in the coming years.

By Bicycle Type Analysis

Mountain Bicycle dominates with 31.2% due to its rising popularity among adventure enthusiasts.

In 2024, Mountain bicycles held a dominant market position in the By Bicycle Type segment of the Bicycle Tire Market, with a 31.2% share. These bicycles are preferred for their sturdy tires designed to handle rough terrains, gravel, and slopes. The growing participation in off-road cycling events and outdoor activities continues to propel their demand globally.

Hybrid bicycles have gained momentum due to their versatility for both urban commuting and light trails. Their balanced tire design offers efficient road grip and comfort, appealing to fitness-conscious consumers and daily riders seeking adaptability. Increasing adoption in cities for short-distance travel also enhances their sales outlook.

Electric bicycles are witnessing significant growth owing to the rising focus on eco-friendly commuting. Their specialized tires are built to handle higher torque and weight loads, ensuring better safety and durability. Technological advancements and government incentives for electric mobility continue to drive tire replacement and sales in this category.

Comfort bicycles appeal to leisure riders with wider, cushioned tires that prioritize smooth rides. Their popularity in urban parks and recreational areas supports steady demand. The emphasis on ergonomic design and comfort for elderly and casual riders fuels continuous interest in this segment.

Youth bicycles maintain consistent demand due to increasing cycling activities among children and teenagers. Their lightweight and smaller tire sizes ensure stability and safety. Growing parental emphasis on outdoor sports and physical activity further contributes to steady market growth.

Cruiser bicycles enjoy niche popularity for their stylish design and relaxed riding experience. Their broad tires enhance comfort and provide better balance, making them a preferred choice for coastal and city leisure rides. Lifestyle appeal and aesthetic customization trends sustain their market demand.

Road bicycles cater to performance-driven riders and professional cyclists. Featuring thinner, high-pressure tires, they deliver speed and efficiency on paved roads. Their use in racing events and competitive cycling supports stable demand despite limited appeal among casual riders.

By Tire Size Analysis

12–22 Inches dominates with 67.1% due to its wide applicability across multiple bicycle categories.

In 2024, 12–22 inches tires held a dominant market position in the By Tire Size segment of the Bicycle Tire Market, with a 67.1% share. These tires are widely used in mountain, hybrid, and youth bicycles due to their versatility and balance between comfort and control. Their adaptability across terrain types continues to boost global demand.

Up to 12 Inches tires serve the niche market for children’s and foldable bicycles. Their compact design provides stability and maneuverability, making them ideal for beginner cyclists. Although smaller in scale, the segment benefits from rising demand for compact mobility solutions and kids’ cycling equipment.

Above 22 Inches tires cater to performance and specialized bicycles. They offer enhanced stability and traction for high-speed cycling and off-road use. Despite representing a smaller market share, this segment attracts enthusiasts and professionals who prioritize advanced performance and endurance cycling experiences.

By Sales Channel Analysis

OEM dominates with 67.4% due to manufacturers’ direct integration and steady new bicycle production.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Bicycle Tire Market, with a 67.4% share. Original Equipment Manufacturers supply tires directly to bicycle producers, ensuring compatibility and quality control. The rise in global bicycle production and the preference for branded, reliable tires bolster OEM sales channels.

Aftermarket remains vital as consumers replace worn-out tires and upgrade to premium options. It benefits from growing cycling participation and maintenance awareness. The availability of diverse tire options online and offline encourages frequent purchases, supporting steady growth in this segment across both urban and recreational markets.

Key Market Segments

By Product Type

- Tubeless Tire

- Tube Tire

- Solid Tire

By Bicycle Type

- Mountain

- Hybrid

- Electric

- Comfort

- Youth

- Cruiser

- Road

By Tire Size

- 12–22 inches

- Up to 12 inches

- Above 22 inches

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Adoption of Bicycles for Sustainable Urban Mobility Solutions

The growing shift toward eco-friendly transportation has made bicycles a preferred choice in urban areas. As cities aim to reduce carbon emissions and traffic congestion, more people are adopting bicycles for daily commuting. This rise in bicycle usage directly fuels the demand for durable and high-performance tires suitable for different road conditions.

Adventure and mountain biking are also gaining massive popularity among fitness enthusiasts and young riders. These activities require tires that provide excellent grip, puncture resistance, and stability on uneven terrain. As a result, tire manufacturers are introducing specialized designs and advanced rubber compounds to meet this growing demand.

Government initiatives worldwide are also playing a crucial role in boosting bicycle usage. Many countries are investing in cycling infrastructure, such as dedicated lanes and public bike-sharing programs. These developments are encouraging more people to use bicycles, further expanding the tire market.

Additionally, the rapid expansion of the e-bike segment is creating new opportunities. E-bikes need stronger and more specialized tires to handle higher speeds and loads. This has pushed manufacturers to innovate with reinforced sidewalls and advanced tread patterns, driving the overall growth of the bicycle tire market.

Restraints

Fluctuations in Raw Material Prices Impacting Production Costs

One of the major challenges in the bicycle tire market is the fluctuating prices of raw materials such as rubber, nylon, and carbon black. These variations increase production costs, making it difficult for manufacturers to maintain stable pricing. Smaller producers, in particular, face pressure in balancing profit margins with affordability.

In developing regions, the limited availability of high-performance bicycle tires also acts as a barrier. Many riders in these areas rely on low-cost or imported tires, which may not meet the standards required for performance or safety. This lack of access restricts market expansion and affects overall demand.

The rise of alternative personal transportation modes, such as electric scooters and shared mobility services, is another restraint. These options offer convenience and speed, diverting potential consumers away from traditional bicycles.

Furthermore, the shorter lifespan of bicycle tires in harsh climates or rough terrains adds to maintenance costs for users. Frequent replacements due to wear and tear discourage long-term bicycle use, especially in regions with extreme weather conditions, limiting the overall market growth potential.

Growth Factors

Advancements in Smart Tire Technologies with Embedded Sensors

Technological innovation is creating strong growth opportunities in the bicycle tire market. Smart tire technologies with embedded sensors are becoming increasingly popular. These sensors monitor pressure, temperature, and performance in real-time, helping riders improve safety and efficiency. This innovation is likely to attract tech-savvy cyclists and professional athletes.

Online retail expansion is another key opportunity. As e-commerce continues to grow, customers can easily compare prices and access a wide range of tire options. This shift to digital platforms is helping brands reach new customer segments and improve aftermarket sales.

Riders are also showing more interest in customized and tubeless tire options. These tires offer better comfort, reduced risk of punctures, and improved performance, appealing to both casual and competitive cyclists. Manufacturers focusing on personalization and advanced tire types are expected to gain a strong market advantage.

The premium and performance bicycle segments are also expanding rapidly. With increasing disposable income and a growing interest in fitness, many consumers are willing to pay more for high-quality tires that enhance riding experience, opening new avenues for manufacturers.

Emerging Trends

Integration of Recycled and Eco-Friendly Materials in Tire Manufacturing

Sustainability is becoming a major trend in the bicycle tire industry. Manufacturers are increasingly using recycled rubber, bio-based polymers, and eco-friendly materials to reduce their environmental impact. These initiatives not only align with global sustainability goals but also attract environmentally conscious consumers.

Collaboration between tire manufacturers and bicycle original equipment manufacturers (OEMs) is also on the rise. Such partnerships are helping to create tires that perfectly match new bike designs, improving performance and aesthetics. These alliances drive innovation and strengthen brand positioning in the market.

The use of 3D printing technology is revolutionizing tire prototyping and design. It enables faster development cycles, cost efficiency, and creative flexibility. Manufacturers can quickly test new tread patterns or materials, leading to more advanced and durable tire models.

Another emerging trend is the development of airless and puncture-resistant tires. These innovative solutions offer riders maintenance-free performance and enhanced durability, addressing long-standing issues like flats and pressure loss. As adoption increases, these products could reshape the future of bicycle tire manufacturing.

Regional Analysis

Asia-Pacific Dominates the Bicycle Tire Market with a Market Share of 46.8%, Valued at USD 4.5 Billion

Asia-Pacific leads the global bicycle tire market owing to rising cycling adoption across China, Japan, and Southeast Asia. Urban mobility initiatives and government-backed cycling infrastructure are boosting demand for high-performance and durable tires. The region benefits from strong manufacturing bases, affordable raw materials, and increasing exports of premium bicycle components, reinforcing its 46.8% share worth USD 4.5 Billion.

North America Bicycle Tire Market Trends

North America exhibits strong growth due to growing health consciousness and recreational cycling culture. The U.S. and Canada are witnessing rising demand for electric and hybrid bicycles, fueling premium tire innovation. Government programs promoting eco-friendly transportation and urban cycling networks further strengthen regional adoption across major cities.

Europe Bicycle Tire Market Trends

Europe remains a mature and innovation-driven market supported by sustainability-focused policies and advanced cycling infrastructure. Countries such as Germany, the Netherlands, and France lead in green commuting, propelling tire replacement cycles and advanced rubber technologies. The region’s focus on carbon neutrality and electric bike adoption continues to stimulate long-term market expansion.

Middle East and Africa Bicycle Tire Market Trends

The Middle East and Africa are gradually embracing cycling, primarily for recreational and fitness purposes. Infrastructure investments in urban cycling tracks and rising youth interest are creating market potential. While still developing, government wellness initiatives and growing tourism sectors are expected to enhance bicycle tire demand in coming years.

Latin America Bicycle Tire Market Trends

Latin America shows steady progress with expanding cycling culture in nations like Brazil, Chile, and Mexico. The increasing use of bicycles for short-distance commuting and fitness drives steady tire replacement demand. Economic recovery, coupled with municipal cycling initiatives, positions the region as an emerging opportunity for tire manufacturers and distributors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bicycle Tire Company Insights

By Product Type Analysis

Tubeless Tire dominates with 47.8% due to its superior performance and reduced puncture risk.

In 2024, Tubeless Tire held a dominant market position in the By Product Type segment of the Bicycle Tire Market, with a 47.8% share. This dominance is driven by their ability to operate at lower air pressure, offering better traction and comfort. Additionally, the growing preference among professional and recreational cyclists for enhanced durability and reduced maintenance further strengthens their demand.

Tube Tire continues to hold a considerable share in the market owing to its affordability and easy replacement features. These tires are widely used in entry-level and traditional bicycles, particularly in developing regions. Their availability across various bicycle models and compatibility with existing rims help sustain their market presence despite competition from advanced tire technologies.

Solid Tire is gaining attention for its puncture-proof design and low maintenance. It is increasingly used in rental and shared bicycles where durability and minimal upkeep are crucial. However, limited comfort and higher rolling resistance compared to pneumatic tires have slightly restricted their widespread adoption, though ongoing material innovations could enhance their performance in the coming years.

By Bicycle Type Analysis

Mountain Bicycle dominates with 31.2% due to its rising popularity among adventure enthusiasts.

In 2024, Mountain bicycles held a dominant market position in the By Bicycle Type segment of the Bicycle Tire Market, with a 31.2% share. These bicycles are preferred for their sturdy tires designed to handle rough terrains, gravel, and slopes. The growing participation in off-road cycling events and outdoor activities continues to propel their demand globally.

Hybrid bicycles have gained momentum due to their versatility for both urban commuting and light trails. Their balanced tire design offers efficient road grip and comfort, appealing to fitness-conscious consumers and daily riders seeking adaptability. Increasing adoption in cities for short-distance travel also enhances their sales outlook.

Electric bicycles are witnessing significant growth owing to the rising focus on eco-friendly commuting. Their specialized tires are built to handle higher torque and weight loads, ensuring better safety and durability. Technological advancements and government incentives for electric mobility continue to drive tire replacement and sales in this category.

Comfort bicycles appeal to leisure riders with wider, cushioned tires that prioritize smooth rides. Their popularity in urban parks and recreational areas supports steady demand. The emphasis on ergonomic design and comfort for elderly and casual riders fuels continuous interest in this segment.

Youth bicycles maintain consistent demand due to increasing cycling activities among children and teenagers. Their lightweight and smaller tire sizes ensure stability and safety. Growing parental emphasis on outdoor sports and physical activity further contributes to steady market growth.

Cruiser bicycles enjoy niche popularity for their stylish design and relaxed riding experience. Their broad tires enhance comfort and provide better balance, making them a preferred choice for coastal and city leisure rides. Lifestyle appeal and aesthetic customization trends sustain their market demand.

Road bicycles cater to performance-driven riders and professional cyclists. Featuring thinner, high-pressure tires, they deliver speed and efficiency on paved roads. Their use in racing events and competitive cycling supports stable demand despite limited appeal among casual riders.

By Tire Size Analysis

12–22 Inches dominates with 67.1% due to its wide applicability across multiple bicycle categories.

In 2024, 12–22 inches tires held a dominant market position in the By Tire Size segment of the Bicycle Tire Market, with a 67.1% share. These tires are widely used in mountain, hybrid, and youth bicycles due to their versatility and balance between comfort and control. Their adaptability across terrain types continues to boost global demand.

Up to 12 Inches tires serve the niche market for children’s and foldable bicycles. Their compact design provides stability and maneuverability, making them ideal for beginner cyclists. Although smaller in scale, the segment benefits from rising demand for compact mobility solutions and kids’ cycling equipment.

Above 22 Inches tires cater to performance and specialized bicycles. They offer enhanced stability and traction for high-speed cycling and off-road use. Despite representing a smaller market share, this segment attracts enthusiasts and professionals who prioritize advanced performance and endurance cycling experiences.

By Sales Channel Analysis

OEM dominates with 67.4% due to manufacturers’ direct integration and steady new bicycle production.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Bicycle Tire Market, with a 67.4% share. Original Equipment Manufacturers supply tires directly to bicycle producers, ensuring compatibility and quality control. The rise in global bicycle production and the preference for branded, reliable tires bolster OEM sales channels.

Aftermarket remains vital as consumers replace worn-out tires and upgrade to premium options. It benefits from growing cycling participation and maintenance awareness. The availability of diverse tire options online and offline encourages frequent purchases, supporting steady growth in this segment across both urban and recreational markets.

Top Key Players in the Market

- Cheng Shin Rubber Ind Co., Ltd.

- HUTCHINSON

- Trek Bicycle Corporation

- The Goodyear Tires & Rubber Company

- Specialized Bicycle Components

- MICHELIN

- Others

Recent Developments

- In November 2024, Cheng Shin Rubber boosted the capital of its Indian subsidiary Maxxis Rubber India, strengthening its production capacity and expanding its presence in the growing Indian tire market.

- In August 2024, Cheng Shin Rubber reported a surge in net profit in H1 2024, driven by strong global demand, improved operational efficiency, and easing raw material costs.

- In April 2024, Goodyear Bicycle Tires renewed its partnership with the Women’s WorldTour team Human Powered Health for the 2024 season, reinforcing its commitment to professional cycling and brand visibility.

- In June 2024, Michelin introduced the “City Street” tire, designed for urban commuting, featuring enhanced durability, puncture resistance, and comfort for everyday riders.

- In April 2024, Michelin launched new Wild Enduro mountain bike tires, optimized for grip, stability, and control on challenging off-road terrain.

- In March 2025, Michelin unveiled the City Touring tire, engineered for urban and light off-road use, combining efficiency on pavement with reliable traction on mixed surfaces.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Billion Forecast Revenue (2034) USD 21.8 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tubeless Tire, Tube Tire, Solid Tire), By Bicycle Type (Mountain, Hybrid, Electric, Comfort, Youth, Cruiser, Road), By Tire Size (12–22 inches, Up to 12 inches, Above 22 inches), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cheng Shin Rubber Ind Co., Ltd., HUTCHINSON, Trek Bicycle Corporation, The Goodyear Tires & Rubber Company, Specialized Bicycle Components, MICHELIN, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cheng Shin Rubber Ind Co., Ltd.

- HUTCHINSON

- Trek Bicycle Corporation

- The Goodyear Tires & Rubber Company

- Specialized Bicycle Components

- MICHELIN

- Others