Global Betaine Market Size, Share, And Industry Analysis Report By Nature (Natural Betaine, Synthetic Betaine), By Product Type (Cocamidopropyl Betaine, Betaine Anhydrous, Betaine Monohydrate, Betaine Hydrochloride), By Forms (Powder, Liquid), By End-Use (Animal Feed, Food and Beverages, Pharmaceutical, Personal Care, Cosmetics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171860

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

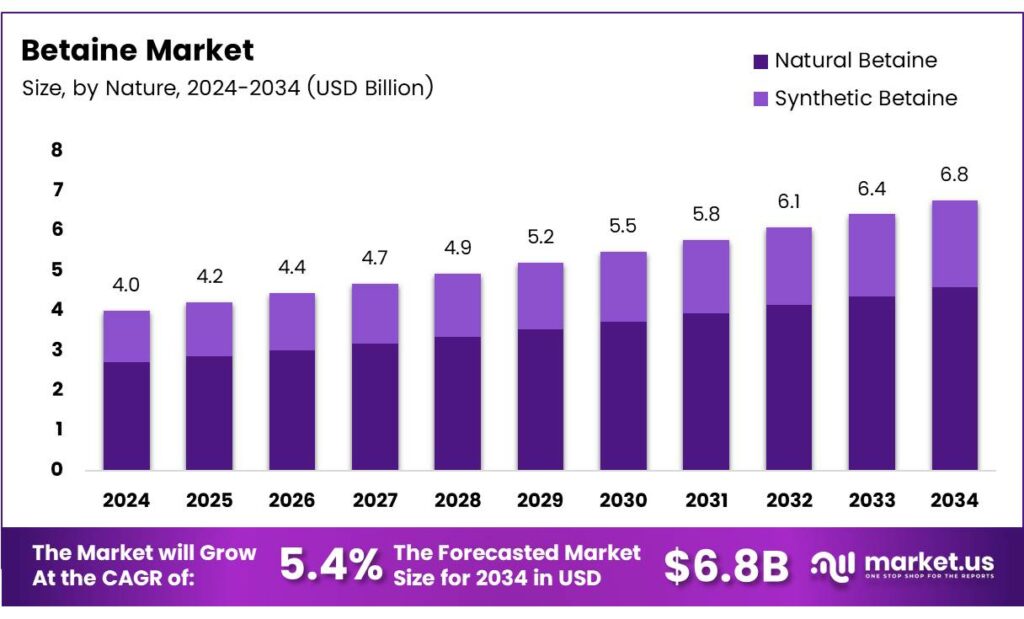

The Global Betaine Market size is expected to be worth around USD 6.8 billion by 2034, from USD 4.0 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Betaine Market covers the global demand for trimethylglycine used across food, feed, cosmetics, pharmaceuticals, and personal care formulations. It includes natural betaine sourced from sugar beet and synthetic grades used for hydration, osmoprotection, and formulation stability. The market expands as industries shift toward clean-label, multifunctional, and high-purity ingredients.

The Betaine industry evolves quickly as manufacturers adopt cleaner, natural, and more functional raw materials. Demand grows steadily because betaine improves texture, moisture retention, and stability in both food and personal-care systems. Moreover, processors search for cost-efficient, multifunctional molecules that enhance performance without increasing formulation complexity. This transition strengthens long-term market penetration.

Natural betaine also retains functional quality with 0.8% moisture, a 117.15 g/mol molar weight, and a flexible usage range of 1–5%. Its strong certification profile, including Ecocert/Cosmos, Natrue, Kosher, and Halal, gives manufacturers a compliant and market-ready ingredient that fits clean-label, regulated, and naturally positioned product lines.

- Manufacturers note clear performance differences across betaine grades, especially due to fluctuating trimethylamine levels in betaine HCl, which range from 0.2–6.0 g/kg across batches. This inconsistency drives producers toward natural betaine, which offers higher stability through 99–99.3% purity, a 241–242°C melting point, and fast solubility at 160 g/100 g in water. These properties help maintain reliable processing and support concentrated formulations.

Growing consumer interest in natural ingredients further accelerates the adoption of betaine sourced from non-GMO sugar beet. Companies benefit because betaine supports hydration, reduces irritation, and improves product mildness. Additionally, regulators encourage safer chemical profiles, pushing brands to reformulate with naturally derived osmolytes. Natural betaine gains preference over synthetic variants.

Key Takeaways

- The Global Betaine Market is projected to reach USD 6.8 billion by 2034, up from USD 4.0 billion in 2024, at a steady 5.4% CAGR from 2025–2034.

- Natural Betaine dominated the By Nature segment with a leading share of 69.9% in 2024.

- Cocamidopropyl Betaine led the By Product Type category with a significant 39.8% share in 2024.

- Powder Form was the dominant format, accounting for 72.4% of the market in 2024.

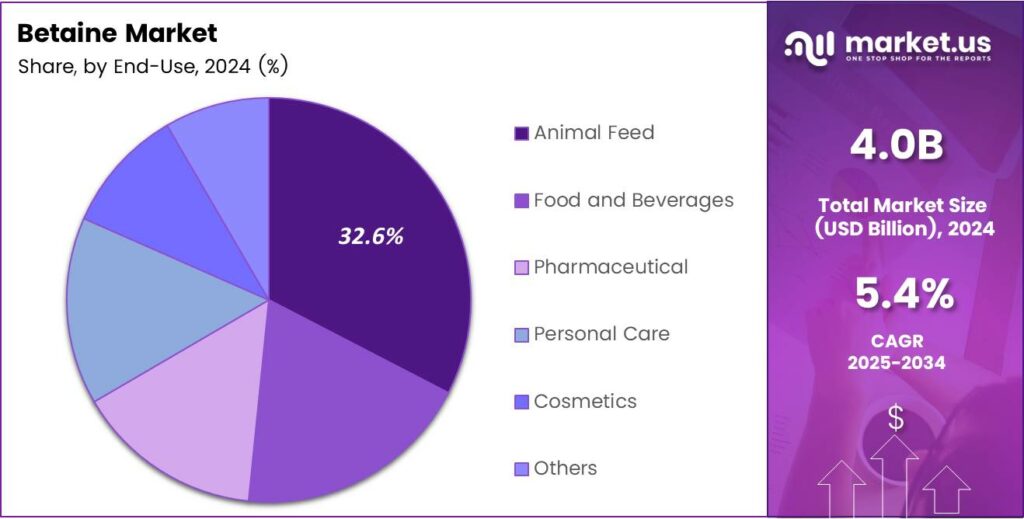

- Animal Feed remained the largest End-Use segment, capturing 32.6% of total demand in 2024.

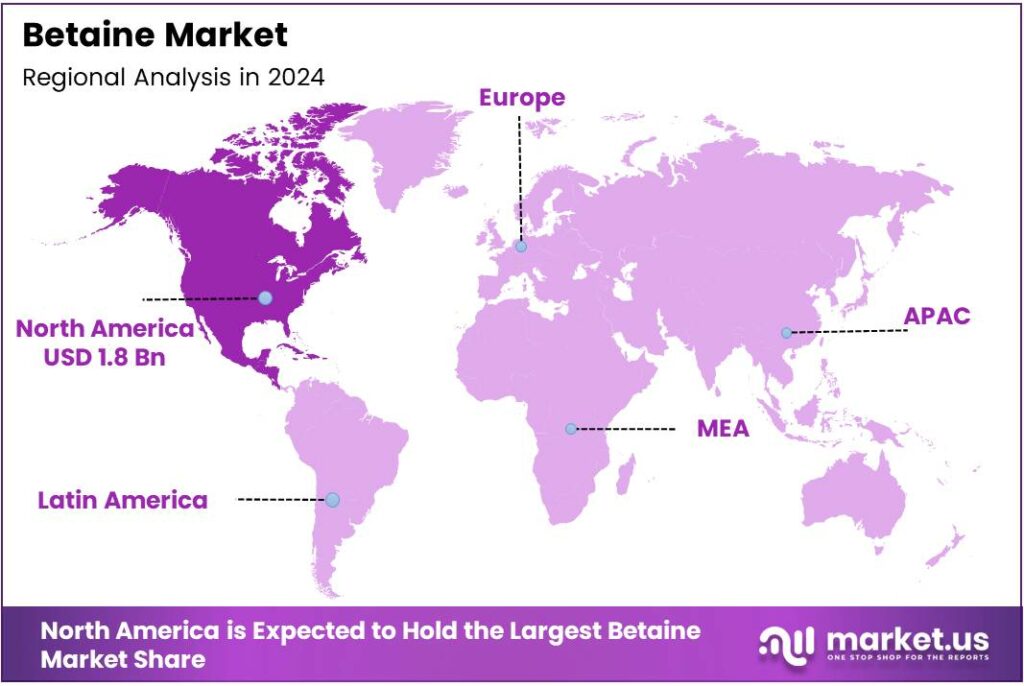

- North America held the highest regional share at 45.2%, generating nearly USD 1.8 billion in 2024.

By Nature Analysis

Natural Betaine dominates with 69.9% due to its clean-label acceptance and broad functional benefits.

In 2024, Natural Betaine held a dominant market position in the By Nature segment of the Betaine Market, with a 69.9% share. Its wide acceptance in food, feed, and personal care industries continues to support its uptake. Moreover, rising demand for gentle and plant-derived ingredients further enhances long-term adoption globally.

Synthetic Betaine held a notable position in the By Nature segment. Although it trails natural sources, its consistent quality and cost advantages keep it relevant. It remains preferred in industrial and large-scale formulations where standardised purity, performance stability, and predictable supply chains matter for manufacturers seeking reliable input materials.

By Product Type Analysis

Cocamidopropyl Betaine dominates with 39.8% due to its wide use in mild cleansing formulations.

In 2024, Cocamidopropyl Betaine held a dominant market position in the By Product Type segment of the Betaine Market, with a 39.8% share. Its strong use in shampoos, soaps, and skincare drives demand. Additionally, its mildness and foam-boosting properties keep it central to personal care formulations worldwide.

Betaine Anhydrous held a key position in the By-Product Type segment. It supports hydration, performance nutrition, and livestock feed applications. Its versatility across multiple industries ensures continued relevance, especially as producers adopt ingredients that improve metabolic efficiency and maintain product stability under different environmental conditions.

Betaine Monohydrate played an important role in the market. It remains favoured in feed and food formulations requiring balanced moisture levels. Its steady handling properties and functional stability help manufacturers maintain consistent formulation performance across diverse product categories and targeted production environments.

By Forms Analysis

Powder Form dominates with 72.4% due to high stability and easy transportation.

In 2024, Powder held a dominant market position in the By Forms segment of the Betaine Market, with a 72.4% share. Its long shelf life, stable performance, and wide use across feed, food, and personal care industries support its strong demand. Its cost-efficient handling further strengthens adoption.

Liquid maintained a solid position in the By Forms segment. It stays relevant for manufacturers who require rapid blending and smooth dispersion. Its suitability for liquid-based formulations in home care and cosmetics ensures continuing interest from producers seeking flexible ingredient formats.

By End-Use Analysis

Animal Feed dominates with 32.6% due to strong adoption in nutrition and performance improvement.

In 2024, Animal Feed held a dominant market position in the By End-Use segment of the Betaine Market, with a 32.6% share. Its role in improving metabolism, growth efficiency, and gut health in livestock supports consistent usage. Rising protein demand continues to elevate its importance in feed formulations.

Food and Beverages secured a significant role in the segment. Betaine’s function as a nutritional enhancer and osmolyte helps manufacturers improve product profiles. Growing consumer interest in wellness-oriented formulations drives their usage across beverages, cereals, and fortified foods globally.

Pharmaceutical applications retained their position within the segment. Betaine’s use in supporting liver health, digestion, and cellular hydration drives its adoption. Producers continue exploring specialised formulations, ensuring steady demand across targeted medicinal and therapeutic categories worldwide.

Personal Care products benefited from expanding betaine usage. Its moisturising, soothing, and mild surfactant characteristics make it essential in shampoos, cleansers, and skincare. The shift toward gentle ingredient profiles boosts its acceptance across mainstream and premium product lines.

Key Market Segments

By Nature

- Natural Betaine

- Synthetic Betaine

By Product Type

- Cocamidopropyl Betaine

- Betaine Anhydrous

- Betaine Monohydrate

- Betaine Hydrochloride

- Others

By Forms

- Powder

- Liquid

By End-Use

- Animal Feed

- Food and Beverages

- Pharmaceutical

- Personal Care

- Cosmetics

- Others

Emerging Trends

Shift Toward Clean-Label and Biobased Ingredients Shapes Market Trends

The betaine market is experiencing strong trends linked to clean-label and biobased formulation preferences. Consumers want transparent ingredients with clear safety benefits, pushing brands to replace synthetic additives with naturally sourced betaine.

- The rise of sugar-beet-based betaine, which offers high purity and stable performance for premium formulations. Betaine fits this need because, at inclusion rates around 500–2,000 mg per kg of feed, it can support better feed conversion and animal resilience. Its sustainability profile aligns with global environmental goals, making it attractive for responsible manufacturing.

Industries across feed, cosmetics, and beverages are moving toward multifunctional ingredients to streamline formulations and reduce complexity. Betaine fits this trend by offering hydration, mildness, stability, and nutritional support in a single ingredient.

Drivers

Growing Demand for Natural and High-Purity Ingredients Drives Market Growth

The betaine market is growing because many industries now prefer natural and high-purity ingredients for cleaner formulations. Companies producing food, beverages, and cosmetics increasingly choose betaine for its mildness and moisture-retention benefits. This shift toward natural products makes betaine a reliable and preferred ingredient.

Manufacturers benefit from betaine’s stability, solubility, and safe usage levels, which help improve large-scale production. As personal care and nutraceuticals expand globally, demand for gentle and multifunctional ingredients continues to rise. This trend directly supports stronger adoption across shampoos, skincare items, and functional foods.

Furthermore, consumers are becoming more aware of ingredient safety, pushing companies to replace harsher chemicals with safer alternatives. Betaine’s compatibility with certifications such as Ecocert/Cosmos, Kosher, and Halal further strengthens its acceptance across global markets.

Restraints

High TMA Variability and Quality Inconsistency Restrains Market Expansion

The biggest restraint in the betaine market comes from inconsistent product quality, especially in synthetic and betaine HCl variants. Many batches show large differences in trimethylamine (TMA) levels, creating uncertainty for manufacturers aiming for consistent performance in formulations.

- These variations make quality control more difficult, raising concerns for food, feed, and cosmetic producers who depend on predictable purity levels. Scientific panels have noted that while crystalline forms of betaine are considered safe, the liquid form contains a significant portion of unknown material 30% on a dry matter basis and therefore has not been fully cleared for safety in all uses.

This factor encourages users to move toward natural betaine, but higher pricing limits its adoption across budget-sensitive sectors. Additionally, small manufacturers often face challenges in meeting global regulatory and certification requirements. Strict approval processes and documentation standards make market entry difficult, slowing the growth of emerging suppliers.

Growth Factors

Rising Use in Functional Foods and Personal Care Offers New Opportunities

Growing interest in wellness, hydration, and functional ingredients is opening new opportunities for betaine. Food and beverage brands are using betaine as a performance enhancer in sports drinks, energy blends, and digestive-support products. This shift unlocks demand in fast-growing health-focused categories.

In personal care, betaine’s ability to reduce skin irritation and improve foam quality makes it valuable for shampoos, face cleansers, and baby-care products. As clean-label beauty expands, brands increasingly adopt betaine to replace sulphates and other harsh surfactants.

Furthermore, animal nutrition companies are exploring betaine’s ability to improve gut health and feed efficiency. As livestock producers focus on sustainable performance, this category is expected to become a major growth driver for the industry.

Regional Analysis

North America Dominates the Betaine Market with a Market Share of 45.2%, Valued at USD 1.8 Billion

North America leads the global betaine market due to its strong food, feed, and personal care manufacturing base. In 2024, the region accounted for a dominant 45.2% share, generating nearly USD 1.8 billion, supported by advanced production technologies and strong regulatory acceptance. Growing demand for nutritional supplements and functional ingredients continues to push consumption across the U.S. and Canada.

Europe remains a mature market driven by clean-label trends, strict quality regulations, and high adoption of natural humectants in cosmetics and food applications. Demand is supported by rising awareness of multifunctional ingredients and increasing use of natural betaine in wellness-focused formulations. Sustainable farming practices also contribute to higher product uptake across Western Europe.

Asia Pacific is emerging as the fastest-growing region, driven by expanding personal care manufacturing, rising awareness of feed additives, and growing packaged food consumption. Countries like China, India, and Southeast Asia are witnessing rapid industrial expansion, creating strong long-term opportunities for natural and synthetic betaine applications in food, pharma, and cosmetics.

The United States remains the core driver of North American market leadership, supported by high production capacity and strong application demand across food, feed, and cosmetic sectors. Increasing focus on wellness products and natural ingredients further boosts the shift toward high-purity betaine. Regulatory clarity and innovation in formulations maintain steady growth momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Betaine Market reflected steady advancement as leading producers focused on quality enhancement, broader application development, and cost-efficient manufacturing.

IFF strengthened its position through its emphasis on high-purity betaine ingredients tailored for personal care and nutrition products. The company benefited from rising demand for natural actives, leveraging its ingredient innovation platforms to support customer-specific formulations across fast-growing emerging markets.

BASF SE maintained a strong competitive stance due to its integrated chemical production model and its ability to scale betaine manufacturing efficiently. Its focus on improving product consistency, formulation stability, and sustainable sourcing positioned the company well among personal care, home care, and feed manufacturers aiming for reliable multifunctional additives.

du Pont remained influential in 2024 with a continued push toward science-driven ingredient development and performance-enhancing betaine solutions. Its broad application portfolio, particularly in food, wellness, and animal nutrition, enabled the company to meet shifting regulatory standards and customer preferences for safe, versatile, and functionally superior betaine grades.

KAO Corp. focuses on high-quality surfactant-based betaine ingredients widely used in personal care and home hygiene products. Its strong commitment to sustainable chemistry, combined with advanced formulation capabilities, supported growing global adoption of mild cleansing and moisture-enhancing applications, helping consumers and manufacturers move toward gentle, naturally aligned product profiles.

Top Key Players in the Market

- IFF

- BASF SE

- du Pont

- KAO Corp.

- Stepan Company

- Sunwin Company

- DCI Chemicals

- Shiv Shakti Group

- Akshar International

- Associated British Foods PLC

Recent Developments

- In 2025, BASF will focus on sustainability in its betaine offerings. The company launched Dehyton PK45 GA/RA, a cocamidopropyl betaine derived from sustainably sourced coconut oil and certified by the Rainforest Alliance, as part of its expansion of natural-based ingredients for personal care.

- In 2025, Stepan presented research at the AOCS conference on surfactants, noting that the addition of cetyl betaine as a co-surfactant has no significant effect on phase inversion temperature in certain formulations, highlighting its role in emulsion stability. Stepan offers a range of betaine-based amphoteric surfactants for personal care.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Natural Betaine, Synthetic Betaine), By Product Type (Cocamidopropyl Betaine, Betaine Anhydrous, Betaine Monohydrate, Betaine Hydrochloride, Others), By Forms (Powder, Liquid), By End-Use (Animal Feed, Food and Beverages, Pharmaceutical, Personal Care, Cosmetics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape IFF, BASF SE, du Pont, KAO Corp., Stepan Company, Sunwin Company, DCI Chemicals, Shiv Shakti Group, Akshar International, Associated British Foods PLC Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- IFF

- BASF SE

- du Pont

- KAO Corp.

- Stepan Company

- Sunwin Company

- DCI Chemicals

- Shiv Shakti Group

- Akshar International

- Associated British Foods PLC