Global Berberine Supplements Market Size, Share and Report Analysis By Form (Caplets, Capsules, Liquid, Powder, Softgel, Tablets), By Source (Organic, Conventional), By Sales Channel (Supermarkets/Hypermarkets, Specialty Stores, Pharmacies And Drug Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175756

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

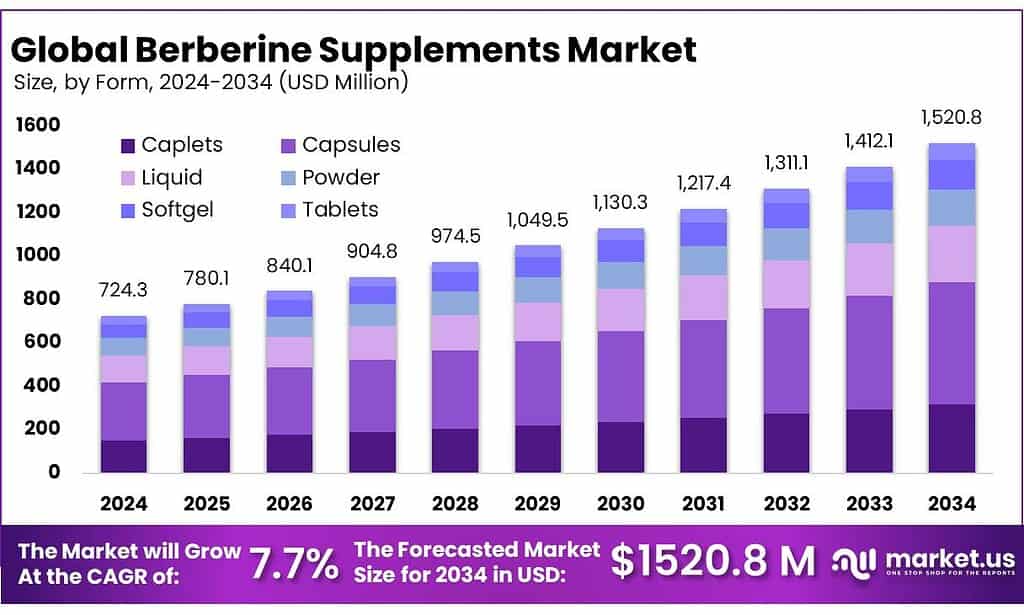

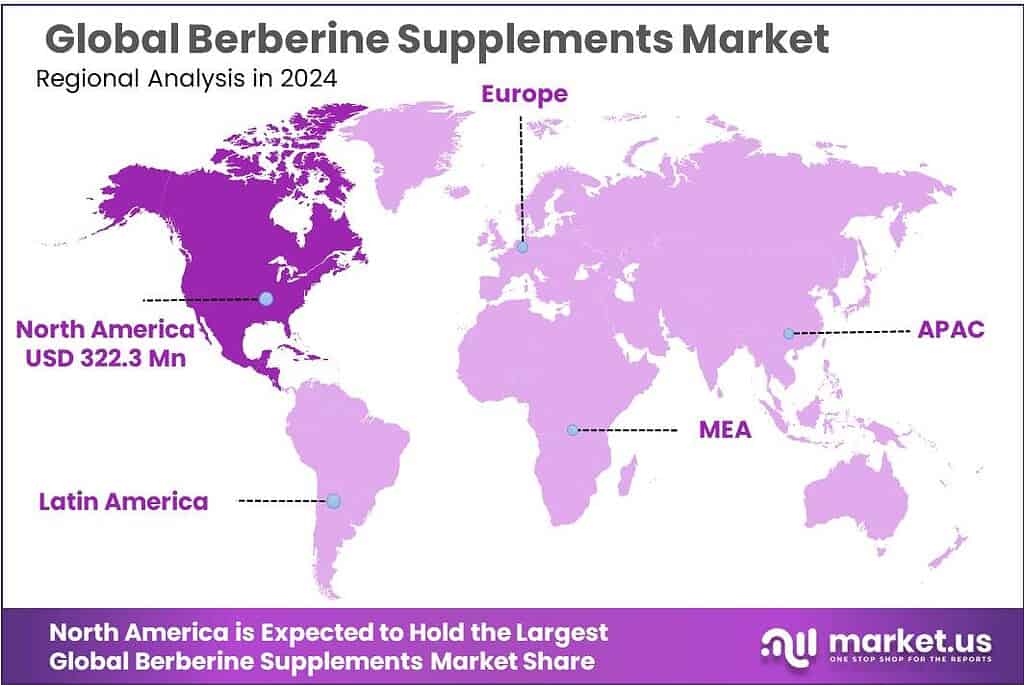

Global Berberine Supplements Market size is expected to be worth around USD 1520.8 Million by 2034, from USD 724.3 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.5% share, holding USD 322.3 Million in revenue.

Berberine supplements sit inside the broader “metabolic health” and “healthy aging” nutrition space. Berberine is a plant-derived alkaloid used in capsules, tablets, and blended formulas positioned around blood-sugar, lipid, and weight-management support. Commercially, the category benefits from mainstream supplement adoption: in the U.S., 57.6% of adults reported using a dietary supplement in the past 30 days, showing how large the addressable consumer base has become.

- In the United States alone, supplement use is normalized: during 2017–2018, 57.6% of adults reported using a dietary supplement in the past 30 days. On the supply side, the market has become highly fragmented and fast-moving—FDA materials describe a jump from roughly 4,000 products (1994) to estimates ranging from 50,000 to more than 80,000 different dietary supplement products in later years, reflecting how quickly new ingredients and formats can scale.

Key driving factors for berberine supplements include the overlap between diabetes risk, overweight/obesity prevalence, and consumer preference for “natural” options. WHO reports that in 2022, 2.5 billion adults were overweight and 890 million were living with obesity; 43% of adults were overweight and 16% had obesity. These population-level numbers tend to translate into sustained retail interest in products marketed for metabolic support, cholesterol support, and weight management—areas where berberine is commonly positioned.

On the purchasing side, industry survey data suggests spend remains resilient: CRN reported median monthly supplement spending of $50 in 2024 (vs $48 in 2023), with users buying via healthcare professionals reporting a median monthly outlay of $100. This matters for berberine because it is frequently sold as a “specialty” supplement, where pricing and repeat purchase behavior can materially influence category growth.

Regulation and trust are becoming the decisive filters for future growth opportunities. In the U.S., FDA’s New Dietary Ingredient (NDI) pathways and updated guidance emphasize pre-market safety notification expectations for certain ingredients and notification efficiency—raising the operational bar for newer forms, extracts, or novel delivery systems. In India, FSSAI’s Health Supplements/Nutraceuticals regulations were notified on 23.12.2016, with compliance timelines that formalized category definitions and labeling expectations for functional and novel foods.

Key Takeaways

- Berberine Supplements Market size is expected to be worth around USD 1520.8 Million by 2034, from USD 724.3 Million in 2024, growing at a CAGR of 7.7%.

- Capsules held a dominant market position, capturing more than a 37.4% share.

- Conventional held a dominant market position, capturing more than a 69.1% share.

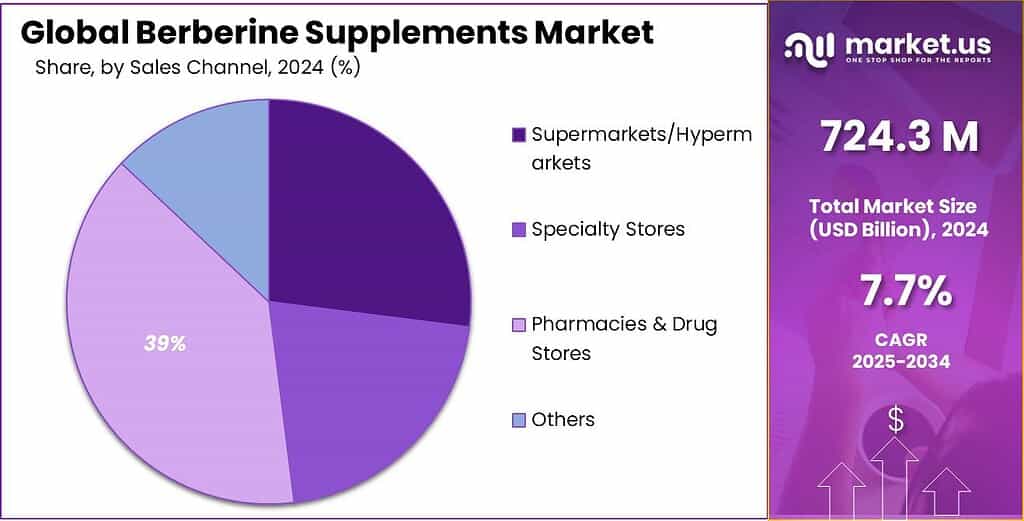

- Pharmacies & Drug Stores held a dominant market position, capturing more than a 39.2% share.

- North America dominates with a 44.5% share, supported by high supplement adoption and strong metabolic-health demand, valued at 322.3 Mn.

By Form Analysis

Capsules dominate with 37.4% share driven by convenience and strong consumer acceptance

In 2024, Capsules held a dominant market position, capturing more than a 37.4% share, mainly because consumers prefer supplement formats that are simple, fast, and easy to take daily. Capsules became the most trusted choice in berberine supplements as they offer accurate dosing, minimal taste, and better swallowing comfort compared to powders or liquids. This format also supports cleaner labels, since capsules do not require flavoring agents or stabilizers, which appeals strongly to health-focused buyers. In 2024, many brands focused on plant-based capsule shells and allergen-free formulations, which further strengthened capsule adoption in retail and e-commerce spaces.

By Source Analysis

Conventional dominates with 69.1% share as brands rely on established sourcing and wider affordability

In 2024, Conventional held a dominant market position, capturing more than a 69.1% share, mainly because most berberine used in supplements is still sourced through traditional cultivation and extraction methods. These processes are well-established, more affordable, and widely accessible for manufacturers, allowing them to maintain competitive pricing in both retail and online channels. Conventional sourcing also supports large-volume production, which is important in a year when berberine demand grew sharply due to rising interest in metabolic and blood-sugar support supplements. As a result, conventional berberine remained the default choice for many brands looking to balance quality, consistency, and cost efficiency.

By Sales Channel Analysis

Pharmacies & Drug Stores dominate with 39.2% share due to strong consumer trust and easy accessibility

In 2024, Pharmacies & Drug Stores held a dominant market position, capturing more than a 39.2% share, mainly because consumers continue to rely on these retail channels for safe, verified, and pharmacist-recommended supplement purchases. Berberine, often associated with metabolic health and daily wellness routines, benefits strongly from the credibility that pharmacies offer. Shoppers visiting these stores prefer professional guidance, clearer product labeling, and the assurance that supplements meet regulatory and quality expectations. This trust factor helped pharmacies and drug stores generate steady footfall and strong repeat purchases throughout 2024.

Key Market Segments

By Form

- Caplets

- Capsules

- Liquid

- Powder

- Softgel

- Tablets

By Source

- Organic

- Conventional

By Sales Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies & Drug Stores

- Others

Emerging Trends

Berberine is increasingly sold as a “metabolic + gut health” daily stack, not a standalone pill

A clear 2024–2025 trend in berberine supplements is the shift from “single-ingredient blood sugar support” toward a routine-based metabolic stack that also speaks to gut health and everyday consistency. Brands are packaging berberine alongside complementary wellness habits—diet quality, fiber, and weight routines—because consumers now want a plan they can follow, not just another bottle. This trend is happening inside a fast-growing herbal supplement economy.

- In the U.S., retail sales of herbal dietary supplements reached $13.231 billion in 2024, up 5.4% over 2023, showing that mainstream demand for botanicals is still moving upward even after the pandemic boom cooled.

What makes this “stacking” trend especially relevant is that consumers are also expanding into supporting products that often sit next to berberine in carts and subscriptions. CRN’s 2024 consumer survey data shows magnesium usage rose to 23% of supplement users in 2024, and prebiotic usage climbed to 7%. Even though those figures are not berberine-specific, they point to a bigger behavior change: shoppers are building multi-product regimens for energy, digestion, stress, and metabolic support—exactly the context where berberine is being marketed and repurchased. When consumers already accept a “combo routine,” it becomes easier for berberine to stay in the daily rotation.

Another force strengthening this trend is the growing number of people who discover metabolic risk through screening and then look for supportive routines. The CDC estimates about 98 million American adults have prediabetes, and more than 8 in 10 don’t know they have it. This kind of information makes consumers more likely to choose products that communicate responsible use clearly and are sold through channels that feel safer. On the manufacturing side, U.S. dietary supplements are expected to comply with 21 CFR Part 111, and brands are leaning into this as a visible quality signal in 2025.

Drivers

Rising metabolic health burden is pushing berberine demand, especially for “daily blood sugar support” routines

A major growth driver for berberine supplements is the rising global focus on metabolic health—especially blood sugar management, weight control, and heart-related wellness. The International Diabetes Federation (IDF) estimates that 589 million adults were living with diabetes in 2024, and projects this could reach 853 million by 2050. IDF also reports that diabetes caused 3.4 million deaths in 2024, underlining why prevention and early control remain a serious, long-term priority worldwide.

That disease burden also brings massive economic pressure, which indirectly fuels consumer interest in preventive choices, including supplements. IDF estimates diabetes was responsible for about USD 1.015 trillion in global health expenditure in 2024. When health systems and households feel cost pressure, the market usually sees a stronger pull toward daily wellness products that are perceived as “supportive” and accessible. This doesn’t mean supplements replace medical care—but it does explain why ingredients associated with metabolic support, such as berberine, continue to find demand across pharmacies, online stores, and wellness retailers in both 2024 and 2025.

On the consumer side, supplement use is already mainstream, which makes it easier for berberine to scale quickly once awareness rises. The Council for Responsible Nutrition (CRN) reported in its 2024 Consumer Survey that 75% of Americans use dietary supplements. In practical terms, a market where three out of four adults already buy supplements is structurally ready for “next-trending” ingredients—especially those tied to high-interest needs like blood sugar and weight support.

Government and public-health programs amplify this driver by keeping metabolic screening, prevention, and lifestyle change in the public conversation. At a global level, WHO’s Global Diabetes Compact sets clear 2030 coverage targets, including 80% of people with diabetes diagnosed, 80% achieving glycemic control, 80% achieving blood pressure control, and 100% access to insulin and blood glucose self-monitoring for people with type 1 diabetes. In the U.S., the CDC highlights evidence that structured lifestyle change programs for prediabetes can reduce the risk of developing type 2 diabetes by 58%, reinforcing the broader preventive mindset that drives the “metabolic wellness” supplement basket.

Restraints

Safety concerns and drug interactions remain a key restraint for the berberine supplements market

One of the biggest challenges restricting the growth of the berberine supplements market is growing awareness of its safety concerns and interactions with medications, especially as more people self-prescribe supplements without medical supervision. Unlike prescription drugs, berberine products are sold as dietary supplements in many countries, meaning they are not evaluated by regulators such as the U.S. FDA for safety or effectiveness before hitting the shelves.

Clinical and scientific sources confirm that while many people tolerate berberine reasonably well, gastrointestinal side effects—like nausea, abdominal pain, constipation, and diarrhea—are regularly reported. In controlled clinical settings, about 34.5% of participants given berberine (500 mg three times a day) experienced gastrointestinal discomfort such as flatulence, diarrhea, or abdominal pain over a 13-week period.

Beyond digestive issues, berberine also interacts with numerous medications. Trusted health institutions like the U.S. National Center for Complementary and Integrative Health (NCCIH) and Cleveland Clinic explicitly note that berberine can interact with drugs such as cyclosporine (used to prevent organ transplant rejection), metformin (a common diabetes medication), and medications metabolized through liver enzymes like CYP3A4.

Safety concerns also lead to specific government and health body guidance on vulnerable populations. Berberine is not recommended for pregnant or breastfeeding women, as it can worsen jaundice in newborns and may lead to a dangerous condition called kernicterus. For infants and children, berberine use remains largely unstudied or discouraged entirely, further narrowing the segment of the general population that might consider long-term supplementation.

Opportunity

Clinical-grade berberine tied to prediabetes screening and pharmacist-led guidance is a clear 2025 growth opportunity

A major growth opportunity for berberine supplements is the expanding pool of consumers who are at metabolic risk but not yet diagnosed, and who are actively looking for practical, everyday “support” tools. In the U.S. alone, the CDC estimates about 98 million American adults have prediabetes, and more than 8 in 10 adults with prediabetes don’t know they have it. This gap—high prevalence, low awareness—creates a large addressable market that is still under-served.

The opportunity becomes stronger when berberine is positioned next to lifestyle change, not as a shortcut. The CDC’s National Diabetes Prevention Program highlights that structured lifestyle change programs can reduce the risk of developing type 2 diabetes by 58%. That data matters for supplement brands because it shapes how responsible health professionals talk to consumers: “start with lifestyle, build a routine, then consider supportive products.” In 2025, brands that connect berberine to this “routine-building” mindset—sleep, movement, fiber-first diets, and weight management—can grow without pushing unrealistic promises.

Another growth lever is quality-led differentiation, because botanical supplements are increasingly judged on credibility. In the U.S., dietary supplement manufacturers are expected to follow Current Good Manufacturing Practice rules under 21 CFR Part 111, which include requirements for quality control systems, specifications, and batch-to-batch consistency. Brands that invest in identity testing, contaminant control, and tighter release specs can win repeat buyers—especially in 2025, when consumers are more skeptical and read labels more closely.

Finally, the wider herbal supplement economy is already growing, which gives berberine a bigger runway. U.S. retail sales of herbal dietary supplements reached $13.231 billion in 2024. When a category is expanding overall, the brands that combine “hot ingredients” with strong quality signals and credible education usually capture the most sustainable share.

Regional Insights

North America dominates with a 44.5% share, supported by high supplement adoption and strong metabolic-health demand, valued at 322.3 Mn.

In 2024, North America led the Berberine Supplements Market, driven by a large consumer base already comfortable with daily supplements and a growing focus on blood-sugar and weight-related wellness. In the U.S., the Council for Responsible Nutrition (CRN) reported that 75% of Americans use dietary supplements, which keeps the “trial barrier” low for trending botanical ingredients like berberine. At the same time, mainstream retail momentum for botanicals remains strong: U.S. retail sales of herbal dietary supplements reached $13.231 billion in 2024, indicating sustained consumer spend on plant-based health products.

Demand is also reinforced by the region’s metabolic risk profile. The CDC estimates about 98 million American adults have prediabetes, and more than 8 in 10 don’t know they have it—an awareness gap that often triggers “blood sugar support” searches after screening or routine lab work. The CDC also estimates 40.1 million people in the U.S. had diabetes in 2023, keeping prevention and lifestyle-driven management highly visible in healthcare conversations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Thorne’s competitive edge is its “clinical-style” positioning—clean formulas, practitioner trust, and premium pricing. The company was acquired by L Catterton at $10.20 per share, described as a 94% premium to the unaffected price, which signals strong investor confidence in its brand and margins. Before going private, Thorne HealthTech reported Q2 2023 net sales of $72.7 million (+33.1% YoY).

Nature’s Sunshine competes in herbal supplements through vertical manufacturing control and international distribution reach. For 2024, the company reported net sales of $454.4 million and operating income of $20.1 million. It also disclosed 819 employees as of December 31, 2024, reflecting a scaled operating base for formulation, manufacturing, and global selling across multiple regions.

Swanson Health is a value-led supplement retailer and brand operator with a long operating history and broad online assortment. The company traces its origins to 1969, and third-party company descriptions note it carries more than 26,000 products, supporting high basket-building and cross-selling. On LinkedIn, the company is listed in the 501–1,000 employees size band, indicating sizable operations.

Top Key Players Outlook

- Herbalife Nutrition Ltd

- Thorne

- Nature’s Sunshine Products, Inc.

- Zhou Nutrition

- Swanson Health

- NOW Foods

- Dr Martins Nutrition

- Nestlé

- Double Wood Supplements

Recent Industry Developments

Herbalife Nutrition’s role in the berberine supplements space fits its wider push into metabolic wellness—the kind of “daily support” positioning that customers already associate with weight management and nutrition routines. In 2024, Herbalife generated $4,993.1 million in net sales, giving it the scale to introduce and promote specialty supplements through its global member network and direct-to-consumer reach.

In 2025, Swanson continued leaning on simple, mainstream berberine formats that are easy for repeat use; for example, its Swanson-branded Berberine listing highlights 400 mg per capsule in a 60 vegan capsule bottle, priced at $21.39, and supported by strong consumer proof points like a 4.4/5 rating from 471 reviews—the kind of “social validation” that typically lifts conversion in metabolic-wellness categories.

Report Scope

Report Features Description Market Value (2024) USD 724.3 Mn Forecast Revenue (2034) USD 1520.8 Mn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Caplets, Capsules, Liquid, Powder, Softgel, Tablets), By Source (Organic, Conventional), By Sales Channel (Supermarkets/Hypermarkets, Specialty Stores, Pharmacies And Drug Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Herbalife Nutrition Ltd, Thorne, Nature’s Sunshine Products, Inc., Zhou Nutrition, Swanson Health, NOW Foods, Dr Martins Nutrition, Nestlé, Double Wood Supplements Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Berberine Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Berberine Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Herbalife Nutrition Ltd

- Thorne

- Nature's Sunshine Products, Inc.

- Zhou Nutrition

- Swanson Health

- NOW Foods

- Dr Martins Nutrition

- Nestlé

- Double Wood Supplements