Global Bays and Bows Window Market Size, Share, Growth Analysis By Window Type (Bay Windows, Bow Windows), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166659

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

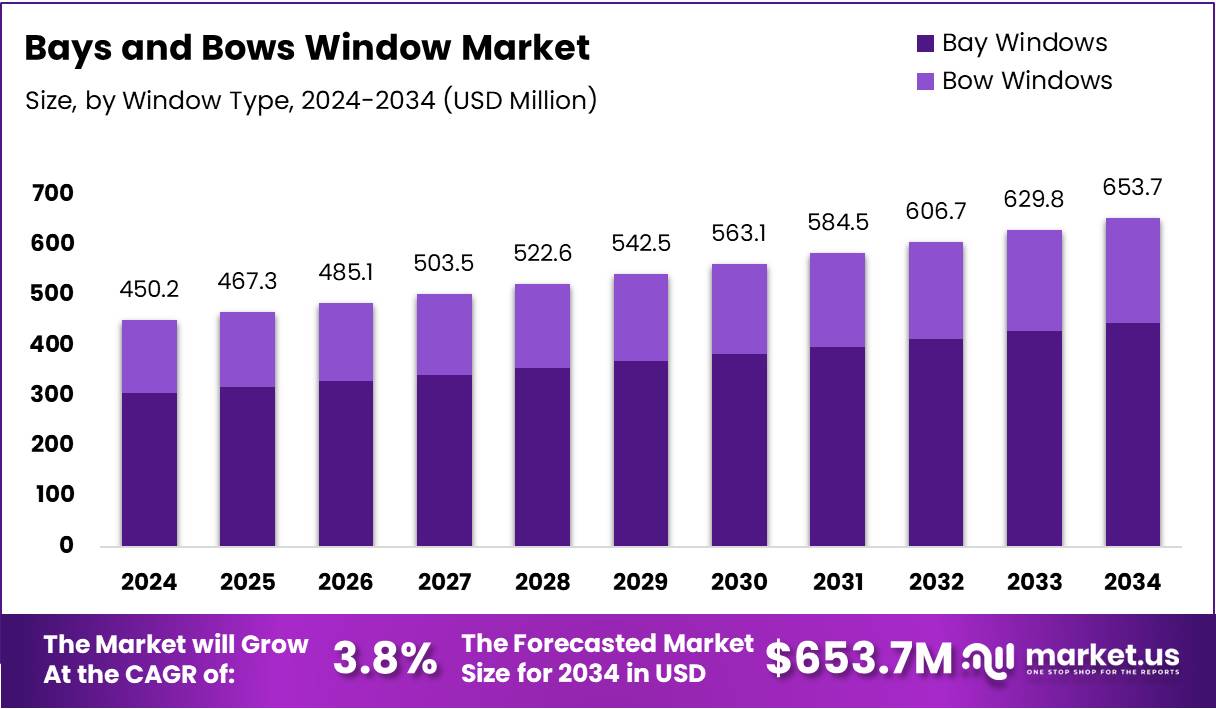

The Global Bays and Bows Window Market size is expected to be worth around USD 653.7 Million by 2034, from USD 450.2 Million in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Bays and Bows Window Market focuses on architectural window structures that extend outward to create extra interior space, wider views, and enhanced natural lighting. These windows remain popular in home-improvement projects because they elevate aesthetics, improve ventilation, and add greater functional value to modern and traditional residential designs.

Moving ahead, demand grows steadily as homeowners prioritize energy-efficient window upgrades and visually appealing expansions. Bays and bows provide a spacious feel and increase light penetration, making them preferred in both new construction and renovation. Their ability to transform room layouts encourages homeowners to invest more confidently in premium window replacements.

Additionally, renovation activities across suburban housing continue driving adoption, especially among consumers seeking better insulation and upgraded home comfort. The design supports improved thermal performance when paired with modern glazing, while offering a more open interior environment. These benefits strengthen long-term market potential across mid-range and premium home-upgrade segments.

Furthermore, supportive government guidelines promoting energy-efficient housing encourage greater installation of insulated, multi-pane, and low-emissivity window systems. Bays and bows align well with these expectations, helping reduce heating and cooling loads when properly designed. As a result, builders and homeowners increasingly consider these windows as part of broader energy-saving initiatives.

Consequently, opportunities expand as manufacturers introduce customizable shapes, smart-glass options, and improved sealing systems. Rising suburban refurbishments also support stable growth, especially among homeowners seeking to enhance property value and curb appeal. The segment benefits from higher awareness of long-term energy savings and enhanced living-space aesthetics.

In the UK, pricing trends influence adoption patterns, with bay windows typically costing between £1,200 and £8,000, while most installations fall between £1,200 and £3,000. These ranges support strong demand from mid-budget renovators who want premium-looking upgrades without excessive spending, reinforcing consistent market activity.

From a performance perspective, modern replacement bay windows reduce noise, lower energy usage, and block 99% of harmful UV rays, strengthening consumer interest in comfort-focused solutions. Additionally, heat gain and heat loss through windows account for 25–30% of residential heating and cooling energy use, highlighting the importance of efficient bay and bow installations.

Finally, standard bay window dimensions support streamlined manufacturing. The average width ranges 3–6 feet, height typically spans 3–6 feet, and depth extends 18–24 inches. These consistent measurements enable easier planning for installers and provide homeowners with reliable sizing expectations across the Bays and Bows Window Market.

Key Takeaways

- Global market expected to reach USD 653.7 Million by 2034, rising from USD 450.2 Million in 2024.

- Market growing at a CAGR of 3.8% during 2025–2034.

- Bay Windows lead the segment with 67.3% share in 2024.

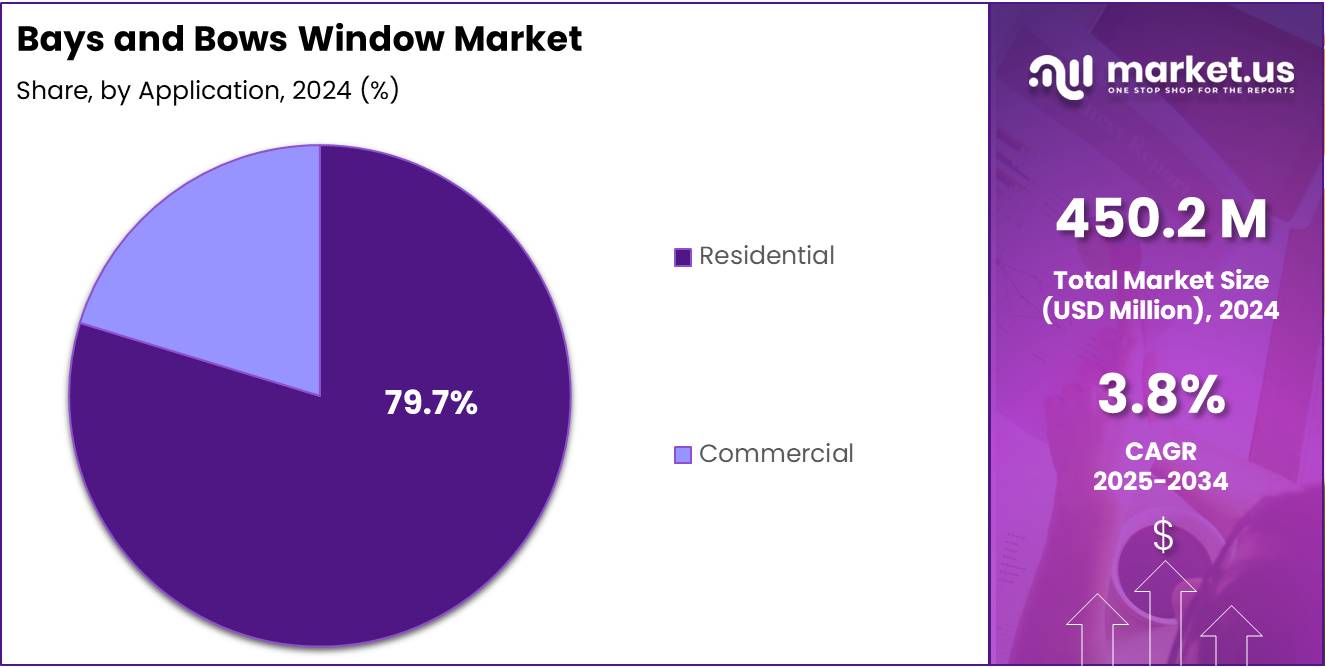

- Residential application dominates with 79.7% share in 2024.

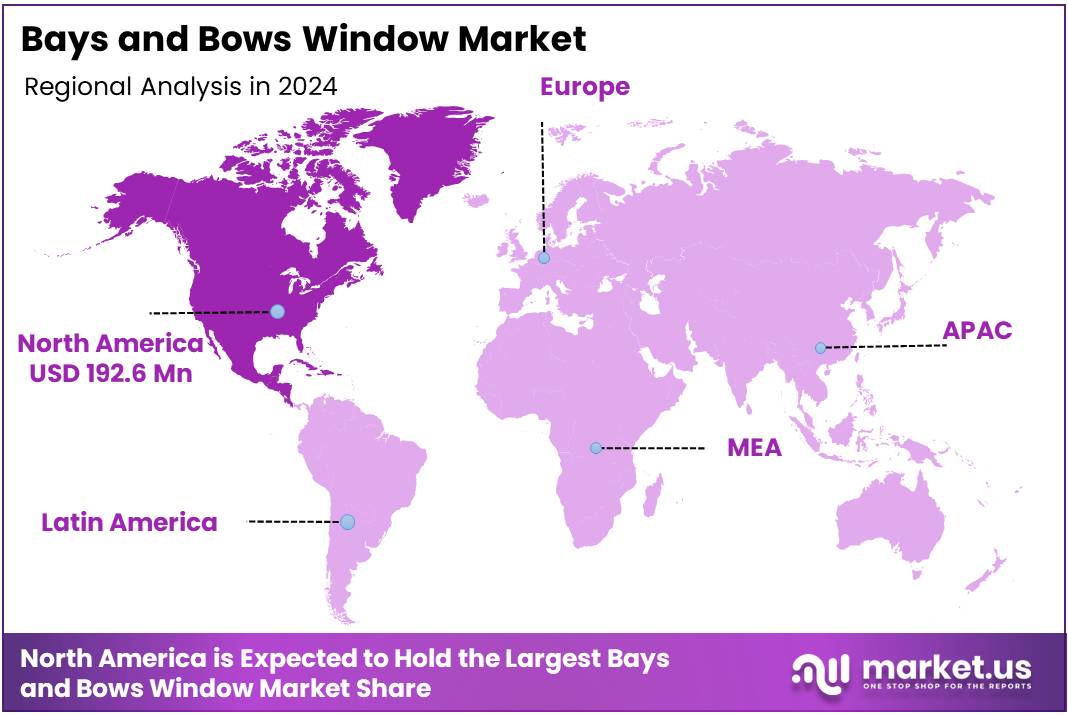

- North America leads regionally with 42.8% share valued at USD 192.6 Million.

By Window Type Analysis

Bay Windows dominate with 67.3% due to their broader installation suitability and higher aesthetic value.

In 2024, Bay Windows held a dominant market position in the By Window Type Analysis segment of the Bays and Bows Window Market, with a 67.3% share. This category benefits from strong demand across renovation projects. Moreover, homeowners prefer the extended indoor space offered by bay windows, further strengthening market traction.

In 2024, Bow Windows maintained a stable growth outlook within the By Window Type segment. This design appeals to buyers wanting a softer architectural curve. Additionally, the multi-panel structure enhances daylight penetration, boosting interest. As renovation spending rises, bow windows continue attracting consumers seeking premium exterior upgrades.

By Application Analysis

Residential dominates with 79.7% driven by large-scale home renovation and aesthetic enhancement needs.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the Bays and Bows Window Market, with a 79.7% share. This segment expands rapidly as homeowners invest in spacious window layouts. Furthermore, rising suburban housing upgrades continue supporting stronger adoption across new-build and retrofit installations.

In 2024, Commercial applications showcased steady adoption across retail fronts and hospitality spaces. These settings prefer bays and bows for their enhanced visibility and natural lighting benefits. Additionally, as commercial spaces modernize, demand for statement window structures grows, enabling this sub-segment to capture consistent market attention.

Key Market Segments

By Window Type

- Bay Windows

- Bow Windows

By Application

- Residential

- Commercial

Drivers

Surge in Residential Aesthetic Upgrades Boosting Demand for Space-Enhancing Window Formats

Homeowners are increasingly investing in aesthetic improvements to elevate property value and interior appeal. This trend is pushing demand for bays and bows windows, as these formats create a wider view, add natural light, and make rooms feel larger. Their ability to upgrade overall home design is strengthening market adoption.

Additionally, governments across regions are tightening energy-efficiency regulations, encouraging households to choose multi-pane window systems. Bays and bows windows equipped with insulated glass help reduce heat loss and lower energy bills. As a result, consumers are selecting these designs not only for appearance but also for long-term energy savings.

Moreover, the rise of high-end residential construction is supporting the use of premium window materials and customized shapes. Luxury developers prefer bays and bows windows because they offer a distinctive architectural look and enhance exterior aesthetics. This shift toward upscale housing is creating steady demand for advanced and durable window solutions.

Restraints

Limited Structural Compatibility and Low Awareness Constrain Market Growth

Limited suitability in small urban homes is becoming a major restraint for the bays and bows window market. Many compact apartments do not have the required wall depth or exterior space to support these outward-projecting structures. This limitation reduces installation opportunities, especially in densely built cities where floor plans are highly restricted.

Additionally, homeowners in these areas often prioritize functional layouts over architectural enhancements. As a result, demand naturally shifts toward simpler window formats that fit tight spaces. This mismatch between product design and housing layout continues to limit market expansion in fast-urbanizing regions.

Low awareness of energy-efficiency advantages also restricts adoption, particularly across emerging markets. Many buyers are unfamiliar with how multi-pane or insulated bay and bow windows can reduce heat transfer and improve indoor comfort. Due to this gap, consumers may see these windows as purely decorative rather than performance-driven upgrades.

This lack of understanding often leads price-sensitive households to choose standard windows instead of higher-value alternatives. Without targeted awareness programs and stronger communication about long-term savings, the market faces slow penetration in developing regions. Together, these challenges create notable restraints for future growth.

Growth Factors

Increasing Use of Customizable Window Geometry Drives Market Growth

The Bays and Bows Window Market is witnessing new growth opportunities as homeowners and builders increasingly look for customizable window shapes. Advanced CAD-based manufacturing makes it easier to design unique window geometries, allowing consumers to select formats that enhance natural light and room dimension. This shift supports higher demand for personalized window structures across both renovation and new-build projects.

At the same time, smart-glass integration is becoming a major upgrade option. As energy control and privacy features gain attention, smart-glass windows offer added value compared to traditional formats. These technologies help regulate indoor temperatures, reduce glare, and support better energy performance. This growing interest in tech-enabled window solutions is opening premium upgrade opportunities for manufacturers.

Additionally, eco-certified frame materials are gaining adoption in sustainable construction projects. Builders are increasingly selecting frames made from recycled or responsibly sourced materials. This benefits the market as green-certified developments become more common, and consumers prioritize eco-friendly choices. The move toward sustainable building practices creates long-term demand for environmentally responsible bay and bow windows.

Together, customization, smart-glass integration, and eco-friendly materials are creating strong growth avenues that help the market evolve toward higher value and better performance.

Emerging Trends

Rapid Shift Toward Larger Panoramic Window Profiles Drives Market Trends

The Bays and Bows Window Market is witnessing a strong shift toward larger panoramic profiles as homeowners seek brighter interiors. This trend is driven by the rising demand for natural light, especially in modern residential spaces. Wider glass surfaces also help make rooms feel more open, which boosts installation preference in both new homes and renovation projects.

At the same time, minimal-frame designs are becoming a major style trend. Consumers are choosing sleek and clean window structures that match contemporary architecture. These slim frames offer a visually lighter look while still supporting structural strength. As a result, manufacturers are focusing on refined frame engineering to meet growing design expectations.

Additionally, multi-pane insulated glass units are gaining popularity as buyers prioritize better thermal performance. These advanced glazing systems help lower energy loss while improving indoor comfort. They also support eco-friendly building goals, making them a preferred upgrade in premium home improvement. Together, these trends highlight how design, comfort, and energy efficiency are shaping the future of the bays and bows window category.

Regional Analysis

North America Dominates the Bays and Bows Window Market with a Market Share of 42.8%, Valued at USD 192.6 Million

North America leads the Bays and Bows Window Market, holding a strong 42.8% share valued at USD 192.6 Million. The region benefits from high residential renovation activity and strong demand for premium, space-enhancing window formats. Additionally, consumer preference for energy-efficient multi-pane designs continues to support steady market expansion across suburban and upscale housing projects.

Europe Bays and Bows Window Market Trends

Europe shows stable growth supported by strict building insulation standards and rising interest in modern architectural window aesthetics. Markets in Western Europe particularly favor multi-pane bay and bow formats due to their energy-saving benefits. Increasing investments in home refurbishment further strengthen regional demand.

Asia Pacific Bays and Bows Window Market Trends

Asia Pacific is emerging as a high-growth region, driven by rapid urban development and rising middle-class spending on home upgrades. Demand is increasing in markets where modern residential layouts support larger window profiles. Growing awareness of natural-light optimization also boosts adoption of bay and bow styles.

Middle East and Africa Bays and Bows Window Market Trends

The Middle East and Africa market is gradually expanding as premium housing and mixed-use projects become more common. Warmer climates drive interest in insulated window formats that enhance cooling efficiency. Growth remains centered in urban corridors undergoing large-scale construction and modernization.

Latin America Bays and Bows Window Market Trends

Latin America experiences moderate demand, supported by rising renovation activity in select urban regions. Consumers increasingly prefer aesthetic enhancements that add space and natural light to older homes. Economic stabilization in key countries is further creating opportunities for premium window installations.

U.S. Bays and Bows Window Market Trends

The U.S. shows strong independent momentum within North America, driven by high spending on home remodeling and curb-appeal improvements. Preference for customizable, energy-efficient window structures is rising across both new construction and renovation projects. Expanding suburban housing developments continue to support sustained market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bays and Bows Window Company Insights

The global Bays and Bows Window Market in 2024 reflects steady expansion as homeowners increasingly prioritize aesthetics, daylight access, and energy-efficient living spaces. Market leaders continue to refine product quality and installation performance to capture premium demand. Their focus on tailored geometries and high-performance glazing supports the segment’s upward trajectory across both residential replacement and new-build applications.

Andersen maintains strong influence in the premium window category by emphasizing durable frame materials and advanced thermal technologies. The company strengthens its market position through consistent design upgrades that meet evolving homeowner preferences for wider views and high insulation value.

Milgard Windows demonstrates notable traction by expanding its portfolio of customizable bay and bow configurations tailored for regional architectural styles. Its strategy centers on improving ease of installation and enhancing energy ratings to support adoption in climate-sensitive markets.

Pella builds competitiveness through integrated design-performance features, including multi-pane options and innovative frame engineering. The company benefits from strong brand perception and an emphasis on customizable finishes that appeal to renovation-driven consumers seeking premium visual appeal.

Marvin advances market share by focusing on high-end craftsmanship and modern aesthetic lines suited for contemporary home upgrades. Its commitment to material innovation and user-focused design helps reinforce value for customers seeking long-lasting structural integrity.

Across the broader market, these leading players collectively push innovation that elevates window performance, reduces energy consumption, and enhances architectural flexibility. Their continuous improvements in engineering and customization standards further position the Bays and Bows segment for sustained growth through 2030.

Top Key Players in the Market

- Andersen

- Milgard Windows

- Pella

- Marvin

- JELD-WEN

- Ply Gem

- ProVia

- Atrium

- Stanek Windows

- Sierra Pacific

Recent Developments

- In Sept 2025, Window Nation acquired NewSouth Window Solutions from MITER Brands to expand its footprint in the fast-growing Florida market. The move strengthens its retail distribution and enhances its direct-to-consumer window replacement portfolio.

- In July 2025, Pella Corporation acquired Weather Shield to accelerate growth in the premium window and door category. This strategic step broadens its high-end product capabilities and deepens its penetration into design-driven residential projects.

- In July 2024, All Weather completed the acquisition of Westeck Windows and Doors to expand its presence in the North American custom window segment. The deal enhances its manufacturing reach and supports demand for performance-oriented architectural window systems.

- In Apr 2024, MITER Brands finalized its acquisition of PGT Innovations to strengthen its market position in impact-resistant and energy-efficient window solutions. The integration significantly boosts its innovation pipeline and production capacity across key U.S. regions.

Report Scope

Report Features Description Market Value (2024) USD 450.2 Million Forecast Revenue (2034) USD 653.7 Million CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Window Type (Bay Windows, Bow Windows), By Application (Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Andersen, Milgard Windows, Pella, Marvin, JELD-WEN, Ply Gem, ProVia, Atrium, Stanek Windows, Sierra Pacific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bays and Bows Window MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Bays and Bows Window MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Andersen

- Milgard Windows

- Pella

- Marvin

- JELD-WEN

- Ply Gem

- ProVia

- Atrium

- Stanek Windows

- Sierra Pacific