Global Battery Contract Manufacturing Market By Battery Type(Lithium-Ion Batteries, Lithium Polymer Batteries, Nickel-Cadmium Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, Others), By Service Type(Cell Manufacturing, Pack Assembly, Prototype Development, Testing and Quality Control, Supply Chain Management, Others), By End-Use(Automotive, Consumer Electronics, Energy Storage, Industrial Applications, Medical Devices, Aerospace and Defense, Others), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119770

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

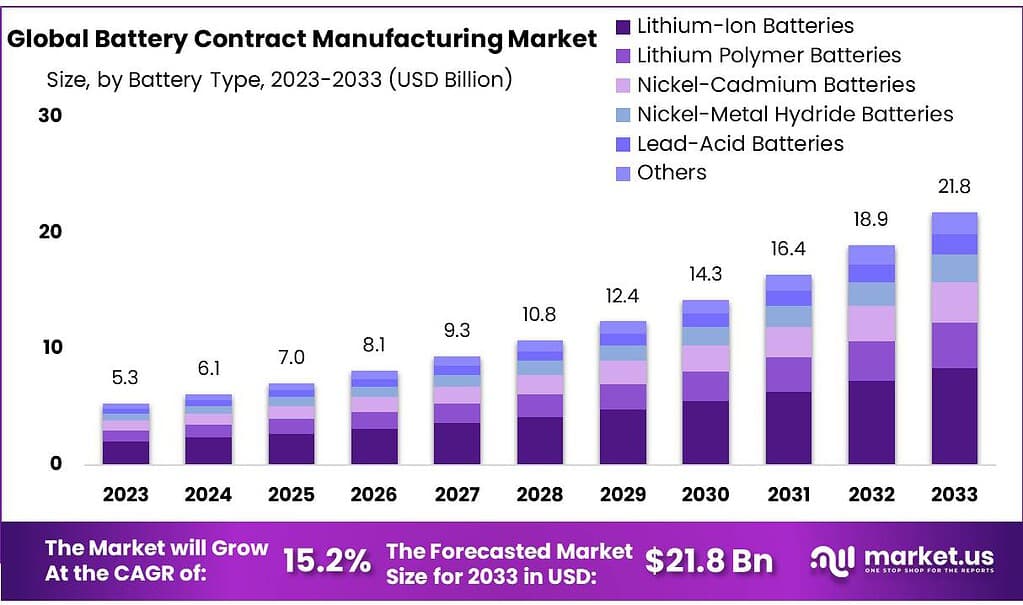

The global Battery Contract Manufacturing Market size is expected to be worth around USD 21.8 billion by 2033, from USD 5.3 billion in 2023, growing at a CAGR of 15.2% during the forecast period from 2023 to 2033.

The battery contract manufacturing market refers to the industry segment where specialized companies provide manufacturing services for batteries on behalf of other firms. This market is essential for businesses that require batteries but prefer to outsource their production to focus on core competencies such as design, marketing, and distribution.

Battery contract manufacturers offer a range of services, including design assistance, production, testing, and supply chain management, catering to various industries such as automotive, consumer electronics, medical devices, and renewable energy systems.

The growing demand for electric vehicles (EVs) and renewable energy storage solutions is significantly driving the battery contract manufacturing market. As the global push towards sustainable energy intensifies, there is a substantial increase in the need for efficient and reliable battery solutions.

This surge in demand is leading many companies, especially automotive manufacturers, to partner with contract manufacturers to scale up battery production quickly and cost-effectively. For instance, the rise in EV adoption is compelling automakers to collaborate with battery specialists to ensure a steady supply of high-performance batteries.

Technological advancements and innovations in battery technologies, such as lithium-ion, solid-state, and next-generation battery chemistries, are also fueling the growth of the battery contract manufacturing market.

These advancements necessitate specialized manufacturing capabilities and expertise, which many companies achieve through partnerships with contract manufacturers. This trend is particularly evident in the consumer electronics sector, where the demand for more powerful, efficient, and compact batteries is driving the need for specialized manufacturing services.

Moreover, the battery contract manufacturing market is characterized by its emphasis on quality control and regulatory compliance, ensuring that batteries meet stringent safety and performance standards. This focus is critical as batteries play a vital role in the functionality and safety of various devices and systems. As a result, contract manufacturers invest heavily in advanced production technologies and quality assurance processes to meet the evolving needs of their clients and the market.

Key Takeaways

- The Battery Contract Manufacturing Market is expected to reach a worth of USD 21.8 billion by 2033, up from USD 5.3 billion in 2023.

- The CAGR for the Battery Contract Manufacturing Market is projected at 15.2% from 2023 to 2033.

- In 2023, Lithium-Ion Batteries held a dominant market position, capturing more than 38.4% share.

- In the same year, Cell Manufacturing accounted for more than 30.3% of the market share.

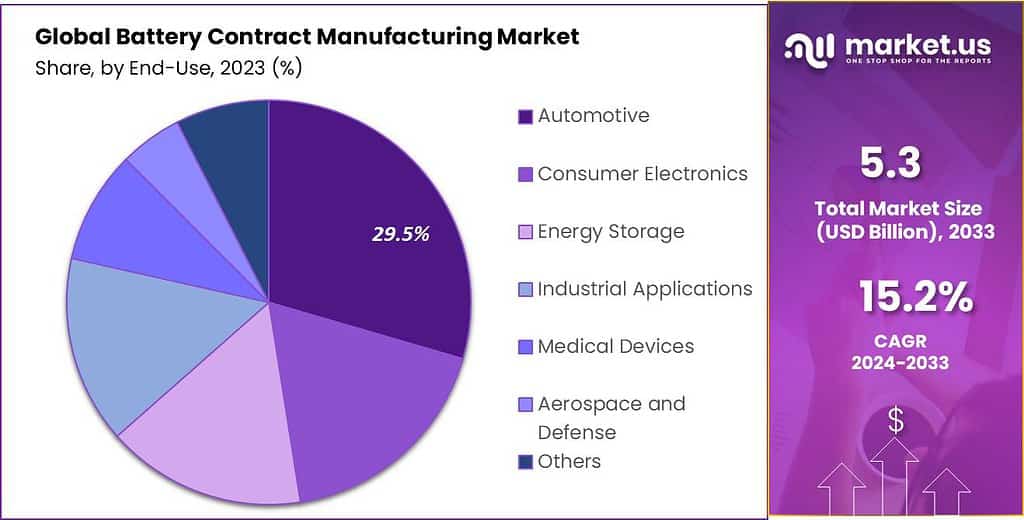

- Automotive held a dominant market position in 2023, capturing more than 29.5% share.

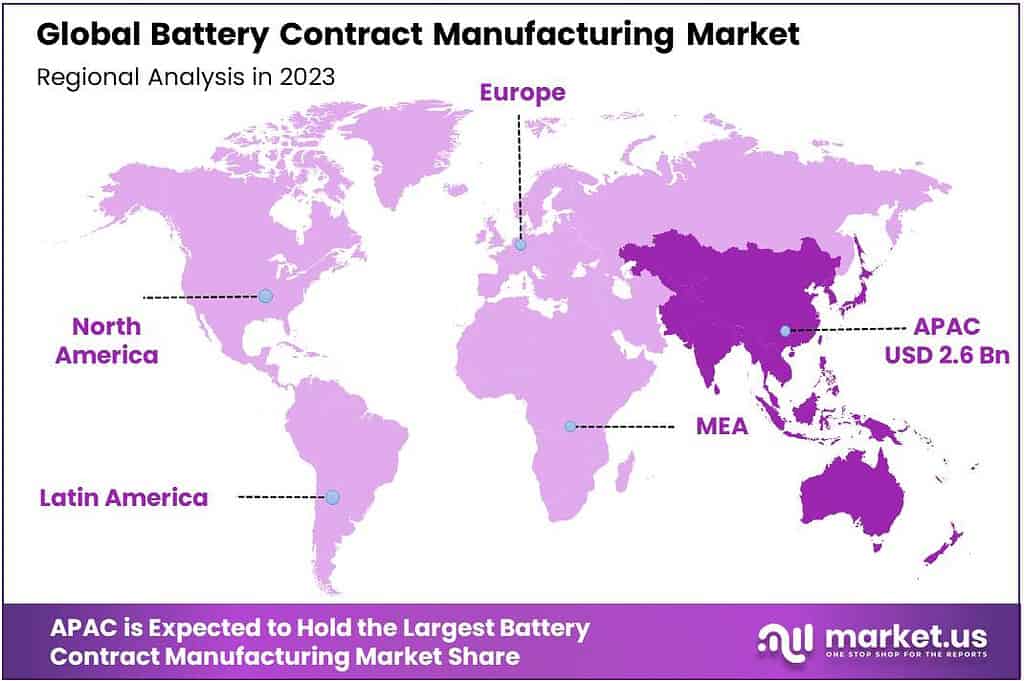

- The Asia Pacific region emerges as a dominant force in the battery contract manufacturing market, boasting a substantial market share of 48.6%.

By Battery Type

In 2023, Lithium-Ion Batteries held a dominant market position, capturing more than a 38.4% share. Lithium-ion batteries are widely favored for their high energy density, long cycle life, and lightweight characteristics, making them ideal for applications in electric vehicles (EVs), consumer electronics, and renewable energy storage systems. The growing demand for EVs and portable electronic devices is significantly boosting the need for lithium-ion batteries, leading to increased contract manufacturing activities to meet this demand.

Lithium Polymer Batteries: These batteries are known for their flexible form factor and lightweight properties, which make them suitable for applications in smartphones, tablets, and wearable devices. Lithium polymer batteries offer similar energy density to lithium-ion batteries but with enhanced safety features and design flexibility. Their growing use in compact and portable electronic devices is driving demand in the contract manufacturing market.

Nickel-Cadmium Batteries: Nickel-cadmium (NiCd) batteries are valued for their robustness and ability to deliver high discharge rates. They are commonly used in power tools, medical equipment, and emergency lighting systems. Despite their relatively lower energy density compared to newer battery technologies, their reliability and long life make them a staple in specific industrial applications.

Nickel-Metal Hydride Batteries: Nickel-metal hydride (NiMH) batteries offer a good balance between performance and cost, providing higher energy density than NiCd batteries and better environmental compatibility. They are often used in hybrid vehicles, cordless phones, and various consumer electronics. The increasing focus on eco-friendly battery solutions is boosting the demand for NiMH batteries in the contract manufacturing market.

Lead-Acid Batteries: Lead-acid batteries are one of the oldest and most reliable battery technologies, widely used in automotive, backup power, and industrial applications. They are known for their low cost, high surge current capability, and robustness. Despite their heavier weight and lower energy density, their extensive use in automotive starter batteries and UPS systems continues to drive their demand in the contract manufacturing sector.

By Service Type

In 2023, Cell Manufacturing held a dominant market position, capturing more than a 30.3% share. Cell manufacturing is a critical component in the battery production process, involving the creation of individual battery cells, which are the core units of any battery pack. This service is essential for producing high-performance batteries used in electric vehicles (EVs), consumer electronics, and renewable energy storage systems. The growing demand for advanced battery cells with higher energy densities and improved safety features is driving the expansion of cell manufacturing services.

Pack Assembly: Pack assembly involves combining multiple battery cells into a single battery pack, complete with necessary control systems and protective casings. This service is vital for producing battery packs tailored to specific applications, such as automotive, industrial, and consumer electronics. The increasing adoption of electric vehicles and the need for custom battery solutions are boosting the demand for pack assembly services in the contract manufacturing market.

Prototype Development: Prototype development services are crucial for companies looking to innovate and bring new battery technologies to market. This involves designing, creating, and testing prototype battery cells and packs to validate performance and safety before full-scale production. The rapid pace of technological advancement in battery technology, including solid-state and next-generation lithium-ion batteries, is driving significant investment in prototype development services.

Testing and Quality Control: Testing and quality control services ensure that battery products meet stringent safety and performance standards. These services include various tests such as performance testing, thermal management testing, and safety assessments. As the demand for reliable and safe batteries grows, particularly in critical applications like electric vehicles and medical devices, the importance of robust testing and quality control processes is increasing.

Supply Chain Management: Supply chain management services encompass the coordination and optimization of the entire battery production and distribution process, from sourcing raw materials to delivering finished products. Effective supply chain management is essential for maintaining production efficiency, reducing costs, and ensuring timely delivery. The complexity of battery production, involving numerous components and materials, is driving the need for specialized supply chain management services to enhance operational efficiency and meet market demand.

By End-Use

In 2023, Automotive held a dominant market position, capturing more than a 29.5% share. The automotive sector’s leading position is driven by the surging demand for electric vehicles (EVs) and hybrid vehicles, which require high-performance and reliable batteries. Contract manufacturing provides automotive companies with the scalability and flexibility needed to meet the growing demand for EV batteries, ensuring consistent supply and enabling manufacturers to focus on innovation and vehicle development.

Consumer Electronics: The consumer electronics segment encompasses devices such as smartphones, laptops, tablets, and wearables, all of which require compact, high-capacity batteries. The increasing demand for portable electronic devices with longer battery life and faster charging capabilities is propelling the need for specialized battery contract manufacturing services to produce advanced lithium-ion and lithium-polymer batteries.

Energy Storage: This segment involves batteries used for storing energy from renewable sources like solar and wind. Energy storage systems are essential for stabilizing the grid, managing peak loads, and providing backup power. The growing emphasis on renewable energy integration and grid stability is driving the demand for large-scale battery storage solutions, making energy storage a significant area for battery contract manufacturing.

Industrial Applications: Industrial applications include batteries for heavy machinery, forklifts, backup power systems, and uninterruptible power supplies (UPS). The need for reliable and durable batteries in industrial environments, where equipment uptime is critical, is boosting the demand for custom battery solutions provided by contract manufacturers.

Medical Devices: Batteries for medical devices must meet stringent safety and reliability standards. This segment covers devices such as portable medical equipment, implantable devices, and diagnostic tools. The growing healthcare sector and the increasing adoption of advanced medical technologies are driving demand for high-quality, dependable batteries.

Aerospace and Defense: This segment requires batteries with high energy density, reliability, and performance under extreme conditions. Applications include power systems for aircraft, satellites, drones, and military equipment. The critical nature of these applications necessitates robust and high-performance batteries, supported by specialized contract manufacturing services.

Market Key Segments

By Battery Type

- Lithium-Ion Batteries

- Lithium Polymer Batteries

- Nickel-Cadmium Batteries

- Nickel-Metal Hydride Batteries

- Lead-Acid Batteries

- Others

By Service Type

- Cell Manufacturing

- Pack Assembly

- Prototype Development

- Testing and Quality Control

- Supply Chain Management

- Others

By End-Use

- Automotive

- Consumer Electronics

- Energy Storage

- Industrial Applications

- Medical Devices

- Aerospace and Defense

- Others

Drivers

Growing Demand for Electric Vehicles (EVs)

A major driver propelling the battery contract manufacturing market is the escalating demand for electric vehicles (EVs). As concerns about environmental sustainability intensify and global emission regulations become stricter, there is a significant push towards electrification of the automotive sector. This shift is prompting a surge in the production of EVs, which rely heavily on advanced battery technologies to operate efficiently.

The transition to electric vehicles is not just a trend but a critical component of global efforts to reduce carbon emissions. Governments worldwide are supporting this shift through various incentives such as subsidies for EV purchases, investments in charging infrastructure, and stringent emissions targets for automotive manufacturers. These policies are effectively increasing consumer adoption of EVs, which in turn drives the demand for high-capacity, reliable batteries.

Battery contract manufacturers play a crucial role in this ecosystem. They provide the expertise, capacity, and technological innovation necessary to meet the growing demand for EV batteries. As battery technology continues to evolve, these manufacturers are essential in scaling production, reducing costs, and improving the performance and safety of batteries. Innovations in battery design, such as improvements in energy density and charging speed, are directly influenced by the capabilities of contract manufacturers.

Moreover, the automotive industry’s reliance on these manufacturers is increasing due to the complex requirements of EV battery production, which demands high precision and adherence to strict quality and safety standards. The partnership between automotive companies and battery manufacturers helps ensure that the supply of batteries keeps pace with the accelerating production of EVs, thus supporting the continued growth of the electric vehicle market.

Restraints

Supply Chain Vulnerabilities and Material Shortages

A significant restraint facing the battery contract manufacturing market is the vulnerability of global supply chains and the persistent shortages of critical raw materials necessary for battery production. The battery industry, particularly for electric vehicles (EVs) and high-tech consumer electronics, relies heavily on materials such as lithium, cobalt, nickel, and manganese.

These materials are integral for manufacturing high-density, long-life batteries. However, the supply of these materials is concentrated in a few countries, with geopolitical tensions, trade disputes, and regulatory changes frequently impacting their availability and cost.

The increasing demand for batteries has led to intensified pressure on these supply chains, pushing the prices of raw materials higher and leading to significant volatility. For instance, any political instability in lithium-producing countries can create substantial disruptions in the supply chain, affecting the production schedules of battery manufacturers and, consequently, the delivery timelines for end products like EVs and portable electronics.

Moreover, the environmental impact associated with mining these materials and the growing regulatory scrutiny regarding sustainable sourcing practices adds further complexity to securing raw materials. Manufacturers are under increasing pressure to not only secure supply chains but also to ensure they are compliant with international environmental and labor standards. This dual challenge can lead to delays, increased costs, and greater operational complexities.

Additionally, the reliance on specific geographic regions for critical minerals makes the market susceptible to supply chain disruptions caused by natural disasters, labor strikes, or transportation bottlenecks. These disruptions can halt production lines and inflate costs, affecting the overall profitability and operational efficiency of battery contract manufacturers.

In response to these challenges, many companies are exploring alternative materials and technologies that reduce dependency on volatile raw materials. Innovations such as battery recycling technologies, the development of synthetic alternatives for scarce minerals, and investment in local sourcing and production capabilities are being pursued to mitigate these risks. However, scaling these solutions to meet global demand remains a challenge and requires significant investment and time.

Opportunity

Expansion into Energy Storage Solutions for Renewable Energy

A significant opportunity for the battery contract manufacturing market lies in the expansion into energy storage solutions for renewable energy sectors. As the world increasingly shifts towards sustainable energy sources like solar and wind, the need for efficient and reliable energy storage systems has become paramount. These systems are essential for stabilizing the intermittent nature of renewable energy and making it a viable alternative to traditional fossil fuels.

The global push for cleaner energy solutions is not just a response to environmental concerns but also a strategic move towards energy independence and sustainability. Governments around the world are implementing favorable policies and incentives for renewable energy projects, which include subsidies, tax breaks, and grants for energy storage development. These policies are designed to reduce the overall cost of renewable energy systems and accelerate their adoption.

Battery storage plays a crucial role in this transition. It allows for the storage of excess energy generated during peak production times, which can then be used during periods of low production. This not only enhances the efficiency of renewable energy systems but also ensures a continuous and reliable energy supply, critical for both residential and commercial energy consumers.

Battery contract manufacturers are well-positioned to capitalize on this growing demand. By expanding their capabilities to include the production of high-capacity, long-duration storage batteries, such as lithium-ion or advanced solid-state batteries, they can meet the evolving needs of the renewable energy sector. Moreover, these manufacturers can leverage their expertise in high-volume production and cost-effective manufacturing processes to supply batteries that are both affordable and reliable.

Furthermore, the growth in this sector is supported by advancements in battery technology, which are continually improving the cost, capacity, safety, and lifespan of batteries. Innovations such as enhanced electrolyte formulations and improved cathode materials are making batteries more efficient and environmentally friendly. These advancements are crucial for meeting the performance standards required by renewable energy applications.

Trends

Increasing Adoption of Automation and AI in Battery Manufacturing

A major trend reshaping the battery contract manufacturing market is the increasing adoption of automation and artificial intelligence (AI) technologies. As the demand for batteries, particularly for electric vehicles (EVs) and renewable energy storage, continues to grow, manufacturers are turning to more advanced manufacturing techniques to enhance efficiency, reduce costs, and improve product quality.

Automation in battery manufacturing involves using robotic systems and automated assembly lines to handle various production tasks, from cell assembly to battery packing. This shift not only speeds up the manufacturing process but also reduces the likelihood of human error, ensuring consistency and reliability in the production of high volumes of batteries. Moreover, automation allows for better scalability of production processes, enabling manufacturers to quickly adjust production rates in response to market demands or supply chain disruptions.

Parallel to automation, AI is playing a crucial role in optimizing manufacturing operations. AI algorithms are used to analyze vast amounts of production data to identify patterns and predict potential issues before they occur. This predictive maintenance can significantly reduce downtime and maintenance costs. AI also helps in enhancing quality control processes through real-time monitoring and analysis, ensuring that each battery meets stringent performance and safety standards before it leaves the factory.

Additionally, AI technologies facilitate the integration of smart manufacturing practices in battery production. This includes the use of IoT (Internet of Things) devices to monitor equipment performance and environmental conditions, thereby enabling more informed decision-making and greater operational transparency. Smart factories, equipped with AI and IoT, can dynamically optimize energy use, streamline supply chain logistics, and adapt production schedules based on real-time market data, leading to more efficient operations.

The convergence of automation and AI is not only transforming how batteries are manufactured but also improving the sustainability of manufacturing practices. By reducing waste, optimizing energy consumption, and enhancing the recycling of materials, these technologies contribute to the environmental goals of reducing the overall carbon footprint of battery production.

Regional Analysis

The Asia Pacific region emerges as a dominant force in the battery contract manufacturing market, boasting a substantial market share of 48.6%. Projections indicate that the market is poised to achieve a valuation of USD 2.5758 Billion by the end of the forecast period, buoyed by robust adoption across critical sectors such as automotive, consumer electronics, and energy storage.

This growth trajectory is chiefly propelled by powerhouse economies like China, India, Japan, and Australia, where a notable uptick in battery contract manufacturing activities is observed. These countries are actively responding to the escalating demand for sustainable energy solutions, underscoring the region’s steadfast commitment to pioneering manufacturing practices in the battery industry.

In North America, the battery contract manufacturing market is witnessing steady expansion. This upward trend is underpinned by growing demand from industries that leverage contract manufacturing for battery production to develop environmentally friendly products. The region’s diverse industrial landscape and advancements in manufacturing technologies play pivotal roles in fostering the adoption of contract manufacturing services for batteries.

Similarly, Europe is experiencing notable growth in the battery contract manufacturing sector. This growth is propelled by heightened consumer consciousness regarding sustainable practices and the increasing availability of contract-manufactured batteries across diverse industrial applications. Stringent environmental regulations and a strong emphasis on sustainable manufacturing further bolster the market’s growth prospects in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the realm of battery contract manufacturing, several key players wield significant influence, driving innovation, market expansion, and technological advancement. These players encompass a diverse range of companies, each contributing distinct expertise and capabilities to the competitive landscape.

Among them, major industry leaders such as Panasonic Corporation, LG Chem Ltd., and Samsung SDI Co., Ltd. stand out prominently. These entities boast extensive experience, robust infrastructures, and a proven track record of delivering high-quality battery solutions across various sectors, including automotive, consumer electronics, and energy storage.

Market Key Players

- CATL

- LG Energy Solution, Ltd.

- Panasonic Corporation

- SAMSUNG SDI Co., Ltd.

- BYD Company Ltd.

- SVOLT Energy Technology

- Tesla

- Toshiba Corporation

- EVE Energy Co., Ltd.

- SK On Jiangsu Co.,Ltd

- CALB Group.,Ltd

- Gotion High-Tech Co.,Ltd

- Sunwoda Electronic Co., Ltd.

- Farasis Energy

- EnerDel

Recent Developments

In January 2024, CATL secured contracts with several major automakers and energy companies, solidifying its position as a key supplier of lithium-ion batteries for electric vehicles and grid-scale energy storage projects.

In March 2024, LG Energy Solution solidified its position as a leading provider of lithium-ion batteries, securing major contracts with global OEMs and energy companies.

Report Scope

Report Features Description Market Value (2023) US$ 5.3 Bn Forecast Revenue (2033) US$ 21.8 Bn CAGR (2024-2033) 15.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Battery Type(Lithium-Ion Batteries, Lithium Polymer Batteries, Nickel-Cadmium Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, Others), By Service Type(Cell Manufacturing, Pack Assembly, Prototype Development, Testing and Quality Control, Supply Chain Management, Others), By End-Use(Automotive, Consumer Electronics, Energy Storage, Industrial Applications, Medical Devices, Aerospace and Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape CATL, LG Energy Solution, Ltd., Panasonic Corporation, SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, Tesla, Toshiba Corporation, EVE Energy Co., Ltd., SK On Jiangsu Co.,Ltd, CALB Group.,Ltd, Gotion High-Tech Co.,Ltd, Sunwoda Electronic Co., Ltd., Farasis Energy, EnerDel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Battery Contract Manufacturing Market?Battery Contract Manufacturing Market size is expected to be worth around USD 21.8 billion by 2033, from USD 5.3 billion in 2023

What CAGR is projected for the Battery Contract Manufacturing Market?The Battery Contract Manufacturing Market is expected to grow at 15.2% CAGR (2023-2033).Name the major industry players in the Battery Contract Manufacturing Market?CATL, LG Energy Solution, Ltd., Panasonic Corporation, SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, Tesla, Toshiba Corporation, EVE Energy Co., Ltd., SK On Jiangsu Co.,Ltd, CALB Group.,Ltd, Gotion High-Tech Co.,Ltd, Sunwoda Electronic Co., Ltd., Farasis Energy, EnerDel

Battery Contract Manufacturing MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Battery Contract Manufacturing MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- CATL

- LG Energy Solution, Ltd.

- Panasonic Corporation

- SAMSUNG SDI Co., Ltd.

- BYD Company Ltd.

- SVOLT Energy Technology

- Tesla

- Toshiba Corporation

- EVE Energy Co., Ltd.

- SK On Jiangsu Co.,Ltd

- CALB Group.,Ltd

- Gotion High-Tech Co.,Ltd

- Sunwoda Electronic Co., Ltd.

- Farasis Energy

- EnerDel