Global Basil Extract Market Size, Share, Report Analysis By Type (Powder, Capsule, Oil), By Application (Pharmaceutical, Personal Care Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156993

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

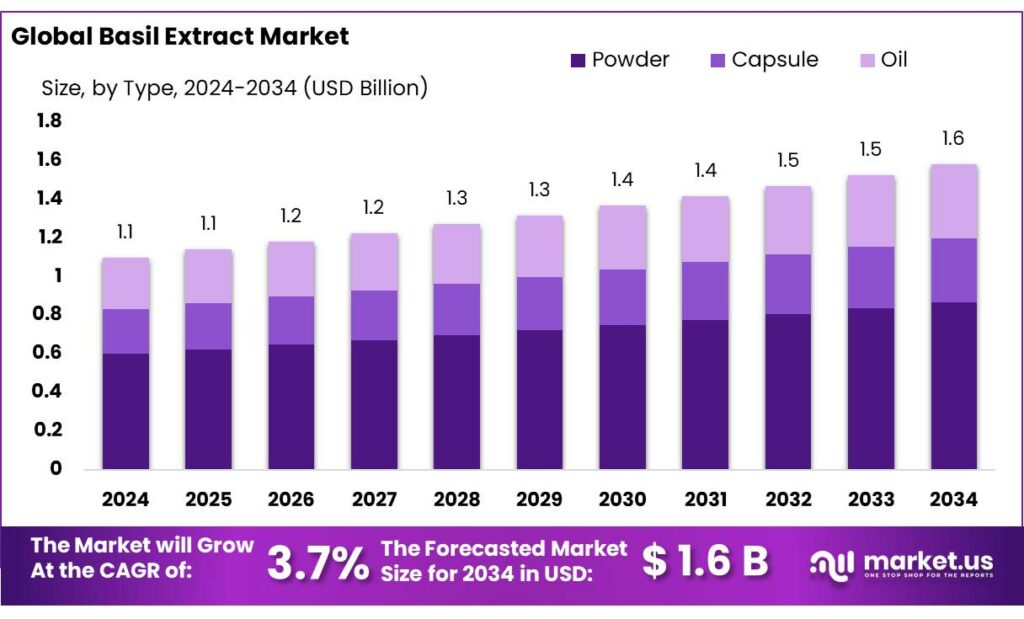

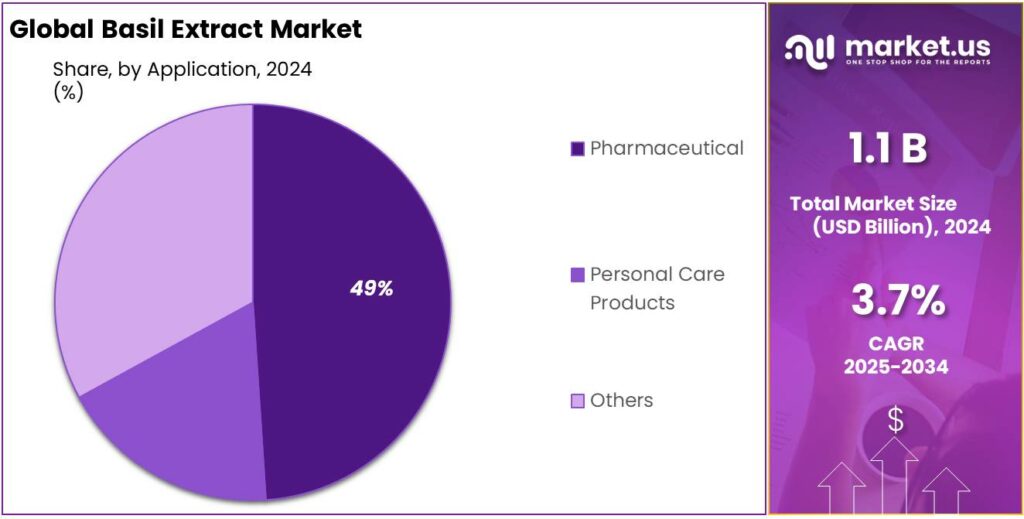

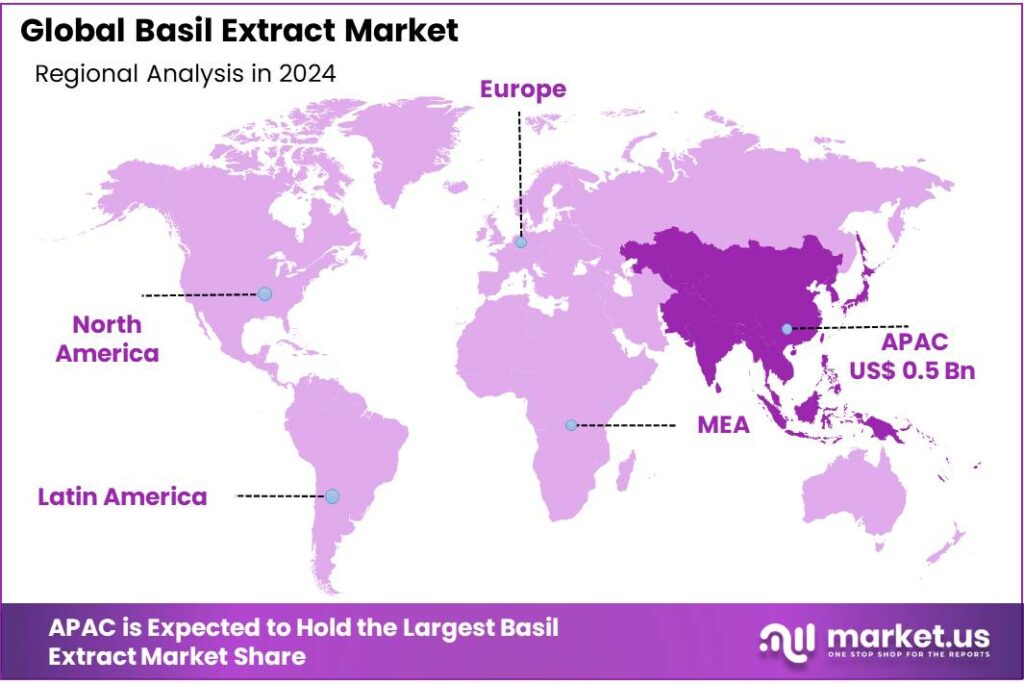

The Global Basil Extract Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034. In 2024, Asia‑Pacific (APAC) held a dominant market position, capturing more than a 48.90 % share, holding USD 0.5 Billion revenue.

Basil extract—derived from Ocimum basilicum—is a botanical ingredient rich in essential oils, phenolics, and flavonoids, widely valued in the food, pharmaceutical, cosmetic, and nutraceutical sectors for its antioxidant, anti‑inflammatory, and antimicrobial properties.

A review underscores basil’s potential as a candidate for pharmaceutical development and natural medicines in response to rising demand for safer alternatives amid global health challenges. Another study confirms its strong antibacterial activity, noting that extracts can degrade bacterial cell walls and combat resistant pathogens.

The basil extract in India is characterized by a growing emphasis on sustainable and organic farming practices. Hydroponic cultivation of basil, for instance, offers up to 8–10 harvest cycles per year, with yields ranging from 6–10 kg per square meter. This method not only enhances productivity but also meets the increasing demand for pesticide-free, high-quality basil.

Moreover, the Indian government has been proactive in supporting the medicinal plant sector through various schemes. For example, the Ministry of AYUSH provides financial assistance for the registration of AYUSH products with international regulatory agencies, reimbursing up to 50% of the fees, capped at INR 50 lakhs.

Key Takeaways

- Basil Extract Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 3.7%.

- Powder held a dominant market position, capturing more than a 54.8% share of the global basil extract market.

- Pharmaceutical held a dominant market position, capturing more than a 49.4% share of the global basil extract market.

- Asia‑Pacific (APAC) firmly stands as the leading region in the global basil extract market, accounting for 48.90 % of total regional revenue—translating to approximately USD 0.5 billion.

By Type Analysis

Powder dominates with 54.8% share due to its easy use and long shelf life

In 2024, Powder held a dominant market position, capturing more than a 54.8% share of the global basil extract market. This segment leads because powdered basil extract is easy to store, simple to use, and offers a long shelf life without the need for refrigeration. Powdered form is especially preferred by food processing industries, herbal product manufacturers, and cosmetics producers who need consistent quality and concentration in bulk applications. Its versatility allows it to be added into capsules, teas, seasonings, skincare products, and supplements without altering the texture or consistency of the final product.

By 2025, demand for basil extract in powdered form is expected to grow steadily, driven by increasing interest in herbal wellness products and clean-label ingredients. With consumers across North America, Asia-Pacific, and Europe becoming more conscious of natural product usage, the powdered type offers a convenient, scalable option for brands to cater to both retail and industrial needs.

By Application Analysis

Pharmaceutical dominates with 49.4% share due to rising herbal medicine demand

In 2024, Pharmaceutical held a dominant market position, capturing more than a 49.4% share of the global basil extract market. This leadership is mainly driven by the increasing use of basil extract in natural and plant-based medicinal products. Basil, known for its anti-inflammatory, antioxidant, and antimicrobial properties, is widely used in herbal formulations to treat respiratory issues, digestive problems, and skin disorders. The pharmaceutical sector has recognized basil extract as a reliable and safe ingredient, especially in Ayurvedic and traditional medicine systems, where it has long been a key component.

The growing consumer shift towards herbal remedies and reduced reliance on synthetic drugs has further strengthened the role of basil extract in modern pharmaceutical products. By 2025, the segment is expected to grow steadily as companies invest more in clinical research to back the health claims associated with basil. In countries like India and China, where herbal medicine is deeply rooted in the culture, pharmaceutical companies are expanding their product lines with basil-based capsules, syrups, and ointments.

Key Market Segments

By Type

- Powder

- Capsule

- Oil

By Application

- Pharmaceutical

- Personal Care Products

- Others

Emerging Trends

Rising Demand for Natural and Organic Products Drives Growth in the Basil Extract Market

The global basil extract market is experiencing significant growth, driven by increasing consumer preference for natural and organic products. As consumers become more health-conscious and seek cleaner, more transparent ingredient labels, basil extract has emerged as a favored choice across various industries, including food and beverages, pharmaceuticals, and personal care.

The food and beverage industry is a major contributor to this growth. Basil extract is increasingly used as a natural flavoring agent and preservative in products like sauces, dressings, and beverages. The clean-label movement, where consumers prefer products with simple, recognizable ingredients, has further propelled the demand for basil extract. Additionally, the rise of functional foods and beverages, which offer health benefits beyond basic nutrition, has created new opportunities for basil extract applications.

The personal care industry is also witnessing a surge in the use of basil extract. Its antimicrobial and anti-inflammatory properties make it an ideal ingredient in skincare and haircare products. Consumers’ preference for natural and organic personal care products has driven manufacturers to include basil extract in their offerings, catering to the demand for clean and effective beauty solutions.

Government initiatives play a crucial role in supporting the growth of the basil extract market. In India, the government’s promotion of organic farming through schemes like the National Mission on Agricultural Extension and Technology (NMAET) has encouraged the cultivation of basil and other herbs. These initiatives aim to enhance the production of organic basil, ensuring a steady supply for the growing market.

Drivers

Growing Demand for Natural and Plant-Based Ingredients Drives the Basil Extract Market

The increasing consumer preference for natural and plant-based ingredients in food and beverages has significantly contributed to the growth of the basil extract market. As consumers become more health-conscious, they are shifting away from synthetic additives and preservatives, seeking products that offer natural and holistic benefits. This trend is particularly prominent in the food, personal care, and wellness sectors, where basil extract is being recognized for its antioxidant, anti-inflammatory, and antimicrobial properties.

According to the U.S. Food and Drug Administration (FDA), the demand for plant-based and natural ingredients is growing rapidly, as consumers increasingly seek healthier options that align with wellness trends. The natural ingredients market has been expanding due to growing concerns over synthetic chemicals in processed foods, which has led to an increase in demand for natural herbs and spices like basil.

Government initiatives also play a key role in promoting the use of natural ingredients like basil in food products. For instance, the European Union’s Green Deal and the Farm to Fork Strategy have aimed to encourage sustainable agriculture and the use of plant-based and organic ingredients in food production. The USDA also supports the use of natural herbs through various programs aimed at promoting organic farming, which includes basil as a key herb for crop diversification. These initiatives provide farmers and food manufacturers with incentives to incorporate more natural herbs and botanicals into their products.

Restraints

Supply Chain Disruptions and High Production Costs Restrain the Basil Extract Market

One of the major restraining factors affecting the growth of the basil extract market is the volatility in supply chains and the high production costs associated with sourcing and processing basil. The herb, while widely used across food, beverage, and personal care industries, is heavily dependent on agricultural conditions, and disruptions in the supply chain can significantly impact availability and pricing.

In recent years, the agricultural sector has faced challenges that have led to fluctuations in the cost and availability of many herbs, including basil. According to the Food and Agriculture Organization (FAO), adverse weather conditions such as droughts and floods have caused a reduction in the overall yield of basil in key producing countries like India, Egypt, and Thailand.

This disruption in production can lead to increased prices for basil raw materials, directly impacting manufacturers and product prices in downstream industries. For instance, in 2021, global agricultural commodity prices saw a significant increase due to supply chain constraints, with herb prices, including basil, experiencing a notable spike.

Additionally, the production of basil extract involves complex processing that requires specialized equipment and techniques, which adds to the overall cost. Extracting basil’s beneficial compounds, such as antioxidants and essential oils, requires a controlled and precise method, which can be energy-intensive. This high processing cost, combined with the fluctuating prices of raw materials, increases the price of basil extract, which can limit its use in price-sensitive markets. Many small and medium-sized companies find it difficult to absorb these costs, which could lead to lower profitability or even push them out of the market.

Opportunity

Government Initiatives and Support for Basil Extract Market Growth

The global shift toward natural and organic ingredients in food and personal care products has opened up significant growth opportunities for basil extract. Governments worldwide are implementing policies and programs that not only promote the use of such ingredients but also support their sustainable production and market expansion.

In the United States, the Department of Agriculture (USDA) has introduced the Organic Market Development Grant (OMDG) Program, allocating up to $75 million in competitive grants. These funds are aimed at expanding and improving markets for domestically produced organic products, including herbs like basil. This initiative is designed to support business entities, non-profit organizations, and government entities involved in organic agriculture, thereby enhancing the availability and market reach of organic basil extract.

Similarly, in India, the government has established the “India Organic” certification mark through the Agricultural and Processed Food Products Export Development Authority (APEDA). This certification ensures that products, such as basil extract, meet national organic standards, which include the prohibition of chemical fertilizers, pesticides, and hormones. By promoting organic farming practices, the certification aims to increase consumer trust and demand for organic basil products .

Regional Insights

APAC leads with 48.90 % share, driving USD 0.5 billion in basil extract sales

Asia‑Pacific (APAC) firmly stands as the leading region in the global basil extract market, accounting for 48.90 % of total regional revenue—translating to approximately USD 0.5 billion in 2024. This dominant performance is fueled by APAC’s long-standing culinary traditions and a deep-rooted trust in herbal wellness, with major markets like India and China at the forefront.

Moreover, APAC’s market leadership is being reinforced by rising disposable incomes, growing interest in botanical health solutions, and expanding export capabilities. Businesses in the region are capitalizing on both domestic demand and international flows, as they refine extraction techniques and forge partnerships across sectors—from food and beverage to pharmaceuticals and cosmetics.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1990 in Aluva, Kerala, Arjuna Natural Extracts is a leading Indian manufacturer of standardized botanical extracts. It services over 60 countries with clinically backed ingredients, supported by more than 120 international patents and 150 published clinical studies. The company specializes in plant-based actives—like turmeric, amla, green tea, and more—and is known for combining deep herbal research with global quality standards.

IFF, a global specialty chemicals and flavoring giant, operates in over 44 countries with 150 manufacturing, creative, and application centers—bringing robust R&D, fragrance, and botanical expertise to markets worldwide. While not exclusively a basil-extract maker, IFF creates basil-based flavors and aromas within its expansive portfolio, pairing science with sensory innovation to support food, beverage, and wellness brands globally.

Mountain Rose Herbs, based in Eugene, Oregon, is a trusted grower, processor, and retailer of over 1,500 botanical items, including holy basil tinctures. Known for sustainability, organic certification, and fair-trade ethics, the company specializes in small-batch tinctures and extracts using organic alcohol. Their transparent, handcrafted approach appeals to ethically minded consumers seeking nature-first herbal products.

Top Key Players Outlook

- Amoretti

- Arjuna Natural Pvt. Ltd.

- International Flavors & Fragrances Inc

- Kefiplant

- Mountain Rose Herbs

- Nature’s Answer

- NOW Foods

- Nutra Green Biotechnology Co., Ltd.

- OliveNation

- Synthite Industries Ltd

Recent Industry Developments

In 2024, Amoretti—best known for its intensely flavored, water- and oil-soluble basil extracts—reported estimated annual revenues of USD 61.5 million and maintained a workforce of 159 employees.

In 2024, Arjuna Natural—one of India’s foremost botanical extract manufacturers—reported a global turnover exceeding ₹500 crore, with aspirations to reach ₹600 crore in FY 2024–25.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 1.6 Bn CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Powder, Capsule, Oil), By Application (Pharmaceutical, Personal Care Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amoretti, Arjuna Natural Pvt. Ltd., International Flavors & Fragrances Inc, Kefiplant, Mountain Rose Herbs, Nature’s Answer, NOW Foods, Nutra Green Biotechnology Co., Ltd., OliveNation, Synthite Industries Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amoretti

- Arjuna Natural Pvt. Ltd.

- International Flavors & Fragrances Inc

- Kefiplant

- Mountain Rose Herbs

- Nature's Answer

- NOW Foods

- Nutra Green Biotechnology Co., Ltd.

- OliveNation

- Synthite Industries Ltd