Global Barn Surveillance Systems Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Camera Type (Fixed Cameras, Pan-Tilt-Zoom (PTZ) Cameras, Thermal Imaging Cameras, Others), By Connectivity (Wired Systems, Wireless/Wi-Fi Systems, Cellular (4G/5G) Systems), By Application (Livestock Monitoring & Health, Security & Theft Prevention, Fire & Environmental Hazard Detection, Feed & Equipment Monitoring, Others), By End-User (Dairy Farms, Poultry Farms, Swine/Hog Farms, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173954

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Global Adoption Insights

- Operational Performance Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Camera Type

- By Connectivity

- By Application

- By End-User

- By Region

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Growth Drivers

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

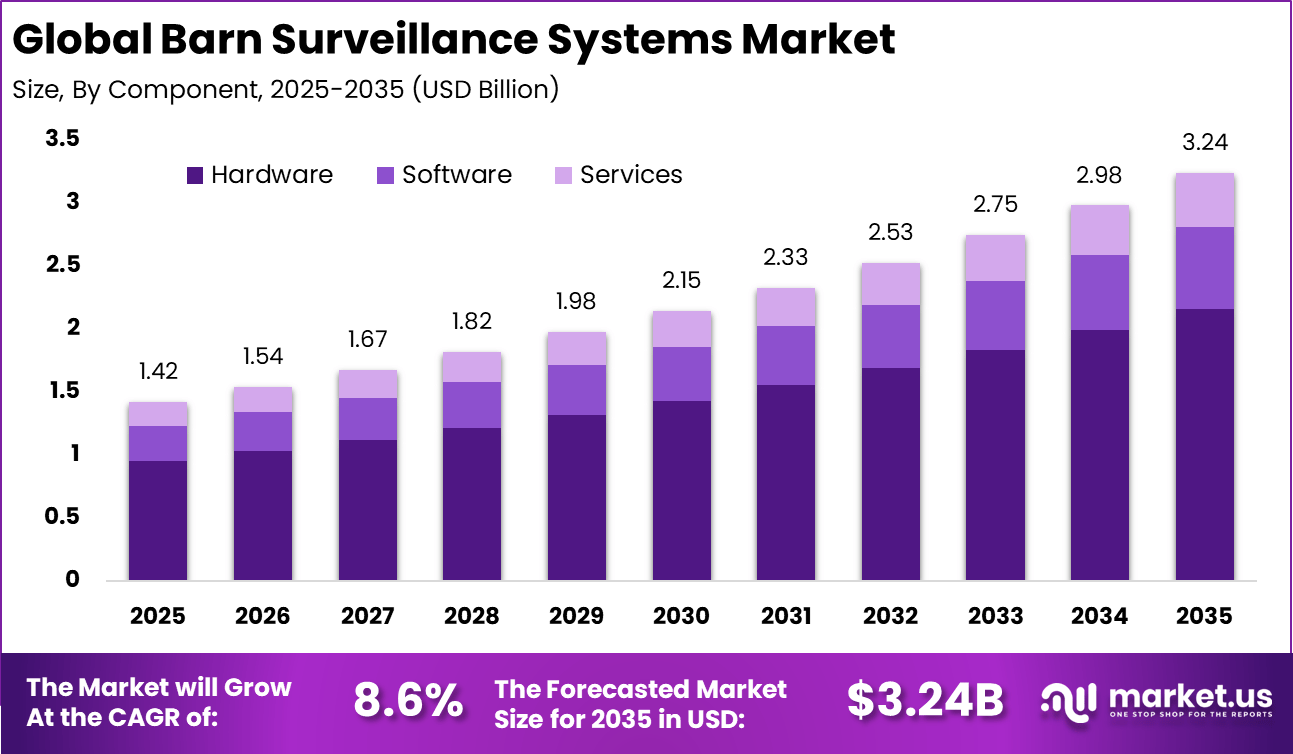

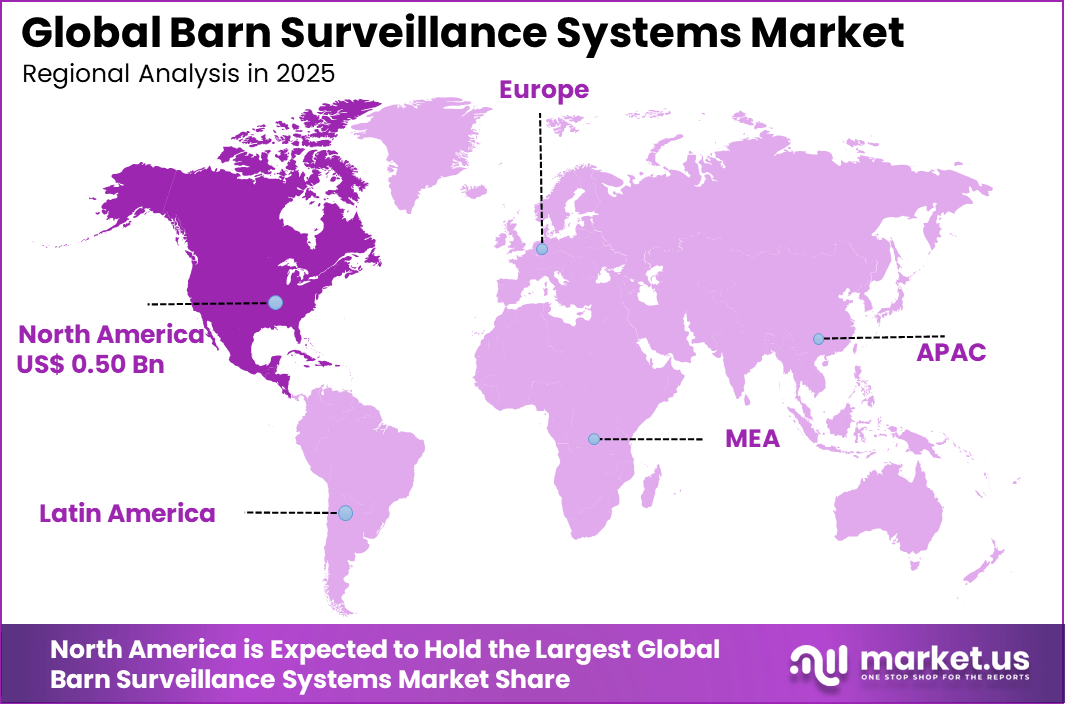

The Global Barn Surveillance Systems Market size is expected to be worth around USD 3.24 billion by 2034, from USD 1.42 billion in 2025, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.4% share, holding USD 0.50 billion in revenue.

The barn surveillance systems market refers to hardware and software solutions designed to monitor livestock, barn interiors, and agricultural assets for security, safety, and operational efficiency. These systems integrate cameras, sensors, environmental monitors, and communication networks to capture real-time video, detect motion, and alert farm managers to anomalies. Solutions include wired and wireless CCTV systems, thermal imaging units, animal behaviour analytics, and remote viewing platforms accessible via mobile and web interfaces.

One primary driver of the barn surveillance systems market is the need to enhance livestock safety and welfare. Animals can be vulnerable to illness, injury, or stress during unsupervised periods, particularly in intensive operations. Surveillance systems enable early detection of distress, unusual behaviour, or environmental hazards. This capability allows caretakers to respond quickly, reducing losses and improving animal wellbeing.

For instance, in October 2025, Bosch advanced its alarm systems with AI-powered sensors for agricultural use, integrating infrared and microwave detection to minimize false alarms in barns. Brisbane SMEs adopted these for unified security networks combining video surveillance and access control tailored to livestock environments.

Demand for barn surveillance systems is shaped by the digitalisation of agriculture and the broader adoption of smart farming practices. Precision agriculture technologies such as IoT sensors, automated feeding systems, and environmental control units are increasingly integrated with video monitoring to optimise barn conditions. Farm managers seek unified platforms that correlate animal behaviour, environmental parameters, and system alerts.

Key Takeaway

- In 2025, the hardware segment dominated with a 66.8% share, indicating strong demand for cameras, sensors, and monitoring devices that form the core of barn surveillance infrastructure.

- The fixed camera segment held a leading 58.4% share, reflecting preference for permanently installed systems that provide continuous and stable coverage of livestock areas.

- Wireless and Wi Fi based systems captured a 52.7% share, supported by easier installation, flexible scalability, and reduced cabling requirements across large farm facilities.

- Livestock monitoring and health applications accounted for 38.3% share, highlighting growing focus on animal welfare, early disease detection, and productivity optimization.

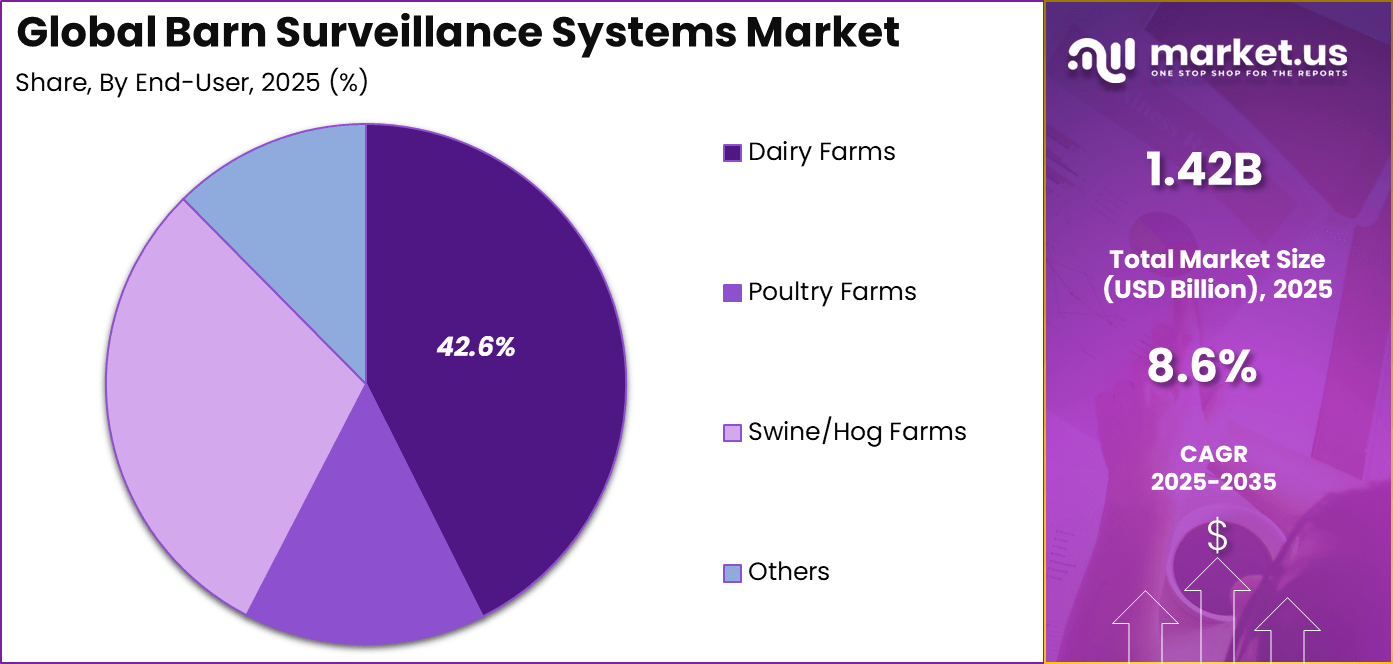

- Dairy farms represented the largest end user group with a 42.6% share, driven by the need for constant herd monitoring, milking process oversight, and compliance with animal health standards.

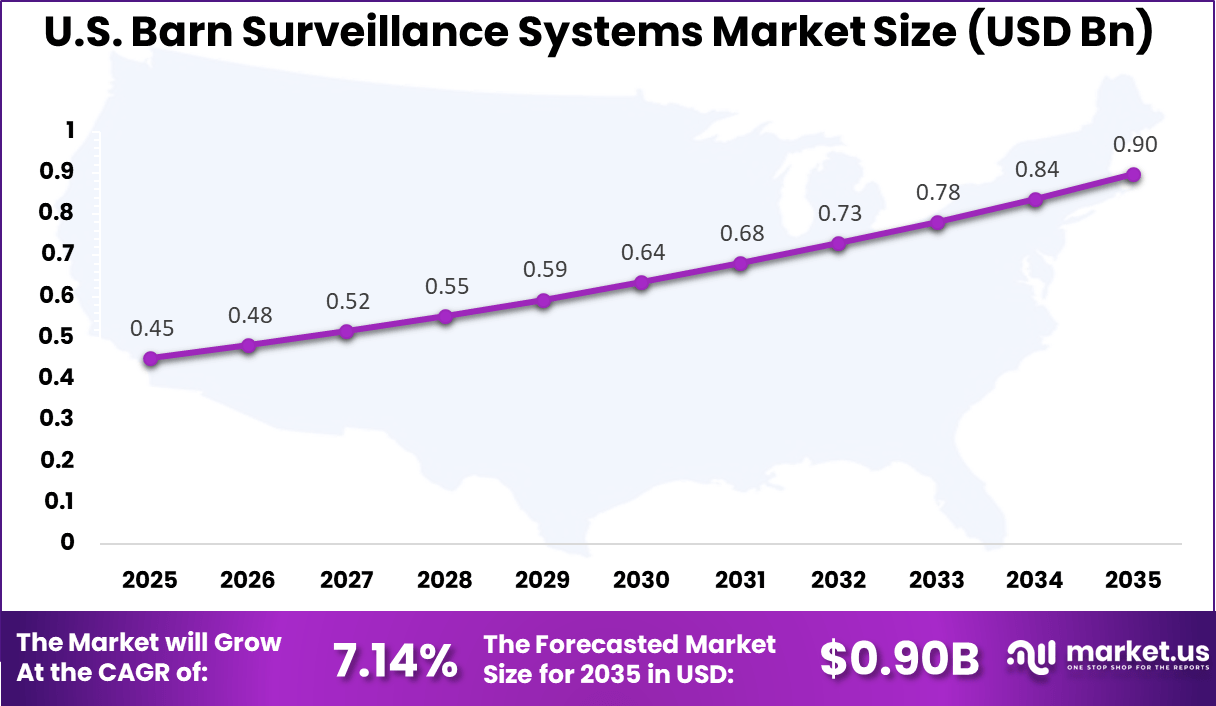

- The U.S. market reached USD 0.45 billion in 2025, expanding at a steady 7.14% growth rate, supported by modernization of agricultural practices and increased adoption of smart farming technologies.

- North America maintained regional leadership with more than a 35.4% share in 2025, backed by advanced farm infrastructure, higher technology adoption, and strong investment in livestock monitoring solutions.

Global Adoption Insights

- Adoption of barn surveillance systems varied widely across regions and livestock types, even as broader smart farming technologies reached about 62% penetration among modernized farms. This indicates uneven transition from general digital tools to dedicated camera based livestock monitoring.

- In dairy and beef operations, only around 17% of farmers used barn cameras specifically for livestock observation. Adoption remained selective, often limited to larger or more technology ready farms.

- Poultry farming showed substantially higher uptake, as 41% of laying hen operations and 47% of broiler farms relied on smartphones for barn monitoring. High stocking density and continuous monitoring needs supported faster adoption.

- Specialized livestock segments, such as suckler cow and meat sheep farming, recorded lower adoption levels at roughly 5% to 10%. Cost sensitivity and outdoor grazing models limited the immediate value of fixed surveillance systems.

- High tech integration strongly influenced adoption, as 58% of farms using automatic milking systems also deployed barn cameras. This reflects a clear link between existing automation and willingness to invest in advanced monitoring solutions.

Operational Performance Statistics

- Labor efficiency improved significantly, as users of cellular surveillance systems reported up to 60% reduction in manual monitoring labor. This shift allowed farm staff to focus on animal care and operational tasks rather than constant visual supervision.

- Crime deterrence benefits were notable, with surveillance deployment associated with crime reduction levels of 50% or more. Continuous monitoring and visible camera presence contributed to lower theft and unauthorized access incidents.

- Tracking accuracy remained high for core livestock monitoring functions. Advanced systems achieved about 96% accuracy in cattle re identification and close to 90% accuracy in movement tracking, supporting reliable herd management.

- Biosecurity compliance monitoring showed more moderate performance, with accuracy levels ranging between 36% and 53% for tasks such as hand washing and hygiene compliance. This highlights an area for further system refinement and sensor integration.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of precision livestock farming Continuous monitoring of animal health and behavior ~2.6% North America, Europe Short Term Rising labor shortages Automation to reduce manual barn supervision ~2.1% North America Short Term Increasing focus on animal welfare Compliance with welfare and safety standards ~1.7% Europe, North America Mid Term Adoption of IoT in agriculture Real time data capture and alerts ~1.3% Global Mid Term Expansion of large scale dairy operations Higher need for centralized monitoring ~0.9% North America, Asia Pacific Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High upfront system cost Capital intensive hardware installations ~2.4% Emerging Markets Short Term Connectivity limitations Rural network infrastructure constraints ~2.0% Global Short to Mid Term Data privacy concerns Surveillance of farm operations ~1.6% North America, Europe Mid Term Equipment maintenance needs Sensor calibration and replacements ~1.3% Global Mid Term Technology adoption resistance Traditional farming practices ~1.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Limited awareness Underestimation of surveillance benefits ~2.7% Emerging Markets Short Term Budget constraints Smaller farms delaying investment ~2.2% Global Short to Mid Term Integration complexity Compatibility with existing farm systems ~1.8% Global Mid Term Power supply issues Dependence on stable electricity ~1.3% Emerging Markets Long Term Lack of technical skills Limited on site expertise ~1.0% Global Long Term By Component

Hardware accounts for 66.8%, indicating its central role in barn surveillance systems. Components like cameras, sensors, and monitoring devices ensure effective security and monitoring. These systems provide real-time data on barn conditions and animal behavior. Hardware solutions are crucial for maintaining reliable surveillance. They offer high durability for harsh environmental conditions.

The dominance of hardware is driven by the need for stable, long-term equipment in barns. Surveillance systems must withstand varying weather and temperature conditions. Hardware components support consistent monitoring over extended periods. Integrating hardware with software systems improves functionality. This keeps hardware as the primary component in surveillance setups.

For Instance, in May 2025, Hikvision rolled out rugged hardware cameras for poultry sheds at Woodhouse Field Farm, featuring Wi-Fi-enabled sensors built for constant monitoring of bird welfare and feeding. The durable components handle farm dust and humidity, giving farmers clear footage around the clock.

By Camera Type

Fixed cameras hold 58.4% of the market, making them the preferred camera type for barn surveillance. These cameras are installed at strategic locations for continuous monitoring of livestock and barn areas. Fixed cameras provide stable, high-resolution imagery. Their ability to cover fixed angles ensures comprehensive surveillance. They require less maintenance compared to rotating systems.

The widespread use of fixed cameras is driven by their simplicity and effectiveness. They are easy to install and offer consistent performance. Fixed cameras also support cost-effective solutions for barn operators. With proper positioning, they cover critical areas efficiently. This keeps fixed cameras in high demand.

For instance, in December 2024, Axis launched fixed network cameras integrated with radar for perimeter security at solar farms, adaptable for fixed barn views to track livestock without movement. These stationary units provide sharp, reliable imaging in fixed positions for key areas like stalls.

By Connectivity

Wireless/Wi-Fi systems represent 52.7%, showing strong preference for remote monitoring solutions. These systems allow barn owners to access surveillance footage from anywhere, improving convenience. Wi-Fi connectivity supports seamless data transfer to mobile devices and cloud storage. Wireless systems reduce the need for extensive wiring, simplifying installation. They are highly flexible and scalable.

Adoption of wireless systems is driven by the need for flexible and easy-to-install solutions. Wireless cameras can be placed in locations without requiring additional wiring infrastructure. They also allow for real-time monitoring on mobile devices. Wireless technology supports multi-device access, improving usability. This sustains the demand for wireless and Wi-Fi-enabled systems.

For Instance, in July 2025, Reolink introduced wireless 4G farm security cameras for rural barns, allowing remote livestock checks without Wi-Fi infrastructure. Solar-powered and weatherproof, they send instant alerts on animal activity via mobile apps.

By Application

Livestock monitoring and health account for 38.3%, making it a key application of barn surveillance systems. These systems track animal behavior, movement, and health parameters. Early detection of health issues helps improve herd management. Surveillance also supports feeding patterns and environmental conditions. Timely intervention improves overall productivity.

Growth in this application is driven by the need for improved animal welfare and farm efficiency. Monitoring helps prevent disease spread and supports proactive health management. Barn surveillance systems contribute to informed decision-making. Data from surveillance systems can be integrated into farm management tools. This keeps livestock monitoring central to adoption.

For Instance, in December 2024, Hikvision partnered with AIHerd, using 360° fixed cameras every 15 meters in barns for full livestock coverage and health alerts on issues like pathologies. Farmers get video links to specific animals for quick checks on well-being.

By End-User

Dairy farms represent 42.6%, making them the largest end-user group. Dairy operations require continuous monitoring of livestock and barn environments. Surveillance systems help ensure cow health and optimize milk production. Monitoring also assists with detecting behavioral changes in dairy cows. This improves animal welfare and farm productivity.

The strong adoption in dairy farms is driven by the need to maintain high standards of hygiene and health. Surveillance systems help monitor temperature, feeding, and movement, ensuring optimal conditions. Effective monitoring reduces labor costs and improves operational efficiency. Dairy farmers increasingly rely on technology for better management. This sustains the demand from dairy farms.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Dairy farms Animal behavior and health monitoring 42.6% Advanced Poultry farms Flock surveillance and safety 21.8% Developing Swine farms Environmental and movement monitoring 18.4% Developing Equine facilities Security and animal observation 10.2% Developing Mixed livestock farms General barn monitoring 7.0% Early For Instance, in November 2025, Dahua deployed fixed solar-powered 4G cameras for remote dairy farm monitoring in Australia, detecting intrusions and health anomalies in herds. The system supports dairy operations with easy installs and real-time data for calving oversight.

By Region

North America accounts for 35.4%, supported by a well-developed agricultural technology ecosystem. The region has a high rate of farm technology adoption. Barn surveillance systems are widely used to improve livestock care and barn security. Technological innovation drives market growth. The region remains a key market.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Large scale dairy farm automation 35.4% USD 0.50 Bn Advanced Europe Animal welfare regulations 27.9% USD 0.40 Bn Advanced Asia Pacific Modernization of livestock farms 23.6% USD 0.34 Bn Developing Latin America Commercial dairy expansion 7.1% USD 0.10 Bn Developing Middle East and Africa Early smart farming initiatives 6.0% USD 0.09 Bn Early For instance, in June 2025, Honeywell’s Community Intelligence report noted rising ransomware threats in agriculture alongside surging attacks, emphasizing the need for advanced security systems. This highlights Honeywell’s role in protecting farm operations, including barn surveillance, reinforcing North America’s focus on cybersecurity-integrated monitoring.

The United States reached USD 0.45 Billion with a CAGR of 7.14%, reflecting steady expansion. Adoption is driven by the growth of large-scale dairy and livestock farms. The emphasis on improving animal welfare and farm efficiency supports demand. Farmers continue to invest in advanced monitoring systems. Market growth remains stable.

For instance, in December 2025, Arlo launched new AI-powered security cameras with pan-tilt functionality and Automatic Motion Tracking, offering 360-degree coverage suitable for barn monitoring. The cameras feature advanced Arlo Intelligence for object recognition and privacy controls, strengthening U.S. dominance in smart surveillance systems adaptable to livestock and farm security needs.

Investment Opportunities

Investment opportunities in the barn surveillance systems market exist in platforms that integrate video monitoring with farm management and analytics systems. Solutions that correlate environmental sensor data, animal behaviour metrics, and video insights into unified dashboards offer strong value to large operations. Investors may focus on cloud based and modular technologies that scale with farm size and connect across distributed sites.

Another opportunity lies in AI assisted analytics and predictive monitoring capabilities. Software that can detect early signs of animal distress, equipment failure, or biosecurity threats enhances system differentiation. Investors may also explore partnerships with agricultural IoT providers and veterinary technology firms to deliver holistic animal care platforms. These advanced features support premium pricing and deeper adoption.

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Dairy farm operators Very High ~42.6% Animal health and productivity Long term system deployment Large livestock producers High ~24% Operational efficiency Phased investment Agritech solution providers High ~16% Integrated farm platforms Technology driven Cooperative farms Moderate ~11% Shared monitoring infrastructure Group purchasing Small independent farms Low to Moderate ~6% Cost sensitive adoption Selective usage Business Benefits

Adoption of barn surveillance systems improves animal welfare outcomes by enabling early intervention when issues arise. Timely detection of illness, injury, or stress reduces mortality and supports higher productivity. This positive impact on animal health contributes to operational performance and product quality.

Surveillance also enhances farm security and risk management. Monitoring systems deter theft, vandalism, and trespassing while reducing potential losses. Clear documentation supports insurance claims and compliance with safety standards. These risk mitigation benefits strengthen farm resilience.

Regulatory Environment

The regulatory environment for the barn surveillance systems market includes animal welfare and facility safety standards that vary by region and agricultural sector. Many jurisdictions require documentation of animal care practices and facility conditions for certifications and food safety audits. Surveillance systems can support compliance with these mandates by providing objective records.

Data protection and privacy regulations also influence system deployment, particularly when video monitoring captures employee or visitor images. Farm operators must adhere to local laws regarding video recording consent, data storage, and access controls. Regulatory alignment builds trust and reduces legal exposure for farms implementing surveillance technologies.

Growth Drivers

A central driver of expansion in the barn surveillance systems market is the increasing necessity for real-time livestock monitoring to maintain animal welfare and operational oversight. Farmers are utilising surveillance solutions to detect behavioural anomalies, monitor feeding and movement patterns, and ensure optimal environmental conditions.

These capabilities contribute to improved animal health outcomes and can reduce the need for manual on-site checks. The resulting improvements in productivity and cost savings encourage further investment in surveillance technology. Another significant growth factor is the rising need for asset protection and biosecurity compliance within agricultural operations.

Incidents of equipment theft, infrastructure damage, and disease outbreaks have underscored the importance of secure, continuous monitoring systems. Integration with IoT devices and AI-driven analytics enhances proactive detection of threats and anomalies. This has led to a preference for comprehensive solutions that combine video surveillance, environmental sensing, and automated alerts.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Camera Type

- Fixed Cameras

- Pan-Tilt-Zoom (PTZ) Cameras

- Thermal Imaging Cameras

- Others

By Connectivity

- Wired Systems

- Wireless/Wi-Fi Systems

- Cellular (4G/5G) Systems

By Application

- Livestock Monitoring & Health

- Security & Theft Prevention

- Fire & Environmental Hazard Detection

- Feed & Equipment Monitoring

- Others

By End-User

- Dairy Farms

- Poultry Farms

- Swine/Hog Farms

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Barn Surveillance Systems Market is shaped by established video security leaders such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Inc., and Honeywell International, Inc.. These players focus on high resolution cameras, advanced analytics, and reliable hardware performance. Their portfolios are often extended to outdoor and low light environments.

Mid tier and emerging security providers are strengthening competition through smart home and flexible surveillance offerings. Companies such as Hanwha Vision Co., Ltd., Vivint Smart Home, Inc., SimpliSafe, Inc., Arlo Technologies, Inc., and Lorex Technology, Inc. emphasize ease of installation and cloud connectivity. Their solutions appeal to small and mid sized farms. Subscription based monitoring and mobile alerts enhance adoption.

Technology focused and agriculture specific players add differentiated value to the market. Firms including Reolink Digital Technology Co., Ltd., Uniview Technologies Co., Ltd., AgriWebb, Inc., and HerdDogg, Inc. integrate surveillance with livestock data insights. These systems support health tracking and operational efficiency. Analytics driven platforms enable proactive farm management.

Top Key Players in the Market

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Axis Communications AB

- Bosch Security Systems, Inc.

- Honeywell International, Inc.

- Hanwha Vision Co., Ltd.

- Vivint Smart Home, Inc.

- SimpliSafe, Inc.

- Arlo Technologies, Inc.

- Lorex Technology, Inc.

- Reolink Digital Technology Co., Ltd.

- Uniview Technologies Co., Ltd.

- AgriWebb, Inc.

- HerdDogg, Inc.

- Others

Recent Developments

- In September 2025, Dahua launched the WITHS wireless camera series at IFA Berlin, featuring AI human/pet detection, auto-tracking, and solar-powered options ideal for remote barns. The Apollo Series supports off-grid agricultural monitoring with 4G connectivity, addressing surveillance challenges in livestock facilities without power infrastructure.

- In February 2025, Hikvision released Pro Series Network Cameras with ColorVu 3.0 technology, delivering full-color imaging in low-light conditions perfect for 24/7 barn surveillance. These cameras enhance livestock monitoring by capturing clear footage of animal behavior and facility security overnight.

Report Scope

Report Features Description Market Value (2025) USD 1.4 Bn Forecast Revenue (2035) USD 3.2 Bn CAGR(2025-2035) 8.6% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Camera Type (Fixed Cameras, Pan-Tilt-Zoom (PTZ) Cameras, Thermal Imaging Cameras, Others), By Connectivity (Wired Systems, Wireless/Wi-Fi Systems, Cellular (4G/5G) Systems), By Application (Livestock Monitoring & Health, Security & Theft Prevention, Fire & Environmental Hazard Detection, Feed & Equipment Monitoring, Others), By End-User (Dairy Farms, Poultry Farms, Swine/Hog Farms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Inc., Honeywell International, Inc., Hanwha Vision Co., Ltd., Vivint Smart Home, Inc., SimpliSafe, Inc., Arlo Technologies, Inc., Lorex Technology, Inc., Reolink Digital Technology Co., Ltd., Uniview Technologies Co., Ltd., AgriWebb, Inc., HerdDogg, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Barn Surveillance Systems MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Barn Surveillance Systems MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Axis Communications AB

- Bosch Security Systems, Inc.

- Honeywell International, Inc.

- Hanwha Vision Co., Ltd.

- Vivint Smart Home, Inc.

- SimpliSafe, Inc.

- Arlo Technologies, Inc.

- Lorex Technology, Inc.

- Reolink Digital Technology Co., Ltd.

- Uniview Technologies Co., Ltd.

- AgriWebb, Inc.

- HerdDogg, Inc.

- Others