Global Bank Statement Aggregation Market By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Application (Personal Finance Management, Business Finance Management, Credit Assessment, Fraud Detection, Others), By End-User (Banks, Financial Institutions, Fintech Companies, Enterprises, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169796

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Increasing Adoption Technologies

- By Component

- By Deployment Mode

- By Application

- By End-User

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

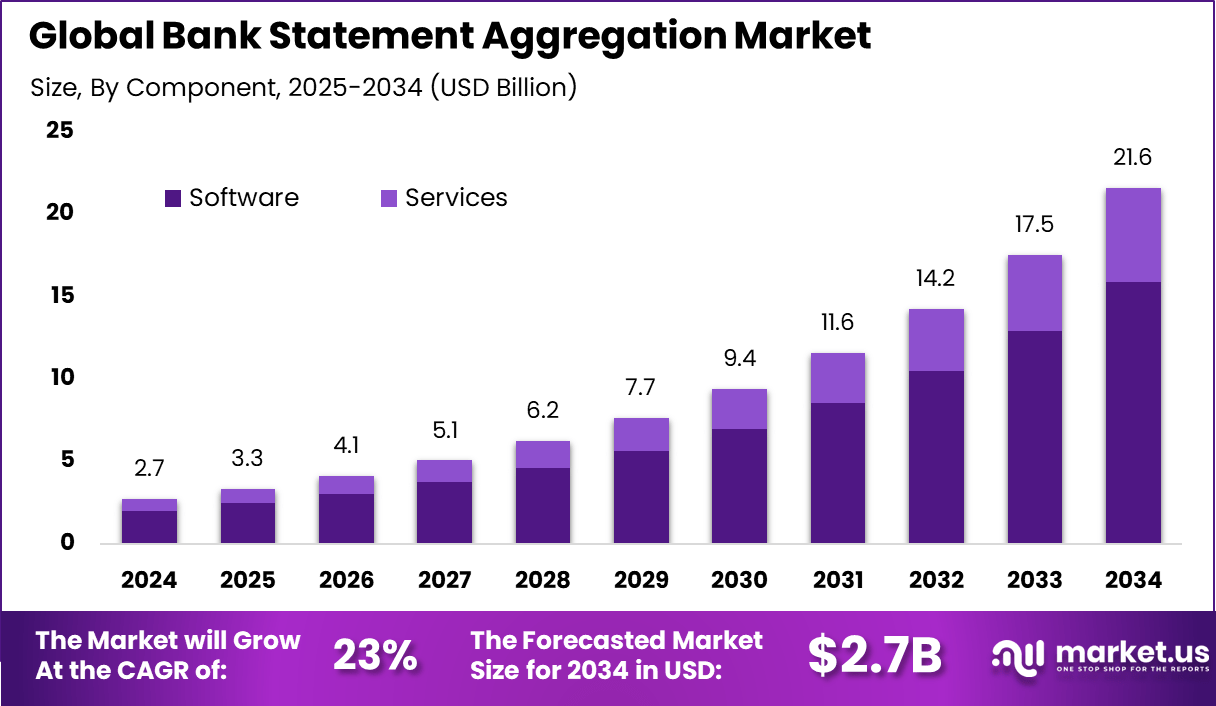

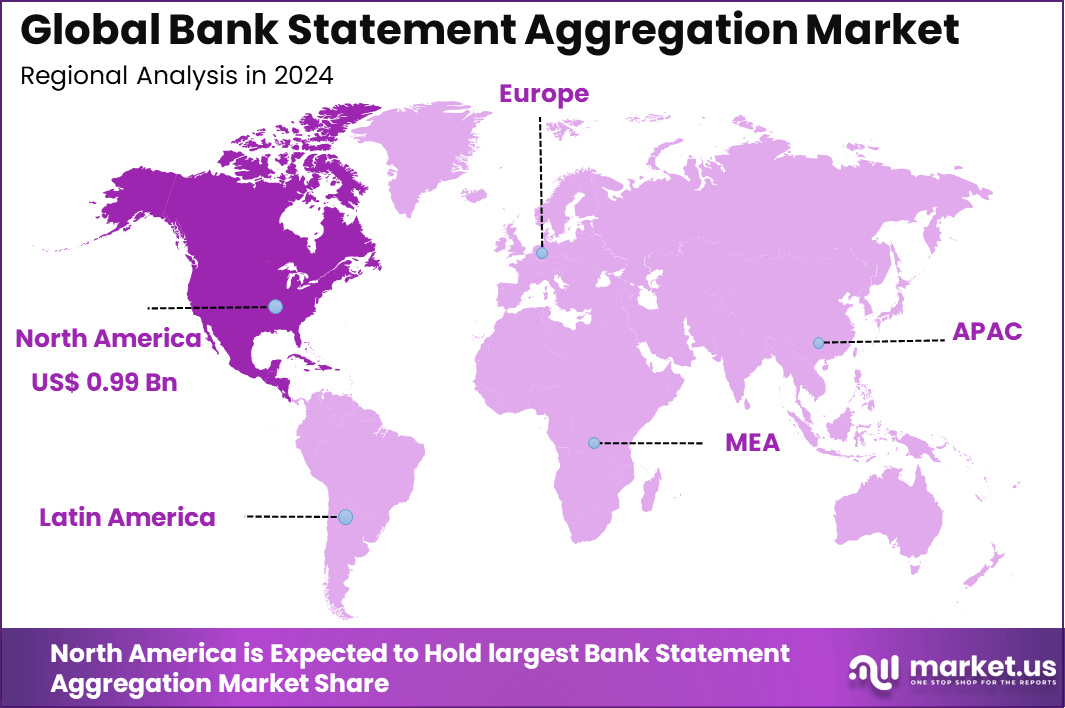

The Global Bank Statement Aggregation Market generated USD 2.7 billion in 2024 and is predicted to register growth from USD 3.3 billion in 2025 to about USD 21.6 billion by 2034, recording a CAGR of 23% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.4% share, holding USD 0.99 Billion revenue.

Bank statement aggregation refers to the process of automatically collecting financial records from multiple bank accounts and other financial sources to present a unified view of an individual’s or business’s financial data. This process typically uses secure application programming interfaces (APIs) and data integration tools to unify transaction histories, balances, cash flows, and other financial information into a single platform.

The core objective is to enhance financial visibility, reduce manual data handling, and support informed decision making in banking and financial services. growth in digital banking adoption and the expansion of open banking policies have significantly advanced the bank statement aggregation market. Financial service providers and fintech platforms increasingly require real-time access to consolidated financial data to deliver better customer experiences and more accurate insights.

Based on India’s AA ecosystem recorded strong expansion, crossing 100 million successful consents by August 2024, rising from 5.5 million to 63.75 million requests. More than 223 million users had linked accounts, enabling 2.61 billion financial accounts across the network. Over USD 10 billion in loans were issued using AA-based data in 2024, with nearly half disbursed between April and September.

The rise in demand for seamless financial data integration stems from both consumer expectations for control over financial information and institutional needs for improved credit assessment and fraud detection. Regulatory initiatives in multiple regions promoting consent-based data sharing further support market momentum. Demand for bank statement aggregation solutions is strong among banks, fintech firms, and enterprises seeking unified financial data views.

Consumers with multiple accounts and financial products prefer aggregation tools that provide consolidated transaction histories, budgeting insights, and automated reconciliation. Financial institutions leverage aggregated data for personalized product offerings, improved risk evaluation, and enhanced operational efficiency. The demand trend reflects a broader shift toward data-driven financial services where consolidated data is critical for competitive differentiation.

Top Market Takeaways

- By component, software held 73.7% of the bank statement aggregation market, fueled by demand for automated data parsing and multi-account integration tools.

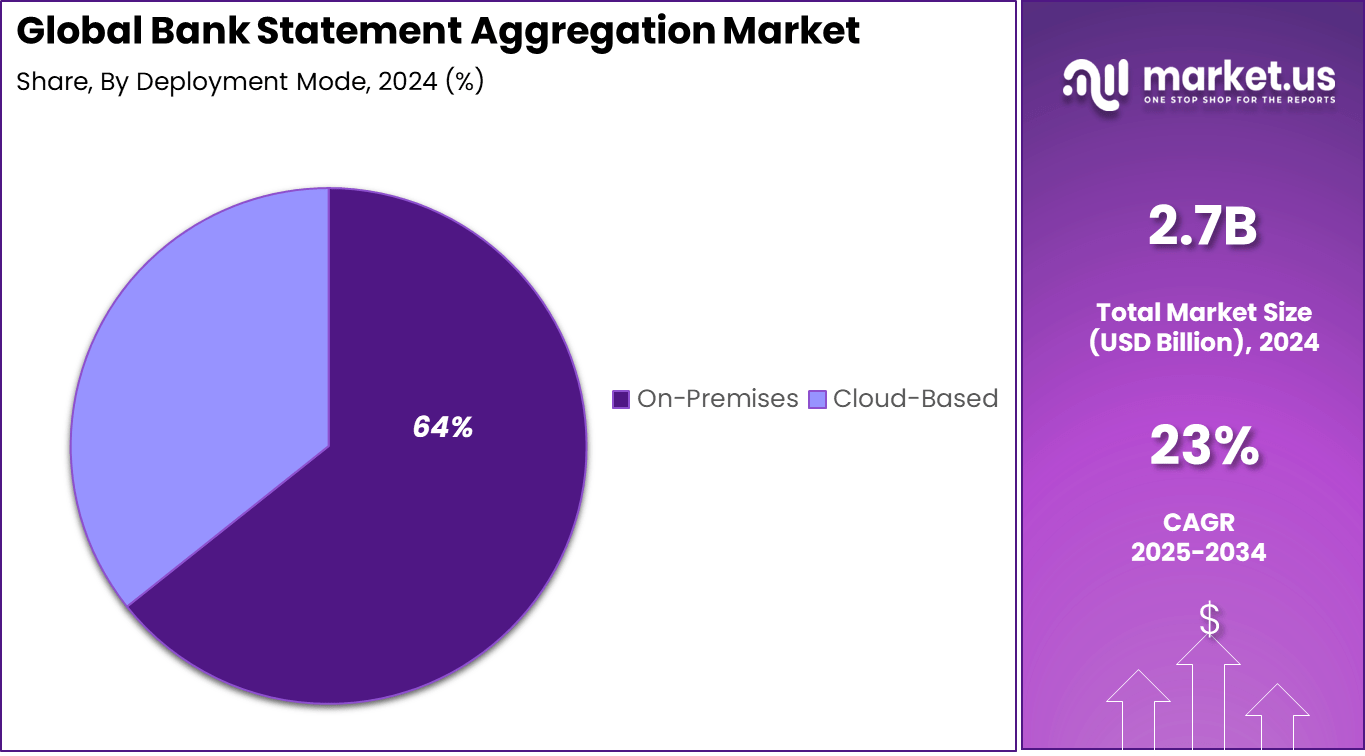

- By deployment mode, on-premises deployments captured 64.3% share, prioritizing data sovereignty and seamless legacy system compatibility in financial institutions.

- By application, personal finance management led with 35.6%, driven by consumer needs for consolidated spending insights and budgeting automation.

- By end-user, banks accounted for 36.4% of the market, leveraging aggregation for enhanced customer onboarding and credit assessment processes.

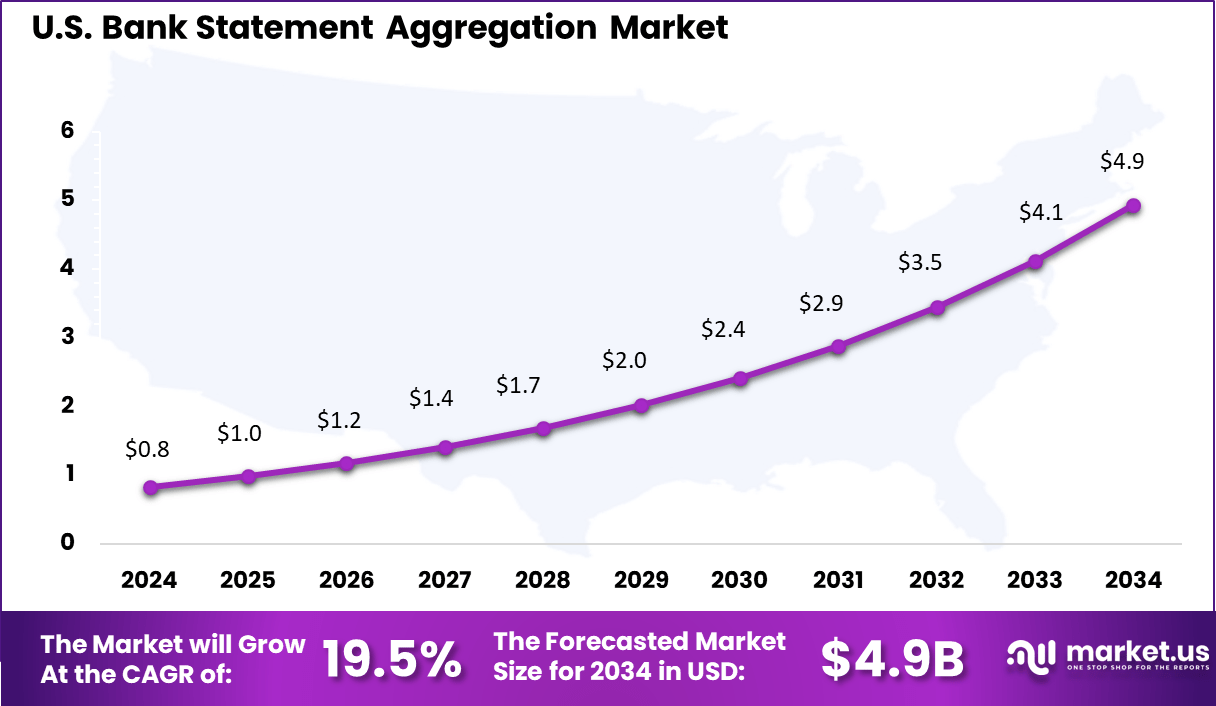

- North America represented 36.4% of the global market, with the U.S. valued at USD 0.83 billion in 2025 and projected to grow at a CAGR of 19.5%.

Increasing Adoption Technologies

Technologies enabling adoption in this market include secure API frameworks, open banking standards, and advanced data integration platforms. Open finance APIs allow financial institutions to share customer-authorized data without relying on less secure methods like screen scraping, improving stability and data access reliability.

API standardization facilitates faster integration of bank statement data into third-party platforms and supports real-time updates for analytics and decision workflows. The primary reasons for adopting bank statement aggregation systems are enhancement of financial insight, reduction of manual processes, and support for automated risk assessment.

Aggregation tools enable quicker credit evaluations by presenting a full financial picture rather than isolated account snapshots. They also improve efficiency for personal and business budgeting, helping stakeholders understand spending patterns and liquidity positions. For institutions, aggregated financial data supports compliance operations and strengthens analytics capabilities.

By Component

The software segment accounts for 73.7% of the market share, making it the most dominant component in bank statement aggregation. This strong position is driven by the rising use of digital banking platforms, mobile finance apps, and automated financial tools.

Software platforms allow users to collect and analyze transaction data from multiple bank accounts in real time, which improves visibility and financial control. Features such as automatic categorization, transaction history tracking, and spending insights continue to support high adoption. Demand is further supported by the growing need for secure API connections and compliance-ready systems.

Financial institutions depend on advanced software frameworks to ensure safe data sharing between banks and third-party platforms. Regular system upgrades, AI-powered tagging, and analytics tools also improve performance and reliability. These factors position software as the core foundation of statement aggregation solutions.

By Deployment Mode

On-premises deployment holds a 64% share of the market, mainly due to the high priority placed on data security and regulatory control by financial institutions. Banks prefer to store and process sensitive customer data within their own infrastructure to minimize cyber risks and external access. This deployment model offers direct oversight of data handling, access rights, and internal compliance systems.

Another reason for its strong demand is performance stability and control over system customization. Large banks handle high transaction volumes and require uninterrupted service availability. On-premises systems allow better integration with legacy banking platforms and internal risk management tools. These operational advantages continue to sustain demand across traditional banking institutions.

By Application

Personal finance management represents 35.6% of the application share, making it the leading use case in the market. Consumers are increasingly seeking tools that help them monitor income, expenses, savings, and debt in a single view. Bank statement aggregation enables real-time tracking across multiple financial accounts, which supports better budgeting and financial planning.

Growth in digital wallets, mobile banking apps, and consumer financial awareness has further strengthened this segment. Users now prefer automated expense summaries and real-time alerts over manual tracking. Banks and fintech firms are actively integrating personal finance tools to improve customer engagement and digital adoption. This trend continues to expand across both developed and emerging markets.

By End-User

Banks account for 36.4% of the total end-user share, making them the largest adopters of statement aggregation platforms. Banks use these tools to offer customers consolidated views of transactions, external accounts, and financial behavior. This improves transparency and helps strengthen long-term customer relationships through improved digital services.

Another growth driver is the competitive pressure from fintech platforms. To retain customers and expand digital service depth, banks are embedding aggregation tools within core banking apps. These platforms also help banks with fraud monitoring, credit assessment, and behavioral analytics. As digital transformation continues across banking operations, this segment is expected to maintain steady demand.

Key Benefits

- One dashboard shows balances, transactions, and trends from all accounts, easing daily money oversight.

- Time drops on logins and reconciliations, letting teams focus on planning over chasing statements.

- Credit checks turn instant with verified data, helping lenders approve more while dodging risks.

- Fraud flags pop early through pattern scans across linked accounts, tightening security without extra work.

- Tax or audit prep simplifies as data pulls together neatly for reports or compliance filings.

Usage

- Loan apps pull income proofs and spends from banks to run quick eligibility and risk checks.

- Personal finance tools blend accounts for budgeting, savings tips, and spending breakdowns.

- Wealth advisors view full portfolios to tailor investment picks or retirement plans.

- Businesses reconcile books against bank records across outlets to catch errors or shortfalls.

- Fraud teams monitor flows for odd patterns like sudden big pulls or mismatched trades.

Emerging Trends

Key Trend Description AI-Powered Analysis Automates pattern detection in statements for cash flow insights, fraud alerts, and spending categorization using machine learning. Consent-Based Data Sharing Secure APIs enable user-controlled data access across banks, strengthening open finance ecosystems and real-time aggregation. Open Finance Expansion Extends data aggregation beyond banking into investments and insurance to support holistic financial views and personalized services. Real-Time Aggregation Instant data integration supports dynamic credit decisions and lending workflows without delays from manual uploads. Embedded Integration Aggregation capabilities are embedded into fintech apps for seamless payments, budgeting, and loan automation. Growth Factors

Key Factors Description Open Banking Regulations Frameworks such as PSD2 and Account Aggregator systems promote secure data sharing and interoperability. Digital Lending Demand Lenders require comprehensive financial histories to improve credit assessment accuracy and MSME financing. Fintech Proliferation Partnerships create unified financial views and enable innovative services driven by aggregated data insights. Financial Inclusion Push Aggregation supports cash-flow based lending for underserved users and reduces dependence on collateral or credit scores. Data Volume Surge Rising digital payment activity increases demand for scalable tools to consolidate and analyze financial data. Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Application

- Personal Finance Management

- Business Finance Management

- Credit Assessment

- Fraud Detection

- Others

By End-User

- Banks

- Financial Institutions

- Fintech Companies

- Enterprises

- Others

Regional Analysis

North America accounts for 36.4% of the global Bank Statement Aggregation market, driven by advanced fintech ecosystems, high digital banking penetration, and demand for automated financial data consolidation among banks and consumers.

Leading providers enable seamless aggregation across multiple accounts for personal finance management, lending decisions, and compliance reporting, supported by robust API infrastructures and regulatory frameworks like open banking initiatives. The region’s mature market benefits from early adoption in wealth management and SMB lending, positioning it ahead of other geographies in innovation and scale.

The U.S. market for Bank Statement Aggregation reaches USD 0.83 billion, growing at a CAGR of 19.5%, propelled by stringent financial regulations and the need for real-time data insights in retail banking and fintech applications.

Major banks and aggregators like Plaid integrate statement data for credit underwriting, expense tracking, and fraud prevention, leveraging AI to process unstructured PDFs and transaction histories efficiently. High consumer reliance on mobile apps and digital wallets accelerates platform adoption, with the U.S. leading North America through investments in secure data pipelines.

In the United States, consumer adoption of aggregation platforms continued to rise, with 180 million users relying on these tools in 2025. Surveys show that 82% of consumers believe they own their financial data, while 78% expect a unified view of their information. Around 44% use digital tools to access a single consolidated financial view, and 29% connect multiple accounts within one app.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A primary driver is the need for quick and reliable verification of financial information. Lenders, leasing companies and financial advisors often need up to date bank statements to make risk assessments or confirm income patterns. Bank statement aggregation platforms automate this process, removing delays caused by manual uploading or incomplete information. This improves workflow efficiency for both institutions and clients.

Another driver is the growth of financial technology services. Budgeting apps, payment platforms, credit management tools and wealth management services all require consistent access to banking data. Aggregation platforms act as the central link that enables these tools to function smoothly across many banks and account types. This dependency supports ongoing demand for aggregated data services.

Restraint Analysis

A major restraint is the variation in data standards across financial institutions. Not all banks use consistent formats or support the same connectivity protocols. This lack of uniformity increases integration work for aggregation providers and may affect data accuracy. Smaller providers may struggle to maintain reliable connectivity with a wide range of institutions.

Another restraint relates to customer concerns about data sharing. Even with secure protocols, some users hesitate to grant access to banking information. Any publicized security incident within the industry can slow adoption and increase caution among new customers. Building trust through transparent data practices remains a challenge for providers.

Opportunity Analysis

There is a strong opportunity to expand aggregation services into business finance. Many small and medium enterprises manage multiple accounts across different banks. A unified platform that aggregates business statements, tracks cash flow and supports financial reporting can offer significant value. Providers who offer business specific features can tap into this growing segment.

Another opportunity lies in global expansion as cross border financial activity increases. Businesses and individuals often hold accounts in more than one country. Platforms that support multi country aggregation with local compliance features can serve a broad international user base. This creates room for growth as financial ecosystems become more interconnected.

Competitive Analysis

Plaid, Yodlee, Finicity, Tink, Salt Edge, and TrueLayer lead the bank statement aggregation market with large connectivity networks that provide secure access to transaction histories, balances, and account metadata. Their platforms support financial institutions, fintech apps, and credit platforms that require accurate and real-time banking data. These companies focus on strong API performance, consent-driven data sharing, and high regulatory compliance.

MX Technologies, Flinks, Bankin’, Nordigen, Bud Financial, Basiq, Kontomatik, Figo, and Bankable strengthen the competitive landscape with regional coverage and analytics-driven aggregation capabilities. Their solutions help lenders, personal finance apps, and risk assessment platforms derive insights from categorized transactions and enriched financial profiles. These providers emphasize affordability, transparent data governance, and easy integration for developers.

Quovo, Belvo, Codat, Moneyhub, Crealogix, and other participants expand the market with specialized aggregation for credit scoring, SMB accounting, and cross-border financial applications. Their tools focus on clean data normalization, multi-bank connectivity, and cash-flow intelligence. These companies serve emerging markets and digital lenders seeking accurate real-time data.

Top Key Players in the Market

- Plaid

- Yodlee (Envestnet)

- Finicity (Mastercard)

- Tink (Visa)

- Salt Edge

- TrueLayer

- MX Technologies

- Flinks

- Bankin’

- Nordigen (GoCardless)

- Bud Financial

- Basiq

- Kontomatik

- Figo (Finleap Connect)

- Bankable

- Quovo (Plaid)

- Belvo

- Codat

- Moneyhub

- Crealogix

- Others

Future Outlook

The Bank Statement Aggregation market is set for continued expansion as open banking, digital lending, and personal finance apps depend more on seamless access to verified account and transaction data. Banks, fintechs, and lenders will increasingly embed aggregation tools into onboarding, underwriting, and financial management journeys to cut paperwork, reduce fraud, and speed up decisions.

Regulatory focus on consent-based data sharing and secure APIs will support broader ecosystem use, while emerging markets turn to aggregation to widen credit access and deepen financial inclusion for consumers and small businesses.

Opportunities lie in

- Embedding aggregation into digital lending and BNPL workflows to improve income verification, affordability checks, and portfolio monitoring.

- Building white-label aggregation platforms for banks, fintechs, and corporates seeking unified cash, treasury, and expense visibility across multiple accounts.

- Developing advanced analytics on top of aggregated statements to power credit scoring alternatives, personalized financial advice, and early warning alerts for defaults.

Recent Developments

- September, 2025 – Plaid renewed its data access agreement with JPMorgan Chase, agreeing to pay for consumer-permissioned bank data sharing to ensure continuity amid rising bank fees on aggregators, without changing customer pricing.

- November, 2025 – FICO partnered with Plaid to launch UltraFICO Score using aggregated cash flow data from bank statements, mapping transaction patterns to traditional credit scoring for more inclusive lending decisions.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 21.6 Bn CAGR(2025-2034) 23% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Application (Personal Finance Management, Business Finance Management, Credit Assessment, Fraud Detection, Others), By End-User (Banks, Financial Institutions, Fintech Companies, Enterprises, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Plaid, Yodlee (Envestnet), Finicity (Mastercard), Tink (Visa), Salt Edge, TrueLayer, MX Technologies, Flinks, Bankin’, Nordigen (GoCardless), Bud Financial, Basiq, Kontomatik, Figo (Finleap Connect), Bankable, Quovo (Plaid), Belvo, Codat, Moneyhub, Crealogix, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bank Statement Aggregation MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Bank Statement Aggregation MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Plaid

- Yodlee (Envestnet)

- Finicity (Mastercard)

- Tink (Visa)

- Salt Edge

- TrueLayer

- MX Technologies

- Flinks

- Bankin’

- Nordigen (GoCardless)

- Bud Financial

- Basiq

- Kontomatik

- Figo (Finleap Connect)

- Bankable

- Quovo (Plaid)

- Belvo

- Codat

- Moneyhub

- Crealogix

- Others