Global Bank Fee Recovery Services Market By Service Type (Overdraft Fee Recovery, ATM Fee Recovery, Maintenance Fee Recovery, Foreign Transaction Fee Recovery, Others), By End-User (Individuals, Small and Medium Enterprises, Large Enterprises), By Channel (Online Platforms, In-Person Services, Mobile Applications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169491

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Service Type: Overdraft Fee Recovery 42.3%

- By End User: Individuals 84.5%

- By Channel: Online Platforms 41.8%

- Key Reasons for Adoption

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

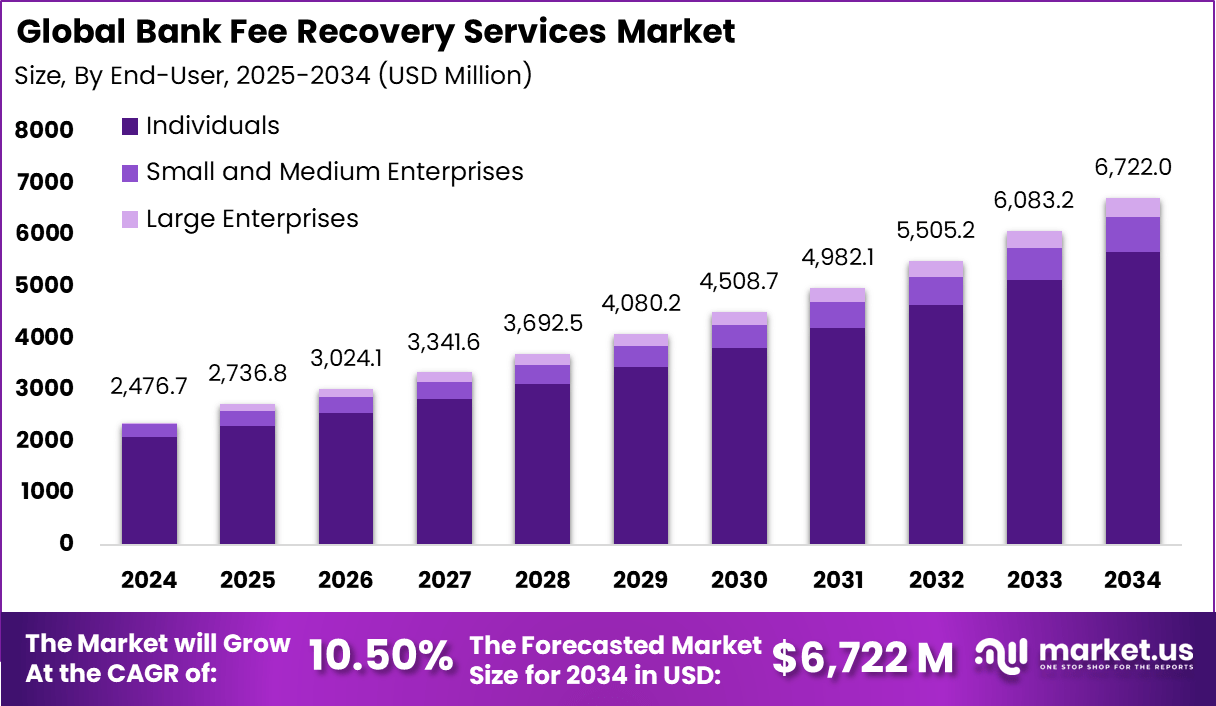

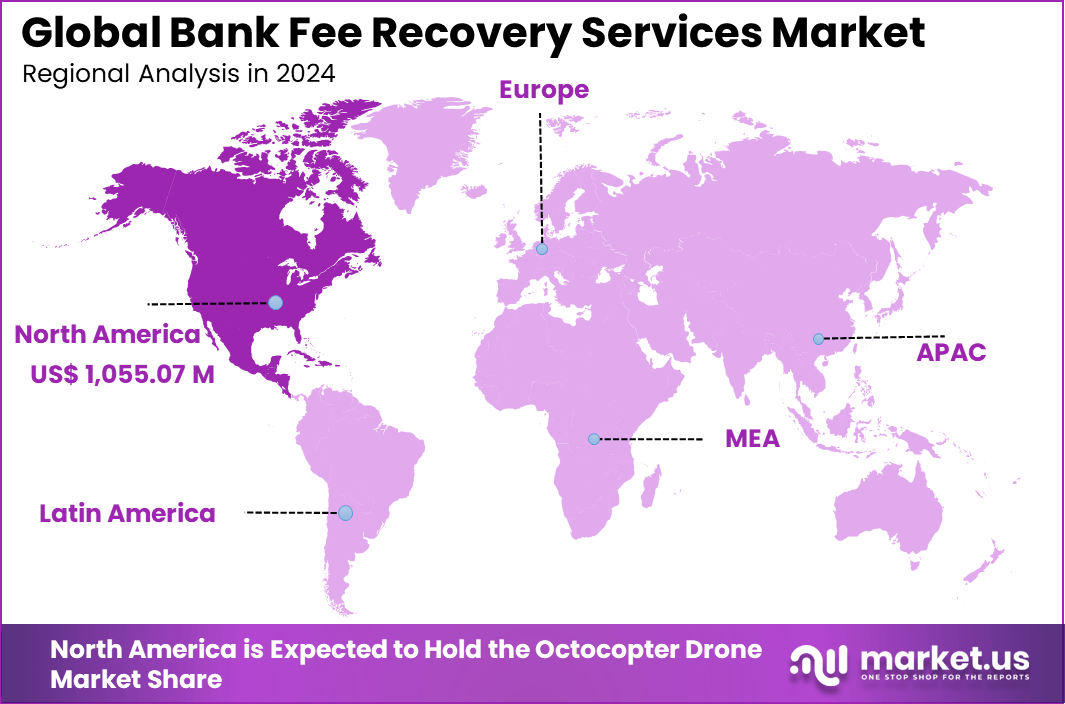

The Global Bank Fee Recovery Services Market generated USD 2,476.7 million in 2024 and is predicted to register growth from USD 2,736.8 million in 2025 to about USD 6,722.0 million by 2034, recording a CAGR of 10.50% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.6% share, holding USD 1,055.07 Million revenue.

The bank fee recovery services market has grown as banks and financial institutions focus on identifying and recovering fees that were incorrectly charged, waived in error or missed due to system gaps. Growth is linked to rising transaction volumes, complex fee structures and the need for tighter revenue control. Fee recovery services help institutions audit large data sets and restore lost non interest income across multiple product lines.

The growth of the market can be attributed to rising digital banking activity, increased use of automated transaction systems and tightening of profit margins in banking operations. Manual fee tracking is prone to errors, especially across high volume accounts. Banks turn to recovery services to locate revenue leakage caused by system issues, rule changes and inconsistent policy application.

Demand is rising across retail banks, commercial banks, card issuing units, wealth management divisions and payment processing teams. Institutions handling large customer bases rely on fee recovery services to review overdraft charges, service fees, transaction costs and penalty structures. Markets with high digital payment usage show stronger demand due to greater fee complexity and transaction density.

Top Market Takeaways

- By service type, overdraft fee recovery leads the market with 42.3% share, focusing on reclaiming fees charged to customers for overdrawing their bank accounts.

- By end-user, individuals dominate with 84.5%, as personal banking customers are the primary users of fee recovery services to minimize unexpected charges.

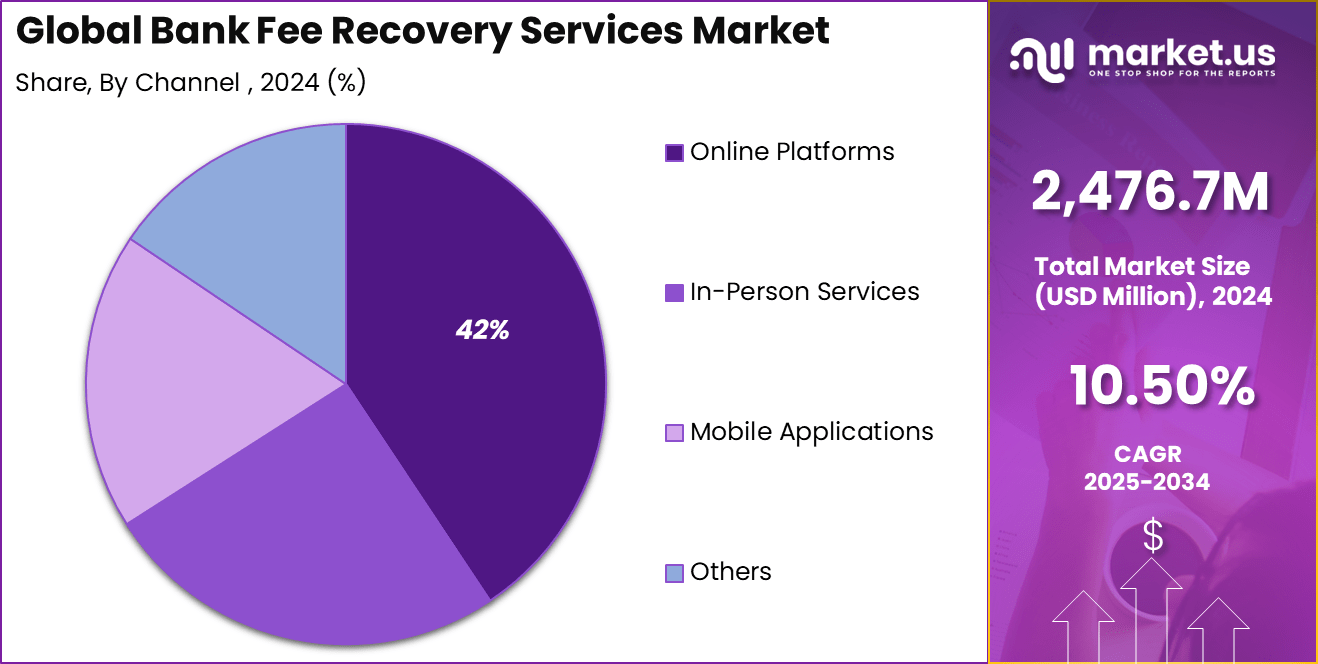

- By channel, online platforms account for 41.8% of the market, driven by the increasing preference for digital and self-service options in managing fees and disputes.

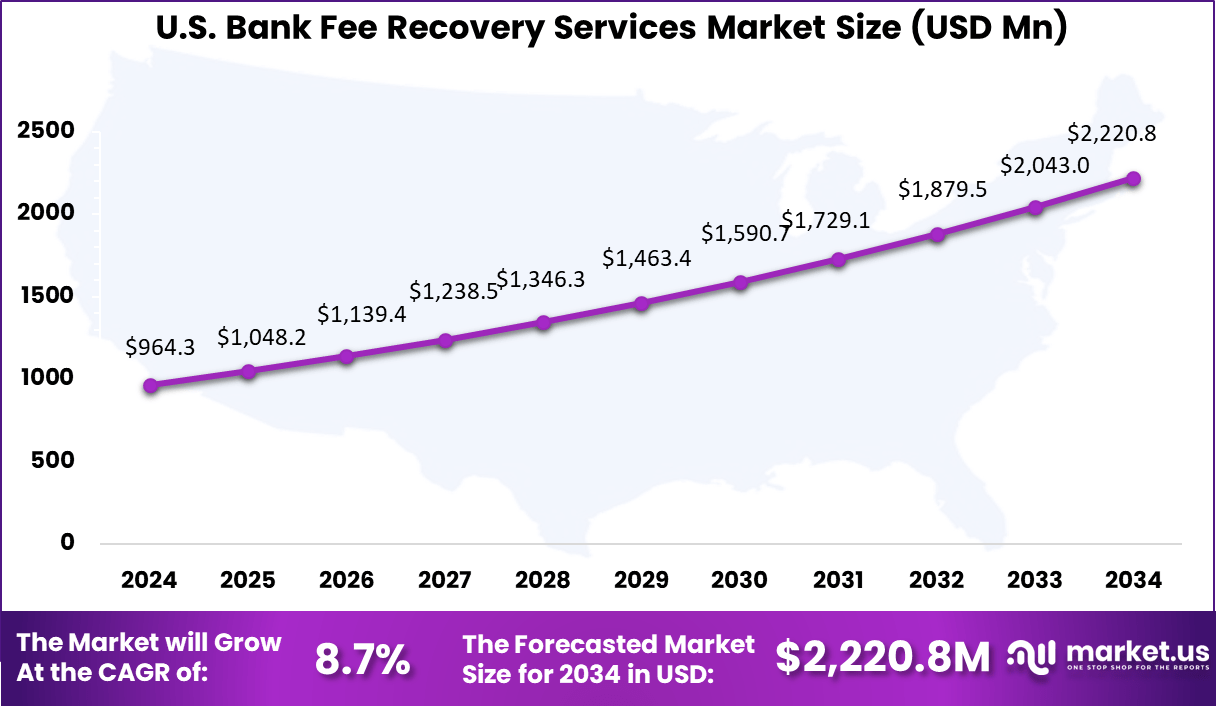

- By region, North America holds 42.6% of the market share, with the U.S. valued at approximately USD 964.3 million. The market grows at a CAGR of 8.7%, supported by technological advancements and regulatory focus on consumer protection.

By Service Type: Overdraft Fee Recovery 42.3%

The overdraft fee recovery segment holds a leading share of 42.3% within the bank fee recovery services market. This dominance is driven by the high frequency of overdraft events across personal checking accounts, especially among customers with variable income patterns and limited savings buffers.

Banks continue to focus on recovering unpaid overdraft balances through automated tracking systems and structured repayment programs. The growing emphasis on digital account monitoring has strengthened the efficiency of overdraft fee identification and recovery across retail banking operations.

By End User: Individuals 84.5%

Individuals account for a dominant 84.5% share of total end user demand. This large share reflects the high volume of retail banking customers who regularly interact with overdraft facilities, late payment charges, and account maintenance fees.

The rising use of debit cards, instant payments, and mobile banking has increased the exposure of individual users to transaction based penalties. As a result, banks continue to invest in structured recovery services focused on consumer level fee resolution.

By Channel: Online Platforms 41.8%

Online platforms represent 41.8% of total service delivery across the bank fee recovery ecosystem. Digital recovery channels allow banks to notify users instantly, offer repayment options, and track recovery status in real time.

The convenience of mobile apps, internet banking portals, and automated reminders has improved recovery success rates. Customers increasingly prefer digital channels for settling outstanding fees due to ease of access and faster transaction processing.

Key Reasons for Adoption

- Banks layer on hidden fees like overdraft charges or wire fees that customers overlook in fine print. Recovery services dig through statements to spot and reclaim these overcharges, especially as fee structures get more tangled.

- Class action suits against big banks have won big refunds in overdraft cases, showing fees often break rules on disclosures. Firms jump on these to grab shares without fighting cases solo.

- Businesses lose track of old accounts or merged banks, leaving unclaimed fees sitting dormant. Services scan records and file claims to pull back funds plus interest before deadlines hit.

- Manual audits eat hours sifting statements for errors like double charges or excess service fees. Outsiders handle the grind, spotting issues staff miss under daily pressure.

- Regulators push fair fee practices, with fines piling up for non-compliance. Companies adopt these to stay clean and turn compliance into cash recovery amid rising scrutiny.

Key Benefits

- Frees up instant cash from reclaimed fees for operations or debt paydown. No upfront costs since most work on contingency, only paid from wins.

- Improves bank ties by flagging billing errors politely, leading to better rates or waived future fees. Turns recovery into leverage for ongoing deals.

- Boosts bottom line through better budgeting once excess fees stop leaking out. Clients forecast costs accurately without surprise hits.

- Builds audit trails for disputes, strengthening cases if banks push back. Experts know regs cold, raising success rates over DIY efforts.

- Scales for high-volume clients like chains or corps with accounts everywhere. Handles volume without bloating internal teams.

Usage

- Firm reviews a mid-size manufacturer’s statements and finds excess wire fees from ignored caps. Files claim, bank refunds in two months.

- Non-profit spots overdraft patterns in class action mold, recovers from multiple branches via group filing. Uses funds for programs.

- Retailer claims dormant fees from closed locations via portal scan. Service submits docs, pulls back cash with interest in weeks.

- Law firm audits client escrow accounts, nabs double-posted service charges. Bank adjusts ledger same quarter.

- Corp taps service for foreign wire overcharges post-merger. Recovers across subsidiaries, avoiding tax hits on old books.

Emerging Trends

Key Trend Description AI-Powered Fee Detection Platforms use AI and machine learning to scan statements in real time and identify unwarranted charges such as overdrafts. Cloud-Based Platforms Scalable cloud solutions allow fast deployment and integration with banking apps for SMEs and individuals. Automated Dispute Tools Self-service apps enable users to handle claims with one-click filing and track refunds without manual input. Open Banking Integration APIs link recovery services directly to bank data for seamless fee monitoring across multiple accounts. Mobile-First Access Apps provide instant alerts and recovery for ATM and foreign transaction fees on the go. Growth Factors

Key Factors Description Complex Fee Structures Banks add multiple layers of charges such as maintenance and transaction fees, increasing recovery needs. Rising Consumer Awareness Individuals and businesses increasingly challenge hidden fees due to improving financial literacy. Regulatory Transparency Rules Clear disclosure mandates in North America and Europe increase dispute volumes. Digital Banking Shift Growth in online transactions multiplies fee types, driving demand for automated recovery. SME Cost Pressures Small firms actively seek refunds to control expenses under tight operating margins. Key Market Segments

By Service Type

- Overdraft Fee Recovery

- ATM Fee Recovery

- Maintenance Fee Recovery

- Foreign Transaction Fee Recovery

- Others

By End-User

- Individuals

- Small and Medium Enterprises

- Large Enterprises

By Channel

- Online Platforms

- In-Person Services

- Mobile Applications

- Others

Regional Analysis

North America takes 42.6% of the bank fee recovery services market. The U.S. drives this with USD 964.3 million in value. Growth hits a 8.7% CAGR. Banks face pushback on overdraft and hidden fees after CFPB rules cut automatic charges, which opens doors for recovery firms to scan accounts and reclaim funds. Small businesses and consumers turn to these services as digital banking hides fee traps in apps and transfers.

Firms use AI tools to pull years of statements, spotting patterns like surprise wire fees or ATM hits from travel. Lenders settle fast to avoid class actions, boosting volumes amid rate hikes that spike overdrafts. Canada adds pull with similar consumer rules, yet U.S. volume leads on sheer account counts. Demand grows as fintechs bundle recovery checks into apps for everyday users.

The U.S. market stands at USD 964.3 million for bank fee recovery services. This fits North America’s 42.6% share and 8.7% CAGR. Millions of accounts hold unclaimed fees from old rules before fee caps took hold in 2022. Services target consumers hit by NSF charges and businesses nailed on merchant processing slips.

Law changes let firms file claims without lawsuits, speeding payouts on average 60 days. Big banks like Wells Fargo face audits from recovery pros after past scandals, which feeds steady work. Growth comes from app-based scanners that flag fees in real time for gig workers and families. Brokers link services to credit repair, widening reach in tight budgets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver in the bank fee recovery services market is the rising number of fees charged across personal and business accounts. Customers often face charges for overdrafts, maintenance, transfers, or ATM use, and many find these fees difficult to understand or verify. Recovery services help review statements, identify unnecessary fees, and request refunds from banks. As customers become more aware of these charges, demand for recovery assistance increases.

Another driver is the growth of digital banking. More transactions now occur through online or mobile channels, which increases the number of small fees and makes it harder for users to track them manually. When mistakes or unclear charges appear, recovery services offer a structured way to review records and correct issues. This supports steady market growth.

Restraint Analysis

A major restraint is low awareness among many banking customers. Some individuals and small businesses do not know that fee recovery services exist or believe that banks will not refund fees even when mistakes are found. This limits the number of users who seek help.

Another restraint is the difficulty of analyzing detailed transaction histories. Recovery teams must examine long account records and understand fee rules that differ across banks. If records are incomplete or unclear, the chance of successful recovery is reduced. This challenge makes it harder for providers to guarantee outcomes.

Opportunity Analysis

There is strong opportunity in serving small and medium businesses. These users often complete large numbers of transactions each month and may pay repeated fees without noticing. Recovery services that help reduce unnecessary costs can appeal to businesses seeking better financial control.

Another opportunity comes from expanding into regions where digital banking is growing quickly. As more customers open accounts and perform electronic transactions, questions about fees become more common. Recovery services can meet this need by offering clear reviews of charges and helping users recover amounts that were incorrectly applied.

Challenge Analysis

A major challenge is the wide variation in fee rules across banks and regions. Each institution has its own structure for overdrafts, transfers, or card transactions. Recovery services must understand these differences to analyze statements correctly. This increases the complexity of operations.

Another challenge involves cooperation from banks. Some banks may take longer to review claims or may dispute refund requests. When outcomes are uncertain, customers may lose confidence in recovery services. Maintaining trust while operating in this environment requires consistent communication and clear processes.

Competitive Analysis

Fiserv, Wolters Kluwer, ACI Worldwide, and Jack Henry & Associates lead the bank fee recovery services market with platforms that automate fee tracking, dispute management, and recovery workflows across retail and commercial banking. Their systems help banks identify missed charges, incorrect fee postings, and revenue leakages. These companies focus on accuracy, regulatory alignment, and core banking integration. Rising pressure on banks to protect non-interest income reinforces their market leadership.

Oracle Financial Services, Temenos, Infosys Finacle, SAP, Bottomline Technologies, Sopra Banking Software, and Alkami Technology strengthen the competitive landscape with embedded fee management, real-time reconciliation, and digital channel recovery tools. Their solutions support consistent fee enforcement across payments, lending, and account services.

BankFeeFinder, Verint Systems, KPMG, PwC, and EY broaden the market with analytics-driven fee recovery, assurance services, and consulting-led revenue optimization programs. Their offerings help banks detect systemic leakage, improve fee governance, and strengthen compliance. These companies focus on data-led insights and process improvement. Growing focus on margin protection and transparent fee practices continues to drive adoption of bank fee recovery services.

Top Key Players in the Market

- Fiserv

- Wolters Kluwer

- ACI Worldwide

- Jack Henry & Associates

- Oracle Financial Services

- Temenos

- Infosys Finacle

- SAP SE

- Bottomline Technologies

- Sopra Banking Software

- Alkami Technology

- BankFeeFinder

- Verint Systems

- KPMG

- PwC

- EY (Ernst & Young)

- Others

Future Outlook

The bank fee recovery services market appears set for sustained evolution. Financial institutions and corporate clients will increasingly seek ways to reclaim unwarranted charges amid rising transaction volumes and complex fee structures in digital banking.

Service providers will enhance offerings with AI-driven audits, automated dispute resolution, and real-time analytics to boost recovery efficiency, while regulatory focus on transparency strengthens demand across banks, fintechs, and businesses. Digital platforms and partnerships will expand access, enabling smaller entities to challenge hidden fees from global transactions seamlessly.

Opportunities lie in

- AI-powered auditing tools for faster detection and recovery of complex transaction fees.

- Partnerships with fintechs to serve SMEs navigating digital banking disputes.

- Expansion into emerging markets with growing cross-border payments and fee transparency needs.

Recent Developments

- October, 2025, Fiserv reported third quarter results with strong revenue growth across banking services. September 2025, company implemented processing rate adjustments impacting fee structures.

- August, 2025, Wolters Kluwer analysis showed federal regulatory enforcement decline affecting compliance fee monitoring. July 2025, company announced divestment of finance risk and regulatory reporting unit.

Report Scope

Report Features Description Market Value (2024) USD 2,476.7 Mn Forecast Revenue (2034) USD 6,722.0 Mn CAGR(2025-2034) 10.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Overdraft Fee Recovery, ATM Fee Recovery, Maintenance Fee Recovery, Foreign Transaction Fee Recovery, Others), By End-User (Individuals, Small and Medium Enterprises, Large Enterprises), By Channel (Online Platforms, In-Person Services, Mobile Applications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fiserv, Wolters Kluwer, ACI Worldwide, Jack Henry & Associates, Oracle Financial Services, Temenos, Infosys Finacle, SAP SE, Bottomline Technologies, Sopra Banking Software, Alkami Technology, BankFeeFinder, Verint Systems, KPMG, PwC, EY (Ernst & Young), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bank Fee Recovery Services MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Bank Fee Recovery Services MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiserv

- Wolters Kluwer

- ACI Worldwide

- Jack Henry & Associates

- Oracle Financial Services

- Temenos

- Infosys Finacle

- SAP SE

- Bottomline Technologies

- Sopra Banking Software

- Alkami Technology

- BankFeeFinder

- Verint Systems

- KPMG

- PwC

- EY (Ernst & Young)

- Others