Global Banana Ketchup Market Size, Share Analysis Report By Type (Sweet Banana Ketchup, Spicy Banana Ketchup), By Packaging (Glass Bottle, Plastic Bottle, Pouches and Sachets, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Grocery Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159222

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

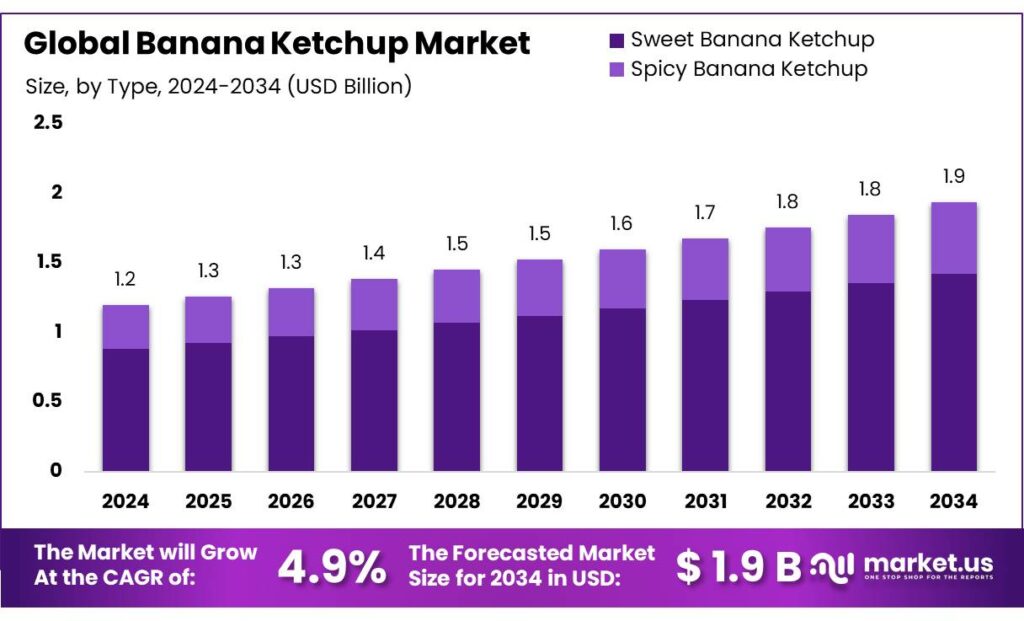

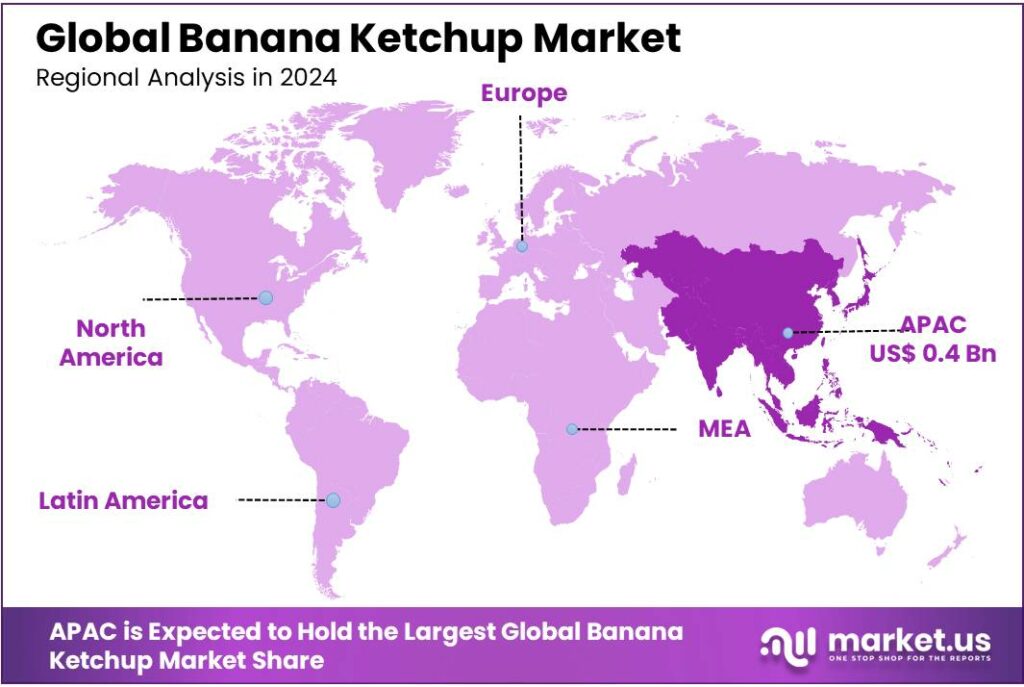

The Global Banana Ketchup Market size is expected to be worth around USD 1.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 0.4 Billion in revenue.

The banana ketchup industry has evolved from a wartime necessity into a globally recognized condiment, particularly in the Philippines. Invented during World War II by Filipino food technologist María Y. Orosa, banana ketchup was developed as a substitute for tomato ketchup due to the scarcity of tomatoes and the abundance of bananas. Orosa’s innovation utilized local resources, aligning with her mission to address malnutrition and promote self-sufficiency in food production.

In the Philippines, banana ketchup has become a staple in Filipino cuisine, commonly used in dishes such as spaghetti, fried chicken, and breakfast silog. The country’s banana industry supports this demand, with over 9 million metric tons of bananas produced annually across approximately 451,000 hectares of land. The majority of this production is concentrated in regions like Davao, Northern Mindanao, and SOCCKSARGEN, where varieties such as Saba, Cavendish, and Latundan are cultivated.

Government initiatives have also played a crucial role in supporting the banana ketchup industry. The Philippine government’s “One Town, One Product” (OTOP) program promotes local products, including banana-based items, by providing funding and support to small and medium-sized enterprises (SMEs). Such initiatives aim to enhance product quality, marketability, and production capabilities, thereby fostering industry growth.

In the Philippines, banana ketchup holds cultural significance and is a key component of the local food industry. The Philippine banana export industry was valued at approximately USD 1.6 billion in 2020, ranking second globally and accounting for 12% of the world total export value. Despite challenges such as declining per capita banana consumption, which decreased from 50 kg/year in 2015 to 19 kg/year in 2020, the industry continues to thrive. The Department of Agriculture’s High Value Crops Development Program has been instrumental in promoting banana production and utilization, including the development of banana-based products like banana ketchup.

Key Takeaways

- Banana Ketchup Market size is expected to be worth around USD 1.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.9%.

- Sweet Banana Ketchup held a dominant market position, capturing more than 73.6% of the global market.

- Glass Bottle packaging held a dominant market position, capturing more than 48.9% of the global banana ketchup market.

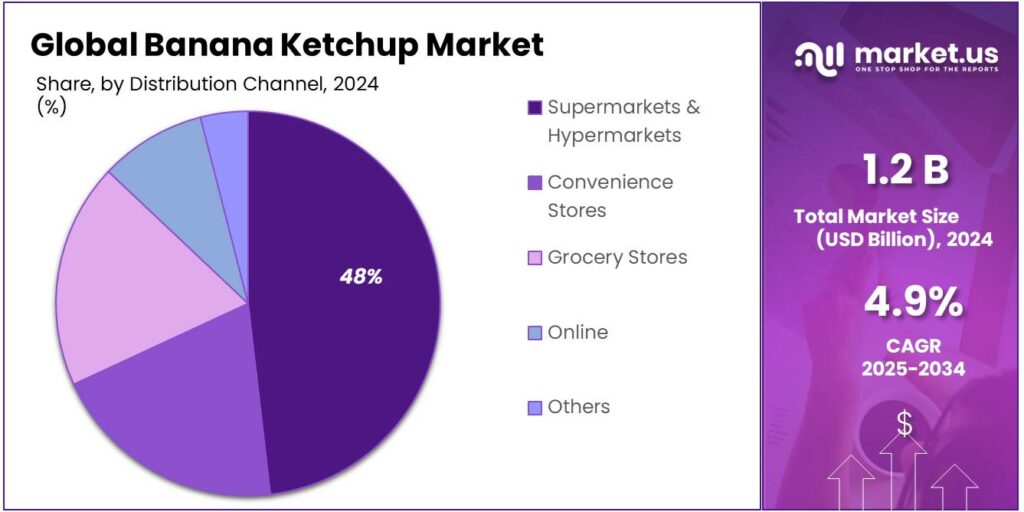

- Supermarkets & Hypermarkets held a dominant market position, capturing more than 48.3% of the banana ketchup market share.

- Asia Pacific region is the dominant market for banana ketchup, holding a significant share of 38.40%, valued at USD 0.4 billion.

By Type Analysis

Sweet Banana Ketchup Dominates with 73.6% Market Share in 2024

In 2024, Sweet Banana Ketchup held a dominant market position, capturing more than 73.6% of the global market. This variety of banana ketchup is particularly popular due to its balanced flavor profile, which blends the natural sweetness of ripe bananas with the tanginess of vinegar, making it a versatile condiment. Sweet Banana Ketchup is widely used in both home kitchens and restaurants, particularly in Southeast Asia, where it is a staple in Filipino cuisine. The rise in demand for ethnic and unique flavors in international markets, especially in the U.S. and Europe, has also contributed to its increasing market share.

The significant market share of Sweet Banana Ketchup is primarily attributed to its broad appeal across various consumer segments, including families, fast food chains, and foodservice industries. The growing trend of healthier and more natural food products has bolstered its popularity, as consumers are more inclined toward condiments with fewer additives and preservatives. Additionally, innovations in packaging and branding, aimed at making the product more accessible and appealing to a wider audience, have further cemented its position as the leading type of banana ketchup globally.

By Packaging Analysis

Glass Bottle Dominates Banana Ketchup Market with 48.9% Share in 2024

In 2024, Glass Bottle packaging held a dominant market position, capturing more than 48.9% of the global banana ketchup market. This packaging type remains a popular choice among consumers due to its premium feel, aesthetic appeal, and ability to preserve the product’s flavor and freshness over time. Glass bottles are preferred for their ability to maintain the quality of the ketchup, especially in terms of taste and texture, which are key factors for consumers seeking high-quality condiments. The clear packaging also allows for an attractive display of the vibrant color of banana ketchup, making it stand out on store shelves.

The preference for Glass Bottle packaging is driven by consumer perception of higher quality and a desire for eco-friendly packaging options. As sustainability becomes an increasing priority for both consumers and manufacturers, glass bottles are seen as a more environmentally friendly option compared to plastic alternatives, as they are recyclable and do not contribute to plastic waste. Furthermore, the premium positioning of glass packaging appeals to higher-end food markets and retailers, which further strengthens its market share.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Lead Banana Ketchup Market with 48.3% Share in 2024

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than 48.3% of the banana ketchup market share. This distribution channel remains the preferred shopping destination for consumers due to its wide product variety, convenient shopping experience, and the ability to compare different brands and types of banana ketchup in one place. These large retail chains offer both well-known and niche banana ketchup brands, making it easier for consumers to find their preferred products. Supermarkets and hypermarkets also benefit from frequent foot traffic, especially in urban areas, further driving the sales of banana ketchup.

The ongoing growth of supermarkets and hypermarkets as the primary distribution channel can also be attributed to their ability to offer promotions, discounts, and attractive in-store displays that draw in shoppers. Additionally, the presence of established retail networks and the ability to reach a broader consumer base in various geographic regions strengthens the market position of banana ketchup in these stores.

Key Market Segments

By Type

- Sweet Banana Ketchup

- Spicy Banana Ketchup

By Packaging

- Glass Bottle

- Plastic Bottle

- Pouches and Sachets

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

Emerging Trends

Clean-label & health-aware reformulations are reshaping banana ketchup

People who grew up on banana ketchup still love its sweet, tangy comfort — but a clear modern trend is pushing makers to rethink recipes so the sauce sits better on today’s plates and grocery lists. Consumers worldwide are watching sugar and salt more closely, and food businesses are responding by reformulating familiar products rather than retiring them. This matters for banana ketchup because it traditionally uses sugar and salt to balance flavor and preserve the bottle; now producers are testing reduced-sugar recipes, natural sweeteners, and shorter ingredient lists to meet shopper demand for “cleaner” labels while keeping that comforting banana note.

- The World Health Organization recommends limiting “free” sugar to less than 10% of daily energy, and suggests a further target of about 25 grams (≈6 teaspoons) per day for extra health benefits — a guideline that helps explain why customers ask for lower-sugar condiments.

The supply side makes reformulation realistic. Countries that make a lot of bananas want more stable incomes for farmers, so governments have encouraged value-added processing and food safety improvements that let smaller firms sell reformulated products at scale. In the Philippines, for example, recent industry planning shows the country produced more than 9 million metric tonnes of bananas on roughly 451,000 hectares — a raw-material base that can support both traditional and reworked banana ketchup lines.

Technical help and standards also steer the trend. The Philippine FDA has a specific national standard and code of practice for banana ketchup (PNS/FDA 40:2015 and related guidance), which gives processors clear rules on labeling, additives, and safety — a helpful framework when companies swap sugar for alternative sweeteners or trim preservatives. Clear standards make it easier for a producer to launch a “reduced sugar” version without confusing regulators or shoppers.

Drivers

Abundant banana supply and the push for value-added products

One major driving factor for the popularity and commercial growth of banana ketchup is the sheer abundance of bananas — which pushes farmers, processors, and government programs to turn surplus fruit into durable, higher-value products. The Philippines alone produces millions of tonnes of bananas every year: recent government material reports total national production at over 9 million metric tonnes on roughly 451,000 hectares — a scale that naturally encourages processing and product innovation to avoid waste and raise farmer incomes.

Seasonal gluts make fresh-market prices volatile, so turning fruit into shelf-stable condiments — like banana ketchup — is both practical and lucrative. For example, in a single quarter (April–June 2023) the Philippine Statistical Authority estimated 2.269 million metric tons of banana production, highlighting how frequent harvest peaks create supply that needs processing pathways.

Globally, banana production and trade are large enough that small shifts in use or processing matter. FAO/market reviews put world production in recent years well over 100 million tonnes (FAO estimates showed global production rising toward ~135 million tonnes in 2022 and similar levels in 2023), which means many banana-growing countries face the same incentive to develop value-added goods rather than sell only raw fruit. That global scale gives both local entrepreneurs and exporters room to create niche products — banana ketchup being one culturally rooted example.

Recent reports note credit and rehabilitation support aimed at expanding and stabilizing banana production, with the Department of Agriculture citing credit packages targeted at roughly ₱450,000 per hectare for farm rehabilitation — funding that helps producers invest in post-harvest facilities, small processing lines, and quality control needed for products like banana ketchup.

Restraints

Rising Concerns of Sugar and Salt Consumption in Banana Ketchup

One important restraining factor for the growth of banana ketchup is the increasing concern over its sugar and salt content. While banana ketchup has been a beloved condiment in the Philippines and is slowly gaining recognition internationally, many health-conscious consumers are becoming cautious about products that contain high amounts of added sugars and sodium. This shift in consumer preference is not only cultural but also backed by global health organizations and government advisories.

The World Health Organization (WHO) recommends that adults should limit free sugar intake to less than 10% of their total daily energy intake, and reducing it further to below 5% would provide additional health benefits. This translates roughly to about 25 grams (6 teaspoons) of sugar per day for an average adult. However, banana ketchup, like tomato ketchup, typically contains sugar as one of its main ingredients to balance out the tangy flavor. For many consumers who are increasingly checking labels, this has become a barrier.

- According to the World Health Organization, the global average salt intake is estimated at 10.8 grams per day, which is more than double the recommended limit of 5 grams per day.

These dietary concerns are reflected in government actions as well. For instance, the Philippine Department of Health has implemented nutrition labeling policies under its “Healthy Options” framework, encouraging manufacturers to reduce sugar and salt in processed food, including condiments. The Food and Drug Administration (FDA) of the Philippines has also issued standards that require clear labeling of banana ketchup, including nutritional content such as sodium and sugar levels, through the official PNS/FDA 40:2015 regulation.

Opportunity

Export Potential in Global Banana-Producing and Consuming Markets

One major growth opportunity for banana ketchup lies in its export potential, especially as global banana production continues to rise and countries search for innovative, value-added food products. Bananas are among the world’s most widely consumed fruits, and this gives banana ketchup a strong base for international expansion.

- According to the Food and Agriculture Organization (FAO), global banana production reached about 135 million tonnes in 2022, making it one of the largest fruit crops in the world.

The Philippines, where banana ketchup originated, plays a leading role in this opportunity. The country is the second-largest exporter of bananas worldwide, shipping millions of tonnes annually, mainly to East Asia and the Middle East. In 2023 alone, the Philippine Statistics Authority (PSA) recorded 9.22 million metric tons of banana production, making it a backbone crop for both domestic food security and international trade.

On the consumer side, the trend toward exploring ethnic and unique condiments is also opening new doors. According to the World Trade Organization (WTO), global agri-food exports have been steadily increasing, with processed food accounting for a growing share of trade. Processed agricultural exports made up over 7 trillion USD in 2021, a figure that has continued to grow in the post-pandemic period as people seek diverse food experiences at home.

Regional Insights

Asia Pacific Leads the Banana Ketchup Market with 38.40% Share in 2024

The Asia Pacific region is the dominant market for banana ketchup, holding a significant share of 38.40%, valued at USD 0.4 billion in 2024. The region’s strong preference for banana-based products, particularly in countries like the Philippines, where banana ketchup is a cultural staple, has played a crucial role in its market leadership. In the Philippines, banana ketchup is an integral part of daily cuisine, with local consumption continuously driving the growth of the product.

The Asia Pacific market benefits from a large population base, increasing disposable incomes, and a growing middle class, all of which contribute to the demand for convenience foods and processed condiments. The region’s expanding urban population, with rising consumption of ready-to-eat and quick-serve meals, further supports the demand for banana ketchup. Government initiatives in the Philippines, aimed at boosting banana production and food processing, also contribute to the growth of the market by ensuring a steady supply of raw materials for banana ketchup production.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NutriAsia is a leading Filipino food company renowned for its condiment brands like UFC, Papa, and Mafran. Their UFC Banana Sauce, known for its “Tamis Anghang” (sweet and spicy) flavor, is a staple in Filipino households and widely exported. In 2024, NutriAsia introduced the UFC Banana Ketchup Rich Blend, the first squeezable banana ketchup in the Philippines, catering to the younger demographic and enhancing user convenience. The company ensures compliance with international standards, reformulating products to meet U.S. FDA regulations, thereby expanding its global reach.

Del Monte Foods, a prominent player in the food industry, offers a variant of banana ketchup known for its “Extra Rich” formulation. This product boasts a thicker consistency and a richer taste, achieved by using high-quality, locally grown bananas. Del Monte’s banana ketchup is marketed as a versatile condiment, suitable for various dishes, and emphasizes its premium quality to appeal to health-conscious consumers.

Baron Foods Ltd., based in Saint Lucia, produces a unique banana ketchup that blends bananas with exotic herbs and spices, resulting in an authentic Caribbean flavor. Their product is free from added sugars, relying solely on the natural sweetness of bananas. Baron’s banana ketchup is positioned as a gourmet condiment, ideal for enhancing the taste of meats, barbecues, and as a dipping sauce, appealing to consumers seeking natural and bold flavors.

Top Key Players Outlook

- NutriAsia, Inc.

- Dole Food Company, Inc.

- McCormick & Company, Inc.

- Del Monte Foods, Inc.

- Hot-Headz! Ltd.

- Baron Foods Ltd.

- Fila Manila

- Ben and Pat’s Sauce Co.

- Craft Hot Sauce

Recent Industry Developments

In 2024 Baron Foods Ltd, continued to focus on crafting high-quality condiments that blend bananas with exotic herbs and spices. Their banana ketchup is available in 155g and 397g glass bottles, catering to diverse consumer needs. Baron Foods emphasizes the use of wholesome St. Lucian bananas, ensuring a product that reflects the rich agricultural heritage of the region.

In 2024 Hot-Headz! Ltd, is expected to generate approximately USD 15 million in revenue from its banana ketchup and other specialty sauces. Hot-Headz! Ltd’s banana ketchup products often include a combination of sweet, tangy, and spicy elements, appealing to consumers who enjoy more adventurous and intense flavor profiles.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 1.9 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sweet Banana Ketchup, Spicy Banana Ketchup), By Packaging (Glass Bottle, Plastic Bottle, Pouches and Sachets, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Grocery Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NutriAsia, Inc., Dole Food Company, Inc., McCormick & Company, Inc., Del Monte Foods, Inc., Hot-Headz! Ltd., Baron Foods Ltd., Fila Manila, Ben and Pat’s Sauce Co., Craft Hot Sauce Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NutriAsia, Inc.

- Dole Food Company, Inc.

- McCormick & Company, Inc.

- Del Monte Foods, Inc.

- Hot-Headz! Ltd.

- Baron Foods Ltd.

- Fila Manila

- Ben and Pat's Sauce Co.

- Craft Hot Sauce