Global Bamboo Products Market Size, Share, Growth Analysis By Product Type (Furniture, Lifestyle Products, Personal Accessories, Yarn & Textiles, Building and Construction Products, Bamboo Structures, Gazebos, Cottages, Others), By End User (Personal and Residential, Commercial, Industrial and Infrastructure), By Sales Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169135

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

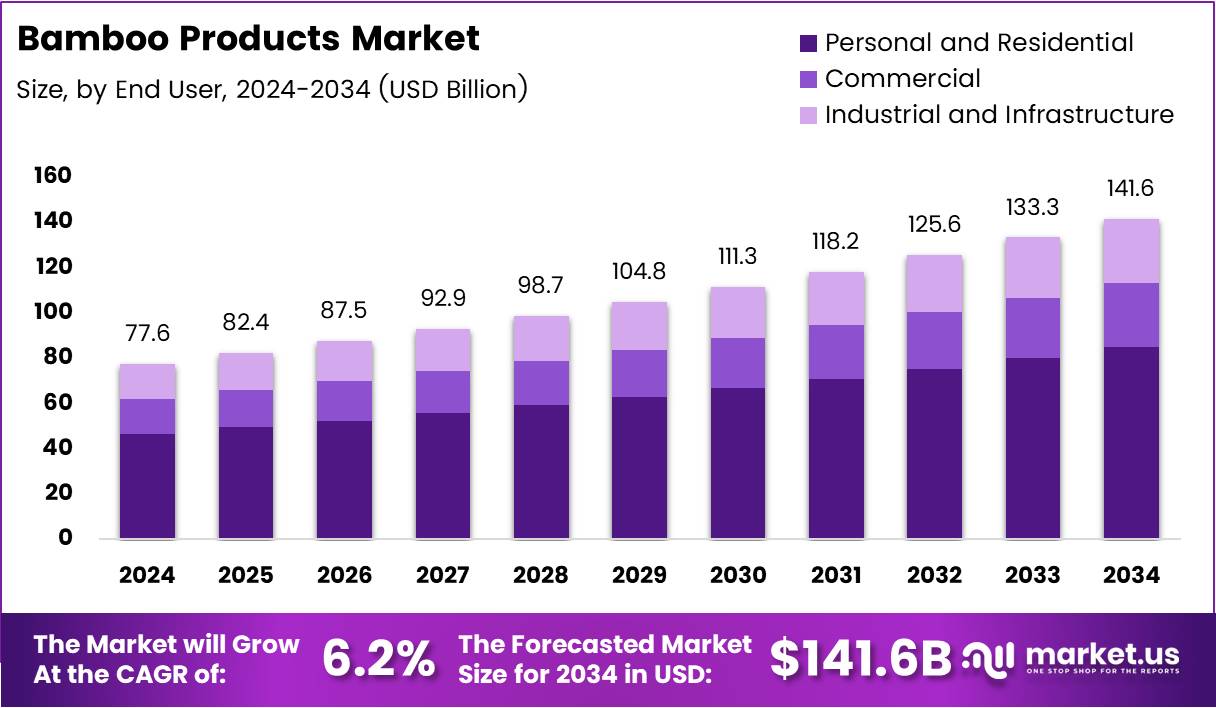

The Global Bamboo Products Market is expected to reach approximately USD 141.6 Billion by 2034, up from USD 77.6 Billion in 2024, expanding at a CAGR of 6.2% during the forecast period. This remarkable growth reflects increasing consumer awareness toward sustainable living and eco-friendly alternatives. The market encompasses diverse applications including furniture, textiles, construction materials, and lifestyle accessories.

Rising environmental concerns drive the shift toward renewable materials in manufacturing and construction sectors. Bamboo offers exceptional strength, rapid growth cycles, and carbon sequestration capabilities, making it an ideal substitute for conventional wood and plastic products. Governments worldwide are implementing supportive policies to promote green building standards and sustainable material sourcing practices.

The furniture segment dominates the product landscape, capturing significant market share due to bamboo’s aesthetic appeal and durability. Personal and residential end users lead consumption patterns, reflecting growing household adoption of eco-conscious products. Online sales channels are transforming distribution dynamics, enabling direct consumer access to bamboo-based goods globally.

According to TradeImex, global bamboo imports reached USD 161.79 million in 2023, demonstrating strong international trade activity. Furthermore, according to FAO, the total export value of bamboo products amounted to USD 2.9 billion in 2018, with China leading at over USD 2 billion, followed by Canada, Netherlands, Vietnam, and India.

Innovation in bamboo processing technologies enhances product quality and manufacturing efficiency. Companies are developing engineered bamboo composites for automotive interiors, premium textiles, and biodegradable packaging solutions. Strategic investments in bamboo-based bioenergy and biomass applications present substantial growth opportunities. The convergence of sustainability trends and technological advancement positions the bamboo products market for robust expansion.

Key Takeaways

- Global Bamboo Products Market size projected to reach USD 141.6 Billion by 2034 from USD 77.6 Billion in 2024.

- Market growing at a CAGR of 6.2% during the forecast period 2025-2034.

- Furniture segment dominates product type category with 31.8% market share.

- Personal and Residential end user segment leads with 51.3% market share.

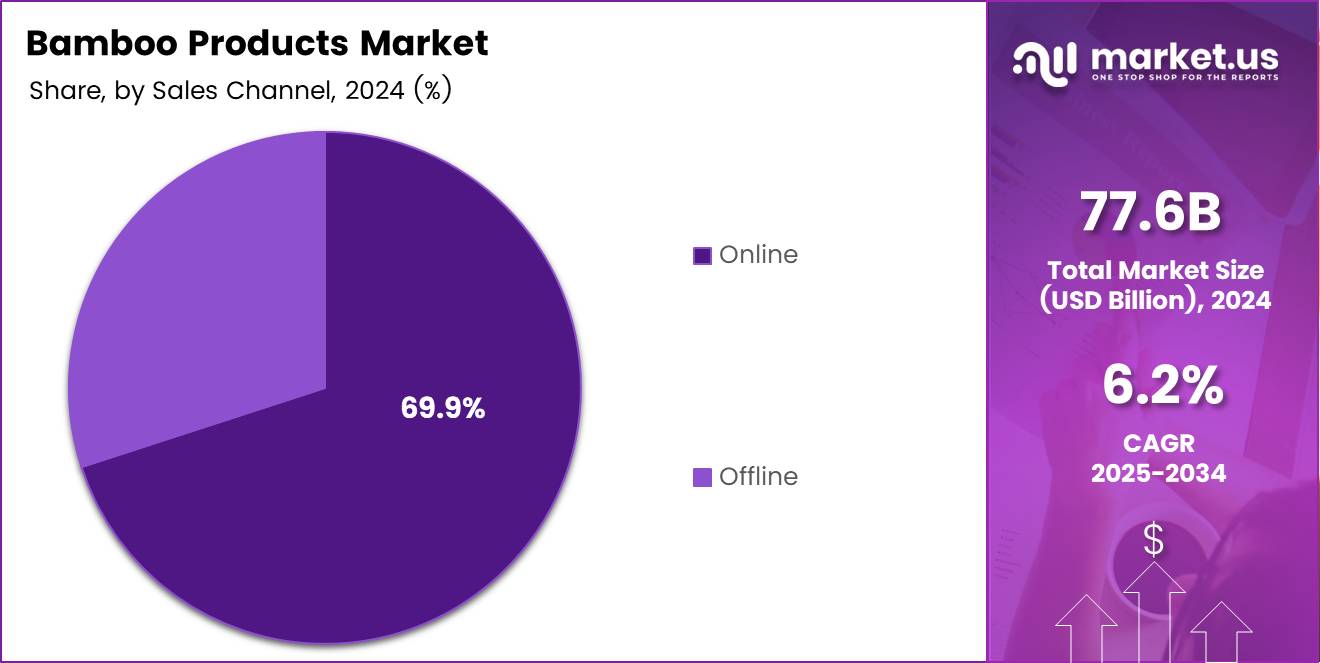

- Online sales channel accounts for 69.9% of total distribution.

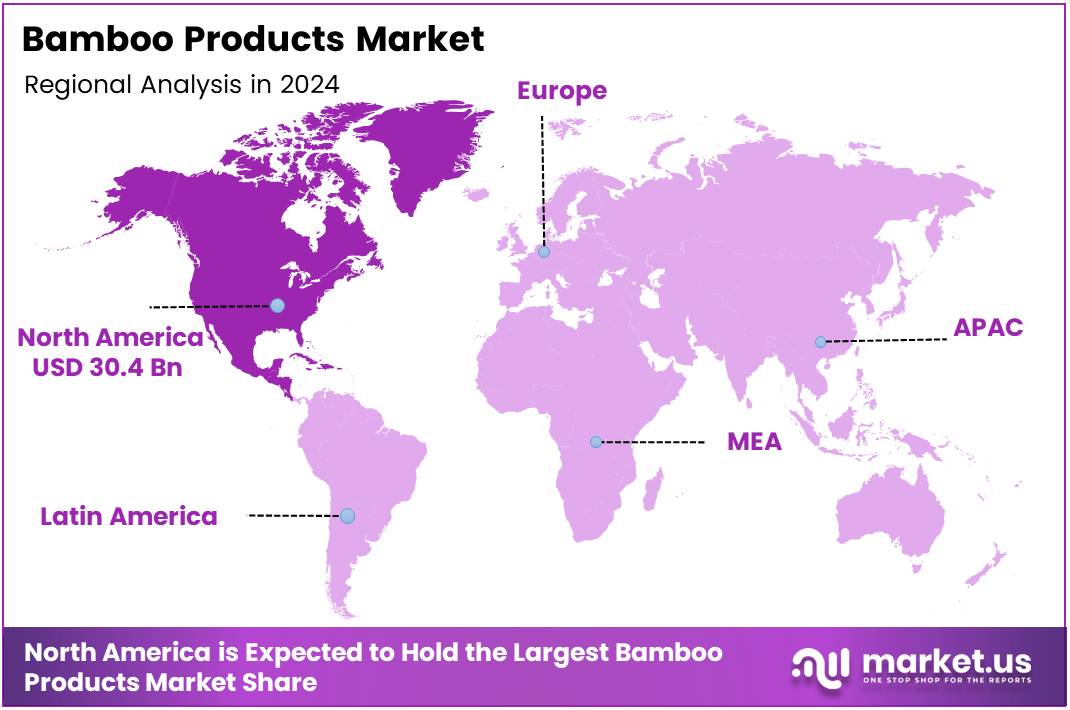

- North America holds dominant regional position with 39.30% share, valued at USD 30.4 Billion.

Product Type Analysis

Furniture dominates with 31.8% due to bamboo’s durability, aesthetic appeal, and sustainable sourcing advantages.

In 2024, Furniture held a dominant market position in the By Product Type Analysis segment of Bamboo Products Market, with a 31.8% share. Bamboo furniture combines natural elegance with structural strength, appealing to environmentally conscious consumers. Manufacturers leverage bamboo’s rapid renewability to produce beds, tables, chairs, and storage units. The material’s resistance to moisture and insects enhances product longevity, driving residential and commercial adoption.

Lifestyle Products represent a growing category encompassing decorative items, kitchenware, and home accessories. Consumers increasingly prefer bamboo-based utensils, cutting boards, and serving trays for their non-toxic properties. These products align with minimalist design trends while offering functional benefits. Retailers expand offerings to meet rising demand for sustainable everyday essentials.

Personal Accessories include bamboo sunglasses, watches, jewelry, and phone cases gaining popularity among eco-conscious buyers. These items showcase bamboo’s versatility in fashion and technology applications. Brands emphasize lightweight construction and unique grain patterns to differentiate products. The segment benefits from social media marketing and influencer partnerships.

Yarn & Textiles utilize bamboo fibers for apparel, bedding, and towels offering softness and breathability. Bamboo fabric production employs mechanical or chemical processing methods to extract cellulose. The resulting textiles provide natural antibacterial properties and moisture-wicking capabilities. Fashion brands incorporate bamboo blends for sustainable clothing lines targeting health-conscious consumers.

Building and Construction Products feature engineered bamboo flooring, panels, and structural components for residential and commercial projects. Architects specify bamboo materials for green building certifications and sustainable design objectives. The segment benefits from technological advances in lamination and treatment processes. Government incentives for eco-friendly construction boost adoption rates.

Bamboo Structures deliver permanent and temporary architectural solutions including pavilions, bridges, and support frameworks. Engineers exploit bamboo’s high tensile strength for innovative structural applications. These constructions demonstrate cost-effectiveness in tropical and subtropical regions. Cultural heritage projects increasingly incorporate traditional bamboo building techniques.

Gazebos crafted from bamboo provide outdoor shelter for gardens, resorts, and recreational spaces. The natural aesthetic complements landscape designs while requiring minimal maintenance. Prefabricated gazebo kits simplify installation for residential customers. Commercial venues utilize bamboo gazebos to create distinctive outdoor dining and entertainment areas.

Cottages constructed with bamboo materials offer affordable and sustainable housing solutions in developing markets. Builders combine bamboo framing with modern insulation and finishing techniques. These structures address housing shortages while minimizing environmental impact. International development organizations support bamboo cottage initiatives for disaster relief and rural communities.

End User Analysis

Personal and Residential dominates with 51.3% driven by household adoption of sustainable furnishings and daily-use products.

In 2024, Personal and Residential held a dominant market position in the By End User Analysis segment of Bamboo Products Market, with a 51.3% share. Homeowners prioritize eco-friendly alternatives for furniture, flooring, and decorative items throughout living spaces. Rising disposable incomes enable consumers to invest in premium bamboo products offering superior quality. Interior designers recommend bamboo materials for modern, sustainable home environments.

Commercial establishments including hotels, restaurants, offices, and retail stores increasingly specify bamboo furnishings and fixtures. Business operators seek durable, low-maintenance solutions that align with corporate sustainability commitments. Bamboo products enhance brand image while reducing long-term replacement costs. The hospitality industry particularly favors bamboo for creating distinctive guest experiences.

Industrial and Infrastructure applications encompass scaffolding, construction materials, and manufacturing components for large-scale projects. Contractors utilize bamboo scaffolding in Asian markets due to cost advantages and traditional expertise. Infrastructure developers explore bamboo composites for bridges, sound barriers, and temporary structures. Government initiatives promote bamboo in public works projects across developing nations.

Sales Channel Analysis

Online dominates with 69.9% reflecting e-commerce growth and direct-to-consumer brand strategies.

In 2024, Online held a dominant market position in the By Sales Channel Analysis segment of Bamboo Products Market, with a 69.9% share. Digital platforms enable bamboo product manufacturers to reach global audiences without physical retail infrastructure. E-commerce marketplaces showcase extensive product catalogs with detailed specifications and customer reviews. Online sales channels reduce distribution costs while providing data-driven insights into consumer preferences.

Offline channels including specialty stores, department stores, and furniture showrooms maintain relevance for customers seeking tactile product evaluation. Traditional retailers offer personalized consultation and immediate product availability for local buyers. Physical stores serve as brand experience centers complementing online marketing efforts. Hybrid retail strategies integrate online ordering with in-store pickup and customer service.

Key Market Segments

By Product Type

- Furniture

- Lifestyle Products

- Personal Accessories

- Yarn & Textiles

- Building and Construction Products

- Bamboo Structures

- Gazebos

- Cottages

- Others

By End User

- Personal and Residential

- Commercial

- Industrial and Infrastructure

By Sales Channel

- Online

- Offline

Rising Consumer Preference for Biodegradable and Compostable Household Materials Drives Market Growth

Environmental awareness campaigns educate consumers about plastic pollution and deforestation impacts on ecosystems. Shoppers actively seek biodegradable alternatives for daily-use items reducing household waste footprints. Bamboo products decompose naturally without releasing harmful chemicals into soil or water systems. Retailers respond by expanding bamboo product ranges across kitchenware, utensils, and storage categories.

Sustainable construction practices gain momentum as architects and builders prioritize renewable materials for residential and commercial projects. Engineered bamboo offers comparable strength to hardwoods while regenerating within three to five years. Green building certifications incentivize bamboo material specification through point systems and compliance requirements. Developers capitalize on consumer demand for eco-certified properties.

Government initiatives worldwide promote renewable resources through subsidies, tax incentives, and regulatory frameworks supporting green manufacturing. National bamboo missions in developing countries encourage plantation expansion and processing industry development. International trade agreements facilitate bamboo product exports while reducing tariff barriers. Public procurement policies increasingly mandate sustainable material sourcing.

Innovation in bamboo processing technologies enables mass production of consistent, high-quality products meeting industrial standards. Automated machinery improves fiber extraction, treatment, and lamination processes reducing labor costs. Research institutions develop new bamboo composites and chemical treatments enhancing durability and fire resistance. Technology transfer programs assist manufacturers in adopting advanced processing equipment.

Limited Standardization and Quality Certification Across Global Bamboo Supply Chains

Inconsistent grading systems create challenges for buyers assessing bamboo product quality across different suppliers and regions. Lack of universal testing standards results in variable durability, strength, and appearance characteristics among competing products. Importers face difficulties verifying sustainability claims without recognized third-party certification programs. Industry fragmentation prevents establishment of comprehensive quality assurance frameworks.

Competition from lower-cost synthetic and conventional wood alternatives pressures bamboo product pricing in price-sensitive market segments. Plastic manufacturers achieve economies of scale unavailable to smaller bamboo processors, enabling aggressive pricing strategies. Established timber industries benefit from mature supply chains and consumer familiarity with traditional wood products.

Marketing budgets of synthetic material producers outpace bamboo industry promotional investments. Consumer perception sometimes associates bamboo with lower-cost, temporary products rather than premium alternatives. Distribution networks for conventional materials remain more extensive and accessible than bamboo product channels.

Development of High-Value Bamboo Fiber Textiles and Apparel Segments

Fashion industry exploration of sustainable materials creates opportunities for bamboo-derived fabrics in mainstream clothing markets. Technical advances produce softer, more drapable bamboo textiles competing with cotton and polyester blends. Athletic wear brands incorporate bamboo fibers for moisture management and odor control properties. Luxury fashion houses experiment with bamboo-silk blends for high-end garment collections.

Strategic investments in bamboo-based bioenergy and biomass solutions address renewable energy demands while utilizing processing waste streams. Power generation facilities convert bamboo residues into electricity through gasification and combustion technologies. Biochemical research explores bamboo cellulose for biofuel production and industrial chemical manufacturing. Carbon credit markets reward bamboo cultivation for sequestration benefits.

Expansion of bamboo applications in automotive interior components leverages lightweight, renewable materials for vehicle manufacturing. Automotive suppliers develop bamboo-fiber composites for door panels, dashboards, and trim elements reducing vehicle weight. Luxury car manufacturers highlight bamboo interiors as premium, sustainable design features. Regulatory pressure for reduced vehicle emissions incentivizes lightweight material adoption.

Rising demand for premium bamboo kitchenware and designer home décor reflects consumer willingness to pay for artisanal craftsmanship. High-end homeware brands curate limited-edition bamboo collections featuring unique finishes and designs. Interior design trends emphasize natural materials creating warm, organic living environments. Social media influencers showcase bamboo products generating aspirational lifestyle content.

Surge in Eco-Luxury Brands Promoting Bamboo-Made Lifestyle Products

Premium consumer brands position bamboo products as sophisticated alternatives to conventional materials targeting affluent, environmentally conscious buyers. Marketing campaigns emphasize sustainability credentials alongside design excellence and product innovation. Celebrity endorsements and influencer partnerships amplify brand visibility within target demographics. Luxury retail channels integrate bamboo products into curated lifestyle collections.

Increased use of bamboo composites in lightweight furniture design addresses urban living space constraints and mobility requirements. Manufacturers engineer bamboo-polymer blends achieving reduced weight without compromising structural integrity. Modular furniture systems utilize bamboo components for easy assembly and reconfiguration. Design awards recognize innovative bamboo furniture solutions encouraging industry creativity.

Growing popularity of minimalist bamboo packaging in cosmetics and personal care responds to consumer demand for plastic-free alternatives. Beauty brands develop bamboo containers, applicators, and accessories reinforcing sustainable brand positioning. Packaging suppliers offer customizable bamboo packaging solutions with branded finishes and closures. Regulatory restrictions on single-use plastics accelerate adoption of bamboo packaging alternatives.

Adoption of smart manufacturing for precision-engineered bamboo products enhances quality control and production efficiency. Computer numerical control machines enable intricate bamboo component fabrication with tight tolerances. Automated quality inspection systems detect defects using machine vision technology reducing waste rates. Industry 4.0 integration connects manufacturing operations improving supply chain transparency and responsiveness.

North America Dominates the Bamboo Products Market with a Market Share of 39.30%, Valued at USD 30.4 Billion

North America leads the global bamboo products market with a 39.30% share, valued at USD 30.4 Billion, driven by strong consumer environmental consciousness and established green building movements. United States consumers demonstrate high purchasing power for premium sustainable products across home furnishings and lifestyle categories. Canadian markets benefit from government sustainability initiatives and eco-certification programs promoting renewable materials. Robust e-commerce infrastructure facilitates direct-to-consumer bamboo product sales throughout the region.

Europe Bamboo Products Market Trends

European markets emphasize circular economy principles and strict environmental regulations driving bamboo product adoption. Scandinavian countries lead in sustainable furniture design integrating bamboo materials into contemporary aesthetics. European Union policies support renewable resource utilization through procurement guidelines and construction standards. Consumers prioritize product longevity and responsible sourcing when selecting bamboo goods.

Asia Pacific Bamboo Products Market Trends

Asia Pacific maintains traditional bamboo utilization while modernizing processing capabilities and expanding export operations. China dominates global bamboo production and manufacturing with extensive plantation resources and industrial infrastructure. Southeast Asian nations leverage bamboo abundance for regional construction and handicraft industries. Growing middle-class populations increase domestic demand for quality bamboo furniture and consumer products.

Middle East and Africa Bamboo Products Market Trends

Middle East markets show increasing interest in sustainable construction materials for luxury hospitality and residential developments. African nations explore bamboo cultivation as income-generating opportunity for rural communities and sustainable housing solutions. Regional climate conditions suit bamboo growth in select areas enabling local supply chain development. International development partnerships support bamboo industry establishment across the region.

Latin America Bamboo Products Market Trends

Latin American countries possess significant bamboo resources with potential for expanded commercial utilization and processing industries. Growing environmental awareness drives consumer interest in locally-sourced bamboo products replacing imported alternatives. Regional governments implement reforestation programs incorporating bamboo species for erosion control and economic development. Artisan communities maintain traditional bamboo crafts while adapting designs for contemporary markets.

Key Bamboo Products Company Insights

The global Bamboo Products Market in 2024 features several established manufacturers and innovative startups driving industry growth through technological advancement and market expansion strategies. Leading companies invest in research and development to enhance product quality while meeting sustainability standards.

MOSO International BV specializes in engineered bamboo flooring and panels serving construction markets with high-quality, certified sustainable products. The company maintains extensive distribution networks across Europe and North America establishing bamboo as premium building material alternative.

Bamboo Village Company focuses on traditional and contemporary bamboo handicrafts, furniture, and architectural solutions for residential and commercial applications. Their product portfolio emphasizes artisanal craftsmanship combined with modern design sensibilities appealing to eco-conscious consumers.

Kerala State Bamboo Corporation operates as government-supported enterprise promoting bamboo industry development in India through plantation management and product manufacturing. The organization facilitates rural employment while supplying diverse bamboo products for domestic and international markets.

Shanghai Tenbro Bamboo Textile Company pioneers bamboo fiber production for textile applications including apparel, home textiles, and technical fabrics. Their manufacturing capabilities enable large-scale production meeting fashion industry demands for sustainable material alternatives.

Additional key players including Smith & Fong Company, Huayu Group, Pappco Greenware, Xiamen HBD Industries and Trade Company, Bamboo Master, and Meysher Industrial Group contribute to market development through specialized product offerings and regional market expertise.

Key Companies

- MOSO International BV

- Bamboo Village Company

- Kerala State Bamboo Corporation

- Shanghai Tenbro Bamboo Textile Company

- Smith & Fong Company

- Huayu Group

- Pappco Greenware

- Xiamen HBD Industries and Trade Company

- Bamboo Master

- Meysher Industrial Group

Recent Developments

- October 2025: Latham & Watkins advised CVC Capital Partners in the acquisition of Bamboo from White Mountains Insurance Group for USD 1.75 Billion. This transaction represents significant private equity interest in bamboo-related businesses reflecting industry growth potential and consolidation trends.

- November 2024: Former Gates Foundation leader secured USD 1.8 Million in funding for engineered bamboo building materials startup. The investment supports development of innovative construction solutions utilizing advanced bamboo composite technologies for sustainable infrastructure applications.

- April 2024: Amwoodo, a bamboo products manufacturer, secured USD 1 Million in funding from Rainmatter, Zerodha’s venture capital fund. The capital injection enables production capacity expansion and product line diversification targeting growing consumer demand for sustainable alternatives.

Report Scope

Report Features Description Market Value (2024) USD 77.6 Billion Forecast Revenue (2034) USD 141.6 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Furniture, Lifestyle Products, Personal Accessories, Yarn & Textiles, Building and Construction Products, Bamboo Structures, Gazebos, Cottages, Others), By End User (Personal and Residential, Commercial, Industrial and Infrastructure), By Sales Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape MOSO International BV, Bamboo Village Company, Kerala State Bamboo Corporation, Shanghai Tenbro Bamboo Textile Company, Smith & Fong Company, Huayu Group, Pappco Greenware, Xiamen HBD Industries and Trade Company, Bamboo Master, Meysher Industrial Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MOSO International BV

- Bamboo Village Company

- Kerala State Bamboo Corporation

- Shanghai Tenbro Bamboo Textile Company

- Smith & Fong Company

- Huayu Group

- Pappco Greenware

- Xiamen HBD Industries and Trade Company

- Bamboo Master

- Meysher Industrial Group