Global Background Check Software Market Size, Share, Industry Analysis Report By Background Check Software Type (Employment/Pre-hire Screening, Criminal History Check, Identity and SSN Verification, Credit and Financial History, Education and License Verification, Global Watch-list and Adverse-Media Scan, Other Check Types), By Deployment (Cloud, On-premise), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By End-Use Industry (IT and Telecommunication, BFSI, Healthcare and Life-Sciences, Government and Public Sector, Manufacturing, Retail and E-commerce, Education, Other End-Use Industries), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158696

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of Generative AI

- Investment and Business benefits

- Regional Overview: North America

- By Background Check Software Type

- By Deployment

- By Organization Size

- By End-Use Industry

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

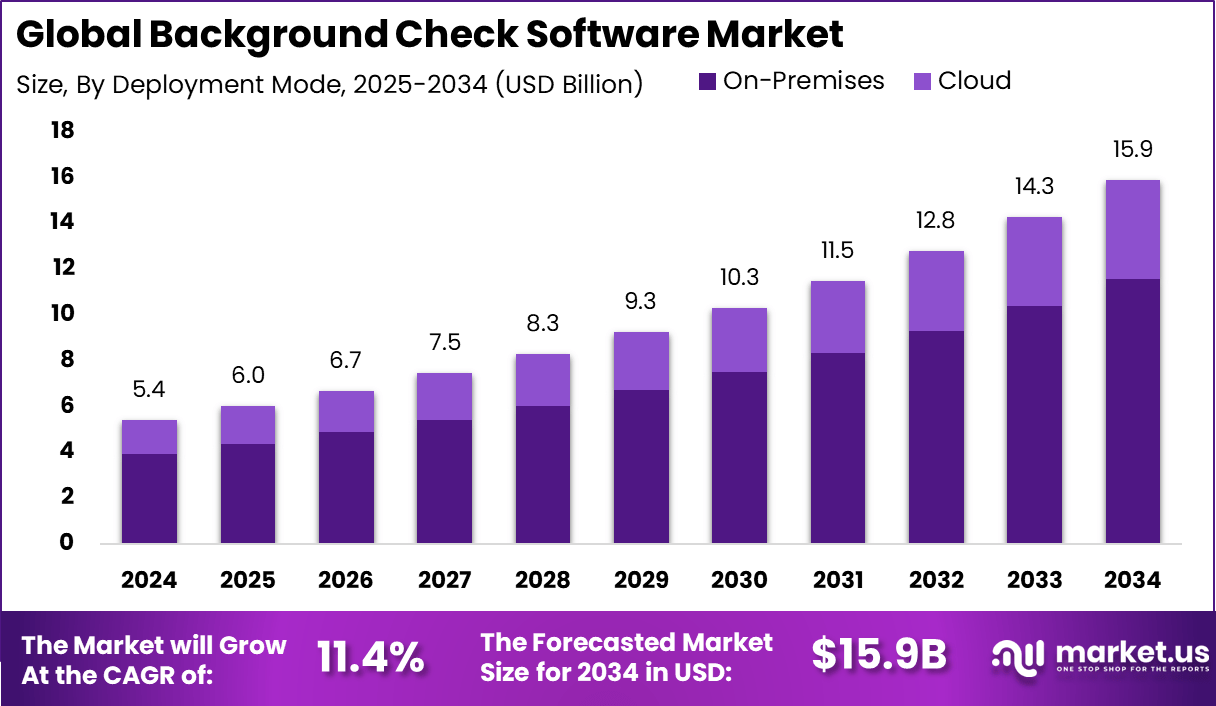

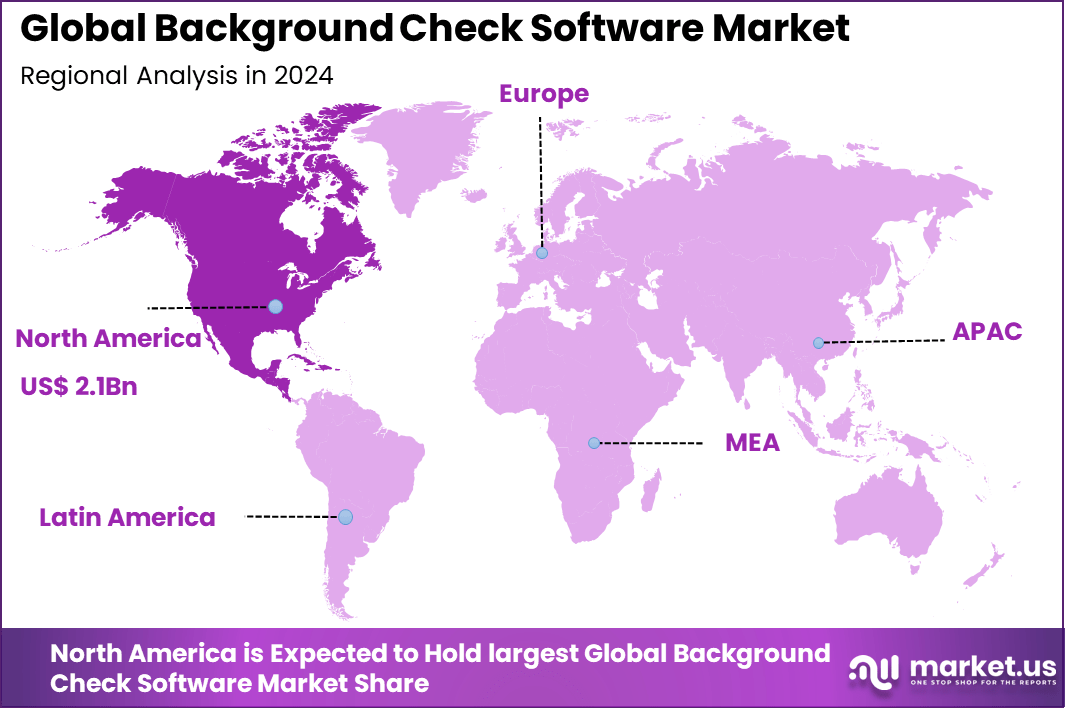

The Global Background Check Software Market size is expected to be worth around USD 15.9 Billion By 2034, from USD 5.4 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 39.4% share, holding USD 2.1 Billion revenue.

The Background Check Software Market refers to digital platforms and tools that automate the process of verifying an individual’s personal, professional, and financial history. These systems integrate with public records, credit databases, employment history, criminal records, and educational credentials to provide accurate screening results. The market serves employers, recruitment agencies, landlords, financial institutions, and government organizations that require reliable identity verification and risk assessment.

One of the top driving factors fueling this market is the rising importance of security in workplaces. Nearly 28% of respondents in a corporate risk survey identified workplace violence as a major security concern, illustrating why employers need reliable screening tools. Additionally, more than 70% of organizations routinely conduct criminal background checks on candidates, reflecting growing awareness of the need for thorough employee verification.

Technological adoption is significant in this market, particularly the increased use of AI, automation, and data analytics. AI-driven background checks improve speed and accuracy by automating data collection and analysis, reducing human error. Technologies such as biometric verification, blockchain for credential validation, and cloud computing are becoming more common.

According to 9cv9.com, background checks are a standard part of the hiring process for most employers. Nearly 95% of employers conduct at least one form of background screening before hiring. Among these, 92% perform criminal background checks, making it the most common type of verification.

Employment history and education are also key areas of focus. Around 87% of employers verify previous employment records, while 72% check education qualifications to confirm candidate credentials. Additionally, 67% of employers conduct reference checks to assess character and past performance.

For specific positions, especially those involving financial responsibility, 47% of employers run credit background checks. Similarly, about 36% perform motor vehicle record (MVR) checks, particularly for roles that involve driving or transportation responsibilities. These figures underscore how comprehensive screening has become an essential component of risk management in recruitment.

Key Insight Summary

- By software type, Employment/Pre-hire Screening dominated with a 36.4% share, reflecting the growing need for workforce verification and compliance.

- By deployment, the On-premise segment led with a commanding 72.7% share, highlighting the preference for enhanced data control and security.

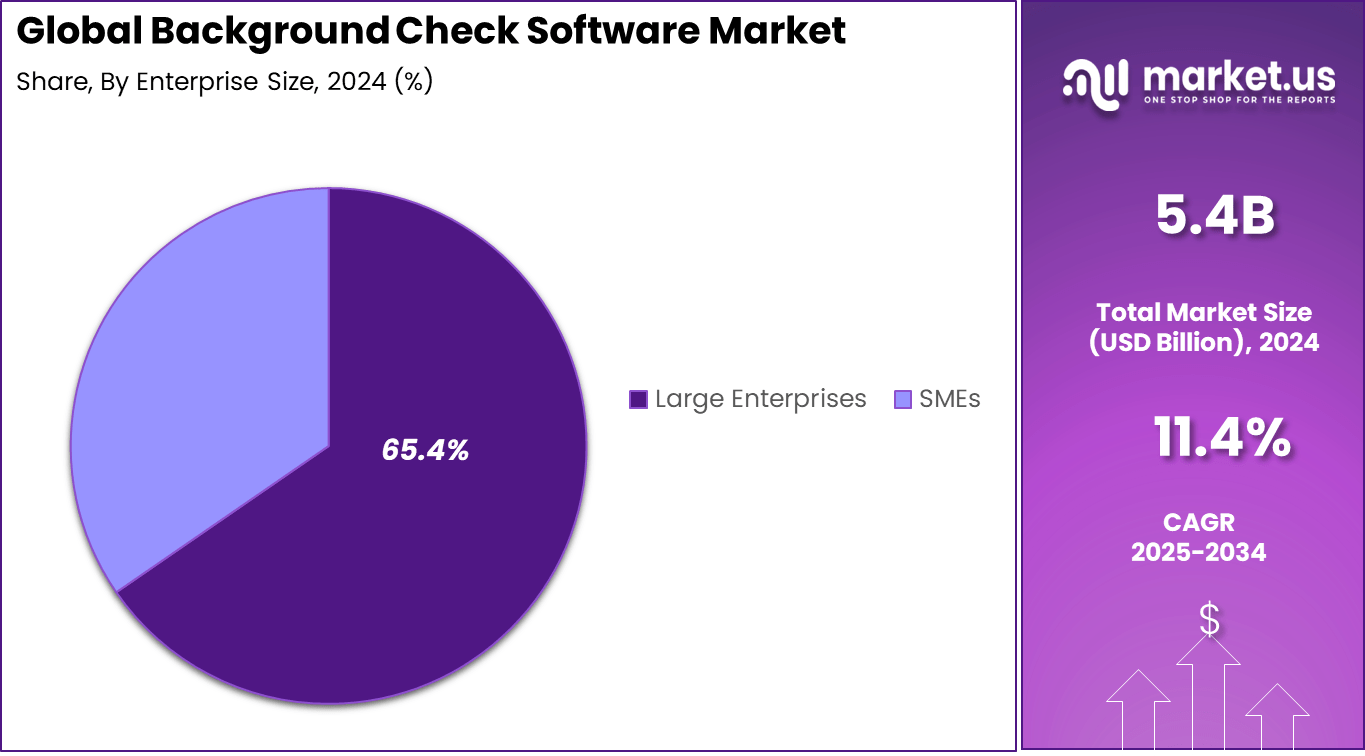

- By organization size, Large Enterprises captured 65.4% share, as they require extensive background checks for large-scale hiring.

- By end-use industry, IT and Telecommunication held the top position with a 30.5% share, driven by high recruitment volumes and strict data protection requirements.

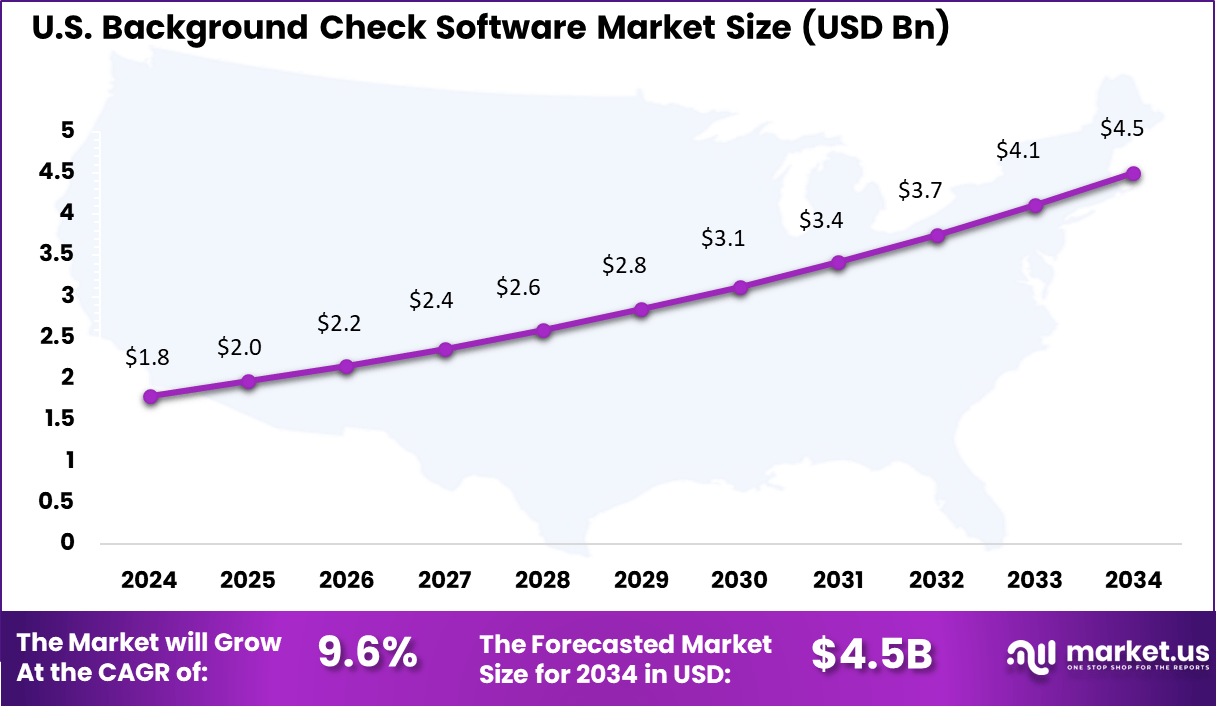

- Regionally, North America accounted for 39.4% share, with the U.S. market valued at USD 1.80 Billion in 2024, growing at a steady 9.6% CAGR.

Role of Generative AI

The role of generative AI in background check software has become increasingly significant in 2025. It transforms how verification processes are conducted by automating complex tasks such as identity verification, document authentication, and risk scoring.

Generative AI models analyze vast datasets rapidly, spotting inconsistencies like falsified information and automating natural language processing on resumes or social media data to gain a deeper understanding of candidate profiles. This leads to faster turnaround times, with statistics showing AI reduces the duration of background checks by up to 50%, improving both speed and accuracy while keeping data compliant with privacy laws.

AI’s ability to predict potential risks before they become apparent is enabling companies to shift from reactive to proactive hiring decisions, using behavioral analytics powered by large language models to assess candidates more holistically.

Investment and Business benefits

Investment opportunities in the Background Check Software Market lie in developing scalable, cloud-based platforms that integrate AI and machine learning for deeper data insights. Opportunities also exist in expanding into emerging markets where digital recruitment is growing fast. As regulations around privacy and security evolve, companies that provide compliant, user-friendly, and automated screening tools can capture market share.

The increasing need for cross-border verification and faster onboarding processes further broadens potential investments. Business benefits of using background check software include improved hiring quality, reduced risk of workplace incidents, and better compliance management. Organizations report smoother HR operations and stronger security postures by adopting these technologies.

Regional Overview: North America

North America leads the background check software market, accounting for about 39.4% of the global share. The US alone, with a strong regulatory framework and mature HR technology adoption, plays a major role in this dominance. Stringent legal regulations on employment and labor compliance drive widespread adoption among government and private sector organizations.

Recent trends in the US show growing integration of AI and machine learning for faster, more accurate screening. Remote work trends have intensified the demand for digital screening methods, while data privacy regulations shape how software vendors develop solutions. North America continues to push innovation and adoption in this space.

U.S. Market Trends

The US market is experiencing increasing demand for background check software due to rising remote hiring and workforce digitization. Companies are adopting AI-enabled tools to speed up verification with higher accuracy while maintaining compliance with laws like the Fair Credit Reporting Act. Usage is growing across industries such as healthcare, finance, and logistics, which require detailed employee vetting.

Regulatory updates and increasing workplace safety concerns encourage employers to deploy more comprehensive screening, including criminal, education, and employment verification. Advanced analytics and data integration are helping organizations detect risks earlier and make more informed decisions in the recruitment process.

Europe Market Trends

Europe’s background check software market emphasizes strict data protection regulations, especially under GDPR, which impacts how organizations manage candidate information. Countries like the UK, Germany, and France contribute significantly to market growth as employers adopt compliant and secure screening processes. Strong regulatory oversight demands transparent and ethical use of verification data.

The European market increasingly favors cloud-based screening solutions for their flexibility and ease of updating in line with regulatory changes. There is growth interest in specialized checks tailored to public sector, finance, and healthcare industries. Digital identity verification and social media screening are rising trends in the region.

Asia Pacific Market Trends

The Asia Pacific region is witnessing rapid expansion in background check software usage, driven by fast industrialization and broad digital hiring adoption in countries like China, India, and Japan. The region benefits from increasing smartphone penetration and the rise of gig economy work arrangements, requiring flexible and scalable background verification solutions.

Government mandates in some countries are encouraging the professionalization of hiring and workforce security, stimulating demand for reliable software. Adoption of AI and blockchain technologies is slowly entering the market, enhancing accuracy, transparency, and fraud prevention in the screening process.

By Background Check Software Type

In 2024, Employment and pre-hire screening represents a significant segment of the background check software market, holding a 36.4% share. This segment is critical for organizations seeking to verify candidate credentials before hiring, ensuring legitimacy and reducing hiring risks.

The emphasis on thorough employee vetting reflects a strong commitment to workforce integrity, which is increasingly important as companies face tighter compliance and regulatory demands. The pre-hire segment continues to grow due to rising remote hiring and contractor onboarding, which require faster and more reliable verification solutions.

By Deployment

In 2024, On-premise deployment remains the dominant choice in the background check software space, capturing a commanding 72.7% share. Many enterprises prefer this model due to its perceived security advantages and greater control over sensitive data. On-premise solutions allow firms to keep background screening processes internal and align them tightly with existing IT infrastructures.

At the same time, the higher cost and resource requirements associated with on-premise systems represent challenges for smaller players. Nonetheless, sectors with strict regulatory and privacy demands particularly value on-premise deployments. These solutions often support integration with legacy systems, enabling seamless data management and compliance monitoring.

By Organization Size

In 2024, Large enterprises dominate the use of background check software with a 65.4% share. These organizations typically have more complex and higher volumes of hiring needs, requiring comprehensive and scalable verification solutions. Background checks are fundamental in these settings to mitigate risks related to employee misconduct and regulatory compliance.

Large enterprises also have the resources to invest in advanced, customized screening technologies that integrate seamlessly with their internal HR systems. Their procurement processes often demand high reliability, audit trails, and detailed reporting features. This makes them key adopters and innovators in the background check software ecosystem.

By End-Use Industry

In 2024, the IT and telecommunication industry accounts for a significant 30.5% share of background check software usage. This sector values background checks highly due to the sensitive nature of its work, the need to protect data security, and the fast pace of hiring to keep up with technological advancements. Robust verification processes help reduce risks related to fraud, data breaches, and insider threats.

Fast hiring cycles and a competitive talent market push firms in this industry to adopt automated and quick-turnaround background screening solutions. The ability to scale and customize checks according to various roles is a priority, given the wide range of skills and security clearances required across IT and telecom functions.

Emerging Trends

Emerging trends in background check software for 2025 focus heavily on automation and data enrichment. Continuous or real-time monitoring is gaining ground, moving beyond the traditional one-time check to ongoing assessments during employment. Social media screening is now commonly integrated, enabling employers to scan and ethically interpret digital footprints to understand candidate behavior better.

There is also a rising emphasis on multilingual AI capabilities tailored to regional languages, which broadens access in diverse markets. Another trend is the integration of IoT and 5G technologies for instant identity verification, especially in industries where security and speed are critical. These approaches are becoming standard as companies look for accuracy and compliance within shorter operational cycles.

Growth Factors

Growth factors driving this market include rising demand for faster and more reliable screening processes and increasing regulatory requirements worldwide that push businesses to adopt advanced automated platforms. The growth of remote work and gig economies intensifies the need for scalable verification tools able to handle large volumes efficiently, with government compliance mandates further stimulating adoption.

More than half of enterprises are now leveraging AI-powered software for employee and vendor onboarding. Data shows that cloud-based solutions dominate adoption due to their flexibility and cost-effectiveness, and AI continues to improve risk detection by reducing human error significantly.

Key Market Segments

By Background Check Software Type

- Employment/Pre-hire Screening

- Criminal History Check

- Identity and SSN Verification

- Credit and Financial History

- Education and License Verification

- Global Watch-list and Adverse-Media Scan

- Other Check Types

By Deployment

- Cloud

On-premise

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-Use Industry

- IT and Telecommunication

- BFSI

- Healthcare and Life-Sciences

- Government and Public Sector

- Manufacturing

- Retail and E-commerce

- Education

- Other End-Use Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Need for Regulatory Compliance and Risk Management

The growing emphasis on regulatory compliance is a major driver for background check software. Organizations in sensitive sectors like healthcare, finance, and IT face strict laws requiring thorough employee screening to avoid legal penalties and operational risks.

Companies increasingly rely on this software to automate verification of work history, criminal records, and education to meet diverse and evolving compliance requirements. For instance, regulations such as the Fair Credit Reporting Act (FCRA) in the U.S. mandate careful screening of candidates, boosting demand for reliable background check solutions.

Additionally, businesses want to reduce risks linked to fraud, theft, or hiring unfit candidates by using these tools. The pandemic accelerated digital transformation in hiring, pushing more firms to adopt automated background checks to maintain hiring speed and accuracy remotely.

Restraint

Data Privacy and Security Concerns

Data privacy remains one of the most significant restraints for background check software adoption. Handling highly sensitive personal information requires strict protection to comply with regulations like GDPR and avoid breaches. Many potential users hesitate to fully implement such solutions due to fears over data misuse or exposure, which can damage trust with both candidates and regulators.

For instance, the complexity of meeting various regional data security laws complicates software deployment globally, especially for multinational companies. Moreover, frequent cyber threats and data breaches in recent years have heightened skepticism about how background check data is stored and shared.

Companies must invest heavily in cybersecurity measures to win user confidence, adding to operational costs. This restraint is especially challenging for smaller businesses with limited budgets, restricting the wider uptake of advanced screening technologies despite their benefits.

Opportunity

Growth of Cloud-Based and AI-Driven Solutions

The increasing availability of cloud-based and AI-enhanced background check software presents a strong market opportunity. Cloud platforms allow businesses of all sizes to access flexible and scalable screening services remotely, simplifying global hiring and reducing infrastructure costs.

For example, companies can now perform real-time verifications and integrate checks into broader HR systems without heavy upfront investments, making background screening accessible to small and medium enterprises. Additionally, AI and machine learning technologies improve the speed and accuracy of background checks by automating data analysis and detecting anomalies or risks early.

Emerging applications include biometric identity verification and blockchain for credential validation, adding layers of security and trust. These innovations open new avenues for differentiation and expansion, especially in sectors with stringent compliance needs like healthcare and BFSI.

Challenge

Regulatory Complexity Across Borders

One of the key challenges in this market comes from the complex landscape of global regulations. Different countries and regions have varying laws governing background checks, data privacy, and employment practices.

For instance, compliance requirements in Europe under GDPR differ substantially from U.S. federal and state laws. This fragmentation makes it difficult for software providers to create solutions that are fully compliant everywhere, limiting scalability for multinational clients.

Businesses operating across multiple regions must navigate these diverse legal frameworks to avoid penalties, which increases operational complexity and cost. The lack of standardized regulations can slow down adoption and create barriers for vendors trying to offer seamless international background check services.

Competitive Analysis

In the background check software market, Sterling Infosystems, HireRight, First Advantage, and Checkr are leading players with strong global footprints. Their platforms are widely adopted by enterprises for pre-employment screening, identity verification, and compliance management.

Mid-tier providers including Accurate Background, IntelliCorp Records, Inflection Risk Solutions, Orange Tree Employment Screening, Asurint, and Information Mart add depth to the market. Their solutions are designed to provide reliable screening services to small and mid-sized businesses.

Other players such as Verified Credentials, Employment Screening Resources, Onfido, Certn, PeopleCheck, Triton Canada, Pinkerton Consulting, SpringRole Technologies, Choice Screening, and TruthFinder strengthen the competitive landscape.

Top Key Players in the Market

- Sterling Infosystems, Inc.

- HireRight Holdings Corporation

- First Advantage Corporation

- Checkr, Inc.

- Accurate Background, LLC

- IntelliCorp Records, Inc.

- Inflection Risk Solutions, LLC

- Orange Tree Employment Screening, LLC

- Asurint, LLC

- Information Mart, Inc.

- Verified Credentials, Inc.

- Employment Screening Resources LLC

- Onfido Limited

- Certn Inc.

- PeopleCheck Pty Ltd

- Triton Canada Inc.

- Pinkerton Consulting and Investigations, Inc.

- SpringRole Technologies Pvt. Ltd.

- Choice Screening, Inc.

- TruthFinder, LLC

- Other Major Players

Recent Developments

- In July 2024, HireRight introduced a machine-learning feature that cut verification times by 40%, enhancing the efficiency of its screening services. This update makes their platform more attractive to businesses aiming to reduce hiring delays while maintaining thorough screening.

- February 2024, First Advantage announced its plan to acquire Sterling Check Corp. valued at approximately $2.2 billion in cash and stock, expanding its footprint and capabilities in background screening services.

- January 2024, Checkr launched an AI-powered background check platform designed to speed up verification and improve accuracy. This new offering uses artificial intelligence to reduce the time taken for background results and provides predictive insights on candidate risks, helping employers hire faster without compromising on reliability.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Bn Forecast Revenue (2034) USD 15.9 Bn CAGR(2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Background Check Software Type (Employment/Pre-hire Screening, Criminal History Check, Identity and SSN Verification, Credit and Financial History, Education and License Verification, Global Watch-list and Adverse-Media Scan, Other Check Types), By Deployment (Cloud, On-premise), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By End-Use Industry (IT and Telecommunication, BFSI, Healthcare and Life-Sciences, Government and Public Sector, Manufacturing, Retail and E-commerce, Education, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sterling Infosystems, Inc., HireRight Holdings Corporation, First Advantage Corporation, Checkr, Inc., Accurate Background, LLC, IntelliCorp Records, Inc., Inflection Risk Solutions, LLC, Orange Tree Employment Screening, LLC, Asurint, LLC, Information Mart, Inc., Verified Credentials, Inc., Employment Screening Resources LLC, Onfido Limited, Certn Inc., PeopleCheck Pty Ltd, Triton Canada Inc., Pinkerton Consulting and Investigations, Inc., SpringRole Technologies Pvt. Ltd., Choice Screening, Inc., TruthFinder, LLC, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Background Check Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Background Check Software MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sterling Infosystems, Inc.

- HireRight Holdings Corporation

- First Advantage Corporation

- Checkr, Inc.

- Accurate Background, LLC

- IntelliCorp Records, Inc.

- Inflection Risk Solutions, LLC

- Orange Tree Employment Screening, LLC

- Asurint, LLC

- Information Mart, Inc.

- Verified Credentials, Inc.

- Employment Screening Resources LLC

- Onfido Limited

- Certn Inc.

- PeopleCheck Pty Ltd

- Triton Canada Inc.

- Pinkerton Consulting and Investigations, Inc.

- SpringRole Technologies Pvt. Ltd.

- Choice Screening, Inc.

- TruthFinder, LLC

- Other Major Players