Global Baby Tricycle Market Size, Share, Growth Analysis By Type of Tricycle (Push Tricycles, Pedal Tricycles), By Age Group (Toddler Tricycles, Preschool Tricycles, School-age Tricycles), By Wheel Configuration (Classic Tricycles, Delta Tricycles), By Design and Features (Basic Tricycles, Themed Tricycles, Foldable Tricycles, Electric Tricycles), By Distribution Channel (Offline Retail, Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172147

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type of Tricycle Analysis

- Age Group Analysis

- Wheel Configuration Analysis

- Design and Features Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Baby Tricycle Company Insights

- Recent Developments

- Report Scope

Report Overview

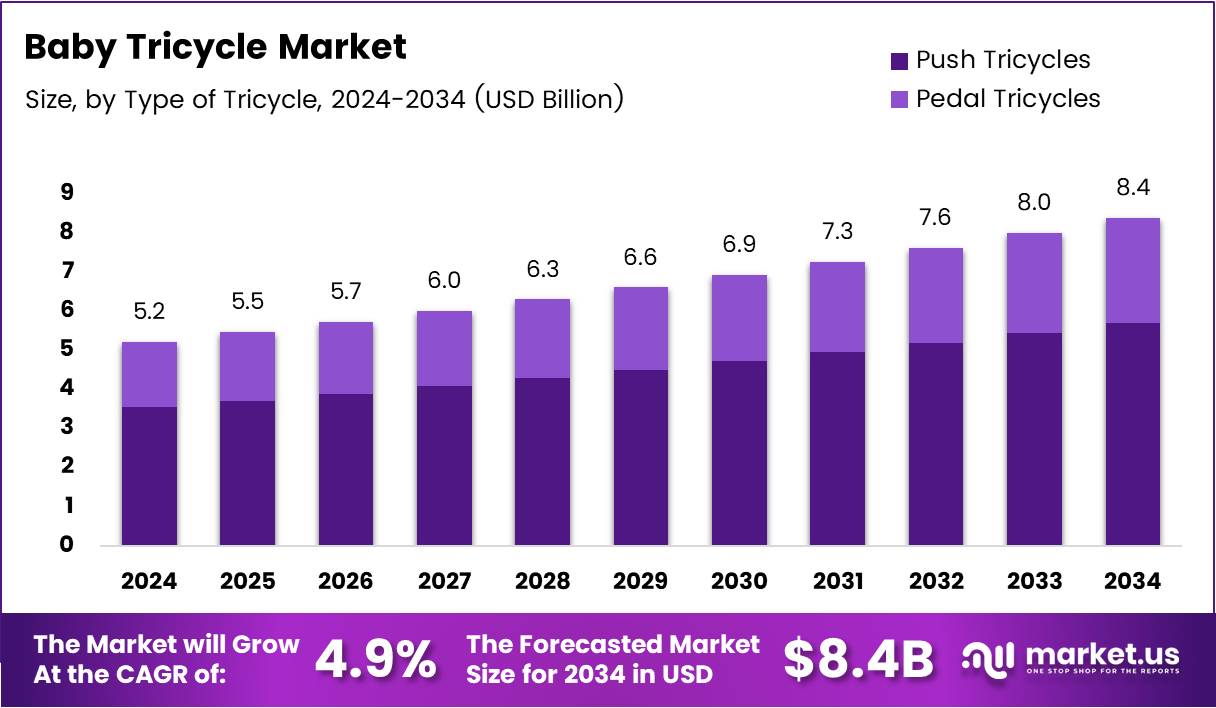

Global Baby Tricycle Market size is expected to be worth around USD 8.4 Billion by 2034 from USD 5.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The baby tricycle market represents a specialized segment within the broader children’s ride-on toys industry. These products encompass various designs tailored for toddlers and young children, ranging from simple push models to advanced pedal versions.

Baby tricycles serve as essential developmental tools that help young children build motor skills, balance, and coordination. The market includes classic three-wheeled designs, innovative convertible models, and feature-rich options with parent-control handles.

The market demonstrates robust expansion driven by urbanization and changing parenting priorities worldwide. Modern parents increasingly recognize outdoor play equipment as vital for childhood development. Nuclear families in urban settings seek compact, multi-functional products that support physical activity.

Rising disposable incomes across developing economies enable families to invest in premium children’s products. Parents now prioritize quality, safety features, and educational value over price alone. Enhanced distribution networks support market penetration in tier-2 and tier-3 cities.

Product innovation remains central to market dynamics, with manufacturers introducing convertible designs that adapt as children grow. Eco-friendly materials and sustainable manufacturing practices gain traction among environmentally conscious consumers. Smart tricycles incorporating safety sensors represent emerging premium segments.

According to KUMC, a 2024 report on childhood physical activity indicated only 20%-28% of U.S. children meet daily recommended physical activity levels. This concerning trend underscores the importance of outdoor play equipment like tricycles for promoting active lifestyles.

Government initiatives promoting early childhood physical development further support market growth. Regional safety standards and certification requirements shape product development strategies across North America, Europe, and Asia Pacific markets, ensuring consumer protection and product reliability.

Key Takeaways

- Global Baby Tricycle Market projected to reach USD 8.4 Billion by 2034 from USD 5.2 Billion in 2024.

- Market growing at a CAGR of 4.9% during 2025-2034 forecast period.

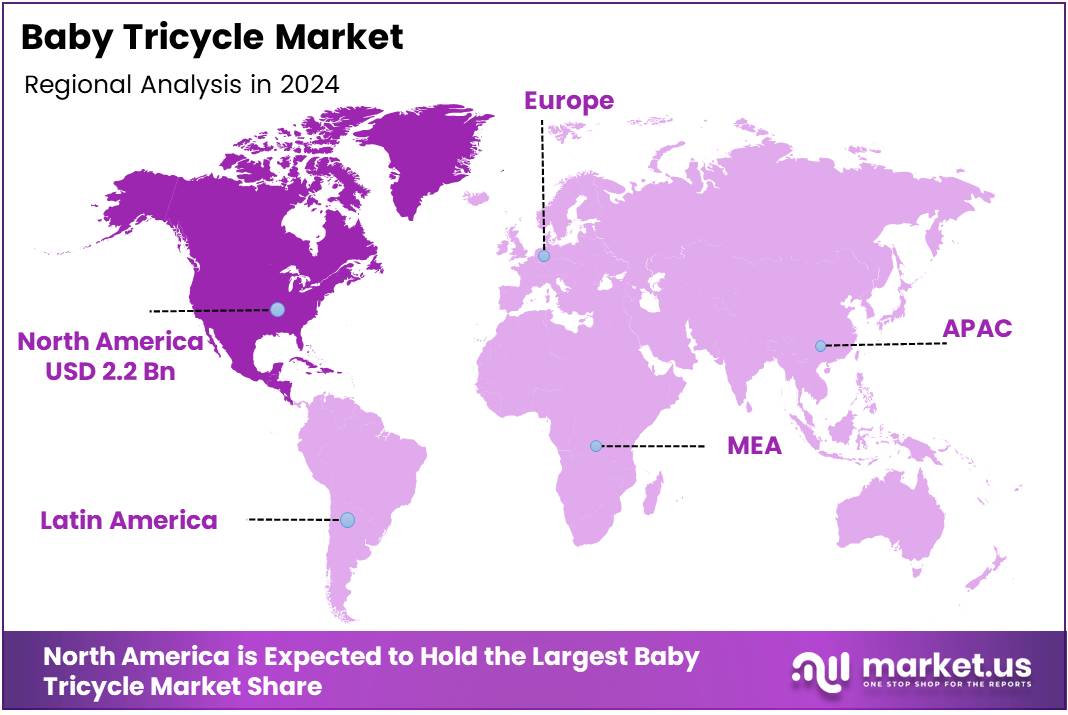

- North America dominates with 43.7% market share, valued at USD 2.2 Billion.

- Push Tricycles lead the market with 62.4% share in type segment.

- Toddler Tricycles command 51.2% of age group segment.

- Classic Tricycles hold 67.8% share in wheel configuration segment.

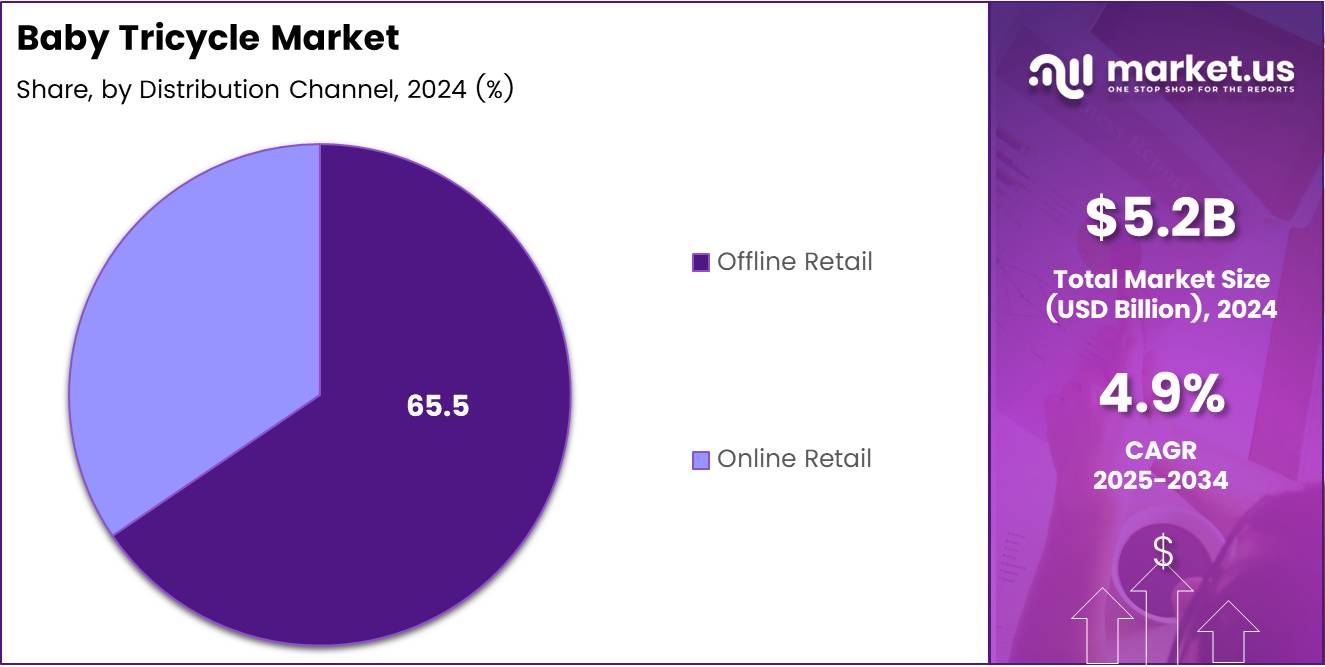

- Offline Retail channels account for 65.5% of distribution.

- Basic Tricycles represent 37.7% of design and features segment.

Type of Tricycle Analysis

Push Tricycles dominate with 62.4% share due to parental safety preferences and extended usage capability.

In 2024, Push Tricycles held a dominant market position in the Type of Tricycle segment of Baby Tricycle Market, with a 62.4% share. These models feature parent-control steering handles that allow caregivers to guide younger children safely during outdoor activities.

Push tricycles appeal to parents seeking supervised outdoor experiences for toddlers aged 12-24 months. The design combines safety assurance with developmental benefits, enabling early introduction to ride-on toys. Parents appreciate the control and peace of mind these models provide.

Pedal Tricycles represent the traditional segment, targeting children aged 2-5 years with developed leg strength. These models encourage independent riding and physical exercise. Manufacturers increasingly offer convertible designs that transition from push to pedal modes, extending product lifecycle significantly.

Age Group Analysis

Toddler Tricycles dominate with 51.2% share driven by early childhood development focus and parental investment patterns.

In 2024, Toddler Tricycles held a dominant market position in the Age Group segment of Baby Tricycle Market, with a 51.2% share. This segment targets children aged 1-3 years, featuring low seats, wide bases, and stability-focused designs for maximum safety.

Parents prioritize safety features and ergonomic construction for this vulnerable age group. The segment benefits from first-time purchase patterns as families introduce outdoor play equipment. Enhanced safety standards drive premium pricing in this category.

Preschool Tricycles cater to children aged 3-5 years, incorporating larger frames and enhanced features. These models support developing coordination skills and prepare children for bicycle transition. The segment experiences steady demand as children outgrow toddler models.

School-age Tricycles target children aged 5-8 years, offering advanced features and durability. Though smaller in market share, this segment serves specific needs for extended tricycle use. Specialized designs include cargo options and performance-oriented models.

Wheel Configuration Analysis

Classic Tricycles dominate with 67.8% share due to proven stability design and widespread manufacturing availability.

In 2024, Classic Tricycles held a dominant market position in the Wheel Configuration segment of Baby Tricycle Market, with a 67.8% share. The traditional two-rear, one-front wheel arrangement provides optimal stability for young riders learning balance and coordination.

This configuration remains preferred for toddler and preschool segments where balance development is primary. Manufacturing simplicity and cost-effectiveness support market dominance across price points. Parents trust this time-tested design for safety and reliability.

Delta Tricycles feature two front wheels and one rear wheel, offering alternative stability dynamics. This configuration provides enhanced turning capability and different riding experiences. Delta designs appeal to parents seeking innovative alternatives and are increasingly incorporated in premium product lines.

Design and Features Analysis

Basic Tricycles dominate with 37.7% share reflecting price-sensitive consumer segments and fundamental functionality focus.

In 2024, Basic Tricycles held a dominant market position in the Design and Features segment of Baby Tricycle Market, with a 37.7% share. These models offer essential functionality without additional features, appealing to budget-conscious families and emerging markets.

Simple construction reduces costs while maintaining safety standards. The segment serves as entry point for first-time buyers and value-oriented consumers. Affordability drives high volume sales, particularly in developing regions.

Themed Tricycles incorporate licensed characters and branded designs, attracting children through visual appeal. These models command premium pricing and leverage popular media franchises. Parents invest in themed options to encourage outdoor play through child preferences.

Foldable Tricycles address urban storage constraints and travel requirements. Compact designs enable apartment living compatibility and transportation convenience. The segment grows with urbanization and mobility-focused lifestyles among modern families.

Electric Tricycles represent emerging premium segment with battery-powered assistance. These innovative models appeal to tech-forward parents and older children. Limited adoption reflects higher costs and regulatory considerations, though innovation continues expanding this niche.

Distribution Channel Analysis

Offline Retail dominates with 65.5% share due to hands-on product evaluation preferences and immediate purchase satisfaction.

In 2024, Offline Retail held a dominant market position in the Distribution Channel segment of Baby Tricycle Market, with a 65.5% share. Physical stores enable parents to assess size, quality, and safety features directly before purchasing.

Specialized baby product retailers and department stores provide expert guidance and assembly services. Immediate possession eliminates shipping concerns for bulky products. Parents value the tactile experience and professional advice available in-store.

Online Retail grows rapidly through e-commerce platforms and brand websites. Digital channels offer broader selection, competitive pricing, and home delivery convenience. Detailed specifications, customer reviews, and video demonstrations support informed decision-making effectively.

Key Market Segments

By Type of Tricycle

- Push Tricycles

- Pedal Tricycles

By Age Group

- Toddler Tricycles

- Preschool Tricycles

- School-age Tricycles

By Wheel Configuration

- Classic Tricycles

- Delta Tricycles

By Design and Features

- Basic Tricycles

- Themed Tricycles

- Foldable Tricycles

- Electric Tricycles

By Distribution Channel

- Offline Retail

- Online Retail

Drivers

Rising Urban Nuclear Families and Increasing Disposable Income Drive Baby Tricycle Market Expansion

Urban nuclear family structures reshape children’s product consumption patterns globally. Smaller households allocate higher budgets per child for developmental toys and outdoor equipment. Parents in metropolitan areas prioritize compact, multi-functional products that fit apartment living constraints.

Growing disposable incomes across emerging economies enable premium product purchases. Middle-class expansion in Asia Pacific and Latin America drives market growth through improved purchasing power. Parents increasingly invest in quality baby products that offer safety certifications and developmental benefits.

Early childhood motor skill development gains recognition among modern parents. Healthcare professionals and educators emphasize outdoor physical activity for cognitive and physical growth. Tricycles provide structured exercise that builds leg strength, coordination, and spatial awareness.

Organized retail expansion and e-commerce platform growth enhance product accessibility. Modern trade channels reach tier-2 and tier-3 cities previously underserved by specialized baby stores. Online marketplaces offer extensive selection with doorstep delivery, reducing purchase barriers significantly.

Restraints

Safety Compliance Challenges and Short Product Lifecycle Constrain Market Growth

Safety compliance and certification requirements vary significantly across regions, creating manufacturing complexities. Different standards in North America, Europe, and Asia Pacific necessitate product modifications and testing protocols. Smaller manufacturers struggle with certification costs and regulatory navigation.

Short product usage lifecycle limits repeat purchase frequency from individual households. Children typically outgrow tricycles within 2-3 years, reducing replacement demand. Unlike consumable products, durable ride-on toys don’t require frequent repurchase from the same family.

Second-hand market activity further impacts new product sales. Durable construction enables tricycle longevity, encouraging resale and hand-me-down practices. Online marketplaces facilitate used product transactions, providing cost-effective alternatives for budget-conscious families.

Seasonal demand fluctuations create inventory and production planning challenges. Peak purchasing occurs during holidays and favorable weather periods. Manufacturers face storage costs during off-seasons while maintaining production capacity for peak demand.

Growth Factors

Product Innovation and Market Expansion Drive Future Growth Opportunities

Convertible and multi-stage tricycle designs extend product lifecycle significantly. These innovative models transform from push tricycles to pedal versions as children develop. Adjustable features accommodate growth spurts, reducing need for frequent replacements and enhancing value proposition.

Eco-friendly and sustainable material adoption responds to environmental consciousness. Manufacturers increasingly use recycled plastics, bamboo, and non-toxic paints in production. Green certifications attract environmentally aware parents and differentiate brands in competitive markets.

Smart tricycle integration represents emerging premium segment with substantial potential. GPS tracking, safety sensors, and parent control apps add technology-driven value. These features address modern parental concerns about child safety and activity monitoring effectively.

Emerging markets in tier-2 cities and developing regions offer untapped growth potential. Urbanization drives demand in previously underserved areas with growing middle classes. Infrastructure improvements and retail expansion enable market entry, creating new revenue opportunities.

Emerging Trends

Design Innovation and Digital Influence Shape Baby Tricycle Market Evolution

Push-handle and parent-steering tricycles gain popularity among safety-conscious families. These designs enable caregivers to maintain control while children experience riding. The trend reflects modern parenting approaches balancing independence with supervision for young children.

Lightweight and foldable models address urban mobility and storage challenges. Travel-friendly designs appeal to families with active lifestyles and limited living space. Portability enables park visits, vacations, and grandparent visits without transportation hassles.

Gender-neutral and customizable designs reflect changing social attitudes and personalization trends. Parents increasingly reject traditional color stereotypes, demanding diverse aesthetic options. Customizable accessories and modular components enable unique configurations that express individual preferences.

Social media parenting communities significantly influence product innovation and purchasing decisions. Instagram and YouTube showcasing drives awareness of new features and brands. Parent reviewers and influencers impact consumer preferences through authentic testimonials and product demonstrations.

Regional Analysis

North America Dominates the Baby Tricycle Market with a Market Share of 43.7%, Valued at USD 2.2 Billion

North America commands the largest market position with 43.7% share, valued at USD 2.2 Billion in 2024. Strong consumer spending power and safety-conscious parenting culture drive premium product adoption. Established retail infrastructure and e-commerce penetration support widespread accessibility across urban and suburban markets.

Europe Baby Tricycle Market Trends

Europe represents a mature market emphasizing sustainability and design quality. Consumers prioritize eco-friendly materials and minimalist aesthetics aligned with Scandinavian design principles. Strict safety regulations ensure product reliability but create entry barriers for new manufacturers.

Asia Pacific Baby Tricycle Market Trends

Asia Pacific exhibits fastest growth driven by population size and rising middle class. China and India lead demand through urbanization and increasing disposable incomes. Local manufacturers dominate with cost-effective products while international brands capture premium segments successfully.

Middle East and Africa Baby Tricycle Market Trends

Middle East and Africa show emerging potential with urban development and young populations. Gulf countries demonstrate preference for premium international brands. African markets remain price-sensitive with growing modern retail presence creating new opportunities.

Latin America Baby Tricycle Market Trends

Latin America experiences gradual growth constrained by economic volatility and income disparities. Brazil and Mexico lead regional demand through large populations and expanding middle classes. Affordability remains critical factor with strong preference for value-oriented products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Baby Tricycle Company Insights

The global Baby Tricycle Market in 2024 features established players leveraging brand recognition and innovation. Radio Flyer maintains strong market presence through iconic American heritage and quality reputation, offering classic and modern designs that appeal to multi-generational consumers seeking reliability.

Schwinn capitalizes on its cycling industry expertise to deliver well-engineered tricycles emphasizing durability and safety features. The brand leverages decades of bicycle manufacturing experience to ensure superior product quality and performance.

smarTrike differentiates through innovative convertible designs and smart technology integration, targeting tech-savvy parents seeking multi-stage products. Their focus on adaptability and modern features resonates with contemporary parenting values.

Joovy focuses on functional design and value positioning, appealing to practical-minded families seeking reliable performance at competitive prices. Their straightforward approach attracts budget-conscious consumers without compromising essential safety and quality standards.

These key players compete through product innovation, safety certifications, and distribution network expansion. Companies invest in eco-friendly materials and smart features to capture premium segments. Strategic partnerships with retail chains and e-commerce platforms enhance market reach effectively.

Key Companies:

- Radio Flyer

- Schwinn

- smarTrike

- Joovy

- Little Tikes

- Hape

- Kettler

- Strider Sports International

Recent Developments

- November 2025: Lifelong Online launched kids’ scooters and tricycles on Blinkit, expanding quick-commerce availability for baby products. This partnership provides urban consumers with 10-minute delivery options, combining quality and affordability with unprecedented convenience for active play equipment.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 8.4 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Tricycle (Push Tricycles, Pedal Tricycles), By Age Group (Toddler Tricycles, Preschool Tricycles, School-age Tricycles), By Wheel Configuration (Classic Tricycles, Delta Tricycles), By Design and Features (Basic Tricycles, Themed Tricycles, Foldable Tricycles, Electric Tricycles), By Distribution Channel (Offline Retail, Online Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Radio Flyer, Schwinn, smarTrike, Joovy, Little Tikes, Hape, Kettler, Strider Sports International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Radio Flyer

- Schwinn

- smarTrike

- Joovy

- Little Tikes

- Hape

- Kettler

- Strider Sports International