Global Baby Care Products Packaging Market Size, Share, Growth Analysis By Material (Plastic, Paper, Glass, Others), By Packaging Type (Flexible, Rigid), By Product Type (Bottles and Jars, Pouches and Sachets, Cans, Tubes and Sticks, Others), By Application (Baby Food, Baby Drinks and Formula, Baby Toiletries and Personal-Care, Baby Healthcare / OTC, Baby Apparel and Accessories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168689

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

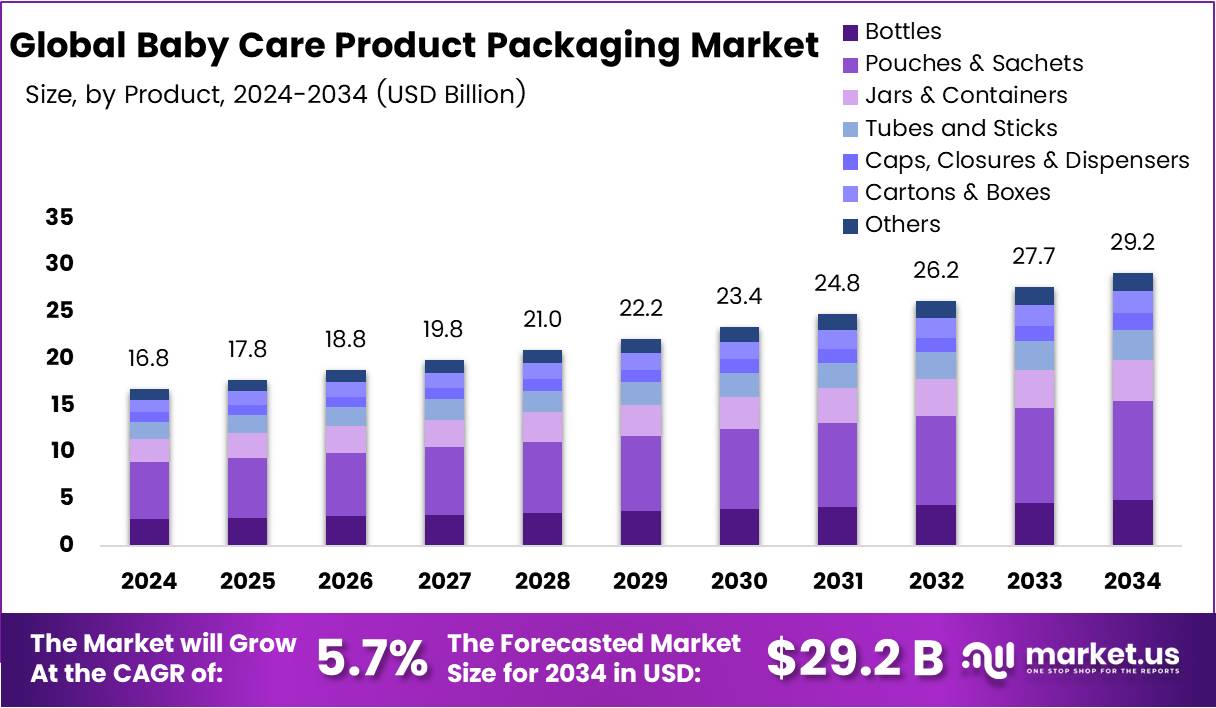

The Global Baby Care Product Packaging Market size is expected to be worth around USD 29.2 billion by 2034, from USD 16.8 billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Baby care packaging refers to the specialized containers, pouches, and materials used for infant hygiene and feeding products. The baby care packaging market is characterized by growing demand for safety, convenience, and sustainability, driven by evolving consumer preferences and regulatory requirements. With increasing awareness around infant health, manufacturers are prioritizing packaging that ensures safety, such as child-resistant seals and non-toxic, eco-friendly materials.

Flexible packaging, such as pouches and sachets, has gained popularity due to its lightweight nature, ease of use, and reduced environmental footprint compared to rigid options such as bottles and jars. Furthermore, there is a focus on innovative designs that enhance user convenience, such as resealable pouches for baby food and wipes. Additionally, sustainability plays a critical role, with many brands transitioning to recyclable, biodegradable, or plant-based materials in response to growing environmental concerns.

- According to a report by Plastics Europe, in 2023, 9.6% of the total plastic packaging consumption was circular packaging, including recycled plastic packaging and bio-based plastic packaging.

Key Takeaways

- The global baby care packaging market was valued at US$16.8 billion in 2024.

- The global baby care packaging market is projected to grow at a CAGR of 5.7% and is estimated to reach US$29.2 billion by 2034.

- Based on types of product, pouches & sachets dominated the baby care packaging market, constituting 36.4% of the total market share.

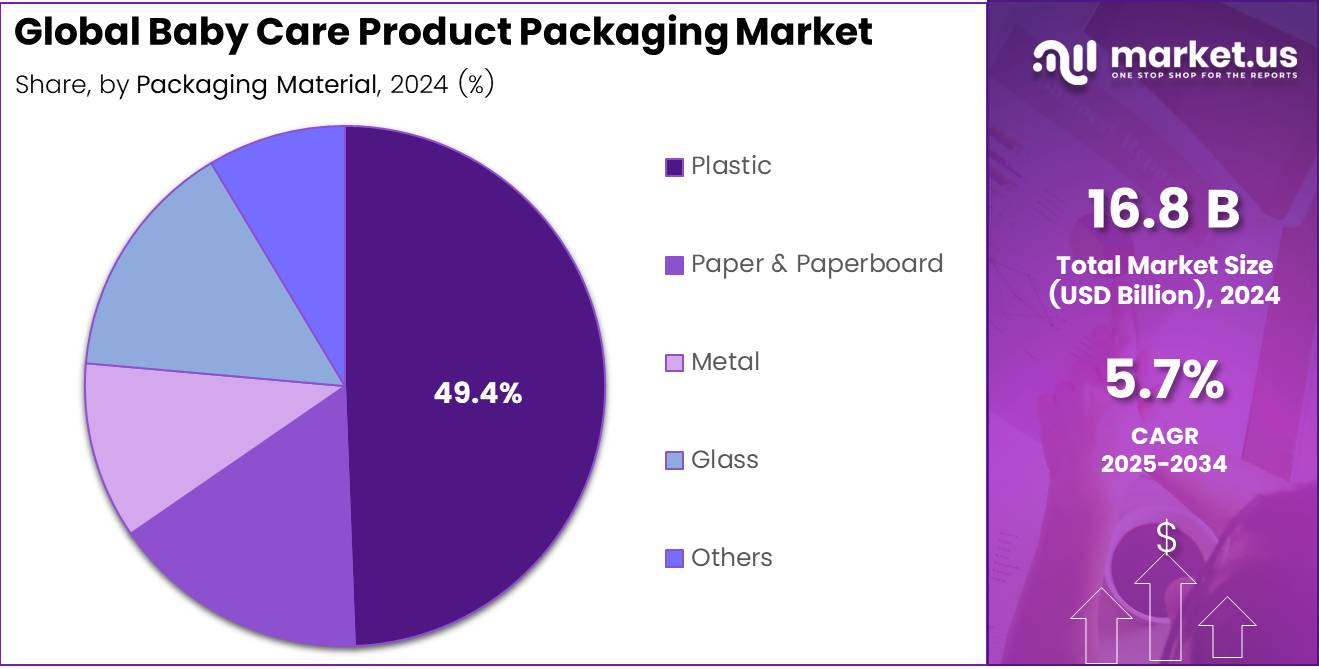

- Based on the material of the packaging, plastic dominated the baby care packaging market, with a substantial market share of around 49.4%.

- Based on the types, flexible baby care packaging led the market, comprising 56.2% of the total market.

- Among the applications, baby food held a major share in the baby care packaging market, 37.6% of the market share.

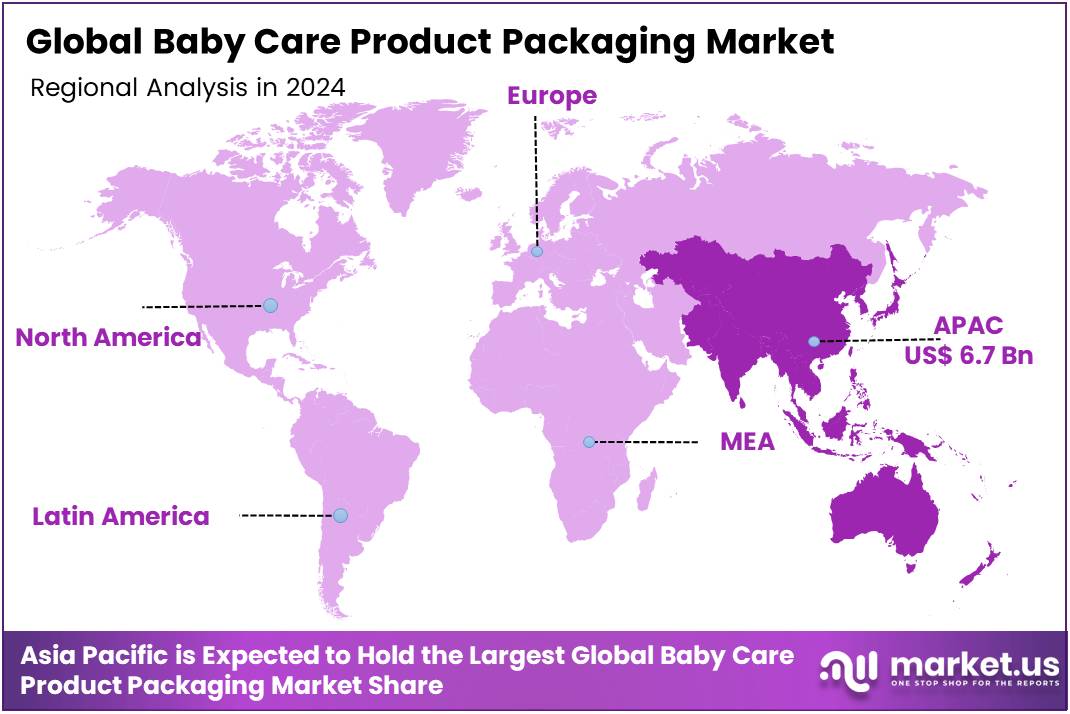

- In 2024, the Asia Pacific was the most dominant region in the baby care packaging market, accounting for 39.8% of the total global consumption.

Product Type Analysis

Pouches & Sachets are a Prominent Segment in the Baby Care Packaging Market.

The baby care packaging market is segmented based on types of packaging into bottles, pouches & sachets, jars & containers, tubes and sticks, caps, closures & dispensers, cartons & boxes, and others. The pouches & sachets led the baby care packaging market, comprising 36.4% of the market share.

Pouches and sachets are increasingly favored in baby care packaging due to their convenience, cost-effectiveness, and enhanced functionality compared to traditional packaging formats such as bottles or jars. These flexible, lightweight packaging solutions are easy to handle, store, and dispose of, offering significant space-saving advantages.

For instance, baby food brands have widely adopted pouches for purees and snacks, as they are easier to carry, reseal, and prevent spills, making them ideal for on-the-go parents. With growing consumer preference for convenient and practical packaging, pouches and sachets are becoming the go-to option in the baby care sector.

Packaging Material Analysis

Plastic Packaging Material Dominated the Baby Care Packaging Market.

On the basis of packaging material, the baby care packaging market is segmented into plastic, paper & paperboard, metal, glass, and others. Plastic material dominated the baby care packaging market, comprising 49.4% of the market share, due to its versatility, cost-effectiveness, and durability. It is lightweight, reducing transportation costs and making it ideal for products such as diapers, wipes, lotions, and baby food.

Additionally, the flexibility of plastic allows manufacturers to create a wide range of packaging formats, including pouches, bottles, and containers, which can be tailored for child safety, tamper-evidence, and ease of use. While materials such as glass or metal offer higher protection and aesthetics, they are heavier, more expensive, and prone to breakage, making them less practical for daily baby care products. Additionally, plastic packaging is often more recyclable, meeting both safety standards and growing consumer demand for sustainable packaging solutions.

Type Analysis

Flexible Baby Care Packaging Held a Major Share of the Market.

The flexible baby care packaging dominated the market, with a notable market share of 56.2%. Flexible baby care packaging is increasingly preferred over rigid packaging due to its practical benefits in terms of cost, convenience, and sustainability. Flexible materials such as pouches and sachets are lightweight, reducing transportation costs and making them easier to handle, store, and dispose of compared to rigid alternatives such as bottles and jars.

For instance, baby food products, such as purees, are commonly packaged in flexible pouches, which offer portability, re-sealability, and ease of use, especially for on-the-go parents. Additionally, flexible packaging often requires less material, leading to a reduction in overall environmental impact. The ability to create smaller packaging formats without sacrificing product integrity further appeals to both manufacturers and consumers.

Application Analysis

Baby Care Packaging Products Are Mostly Utilized for Baby Food.

Based on the Application, the baby care packaging market is segmented into baby food, baby drinks & formula, personal care, healthcare/OTC, apparel & accessories, and others. Among the applications of the baby care packaging, 37.6% of the products consumed globally are for baby food, due to the growing demand for convenience, safety, and hygiene in feeding products.

Baby food, particularly purees, snacks, and cereals, requires packaging that is easy to handle, resealable, and able to preserve freshness over time. Pouches, jars, and flexible containers are ideal for these products, offering portability for parents on the go, as well as tamper-evident seals to ensure safety.

In contrast, baby drinks and formula often require specialized packaging to prevent spoilage and maintain nutritional integrity, leading to a more niche demand. While personal care and healthcare packaging are important, the rapid expansion of the baby food sector has driven higher volumes of packaging production in this area.

Key Market Segments

By Product Type

- Bottles

- Pouches & Sachets

- Jars & Containers

- Tubes and Sticks

- Caps, Closures & Dispensers

- Cartons & Boxes

- Others

By Packaging Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Type

- Flexible

- Rigid

By Application

- Baby Food

- Baby Drinks & Formula

- Personal Care

- Skincare

- Haircare

- Toiletries

- Healthcare / OTC

- Apparel & Accessories

- Others

Drivers

Stringent Safety Standards Drive the Baby Care Packaging Market.

Stringent safety standards are a key driver in the evolution of the baby care packaging market, as manufacturers increasingly prioritize child safety in product design. Regulatory bodies worldwide enforce rigorous guidelines to ensure packaging materials are non-toxic, tamper-proof, and secure for young children.

For instance, the U.S. Consumer Product Safety Commission (CPSC) mandates that packaging for baby products, such as bottles, toys, and wipes, must be free from hazardous chemicals such as BPA and phthalates. Similarly, the REACH Regulation establishes restrictions for chemicals and heavy metals in consumer products sold in the EU. Children’s articles are subject to additional specific requirements, such as restrictions on certain phthalates.

Furthermore, according to the U.S. Poison Prevention Packaging Act (PPPA), packaging must be child-resistant to prevent accidental ingestion or exposure to harmful substances. In addition, the rising awareness of environmental sustainability has led to a shift towards eco-friendly packaging, with many brands adopting recyclable or biodegradable materials. These enhanced safety and environmental standards protect infants and foster greater consumer trust, encouraging purchasing decisions. The safety measures are integral to shaping product innovation and consumer preferences in the baby care sector.

Restraints

High Production Costs Might Pose a Challenge to the Baby Care Packaging Market.

High production costs associated with premium materials, extensive testing, and significant research and development (R&D) efforts present a notable challenge in the baby care packaging market. The demand for safe, eco-friendly, and innovative packaging often requires manufacturers to invest in costly materials, such as biodegradable plastics, non-toxic inks, and tamper-evident seals.

For instance, companies producing baby food packaging are increasingly opting for plant-based alternatives, which tend to have higher production costs than traditional plastic. Additionally, the rigorous testing required to ensure that packaging meets safety standards for infant products, such as child-proof seals or contamination prevention, adds to the expense.

Furthermore, the emphasis on child-resistant and functional designs to appeal to parents further increases costs. These escalating expenses may force companies to reconsider their production processes or pass costs onto consumers, potentially limiting market accessibility.

Growth Factors

Parental Demand for Safety and Hygiene Creates Opportunities in the Baby Care Packaging Market.

The growing demand from parents for safety, hygiene, and convenience in baby products is significantly influencing the baby care packaging market. As parents become more conscientious about the health and well-being of their children, there is an increased preference for packaging that offers both protection and cleanliness.

Products such as baby wipes, diapers, and food containers are increasingly being designed with tamper-evident seals and antimicrobial properties to ensure safety and hygiene. For instance, in December 2025, SIG, a leading systems and solutions provider for aseptic packaging, announced that Petite Palates, an emerging baby food brand in the United States, chose SIG’s advanced aseptic spouted pouch technology for its products.

Additionally, the increasing number of parents has contributed to a larger consumer base, as the world birth rate for 2024 was 17.30, a 5.9% increase from 2023, further stimulating demand for high-quality, hygienic packaging solutions. The evolving needs create significant opportunities for companies to innovate and capture market share by prioritizing safety and hygiene in their packaging.

Emerging Trends

A Strong Push for Sustainability.

The push for eco-friendly and sustainable materials in baby care packaging is rapidly gaining momentum, driven by consumer demand and environmental concerns. As awareness about plastic pollution grows, many brands are transitioning to biodegradable, recyclable, or compostable materials. For instance, several baby diaper brands have introduced products with packaging made from plant-based plastics or recycled materials.

In April 2025, US startup Hiro Technologies unveiled MycoDigestible Diapers, which come with plastic-eating fungi that break the material down in a landfill. Additionally, baby care product brands are reconsidering their strategies to align themselves with the growing demand for eco-friendly products.

In November 2025, Johnson’s Baby announced the transition of the brand with the launch of its advanced product range covering skin-science-related formulations and sustainable packaging. Furthermore, to cater to a broader customer base, packaging innovations such as biodegradable films and paper-based alternatives are being explored.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Increased Prices of Baby Care Packaging.

Current geopolitical tensions have created significant disruptions in the baby care packaging market, impacting both supply chains and production costs. For instance, the trade disputes between major economies, such as the U.S. and China, have resulted in tariffs and delays in the importation of essential raw materials such as plastics, metals, and glass, which are crucial for manufacturing packaging.

These disruptions have led to increased production costs, with companies facing higher expenses for securing materials and maintaining consistent supply chains. Additionally, supply chain interruptions, particularly in regions such as Southeast Asia and Eastern Europe, have caused an increase in material costs and affected lead times.

Similarly, geopolitical instability, such as the Russia-Ukraine conflict, has exacerbated energy price fluctuations, which directly affect the cost of manufacturing processes, further driving up packaging costs. Companies in the baby care sector, particularly those that rely on global supply chains, are facing challenges in ensuring consistent quality and availability of packaging materials.

Furthermore, these geopolitical instabilities have prompted many businesses to reassess their sourcing strategies, potentially shifting production closer to key markets to mitigate risks and reduce dependency on volatile regions.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Baby Care Packaging Market.

In 2024, the Asia Pacific dominated the global baby care packaging market, holding about 39.8% of the total global consumption. The region holds the largest share of the global baby care packaging market due to a combination of factors such as an increasing number of babies each year, a rapidly growing middle-class population, and increasing awareness of infant health and safety.

For instance, in 2024, China saw an increase to 9.54 million newborns, a 5.8% rise from 2023, and India saw over 23 million births. Countries such as China and India, with their large and expanding populations, represent a significant consumer base for baby care products.

Additionally, the region has seen a rise in disposable income, leading to increased demand for premium baby care products and their associated packaging, such as child-proof and hygienic packaging for diapers, food, and skincare items. Furthermore, as environmental concerns intensify, many Asian manufacturers tend towards sustainable packaging solutions. As urbanization continues and lifestyles shift towards modern, convenience-oriented solutions, the demand for sophisticated, safe, and eco-friendly packaging in the Asia Pacific region remains strong, reinforcing its dominant market position.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Baby Care Product Packaging Company Insights

Companies in the baby care packaging industry focus on several strategic activities to increase their sales and market share. The companies invest in product innovation, developing packaging solutions that prioritize convenience, safety, and sustainability, such as easy-to-use, resealable pouches or eco-friendly materials. In addition, many companies focus on enhancing the functionality and aesthetics of their packaging to attract health-conscious and environmentally aware consumers.

Similarly, the companies focus on expanding distribution channels by increasingly partnering with e-commerce platforms and global retailers to reach a broader consumer base. Furthermore, major players emphasize collaborations with major baby care brands to maintain a consistent supply. Moreover, these companies focus on mergers and acquisitions to expand their market reach and product portfolio.

Top Key Players in the Market

- Amcor PLC

- Tetra Laval International S.A.

- Mondi plc

- Sonoco Products Company

- Winpak Ltd

- Huhtamaki Oyj

- UFlex Ltd

- AptarGroup Inc.

- Sealed Air Corp.

- DS Smith plc

- Klöckner Pentaplast

- CCL Industries Inc.

- Gerresheimer AG

- Essel Propack

- Crown Holdings Inc.

- Ball Corporation

- Plastipak Holdings

- RPC Group

- Other Key Players

Recent Developments

- In November 2024, Switzerland-based Amcor Plc announced it to buy U.S. peer Berry Global for US$8.43 billion in an all-stock deal, creating a consumer and healthcare packaging giant with combined revenues of US$24 billion.

Report Scope

Report Features Description Market Value (2024) USD 16.8 billion Forecast Revenue (2034) USD 29.2 billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bottles, Pouches & Sachets, Jars & Containers, Tubes and Sticks, Caps, Closures & Dispensers, Cartons & Boxes, and Others), By Packaging Material (Plastic, Paper & Paperboard, Metal, Glass, and Others), By Type (Flexible and Rigid), By Application (Baby Food, Baby Drinks & Formula, Personal Care, Healthcare/OTC, Apparel & Accessories, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor PLC, Tetra Laval International S.A., Mondi plc, Sonoco Products Company, Winpak Ltd., Huhtamaki Oyj, UFlex Ltd., AptarGroup Inc., Sealed Air Corp., DS Smith plc, Klöckner Pentaplast, CCL Industries Inc., Gerresheimer AG, Essel Propack, Crown Holdings Inc., Ball Corporation, Plastipak Holdings, RPC Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Baby Care Products Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Baby Care Products Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor PLC

- Tetra Laval International S.A.

- Mondi plc

- Sonoco Products Company

- Winpak Ltd

- Huhtamaki Oyj

- UFlex Ltd

- AptarGroup Inc.

- Sealed Air Corp.

- DS Smith plc