Global Aviation Gasoline (Avgas) Market By Type(100LL Avgas, 100VLL Avgas, Others), By Aircraft Type(Piston Engine Aircraft, Turboprop Aircraft, Military Jets), By Application(Private, Commercial, Military), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122857

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

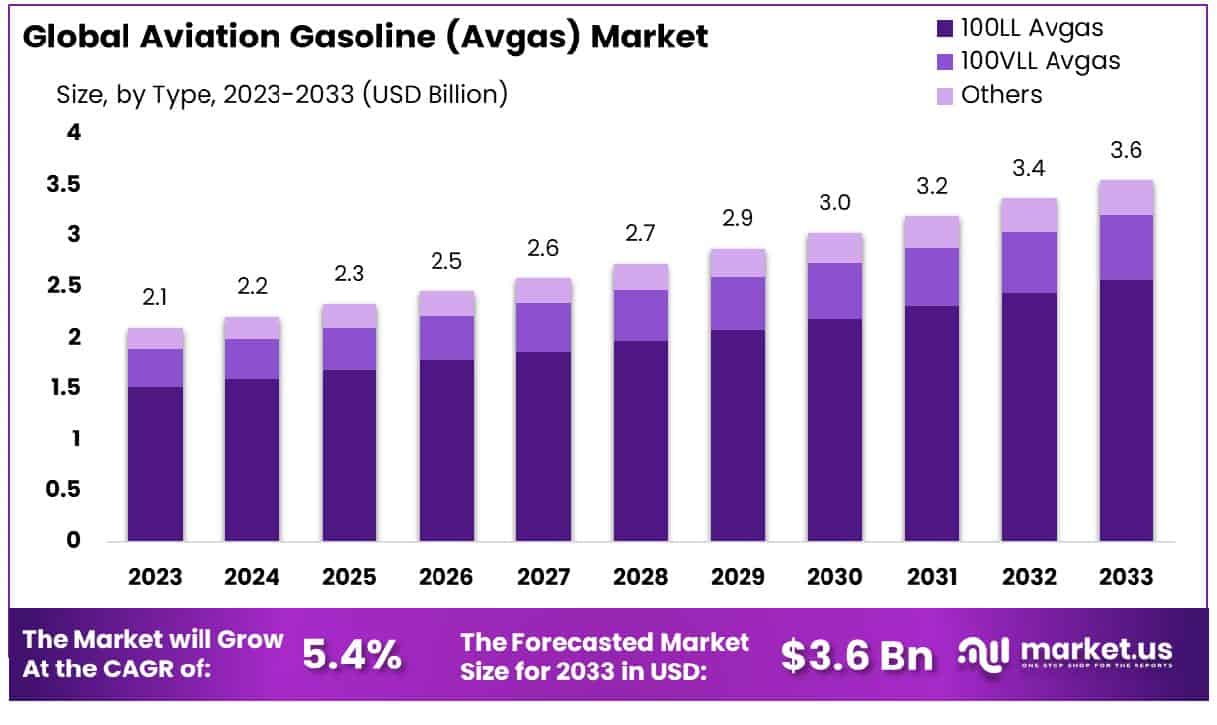

The Global Aviation Gasoline (Avgas) Market size is expected to be worth around USD 3.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Aviation Gasoline (Avgas) Market refers to the specialized segment of the aviation industry dedicated to the production, distribution, and sale of aviation gasoline, a fuel type specifically formulated for piston-engine aircraft. Avgas is distinct from jet fuel, characterized by higher octane ratings essential for the high compression ratios of aircraft piston engines.

This market caters to a range of aviation stakeholders, including manufacturers, regulatory bodies, and end-users like flight training schools and private pilots. It is influenced by factors such as regulatory standards, technological advancements, and global economic conditions, impacting production costs and market demand.

The Aviation Gasoline (Avgas) market, catering exclusively to the aviation industry, particularly piston-engine aircraft, exhibits resilience despite volatile gasoline prices. In 2023, Avgas prices mirrored broader economic indicators and the fluctuations in crude oil markets, significantly impacting operational costs within the sector.

Notably, gasoline prices peaked at $3.88 per gallon in mid-September 2023, a marked decrease from the 2022 high of $5.01 per gallon in June. This decline is attributed to more stable crude oil prices, contrasting with the previous year’s volatility.

As the year progressed, gasoline prices softened further, settling at $3.05 per gallon by year-end. This downward trend provided some relief to aviation operators by easing the pressure on operational budgets.

Regionally, the disparity in gasoline prices was pronounced, with the Gulf Coast experiencing the lowest rates at $3.09 per gallon, while the West Coast faced the highest at $4.51 per gallon. This regional variation underscores the importance of geographic factors in fuel pricing, which in turn affects regional market dynamics within the Avgas industry.

For stakeholders in the Avgas market, understanding these trends is crucial. They indicate potential shifts in supply chain strategies and operational planning. Additionally, the current stability in Avgas prices, if sustained, could foster a cautiously optimistic outlook for market growth, enabling industry players to strategize around these cost dynamics effectively.

Key Takeaways

- Market Growth: The Global Aviation Gasoline (Avgas) Market size is expected to be worth around USD 3.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

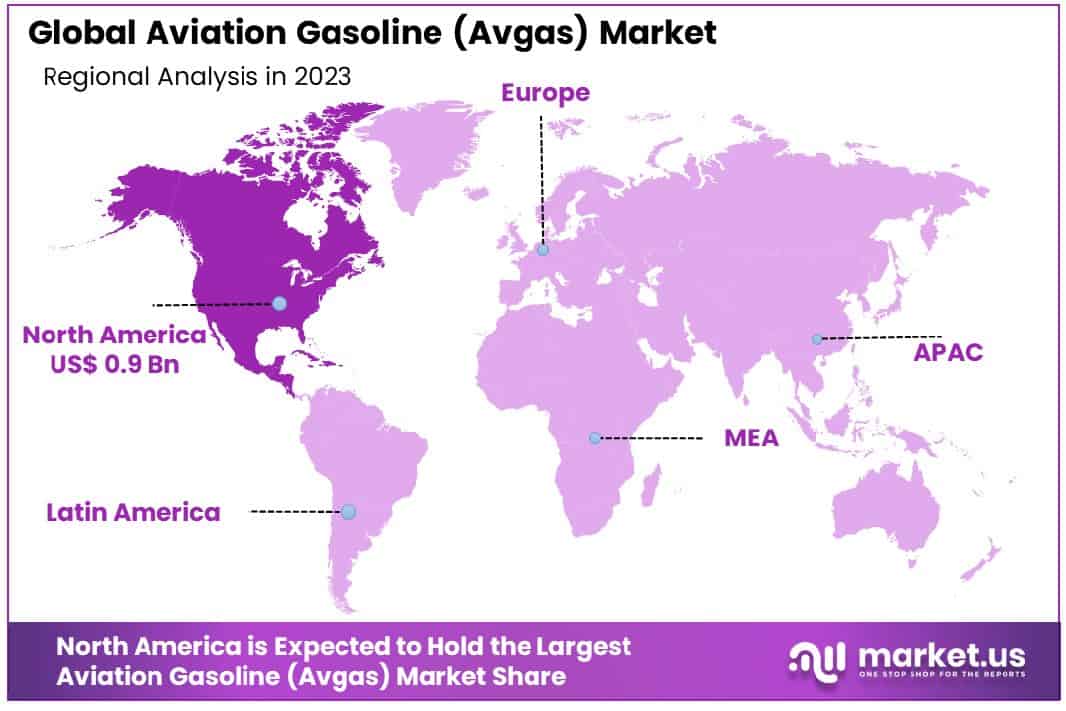

- Regional Dominance: North America holds 44.6% of the USD 0.9 billion Avgas market.

- Segmentation Insights:

- By Type: 100LL Avgas dominates the market, holding a 72.3% share.

- By Aircraft Type: Piston Engine Aircraft constitute 63.5% of the aviation fuel market.

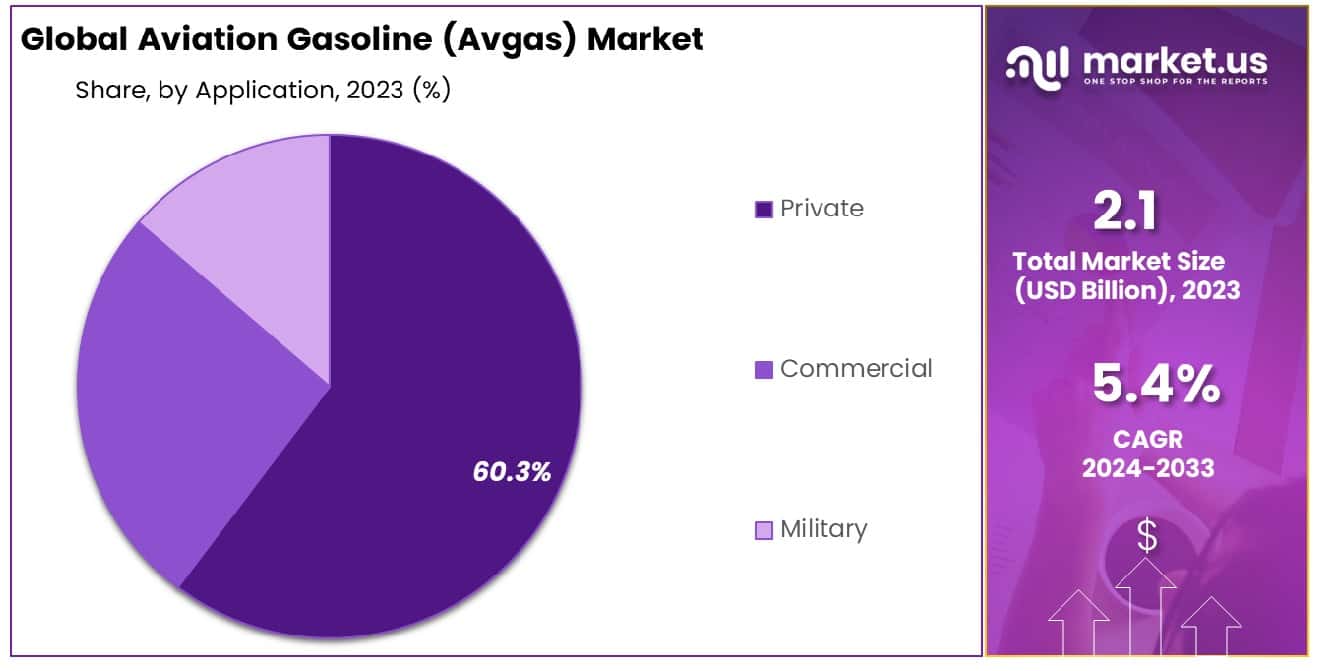

- By Application: Private applications lead to Avgas usage, accounting for 60.3% of demand.

- Growth Opportunities: The 2023 growth opportunities for the Avgas market include developing lead-free alternatives and expanding into emerging markets, aligning with environmental goals and economic growth in new regions.

Driving Factors

Increasing Demand for General Aviation Aircraft

The escalating demand for general aviation aircraft is a pivotal driver for the Avgas market. General aviation aircraft predominantly rely on aviation gasoline (Avgas) due to its suitability for piston-engine planes. As global economies strengthen and personal and business travel increases, the demand for these aircraft rises correspondingly.

The expansion in aircraft numbers necessitates higher Avgas consumption, directly influencing production and distribution strategies in the industry. This trend is reflected in the increase in aircraft orders and deliveries, which are anticipated to rise significantly over the next decade, enhancing the growth trajectory of the Avgas market.

Expansion of Aviation Training Institutes Globally

The global expansion of aviation training institutes significantly contributes to the growth of the Avgas market. With more institutes operational, there is a higher need for training aircraft, which primarily operate on Avgas. This increase in aviation training activities boosts Avgas demand systematically.

The establishment of new training centers across emerging markets in Asia, Africa, and Latin America mirrors this growth, fueled by rising economic capabilities and increasing local demand for commercial pilots. This factor not only drives direct consumption of Avgas but also supports the broader aviation sector’s growth, further intensifying Avgas market development.

Advancements in Piston Engine Aircraft Technology

Technological advancements in piston engine aircraft play a crucial role in shaping the Avgas market. Innovations aimed at enhancing fuel efficiency and reducing emissions are making Avgas-powered aircraft more appealing. These advancements include improvements in engine design and the integration of more sophisticated fuel management systems, which increase the operational efficiency of Avgas engines.

Consequently, these technological enhancements not only sustain but potentially expand the market for Avgas by maintaining the relevance and efficacy of piston-engine aircraft in an increasingly environmentally conscious world.

Restraining Factors

Stringent Environmental Regulations

Stringent environmental regulations significantly impact the Avgas market by imposing restrictions on emissions and mandating the use of cleaner alternatives. These regulations, driven by global initiatives to reduce aviation’s environmental footprint, directly challenge the continued use of leaded Avgas, the primary fuel for piston-engine aircraft. For example, the push for unleaded aviation fuel stems from environmental concerns associated with lead emissions, which pose health and environmental risks.

Regulatory bodies, including the Environmental Protection Agency (EPA) and the International Civil Aviation Organization (ICAO), are increasingly focusing on reducing these impacts, which in turn pressures the Avgas market to innovate towards more sustainable solutions. This shift may restrain market growth as manufacturers and consumers gradually transition to greener alternatives.

Rising Fuel Alternatives and Technologies

The emergence of alternative fuels and advancing propulsion technologies further constrain the growth of the Avgas market. Developments in electric propulsion systems, sustainable aviation fuels (SAFs), and even hydrogen fuel technologies are beginning to provide viable alternatives to conventional Avgas. These alternatives not only offer environmental benefits but also promise enhancements in efficiency and operational costs.

As these technologies gain traction, particularly in training and light aircraft segments, the demand for Avgas could see a corresponding decline. This shift is accelerated by increasing investments in research and development of alternative fuels, backed by both governmental support and private sector interest, reflecting a transformative period in aviation fuel dynamics. Combined, these factors create a challenging environment for the Avgas market, demanding adaptation and innovation to maintain relevance in a rapidly evolving industry landscape.

By Type Analysis

100LL Avgas dominates with a 72.3% market share, preferred for its high octane.

In 2023, Avgas held a dominant market position in the By Type segment of the Aviation Gasoline (Avgas) Market, capturing more than a 72.3% share. The breakdown of market shares by product types is as follows: 100LL Avgas at 68.5%, 100VLL Avgas at 3.8%, and other types comprising the remaining 27.7%. This distribution underscores the significant reliance on 100LL Avgas within the sector, driven primarily by its widespread acceptance and compliance with most high-performance piston aircraft engines.

The 100LL Avgas, characterized by its low lead content, remains the preferred choice due to its compatibility with environmental standards and its ability to reduce engine wear and tear, thereby extending aircraft longevity and reducing maintenance costs. The market’s partial shift towards 100VLL Avgas reflects ongoing efforts to further lower lead content, aligning with global environmental directives aimed at minimizing aviation’s ecological footprint.

However, the segment labeled “Others” encompasses a variety of specialized fuel types that cater to niche aviation needs. These alternatives are gradually gaining traction, propelled by innovative advancements in fuel technology and an increasing emphasis on sustainability within the aviation industry. The rise in the adoption of these alternative fuels is anticipated to reshape market dynamics and possibly redistribute market shares in the coming years.

Overall, the Aviation Gasoline (Avgas) Market exhibits robust growth potential, influenced by technological innovations, regulatory policies, and a shifting focus toward more sustainable aviation practices. As the market evolves, the demand patterns are expected to reflect a gradual yet definitive transition towards environmentally friendlier aviation fuel options.

By Aircraft Type Analysis

Piston engine aircraft predominantly utilize Avgas, accounting for 63.5% of its total consumption in 2023.

In 2023, Piston Engine Aircraft held a dominant market position in the By Aircraft Type segment of the Aviation Gasoline (Avgas) Market, capturing more than a 63.5% share. The market distribution among the aircraft types is as follows: Piston Engine Aircraft at 63.5%, Turboprop Aircraft at 21.2%, and Military Jets comprising 15.3%. This dominance of Piston Engine Aircraft is attributed to their extensive use in general aviation and flight training schools where Avgas is a primary fuel choice due to its high octane ratings that are suitable for high-compression engines.

Piston Engine Aircraft are preferred for their cost-effectiveness and reliability, making them a staple in civil aviation, particularly in flight training and personal aviation. The sustained demand within this segment underscores the ongoing reliance on Avgas, despite rising interest in alternative fuels and propulsion systems.

Turboprop Aircraft, which account for over a fifth of the market share, utilize Avgas in specific models that are designed for both civil and military applications. These aircraft offer a balance of performance and fuel efficiency, ideal for regional and cargo flights where jet engines might not be economically viable.

Meanwhile, Military Jets form a smaller but significant portion of the market. These aircraft typically use specialized types of Avgas and are included in this category due to their operational requirements that demand high-performance aviation fuels.

The Avgas market is influenced by factors such as regulatory changes, technological advancements, and shifts in industry practices toward more sustainable and efficient aviation solutions. Going forward, the sector is expected to witness moderate changes, with potential growth in alternative fuel technologies that could impact Avgas consumption patterns across different aircraft types.

By Application Analysis

Private applications lead Avgas usage, comprising 60.3% of the market, reflecting significant personal aviation demand.

In 2023, Private usage held a dominant market position in the By Application segment of the Aviation Gasoline (Avgas) Market, capturing more than a 60.3% share. The specific distribution of the market shares among different applications was as follows: Private at 60.3%, Commercial at 25.4%, and Military at 14.3%. This significant market share held by Private applications is primarily due to the substantial number of privately owned piston-engine aircraft that require high-octane Avgas for optimal performance.

Private aviation, predominantly involving piston-engine aircraft, continues to be a major consumer of Avgas. This sector benefits from the specific characteristics of Avgas that support high performance and safety standards required for private flying. The high reliance on Avgas in this segment is driven by its availability and the technical requirements of most small aircraft engines which are not yet compatible with alternative fuels.

Commercial aviation within this context refers to the use of Avgas in commercial activities such as charter services, flight training, and agricultural applications. Although a smaller portion of the market, it plays a crucial role in specific niche operations where jet fuel is not feasible.

The Military segment, while smaller in market share, often utilizes Avgas for training aircraft and certain light-duty operational units. The specific requirements for military-grade fuel contribute to the continued use of Avgas in this sector, although there is a growing push towards more sustainable and less environmentally impactful alternatives.

Overall, the Avgas market is heavily influenced by the Private sector’s needs, with ongoing demand stability anticipated. However, evolving environmental regulations and technological advancements in engine and alternative fuel development may redefine future consumption patterns across all applications.

Key Market Segments

By Type

- 100LL Avgas

- 100VLL Avgas

- Others

By Aircraft Type

- Piston Engine Aircraft

- Turboprop Aircraft

- Military Jets

By Application

- Private

- Commercial

- Military

Growth Opportunities

Development of Lead-Free Avgas Alternatives

The development of lead-free Avgas alternatives represents a significant growth opportunity for the Avgas market in 2023. As environmental regulations become more stringent and the aviation industry’s commitment to reducing its carbon footprint strengthens, the demand for sustainable aviation solutions is escalating. The introduction of lead-free Avgas caters to this need by offering an environmentally friendly alternative that complies with global emission standards while maintaining the performance standards required for piston-engine aircraft.

This shift not only helps manufacturers meet regulatory demands but also positions them favorably in a market that is increasingly driven by environmental consciousness. Companies that innovate in this space are likely to see increased market share and enhanced brand loyalty from stakeholders prioritizing sustainability. Furthermore, the transition to lead-free Avgas opens new avenues for collaboration with technology providers and regulatory bodies, ensuring compliance and fostering industry-wide adoption.

Expansion into Emerging Markets

The expansion into emerging markets offers another substantial growth opportunity for the Avgas market in 2023. Regions such as Asia-Pacific, Latin America, and Africa are witnessing rapid economic growth, leading to increased investments in general aviation infrastructure, including aviation training institutes and regional transportation networks. As these markets develop, the demand for general aviation, and consequently for Avgas, is expected to rise significantly.

By establishing a strong presence in these emerging markets, Avgas suppliers can capitalize on new revenue streams and diversify their market base. Strategic partnerships with local distributors and investments in local aviation facilities could further enhance market penetration and brand recognition. Additionally, the unique needs and growth dynamics of these regions provide a fertile ground for tailored marketing strategies and product offerings, potentially driving further innovation and adaptation in the Avgas industry.

Latest Trends

Increasing Adoption of Sustainable and Cleaner Fuel Options

In 2023, the global Avgas market is witnessing a pronounced trend towards the adoption of sustainable and cleaner fuel options. This shift is driven by the aviation industry’s broader commitment to reduce its environmental impact and comply with stringent global emissions standards. As stakeholders across the spectrum, from regulators to end consumers, increasingly prioritize sustainability, the demand for eco-friendly Avgas solutions is rising.

This trend is catalyzing the development and commercialization of advanced, less polluting Avgas formulations, such as unleaded variants that offer comparable performance without the environmental and health risks associated with lead. This move not only helps in adhering to environmental regulations but also plays a crucial role in maintaining market competitiveness and appeal to environmentally conscious consumers.

Technological Innovations in Fuel Efficiency and Engine Performance

Technological innovations in fuel efficiency and engine performance are shaping the latest trends in the Avgas market in 2023. Advancements in fuel formulation and engine design are enhancing the efficiency and performance of piston-engine aircraft, which primarily rely on Avgas. These innovations include the integration of new additives that improve combustion efficiency and reduce maintenance needs, as well as advancements in engine mechanics that optimize fuel consumption and increase operational longevity.

Such technological strides are essential for keeping Avgas relevant in an increasingly competitive fuel market, where efficiency and performance are paramount. Moreover, these improvements contribute to reducing operational costs for aviation operators and bolstering the overall appeal of Avgas-powered aircraft amidst growing competition from alternative fuel technologies.

Regional Analysis

North America dominates the Avgas market with a 44.6% share, valued at USD 0.9 billion.

North America, holding a 44.6% share of the global market, USD 0.9 billion, continues to be a major player in the Avgas sector, driven by a robust general aviation community and extensive flight training operations. The region’s developed aviation infrastructure and high volume of active aircraft necessitate substantial Avgas consumption, maintaining its significant market share. Moreover, North America is at the forefront of developing and adopting lead-free Avgas alternatives, responding to stringent environmental regulations aimed at reducing aviation’s ecological footprint.

Europe follows with a strong emphasis on environmental sustainability, which influences its Avgas market dynamics. The region’s strict emission standards have accelerated the adoption of cleaner and sustainable fuel options, shaping the demand patterns for Avgas. European countries are increasingly investing in research and development of alternative fuels, which might moderately restrict Avgas demand but also open avenues for innovative Avgas formulations.

Asia-Pacific is the dominant region in the Avgas market, accounting for 53.8% of the global demand. This region’s growth is propelled by rapid economic development, increasing air traffic, and the expansion of aviation training institutes. The burgeoning general aviation sector in countries like China and India significantly contributes to the heightened demand for Avgas, supported by governmental initiatives to improve regional connectivity through aviation.

Middle East & Africa and Latin America are emerging as significant markets with potential growth opportunities. These regions are witnessing gradual increases in general aviation activities and the establishment of new aviation training facilities, which in turn boosts Avgas consumption. Although currently smaller in market size, their strategic geographic positions and increasing investments in aviation infrastructure are set to elevate their shares in the global Avgas market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

The global aviation gasoline (Avgas) market in 2023 has been prominently shaped by the operations and strategic developments of key players such as ExxonMobil Corporation, Shell Aviation, and Chevron Corporation, among others. These corporations hold substantial market shares and have a significant influence on market dynamics due to their extensive distribution networks, robust supply chains, and comprehensive product offerings.

ExxonMobil Corporation has maintained its leadership position through continuous innovation in fuel technology and a strong commitment to sustainability practices. The company has focused on developing Avgas formulations that reduce environmental impact, aligning with global regulations on emissions.

Shell Aviation has enhanced its market presence by expanding its supply chain capabilities and forming strategic alliances with major airlines and aircraft manufacturing. This approach not only secures Shell’s supply chain but also positions it as a reliable supplier of high-quality aviation fuels.

Chevron Corporation has leveraged its global reach to cater to emerging markets where aviation activities are expanding significantly. Chevron’s investment in research and development has yielded advanced Avgas solutions that offer superior performance and engine reliability.

BP Plc and TotalEnergies are also pivotal in driving the Avgas market. Both companies have focused on the sustainability aspect of their fuel products, introducing bio-aviation variants of Avgas. This shift towards greener alternatives is likely to resonate well with the market’s growing environmental concerns.

Furthermore, smaller players like Avfuel Corporation and Eastern Aviation Fuels contribute to the market’s competitive dynamics by offering specialized services and tailored solutions, particularly to private and general aviation sectors.

Market Key Players

- ExxonMobil Corporation

- Shell Aviation

- Chevron Corporation

- BP Plc

- Phillips 66 Company

- TotalEnergies

- Air BP

- FBO Partners

- Avfuel Corporation

- Eastern Aviation Fuels

- Pinnacle Petroleum

- World Fuel Services Corporation

- AvGas LLC

- Q8 Aviation

- Gazprom Neft Aviation

Recent Development

- In December 2023, Metafuels secured $8M in seed funding to advance sustainable aviation fuel technology, aiming to reduce CO2 emissions by up to 90% for long-haul flights with their innovative synthetic fuel blend, Aerobrew.

- In January 2024, Trinity College Dublin partners with SMBC Aviation Capital to establish a new SAF Research Facility, advancing sustainable aviation fuel research with projects focusing on emissions reduction and technology innovation.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 3.6 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(100LL Avgas, 100VLL Avgas, Others), By Aircraft Type(Piston Engine Aircraft, Turboprop Aircraft, Military Jets), By Application(Private, Commercial, Military) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ExxonMobil Corporation, Shell Aviation, Chevron Corporation, BP Plc, Phillips 66 Company, TotalEnergies, Air BP, FBO Partners, Avfuel Corporation, Eastern Aviation Fuels, Pinnacle Petroleum, World Fuel Services Corporation, AvGas LLC, Q8 Aviation, Gazprom Neft Aviation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Aviation Gasoline (Avgas) Market Size in 2023?The Global Aviation Gasoline (Avgas) Market Size is USD 3.6 Billion in 2023.

What is the projected CAGR at which the Global Aviation Gasoline (Avgas) Market is expected to grow at?The Global Aviation Gasoline (Avgas) Market is expected to grow at a CAGR of 5.4% (2024-2033).

List the segments encompassed in this report on the Global Aviation Gasoline (Avgas) Market?Market.US has segmented the Global Aviation Gasoline (Avgas) Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(100LL Avgas, 100VLL Avgas, Others), By Aircraft Type(Piston Engine Aircraft, Turboprop Aircraft, Military Jets), By Application(Private, Commercial, Military)

List the key industry players of the Global Aviation Gasoline (Avgas) Market?ExxonMobil Corporation, Shell Aviation, Chevron Corporation, BP Plc, Phillips 66 Company, TotalEnergies, Air BP, FBO Partners, Avfuel Corporation, Eastern Aviation Fuels, Pinnacle Petroleum, World Fuel Services Corporation, AvGas LLC, Q8 Aviation, Gazprom Neft Aviation

Name the key areas of business for Global Aviation Gasoline (Avgas) Market?The US, Canada, Mexico are leading key areas of operation for Global Aviation Gasoline (Avgas) Market.

Aviation Gasoline (Avgas) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Aviation Gasoline (Avgas) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample - Market Growth: The Global Aviation Gasoline (Avgas) Market size is expected to be worth around USD 3.6 Billion by 2033, From USD 2.1 Billion by 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

-

-

- ExxonMobil Corporation

- Shell Aviation

- Chevron Corporation

- BP Plc

- Phillips 66 Company

- TotalEnergies

- Air BP

- FBO Partners

- Avfuel Corporation

- Eastern Aviation Fuels

- Pinnacle Petroleum

- World Fuel Services Corporation

- AvGas LLC

- Q8 Aviation

- Gazprom Neft Aviation