Global Autonomous Utility Vehicles Market Size, Share, Growth Analysis By Power Source (Electric, Hydrogen Fuel Cells, Hybrid), By Vehicle Size (Compact, Medium, Heavy-Duty), By Vehicle (Pickup Trucks, Sport Utility Vehicles (SUVs), Crossovers, Vans, Others), By Level of Autonomy (Level 1, Level 2, Level 3, Level 4), By Application (Commercial, Personal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174630

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

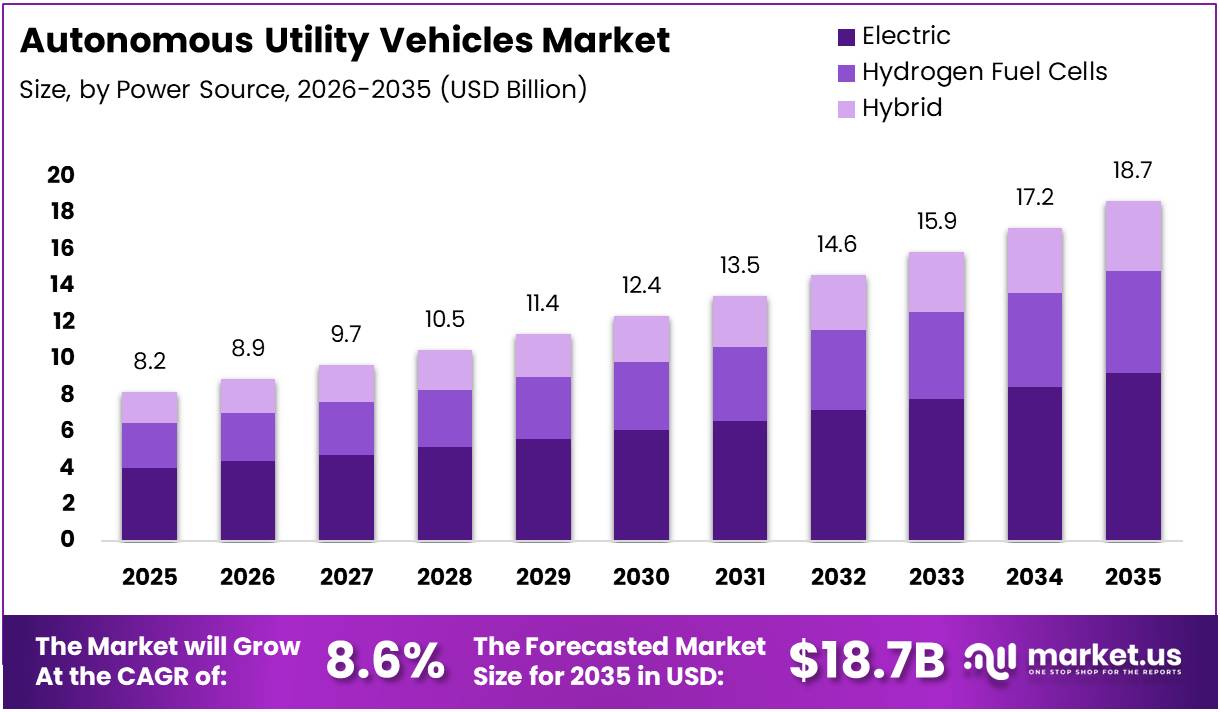

The Global Autonomous Utility Vehicles Market size is expected to be worth around USD 18.7 Billion by 2035, from USD 8.2 Billion in 2025, growing at a CAGR of 8.6% during the forecast period from 2026 to 2035.

The Autonomous Utility Vehicles Market encompasses self-driving commercial vehicles designed for industrial, agricultural, and logistics applications. These vehicles integrate advanced sensors, artificial intelligence, and GPS navigation systems to operate without human intervention. The market addresses critical labor shortages while enhancing operational efficiency across multiple sectors. Growing demand for automated solutions drives substantial market expansion globally.

Market growth accelerates as industries recognize autonomous technology’s transformative potential. Labor-intensive sectors increasingly adopt these solutions to overcome workforce challenges and rising operational costs. The technology delivers measurable productivity improvements while reducing human error risks. Furthermore, technological advancements make autonomous systems more accessible and commercially viable for diverse applications.

Significant opportunities emerge across agriculture, mining, construction, and warehouse logistics segments. Organizations seek solutions that optimize resource utilization and minimize downtime in demanding operational environments. Remote and hazardous work environments particularly benefit from autonomous deployment. Additionally, smart city initiatives create new avenues for autonomous utility vehicle integration in urban infrastructure management.

Government investment substantially bolsters market development through targeted funding programs and infrastructure modernization initiatives. Regulatory frameworks evolve to accommodate autonomous technology while ensuring safety standards remain paramount. Policymakers recognize automation’s role in addressing demographic shifts and productivity challenges. Consequently, supportive policies accelerate commercial adoption across developed and emerging markets.

Operational efficiency gains validate autonomous technology’s commercial appeal among industry stakeholders. Autonomous trucks work continuously without breaks, improving operational uptime by 20-25% over manually driven trucks. This enhancement directly impacts logistics productivity and cost structures. Moreover, driverless tractors reduce human labor needs by up to 50%, addressing agricultural sector workforce constraints effectively. These statistical improvements demonstrate tangible return on investment, encouraging broader market adoption.

Key Takeaways

- The global autonomous utility vehicles market is projected to grow from USD 8.2 Billion in 2025 to USD 18.7 Billion by 2035, registering a CAGR of 8.6%.

- Electric power source leads the market with a 49.3% share in 2025, driven by lower operating costs and energy efficiency.

- Medium-sized autonomous utility vehicles dominate by vehicle size, accounting for 41.9% of the market in 2025.

- Pickup trucks are the largest vehicle segment, holding a 29.5% market share in 2025 due to high versatility across industries.

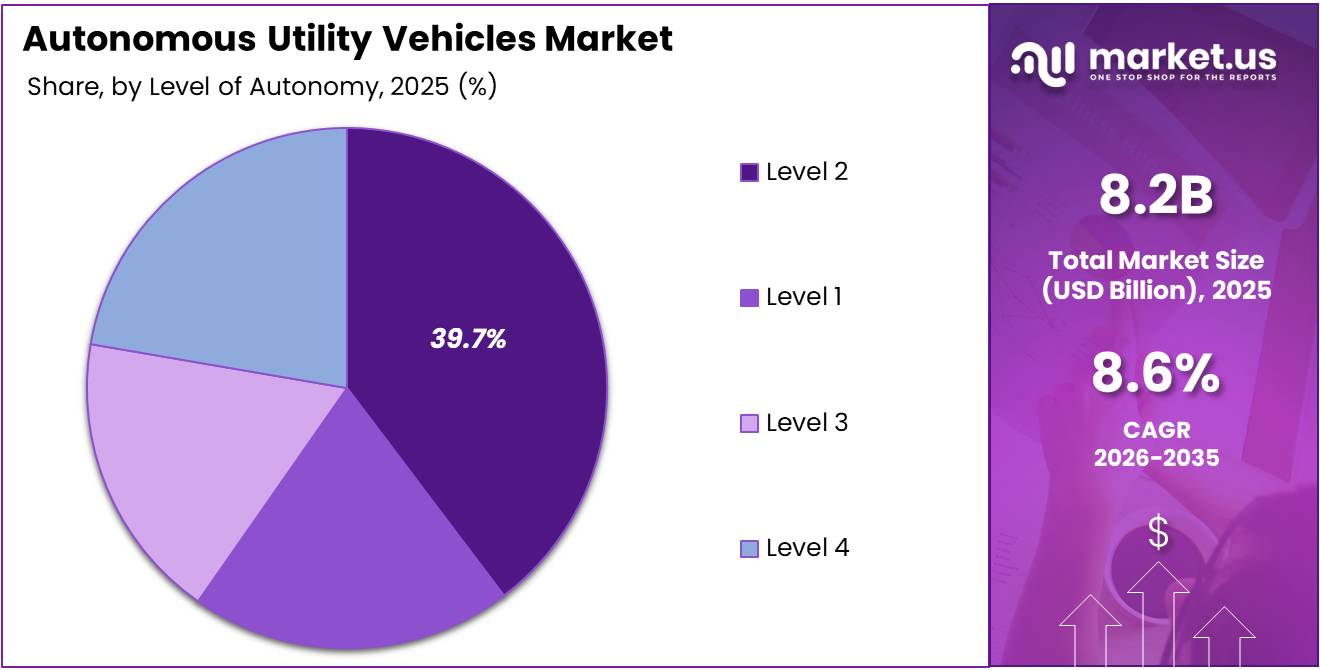

- Level 2 autonomy is the most adopted level, representing 39.7% of the market in 2025.

- Commercial applications account for the majority share at 72.4% in 2025, reflecting strong adoption in logistics, agriculture, and construction.

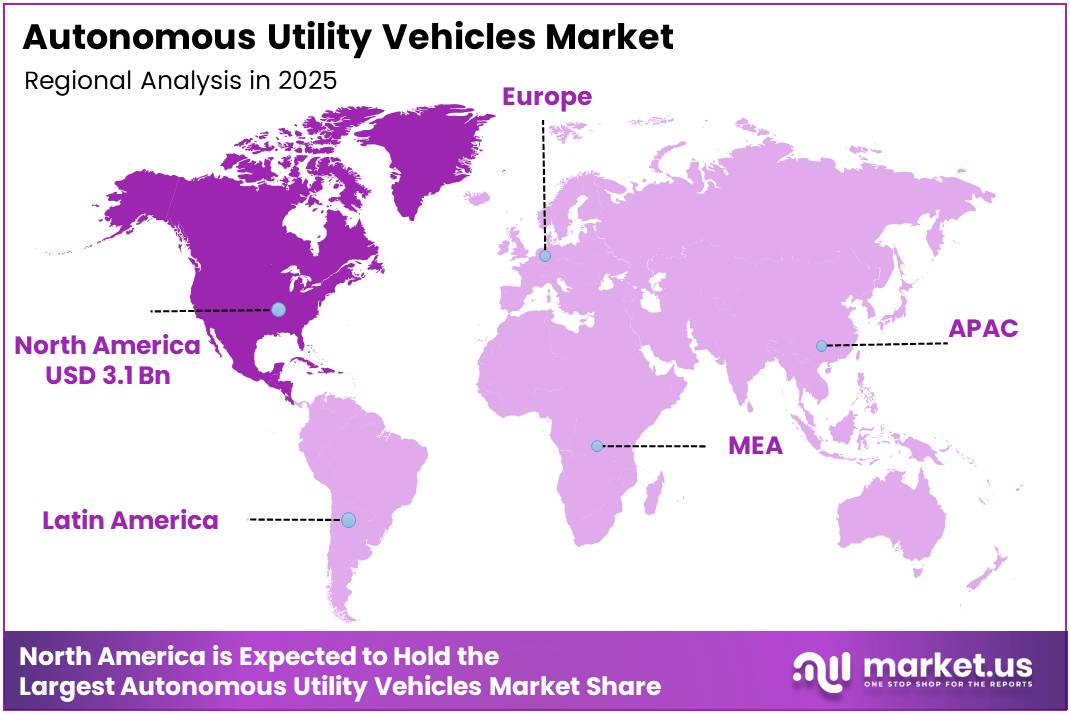

- North America leads the global market with a 38.4% share, valued at USD 3.1 Billion, supported by advanced automation infrastructure.

Power Source Analysis

Electric dominates with 49.3% due to its superior energy efficiency and lower operational costs.

In 2025, Electric held a dominant market position in the By Power Source Analysis segment of Autonomous Utility Vehicles Market, with a 49.3% share. Electric autonomous utility vehicles gain traction through environmental benefits and reduced carbon footprints. Battery technology advancements substantially improve range capabilities, making electric powertrains viable for commercial applications.

Hydrogen Fuel Cells represent emerging alternatives offering rapid refueling and extended driving ranges. Although holding smaller market share, hydrogen-powered vehicles demonstrate potential for heavy-duty applications where battery limitations exist. Infrastructure development and technological innovations gradually enhance commercial feasibility of hydrogen systems.

Hybrid power sources combine combustion engines with electric propulsion, delivering enhanced fuel efficiency and flexibility. These vehicles appeal to operators requiring transitional solutions before committing to pure electric platforms. Hybrid autonomous vehicles serve as practical stepping stones, reducing emissions while maintaining operational reliability.

Vehicle Size Analysis

Medium dominates with 41.9% due to its optimal balance between payload capacity and maneuverability.

In 2025, Medium held a dominant market position in the By Vehicle Size Analysis segment of Autonomous Utility Vehicles Market, with a 41.9% share. Medium-sized autonomous vehicles address commercial operation requirements, offering substantial cargo capacity without compromising agility. These vehicles efficiently operate in urban environments, construction sites, and distribution centers where space constraints necessitate compact dimensions.

Compact autonomous utility vehicles cater to applications demanding maximum maneuverability in confined spaces and congested settings. These smaller vehicles excel in last-mile delivery, campus logistics, and facility maintenance. Compact models consume less energy and require minimal parking infrastructure, making them economically attractive.

Heavy-Duty autonomous vehicles serve specialized industrial applications requiring exceptional payload capacities and robust construction. These platforms dominate mining operations, large-scale construction, and agricultural enterprises where substantial hauling capacity justifies higher investments. Heavy-duty vehicles continue expanding in sectors demanding maximum durability and performance.

Vehicle Analysis

Pickup Trucks dominates with 29.5% due to their exceptional versatility and widespread industry adoption.

In 2025, Pickup Trucks held a dominant market position in the By Vehicle Analysis segment of Autonomous Utility Vehicles Market, with a 29.5% share. Autonomous pickup trucks prove indispensable across construction, agriculture, and utility sectors through unmatched cargo flexibility and terrain adaptability. These vehicles integrate advanced autonomous technologies while maintaining traditional utility capabilities, enabling enhanced productivity without sacrificing versatility.

Sport Utility Vehicles (SUVs) equipped with autonomous capabilities gain momentum in commercial transportation and executive mobility services. These vehicles offer superior passenger comfort, advanced safety features, and premium appeal resonating with corporate fleets. Autonomous SUVs demonstrate excellent performance across varied weather conditions and terrain types.

Crossovers combine passenger comfort with utility functionality, appealing to businesses requiring multipurpose solutions. These autonomous vehicles efficiently serve hospitality, tourism, and corporate shuttle services where passenger experience and cargo flexibility matter equally. Crossovers offer better fuel efficiency compared to larger SUVs.

Vans dominate commercial delivery and logistics, providing maximum cargo volume and configurable layouts for autonomous operations. These vehicles excel in urban delivery networks, mobile services, and passenger transport requiring substantial capacity. Autonomous vans experience robust demand from e-commerce and courier services.

Others encompass specialized autonomous vehicles for niche applications including emergency services and custom industrial solutions. These vehicles address unique operational requirements that standard categories cannot fulfill, demonstrating growing market diversification and customization capabilities across emerging use cases and industries.

Level of Autonomy Analysis

Level 2 dominates with 39.7% due to its practical implementation feasibility and regulatory compliance.

In 2025, Level 2 held a dominant market position in the By Level of Autonomy Analysis segment of Autonomous Utility Vehicles Market, with a 39.7% share. Level 2 systems provide partial automation including adaptive cruise control and lane-keeping assistance while requiring continuous driver supervision. This autonomy level represents the most commercially viable solution, balancing technological sophistication with safety requirements and regulatory acceptance.

Level 1 autonomous features represent basic driver assistance technologies such as automated braking or steering support. These systems provide foundational safety enhancements and introduce operators to autonomous capabilities gradually. Level 1 technologies remain cost-effective solutions for businesses beginning their automation journey.

Level 3 autonomy enables conditional automation where vehicles handle driving tasks under specific conditions while drivers remain ready to intervene. These systems demonstrate growing adoption in controlled environments like highways and dedicated routes. Level 3 technologies bridge the gap between assisted driving and higher autonomy levels.

Level 4 represents high automation where vehicles operate independently within defined domains without requiring driver intervention. Although technologically advanced, Level 4 systems face regulatory, infrastructure, and cost challenges limiting widespread deployment. Pilot programs continue demonstrating transformative potential across specialized applications.

Application Analysis

Commercial dominates with 72.4% due to substantial productivity gains and operational cost reductions.

In 2025, Commercial held a dominant market position in the By Application Analysis segment of Autonomous Utility Vehicles Market, with a 72.4% share. Commercial applications encompass logistics, construction, agriculture, mining, and facility management where autonomous vehicles deliver measurable returns through enhanced efficiency and reduced labor costs.

Personal applications remain comparatively limited but demonstrate growing interest among consumers seeking advanced convenience and enhanced safety capabilities. Personal autonomous vehicles appeal to recreational users, rural property owners, and technology enthusiasts. As technologies mature and regulations evolve, personal adoption is expected to accelerate significantly.

Key Market Segments

By Power Source

- Electric

- Hydrogen Fuel Cells

- Hybrid

By Vehicle Size

- Compact

- Medium

- Heavy-Duty

By Vehicle

- Pickup Trucks

- Sport Utility Vehicles (SUVs)

- Crossovers

- Vans

- Others

By Level of Autonomy

- Level 1

- Level 2

- Level 3

- Level 4

By Application

- Commercial

- Personal

Drivers

Rapid Adoption of Autonomous Utility Vehicles in Warehousing, Logistics, and Distribution Operations Drives Market Growth

The autonomous utility vehicles market is experiencing significant momentum as warehousing and logistics facilities increasingly deploy self-driving vehicles to streamline operations. Distribution centers are adopting these vehicles to move goods efficiently across large facilities without human intervention. This shift reduces operational bottlenecks and improves throughput in fast-paced environments.

Industries are actively seeking labor-efficient solutions as workforce shortages and rising labor costs challenge traditional utility operations. Autonomous vehicles eliminate the need for constant human supervision while maintaining consistent performance levels. Commercial and industrial facilities benefit from round-the-clock operations without fatigue-related productivity declines.

Technology improvements in artificial intelligence, machine vision, and sensor fusion are making autonomous utility vehicles more dependable than ever. Advanced sensors allow vehicles to navigate complex environments safely and avoid obstacles in real-time. Machine learning algorithms continuously improve route optimization and decision-making capabilities.

Restraints

Limited Standardization of Autonomous Vehicle Regulations Constrains Market Expansion

The autonomous utility vehicles market faces challenges due to inconsistent regulatory frameworks across different industrial settings and geographical regions. Facilities operate under varying safety standards and compliance requirements, creating confusion for manufacturers and end-users. This regulatory fragmentation slows adoption as businesses wait for clearer guidelines before committing to autonomous solutions.

Different industries lack uniform protocols for autonomous vehicle deployment, making implementation unpredictable. Companies must navigate complex approval processes that differ between warehouses, factories, and outdoor environments. These uncertainties increase project timelines and deter smaller operations from investing in autonomous technology.

System integration complexity presents another significant barrier as businesses struggle to incorporate autonomous vehicles into existing fleets and infrastructure. Legacy systems often lack compatibility with modern autonomous platforms, requiring expensive retrofits or complete overhauls. Coordinating autonomous vehicles with traditional equipment demands sophisticated software and hardware integration. Infrastructure modifications, including charging stations and navigation markers, add substantial costs.

Growth Factors

Expansion of Autonomous Utility Vehicles in Agriculture, Mining, and Construction Creates Market Opportunities

The autonomous utility vehicles market finds substantial growth potential as agriculture, mining, and construction sectors explore automation for heavy-duty tasks. These industries operate in challenging outdoor environments where autonomous vehicles can transport materials, equipment, and supplies safely. Harsh working conditions make autonomous solutions attractive for reducing human exposure to hazardous situations.

Smart city initiatives are driving deployment of autonomous utility fleets for municipal maintenance and public service applications. Cities are testing self-driving vehicles for tasks like waste collection, street cleaning, and park maintenance. These applications improve service efficiency while reducing operational costs for municipal budgets.

Large-scale facilities including airports, seaports, and university campuses represent expanding markets for automated material transport solutions. These locations require constant movement of baggage, cargo, supplies, and equipment across extensive areas. Autonomous utility vehicles offer consistent, reliable transportation without the complexity of managing large driver workforces.

Emerging Trends

Integration of Electric Powertrains with Autonomous Platforms Shapes Market Trends

The autonomous utility vehicles market is witnessing a significant trend toward combining electric powertrains with autonomous driving capabilities. This integration delivers dual benefits of zero emissions and operational automation, appealing to environmentally conscious organizations. Electric autonomous vehicles reduce fuel costs while meeting sustainability targets that many corporations have adopted.

Fleet management software and real-time remote monitoring systems are becoming standard features in autonomous utility vehicle deployments. These platforms provide operators with comprehensive visibility into vehicle performance, location tracking, and maintenance needs. Real-time data analytics enable predictive maintenance and optimize route planning, maximizing fleet utilization and minimizing downtime.

Last-mile logistics and closed-campus transportation applications are driving autonomous utility vehicle adoption in specific operational environments. Companies are deploying these vehicles for final delivery stages within controlled areas like business parks and industrial complexes. Closed-campus settings provide ideal testing grounds with predictable traffic patterns and limited variables.

Regional Analysis

North America Dominates the Autonomous Utility Vehicles Market with a Market Share of 38.4%, Valued at USD 3.1 Billion

North America leads the autonomous utility vehicles market with a market share of 38.4% valued at USD 3.1 billion. The region’s dominance is driven by advanced technological infrastructure, significant automation investments across industrial and agricultural sectors, and supportive regulatory frameworks. The United States spearheads growth through early technology adoption, presence of major innovators, and increasing focus on operational efficiency and safety in warehousing, construction, and agriculture.

Europe Autonomous Utility Vehicles Market Trends

Europe represents a significant market driven by stringent environmental regulations and government initiatives promoting sustainable automation. Growth is fueled by smart city investments, advanced manufacturing capabilities, and increasing adoption across logistics and municipal services. Germany, France, and the United Kingdom lead development through collaborative efforts between automotive manufacturers and technology providers.

Asia Pacific Autonomous Utility Vehicles Market Trends

Asia Pacific is experiencing rapid growth driven by accelerating industrialization, expanding e-commerce infrastructure, and rising labor costs. China, Japan, and South Korea are investing substantially in robotics and automation to enhance productivity across manufacturing, logistics, and agriculture. Government initiatives promoting smart manufacturing and large-scale warehouse deployments are accelerating regional market expansion.

Middle East and Africa Autonomous Utility Vehicles Market Trends

The Middle East and Africa region is gradually emerging with growing interest in automation and smart infrastructure development. Growth is driven by economic diversification efforts and investments in logistics automation. However, limited technological infrastructure, high investment costs, and workforce development needs present challenges to rapid adoption.

Latin America Autonomous Utility Vehicles Market Trends

Latin America represents an emerging market with gradual adoption in agriculture, mining, and logistics industries. Brazil, Mexico, and Chile are exploring autonomous solutions to enhance operational efficiency and safety. Economic volatility, limited infrastructure, and regulatory uncertainties moderate the pace of adoption in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autonomous Utility Vehicles Company Insights

Daimler AG continues to strengthen its position in the autonomous utility vehicles market through its advanced Mercedes-Benz commercial vehicle division, focusing on integrating cutting-edge autonomous driving technologies into utility vehicle platforms. The company’s strategic investments in AI-driven safety systems and electric powertrains demonstrate its commitment to sustainable autonomous solutions for industrial and commercial applications.

Ford Motor Company maintains a competitive edge by leveraging its extensive experience in the utility vehicle segment, particularly through its F-Series and Transit platforms, which are being enhanced with autonomous capabilities for fleet operations. Ford’s collaborative approach with technology partners and its focus on practical, work-oriented autonomous solutions position it well for capturing market share in the commercial and municipal utility vehicle sectors.

General Motors Company stands out with its Cruise autonomous technology subsidiary and BrightDrop commercial vehicle brand, enabling the company to offer integrated autonomous solutions for delivery and utility applications. GMC’s strategic focus on electric autonomous platforms and its established relationships with fleet operators provide significant advantages in deploying autonomous utility vehicles at scale.

Honda Motor Co., Ltd. brings its reputation for reliability and innovation to the autonomous utility vehicle market, emphasizing safety-first approaches and gradual automation integration across its commercial vehicle lineup. The company’s investments in sensing technologies and vehicle-to-everything communication systems reflect its methodical strategy to ensure autonomous utility vehicles meet stringent safety and operational requirements for diverse industrial applications.

Top Key Players in the Market

- Daimler AG

- Ford Motor Company

- General Motors Company (GMC)

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Nissan Motor Corporation

- Stellantis

- Toyota Motor Corporation

- Volkswagen AG

Recent Developments

- In December 2025, Quantum Systems acquired FERNRIDE to strengthen its position in autonomous ground systems. This move expands its capabilities beyond aerial platforms into autonomous logistics and ground-based utility vehicles.

- In June 2025, Voltrac raised €2M and launched an autonomous electric tractor platform targeting agriculture and frontline logistics. The development signals early commercialisation of autonomous utility vehicles in off-road and industrial use cases.

- In February 2025, Waabi Innovation partnered with Volvo Autonomous Solutions to co-develop self-driving trucks. The collaboration integrates Waabi’s AI-driven autonomy platform into Volvo’s VNL Autonomous truck lineup.

Report Scope

Report Features Description Market Value (2025) USD 8.2 Billion Forecast Revenue (2035) USD 18.7 Billion CAGR (2026-2035) 8.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Source (Electric, Hydrogen Fuel Cells, Hybrid), By Vehicle Size (Compact, Medium, Heavy-Duty), By Vehicle (Pickup Trucks, Sport Utility Vehicles (SUVs), Crossovers, Vans, Others), By Level of Autonomy (Level 1, Level 2, Level 3, Level 4), By Application (Commercial, Personal) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Daimler AG, Ford Motor Company, General Motors Company (GMC), Honda Motor Co., Ltd., Hyundai Motor Company, Nissan Motor Corporation, Stellantis, Toyota Motor Corporation, Volkswagen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Utility Vehicles MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Autonomous Utility Vehicles MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Daimler AG

- Ford Motor Company

- General Motors Company (GMC)

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Nissan Motor Corporation

- Stellantis

- Toyota Motor Corporation

- Volkswagen AG