Global Autonomous Enterprise Market Size, Share, Industry Analysis Report By Component (Solution, Services), Business Function (Accounting & Finance, IT, Human Resource, Sales & Marketing, Supply Chain & Operations), By Application (Process Automation, Order Management, Credit Evaluation and Management, Predictive Maintenance, Customer and Employee Management, Others), By End Use (Retail and E-commerce, Healthcare, IT & Telecom, BFSI, Manufacturing, Transportation and Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156081

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

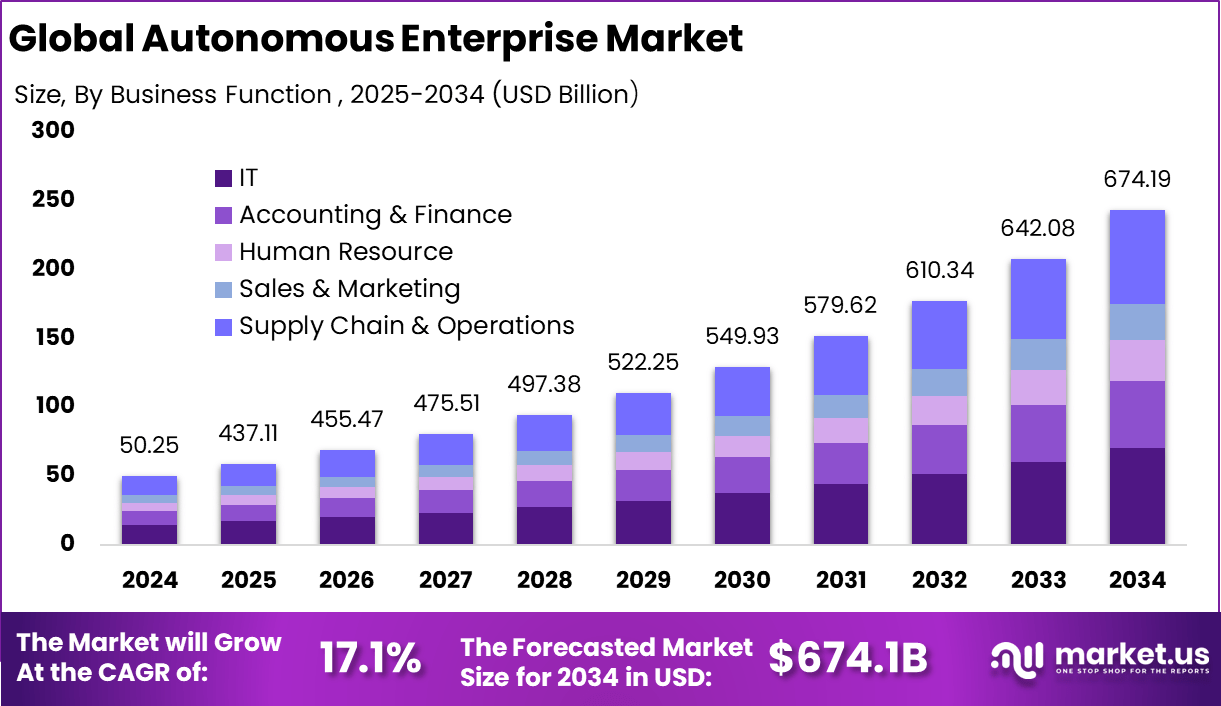

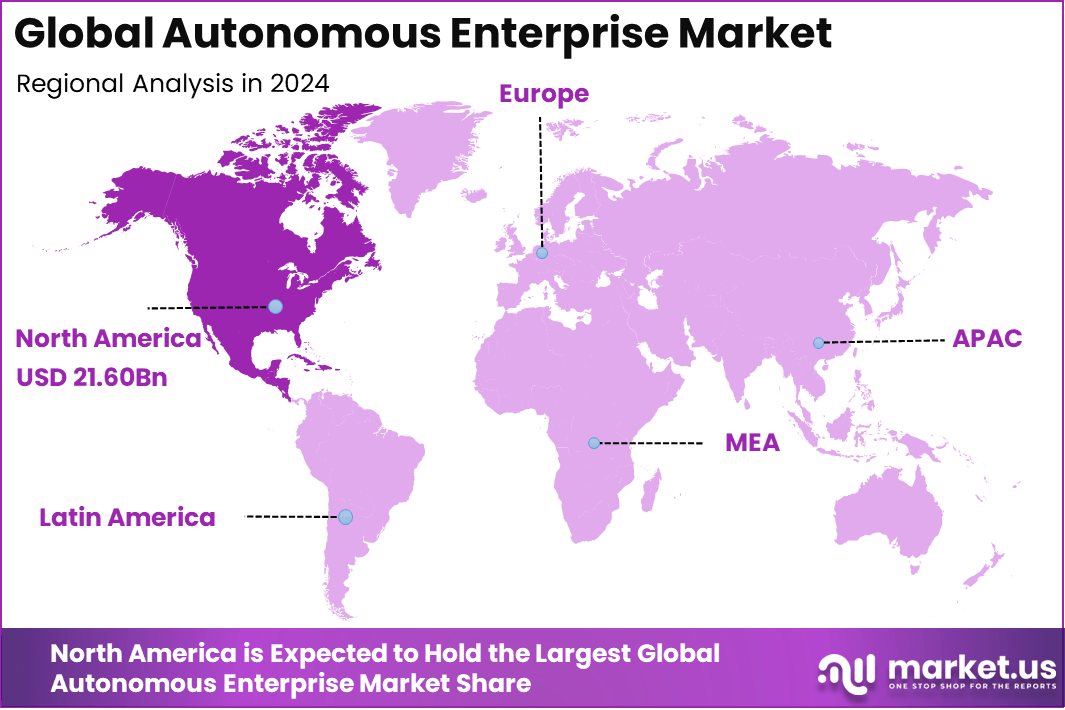

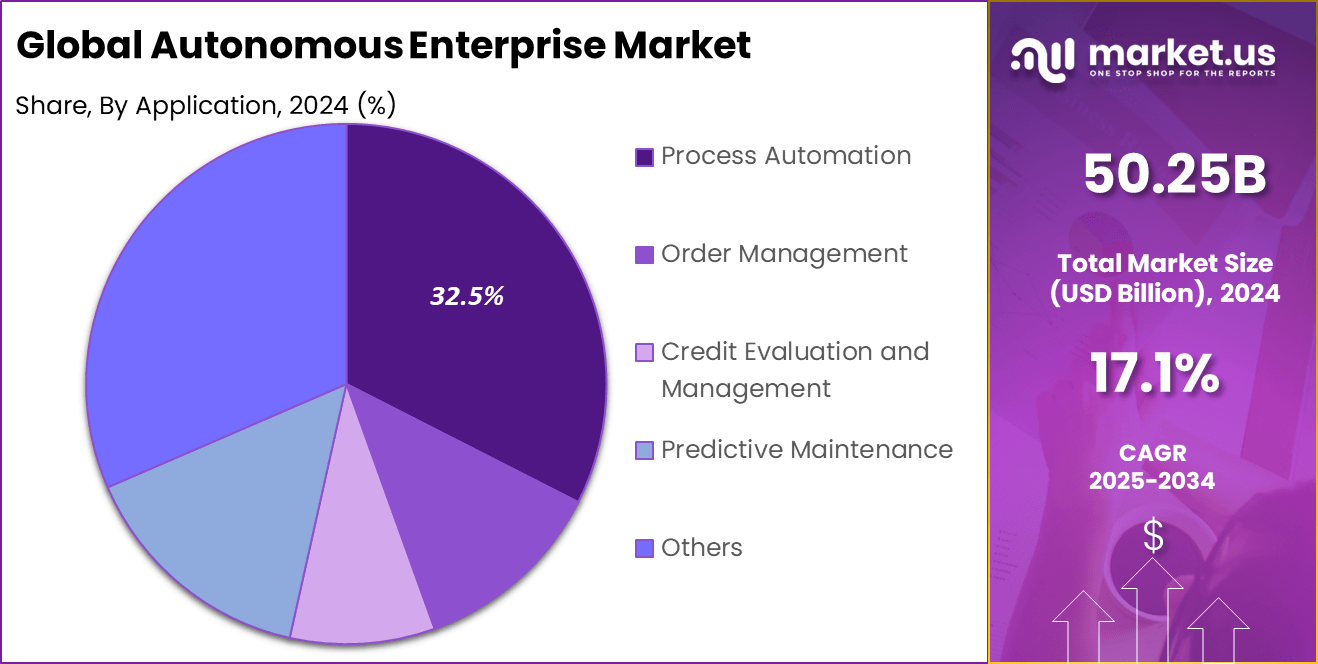

The Global Autonomous Enterprise Market size is expected to be worth around USD 674.19 Billion By 2034, from USD 50.25 billion in 2024, growing at a CAGR of 17.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 43% share, holding USD 21.60 Billion revenue.

The Autonomous Enterprise Market refers to businesses that use advanced technologies like artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and advanced analytics to automate and optimize operations with minimal human intervention. These enterprises streamline routine tasks, decision-making, and workflows, aiming to improve efficiency, reduce costs, and increase scalability across various business processes.

The main driving factors of this market include the growing demand for automation to enhance operational efficiency and competitiveness. Businesses benefit from autonomous systems that can perform complex processes, provide predictive analytics, and adapt by learning from data, enabling faster and more accurate decision-making. Rising concerns about data security also play a role, as autonomous enterprise solutions include strong safeguards like encryption, real-time monitoring, and threat detection.

Key Insight Summary

- 65.5% share was held by the Solutions segment, showing enterprises’ preference for integrated platforms over standalone services.

- 29.0% of adoption came from the IT function, highlighting its role as the primary driver of autonomous transformation.

- 32.5% share was captured by Process Automation applications, reflecting the demand for efficiency, accuracy, and cost savings.

- 25.8% share was led by the BFSI sector, where automation is reshaping compliance, risk management, and customer experience.

Investment & Benefits

Investment opportunities in the autonomous enterprise market are expanding, especially in AI-powered platforms, cloud-based services, and industry-specific automation tools. IT operations, customer service, finance, and supply chain management are key areas attracting investments. Companies that develop scalable, secure, and AI-driven solutions stand to capture significant market share.

From a business perspective, adopting autonomous enterprise solutions shifts resources from routine maintenance to innovation and growth initiatives. It frees employees from repetitive tasks, allowing them to focus on strategic, creative, and problem-solving activities that drive revenue. These solutions reduce human errors, ensure better regulatory compliance, and improve risk control through real-time monitoring and early issue detection.

The regulatory environment for autonomous enterprises is evolving alongside technology advancements. Enterprises must comply with data privacy, security, and industry-specific regulations. While some regions lack unified policies, governments are increasingly focusing on frameworks that balance innovation with risk management and ethical use of AI.

North America Market Size

In 2024, North America held a dominant market position, capturing more than 43% share of the autonomous enterprise market, with revenue reaching USD 21.6 billion. This leadership is primarily due to the region’s strong digital infrastructure, high adoption of AI-driven platforms, and a mature ecosystem of cloud services.

Enterprises in the United States and Canada have rapidly integrated intelligent automation across key business functions, such as IT operations, finance, and customer service. The increasing focus on operational efficiency and real-time decision-making has further encouraged early deployment of autonomous systems across large enterprises.

The demand in North America has also been reinforced by a regulatory environment that supports innovation while maintaining data compliance. Organizations have adopted scalable, secure, and self-learning enterprise platforms that reduce human intervention in repetitive tasks. This shift has been driven by rising labor costs, growing cybersecurity concerns, and the need for faster digital transformation.

Regional Insights

Region Market Characteristics Asia-Pacific Fastest growth due to digital transformation, government funding, and expanding IT sectors Europe Growth propelled by privacy regulations, digital innovation, and manufacturing automation Other Regions Emerging adoption in Latin America, Middle East, and Africa facilitated by infrastructure development By Component

The solution segment dominates the Autonomous Enterprise Market with a significant 65.5% share in 2024, reflecting strong demand for integrated products and services designed to automate enterprise operations. Solutions include AI-driven software platforms, robotic process automation (RPA), and advanced analytics tools that collectively enable enterprises to operate with minimal human intervention.

This segment’s growth is driven by organizations seeking to enhance operational efficiency, improve decision-making accuracy, and reduce costs. Enterprises favor comprehensive solutions that provide end-to-end automation capabilities, supporting the transformation into autonomous businesses.

By Business Function

The IT function commands a 29.0% share of the autonomous enterprise market in 2024, highlighting its pivotal role in digital transformation initiatives. Autonomous IT systems automate routine tasks such as network monitoring, incident response, and system maintenance, freeing IT teams to focus on strategic activities.

Automation in IT improves service uptime, reduces errors, and accelerates problem resolution. As enterprises increasingly adopt cloud computing and complex infrastructures, autonomous IT solutions become essential to manage and optimize these environments effectively.

By Application

Process automation represents 32.5% of the market in 2024, emphasizing its importance in driving enterprise autonomy. This application focuses on automating repetitive, rule-based tasks across departments, from finance and HR to supply chain management.

By deploying process automation, organizations can streamline workflows, shorten cycle times, and enhance compliance. The ability to scale automation across various processes supports companies’ goals of becoming fully autonomous enterprises.

By End Use

The BFSI sector holds a 25.8% share, reflecting its early adoption of autonomous enterprise technologies to enhance efficiency and compliance. Autonomous systems in BFSI optimize operations such as risk assessment, fraud detection, customer service, and regulatory reporting.

Given the sector’s stringent regulatory landscape and volume of transactions, automation reduces operational risks and improves accuracy. BFSI organizations continue to invest heavily in autonomous solutions to maintain competitive advantage and drive innovation.

Key Trends and Innovations

Trend/Innovation Description Self-Optimizing and Adaptive Workflows Systems that learn and improve without human intervention AI-Driven Predictive Analytics Forecasting to anticipate issues and optimize resources Autonomous Customer Service Chatbots and voice assistants handling complex interactions Integration of RPA & AI Combining software bots and AI for holistic automation Edge Computing & Real-Time Decision Making Decentralized data processing for faster autonomous response Collaboration Between Humans & Machines Enhanced interaction for decision support and conflict resolution Key Market Segments

-

Component

- Solution

- Robotic Process Automation (RPA)

- Autonomous Networks

- Accounts Automation

- Security Automation

- Autonomous Agents

- Others

- Services

- Professional Services

- Managed Services

- Solution

-

Business Function

- Accounting & Finance

- IT

- Human Resource

- Sales & Marketing

- Supply Chain & Operations

-

Application

- Process Automation

- Order Management

- Credit Evaluation and Management

- Predictive Maintenance

- Customer and Employee Management

- Others

-

End Use

- Retail and E-commerce

- Healthcare

- IT & Telecom

- BFSI

- Manufacturing

- Transportation and Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for Operational Efficiency and Cost Reduction

The autonomous enterprise market is strongly driven by businesses’ growing need to enhance operational efficiency while reducing costs. Automating repetitive and decision-intensive processes frees employees to focus on strategic tasks, significantly lowering labor expenses and improving accuracy by minimizing human errors.

Additionally, as digital transformation accelerates, enterprises face increasing complexity and data volume, demanding scalable solutions that can manage workflows autonomously. This demand is particularly high in sectors like banking, healthcare, retail, and supply chain, where operational agility and cost control are critical competitive differentiators.

Restraint

High Initial Investment and Complex Integration

Despite strong growth prospects, high initial investment costs and complexity in integrating autonomous solutions with legacy infrastructure pose significant restraints. Enterprises must invest extensively in AI platforms, cloud services, data management systems, and skilled personnel to develop and maintain autonomous capabilities.

Legacy systems often lack the interoperability needed for seamless adoption, requiring costly customization. Additionally, organizations may face resistance due to change management challenges, security concerns, and compliance requirements, all of which can slow implementation and increase risk.

Opportunity

Expansion in Cloud-Native Architectures and Edge Computing

There is significant opportunity for autonomous enterprise technologies to expand through cloud-native architectures and edge computing. Cloud platforms enhance scalability, interoperability, and remote management of autonomous systems, while edge computing supports real-time data processing closer to operational sources, reducing latency.

This synergy enables enterprises to deploy autonomous applications across distributed environments such as manufacturing floors, retail locations, and remote sites with improved responsiveness and security. As cloud adoption grows and edge computing matures, enterprises can unlock new use cases and efficiencies, further driving market expansion.

Challenge

Ensuring Security, Compliance, and Ethical Governance

A critical challenge for the autonomous enterprise market is ensuring robust security, regulatory compliance, and ethical governance. Autonomous systems process vast amounts of sensitive data and make decisions that affect operations and customers, requiring stringent safeguards against cyber threats and data breaches.

Furthermore, regulatory frameworks around AI use, data privacy, and accountability are evolving rapidly, necessitating continuous compliance efforts. Enterprises must implement transparent governance models, fairness audits, and risk mitigation strategies to maintain trust, meet legal obligations, and responsibly leverage autonomous technologies.

Competitive Analysis

In the autonomous enterprise market, technology giants such as Microsoft Corporation, Hewlett Packard Enterprise Development LP, Atos SE, and SAP SE are playing a leading role. Their strong portfolios in cloud computing, enterprise software, and AI integration provide the foundation for automated business operations. These players focus on combining digital platforms with intelligent automation to support large enterprises.

Networking and cybersecurity providers such as Cisco Systems, Inc. and Palo Alto Networks are central to this transformation. They focus on securing automated workflows, ensuring real-time monitoring, and enabling compliance with strict regulatory standards. Their expertise in network automation, security orchestration, and zero-trust frameworks positions them as critical partners for enterprises adopting automation.

Specialized automation companies including Blue Prism Limited, Automation Anywhere, Inc., AutomationEdge, Nice S.p.A., and UiPath dominate the software-driven automation space. These firms provide robotic process automation (RPA), AI-powered orchestration, and low-code platforms that streamline business processes.

Top Key Players in the Market

- Microsoft Corporation

- Hewlett Packard Enterprise Development LP

- Atos SE

- SAP SE

- Cisco Systems, Inc.

- Palo Alto Networks

- Blue Prism Limited

- Automation Anywhere, Inc.

- AutomationEdge

- Nice S.p.A.

- UiPath

Recent Developments

- In May 2025, Kore.ai entered a partnership with Microsoft to integrate its advanced agent platform and business solutions with Microsoft’s scalable infrastructure and AI capabilities. This collaboration is designed to support enterprises in adopting AI rapidly, securely, and at scale while promoting flexible and human-centric solutions that enhance productivity.

- In March 2025, Hewlett Packard Enterprise and NVIDIA introduced enterprise AI solutions under the NVIDIA AI Computing by HPE portfolio. These full-stack private cloud offerings deliver greater performance, power efficiency, and security, enabling organizations to train, fine-tune, and run inference on generative, agentic, and physical AI models more effectively.

- In February 2025, Cisco expanded its partnership with NVIDIA to deliver advanced AI solutions focused on high-performance, low-latency, and energy-efficient connectivity. The collaboration addresses the rising demands of AI workloads across data centers, cloud environments, and enterprise applications.

- In 2024, Microsoft intensified its autonomous enterprise strategy by unveiling ten pre-built autonomous AI agents integrated into Dynamics 365, supporting key functions such as supply chain, finance, sales, and customer service. This move reflects a broader vision of Microsoft positioning Copilot as the central AI operating system for enterprises, combining AI at the cloud and edge levels for improved data privacy and responsiveness.

Report Scope

Report Features Description Market Value (2024) USD 50.25 Bn Forecast Revenue (2034) USD 674.19 Bn CAGR(2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), Business Function (Accounting & Finance, IT, Human Resource, Sales & Marketing, Supply Chain & Operations), By Application (Process Automation, Order Management, Credit Evaluation and Management, Predictive Maintenance, Customer and Employee Management, Others), By End Use (Retail and E-commerce, Healthcare, IT & Telecom, BFSI, Manufacturing, Transportation and Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Hewlett Packard Enterprise Development LP, Atos SE, SAP SE, Cisco Systems, Inc., Palo Alto Networks, Blue Prism Limited, Automation Anywhere, Inc., AutomationEdge, Nice S.p.A., UiPath Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Enterprise MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Enterprise MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Hewlett Packard Enterprise Development LP

- Atos SE

- SAP SE

- Cisco Systems, Inc.

- Palo Alto Networks

- Blue Prism Limited

- Automation Anywhere, Inc.

- AutomationEdge

- Nice S.p.A.

- UiPath