Global Autonomous AI Market Size, Share, Industry Analysis Report By Component (Solutions/Platforms, Services), By Technology (Machine Learning (ML) & Deep Learning, Reinforcement Learning (RL), Generative AI & Self-Learning Models, Computer Vision, Natural Language Processing (NLP), Others), By Deployment Mode (Cloud-based, On-Premises), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Application (Autonomous Robotics, Autonomous Vehicles, Autonomous Decision-Making Software, Autonomous IT Operations (AIOps), Defense & Security Systems, Healthcare & Life Sciences, Others), By Industry Vertical (Automotive & Transportation, Manufacturing & Industrial, BFSI, Healthcare & Life Sciences, Aerospace & Defense, Retail & E-commerce, IT & Telecom, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156047

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Investment & Benefits

- U.S. Autonomous AI Market Size

- Component Analysis

- Technology Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- Industry Vertical Analysis

- Top Growth Factors

- Key Trends and Innovations

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

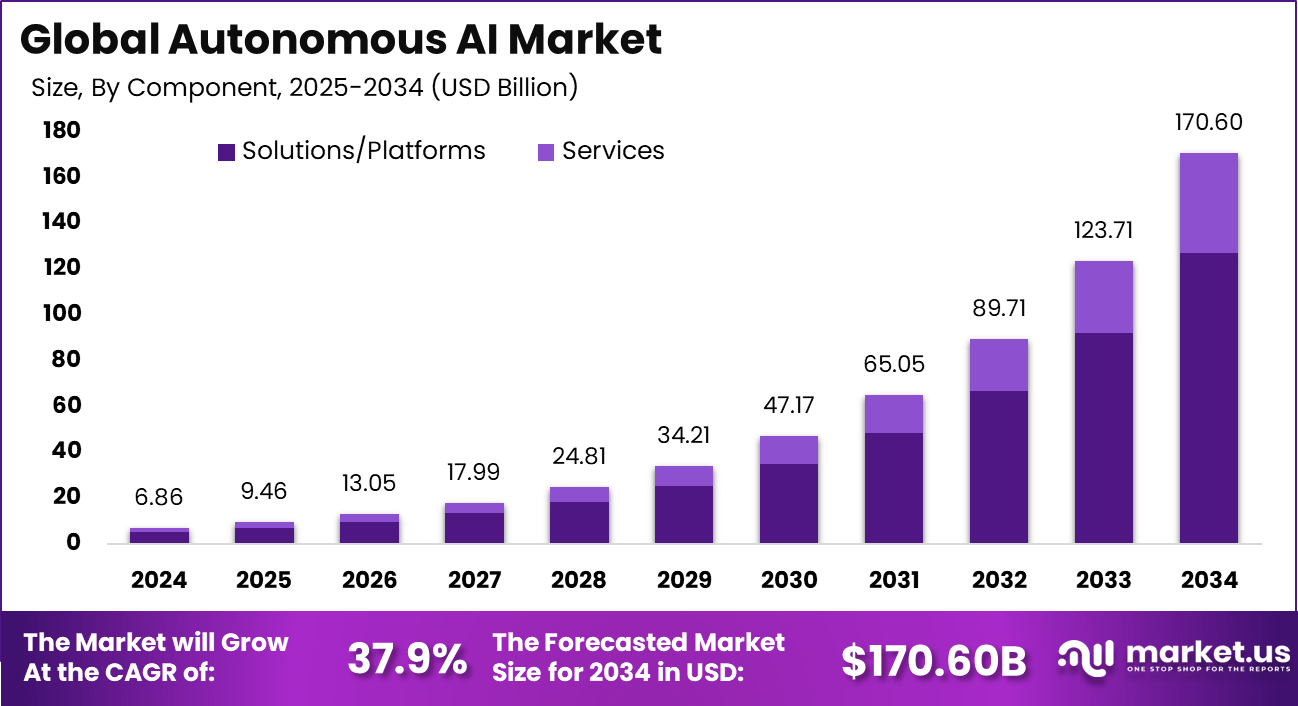

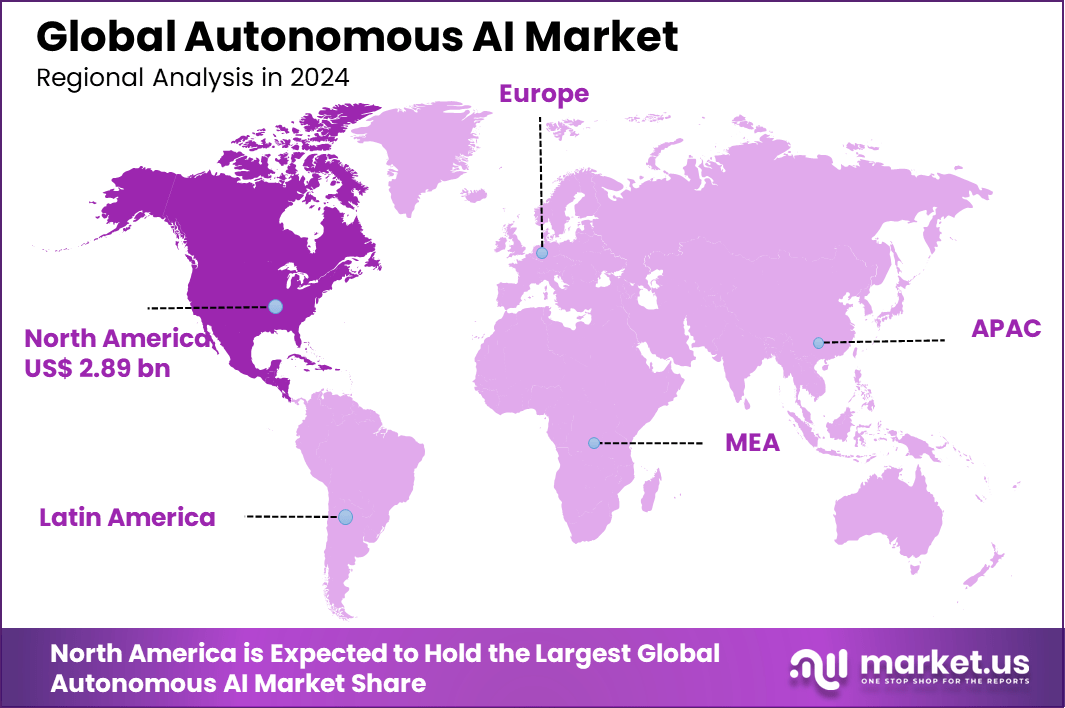

The Global Autonomous AI Market size is expected to be worth around USD 170.60 billion by 2034, from USD 6.86 billion in 2024, growing at a CAGR of 37.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.2% share, holding USD 2.89 billion in revenue.

The autonomous AI market is rapidly evolving, characterized by artificial intelligence systems and agents capable of independently performing complex tasks, making decisions, and adapting to changing environments without human intervention. These systems are integral to numerous applications, including self-driving vehicles, robotics, customer service automation, healthcare diagnostics, and industrial automation.

Demand for autonomous AI is rising as organizations seek solutions that deliver continuous, around-the-clock services without human limitations. The market sees substantial adoption among enterprises aiming to automate repetitive and high-volume tasks, thereby freeing human workers to focus on more strategic work. Autonomous AI is also gaining traction in customer interaction roles, where personalized, data-driven responses improve user engagement.

According to Ahrefs, U.S. private AI funding reached $109.1 billion in 2024, making it 12 times higher than China and 24 times that of the UK. In the UK, the AI sector is expanding at a rate 30 times faster than the rest of the economy, while AI companies accounted for about 20% of all venture capital funding in the EU. On a global scale, 66% of people intentionally use AI on a regular basis.

For instance, in August 2025, Airbus partnered with Shield AI to integrate autonomous AI technology into its helicopters. The collaboration is designed to enhance flight operations by enabling autonomous navigation, improving safety, and reducing pilot workload. With Shield AI’s advanced software, helicopters will be able to perform complex missions without human control, marking a notable advancement in autonomous aviation.

Key Takeaway

- 74.4% share was held by the Solutions/Platforms segment, making it the largest contributor to the market.

- 34.6% came from Machine Learning (ML) & Deep Learning technologies, highlighting their core role in autonomous AI development.

- 82.2% share was captured by Cloud-based deployment, showing clear preference for scalable and flexible infrastructure.

- 62.5% of adoption was from Large Enterprises, reflecting their ability to invest in advanced AI systems.

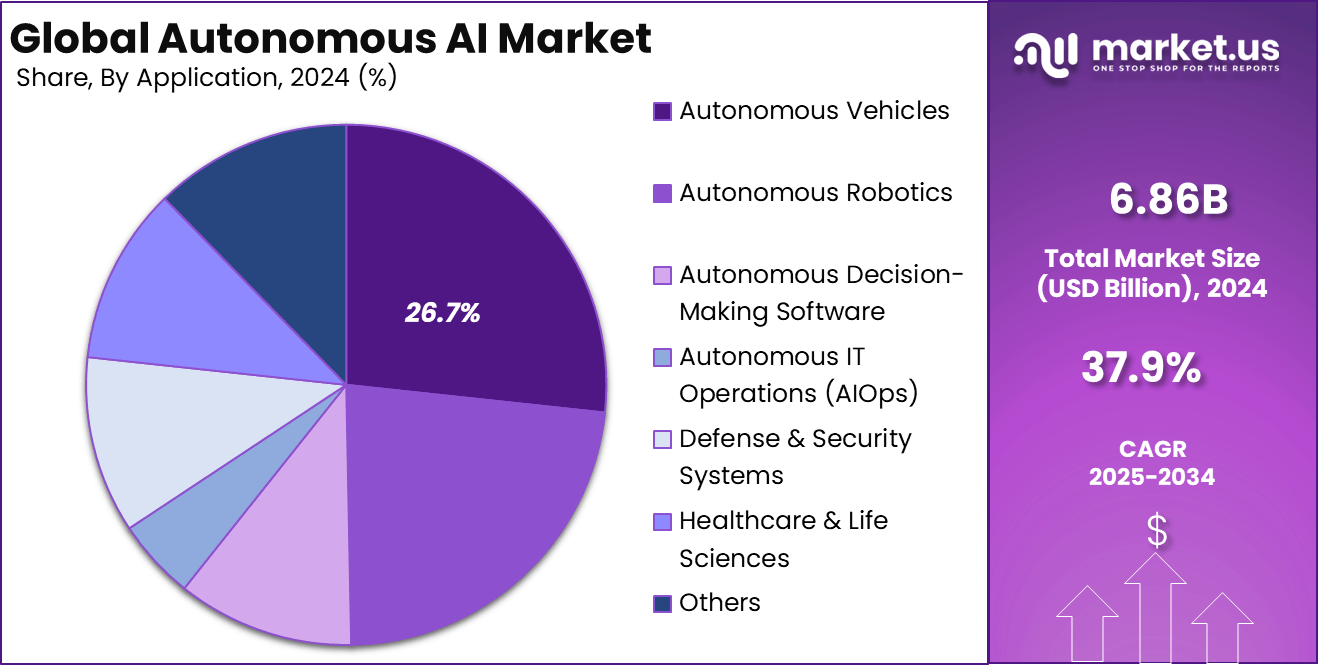

- 26.7% share was held by the Autonomous Vehicles segment, showing rapid integration of AI into mobility solutions.

- 24.3% of demand came from the Automotive & Transportation industry, reinforcing its position as a leading adopter of autonomous AI.

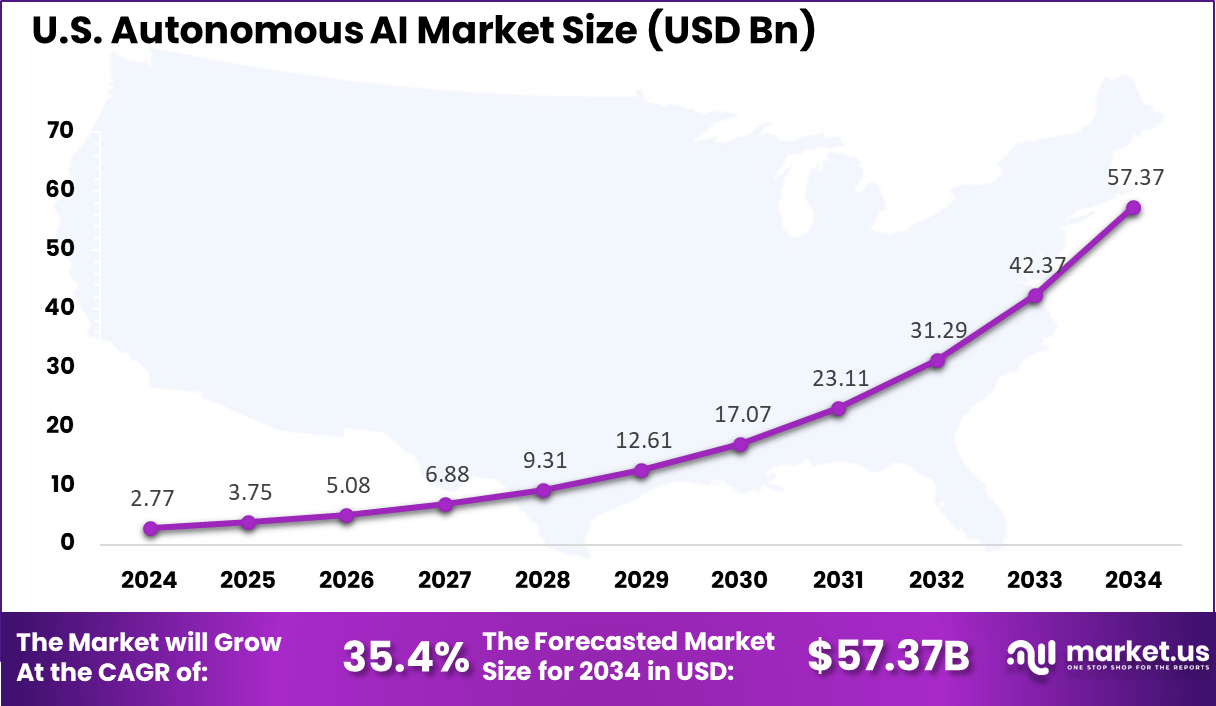

- The U.S. market stood at USD 2.77 Billion in 2024, supported by a high-growth 35.4% CAGR, signaling strong expansion potential.

- North America led globally with 42.2% share, driven by advanced AI research, strong enterprise adoption, and government support for autonomous technologies.

Investment & Benefits

Investment opportunities in the autonomous AI market are notable due to the model’s ability to generate recurring value through automation and enhanced productivity. Investors are drawn by predictable growth driven by expanding industry use cases and ongoing innovation. Companies focusing on autonomous vehicles, industrial automation, healthcare AI, and customer service automation are attracting significant funding for research and development.

Public sector investments aimed at building smart infrastructure and AI ecosystems further support market expansion. Businesses benefit from deploying autonomous AI through increased operational efficiency, reduced costs, and improved decision accuracy. Autonomous agents operate 24/7, allowing continuous monitoring and rapid responses to real-time events.

Additionally, autonomous AI facilitates enhanced customer experiences through personalized interactions and supports compliance and security through consistent data handling. Over time, these AI agents improve themselves through ongoing learning, which drives continuous performance gains and long-term value creation for organizations.

U.S. Autonomous AI Market Size

The market for Autonomous AI within the U.S. is growing tremendously and is currently valued at USD 2.77 billion, the market has a projected CAGR of 35.4%. The market is expanding rapidly due to breakthroughs in technology, substantial investments, and increasing demand for automation in sectors like healthcare, finance, manufacturing, and retail.

Furthermore, the availability of scalable cloud infrastructure and supportive regulations is fueling growth, positioning the U.S. as a key player in the global autonomous AI landscape. For instance, in July 2025, Xtend secured a $30 million extension to complete its $70 million Series B funding round to expand its autonomous AI robots across the United States.

These robots, tested in real battle conditions, are being advanced for defense, security, and broader applications. The investment highlights the U.S. dominance in the autonomous AI market, strengthening its leadership in developing and deploying cutting-edge AI technologies for critical sectors.

In 2024, North America held a dominant market position in the Global Autonomous AI Market, capturing more than a 42.2% share, holding USD 2.89 billion in revenue. The market is growing due to its robust technological infrastructure, substantial investments, and leadership in AI innovation.

The U.S. is home to leading tech companies and startups that are advancing autonomous systems in sectors such as automotive, healthcare, and logistics. Furthermore, supportive government policies and the availability of advanced cloud computing resources have accelerated the region’s growth, solidifying its position as a key player in the development and deployment of autonomous AI technologies.

For instance, in June 2025, Plus Automation and Churchill IX merged to create PlusAI, focusing on AI-led virtual drivers for autonomous trucking. The move strengthens North America’s lead in the autonomous AI market by driving innovations in freight logistics that improve safety, boost efficiency, and cut costs.

Component Analysis

In 2024, the Solutions/Platforms segment held a dominant market position, capturing a 74.4% share of the Global Autonomous AI Market. This dominance is due to the growing demand for integrated AI solutions that streamline processes across industries.

These platforms enable businesses to deploy autonomous systems efficiently, offering scalability, flexibility, and advanced analytics. With key players focusing on developing robust, user-friendly platforms for sectors like healthcare, automotive, and logistics, the Solutions/Platforms segment continues to lead market growth.

For Instance, in April 2025, ArabicAI launched an Arabic-first autonomous AI platform tailored to meet the needs of Arabic-speaking markets. This innovative platform aims to enhance automation and AI-driven decision-making for businesses in the Middle East and North Africa. By focusing on the unique needs of Arabic-speaking regions, ArabicAI is addressing the gap in language-specific AI solutions.

Technology Analysis

In 2024, the ML & Deep Learning segment held a dominant market position, capturing a 34.6% share. The dominance is due to the increasing need for advanced data processing, predictive analytics, and real-time decision-making across industries. ML and deep learning algorithms enable autonomous systems to learn from vast datasets, improving their accuracy and efficiency in applications like self-driving cars, robotics, and healthcare diagnostics.

For instance, in April 2024, Purdue University launched the world’s first center dedicated to pioneering the use of AI in autonomous aviation transportation. This initiative focuses on advancing machine learning (ML) technologies to enhance the development of autonomous aircraft and air traffic management systems. By applying ML and AI, the center aims to innovate safer, more efficient autonomous aviation solutions.

Deployment Mode Analysis

In 2024, the Cloud-based segment held a dominant market position, capturing an 82.2% share of the Global Autonomous AI Market. This dominance is due to the scalability, flexibility, and cost-efficiency that cloud platforms offer for deploying autonomous AI systems.

Cloud-based solutions allow businesses to store and process vast amounts of data, enabling real-time decision-making and seamless integration of AI technologies. Additionally, cloud infrastructure supports rapid innovation and accessibility, driving broader adoption across industries such as healthcare, automotive, and logistics.

For Instance, in May 2025, Nutanix introduced new cloud-native infrastructure solutions, including AI agents that leverage cloud-based deployment for autonomous systems. These innovations enable businesses to scale their AI applications more efficiently, utilizing the flexibility and cost-effectiveness of cloud environments.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 62.5% share of the Global Autonomous AI Market. The dominance is due to the need for enhanced automation to boost efficiency, lower costs, and improve decision-making in complex operations.

Large enterprises are equipped with the resources to invest in advanced autonomous AI technologies, allowing them to scale operations, handle large datasets, and foster innovation across industries like manufacturing, finance, and logistics. Their strong IT infrastructure and significant budgets enable quick adoption and seamless integration of autonomous AI solutions into their business models.

For instance, in August 2025, Tredence launched “Milky Way,” an enterprise-ready constellation of AI agents designed to enable autonomous decision intelligence for large enterprises. This platform leverages autonomous AI to streamline complex decision-making processes, improve operational efficiency, and drive innovation across industries.

Application Analysis

In 2024, the Autonomous Vehicles segment held a dominant market position, capturing a 26.7% share of the Global Autonomous AI Market. The dominance is due to the rapid advancements in self-driving technology, fueled by improvements in AI, machine learning, and sensor technologies.

Autonomous vehicles promise enhanced safety, efficiency, and reduced human error in transportation. Significant investments from major automakers and tech companies, along with favorable regulatory frameworks, have accelerated the adoption and development of autonomous vehicles.

For instance, in August 2025, Helm.ai and Honda Motor Co. announced a multi-year joint development agreement to enhance Advanced Driver Assistance Systems (ADAS) for mass-production consumer vehicles. This collaboration focuses on deploying autonomous AI technologies to improve vehicle safety, navigation, and overall driving experience.

Industry Vertical Analysis

In 2024, the Automotive & Transportation segment held a dominant market position, capturing a 24.3% share of the Global Autonomous AI Market. This dominance is due to the rising adoption of autonomous and semi-autonomous vehicles, fueled by advanced AI technologies like ADAS, computer vision, and machine learning.

The ongoing progress in self-driving technologies and the increasing demand for safer, more efficient transportation solutions are key drivers. Furthermore, investments in electric and hybrid autonomous vehicles, along with AI applications in commercial transportation and logistics, are significantly boosting market growth.

For instance, in January 2025, at CES, Nvidia’s DRIVE partners showcased their latest advancements in autonomous AI for the automotive and transportation sectors. These innovations include cutting-edge self-driving vehicle technologies powered by AI, which enhance safety, navigation, and overall driving experiences.

Top Growth Factors

Factor Description Increasing AI & Machine Learning Capabilities Enabling autonomous decision-making and real-time adaptability Government & Private Sector Investments Significant funding to develop infrastructure, large language models, and AI research Growing Demand for Automation Enterprises adopting autonomous systems for efficiency and innovation Expansion of Smart Infrastructure Adoption in smart cities, autonomous vehicles, robotics, and industrial automation Advances in Edge AI and 5G Enhanced computational power and connectivity for real-time autonomous AI operations Key Trends and Innovations

Trend / Innovation Description Autonomous Agents & Multi-agent Collaboration Systems capable of independent goal pursuit and inter-agent coordination Integration of Generative AI Combination of generative models with autonomous operation for decision making Ethical and Explainable AI Increasing focus on transparency and responsible AI frameworks AI-Driven Workflow Optimization Autonomous workflows improving operational efficiency and reducing human intervention Hybrid Cloud & Edge AI Deployment Distributed AI systems balancing local processing and cloud-scale learning Key Market Segments

By Component

- Solutions/Platforms

- Autonomous decision-making engines

- Reinforcement learning platforms

- Self-optimizing AI frameworks

- Robotics control software

- Services

- Deployment & integration

- Training & consulting

- Managed AI operations

By Technology

- Machine Learning (ML) & Deep Learning

- Reinforcement Learning (RL)

- Generative AI & Self-Learning Models

- Computer Vision

- Natural Language Processing (NLP)

- Others

By Deployment Mode

- Cloud-based

- On-Premises

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Autonomous Robotics

- Autonomous Vehicles

- Autonomous Decision-Making Software

- Autonomous IT Operations (AIOps)

- Defense & Security Systems

- Healthcare & Life Sciences

- Others

By Industry Vertical

- Automotive & Transportation

- Manufacturing & Industrial

- BFSI

- Healthcare & Life Sciences

- Aerospace & Defense

- Retail & E-commerce

- IT & Telecom

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Demand for Intelligent Automation and Scalable Efficiency

The autonomous AI market is driven by the escalating demand for intelligent automation that reduces operational costs and boosts productivity. Businesses across manufacturing, healthcare, finance, and transportation seek scalable AI solutions that can adapt adaptively to real-time changes and perform decision-making without human intervention.

This demand is supported by advances in machine learning, natural language processing, and robotics that empower AI agents to understand context, predict outcomes, and act proactively. As enterprises strive to streamline workflows and enhance precision, autonomous AI technologies become essential tools for competitive advantage and innovation.

For instance, in August 2025, Apex Systems partnered with Composabl to build and deploy autonomous AI agents in physical environments. This collaboration aims to meet the growing demand for automation across industries such as manufacturing, logistics, and supply chain management. By integrating AI agents into physical environments, businesses can enhance operational efficiency, reduce human error, and streamline workflows.

Restraint

Safety and Ethical Concerns

Safety and ethical concerns are significant restraints in the adoption of autonomous AI. Issues like accidents involving self-driving cars or unintended actions by AI-powered robots raise public and regulatory concerns.

Moreover, ethical questions around decision-making, accountability, transparency, and bias in AI systems add complexity. These concerns slow down adoption as stakeholders demand more robust safety measures and clearer ethical guidelines to ensure that autonomous AI systems operate responsibly and fairly.

For instance, in October 2024, Nvidia discussed safety issues surrounding autonomous AI at the AI Summit in Washington, particularly in the automotive industry. The company highlighted the challenges of ensuring that self-driving cars make safe decisions in complex real-world environments. While AI has the potential to reduce traffic accidents, concerns remain about the technology’s ability to handle unpredictable situations.

Opportunities

Expanding Applications Across Diverse Industries

The autonomous AI market holds vast opportunities in expanding applications across diverse sectors. From self-driving vehicles and drones to healthcare diagnostic systems and automated financial advisors, autonomous AI is revolutionizing traditional operations.

Emerging use cases in smart manufacturing, agriculture, and public safety illustrate its transformative potential. As AI models improve in contextual comprehension and autonomy, industries can deploy intelligent agents for more sophisticated tasks, opening new markets and elevating operational resilience

For instance, in March 2025, GE Healthcare and Nvidia teamed up to develop autonomous AI solutions for healthcare, specifically focusing on digital X-ray imaging. This collaboration aims to enhance diagnostic accuracy by leveraging AI to automatically analyze and interpret medical images, reducing the time required for diagnosis and improving patient outcomes.

Challenges

Skill Shortages

The rapid growth of autonomous AI technologies has led to a significant skills gap. Companies seeking to implement AI, machine learning, and robotics face challenges in hiring qualified professionals due to the high demand and limited talent pool.

This shortage of skilled workers slows down AI development and integration into business processes. Organizations must invest in training, upskilling programs, and partnerships with educational institutions to bridge this gap and ensure they have the expertise to leverage autonomous AI effectively.

For instance, in April 2025, a report by the ISC2 Cybersecurity Workforce Study highlighted a severe shortage of skilled workers in AI and cybersecurity, emphasizing the growing demand for professionals with expertise in autonomous systems. This shortage is creating a barrier for companies looking to leverage autonomous AI to its full potential.

Key Players Analysis

The Autonomous AI market is shaped by global leaders in artificial intelligence research and deployment. OpenAI, Google DeepMind, Microsoft, Anthropic, and Meta are central players driving breakthroughs in generative models, reinforcement learning, and responsible AI frameworks. Their focus has been on creating advanced systems that push the boundaries of reasoning and autonomy.

Amazon Web Services, IBM, Nvidia, Apple, Salesforce, and Adobe are expanding AI integration across industries by offering scalable infrastructure, cloud platforms, and domain-specific solutions. Nvidia plays a critical role by providing GPUs that power most large-scale AI models. AWS and IBM emphasize enterprise adoption through secure, reliable ecosystems.

Salesforce and Adobe focus on AI-driven automation and personalization in customer experience. Together, these firms are advancing the industrialization of autonomous AI by embedding intelligence into business operations and consumer technologies. Asian leaders and emerging innovators also play a significant role.

Baidu, Tencent, and Huawei are accelerating adoption in China through investments in natural language models and AI-powered applications. Oracle and SAP are integrating autonomous AI into enterprise resource planning and business intelligence. Cohere, Hugging Face, Inflection AI, and other emerging players are shaping open-source development and alternative architectures.

Top Key Players in the Market

- OpenAI

- Google DeepMind

- Microsoft

- Anthropic

- Meta

- Amazon Web Services (AWS)

- IBM

- Nvidia

- Apple

- Salesforce

- Adobe

- Baidu

- Tencent

- Huawei

- Oracle

- SAP

- Cohere

- Hugging Face

- AI

- Inflection AI

- Other Key Players

Recent Developments

- In August 2025, Baidu’s Apollo Go entered into a strategic partnership with Lyft to deploy fully autonomous vehicles across key European markets, including Germany and the United Kingdom, starting in 2026. This collaboration aims to expand Baidu’s robotaxi services internationally and integrate with Lyft’s platform to provide safe, efficient, and sustainable mobility solutions.

- In April 2025, Pony.ai and Tencent Cloud announced a strategic partnership to advance autonomous driving technology and robotaxi commercial deployment. This collaboration focuses on integrating Tencent’s AI capabilities with Pony.ai’s autonomous driving systems to accelerate the development and deployment of autonomous vehicles.

Report Scope

Report Features Description Market Value (2024) USD 6.86 Bn Forecast Revenue (2034) USD 170.6 Bn CAGR(2025-2034) 37.9% Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions/Platforms, Services), By Technology (Machine Learning (ML) & Deep Learning, Reinforcement Learning (RL), Generative AI & Self-Learning Models, Computer Vision, Natural Language Processing (NLP), Others), By Deployment Mode (Cloud-based, On-Premises), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Application (Autonomous Robotics, Autonomous Vehicles, Autonomous Decision-Making Software, Autonomous IT Operations (AIOps), Defense & Security Systems, Healthcare & Life Sciences, Others), By Industry Vertical (Automotive & Transportation, Manufacturing & Industrial, BFSI, Healthcare & Life Sciences, Aerospace & Defense, Retail & E-commerce, IT & Telecom, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OpenAI, Google DeepMind, Microsoft, Anthropic, Meta, Amazon Web Services (AWS), IBM, Nvidia, Apple, Salesforce, Adobe, Baidu, Tencent, Huawei, Oracle, SAP, Cohere, Hugging Face, Character.AI, Inflection AI, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OpenAI

- Google DeepMind

- Microsoft

- Anthropic

- Meta

- Amazon Web Services (AWS)

- IBM

- Nvidia

- Apple

- Salesforce

- Adobe

- Baidu

- Tencent

- Huawei

- Oracle

- SAP

- Cohere

- Hugging Face

- AI

- Inflection AI

- Other Key Players