Global Automotive Leaf Spring Suspension Market Size, Share, Growth Analysis By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, and Buses & Coaches), By Material (Steel, Composite, and Alloy), By Application (Front Suspension, Rear Suspension, and All Wheel Suspension), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173210

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

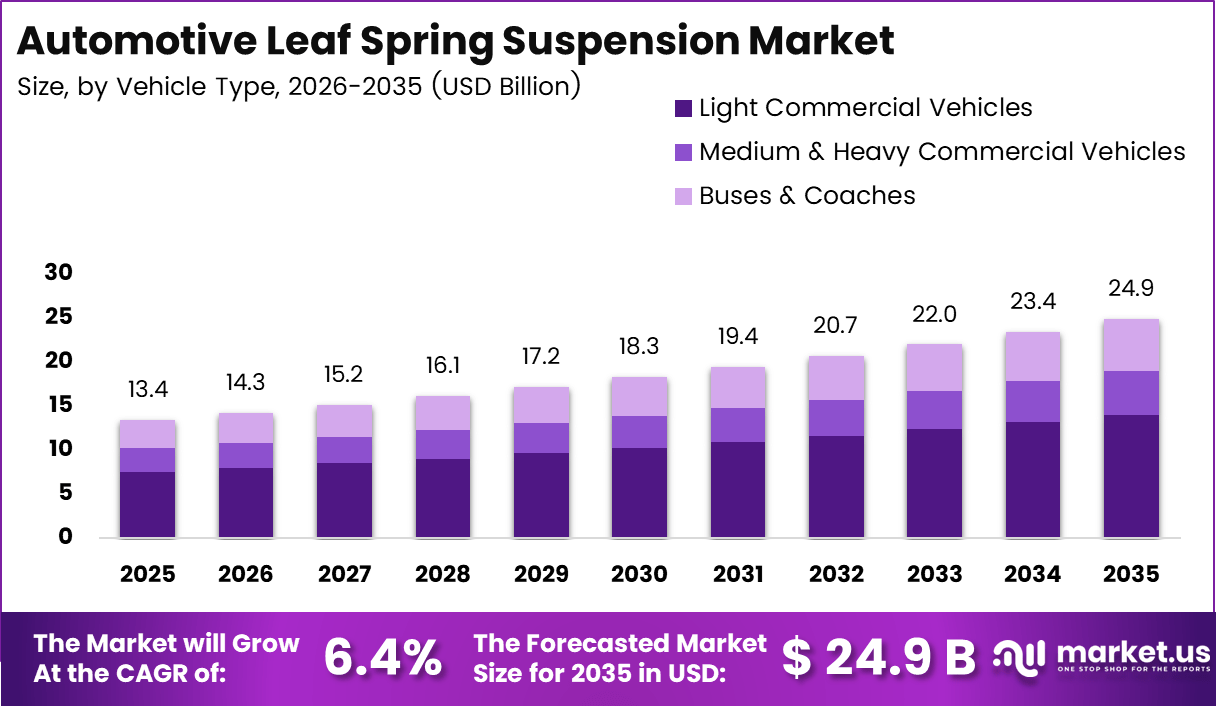

The Global Automotive Leaf Spring Suspension Market size is expected to be worth around USD 24.9 billion by 2035, from USD 13.4 billion in 2025, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

The Automotive Leaf Spring Suspension market represents a fundamental mechanical suspension category supporting load control, ride stability, and axle alignment in commercial vehicles. It includes multi-leaf and parabolic steel springs engineered to absorb road shocks efficiently. As a result, the market remains essential across logistics, construction, agriculture, and utility vehicle operations globally.

Automotive leaf spring suspension systems continue to maintain relevance despite growing adoption of alternative suspension technologies. Consequently, fleet Management favor these systems due to durability, predictable performance, and ease of maintenance. Moreover, lower replacement and repair costs support steady transactional demand across OEM and aftermarket channels.

Market growth is reinforced by increasing commercial vehicle output and expanding freight transportation activities. Additionally, government investments in road infrastructure, industrial corridors, and rural mobility indirectly strengthen suspension demand. Regulations focused on axle load limits, vehicle safety, and durability standards further encourage continued adoption of leaf spring based systems.

Opportunities increasingly arise from engineering optimization rather than pure volume expansion. For example, parabolic leaf spring designs reduce overall vehicle weight while preserving load bearing capacity. Therefore, fuel efficiency improvements and emission compliance benefits position advanced leaf spring suspension solutions favorably within evolving commercial vehicle platforms.

Manufacturing capability advancements significantly influence market competitiveness. According to manufacturer disclosures, imported parabolic rolling machines now support production thickness ranges between 6mm and 60mm with minimal tolerance variation. This precision enables consistent quality across heavy duty suspension applications serving domestic and international markets.

Furthermore, hybrid suspension configurations integrating air systems are gaining traction. As per industry manufacturing sources, air link Z springs now achieve rolling capacities up to 60mm, supporting enhanced ride comfort and load stability. Consequently, such designs address growing fleet demand for balanced suspension performance.

In addition, heavy air link multi-leaf spring assemblies support high payload vehicle categories. According to manufacturing capability data, these assemblies reach maximum diameters of 50mm, enabling robust load distribution. As a result, buses, trailers, and specialized transport vehicles increasingly adopt these reinforced suspension solutions.

Overall, the Automotive Leaf Spring Suspension market demonstrates sustained structural importance. Supported by infrastructure development, regulatory compliance requirements, and advanced manufacturing processes, the market continues evolving steadily. Therefore, investments in lightweight materials, precision engineering, and scalable production capabilities remain critical for long term growth.

Key Takeaways

- The global Automotive Leaf Spring Suspension Market is projected to grow from USD 13.4 billion in 2025 to USD 24.9 billion by 2035 at a 6.4% CAGR.

- Light Commercial Vehicles represent the leading vehicle type segment, accounting for a dominant share of 56.2% in 2025.

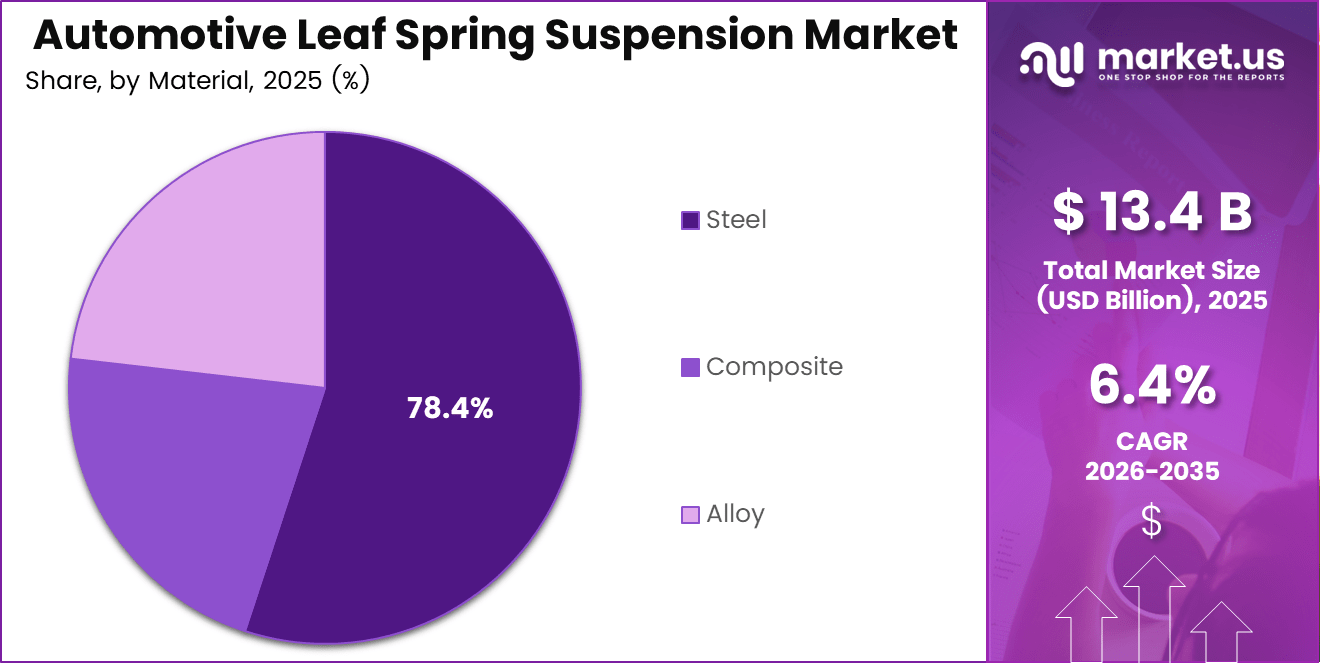

- Steel remains the dominant material segment with a market share of 78.4%, driven by strength and cost efficiency.

- Rear Suspension leads the application segment, holding a dominant share of 66.8% due to higher load bearing requirements.

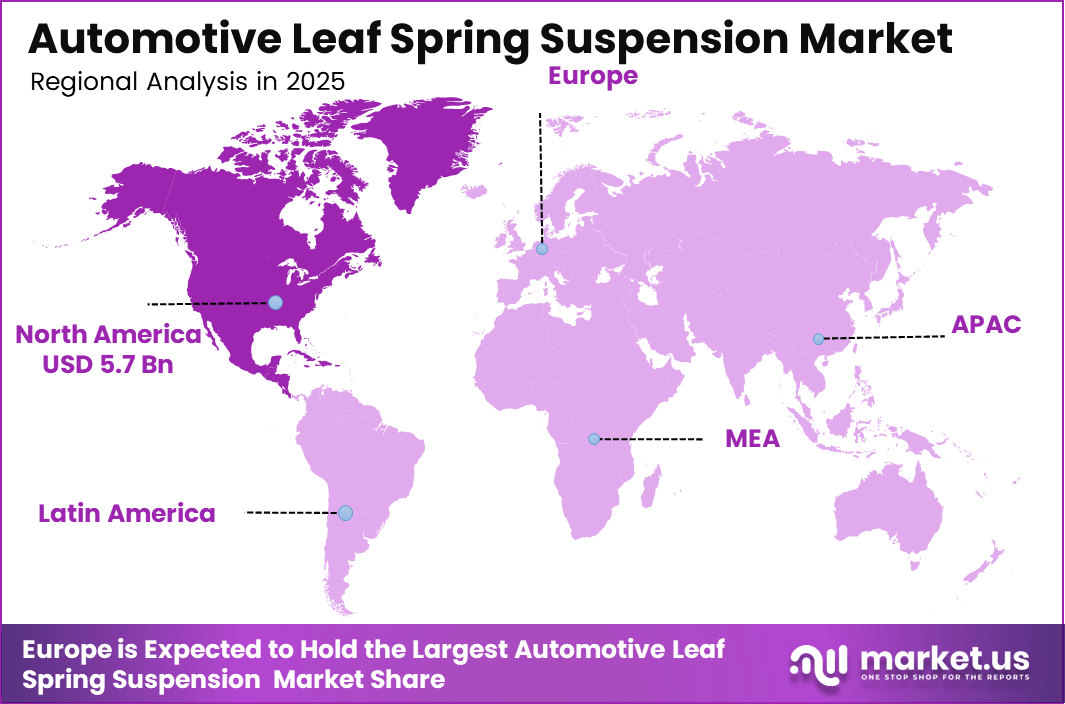

- North America is the leading region, capturing 43.1% of the global market and valued at USD 5.7 billion in 2025.

By Vehicle Type Analysis

Light Commercial Vehicles dominates with 56.2% due to high deployment in urban logistics, construction, and last mile delivery operations.

Light Commercial Vehicles held a dominant market position in the By Vehicle Type Analysis segment of Automotive Leaf Spring Suspension Market, with a 56.2% share. Growth is supported by rising e commerce logistics, frequent stop load cycles, and cost focused fleet operations. Consequently, manufacturers prioritize durability, payload stability, and simplified maintenance.

Medium & Heavy Commercial Vehicles held a significant position in the By Vehicle Type Analysis segment of Automotive Leaf Spring Suspension Market. Demand is driven by long haul freight, mining, and infrastructure activities. As a result, heavy duty leaf springs remain essential for load distribution, axle alignment, and sustained performance under extreme stress conditions.

Buses & Coaches held a stable position in the By Vehicle Type Analysis segment of Automotive Leaf Spring Suspension Market. Adoption is supported by public transport expansion and intercity travel demand. Accordingly, operators value ride consistency, passenger comfort, and long service life, making leaf springs a reliable suspension solution.

By Material Analysis

Steel dominates with 78.4% due to its strength, cost efficiency, and widespread manufacturing compatibility.

Steel held a dominant market position in the By Material Analysis segment of Automotive Leaf Spring Suspension Market, with a 78.4% share. Growth is reinforced by high load tolerance, ease of fabrication, and established supply chains. Consequently, steel remains preferred across commercial and passenger transport applications.

Composite materials held a growing position in the By Material Analysis segment of Automotive Leaf Spring Suspension Market. Adoption is supported by weight reduction goals and fuel efficiency targets. Therefore, composites gain traction in select applications where corrosion resistance and improved ride dynamics are prioritized.

Alloy materials maintained a niche position in the By Material Analysis segment of Automotive Leaf Spring Suspension Market. Usage is driven by performance oriented designs requiring enhanced fatigue resistance. As a result, alloys are applied selectively in specialized and premium suspension configurations.

By Application Analysis

Rear Suspension dominates with 66.8% due to its critical role in load bearing and vehicle stability.

Rear Suspension held a dominant market position in the By Application Analysis segment of Automotive Leaf Spring Suspension Market, with a 66.8% share. Growth is supported by cargo load concentration at the rear axle. Consequently, rear leaf springs remain essential for durability and safety.

Front Suspension held a steady position in the By Application Analysis segment of Automotive Leaf Spring Suspension Market. Demand is influenced by steering control and shock absorption requirements. Therefore, front leaf springs continue to support alignment stability in selected vehicle architectures.

All Wheel Suspension held a limited position in the By Application Analysis segment of Automotive Leaf Spring Suspension Market. Adoption is driven by specialized off road and utility vehicles. As a result, usage remains selective where uniform load distribution is operationally critical.

Key Market Segments

By Vehicle Type

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Buses & Coaches

By Material

- Steel

- Composite

- Alloy

By Application

- Front Suspension

- Rear Suspension

- All Wheel Suspension

Drivers

Rising Commercial Vehicle Production Drives Automotive Leaf Spring Suspension Market Growth

Rising commercial vehicle production across logistics, construction, and agriculture strongly supports market growth. As freight movement increases, fleet operators prefer proven suspension systems. Therefore, leaf springs remain widely used due to their ability to handle rough usage, uneven roads, and continuous load cycles in demanding operating environments.

Increasing load carrying requirements in light duty trucks and heavy duty trucks further strengthen demand. Vehicles transporting goods, raw materials, and farm produce require stable load support. As a result, leaf spring suspensions continue to offer reliable axle control, improved balance, and long term durability under frequent overloading conditions.

Cost efficiency and structural simplicity compared to advanced suspension systems remain major advantages. Leaf springs require fewer components and simpler installation. Consequently, manufacturers and fleet owners favor them to reduce upfront vehicle costs while maintaining acceptable performance for commercial and utility focused operations.

Strong aftermarket demand driven by high wear rates in utility vehicles also fuels growth. Frequent loading, harsh terrain, and long operating hours accelerate component replacement. Therefore, leaf spring suspensions generate steady replacement demand, supporting consistent revenues across repair and maintenance channels.

Restraints

Gradual Shift Toward Advanced Suspension Systems Restrains Market Expansion

A gradual shift toward air and independent suspension in premium vehicle segments limits growth. These systems offer improved comfort and adaptability. As a result, passenger focused and high end commercial vehicles increasingly reduce reliance on traditional leaf spring suspensions.

Higher unsprung weight associated with leaf springs affects ride comfort. Increased stiffness can transmit road shocks to the vehicle body. Therefore, manufacturers targeting comfort oriented applications face limitations when using conventional leaf spring suspension designs.

Handling performance also becomes a concern in modern vehicles. Leaf springs provide limited flexibility during sharp turns and uneven terrain. Consequently, independent suspension systems gain preference in segments where driving dynamics and smooth handling are critical.

Regulatory focus on ride quality and vehicle refinement further influences design choices. As expectations rise, traditional leaf spring systems face pressure to evolve, slightly restraining adoption in comfort sensitive vehicle categories.

Growth Factors

Expanding Electric and Infrastructure Projects Create New Growth Opportunities

Expanding demand for reinforced leaf springs in electric commercial vehicles presents strong opportunities. Battery packs increase vehicle weight. Therefore, reinforced leaf springs support higher load capacity while maintaining stability and safety in electric trucks and delivery vans.

Increasing infrastructure and mining activities in emerging economies also support growth. Construction vehicles operate under heavy loads and rough terrain. As a result, durable leaf spring suspensions remain essential for maintaining vehicle uptime and operational efficiency.

Adoption of corrosion resistant coatings helps extend product lifecycle. Improved surface treatments reduce rust and fatigue. Consequently, manufacturers enhance product value and reduce maintenance costs for fleet operators working in harsh environments.

Growth in fleet modernization programs for public transport and defense vehicles further boosts demand. Governments prioritize reliable and easy to maintain suspension systems. Therefore, leaf springs remain relevant in large scale fleet replacement initiatives.

Emerging Trends

Integration of Parabolic Designs Shapes Key Market Trends

Integration of parabolic and multi leaf designs supports weight optimization trends. These designs reduce overall mass while maintaining strength. As a result, vehicles achieve better efficiency without sacrificing load carrying capability.

Use of high strength steel and advanced heat treatment processes continues to rise. These technologies improve fatigue life and durability. Therefore, manufacturers deliver longer lasting leaf springs suitable for intensive commercial usage.

Rising customization of leaf springs based on vehicle load profiles is another trend. Different applications require specific stiffness levels. Consequently, tailored designs help improve performance and extend component life.

Increasing focus on noise, vibration, and harshness reduction technologies also influences development. Improved bushings and mounting systems reduce discomfort. As a result, leaf spring suspensions adapt to modern expectations while retaining core functional benefits.

Regional Analysis

North America Dominates the Automotive Leaf Spring Suspension Market with a Market Share of 43.1%, Valued at USD 5.7 billion

North America leads the Automotive Leaf Spring Suspension Market due to strong demand from commercial trucks, pickup vehicles, and fleet based logistics operations. In 2025, the region accounted for a dominant 43.1% share, supported by a market value of USD 5.7 billion. High freight movement, replacement demand, and durability focused vehicle usage continue to sustain regional dominance.

Europe Automotive Leaf Spring Suspension Market Trends

Europe shows steady demand driven by light commercial vehicles, agricultural machinery, and cross border logistics activities. The market benefits from structured fleet maintenance practices and long vehicle lifecycles. Additionally, regulatory focus on load safety and axle stability supports continued use of leaf spring suspension systems across multiple vehicle categories.

Asia Pacific Automotive Leaf Spring Suspension Market Trends

Asia Pacific represents a high growth region due to expanding construction, mining, and logistics sectors. Rapid urbanization and infrastructure development increase commercial vehicle deployment. As a result, durable and cost efficient leaf spring suspensions remain widely adopted across domestic and regional transport fleets.

Middle East and Africa Automotive Leaf Spring Suspension Market Trends

The Middle East and Africa market is supported by infrastructure expansion, oil and gas logistics, and heavy duty transport requirements. Vehicles operating in harsh terrain and extreme climates rely on robust suspension systems. Therefore, leaf spring suspensions continue to see stable demand across utility and industrial applications.

Latin America Automotive Leaf Spring Suspension Market Trends

Latin America shows consistent adoption driven by agriculture, mining, and regional freight movement. Cost sensitivity and long service expectations favor traditional suspension designs. Consequently, leaf spring systems remain preferred for load carrying vehicles operating across rural and semi urban road networks.

U.S. Automotive Leaf Spring Suspension Market Trends

The U.S. market benefits from high pickup truck usage, strong aftermarket activity, and continuous fleet replacement cycles. Demand is reinforced by commercial transportation, construction fleets, and utility vehicles. As a result, leaf spring suspension systems maintain a strong presence across both OEM and replacement channels.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Leaf Spring Suspension Company Insights

The global Automotive Leaf Spring Suspension Market in 2025 reflects strategic positioning by key manufacturers and material suppliers reinforcing their roles in a competitive landscape. Action Springs India Pvt. Ltd. continues to leverage its robust manufacturing footprint and deep industry partnerships to meet rising demand across commercial vehicle segments, with a focus on quality consistency and scalable production capacities that support OEMs and aftermarket channels alike. The company’s emphasis on technological refinement and cost efficiency positions it as a reliable supplier in key regional markets.

Agya Auto Ltd. has strengthened its market presence by aligning product development with evolving automotive standards, particularly for light and medium commercial vehicles where ride comfort and load durability are critical. The firm’s investments in precision engineering and customized spring solutions enhance its appeal among tier-1 OEMs, helping to expand its application range and improve supply chain resilience amid volatile raw material pricing.

Akar Auto Industries Ltd. demonstrates significant momentum through its diversified product portfolio and strong distribution networks that penetrate both domestic and export markets. By integrating advanced forming techniques and stringent quality controls, the company addresses stringent performance requirements while maintaining competitive lead times. Its proactive engagement with vehicle manufacturers supports collaborative design enhancements tailored to next generation suspension systems.

Anhui Anhuang Machinery has carved out a niche with its focus on high-strength leaf spring assemblies for heavy duty applications, emphasizing durability and fatigue resistance. The company’s strategic investments in automated production and material optimization help it sustain operational efficiencies and adapt to shifting regulatory and performance benchmarks in global automotive markets, reinforcing its stature as a key supplier in Asia and beyond.

Top Key Players in the Market

- Action Springs India Pvt. Ltd.

- Agya Auto Ltd.

- Akar Auto Industries Ltd.

- Anhui Anhuang Machinery

- Arun Auto Spring Mfg. Co.

- Betts Co.

- BJ Spring Ltd.

- Dorman Products Inc.

- EATON Detroit Spring Inc.

- EMCO INDUSTRIES

- Jamna Auto Industries Ltd.

Recent Developments

- In November 2024, MidOcean Partners completed the acquisition of Arnott Industries, strengthening its exposure to the global automotive aftermarket. The transaction expanded MidOcean’s suspension technology portfolio across North America and Europe, while reinforcing Arnott’s position in air suspension systems for passenger and commercial vehicles.

Report Scope

Report Features Description Market Value (2025) USD 13.4 billion Forecast Revenue (2035) USD 24.9 billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, and Buses & Coaches), By Material (Steel, Composite, and Alloy), By Application (Front Suspension, Rear Suspension, and All Wheel Suspension) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Action Springs India Pvt. Ltd., Agya Auto Ltd., Akar Auto Industries Ltd., Anhui Anhuang Machinery, Arun Auto Spring Mfg. Co., Betts Co., BJ Spring Ltd., Dorman Products Inc., EATON Detroit Spring Inc., EMCO INDUSTRIES, Jamna Auto Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Leaf Spring Suspension MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Leaf Spring Suspension MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Action Springs India Pvt. Ltd.

- Agya Auto Ltd.

- Akar Auto Industries Ltd.

- Anhui Anhuang Machinery

- Arun Auto Spring Mfg. Co.

- Betts Co.

- BJ Spring Ltd.

- Dorman Products Inc.

- EATON Detroit Spring Inc.

- EMCO INDUSTRIES

- Jamna Auto Industries Ltd.