Global Automotive Interior Ambient Lighting Market By Product Type(Ambient Lighting, Dashboard Lights, Headup display, Reading lights), By Technology(LED, Halogen, Xenon), By Vehicle Type(Conventional cars, Green Cars), By Fuel Type(Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Application(Centre Console, Dashboard, Doors, Footwall), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 13899

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

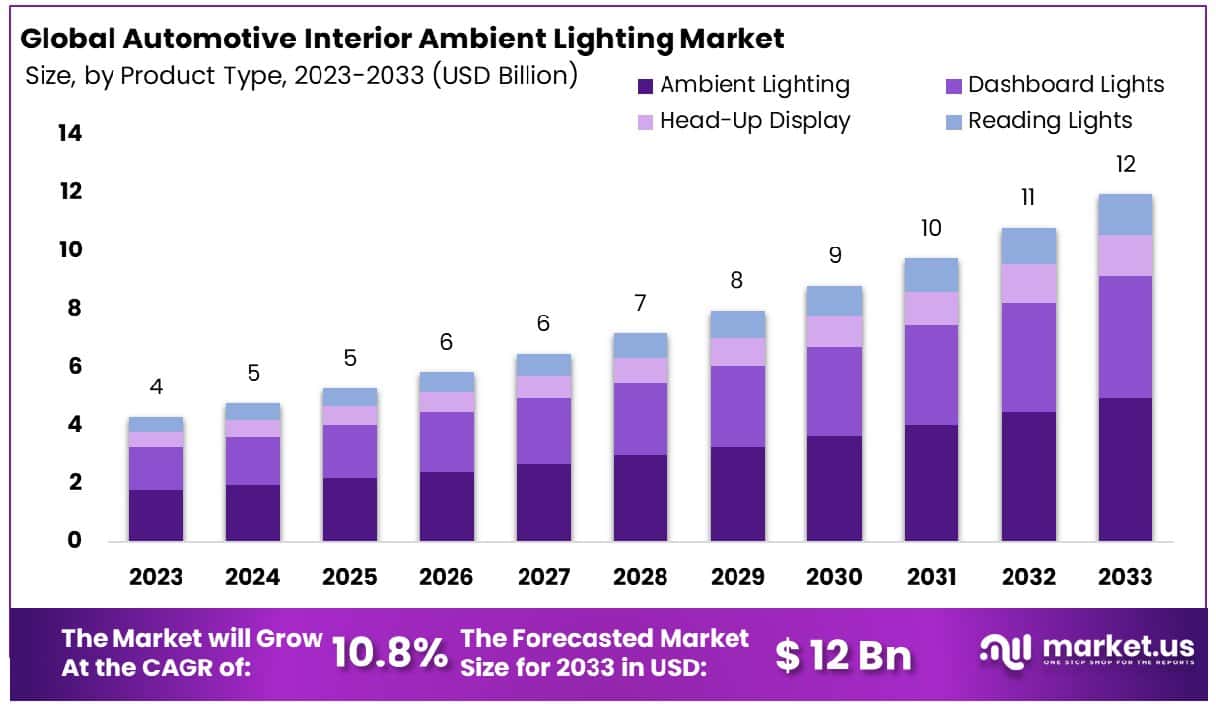

The Global Automotive Interior Ambient Lighting Market size is expected to be worth around USD 12.0 Billion by 2033, From USD 4.0 Billion by 2023, growing at a CAGR of 10.80% during the forecast period from 2024 to 2033.

The Automotive Interior Ambient Lighting Market encompasses the integration of light-based technologies within vehicle cabins to enhance aesthetic appeal, functionality, and occupant comfort. This market’s offerings include various lighting solutions such as LED, OLED, and fiber optics, which are strategically implemented in dashboards, doors, footwells, and other interior components. The demand in this sector is propelled by the increasing consumer desire for luxury and personalized vehicle interiors, advancements in automotive electronics, and stringent safety regulations.

Key stakeholders, including vehicle manufacturers and aftermarket service providers, are leveraging these innovations to improve user experience and safety. The strategic importance of ambient lighting is growing, as it plays a critical role in vehicle branding and differentiation, making it a pivotal focus for Product Managers within the automotive industry.

The automotive interior ambient lighting market is positioned for significant growth, driven by the expanding electric vehicle (EV) segment and evolving consumer preferences for enhanced driving experiences. In 2023, the forecast for EV sales is set to reach 14.1 million units, accounting for a notable 16% share of the global light-vehicle market.

This upward trajectory in EV adoption underscores a broader shift towards sustainability and innovation within the automotive sector, directly influencing the demand for advanced interior ambient lighting solutions. These smart lighting systems, pivotal for creating aesthetic and functional value, are increasingly integrated into electric vehicles to enhance user experience, safety, and vehicle attractiveness.

Furthermore, the evolution of battery technology plays a critical role in shaping the automotive interior ambient lighting market. In 2022, lithium nickel manganese cobalt oxide (NMC) led the battery chemistry market with a 60% share, followed by lithium iron phosphate (LFP) at nearly 30%, and nickel cobalt aluminum oxide (NCA) at about 8%.

The dominance of NMC, renowned for its balance between energy density, safety, and cost, alongside the growing adoption of LFP for its longevity and safety attributes, reflects the automotive industry’s commitment to innovation and sustainability. These advancements in battery chemistry not only facilitate the broader integration of ambient lighting by enhancing vehicle performance and efficiency but also by enabling more creative and energy-efficient lighting designs.

Key Takeaways

- Market Growth: Automotive Interior Ambient Lighting Market size is expected to be worth around USD 12.0 Billion by 2033, From USD 4.0 Billion by 2023, growing at a CAGR of 10.80% during the forecast period from 2024 to 2033.

- Regional Dominance: With a 61.8% market share, the Automotive Interior Ambient Lighting market in Asia Pacific dominates the region.

- Segmentation Insights:

- By Product Type: Ambient lighting dominates with a 41.3% market share, reflecting its widespread adoption in diverse environments.

- By Technology: LED technology leads, holding a 64.8% market share, due to its energy efficiency and longevity benefits.

- By Vehicle Type: Conventional cars command the market, with an 84.1% share, underscoring traditional automotive preference continuity.

- By Fuel Type: Battery electric vehicles remarkably secure a 73.5% market share, indicating a shift towards sustainable transportation solutions.

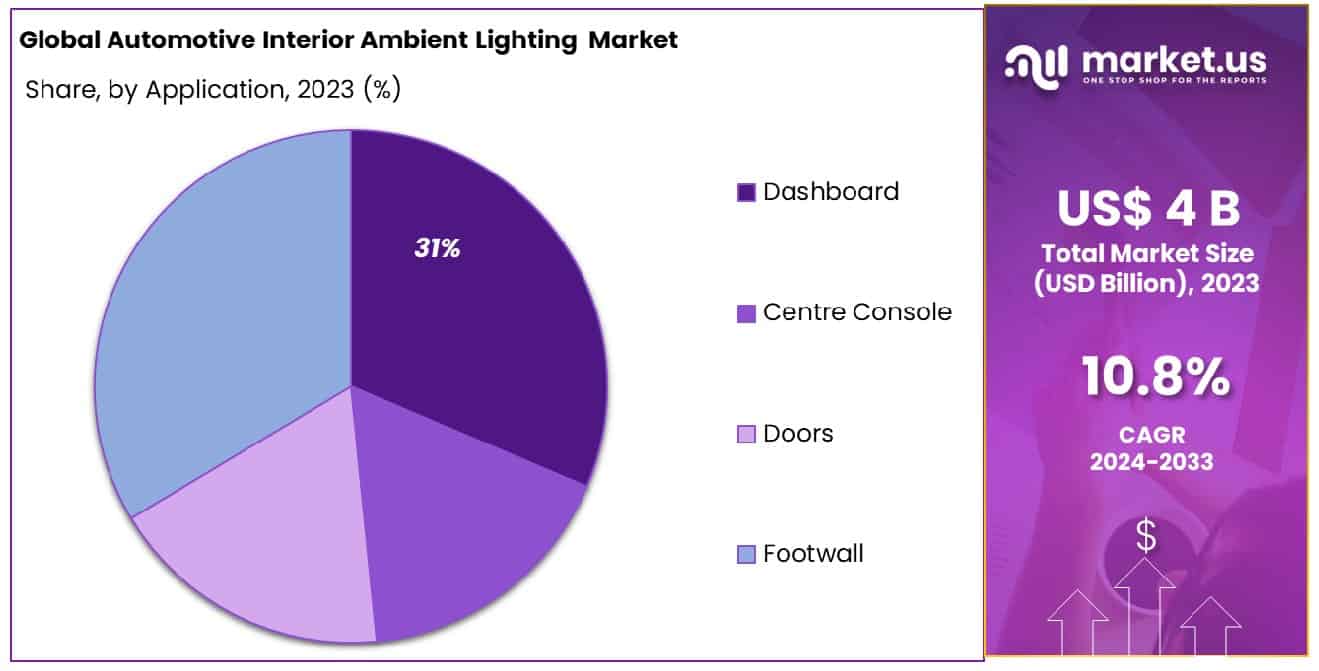

- By Applications: The dashboard application captures a 31.4% market share, highlighting its central role in vehicle aesthetics and functionality.

- Growth Opportunities: The automotive industry is witnessing a shift towards innovative interior ambient lighting solutions driven by consumer demand for comfort, safety, and luxurious driving experiences, particularly in conventional and green cars.

Driving Factors

Increased Consumer Demand for Luxury and Personalization

The growth of the Automotive Interior Ambient Lighting Market can be significantly attributed to the increased consumer demand for luxury and personalization in vehicles. This trend reflects a broader shift towards more customized and comfortable driving experiences. As consumers seek vehicles that not only meet their practical needs but also reflect their style and preferences, the demand for enhanced interior aesthetics, including ambient lighting, has surged.

Ambient lighting systems, which can offer a variety of colors and intensities, play a crucial role in the personalization of vehicle interiors, making them feel more luxurious and tailored to individual tastes. This demand for luxury and personalization drives automakers to incorporate advanced ambient lighting solutions, thereby propelling market growth.

Advancements in LED Technology

Simultaneously, advancements in LED technology have further catalyzed the expansion of the Automotive Interior Ambient Lighting Market. Modern LEDs offer superior brightness, color range, and energy efficiency compared to traditional lighting solutions. This technological evolution has made it possible to integrate more sophisticated and energy-efficient ambient lighting systems into vehicles at a lower cost.

The increased efficiency and reduced power consumption of LEDs align with the automotive industry’s broader goals of energy conservation and sustainability. Additionally, the durability and compact size of LED lights allow for more creative and flexible design possibilities, enabling automakers to innovate in the realm of interior lighting. These advancements not only enhance the aesthetic appeal and functionality of vehicle interiors but also contribute to the overall market growth by making ambient lighting systems more accessible and appealing to a broader range of consumers.

Restraining Factors

High Cost of LED Lights

The incorporation of LED lights into automotive interior ambient lighting systems presents a significant cost implication, which inherently restrains the market’s growth potential. LEDs, despite their energy efficiency and longevity, command a higher initial investment compared to traditional lighting solutions. This high cost can be a deterrent for both automotive manufacturers and consumers, particularly in price-sensitive segments.

However, as technology advances and production scales, a gradual reduction in LED costs is anticipated, which may mitigate this restraining factor over time. Furthermore, the premium segment of the automotive market, less sensitive to price fluctuations, continues to adopt these innovative lighting solutions, underscoring a segmented impact on market growth.

Rise in Demand for Mood Lighting

Contrastingly, the rising demand for mood lighting within automotive interiors acts as a significant driver, counterbalancing some of the negative impacts of the high cost of LED lights. Mood lighting, aimed at enhancing the aesthetic appeal and comfort of the vehicle’s interior, appeals to consumer desires for luxury and personalized driving experiences.

This demand encourages manufacturers to innovate and integrate ambient lighting solutions, despite the higher costs associated with LEDs. The trend towards personalization and luxury in automotive design is expected to persist, supporting the market’s expansion and partially offsetting cost-related growth constraints.

By Product Type Analysis

Ambient lighting dominates with a 41.3% market share, highlighting its widespread adoption in vehicles.

In 2023, the Automotive Interior Ambient Lighting Market witnessed significant contributions from various product types, notably with Ambient Lighting, Dashboard Lights, Headup Display, and Reading Lights leading in innovation and market preference. Among these, Ambient Lighting held a dominant market position in the By Product Type segment, capturing more than a 41.3% share.

This substantial market share can be attributed to the increasing demand for enhanced aesthetic appeal and comfort within vehicle interiors, alongside advancements in LED technology that have made ambient lighting more accessible and customizable.

Dashboard Lights followed, contributing to the market’s dynamics with their essential role in vehicle functionality and driver safety. The integration of innovative technologies in Dashboard Lights has not only improved visibility but also added to the vehicle’s aesthetic value, driving consumer interest.

Headup Displays have also seen a notable increase in adoption, driven by the growing emphasis on safety and convenience. These systems project critical information directly into the driver’s line of sight, reducing the need for drivers to divert their attention from the road, thereby enhancing overall vehicle safety.

Reading Lights, while holding a smaller share of the market, remain integral in providing targeted illumination, and enhancing passenger experience through personalized lighting options. Their continued evolution is expected to contribute to market growth, albeit at a more modest pace compared to other segments.

By Technology Analysis

LED technology leads, holding a 64.8% market share, indicating strong preference and efficiency.

In 2023, the Automotive Interior Ambient Lighting Market was distinguished by its technological segmentation, with LED (Light Emitting Diode), Halogen, and Xenon as the primary technologies employed. LED held a dominant market position in the “By Technology” segment, capturing more than a 64.8% share. This prevalence can be attributed to the superior energy efficiency, longer lifespan, and enhanced brightness offered by LED solutions compared to their counterparts. The shift towards LED technology has been driven by increasing consumer demand for advanced vehicle aesthetics and the automotive industry’s focus on energy conservation and sustainability.

Halogen, once the standard in automotive interior lighting, has seen a decline in market share due to its higher energy consumption and shorter lifespan relative to LED. However, it remains in use due to its cost-effectiveness and ease of installation in a wide range of vehicle models. Xenon technology, known for its intense light output and efficiency, occupies a niche segment. It is primarily favored in high-end vehicles for its distinctive bright, white light, contributing to enhanced visibility and luxury aesthetics.

The transition towards LED technology within the automotive interior ambient lighting market underscores a broader trend toward sustainability and energy efficiency in the automotive sector. This shift is supported by advancements in LED technology, which have enabled a broader spectrum of color and intensity customization, making it a preferred choice for manufacturers aiming to enhance the driving experience through innovative interior lighting solutions.

By Vehicle Type Analysis

Conventional cars command the market with an 84.1% share, underscoring traditional vehicular dominance.

In 2023, the Automotive Interior Ambient Lighting Market was segmented into two primary vehicle types: Conventional Cars and Green Cars. Conventional Cars held a dominant market position, capturing more than an 84.1% share. This significant market share can be attributed to the widespread adoption and manufacturing scale of conventional vehicles, which have historically dominated the automotive industry. The preference for conventional cars, despite growing environmental concerns, underscores their established market presence and consumer loyalty rooted in performance reliability and a broad spectrum of options catering to varying consumer preferences.

On the other hand, Green Cars, encompassing hybrid, electric, and alternative fuel vehicles, represented a smaller segment of the market. The adoption of Green Cars has been on a gradual incline, driven by rising environmental awareness, governmental incentives, and advancements in green technology. However, the market share of Green Cars, while increasing, remained substantially lower compared to Conventional Cars. This disparity underscores the challenges faced by Green Cars, including higher initial costs, limited charging infrastructure, and consumer apprehension regarding new technologies.

The dominance of Conventional Cars in the Automotive Interior Ambient Lighting Market reflects current consumer preferences and the automotive industry’s manufacturing capabilities. However, the growing interest in Green Cars suggests a potential shift in future market dynamics. As technology advances and consumer attitudes evolve, the gap in market share between Conventional and Green Cars is expected to narrow, signaling a transformative period in the automotive industry’s approach to sustainable transportation solutions.

By Fuel Type Analysis

Battery electric vehicles prominently feature with a 73.5% market share, showcasing rapid adoption rates.

In 2023, the Automotive Interior Ambient Lighting Market experienced significant segmentation by fuel type, with Battery Electric Vehicles (BEVs) holding a dominant market position. BEVs captured more than a 73.5% share, illustrating a substantial preference within the market. This was followed by Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), which, although they held smaller market shares, represented important segments within the broader market dynamics.

The prominence of BEVs in the automotive interior ambient lighting market can be attributed to the rising consumer demand for environmentally friendly and energy-efficient vehicles. This trend has been further bolstered by advancements in battery technology, which have improved vehicle range and reduced charging times, making BEVs a more attractive option for consumers. Additionally, the growing network of charging infrastructure and governmental incentives aimed at promoting the adoption of electric vehicles have played pivotal roles in accelerating BEV market penetration.

Hybrid Electric Vehicles and Plug-in Hybrid Electric Vehicles, while occupying smaller segments of the market, remain integral to the automotive industry’s transition towards sustainable mobility solutions. These vehicle types cater to a segment of consumers seeking a balance between traditional fuel-powered vehicles and fully electric options, offering versatility in fueling and usage patterns.

The significant market share held by BEVs underscores a shifting consumer preference toward more sustainable and innovative transportation solutions. This trend is expected to continue, with BEVs, HEVs, and PHEVs collectively driving the evolution of the Automotive Interior Ambient Lighting Market. The expansion of this market segment is indicative of broader industry trends towards electrification and sustainability, reflecting consumer expectations and regulatory pressures for cleaner, more efficient vehicles.

By Applications Analysis

The Dashboard application commands a notable 31.4% share within the market by applications.

In 2023, the Automotive Interior Ambient Lighting Market witnessed a significant stratification across various application segments, with Dashboard, Centre Console, Doors, and Footwall being the primary areas of focus. Among these, the Dashboard segment held a dominant market position, capturing more than a 31.4% share. This prominence can be attributed to increasing consumer demand for enhanced aesthetic appeal and comfort within vehicle interiors, alongside advancements in automotive technologies.

The Centre Console segment followed closely, driven by the integration of interactive and functional lighting to improve usability and driver experience. Lighting in the Doors segment has been essential for safety and convenience, contributing to the overall market growth through innovative design incorporations that enhance vehicle entry and exit experiences. Meanwhile, the Footwall area, though smaller in market share, has seen an uptick in demand for ambient lighting solutions that offer both aesthetic and practical benefits, such as improved visibility and a luxurious ambiance.

The growth in the Dashboard segment, specifically, underscores the evolving consumer preferences towards vehicles that offer a blend of functionality, style, and advanced technological features. Manufacturers and designers have capitalized on this trend, implementing sophisticated ambient lighting solutions that not only serve to illuminate but also to signify the vehicle’s brand identity and enhance the overall driving experience.

The strategic focus on these application segments underscores a broader industry trend toward personalization and differentiation in the automotive market. As manufacturers continue to innovate and expand their offerings, the Automotive Interior Ambient Lighting Market is expected to witness sustained growth, driven by consumer demands for vehicles that combine aesthetic appeal with functional excellence.

Key Market Segments

By Product Type

- Ambient Lighting

- Dashboard Lights

- Headup display

- Reading lights

By Technology

- LED

- Halogen

- Xenon

By Vehicle Type

- Conventional cars

- Green Cars

By Fuel Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

By Application

- Centre Console

- Dashboard

- Doors

- Footwall

Growth Opportunities

Conventional Cars and Green Cars Focus

The automotive industry is witnessing a significant shift towards innovation in both conventional and green cars, driving the demand for interior ambient lighting solutions. Conventional car manufacturers are increasingly integrating ambient lighting features to enhance the overall driving experience and differentiate their products in a competitive market.

Moreover, the rising popularity of electric and hybrid vehicles, in line with global sustainability efforts, presents a unique opportunity for ambient lighting manufacturers to cater to the specific needs of green car owners. As automakers strive to offer premium and technologically advanced interiors across vehicle segments, the demand for ambient lighting solutions is poised to surge.

Consumer Inclination Towards Comfort & Safety Features

Consumer preferences are gravitating toward vehicles equipped with advanced comfort and safety features, including ambient lighting systems. Ambient lighting not only enhances the aesthetic appeal of car interiors but also contributes to a more relaxing and comfortable driving environment, which aligns with consumer demands for luxurious driving experiences.

Furthermore, the integration of ambient lighting with safety features, such as color-coded alerts for potential hazards or adaptive lighting based on driving conditions, resonates with safety-conscious consumers. As consumers prioritize convenience, aesthetics, and safety in their vehicle purchasing decisions, automotive interior ambient lighting emerges as a key differentiator for automakers to attract and retain customers.

Latest Trends

Increasing Sales of Ultra-Luxury Vehicles:

The global Automotive Interior Ambient Lighting Market witnessed a notable surge in demand, primarily fueled by the increasing sales of ultra-luxury vehicles in 2023. Ultra-luxury vehicle manufacturers, striving to enhance the overall driving experience and differentiate their products, extensively incorporated advanced ambient lighting systems into their vehicle interiors.

This trend was particularly prominent in regions with high disposable incomes and a strong penchant for luxury automobiles, such as North America, Europe, and parts of Asia-Pacific. The integration of sophisticated ambient lighting solutions not only added to the aesthetic appeal of these vehicles but also contributed to a heightened sense of exclusivity and luxury, thereby resonating well with discerning consumers.

Optimization of Interior Lighting:

In 2023, automotive manufacturers continued to prioritize the optimization of interior lighting systems to create immersive and customizable driving environments. Advanced LED technologies and innovative design approaches allowed for greater flexibility in adjusting lighting colors, intensity, and patterns to suit varying preferences and driving conditions. Manufacturers focused on enhancing user experience by incorporating intelligent lighting controls and intuitive interfaces, empowering drivers to personalize their vehicle interiors effortlessly.

Moreover, the integration of ambient lighting with other in-car technologies, such as infotainment systems and driver assistance features, further enriched the overall cabin ambiance and functionality. This emphasis on optimizing interior lighting not only catered to evolving consumer expectations for enhanced comfort and convenience but also underscored the automotive industry’s commitment to innovation and technological advancement.

Regional Analysis

In the Asia Pacific region, automotive interior ambient lighting holds a dominant market share of 61.8%, reflecting significant preference.

In the global Automotive Interior Ambient Lighting Market, distinct regional dynamics shape the industry landscape across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

In North America, characterized by a mature automotive sector, the market for interior ambient lighting reflects a steady growth trajectory, driven primarily by consumer demand for enhanced driving experiences and premium vehicle features. According to reports, the region accounted for approximately 18% of the global automotive interior lighting market in 2023, with a notable preference for customizable lighting options and advanced technology integration.

Similarly, Europe demonstrates a significant presence in the automotive interior ambient lighting market, showcasing a sophisticated automotive market and stringent safety regulations. With an approximate market share of 25%, Europe emphasizes the integration of ambient lighting systems for both aesthetic appeal and functional utility, aligning with the region’s emphasis on luxury vehicle segments and innovation in automotive design.

Asia Pacific emerges as the dominating region in the global automotive interior ambient lighting market, commanding a substantial share of approximately 61.8%. This dominance is attributed to the burgeoning automotive industry in countries such as China, Japan, and South Korea, coupled with increasing consumer purchasing power and a growing inclination towards commercial vehicle customization. Moreover, rapid urbanization, technological advancements, and changing consumer lifestyles further propel the demand for interior ambient lighting solutions in the region.

Meanwhile, the Middle East & Africa and Latin America regions present emerging opportunities for market players, albeit with relatively smaller market shares. These regions witness the gradual adoption of interior ambient lighting systems, driven by rising automotive sales and a gradual shift towards premium vehicle segments.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Automotive Interior Ambient Lighting Market witnessed the dominance of several key players, each contributing uniquely to the market landscape. Among these frontrunners, Valco SA emerged as a prominent force, leveraging its innovative lighting solutions and extensive market reach. Valco SA’s commitment to delivering cutting-edge ambient lighting technologies has solidified its position as a key influencer in the automotive lighting sector.

Hella KGaAHueck & Co, a stalwart in the automotive industry, continued to assert its presence with a diverse portfolio of high-quality lighting products. Its reputation for reliability and performance has earned the trust of automakers worldwide, positioning it as a leading choice for interior ambient lighting solutions.

OSRAM Licht AG, renowned for its pioneering advancements in lighting technology, remained a formidable competitor in the market. With a focus on energy efficiency and design flexibility, OSRAM Licht AG continued to captivate consumers and manufacturers alike, driving growth and innovation in the automotive lighting sector.

LSI Industries Inc demonstrated its prowess in delivering tailored lighting solutions to meet the evolving demands of the automotive industry. Its comprehensive product offerings and commitment to customer satisfaction have propelled its prominence in the global market landscape.

Everlight Electronics Co., Ltd, Toshiba Corporation, Oshino Lamps Ltd, Innotec Group, Grupo Antolin, Dominant Opto Technologies Sdn, Bhd, and Stanley Electric Co. Ltd also played pivotal roles in shaping the dynamics of the Automotive Interior Ambient Lighting Market in 2023. With their diverse expertise and unwavering dedication to excellence, these key players collectively drove innovation, fueled market growth, and enriched the automotive experience for consumers worldwide.

Market Key Players

- Valco SA

- Hella KGaAHueck & Co

- OSRAM Licht AG

- LSI Industries Inc

- Everlight Electronics Co, ltd

- Toshiba Corporation

- Oshino Lamps ltd

- Innotec Group

- Grupo Antolin

- Dominant Opto Technologies sdn, Bhd

- Stanley Electric Co.ltd

Recent Development

- In February 2024, Rivian Automotive unveils plans for customizable interior ambient lighting in R1 models, aligning with Tesla’s offerings. Financially, despite revenue growth, concerns arise due to declining net income and earnings per share.

- In January 2024, Hyundai prepares to launch the 2024 Creta Facelift, boasting exterior updates, upgraded infotainment, and potentially hybrid or electric variants, aligning with market trends and enhancing consumer appeal.

- In January 2024, Tesla unveils a revamped Model 3 with an enhanced range, luxurious interior, and advanced entertainment features, setting new standards for electric mobility and luxury driving experience.

- In January 2024, Spain’s Antolin expands in Asia, opening a new plant in Pune, India, focusing on lighting, HMI systems, and electronics for major car manufacturers like Tata, Suzuki, and Toyota.

- In December 2023, Tata Motors’ new Safari and Harrier SUVs achieved historic 5-star safety ratings from Bharat-NCAP, reaffirming their commitment to vehicle safety and setting new benchmarks in India’s automotive industry.

Report Scope

Report Features Description Market Value (2023) USD 4.0 Billion Forecast Revenue (2033) USD 12.0 Billion CAGR (2024-2033) 10.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Ambient Lighting, Dashboard Lights, Headup display, Reading lights), By Technology(LED, Halogen, Xenon), By Vehicle Type(Conventional cars, Green Cars), By Fuel Type(Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Application(Centre Console, Dashboard, Doors, Footwall) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Valco SA, Hella KGaAHueck & Co, OSRAM Licht AG, LSI Industries Inc, Everlight Electronics Co, ltd, Toshiba Corporation, Oshino Lamps Ltd, Innotec Group, Grupo Antolin, Dominant Opto Technologies Sdn, Bhd, Stanley Electric Co.ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Automotive Interior Ambient Lighting Market in 2023?The Automotive Interior Ambient Lighting Market size is USD 4.0 Billion in 2023.

What is the projected CAGR at which the Automotive Interior Ambient Lighting Market is expected to grow at?The Automotive Interior Ambient Lighting Market is expected to grow at a CAGR of 10.80% (2024-2033).

List the segments encompassed in this report on the Automotive Interior Ambient Lighting Market?Market.US has segmented the Automotive Interior Ambient Lighting Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type(Ambient Lighting, Dashboard Lights, Headup display, Reading lights), By Technology(LED, Halogen, Xenon), By Vehicle Type(Conventional cars, Green Cars), By Fuel Type(Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle), By Application(Centre Console, Dashboard, Doors, Footwall)

List the key industry players of the Automotive Interior Ambient Lighting Market?Valco SA, Hella KGaAHueck & Co, OSRAM Licht AG, LSI Industries Inc, Everlight Electronics Co, ltd, Toshiba Corporation, Oshino Lamps ltd, Innotec Group, Grupo Antolin, Dominant Opto Technologies sdn, Bhd, Stanley Electric Co.ltd

Name the key areas of business for Automotive Interior Ambient Lighting Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Automotive Interior Ambient Lighting Market.

Automotive Interior Ambient Lighting MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Interior Ambient Lighting MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Valco SA

- Hella KGaAHueck & Co

- OSRAM Licht AG

- LSI Industries Inc

- Everlight Electronics Co, ltd

- Toshiba Corporation

- Oshino Lamps ltd

- Innotec Group

- Grupo Antolin

- Dominant Opto Technologies sdn, Bhd

- Stanley Electric Co.ltd