Global Automotive Electrical Distribution System Market Size, Share, Growth Analysis By Component (Wiring Harness, Belt Drive, Fuse & Relay, Switches & Sensors, Connectors & Terminals, Control Modules, Others), By Vehicle (Passenger Cars - Hatchback, Sedan, SUV; Commercial Vehicle - LCV, HCV; Off-Highway Vehicles; EVs & Hybrid), By Voltage (12V, 48V, High Voltage Systems), By End Use (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174638

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

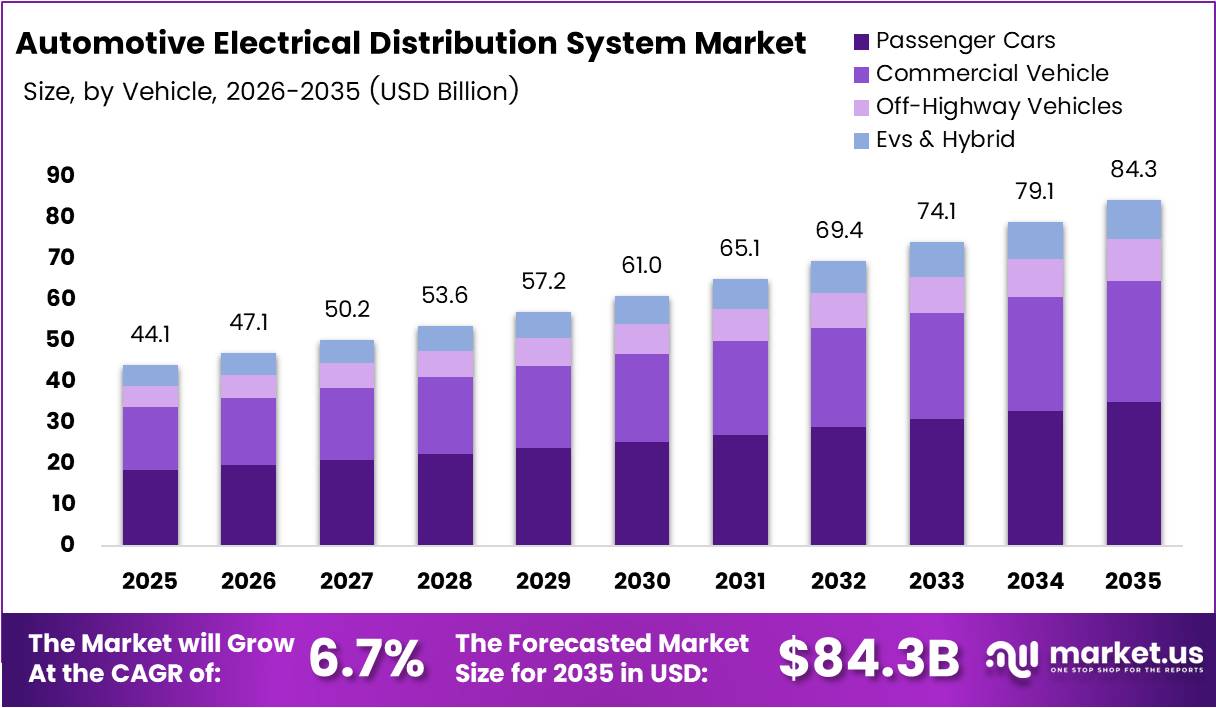

Global Automotive Electrical Distribution System Market size is expected to be worth around USD 84.3 Billion by 2035 from USD 44.1 Billion in 2025, growing at a CAGR of 6.7% during the forecast period 2026 to 2035.

The automotive electrical distribution system represents the comprehensive network managing electrical power flow throughout vehicles. This critical infrastructure encompasses wiring harnesses, fuses, relays, connectors, and control modules. Moreover, it ensures efficient power distribution from batteries to various electrical components.

These systems support advanced functionalities including infotainment, safety features, and powertrain management. The architecture continues evolving with increasing vehicle electrification and electronic content integration. Consequently, modern vehicles demand sophisticated distribution networks for optimal performance and reliability.

The market demonstrates robust growth driven by electric vehicle adoption and advanced driver assistance systems integration. Additionally, rising consumer demand for connected vehicles accelerates technological advancement. However, manufacturers face challenges regarding system complexity and development costs.

Vehicle electrification significantly transforms electrical distribution requirements across automotive segments. Electric vehicles require high-voltage architecture supporting battery management and power electronics. Therefore, manufacturers invest heavily in lightweight wiring solutions and smart distribution technologies for enhanced efficiency.

Government initiatives worldwide promote electric mobility through incentives and infrastructure development. According to the IEA, more than 3 million electric cars were sold in Q1 2024 globally, representing approximately 25% growth compared to 2023. These statistics reflect accelerating market momentum and consumer acceptance.

Regulatory frameworks emphasize emission reduction and fuel efficiency standards globally. Consequently, automakers prioritize electrical system optimization and lightweight component integration. Furthermore, safety regulations mandate advanced electronic architectures supporting collision avoidance and autonomous features.

The U.S. Department of Energy announced in April 2024 a $362 million loan to CelLink Corporation for manufacturing flexible circuit wiring harnesses. According to IEEE Spectrum, automobile network harness may contain over 1,500 wires, totaling 5,000 meters in length and weighing excess of 68 kg.

Key Takeaways

- Global Automotive Electrical Distribution System Market valued at USD 44.1 Billion in 2025, projected to reach USD 84.3 Billion by 2035 at 6.7% CAGR

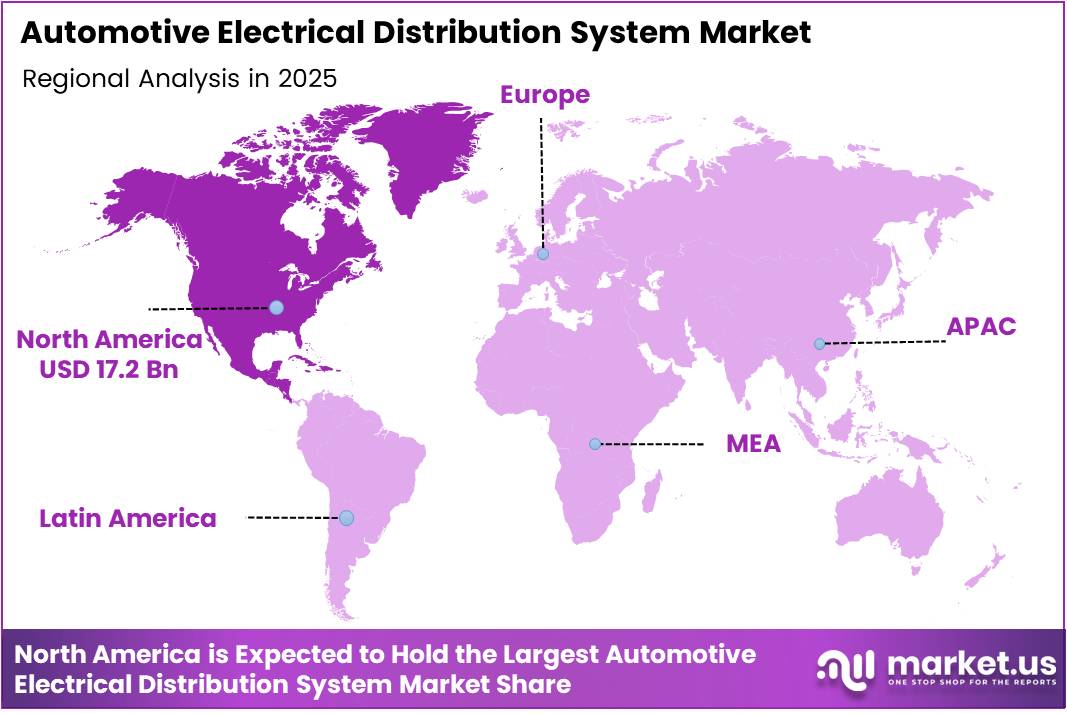

- North America dominates with 39.20% market share, valued at USD 17.2 Billion

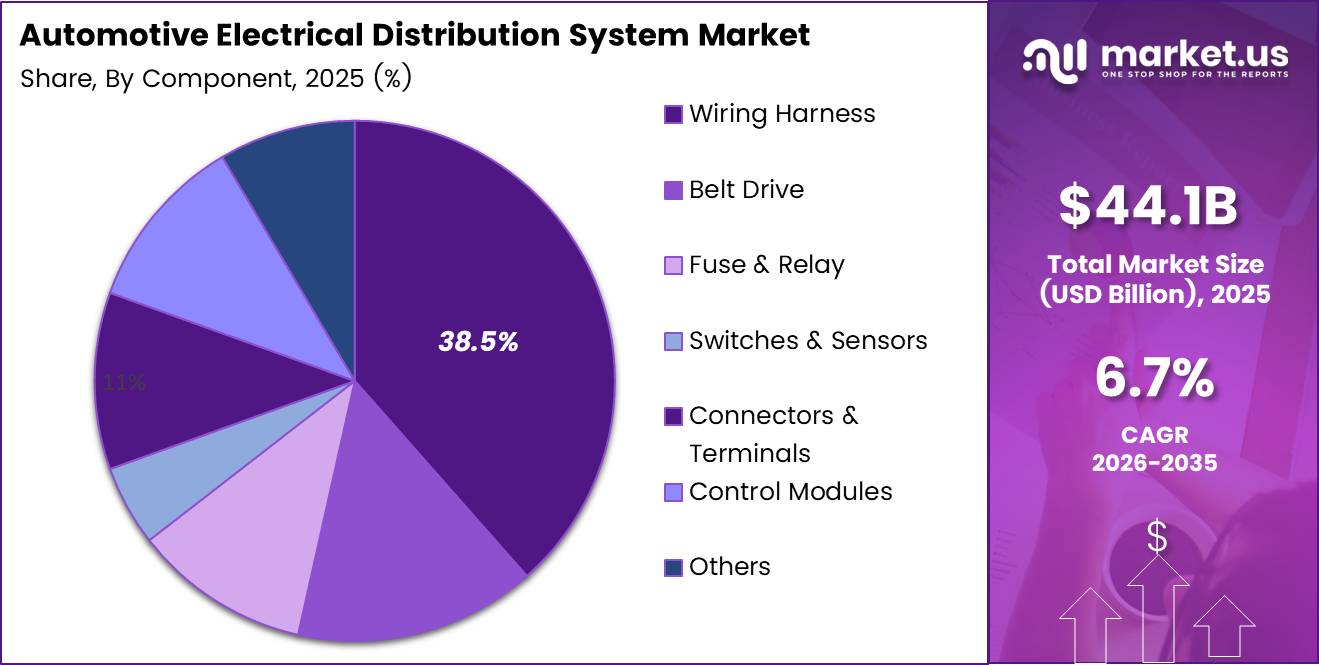

- Wiring Harness segment leads component category with 38.5% market share

- Passenger Cars segment holds 62.4% share in vehicle type analysis

- 12V systems dominate voltage segment with 67.1% market share

- OEM segment accounts for 74.2% of end-use distribution

Component Analysis

Wiring Harness dominates with 38.5% due to critical role in vehicle electrical connectivity and power distribution.

In 2025, Wiring Harness held a dominant market position in the By Component Analysis segment of Automotive Electrical Distribution System Market, with 38.5% share. This segment serves as the backbone for electrical connectivity throughout vehicles. Moreover, wiring harnesses integrate multiple circuits into organized assemblies, reducing installation complexity. These components ensure reliable power transmission and signal communication across various electronic systems.

Belt Drive systems facilitate mechanical power transmission supporting alternator and accessory operations. These components maintain consistent electrical generation while vehicles operate under varying conditions. Additionally, belt drive technology adapts to hybrid and electric architectures. Manufacturers continuously enhance durability and efficiency standards for improved performance outcomes.

Fuse and Relay components provide essential circuit protection preventing electrical overloads and system failures. These safety devices automatically disconnect circuits during abnormal current flow conditions. Furthermore, advanced relay technologies enable intelligent power management and diagnostic capabilities. The segment benefits from increasing electronic content per vehicle.

Switches and Sensors enable driver interface and environmental monitoring throughout vehicle operations. These components facilitate user control over electrical functions and support automated systems. Consequently, sensor integration expands with advanced driver assistance systems adoption. Modern vehicles require numerous switches and sensors for comprehensive functionality.

Connectors and Terminals ensure secure electrical connections between various system components and modules. These precision-engineered parts withstand vibration, temperature variations, and environmental exposure. Moreover, connector technology advances support miniaturization and high-density packaging requirements. Reliable connectivity remains crucial for vehicle electrical system integrity.

Control Modules manage electrical distribution through sophisticated software and hardware integration capabilities. These intelligent units optimize power flow, monitor system health, and enable diagnostic functions. Additionally, control modules support vehicle-to-vehicle and vehicle-to-infrastructure communication protocols. The segment grows with autonomous vehicle technology development.

Vehicle Type Analysis

Passenger Cars dominate with 62.4% due to high production volumes and extensive electrical system integration.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Analysis segment of Automotive Electrical Distribution System Market, with 62.4% share. This segment encompasses hatchbacks, sedans, and SUVs requiring sophisticated electrical architectures. Moreover, passenger vehicles incorporate advanced infotainment, connectivity, and safety features. These applications demand complex distribution systems supporting multiple electronic control units.

Hatchback vehicles benefit from compact electrical distribution designs optimized for space efficiency. These models appeal to urban consumers seeking affordable transportation with modern features. Additionally, hatchbacks increasingly integrate advanced driver assistance systems and connectivity solutions. Manufacturers prioritize lightweight wiring architectures reducing overall vehicle weight.

Sedan configurations require balanced electrical distribution supporting comfort and performance features throughout vehicle length. These vehicles traditionally serve business and family transportation needs with comprehensive electronic systems. Furthermore, sedan electrification accelerates with hybrid and electric powertrain adoption. The segment demands reliable distribution networks supporting long-distance travel requirements.

SUV models necessitate robust electrical systems managing higher power demands from accessories and off-road capabilities. These vehicles integrate sophisticated climate control, entertainment, and safety technologies across multiple seating rows. Consequently, SUVs require extensive wiring harnesses and advanced distribution architectures. The segment experiences strong growth driven by consumer preference trends.

Commercial Vehicles including LCVs and HCVs require heavy-duty electrical distribution systems supporting demanding operational conditions. These vehicles integrate fleet management, telematics, and advanced safety technologies for commercial applications. Moreover, commercial vehicle electrification creates opportunities for high-voltage distribution system adoption. The segment demands durability and reliability under continuous operation.

Off-Highway Vehicles utilize specialized electrical systems designed for harsh environmental conditions and equipment operations. These machines require robust distribution networks supporting hydraulic controls and implement management systems. Additionally, off-highway applications benefit from electrification reducing emissions and operating costs. Construction and agricultural sectors drive demand growth.

EVs and Hybrid vehicles represent the fastest-growing segment with unique electrical distribution requirements. These platforms integrate high-voltage systems supporting battery management and electric propulsion technologies. Furthermore, electric vehicles demand innovative thermal management and power electronics integration solutions. The segment benefits from government incentives and environmental regulations.

Voltage Analysis

12V systems dominate with 67.1% due to established infrastructure and compatibility with traditional vehicle architectures.

In 2025, 12V systems held a dominant market position in the By Voltage Analysis segment of Automotive Electrical Distribution System Market, with 67.1% share. This voltage standard supports conventional vehicle electrical loads including lighting and infotainment systems. Moreover, 12V architecture benefits from extensive supplier ecosystem and cost-effective component availability. Traditional combustion engine vehicles predominantly utilize this voltage configuration.

48V systems emerge as intermediate voltage solution enabling mild hybrid functionality and enhanced electrical capabilities. These architectures support electric superchargers, active suspension systems, and improved start-stop functionality efficiently. Additionally, 48V systems reduce wiring gauge requirements and minimize power losses. The segment experiences rapid adoption across passenger vehicle platforms.

High Voltage Systems serve battery electric and plug-in hybrid vehicles requiring 400V to 800V architectures. These platforms demand sophisticated insulation, safety interlocks, and thermal management solutions for reliable operation. Furthermore, high-voltage distribution enables fast charging capabilities and extended driving ranges. The segment grows proportionally with electric vehicle market expansion.

End Use Analysis

OEM segment dominates with 74.2% due to new vehicle production volumes and integrated system specifications.

In 2025, OEM held a dominant market position in the By End Use Analysis segment of Automotive Electrical Distribution System Market, with 74.2% share. This segment encompasses electrical distribution systems integrated during vehicle manufacturing processes. Moreover, OEMs specify customized architectures optimized for specific vehicle platforms and features. New vehicle production drives consistent demand for distribution system components.

Aftermarket segment serves replacement, repair, and upgrade applications for existing vehicle populations worldwide. This channel provides electrical components for maintenance services and performance enhancement modifications. Additionally, aftermarket demand grows with vehicle age and complexity of electrical systems. The segment benefits from increasing vehicle parc and longer ownership periods.

Key Market Segments

By Component

- Wiring Harness

- Belt Drive

- Fuse & Relay

- Switches & Sensors

- Connectors & Terminals

- Control Modules

- Others

By Vehicle

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Commercial Vehicle

- LCV

- HCV

- Off-Highway Vehicles

- EVs & Hybrid

By Voltage

- 12V

- 48V

- High Voltage Systems

By End Use

- OEM

- Aftermarket

Drivers

Rising Integration of Advanced Driver Assistance Systems (ADAS) in Vehicles

Advanced driver assistance systems require sophisticated electrical distribution networks supporting multiple sensors and control units. These safety technologies demand real-time data processing and reliable power delivery throughout vehicle operations. Moreover, regulatory mandates increasingly require ADAS features in new vehicle models globally.

Consumer demand for enhanced safety features accelerates ADAS adoption across passenger and commercial vehicle segments. Automakers invest significantly in electrical architecture upgrades supporting collision avoidance and automated driving capabilities. Consequently, distribution system complexity increases with each additional ADAS functionality.

Growing vehicle electrification introduces higher electrical content per vehicle requiring enhanced distribution capacity. Electric and hybrid vehicles integrate battery management systems, power electronics, and electric motors demanding sophisticated architectures. Additionally, electrification enables energy recuperation and advanced thermal management functions. These technological advances drive market expansion.

Manufacturers prioritize lightweight wiring solutions reducing vehicle weight and improving fuel efficiency significantly. Compact distribution architectures optimize space utilization enabling additional features and improved packaging flexibility. Furthermore, lightweight components contribute to extended electric vehicle range and performance enhancement.

Restraints

High Development and Integration Cost of Smart Distribution Modules

Smart distribution module development requires substantial investment in research, testing, and validation processes. These advanced components integrate sophisticated electronics and software increasing overall system costs considerably. Moreover, automakers face pricing pressure balancing technological advancement with market competitiveness.

Integration complexity grows with expanding electrical loads requiring extensive engineering resources and extended development timelines. Manufacturers must ensure compatibility across multiple vehicle platforms and electrical architectures simultaneously. Additionally, system validation demands comprehensive testing under various operating conditions.

Complex electrical architectures challenge traditional design methodologies requiring specialized expertise and simulation tools. Engineers must address electromagnetic compatibility, thermal management, and safety requirements throughout development processes. Consequently, smaller suppliers may struggle competing with established manufacturers.

Increasing electrical loads strain existing distribution infrastructure demanding higher capacity components and cooling solutions. Vehicles incorporate numerous electronic systems creating potential bottlenecks and power management challenges throughout operations. Furthermore, system reliability becomes critical with growing dependence on electrical functionality.

Growth Factors

Expansion of 48V Electrical Architecture in Passenger Vehicles

Automakers increasingly adopt 48V systems enabling mild hybrid functionality without high-voltage complexity or costs. This intermediate voltage level supports electric boosting, active chassis systems, and enhanced accessory performance efficiently. Moreover, 48V architecture reduces CO2 emissions meeting stringent regulatory requirements globally.

Development of smart power distribution units advances autonomous vehicle capabilities through intelligent load management. These systems optimize power allocation dynamically based on operational requirements and battery status conditions. Additionally, smart distribution enables predictive maintenance and enhanced diagnostic capabilities improving vehicle reliability.

Electric vehicle platforms require high-voltage distribution systems supporting battery capacities exceeding 400V for optimal performance. These architectures enable fast charging capabilities and extended driving ranges meeting consumer expectations effectively. Consequently, high-voltage system demand grows proportionally with EV market expansion.

Aftermarket segment opportunities emerge from legacy vehicle upgrades incorporating advanced electrical features and connectivity solutions. Vehicle owners seek performance enhancements, infotainment upgrades, and safety system additions through aftermarket channels. Furthermore, aging vehicle populations require electrical system repairs and component replacements.

Emerging Trends

Shift Toward Domain-Based Electrical and Electronic Architectures

Automotive industry transitions from distributed to domain-based architectures consolidating electronic control units into centralized platforms. This approach reduces wiring complexity, weight, and cost while improving software integration capabilities significantly. Moreover, domain architectures enable over-the-air updates and flexible feature deployment.

Solid-state power distribution technologies replace traditional mechanical relays and fuses with semiconductor-based switching devices. These components offer faster switching speeds, enhanced reliability, and intelligent diagnostic capabilities compared to conventional solutions. Additionally, solid-state devices enable precise power management and reduced maintenance requirements.

Manufacturers develop heat-resistant wiring harnesses utilizing advanced materials withstanding higher operating temperatures from electrification. These materials maintain electrical properties and mechanical integrity under extreme thermal cycling conditions encountered in modern vehicles. Furthermore, heat-resistant solutions enable compact packaging near high-temperature components.

Predictive diagnostics integration enables proactive maintenance and enhanced system reliability through continuous monitoring capabilities. These technologies analyze electrical system performance identifying potential failures before critical breakdowns occur during operations. Consequently, predictive diagnostics reduce downtime and maintenance costs significantly.

Regional Analysis

North America Dominates the Automotive Electrical Distribution System Market with a Market Share of 39.20%, Valued at USD 17.2 Billion

North America leads the automotive electrical distribution system market with 39.20% share, valued at USD 17.2 Billion in 2025. The region benefits from strong automotive manufacturing presence and advanced technology adoption rates. Moreover, electric vehicle production accelerates with government incentives and infrastructure investments. Major automakers headquartered in North America drive innovation in electrical architecture development.

Europe Automotive Electrical Distribution System Market Trends

Europe demonstrates significant market growth driven by stringent emission regulations and electrification mandates. The region hosts leading automotive manufacturers prioritizing advanced electrical systems and lightweight solutions. Additionally, European countries invest heavily in electric vehicle infrastructure supporting market expansion. Premium vehicle segment dominance accelerates sophisticated distribution system adoption.

Asia Pacific Automotive Electrical Distribution System Market Trends

Asia Pacific exhibits rapid market expansion propelled by increasing vehicle production and emerging economy growth. China leads regional electric vehicle adoption creating substantial demand for high-voltage distribution systems. Moreover, Japanese and Korean automakers advance electrical architecture technologies for global markets. The region benefits from extensive electronics manufacturing capabilities and cost competitiveness.

Latin America Automotive Electrical Distribution System Market Trends

Latin America shows moderate growth potential driven by expanding middle-class population and vehicle ownership rates. The region focuses on cost-effective electrical solutions balancing affordability with modern feature requirements. Additionally, local manufacturing capabilities develop supporting regional automotive production growth. Brazil and Mexico represent primary markets for distribution system components.

Middle East & Africa Automotive Electrical Distribution System Market Trends

Middle East and Africa demonstrate emerging market opportunities supported by infrastructure development and urbanization trends. The region experiences growing demand for commercial vehicles requiring robust electrical distribution systems. Moreover, premium vehicle imports create demand for advanced electrical architectures and aftermarket services. Government initiatives promote automotive sector development and local manufacturing capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Electrical Distribution System Company Insights

Amphenol Corporation maintains strong market presence through comprehensive interconnect solutions serving automotive electrical distribution applications globally. The company leverages advanced engineering capabilities developing high-performance connectors and cable assemblies for modern vehicles. Moreover, Amphenol invests in electric vehicle technologies supporting high-voltage distribution requirements. Their product portfolio addresses increasing vehicle electrification and electronic content demands across automotive segments.

Aptiv PLC leads electrical architecture innovation providing integrated solutions from wiring harnesses to intelligent distribution systems. The company focuses on software-defined vehicle architectures enabling advanced connectivity and autonomous driving capabilities efficiently. Additionally, Aptiv develops lightweight harness technologies reducing vehicle weight while maintaining performance standards. Their global manufacturing footprint supports major automakers worldwide with localized engineering support.

Lear Corporation specializes in electrical distribution systems and seating solutions serving leading automotive manufacturers internationally. The company advances wire harness technologies incorporating smart sensing and power management capabilities for modern applications. Furthermore, Lear expands electric vehicle component production addressing growing market demand for high-voltage systems. Their vertically integrated manufacturing approach ensures quality control and cost competitiveness.

Leoni AG delivers comprehensive wiring systems and cable solutions addressing automotive industry requirements for reliability and performance. The company develops innovative harness designs optimizing weight, space utilization, and electromagnetic compatibility throughout vehicle operations. Moreover, Leoni invests in automation technologies improving manufacturing efficiency and product consistency across global facilities. Their expertise spans conventional and electric vehicle platforms.

Key Companies

- Amphenol Corporation

- Aptiv PLC

- Draexlmaier

- Eaton Corporation

- Furukawa Electric Co., Ltd.

- Lear Corporation

- Leoni AG

- Littelfuse Inc.

- Magna International

- PKC Group

Recent Developments

- In December 2025, BizLink expanded its presence in the white goods sector through the strategic acquisition of PAS Appliance Systems SA De CV. This acquisition strengthens BizLink’s manufacturing capabilities and market position in appliance wiring solutions.

- In August 2025, Eaton completed the acquisition of Resilient Power Systems Inc., significantly strengthening its power distribution product offerings and technological capabilities. This strategic move enhances Eaton’s position in electrical distribution markets.

- In January 2026, Klipboard acquired Savance Enterprise to substantially boost its presence in the US wholesale distribution sector. The acquisition expands Klipboard’s market reach and service capabilities across North American markets.

- In July 2025, Eaton signed a definitive agreement to acquire Resilient Power Systems Inc., advancing its strategic growth initiatives in power management solutions. The transaction supports Eaton’s expansion in electrical distribution technologies.

Report Scope

Report Features Description Market Value (2025) USD 44.1 Billion Forecast Revenue (2035) USD 84.3 Billion CAGR (2026-2035) 6.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Wiring Harness, Belt Drive, Fuse & Relay, Switches & Sensors, Connectors & Terminals, Control Modules, Others), By Vehicle (Passenger Cars – Hatchback, Sedan, SUV; Commercial Vehicle – LCV, HCV; Off-Highway Vehicles; EVs & Hybrid), By Voltage (12V, 48V, High Voltage Systems), By End Use (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amphenol Corporation, Aptiv PLC, Draexlmaier, Eaton Corporation, Furukawa Electric Co., Ltd., Lear Corporation, Leoni AG, Littelfuse Inc., Magna International, PKC Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Electrical Distribution System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Electrical Distribution System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Amphenol Corporation

- Aptiv PLC

- Draexlmaier

- Eaton Corporation

- Furukawa Electric Co., Ltd.

- Lear Corporation

- Leoni AG

- Littelfuse Inc.

- Magna International

- PKC Group