Global Automotive Differential Market Size, Share, Growth Analysis By Differential Type (Open, Locking, Limited Slip, Electronic Limited Slip, Torque-Vectoring), By Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive / 4 Wheel Drive), By Vehicle Type (Passenger Car, LCV, Truck, Buses), By Component (Pinion Gear, Side Gear, Ring Gear, Differential Housing, Differential Bearing), By Equipment Type (Agricultural Tractors, Forklift), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168817

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Differential Type Analysis

- By Drive Type Analysis

- By Vehicle Type Analysis

- By Component Analysis

- By Equipment Type Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Differential Company Insights

- Recent Developments

- Report Scope

Report Overview

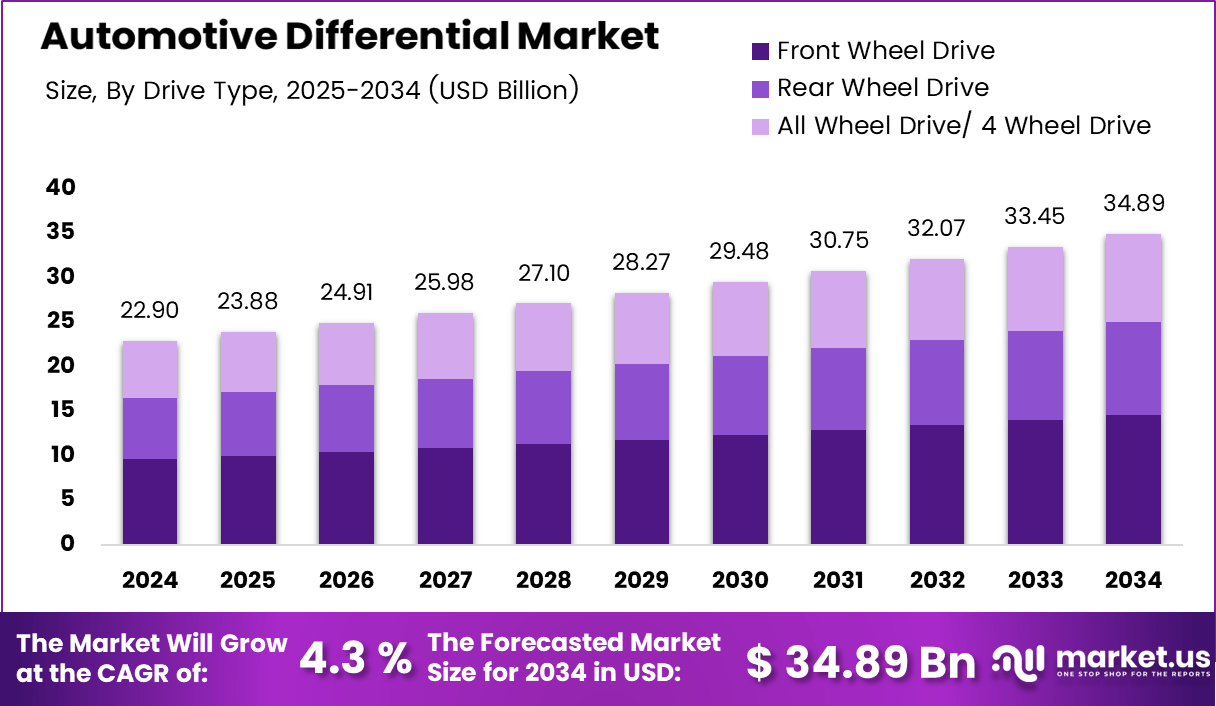

The Global Automotive Differential Market size is expected to be worth around USD 34.89 billion by 2034, from USD 22.9 billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The automotive differential market represents a core system within modern drivetrains, enabling balanced power distribution between wheels and ensuring controlled vehicle movement on turns. It enhances stability while supporting evolving propulsion technologies. As vehicles transition toward advanced mobility formats, differentials remain essential for torque management and optimized driving performance across diverse road conditions.

In addition, the automotive differential plays a critical role in mobility safety by compensating for speed differences between wheels. This mechanism supports smoother cornering and reduces drivetrain stress. Growing vehicle production, rising demand for SUVs, and increased preference for performance-oriented models continue strengthening adoption across global markets, especially in emerging automotive hubs.

Furthermore, the market observes steady expansion as manufacturers shift toward lightweight materials and electronically controlled systems. Advancements in all-wheel-drive architectures accelerate differential integration in passenger and commercial fleets. Government regulations promoting fuel efficiency reinforce interest in precision-engineered differential assemblies that minimize power loss while enhancing traction, stability, and on-road responsiveness for multi-terrain vehicles.

Moreover, several countries are investing heavily in transportation modernization and emission-focused standards, encouraging OEMs to adopt efficient differential technologies. Electrification creates new avenues for differential design, especially for e-axles and multi-motor platforms requiring advanced torque-vectoring logic. These opportunities stimulate continuous innovation in locking, limited-slip, and electronically actuated differential formats.

Additionally, evolving mobility services and autonomous driving trends demand accurate torque distribution for predictable vehicle behaviour. Fleet operators increasingly seek differentials that deliver durability, minimal maintenance, and optimized performance under varying load conditions. As urban traffic density rises, energy-efficient drivetrain components become essential, positioning differentials as a critical element within next-generation automotive engineering.

Toward the technical foundation, differentials enable each wheel to rotate independently, improving traction and handling. According to a Survey, racing cars from the late 19th and early 20th century lacked proper braking systems even at speeds of 150 km/h, highlighting the importance of innovations that later shaped modern differentials and torque-management systems.

According to Research, a basic differential uses bevel gears with a propeller shaft driving a ring gear at 90°, allowing smooth torque transfer. Limited-slip differentials range from 0% to 100%, while a 50% LSD splits torque 25% to the low-traction wheel and 75% to the loaded wheel, reinforcing controlled acceleration and turn stability.

These engineering advancements outline how the automotive differential market continues progressing through regulatory support, electrification opportunities, drivetrain optimization, and evolving vehicle architecture trends.

Key Takeaways

- The Global Automotive Differential Market reached USD 22.9 billion in 2024 and is projected to hit USD 34.89 billion by 2034.

- The market is expected to grow at a 4.3% CAGR during the forecast period from 2025 to 2034.

- Open Differential dominated the Differential Type segment with a 34.7% market share in 2024.

- Front Wheel Drive led the Drive Type segment with a 41.8% share due to cost-efficient layouts.

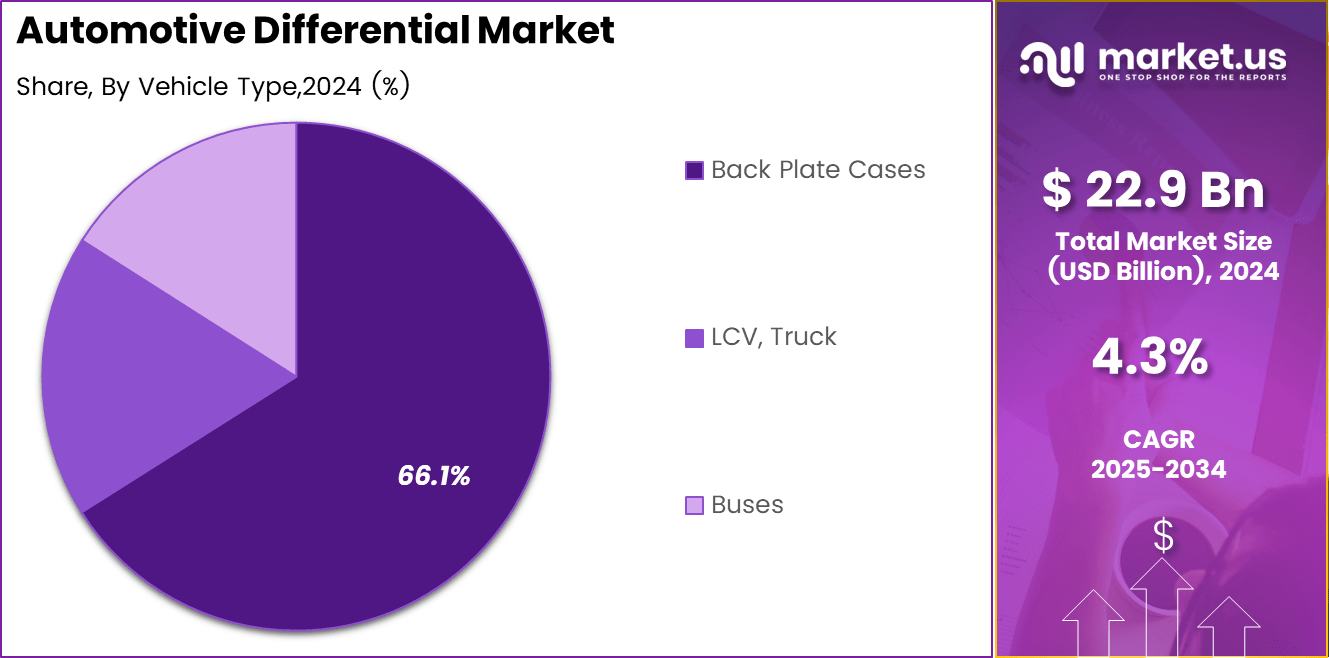

- Passenger Car was the top Vehicle Type, accounting for 66.1% of total installations in 2024.

- Ring Gear emerged as the leading component with a 31.2% contribution in the component category.

- Agricultural Tractors dominated the Equipment Type segment with a 59.4% share in 2024.

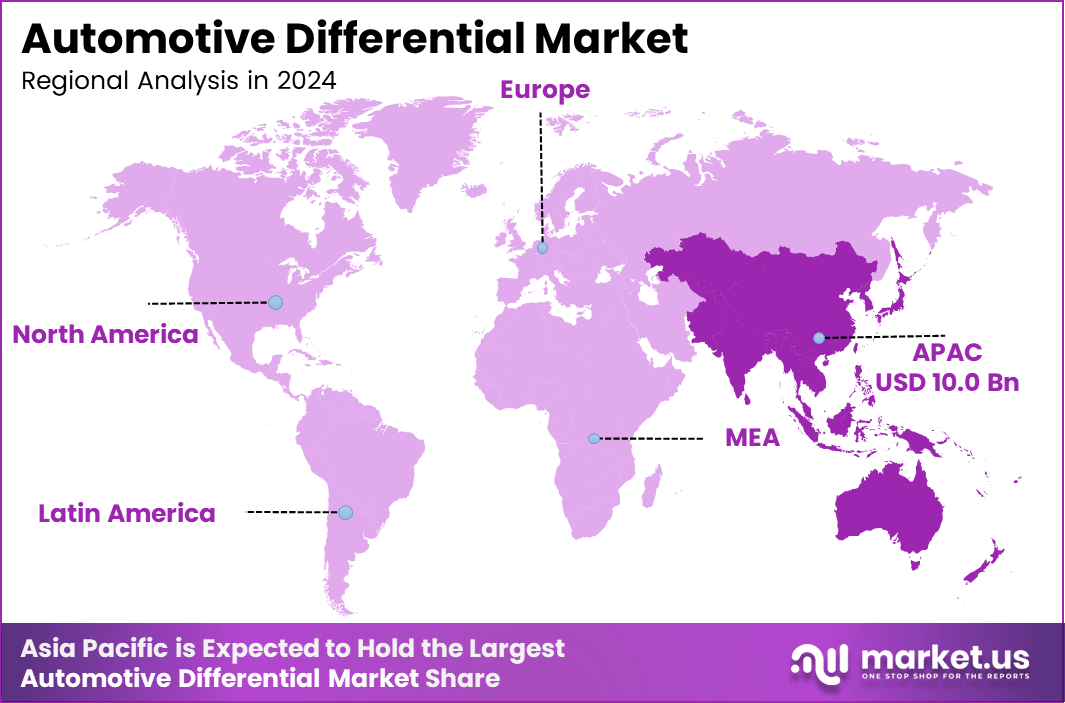

- North America remained one of the key contributing regions, supported by the strong production of passenger and commercial vehicles.

- The market is driven by rising adoption of AWD/4WD systems and performance-oriented drivetrains.

- Electrification trends, including e-axles and torque-vectoring designs, continue shaping future differential demand.

By Differential Type Analysis

Open Differential dominates the segment with 34.7% due to its cost-efficiency and widespread adoption in mass-market vehicles.

In 2024, Open Differential held a dominant market position in the By Differential Type segment of the Automotive Differential Market, with a 34.7% share. This configuration enhances basic torque distribution and ensures smooth cornering, making it preferred for affordable passenger cars. It remains integral to conventional vehicle platforms globally.

Locking Differentials gained traction as manufacturers advanced off-road capabilities and performance stability. This segment observed rising demand as consumers increasingly adopt SUVs and pickup trucks for utility and adventure driving. Its ability to mechanically lock both wheels improves traction, supporting growth across rugged-terrain vehicle applications.

Limited-slip differentials expanded steadily as automakers integrated them into performance-oriented models. Their capability to reduce wheel slip and maintain directional stability strengthened adoption in sports sedans and premium vehicles. The segment benefited from wider performance tuning initiatives that improved vehicle handling and acceleration efficiency.

Electronic Limited Slip and Torque-Vectoring Differentials advanced as OEMs shifted toward intelligent driveline control. These systems enhance cornering dynamics and optimize torque distribution through the use of electronic sensors. Their increasing relevance in EVs and premium vehicles is improving demand, especially where precision handling and high-speed stability remain core buyer priorities.

By Drive Type Analysis

Front Wheel Drive dominates the segment with 41.8% supported by compact vehicle production and efficiency benefits.

In 2024, Front Wheel Drive held a dominant market position in the By Drive Type segment of the Automotive Differential Market, with a 41.8% share. Its low manufacturing cost, improved fuel economy, and space-efficient layout encouraged strong adoption across small cars, sedans, and entry-level vehicles in global markets.

Rear Wheel Drive differentials experienced stable demand as manufacturers improved driveline performance for luxury sedans, sports cars, and commercial vehicles. This layout delivered enhanced power transfer and towing strength, supporting consistent installation in trucks, cargo vehicles, and premium passenger models requiring balanced handling and acceleration control.

All Wheel Drive / 4 Wheel Drive differentials expanded steadily as buyers preferred SUVs and crossovers featuring multi-terrain capability. These systems enhanced traction in variable weather and off-road environments, encouraging broader adoption across mid-range and high-end models. The rise of adventure mobility and utility-oriented driving further supported market penetration.

By Vehicle Type Analysis

Passenger Car dominates the segment with 66.1% driven by high production volumes and strong consumer demand.

In 2024, Passenger Car held a dominant market position in the By Vehicle Type segment of the Automotive Differential Market, with a 66.1% share. Rising urban mobility, new model launches, and drivetrain modernization supported strong differential installation across hatchbacks, sedans, and compact SUVs globally.

LCV and Truck applications expanded gradually as demand rose for logistics fleet upgrades, last-mile delivery growth, and construction-oriented vehicles. Their differential systems supported higher load-bearing capacity and improved torque transfer, enhancing operational reliability for utility and cargo transport fleets across developed and emerging markets.

Buses adopted differentials suitable for heavy passenger loads and long-distance performance. Growth in public transportation projects and intercity mobility improved the adoption of advanced differential housings and bearings, ensuring operational stability and extended service life. Electrification initiatives further strengthened technological improvements within bus driveline systems.

By Component Analysis

Ring Gear dominates the segment with 31.2% due to its critical role in torque transmission.

In 2024, Ring Gear held a dominant market position in the By Component segment of the Automotive Differential Market, with a 31.2% share. Its essential function in torque transfer and rotation reduction makes it a foundational component across passenger cars, LCVs, and heavy vehicles.

Pinion Gear demand increased as precision-engineered components improved differential durability and noise reduction. Manufacturers enhanced gear materials and machining accuracy, supporting deployment in both conventional and performance-oriented vehicles requiring smoother rotational engagement.

Side Gears observed gradual growth as vehicle manufacturers optimized driveline configurations for efficiency and reliability. Enhanced metallurgical strength and improved gear-cutting technologies supported stability across various load conditions, reinforcing their importance in differential assemblies.

Differential Housing and Differential Bearing usage rose as OEMs emphasized vibration control, extended service life, and improved thermal performance. Housing advancements supported lightweight vehicle programs, while high-grade bearings enhanced rotational smoothness, contributing to improved driveline refinement.

By Equipment Type Analysis

Agricultural Tractors dominate the segment with 59.4% supported by high torque demand and rugged operational requirements.

In 2024, Agricultural Tractors held a dominant market position in the By Equipment Type segment of the Automotive Differential Market, with a 59.4% share. Their need for strong traction, controlled torque distribution, and reliable driveline performance across varied terrains strengthened differential adoption.

Forklift applications showed consistent growth as industrial expansion increased material-handling operations. Differential systems in forklifts enhanced maneuverability, improved stability under load, and ensured efficient power transmission during warehouse, port, and logistics-center activities.

Key Market Segments

By Differential Type

- Open

- Locking

- Limited Slip

- Electronic Limited Slip

- Torque-Vectoring

By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive / 4 Wheel Drive

By Vehicle Type

- Passenger Car

- LCV, Truck

- Buses

By Component

- Pinion Gear

- Side Gear

- Ring Gear

- Differential Housing

- Differential Bearing

By Equipment Type

- Agricultural Tractors

- Forklift

Drivers

Increasing Adoption of AWD and 4WD Systems in Passenger and Commercial Vehicles

Growing use of AWD and 4WD vehicles strengthens the need for advanced differentials as buyers expect better traction and stability. Automakers integrate these systems in SUVs, pickups, and premium cars to improve driving confidence on rough and wet roads. This rising demand increases differential installations across global production lines.

Increasing production of performance and sports vehicles further supports market growth as these vehicles require high-precision, limited-slip and torque-vectoring differentials. Such systems help deliver quicker acceleration and enhanced cornering control, making them essential for modern high-output engines. Manufacturers continue to upgrade differential designs to match evolving performance expectations.

Rapid improvements in drivetrain technology also push differential demand upward as automakers aim for smoother torque distribution and improved fuel efficiency. Modern electronic systems monitor wheel speed and traction in real time, requiring differentials capable of fast, accurate torque adjustments. These upgrades accelerate adoption across both premium and mass-market vehicles.

Restraints

High Manufacturing and Integration Costs of Electronically Controlled Differentials

Electronically controlled differentials remain costly to design and produce because they include sensors, actuators, and control units that increase the overall system price. Automakers face higher integration expenses, especially in entry-level and mid-range vehicles, where cost sensitivity is high. This restricts widespread adoption across budget segments.

Maintenance complexity also acts as a restraint, as modern multi-mode differentials require specialized servicing tools and trained technicians. Traditional mechanical systems are easier to repair, whereas electronic units need calibrated diagnostics. This higher maintenance burden may discourage some fleet owners and cost-conscious buyers, slowing market penetration.

Additionally, the need for software updates and system recalibration increases long-term ownership efforts. These challenges make some markets slower to accept advanced differential technologies despite their performance benefits.

Growth Factors

Expansion of EV-Specific Differential Systems for E-Axles and Multi-Motor Platforms

Growth of electric vehicles creates new opportunities for EV-tailored differential systems as e-axles and dual-motor setups require precise torque balancing. Manufacturers are developing lightweight, high-efficiency units that allow EVs to improve traction and range without adding unnecessary mechanical load.

Torque-vectoring differentials also gain importance in autonomous and smart mobility solutions that rely on optimized vehicle stability. These systems help automated vehicles make controlled turns, lane changes, and emergency maneuvers by independently adjusting wheel torque. Their importance increases as autonomy levels rise globally.

Rising aftermarket demand for off-road and performance upgrades further expands opportunities, with enthusiasts seeking locking and limited-slip solutions to enhance vehicle capability. The growing adventure-touring and motorsport culture supports steady aftermarket sales across multiple regions.

Emerging Trends

Shift Toward Electronically Locking and Limited-Slip Differentials in SUVs

A clear trend is the rising preference for electronically locking and limited-slip differentials as SUVs become more mainstream. Consumers want improved stability on highways and better control on rough terrain, prompting automakers to shift to smart differential systems that adjust torque instantly based on road conditions.

Manufacturers are also experimenting with 3D-printed gears and housings to improve precision and reduce production time. Additive manufacturing supports lighter components, enhanced durability, and flexible prototyping for differential parts. This technology is increasingly used in pilot production and performance-oriented vehicle programs.

Together, these trends indicate a strong movement toward lighter, smarter, and more electronically optimized differential systems designed for modern mobility needs.

Regional Analysis

Asia Pacific Dominates the Automotive Differential Market with a Market Share of 43.7%, Valued at USD 10.0 Billion

Asia Pacific led the global Automotive Differential Market in 2024 with a commanding 43.7% share valued at USD 10.0 billion, driven by extensive vehicle production across China, Japan, India, and South Korea. Strong adoption of SUVs, rapid manufacturing expansion, and government-backed mobility programs reinforced regional growth. Rising EV development and drivetrain modernization further enhanced differential demand in both passenger and commercial fleets.

North America Automotive Differential Market Trends

North America observed steady growth supported by the robust production of SUVs, pickup trucks, and high-performance vehicles. Increasing preference for AWD-equipped models strengthened differential integration across newer vehicle platforms. Regulatory emphasis on safety and traction control pushed OEMs to deploy advanced driveline systems across the US and Canada.

Europe Automotive Differential Market Trends

Europe demonstrated sustained demand driven by engineering-focused automotive manufacturing and strong premium vehicle sales. Electrification initiatives boosted interest in torque-vectoring and electronically controlled differentials, especially in Germany and the UK. Regional regulations promoting fuel efficiency encouraged the adoption of lightweight and precision-engineered drivetrain components.

Middle East & Africa Automotive Differential Market Trends

The Middle East & Africa market expanded gradually due to rising SUV usage and infrastructure development across GCC countries. Harsh-terrain driving conditions increased the relevance of 4WD vehicles, supporting differential installations. Growing commercial fleet requirements further contributed to steady adoption across utility vehicles.

Latin America Automotive Differential Market Trends

Latin America experienced moderate growth driven by the rising production of compact cars and light commercial vehicles in Brazil and Mexico. Increased demand for durable driveline components in mining and agricultural applications supported differential utilization. Economic recovery trends and expanding automotive assembly activities added momentum to the regional market.

United States Automotive Differential Market Trends

The United States showcased strong integration of advanced differential technologies across SUVs, sports cars, and commercial fleets. High adoption of AWD and performance-oriented vehicles boosted demand for efficient torque-distribution systems. Evolving drivetrain innovations and growth in off-road vehicle culture further supported market expansion within the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Differential Company Insights

The global Automotive Differential Market in 2024 continues evolving as leading manufacturers focus on efficiency, electronic control, and lightweight drivetrain innovation.

BorgWarner Inc. strengthens its position by advancing electronically controlled limited-slip differentials designed for SUVs, EVs, and performance cars. Its focus on high-precision torque management helps automakers meet rising demand for stability and traction in multi-terrain vehicles. The company also prioritizes scalable designs that support both traditional and electrified platforms.

American Axle & Manufacturing, Inc. (AAM) remains a prominent supplier through its strong portfolio of axle and driveline technologies. The company emphasizes fuel-efficient, lightweight differential systems, addressing global regulatory pressure to reduce emissions. AAM’s engineering expertise supports OEMs seeking improved durability and higher torque capacity for pickup trucks, commercial fleets, and off-road vehicles.

Dana Incorporated enhances its market reach through advanced differential systems integrated with e-axles and hybrid drivetrains. The company plays a key role in supporting the electrification shift by supplying thermally efficient, low-loss gear designs. Dana’s differentiators lie in their robust, high-strength components developed for commercial vehicles, construction machinery, and propulsion-focused automotive applications.

Eaton Corporation plc maintains steady market traction with dependable locking, limited-slip, and electronic differential solutions. Its focus on off-road and utility vehicle applications strengthens demand across agriculture, construction, and specialty vehicles. Eaton’s long-standing engineering reliability supports OEMs aiming to enhance traction control in challenging environments.

Top Key Players in the Market

- BorgWarner Inc

- American Axle & Manufacturing, Inc. (AAM)

- Dana Incorporated

- Eaton Corporation plc

- ZF Friedrichshafen AG

- GKN Automotive

- Hyundai WIA Corporation

- JTEKT Corporation

- Schaeffler Technologies AG & Co. KG

- Linamar Corporation

Recent Developments

- In Oct 2025, BorgWarner expanded its collaboration with Chery to supply advanced all wheel drive (AWD) products for next generation vehicles.

The expanded partnership supports improved vehicle performance and strengthens BorgWarner’s position in electrified and intelligent driveline systems. - In Apr 2024, Eaton Performance launched the Detroit Truetrac differential for 2015–2024 Ford F 150 models equipped with 8.8 inch axles.

The aftermarket focused product enhances stability and off road traction, targeting truck owners seeking improved drivetrain performance. - In Oct 2024, ZF Friedrichshafen AG secured a major multi year contract to supply differential gear sets and driveline components for a new electric vehicle platform of a leading European OEM.

The contract reinforces ZF’s leadership in advanced driveline technologies supporting the transition to electrified mobility.

Report Scope

Report Features Description Market Value (2024) USD 22.9 billion Forecast Revenue (2034) USD 34.89 billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Differential Type (Open, Locking, Limited Slip, Electronic Limited Slip, Torque-Vectoring), By Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive / 4 Wheel Drive), By Vehicle Type (Passenger Car, LCV, Truck, Buses), By Component (Pinion Gear, Side Gear, Ring Gear, Differential Housing, Differential Bearing), By Equipment Type (Agricultural Tractors, Forklift) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BorgWarner Inc, American Axle & Manufacturing, Inc. (AAM), Dana Incorporated, Eaton Corporation plc, ZF Friedrichshafen AG, GKN Automotive, Hyundai WIA Corporation, JTEKT Corporation, Schaeffler Technologies AG & Co. KG, Linamar Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Differential MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Differential MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BorgWarner Inc

- American Axle & Manufacturing, Inc. (AAM)

- Dana Incorporated

- Eaton Corporation plc

- ZF Friedrichshafen AG

- GKN Automotive

- Hyundai WIA Corporation

- JTEKT Corporation

- Schaeffler Technologies AG & Co. KG

- Linamar Corporation