Global Automotive Bushing Market Size, Share, Growth Analysis By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle), By Application (Suspension, Engine, Chassis, Interior, Exhaust, Transmission), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150520

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

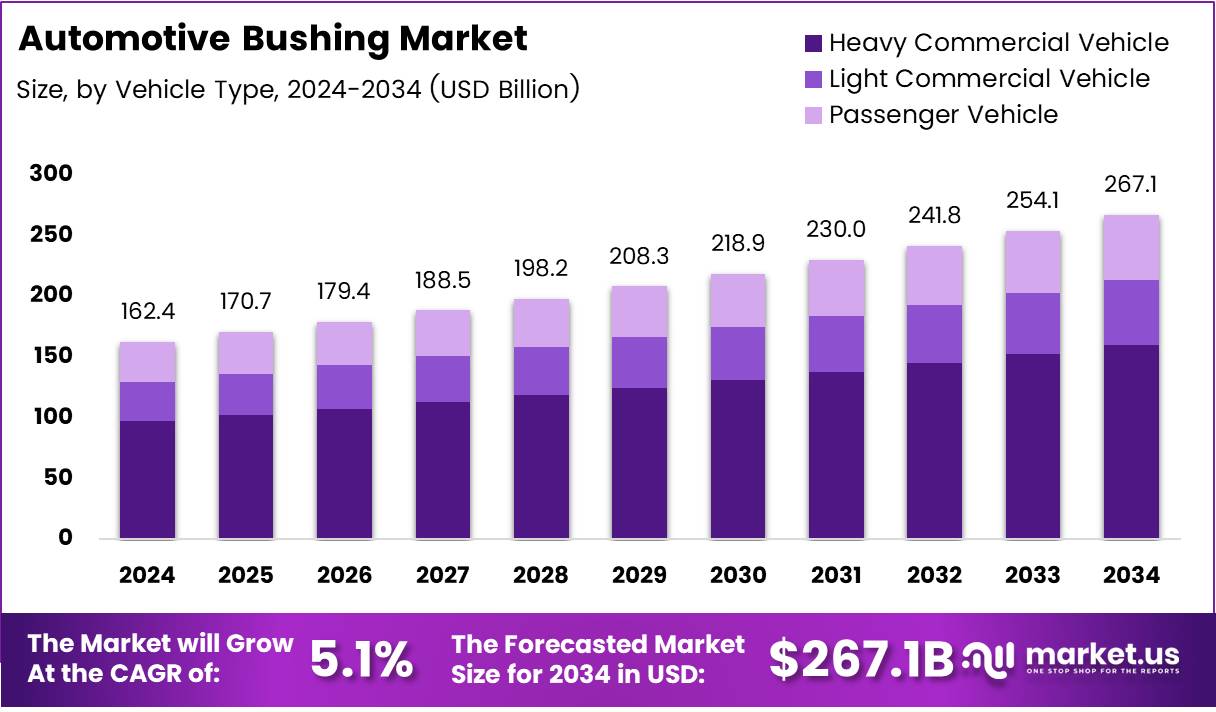

The Global Automotive Bushing Market size is expected to be worth around USD 267.1 Billion by 2034, from USD 162.4 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The automotive bushing market plays a critical role in ensuring the smooth functioning of various automotive systems, particularly the suspension and chassis. Automotive bushings are used to reduce friction and absorb shocks, providing stability and comfort during vehicle operation.

These components are found in key parts like control arms, sway bars, and shock absorbers. They are typically made from rubber or polyurethane, with rubber bushings offering a softer alternative to the firmer polyurethane options, rated at 60-65 Shore A, as per MotorTrend. This flexibility provides vehicles with the necessary durability and comfort in a wide range of driving conditions.

In recent years, the automotive bushing market has experienced significant growth, driven by the increasing demand for high-performance and durable vehicle components.

According to Transport, heavy vehicles are defined as those with a Gross Vehicle Mass (GVM) or Aggregate Trailer Mass (ATM) exceeding 4.5 tonnes, which has heightened the need for robust bushing solutions to withstand increased weight and load pressures. As more heavy vehicles enter the market, especially in commercial transportation and construction sectors, the demand for advanced automotive bushings is expected to rise.

Government investment in infrastructure and regulatory standards further impacts the automotive bushing market. With regulatory bodies emphasizing vehicle safety, sustainability, and emissions standards, automakers are incentivized to use components that meet high durability and environmental standards.

The growing focus on reducing carbon footprints is prompting manufacturers to innovate and produce eco-friendly materials for bushings, aligning with global sustainability trends. Furthermore, government regulations governing vehicle safety ensure that the quality of bushings remains a focal point in automotive designs.

The replacement market for automotive bushings also presents a significant growth opportunity. As per RepairPal, the average cost for a suspension control arm bushing replacement ranges from $304 to $420. This cost indicates the potential for aftermarket suppliers to cater to vehicle owners seeking to maintain or improve their vehicle’s suspension system.

As more consumers recognize the importance of bushing replacement in maintaining vehicle stability and performance, the aftermarket segment of the automotive bushing market is poised for growth.

Key Takeaways

- The Global Automotive Bushing Market is projected to reach USD 267.1 Billion by 2034, growing at a CAGR of 5.1% from 2025 to 2034.

- In 2024, Heavy Commercial Vehicle held the largest share in the By Vehicle Type Analysis segment, with a 41.5% market share.

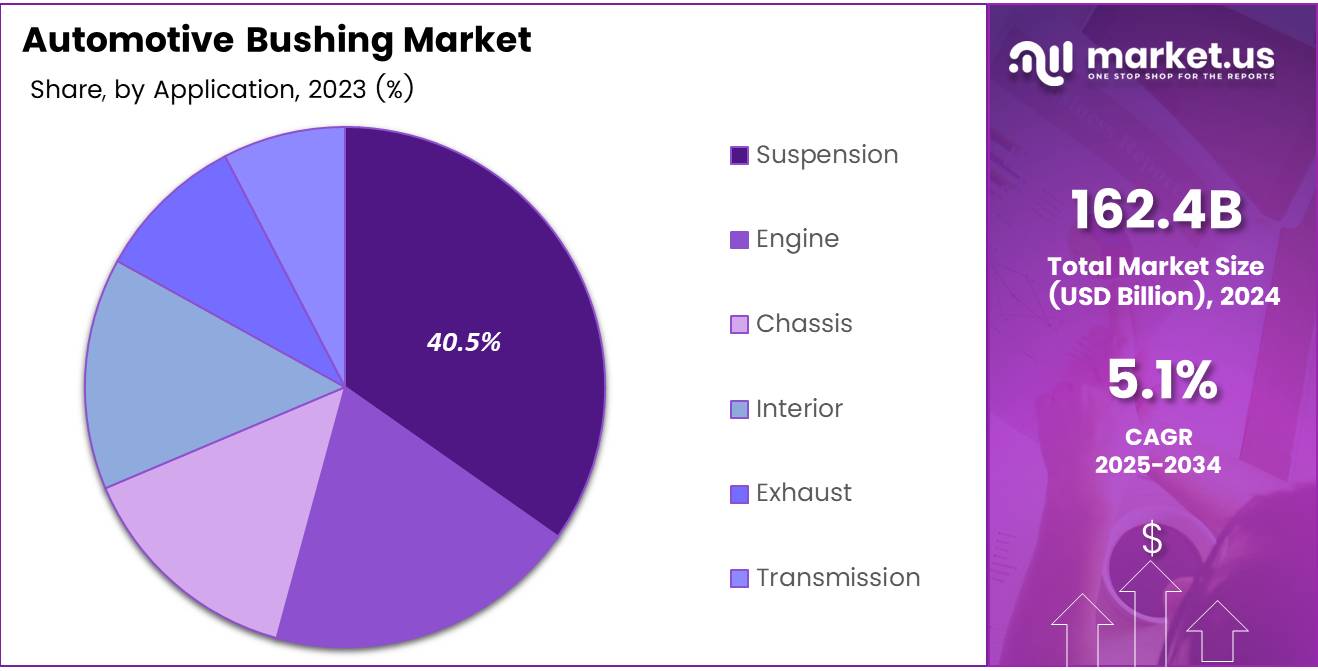

- In 2024, Suspension dominated the By Application Analysis segment with a 40.5% market share.

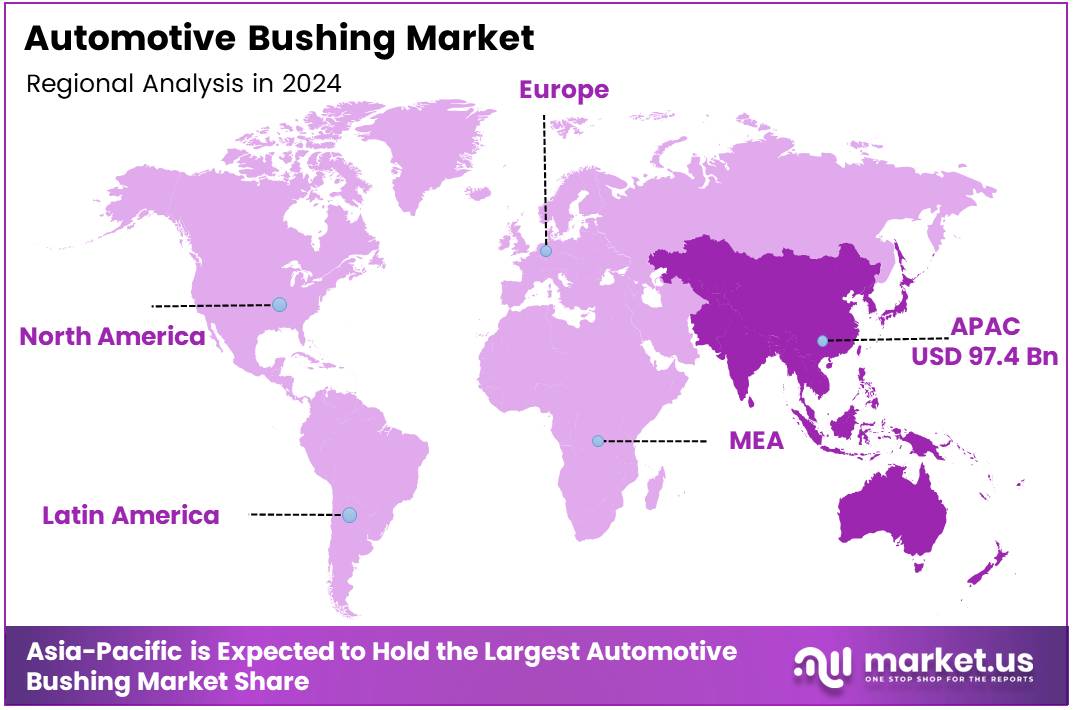

- The Asia Pacific region leads the automotive bushing market with 60.5% of the total market share, valued at USD 97.4 Billion.

Vehicle Type Analysis

In 2024, Heavy Commercial Vehicle held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Bushing Market, with a 41.5% share. This segment’s strong performance can be attributed to the increasing demand for heavy-duty vehicles, which require durable and high-performance components such as bushings.

Light Commercial Vehicles followed with a significant share, driven by the growing e-commerce sector and last-mile delivery needs. These vehicles require automotive bushings to handle the higher load and wear from frequent urban usage.

Passenger Vehicles, while holding a smaller share compared to the commercial vehicle segments, continue to contribute significantly to the market. The increasing demand for passenger cars with improved suspension systems to enhance driving comfort and safety is expected to maintain steady growth in this segment.

Application Analysis

In 2024, Suspension held a dominant market position in the By Application Analysis segment of the Automotive Bushing Market, with a 40.5% share. The suspension application is crucial for improving vehicle stability and comfort, which drives its widespread adoption across all vehicle types.

Engine applications are also significant, though they capture a smaller share compared to suspension. Engine components require bushings that can withstand high temperatures and vibrations.

Chassis, Interior, Exhaust, and Transmission applications follow, each serving a unique role in vehicle design and performance. However, they contribute to a smaller overall share of the market. The growing demand for vehicle durability and comfort is expected to sustain demand for bushings in these applications.

Key Market Segments

By Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Vehicle

By Application

- Suspension

- Engine

- Chassis

- Interior

- Exhaust

- Transmission

Drivers

Increasing Demand for Fuel-Efficient Vehicles Drives Automotive Bushing Market Growth

The automotive bushing market is experiencing significant growth, driven by the increasing demand for fuel-efficient vehicles. As manufacturers strive to meet stricter fuel efficiency standards, the need for advanced bushings has escalated. Bushings are crucial components in vehicles that help reduce friction and wear, improving overall performance and energy efficiency.

The rapid growth in electric vehicle (EV) production is further influencing the demand for automotive bushings. As EVs become more popular, there is a growing need for specific bushing solutions that cater to the unique requirements of these vehicles, including reduced weight and enhanced durability.

Stricter environmental regulations are also pushing automotive manufacturers to adopt advanced bushing solutions. Regulations related to emissions and sustainability are encouraging the use of eco-friendly and long-lasting materials in bushings, which contribute to reduced environmental impact.

Lastly, the rising consumer preference for comfort and noise reduction in vehicles is enhancing the demand for advanced bushings. Consumers are increasingly prioritizing smooth rides and low noise levels, which has prompted automakers to invest in high-performance bushing technologies.

Restraints

High Cost and Regulatory Complexity Restrain Automotive Bushing Market Growth

Despite the growth potential of the automotive bushing market, several challenges are holding back progress. One key restraint is the high cost associated with advanced bushing materials and manufacturing processes. Specialized materials used to produce high-performance bushings can be expensive, impacting the overall cost structure for manufacturers and consumers.

Additionally, the volatility in raw material prices, such as rubber and metals, is affecting the cost of production. Fluctuating prices can create uncertainties in the supply chain, making it difficult for manufacturers to maintain stable pricing for automotive bushings.

The complexities in meeting regulatory standards for bushing materials and design further hinder the market’s expansion. Manufacturers must comply with various safety, environmental, and performance standards, which often require significant investment in research and development.

Furthermore, the limited availability of skilled labor for the installation and maintenance of automotive bushings adds to the challenge. This shortage of qualified technicians can delay production and maintenance schedules, ultimately affecting market growth.

Growth Factors

Growth Opportunities in the Automotive Bushing Market

The automotive bushing market is presented with several growth opportunities, particularly in the electric and hybrid vehicle segments. As the market for electric and hybrid vehicles continues to expand, there is a rising need for bushing solutions that meet the specific demands of these vehicles, such as lighter weight and improved energy efficiency.

The increasing focus on lightweight automotive components is also driving the demand for optimized bushing solutions. As manufacturers seek to reduce the overall weight of vehicles to improve fuel efficiency, bushings made from advanced, lightweight materials are becoming more popular.

Emerging markets represent another key growth opportunity for automotive bushing manufacturers. As automotive industries grow in developing regions, there is an increasing demand for quality components, including bushings, to support new vehicle production.

Additionally, advancements in 3D printing technology offer exciting possibilities for customized bushing production. This innovation allows for the creation of bespoke bushing solutions tailored to specific vehicle models, reducing manufacturing costs and enhancing performance.

Emerging Trends

Trending Factors Shaping the Automotive Bushing Market

Several trends are shaping the future of the automotive bushing market. One key trend is the adoption of smart materials, which enhance the durability and performance of bushings. These materials are designed to adapt to changing conditions, offering improved wear resistance and longevity in various vehicle applications.

The integration of bushing systems with advanced suspension technologies is another significant trend. As automakers focus on improving vehicle dynamics and ride quality, bushings play a critical role in enhancing the overall suspension system’s performance.

There is also a shift towards sustainable and eco-friendly bushing materials. In line with growing consumer demand for green vehicles, automakers are increasingly turning to bushing solutions made from recyclable and environmentally friendly materials.

Lastly, the rise in interest in autonomous vehicles is fueling the demand for advanced bushing solutions. As autonomous vehicle technology continues to evolve, there is a need for bushings that provide enhanced performance, durability, and precision in the vehicle’s mechanical systems.

Regional Analysis

Asia Pacific Dominates the Automotive Bushing Market with a Market Share of 60.5%, Valued at USD 97.4 Billion

The Asia Pacific region holds a dominant position in the automotive bushing market, accounting for 60.5% of the total market share, with a valuation of USD 97.4 Billion.

This growth can be attributed to the increasing demand for automobiles, particularly in emerging markets like China and India, along with a rise in automotive manufacturing activities. The presence of major automotive manufacturers and a robust supply chain further contributes to the region’s leadership in the global market.

North America Automotive Bushing Market Trends

North America follows as a significant market for automotive bushings, driven by high vehicle production and an increasing focus on advanced automotive technologies. The region benefits from a well-established automotive industry, particularly in the U.S., which remains a hub for innovation and vehicle assembly. Rising consumer preference for electric vehicles and stringent government regulations on vehicle safety and performance further enhance the demand for high-quality bushings in this region.

Europe Automotive Bushing Market Insights

Europe continues to be a key player in the automotive bushing market, thanks to the presence of several automotive giants in countries like Germany, France, and Italy. The European market is witnessing growth due to advancements in automotive design, as well as increasing emphasis on fuel-efficient and electric vehicles. The shift towards lightweight and durable materials has significantly impacted the demand for high-performance bushings in this region.

Latin America Automotive Bushing Market Overview

Latin America’s automotive bushing market is expanding, though at a slower pace compared to other regions. The market is primarily driven by vehicle production in countries such as Brazil and Mexico, which have become key manufacturing hubs. The region is experiencing growing demand for cost-effective and durable automotive components, including bushings, as the automotive industry continues to evolve and modernize.

Middle East and Africa Automotive Bushing Market Outlook

The Middle East and Africa automotive bushing market is in a phase of gradual growth, fueled by rising automotive production, particularly in countries like South Africa and the UAE. The demand for high-quality bushings is expected to increase as the automotive industry focuses on enhancing vehicle safety and durability. Additionally, the region’s growing focus on infrastructure development and the adoption of electric vehicles contribute to the positive outlook for the market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Bushing Company Insights

In 2024, Schaeffler AG remains a prominent player in the global automotive bushing market, leveraging its strong engineering capabilities to deliver innovative solutions focused on reducing noise and vibration, thereby enhancing driving comfort and vehicle performance. With a focus on sustainability, Schaeffler continues to invest heavily in research and development to meet the increasing demand for advanced bushing technologies.

Vibracoustic stands as a key competitor, well-known for its leadership in vibration control technologies. The company’s bushing solutions are integral to reducing noise, vibration, and harshness (NVH) in vehicles, positioning them as a preferred choice for automakers striving to meet stringent emission and comfort standards. Vibracoustic’s expertise lies in providing cost-effective and high-quality components for both conventional and electric vehicles.

MEYLE AG continues to expand its footprint in the automotive bushing sector with a strong focus on durable, high-performance products. The company’s extensive portfolio caters to both OEMs and the aftermarket, allowing MEYLE to cater to a wide range of customer needs, particularly in the growing electric vehicle segment where noise reduction is key.

Kesaria Rubber Industries Pvt. Ltd. stands out in the market with its specialized approach to producing rubber-based bushings, supplying products that are known for their resilience and reliability. Its products are used extensively in various automotive applications, contributing to the durability and comfort of vehicles across different market segments, including heavy-duty commercial vehicles.

Top Key Players in the Market

- Schaeffler AG

- Vibracoustic

- MEYLE AG

- Kesaria Rubber Industries Pvt. Ltd.

- Powerflex USA

- Teknorot

- Continental AG (Germany)

- ContiTech Deutschland GmbH

- Vogelsang Fastener Solutions

- GYCX Factory

Recent Developments

- In May 2025, Lumax Auto announced its decision to acquire the remaining 25% stake in IAC India for a total of Rs 221 crore, further consolidating its position in the automotive component market.

- In March 2025, Tata Autocomp secured a strategic move by acquiring International Automotive Components Group in Sweden, expanding its global footprint and enhancing its automotive component offerings.

- In December 2024, Pricol made a strategic acquisition of Sundaram Auto Components’ Injection Moulding Business, strengthening its capabilities in automotive manufacturing and increasing market share in the automotive parts industry.

- In June 2024, VOC Automotive secured INR 1.5 crore in funding from Corporate Warranty India to innovate and transform the two-wheeler service industry, aiming to streamline operations and enhance customer satisfaction in India.

Report Scope

Report Features Description Market Value (2024) USD 162.4 Billion Forecast Revenue (2034) USD 267.1 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle), By Application (Suspension, Engine, Chassis, Interior, Exhaust, Transmission) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schaeffler AG, Vibracoustic, MEYLE AG, Kesaria Rubber Industries Pvt. Ltd., Powerflex USA, Teknorot, Continental AG (Germany), ContiTech Deutschland GmbH, Vogelsang Fastener Solutions, GYCX Factory Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schaeffler AG

- Vibracoustic

- MEYLE AG

- Kesaria Rubber Industries Pvt. Ltd.

- Powerflex USA

- Teknorot

- Continental AG (Germany)

- ContiTech Deutschland GmbH

- Vogelsang Fastener Solutions

- GYCX Factory