Global Automotive Brake Systems Market By Type(Disc Brakes, Drum Brakes), By Vehicle Type(Passenger Cars, Commercial Vehicles), By Technology (Anti-Lock Brake System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), Electronic Brake-Force Distribution (EBD)), By Sales Channel(Original Equipment Manufacturers, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 19840

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

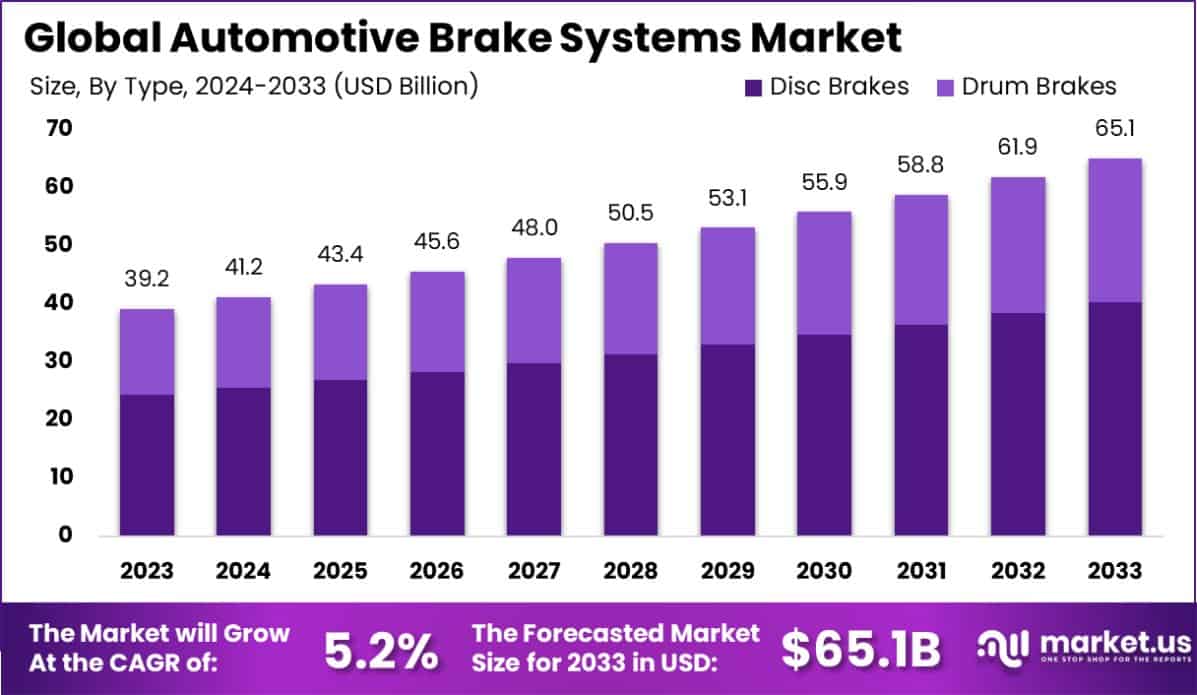

The Global Automotive Brake Systems Market is expected to be worth around USD 65.1 billion by 2033, up from USD 39.2 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Automotive brake systems are crucial components in vehicles, ensuring safety by enabling controlled deceleration and stopping. These systems encompass various mechanisms including disc brakes, drum brakes, anti-lock braking systems (ABS), and electronic stability controls (ESC), which work together to prevent accidents and enhance vehicle handling.

The automotive brake systems market involves the production, distribution, and sale of braking components and systems for various vehicle types. This market is driven by factors such as increasing vehicle production, stringent safety regulations, and advancements in braking technology aimed at enhancing efficiency and reliability.

The growth of the automotive brake systems market can be attributed to the rising global vehicle production and stringent safety standards mandating advanced braking systems in new vehicles. Technological innovations, such as regenerative braking systems in electric vehicles, further propel this growth.

Demand for automotive brake systems is bolstered by the increasing awareness of vehicle safety among consumers and the need for replacement and maintenance of braking components in older vehicles. The push towards reducing road accidents through better braking systems supports sustained demand.

Opportunities in the automotive brake systems market are abundant with the shift towards electric and autonomous vehicles, which require specialized braking systems. The integration of IoT and AI technologies for predictive maintenance and enhanced functionality presents new avenues for market expansion.

The automotive brake systems market is positioned at a crucial juncture, where technological innovation intersects with stringent safety standards and environmental considerations. This market is primarily propelled by the escalating global demand for safer and more efficient vehicles, especially as governments worldwide impose more rigorous safety regulations to curb road accidents.

The recent announcement by the UK government, awarding £88 million to support zero-emission vehicle technologies, underscores a broader commitment to sustainable automotive solutions, indirectly benefiting the brake systems sector by fostering innovations such as regenerative braking.

However, the market faces challenges, including significant recalls that underscore the need for relentless improvement in quality and performance standards. A case in point is BMW’s recent recall of about 1.5 million vehicles due to brake system defects.

This incident not only impacts BMW’s short-term financial projections but also highlights the critical importance of robust manufacturing and quality assurance processes across the industry. Such developments compel manufacturers to enhance their R&D expenditures to mitigate similar risks and uphold brand integrity.

Overall, the automotive brake systems market presents a dynamic landscape with considerable growth opportunities, particularly in adapting to the electrification of vehicles and integrating advanced technologies for improved safety and performance.

Key Takeaways

- The Global Automotive Brake Systems Market is expected to be worth around USD 65.1 billion by 2033, up from USD 39.2 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

- In 2023, Disc Brakes held a dominant market position in the by-type segment of the Automotive Brake Systems Market, with a 62.1% share.

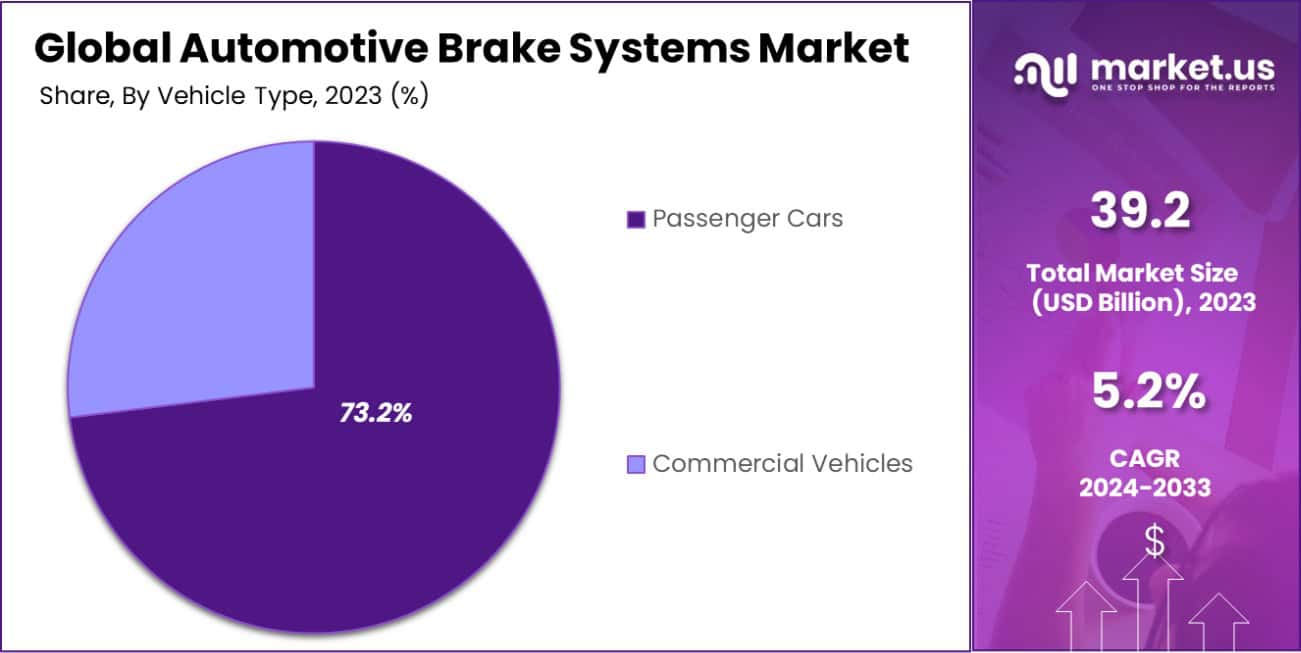

- In 2023, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Brake Systems Market, with a 73.2% share.

- In 2023, Electronic Stability Control (ESC) held a dominant market position in the By Technology segment of the Automotive Brake Systems Market, with a 33.1% share.

- In 2023, Original Equipment Manufacturers held a dominant market position in the By Sales Channel segment of the Automotive Brake Systems Market.

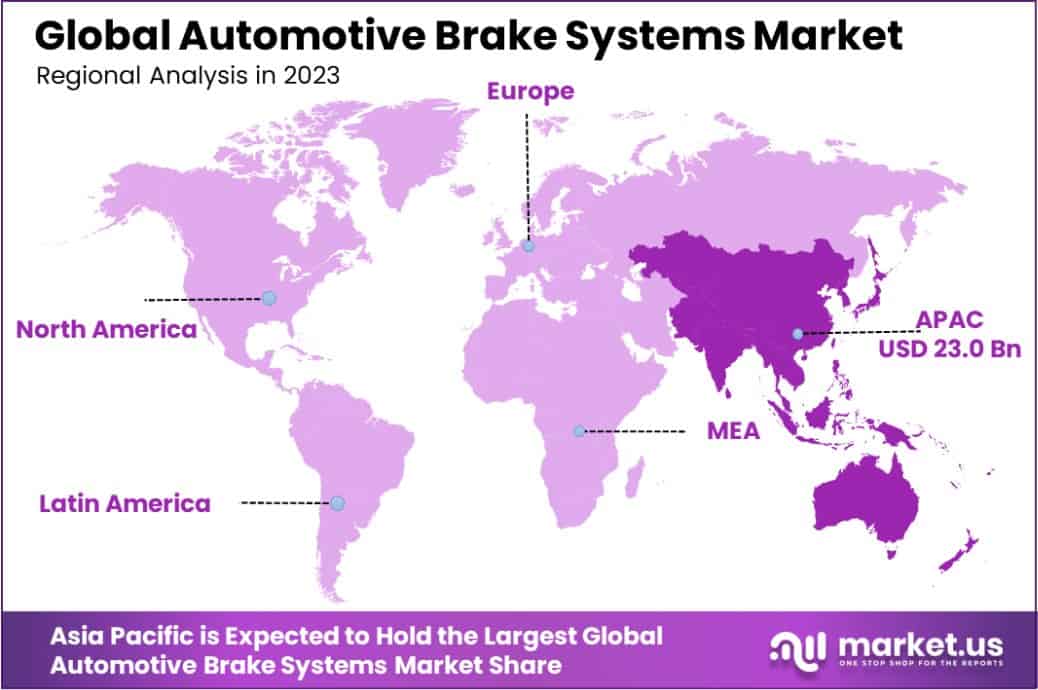

- Asia Pacific dominated a 58.7% market share in 2023 and held USD 23.0 Billion revenue of the Automotive Brake Systems Market.

By Type Analysis

In 2023, Disc Brakes held a dominant market position in the “By Type” segment of the Automotive Brake Systems Market, with a 62.1% share. This prevalence is attributed to their superior performance characteristics, including better heat dissipation and greater effectiveness in wet conditions compared to their counterparts.

Disc brakes are increasingly preferred in new vehicle models across both passenger and commercial vehicles, driven by their ability to provide shorter stopping distances and reduced maintenance requirements.

Conversely, Drum Brakes accounted for a significant portion of the market as well, though to a lesser extent. Favored for their cost-effectiveness and durability, drum brakes remain common in lower-cost vehicles and in rear axle applications, where high-performance braking is less critical.

However, the shift towards more stringent safety standards and consumer preferences for higher-performance vehicles is gradually diminishing the market share of drum brakes.

The segmental dynamics within the Automotive Brake Systems Market reflect ongoing advancements in automotive technology and a shifting regulatory landscape that favors more robust and reliable braking solutions.

As manufacturers continue to innovate, the adoption of disc brakes is expected to grow, further catalyzed by the increasing production of electric and hybrid vehicles, which often require more complex braking systems to manage regenerative braking functions effectively.

By Vehicle Type Analysis

In 2023, Passenger Cars held a dominant market position in the “By Vehicle Type” segment of the Automotive Brake Systems Market, with a 73.2% share. This dominance is largely due to the high volume of passenger car production globally and the increasing focus on safety features, including advanced braking systems, in consumer vehicles.

As consumers become more safety-conscious, there is heightened demand for vehicles equipped with advanced braking technologies such as anti-lock braking systems (ABS) and electronic stability control (ESC), which are more frequently integrated into passenger cars.

On the other hand, Commercial Vehicles also represent a significant segment but with a smaller share of the market. The demand in this segment is driven by the need for robust and reliable braking systems that can handle heavier loads and more rigorous usage conditions typical of commercial operations.

The growth in this segment is supported by the global expansion of logistics and smart transportation industries, necessitating durable and efficient brake systems to ensure safety and compliance with commercial vehicle regulations.

Overall, the distribution within the Automotive Brake Systems Market by vehicle type underscores the broader trends in vehicle production and the pivotal role of safety innovations in driving market preferences.

As the automotive industry continues to evolve, particularly with the increase in electric and autonomous vehicles, the demand dynamics in this market are expected to shift, favoring advanced braking technologies that enhance vehicle safety and performance.

By Technology Analysis

In 2023, Electronic Stability Control (ESC) held a dominant market position in the “By Technology” segment of the Automotive Brake Systems Market, with a 33.1% share. This prominence of ESC can be attributed to its critical role in enhancing vehicle stability and preventing accidents by automatically detecting and reducing loss of traction.

As safety regulations become more stringent globally, the implementation of ESC in new vehicles has become a standard, driven by its proven effectiveness in improving vehicle handling during emergency maneuvers and adverse driving conditions.

The market also features other key technologies such as Anti-Lock Brake System (ABS), Traction Control System (TCS), and Electronic Brake-force Distribution (EBD). Each of these technologies supports different aspects of vehicle safety and performance.

ABS prevents wheel lock-up during braking, TCS avoids wheel spin in acceleration, and EBD optimizes brake force distribution between wheels depending on load and driving status.

While ESC leads in market share, these systems collectively contribute to the dynamic growth of the market, reflecting an increasing consumer and regulatory emphasis on vehicle safety technologies.

Overall, the diverse technology offerings within the Automotive Brake Systems Market highlight a strong focus on innovation and safety, with ESC leading the way in adoption due to its significant impact on improving vehicular control and reducing accident rates.

By Sales Channel Analysis

In 2023, Original Equipment Manufacturers (OEMs) held a dominant market position in the “By Sales Channel” segment of the Automotive Brake Systems Market. The robust presence of OEMs in the market is primarily driven by the continuous production of new vehicles equipped with the latest braking technologies.

This sector benefits significantly from the stringent safety regulations and standards that necessitate the integration of advanced braking systems in new vehicles. OEMs are crucial in implementing these cutting-edge technologies directly at the point of vehicle assembly, ensuring that all newly manufactured vehicles meet both consumer expectations and regulatory requirements.

The Aftermarket segment also plays a vital role, particularly in the maintenance, repair, and upgrade of existing vehicles. As vehicles age, the need for replacement parts and system upgrades grows, providing a steady demand for aftermarket brake system components.

However, the initial installation accuracy and integration of advanced systems by OEMs give them a predominant share of the market. Despite this, the aftermarket is expected to see growth driven by the aging global vehicle fleet and the increasing consumer awareness regarding vehicle safety enhancements.

Collectively, these segments underscore the dynamic nature of the Automotive Brake Systems Market, where innovation by OEMs sets the standard, while aftermarket providers support long-term maintenance and performance optimization.

Key Market Segments

By Type

- Disc Brakes

- Drum Brakes

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Technology

- Anti-Lock Brake System (ABS)

- Traction Control System (TCS)

- Electronic Stability Control (ESC)

- Electronic Brake-Force Distribution (EBD)

By Sales Channel

- Original Equipment Manufacturers

- Aftermarket

Drivers

Market Drivers: Brake System Innovations

The Automotive Brake Systems Market is experiencing significant growth driven by multiple factors. As an analyst, it’s evident that advancements in vehicle safety technology are a primary catalyst.

Modern vehicles increasingly incorporate sophisticated braking systems like anti-lock braking systems (ABS) and electronic stability control (ESC) to meet higher safety standards and consumer expectations for safer driving experiences.

Additionally, global regulations mandating more stringent safety measures have pushed automakers to innovate and integrate these advanced systems into new models. The market is also influenced by the rising consumer awareness about vehicle safety, which boosts demand for vehicles equipped with advanced braking technologies.

Furthermore, the surge in vehicle production worldwide provides a continuous stream of opportunities for the expansion of the brake systems market. These elements collectively make up the core drivers pushing the market forward, reflecting a strong trend towards safer, more reliable automotive braking solutions.

Restraint

Challenges in Automotive Brake Systems Market

Governments worldwide are increasingly implementing strict safety regulations that compel manufacturers to adopt advanced, but costlier, technologies.

This includes the integration of electronic brake systems and anti-lock braking systems (ABS), which, while enhancing vehicle safety, also increase production costs. These elevated costs may limit market growth as they are passed on to consumers, potentially reducing market accessibility and consumer purchase intent.

Additionally, the global supply chain issues, particularly in acquiring essential components like microchips and sensors, further strain production capabilities and delay market expansion.

Opportunities

Key Opportunities in Automotive Brake Systems

The automotive brake systems market is poised for significant growth, driven by advancements in vehicle safety technologies and increasing global automobile production.

Opportunities are particularly abundant in the development of advanced braking systems like anti-lock braking systems (ABS) and electronic stability control (ESC), which are becoming standard due to stringent safety regulations worldwide.

Additionally, the rise of electric and hybrid vehicles presents a unique avenue for the expansion of regenerative braking technologies, which not only enhance vehicle efficiency but also appeal to the growing consumer demand for sustainable automotive solutions.

Moreover, as the industry moves towards autonomous vehicles, the integration of intelligent braking systems that can communicate with other automated systems in the vehicle is becoming crucial, opening new paths for innovation and market penetration.

Challenges

Challenges Facing Brake Systems Market

The automotive brake systems market faces several challenges that could impede its growth. A primary concern is the high cost associated with developing advanced brake technologies, which can deter adoption among manufacturers focused on cost-efficiency.

Regulatory pressures also pose a significant challenge, as companies must comply with evolving global standards for vehicle safety, requiring continuous investment in research and development. Additionally, the rapid advancement of autonomous driving technologies demands that brake systems become more integrated with electronic systems, increasing the complexity and potential for system failures.

Supply chain issues, particularly the availability of essential components like semiconductors, have also disrupted production schedules, affecting the timely delivery of new and advanced brake systems. These factors collectively create hurdles that manufacturers need to overcome to maintain competitiveness and market share.

Growth Factors

Growth Drivers in Brake Systems Market

Several factors are propelling the growth of the automotive brake systems market. The increasing global demand for vehicles, particularly in emerging economies, directly boosts the need for reliable and efficient brake systems.

Technological advancements are also crucial, as newer vehicles incorporate advanced safety features, including sophisticated brake systems that improve performance and safety.

The regulatory environment plays a pivotal role, with governments worldwide implementing stricter safety standards that mandate advanced braking technologies such as electronic stability control and anti-lock braking systems.

Additionally, the shift towards electric and autonomous vehicles is creating opportunities for the development of regenerative and intelligent braking systems that are integral to these new vehicle types.

These dynamics ensure a robust growth trajectory for the automotive brake systems market, fueled by innovation and regulatory requirements.

Emerging Trends

Emerging Trends in Brake Systems

The automotive brake systems market is witnessing several emerging trends that are shaping its future. One significant trend is the shift towards autonomous and semi-autonomous vehicles, which require highly sophisticated braking systems that can independently make decisions based on real-time data.

There is also a growing emphasis on sustainability, driving the adoption of regenerative braking systems that contribute to energy efficiency and are particularly prevalent in electric vehicles. Additionally, the integration of artificial intelligence and machine learning is enhancing the predictive capabilities of brake systems, improving maintenance schedules and overall vehicle safety.

Wireless technologies are being explored to facilitate communication between vehicle braking systems and other devices, enhancing connectivity and functionality. These trends highlight an industry in transition, increasingly influenced by technological innovation and sustainability concerns.

Regional Analysis

The global automotive brake systems market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, with Asia Pacific dominating the market. This region holds a substantial share of 58.7%, equating to USD 23.0 billion, driven by high vehicle production rates, particularly in China, India, and Japan.

The robust automotive manufacturing sector in these countries, coupled with increasing safety regulations and the rising adoption of advanced braking technologies, supports this significant market share.

In North America, stringent safety standards and a high preference for vehicle safety features are propelling the demand for advanced automotive brake systems. Europe continues to advance in automotive technology with a strong focus on reducing vehicular emissions and enhancing road safety, fostering growth in its brake systems market.

The markets in the Middle East & Africa and Latin America are developing, with growth influenced by increasing vehicle penetration and expanding automotive sectors. These regions are gradually adopting more advanced automotive technologies, although at a slower pace compared to other global markets.

Overall, the global spread of the automotive brake systems market is highly influenced by regional advancements in automotive technology and regulatory frameworks focusing on vehicle safety.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global automotive brake systems market is significantly shaped by the contributions and innovations of key players such as Advics Co. Ltd., ZF Friedrichshafen AG, and Akebono Brake Industry Co. Each company plays a pivotal role in driving technological advancements and market dynamics.

Advics Co. Ltd. is renowned for its integration of cutting-edge technologies with traditional braking systems. The company focuses on enhancing the safety features of brake systems through continuous innovation in brake control solutions.

Their products are distinguished by high reliability and performance, which sustains their competitive advantage and supports their market position, particularly in Asia.

ZF Friedrichshafen AG stands out for its broad portfolio that includes advanced braking systems for both conventional and electric vehicles. The company’s commitment to research and development allows it to offer integrated solutions that combine enhanced safety with environmental considerations.

ZF’s strategies are oriented towards addressing the growing demands for sustainable and efficient vehicles, positioning them as a leader not only in Europe but globally.

Akebono Brake Industry Co. specializes in the development of noise-free, vibration-free braking solutions, a crucial factor in the automotive industry’s push toward enhanced user comfort and safety.

Their expertise in ceramic brake technology sets them apart and caters to a niche market segment, providing substantial growth opportunities, especially in markets sensitive to automotive noise pollution.

These companies collectively influence the automotive brake systems market by pushing the boundaries of innovation, safety, and environmental standards. Their strategic focus on quality, sustainability, and technological integration ensures their strong standings in an increasingly competitive and technologically driven market environment.

Top Key Players in the Market

- Advics Co. Ltd.

- ZF Friedrichshafen AG

- Akebono Brake Industry Co.

- Hitachi Automotive System

- Brembo SpA

- Robert Bosh GmbH

- Aisin Seiki Co. Ltd.

- Haldex AB

- Web Co.

- Nissin Kogyo Co. Ltd.

- BWI Group

- Mando Corporation

- Continental AG

- Batz Group

- TE Connectivity

- Cardollite Corporation

- Kor-Pak Corporation

- Pro-Tech Friction Group

- Trimat Limited

- Other Market Players

Recent Developments

- In March 2024, Robert Bosch GmbH secured additional funding for their ongoing project on advanced driver-assistance systems (ADAS) that integrate more closely with brake systems. This funding is expected to accelerate the development of safer, more responsive braking solutions suited for autonomous vehicles.

- In February 2024, Brembo SpA revealed its acquisition of a smaller brake technology firm. This strategic move is intended to enhance Brembo’s capabilities in manufacturing high-performance brake systems and expand its market reach, especially in emerging markets.

- In January 2024, Hitachi Automotive Systems announced the launch of their new line of environmentally friendly brake systems designed to reduce particulate emissions from brakes. This product aims to meet the increasing demand for sustainable automotive components.

Report Scope

Report Features Description Market Value (2023) USD 39.2 Billion Forecast Revenue (2033) USD 65.1 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Disc Brakes, Drum Brakes), By Vehicle Type(Passenger Cars, Commercial Vehicles), By Technology (Anti-Lock Brake System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), Electronic Brake-Force Distribution (EBD)), By Sales Channel(Original Equipment Manufacturers, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advics Co. Ltd., ZF Friedrichshafen AG, Akebono Brake Industry Co., Hitachi Automotive System, Brembo SpA, Robert Bosh GmbH, Aisin Seiki Co. Ltd., Haldex AB, Web Co., Nissin Kogyo Co. Ltd., BWI Group, Mando Corporation, Continental AG, Batz Group, TE Connectivity, Cardollite Corporation, Kor-Pak Corporation, Pro-Tech Friction Group, Trimat Limited, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Brake Systems MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Brake Systems MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Advics Co. Ltd.

- ZF Friedrichshafen AG

- Akebono Brake Industry Co.

- Hitachi Automotive System

- Brembo SpA

- Robert Bosh GmbH

- Aisin Seiki Co. Ltd.

- Haldex AB

- Web Co.

- Nissin Kogyo Co. Ltd.

- BWI Group

- Mando Corporation

- Continental AG

- Batz Group

- TE Connectivity

- Cardollite Corporation

- Kor-Pak Corporation

- Pro-Tech Friction Group

- Trimat Limited

- Other Market Players