Global Biofuels Market By Type (Biodiesel, Ethanol, Bioethanol, Propanol, Butanol, Methanol, Biogas), By Form (Solid, Liquid, and Gaseous), By Feedstock Type (Palm Oil, Jatropha, Sugar Crop, Coarse Grain, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 48137

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

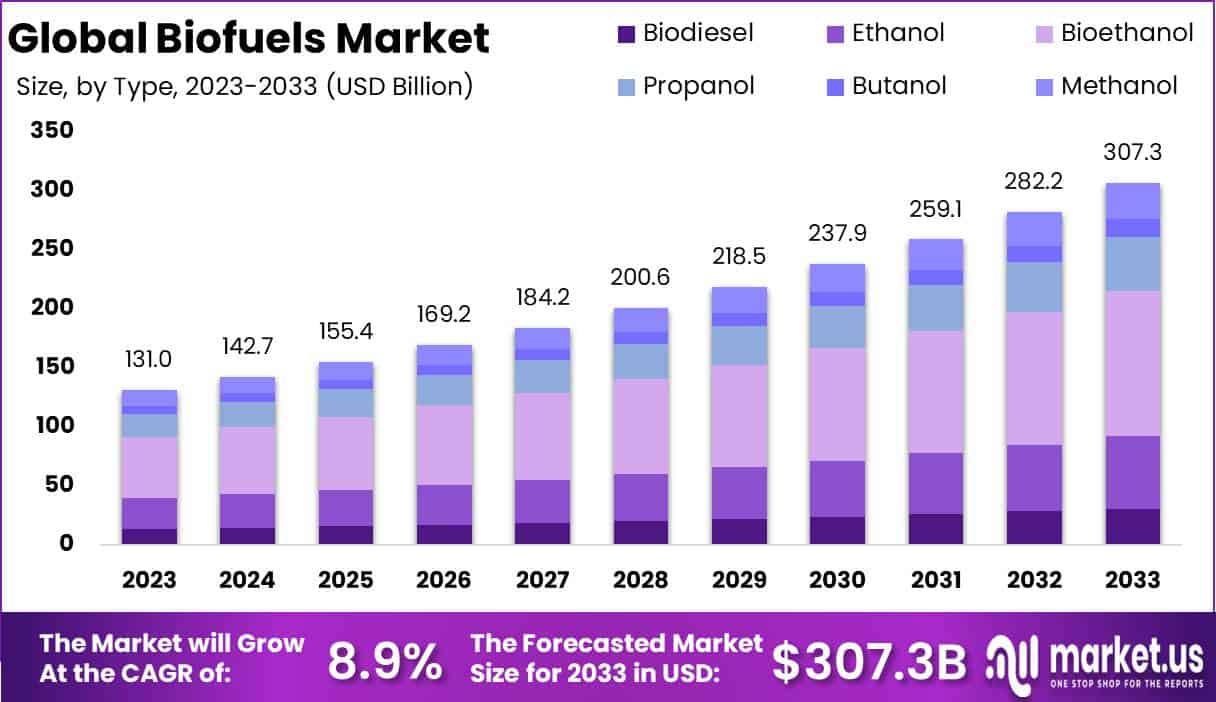

The Global Biofuels Market size is expected to be worth around USD 307.3 Billion by 2033 from USD 131.0 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

The biofuels market refers to the production and use of renewable fuels derived from organic materials, such as agricultural crops, waste, and algae. Biofuels, including ethanol, biodiesel, and advanced biofuels, are positioned as alternatives to conventional fossil fuels, contributing to energy security and reducing greenhouse gas emissions.

With growing global concerns around climate change and sustainability, the biofuels market is becoming a critical part of the renewable energy landscape, offering a cleaner and more sustainable fuel source for transportation, aviation, and industrial use.

Several key factors are driving growth in the biofuels market. Chief among them are government regulations and incentives aimed at reducing carbon emissions and promoting renewable energy.

Many countries have established blending mandates that require a certain percentage of biofuels in gasoline or diesel, creating a stable demand.

Additionally, technological advancements in biofuel production are enhancing efficiency and lowering costs, while increasing public awareness of environmental sustainability is boosting demand for cleaner alternatives to traditional fuels.

Demand for biofuels is expected to rise significantly over the coming years, fueled by increased adoption in the transportation sector, including road transport and aviation, which are under pressure to reduce their carbon footprints.

Rising oil prices and the volatility of the fossil fuel market are further encouraging industries to seek out more stable and environmentally friendly alternatives like biofuels. Moreover, the growing push for net-zero carbon targets, particularly in developed economies, will likely accelerate biofuel adoption.

The biofuels market presents considerable opportunities, particularly in the development of advanced biofuels those derived from non-food sources such as waste or algae.

As these technologies mature, they have the potential to overcome current limitations related to feedstock competition and land use concerns, making biofuels more scalable and sustainable.

Furthermore, there is significant opportunity in emerging markets where rising energy needs and environmental concerns are creating favorable conditions for biofuel investment and infrastructure development.

According to the International Energy Agency (IEA), biofuels play a pivotal role in the decarbonization of the transport sector, offering a low-carbon solution for both existing and emerging technologies.

In 2022, biofuel demand reached a record high of 4.3 EJ (170 billion liters), surpassing pre-pandemic levels. This surge highlights the sector’s resilience and growing relevance in the global energy mix, particularly in road transport.

However, achieving Net Zero Emissions (NZE) by 2050 requires significant scaling of biofuel production, projected to exceed 10 EJ by 2030. This implies an annual growth rate of 11%, driven by the need for advanced feedstocks biofuels derived from waste, residues, and non-food crops rising from a 9% share in 2021 to over 40% by 2030.

Countries like India, Brazil, and the U.S. are spearheading this growth through targeted policies and investments, reinforcing the biofuels market’s potential for rapid expansion in both developed and emerging economies.

Several key initiatives are advancing the market. India achieved a 10% ethanol blending target in 2022, ahead of schedule, as it moves towards 20% blending by 2025. Brazil plans to increase biodiesel blending to 15% by 2026, up from 10% in 2022, while the U.S. has committed $9.4 billion in biofuel support through its Inflation Reduction Act.

By 2030, biofuels could represent 9% of global transport energy demand, compared to 3.5% in 2022, with biojet fuel seeing the most dramatic growth, aiming to reach 10% of aviation fuel by 2030.

Despite this, challenges such as cost competitiveness, feedstock limitations, and regulatory clarity remain critical to ensuring biofuels’ scalability and long-term impact in the race towards decarbonization.

According to REN21, biofuels remain a key player in decarbonizing transportation, especially in 2023. Biofuels supplied over 3.5% of global transport energy, with demand continuing to rise, reaching 170 billion liters (4.3 EJ).

Ethanol production, which made up the largest share at 106 billion liters, and biodiesel at 45.1 billion liters, highlight biofuels’ dominant role in road transport. The production of sustainable aviation fuel (SAF), although still nascent, increased to 200 million liters in 2023, reflecting its growing importance in reducing aviation emissions.

The U.S. led global biofuel production with 70.7 billion liters in 2023, followed by Brazil and Indonesia. New mandates, such as India’s E12 blending target and Brazil’s planned increase to E30, are driving market expansion. To meet growing demand sustainably, the shift to advanced feedstocks like waste and residues is critical, as conventional sources like maize and sugar cane dominate current production.

According to Wikipedia, global biofuel demand is expected to grow by 56% from 2022 to 2027, with biofuels projected to supply 5.4% of global transport fuels by 2027, including 1% for aviation.

Brazil leads in bioethanol production, while the EU dominates biodiesel. Bioethanol production provides 2.2 EJ of energy per year, and biodiesel contributes 1.8 EJ. Despite aviation biofuel demand rising, some policies have been criticized for focusing more on ground transportation, which may slow broader adoption in aviation.

Key Takeaways

- The lobal biofuels market is projected to grow from USD 131.0 billion in 2023 to USD 307.3 billion by 2033, at a CAGR of 8.9%.

- Bioethanol leads the biofuels market with a 41.3% market share in 2023, driven by its widespread use in blending with gasoline, especially in the U.S. and Brazil.

- Liquid biofuels dominate the market with a 46% share, primarily due to their use in transportation and compatibility with existing engine infrastructure.

- Sugar crops dominate the feedstock segment, holding 41% of the market share in 2023, led by efficient ethanol production from sugarcane in Brazil.

- North America leads the global biofuels market with a 41.8% share, supported by favorable policies and strong agricultural supply chains, especially in the U.S.

- Asia-Pacific rapid industrialization and urbanization present significant growth potential, with India aiming for 20% ethanol blending by 2025.

- Restraining Factor: High production costs and limited scalability, especially for advanced biofuels, remain critical restraints that hinder the biofuels market’s competitive edge against fossil fuels.

By Type Analysis

Bioethanol Leads as the Dominating Segment with 41% Market Share in 2023

In 2023, Bioethanol held a dominant market position in the biofuels market, capturing more than 41.3% of the market share. This leadership is largely due to its widespread use in blending with gasoline, particularly in markets like Brazil and the United States, which are global leaders in bioethanol production.

The energy content of global bioethanol production reached 2.2 EJ per year, driven by its cost-effectiveness and high energy yield from feedstocks like maize and sugarcane.

Biodiesel followed closely, with significant market penetration, contributing 1.8 EJ annually. This segment is dominated by the EU, the largest producer, primarily using vegetable oils such as rapeseed and sunflower oil.

Methanol, Propanol, Butanol, and Biogas have smaller shares in the market, though their roles are growing, particularly in niche applications. Methanol and biogas are increasingly being explored for industrial applications, while butanol and propanol are gaining attention for their potential in advanced biofuel production due to higher energy densities and cleaner combustion profiles.

By Form Analysis

Liquid Leads as the Dominating Segment with 46% Market Share in 2023

In 2023, Liquid biofuels held a dominant market position in the biofuels market by form, capturing more than 46% of the total market share. This segment’s leadership is primarily driven by the widespread use of bioethanol and biodiesel in transportation, which are pivotal in meeting global renewable energy targets.

Liquid biofuels are favored for their compatibility with existing internal combustion engines and well-established distribution infrastructure, making them a crucial component in reducing greenhouse gas emissions across the transport sector.

Gaseous biofuels, including biogas and biomethane, accounted for a smaller share but are increasingly gaining traction, particularly in industrial applications and power generation due to their low emissions profile and potential for utilization in waste-to-energy processes.

Solid biofuels, such as wood pellets and biomass, held a more niche position, predominantly used in heating and electricity generation, and remained an important renewable energy source, though their market share was considerably smaller compared to liquid biofuels.

By Feedstock Type

Sugar Crop Leads as the Dominating Segment with 41% Market Share in 2023

In 2023, Sugar Crop held a dominant market position in the biofuels market by feedstock type, capturing more than 41% of the total market share. Sugarcane and sugar beet are key feedstocks in bioethanol production, with countries like Brazil driving the global demand for biofuels derived from sugar crops.

The efficiency of sugar-based biofuels, particularly in terms of higher ethanol yields per hectare, solidifies their leading role in the market.

Coarse Grains, including maize and corn, followed closely, contributing significantly to the production of bioethanol, particularly in the United States, which is one of the world’s largest producers of ethanol using maize as the primary feedstock.

Palm Oil and Jatropha are also prominent feedstocks for biodiesel, with palm oil especially dominant in Indonesia and Malaysia, which are leading global producers.

Meanwhile, the Others category, including waste oils and advanced feedstocks, is expanding as the market shifts toward more sustainable and non-food-based biofuels to reduce competition with food production.

Key Market Segments

Based on Type

- Biodiesel

- Ethanol

- Bioethanol

- Propanol

- Butanol

- Methanol

- Biogas

Based on Form

- Solid

- Liquid

- Gaseous

Based on Feedstock Type

- Palm Oil

- Jatropha

- Sugar Crop

- Coarse Grain

- Others

Driver

Rising Energy Demand and Energy Security

The growing global demand for energy and the need for greater energy security are significant drivers of the biofuels market. With global energy consumption projected to increase by over 20% by 2040, biofuels offer a renewable and domestically sourced alternative to traditional fossil fuels.

This is particularly critical in emerging markets like India and Indonesia, where energy consumption is rising rapidly alongside industrial growth and urbanization. Biofuels are increasingly seen as a way to reduce dependence on imported oil, which enhances national energy security and reduces exposure to volatile oil prices.

In regions with substantial agricultural resources, such as Brazil and the U.S., biofuels allow for the conversion of locally grown feedstocks like sugarcane and corn into fuel, supporting both economic development and energy independence.

As fossil fuel supplies become more uncertain and environmental concerns grow, countries are shifting toward biofuels to balance energy needs with sustainability goals. This shift is particularly crucial in the transportation sector, where biofuels serve as a direct substitute for gasoline and diesel, providing a sustainable pathway to meet rising energy demands.

Restraint

High Production Costs and Limited Scalability

High production costs and limited scalability are critical restraint factors in the biofuels market, directly inhibiting its growth potential. Biofuel production, especially from advanced sources such as cellulosic or algae-based biofuels, requires significant capital investment in both infrastructure and technology.

For instance, the extraction and conversion processes for these biofuels involve complex biochemical reactions and expensive feedstock, which drive up overall production costs. According to industry reports, the cost of producing second-generation biofuels can be two to five times higher than conventional fuels, depending on the technology and scale of production.

These elevated costs restrict the ability of biofuel producers to compete with cheaper fossil fuels, particularly in markets where fossil fuel subsidies or low-cost extraction methods exist.

Furthermore, the scalability issue exacerbates these cost challenges, as many biofuel production facilities operate below optimal capacity, unable to achieve economies of scale. This is often due to the fragmented supply of biomass feedstock or regional limitations in biomass production.

Limited scalability also affects investment inflows into the sector, as investors are hesitant to commit large capital resources to a market that faces uncertainties around cost reduction and technological advancements.

The lack of mature supply chains and the capital-intensive nature of biofuel production further hinder the transition from pilot projects to commercial-scale operations, constraining the market’s growth trajectory.

Opportunity

Advances in Synthetic Biology

In 2024, the global biofuels market is poised for significant growth, driven by breakthroughs in synthetic biology. Synthetic biology has rapidly advanced over the past few years, enabling the development of genetically engineered organisms that can efficiently convert non-food biomass, such as agricultural waste, into biofuels.

This innovation is crucial as it addresses two key industry challenges: reducing reliance on food-based feedstocks and enhancing the overall yield of biofuel production.

Recent advancements have led to engineered microbes capable of producing higher yields of ethanol and biodiesel, reducing production costs and improving scalability.

For example, customized microorganisms can now be designed to target specific metabolic pathways, increasing the efficiency of converting sugars, lipids, and lignocellulosic material into fuel. This not only makes biofuel production more sustainable but also more competitive with fossil fuels in terms of cost.

Moreover, synthetic biology’s ability to develop biofuels from diverse, low-cost feedstocks creates a significant opportunity for regions with abundant agricultural residues or waste materials. Governments are likely to support such innovations through favorable policies aimed at reducing carbon emissions, further driving the adoption of biofuels globally.

Trends

Diversification of Feedstocks

In 2024, one of the most impactful trends in the global biofuels market will be the diversification of feedstocks. Historically, biofuel production has heavily relied on food-based crops such as corn, sugarcane, and soybeans, raising concerns over food security and land use.

However, emerging technologies are enabling the use of alternative, non-food feedstocks, including agricultural residues, waste oils, algae, and lignocellulosic biomass.

This shift toward more sustainable sources of biofuel is crucial for addressing both environmental and supply chain concerns. By expanding the range of feedstocks, producers can reduce competition with food crops and improve the environmental footprint of biofuel production.

Agricultural residues, for example, offer a low-cost and abundant resource that not only reduces waste but also adds value to existing agricultural practices. Similarly, algae are emerging as a promising feedstock due to their high oil yield per hectare and ability to grow in a variety of environments, including non-arable land.

Diversifying feedstocks also helps biofuel producers mitigate risk related to supply volatility and price fluctuations of traditional feedstocks. Governments and industry players are increasingly prioritizing research and development to scale up the use of these alternatives, driven by regulatory pressure to decarbonize the energy sector.

Regional Analysis

North America Dominates Global Biofuels Market with 41.8% Share

The global biofuels market demonstrates regional diversity in terms of production, consumption, and regulatory frameworks. North America leads the market, accounting for 41.8% of the global share, with a market value of approximately USD 50.3 billion.

The region’s dominance is driven by favorable government policies, particularly in the U.S., such as the Renewable Fuel Standard (RFS) program, and a robust agricultural sector that provides ample feedstock for biofuel production, particularly ethanol and biodiesel. The U.S. and Canada also benefit from advanced technological infrastructure, which supports biofuel innovation.

Europe follows closely, driven by stringent environmental regulations such as the Renewable Energy Directive (RED), which mandates increased usage of renewable energy sources, including biofuels, in transportation.

Countries like Germany, France, and the Netherlands are leading players in this region, focusing on reducing carbon emissions through increased biofuel adoption. The region is also heavily investing in advanced biofuels such as bioethanol and biodiesel, with an emphasis on second-generation biofuels.

In the Asia Pacific region, rapid industrialization and urbanization are fueling the demand for alternative fuels, making it a key emerging market for biofuels.

Countries such as China, India, and Indonesia are scaling up biofuel production to reduce their reliance on fossil fuels. For instance, India’s National Biofuel Policy aims to achieve 20% ethanol blending in petrol by 2025, while Indonesia is one of the world’s largest biodiesel producers due to its abundant palm oil resources.

Latin America is another significant market, particularly in Brazil, which has a well-established ethanol production industry based on sugarcane. Brazil’s Proálcool Program and high ethanol consumption have made it a leader in biofuels. The region’s favorable climatic conditions and large agricultural base support its biofuel production, particularly for ethanol.

The Middle East & Africa, though lagging in biofuel production compared to other regions, shows potential due to growing interest in diversifying energy sources.

South Africa and some Gulf Cooperation Council (GCC) countries are beginning to explore biofuel initiatives, driven by both economic and environmental considerations, as part of broader renewable energy strategies. However, market penetration remains lower compared to the other regions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global biofuels market is shaped by key players that are driving innovation, production capacity, and market expansion through strategic investments and technological advancements.

Among these, Neste Nederland BV stands out as a leader in renewable diesel production, leveraging its advanced refining technology and commitment to sustainability.

Similarly, Renewable Energy Group, Inc. (REG) and Archer Daniels Midland Company (ADM) continue to play pivotal roles in biodiesel and ethanol production, benefiting from strong agricultural supply chains in North America.

Chevron and Valero Energy Corporation, two major energy conglomerates, are increasingly focusing on expanding their renewable energy portfolios through significant investments in biofuels, aligning with global decarbonization efforts. This strategic shift is particularly evident in Chevron’s growing presence in sustainable aviation fuel (SAF).

European companies like CropEnergies AG and Gruppo Marseglia are instrumental in promoting bioethanol as an alternative energy source across Europe, driven by the region’s stringent environmental regulations.

Additionally, Louis Dreyfus Company and Bunge Limited, global agribusiness giants, are well-positioned to benefit from increased demand for biofuel feedstocks.

In Asia, companies such as China Clean Energy Inc. are capitalizing on government policies promoting biofuels as part of the broader push towards cleaner energy in the region.

New entrants like Advanced Biofuel Solutions Ltd. and Evergreen Biofuels Holding Sdn Bhd are also contributing to innovation in waste-to-energy technologies, adding to the market’s diversity.

Overall, these key players are critical to the market’s continued growth, focusing on sustainability, scalability, and innovation in renewable energy solutions

Top Key Players in the Market

- Biofuels Digest.

- Neste Nederland BV.

- Infinita Biotech Private Limited.

- Gruppo Marseglia

- Glencore

- Louis Dreyfus Company

- Chevron

- RB FUELS

- Ag Processing Inc.

- Elevance Health.

- Marathon Petroleum Corporation

- Evergreen Biofuels Holding Sdn Bhd

- Minnesota Soybean Processors

- Crop Energies AG

- ENF Ltd.

- Abengoa Bioenergy S.A.

- Renewable Energy Group, Inc.

- Archer Daniels Midland Company

- Valero Energy Corporation

- Advanced Biofuel Solutions Ltd.

- Bunge Limited

- China Clean Energy Inc.

- Other key players

Recent Developments

- In 2024, Trafigura Group Pte Ltd, a global leader in commodities trading and logistics, successfully completed the acquisition of Greenergy’s European and Canadian supply businesses. Greenergy, a major UK-based road fuel supplier and biodiesel producer, had previously owned these businesses through Brookfield Asset Management and its affiliate, Brookfield Business Partners. This acquisition strengthens Trafigura’s presence in the European and Canadian energy markets, aligning with the company’s strategy to expand its supply capabilities and enhance its position in the global energy sector.

- On August 16, 2024, marking the second anniversary of President Biden’s Inflation Reduction Act, U.S. Department of Agriculture (USDA) Secretary Tom Vilsack announced funding for 160 clean energy projects across 26 states. These projects aim to boost domestic biofuel production, provide new opportunities for U.S. farmers and agricultural producers, and support America’s energy security. The initiative is part of the administration’s broader efforts to grow the economy and invest in clean energy.

- In 2023, HF Sinclair Corporation completed the acquisition of all outstanding common units of Holly Energy Partners, L.P. (HEP) not already owned by HF Sinclair. This transaction, which involved a combination of HF Sinclair stock and cash, further consolidates HF Sinclair’s ownership of HEP and strengthens its position in the energy infrastructure sector.

Report Scope

Report Features Description Market Value (2023) US$ 131.0 Bn Forecast Revenue (2033) US$ 307.3 Bn CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Biodiesel, Ethanol, Bioethanol, Propanol, Butanol, Methanol, and Biogas; By Form- Solid, Liquid, and Gaseous; By Feedstock Type- Palm Oil, Jatropha, Sugar Crop, Coarse Grain, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Biofuels Digest, Nestle Nederland B.V, Infinita, Biotech Private Limited, Gruppo Marseglia, Glencore, Louis Dreyfus Company, Chevron, RB FUELS, Elevance Health, Marathon Petroleum Corporation, Evergreen Biofuels, Holding Sdn Bhd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Biofuels Digest.

- Neste Nederland BV.

- Infinita Biotech Private Limited.

- Gruppo Marseglia

- Glencore

- Louis Dreyfus Company

- Chevron

- RB FUELS

- Ag Processing Inc.

- Elevance Health.

- Marathon Petroleum Corporation

- Evergreen Biofuels Holding Sdn Bhd

- Minnesota Soybean Processors

- Crop Energies AG

- ENF Ltd.

- Abengoa Bioenergy S.A.

- Renewable Energy Group, Inc.

- Archer Daniels Midland Company

- Valero Energy Corporation

- Advanced Biofuel Solutions Ltd.

- Bunge Limited

- China Clean Energy Inc.

- Other key players