Global Automotive AI Processor Market Size, Share and Analysis Report By Processor Type (Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application-specific Integrated Circuit (ASIC), Field Programmable Gate Array (FPGA), System on Chip (SoC), Others), By Application (ADAS, Autonomous Driving, Infotainment Systems, Telematics, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), By Technology (Deep Learning, Machine Learning, Computer Vision, Others), By End-User (OEMs, Aftermarket), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175165

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insight Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Processor Type Analysis

- Application Analysis

- Vehicle Type Analysis

- Technology Analysis

- End-User Analysis

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Investment Opportunities

- Business Benefits

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

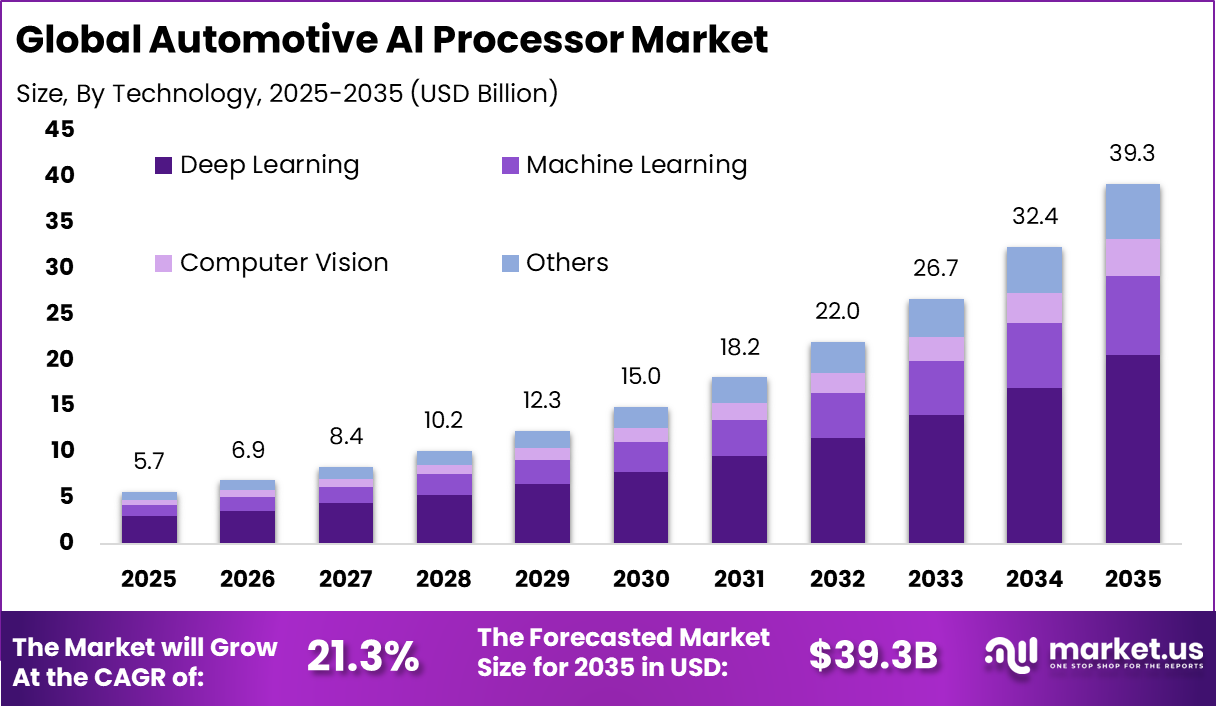

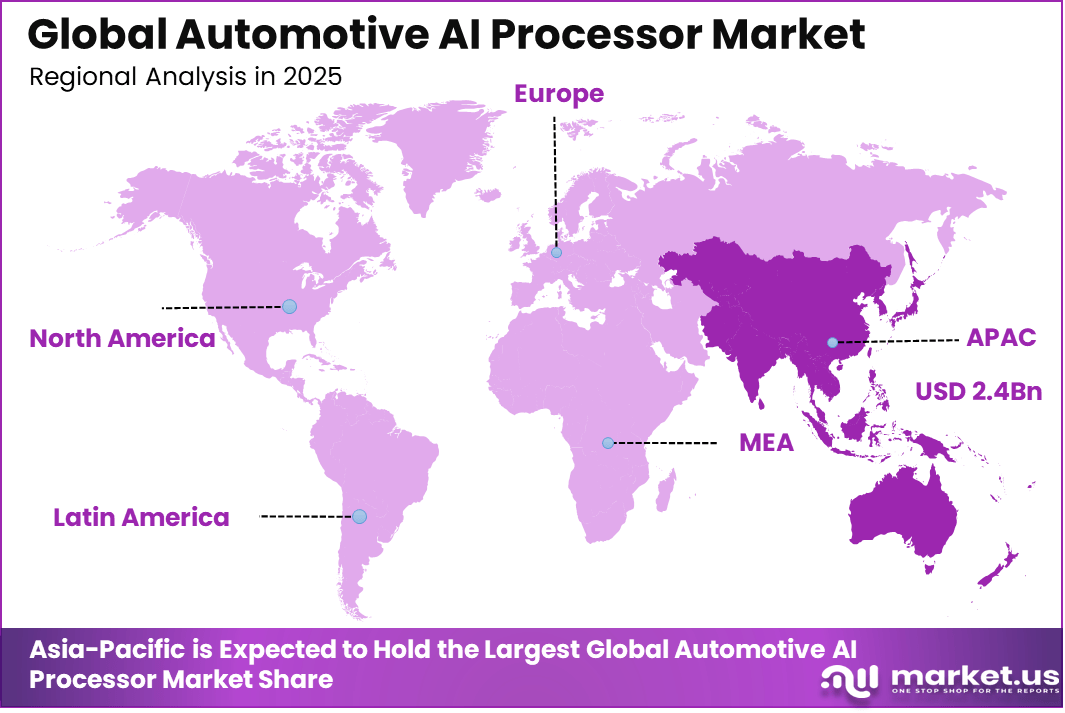

The Global Automotive AI Processor Market size is expected to be worth around USD 39.3 Billion By 2035, from USD 5.7 billion in 2025, growing at a CAGR of 21.3% during the forecast period from 2026 to 2035. Asia-Pacific held a dominan Market position, capturing more than a 42.6% share, holding USD 2.4 Billion revenue.

The automotive AI processor market refers to specialized computing units designed to power artificial intelligence applications in vehicles. These processors handle complex tasks such as autonomous driving, driver assistance, vehicle navigation, and predictive maintenance. Automotive AI processors are used to process large volumes of sensor data, including inputs from cameras, radar, LiDAR, and other sensors.

The adoption of these processors supports advanced driver assistance systems (ADAS), infotainment systems, and increasingly autonomous vehicles. Market development has been influenced by the growing demand for safer, smarter, and more efficient vehicles. As the automotive industry shifts toward electrification and automation, the need for AI-powered solutions to enhance vehicle performance increases.

One major driving factor of the automotive AI processor market is the increasing development of autonomous vehicles. Self-driving cars require high-performance processors to process real-time data from a variety of sensors and make decisions without human intervention. AI processors enable vehicles to analyze their surroundings, detect obstacles, and follow driving regulations in real-time. The demand for autonomous vehicles drives adoption of these advanced processors.

Demand for automotive AI processors is influenced by the rapid development of electric vehicles (EVs) and autonomous vehicle technology. As automakers push toward more advanced, fully autonomous systems, AI processors are needed to support the growing complexity of these features. EVs with advanced driver assistance systems require processors that can handle the increasing amounts of data and power demands. The shift toward electrification and automation supports growing demand.

Top Market Takeaways

- System on Chip (SoC) processors led the automotive AI processor market with a 40.7% share.

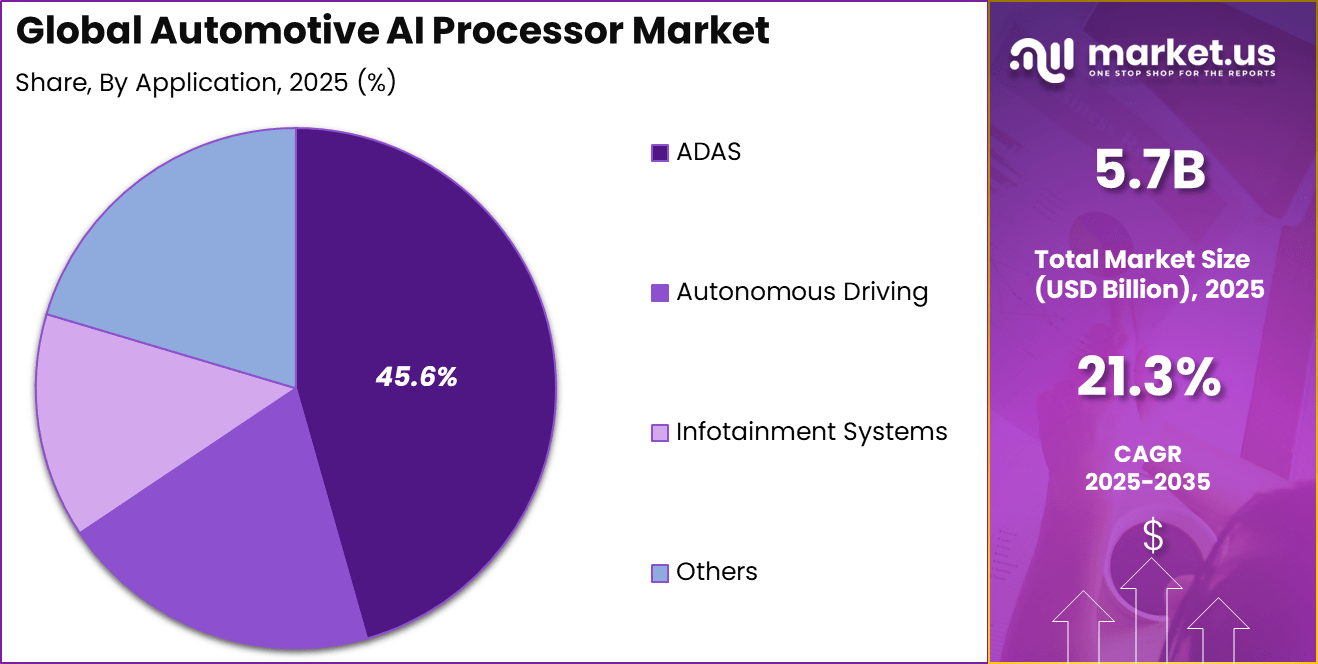

- Advanced Driver Assistance Systems (ADAS) accounted for 45.6% of the market, reflecting the growing demand for safety features.

- Passenger cars dominated vehicle type adoption, capturing 70.3% of the market.

- Deep learning technology led with a 52.5% share, supporting advanced AI capabilities in automotive systems.

- OEMs (Original Equipment Manufacturers) were the primary end-users, accounting for 95.2% of the market.

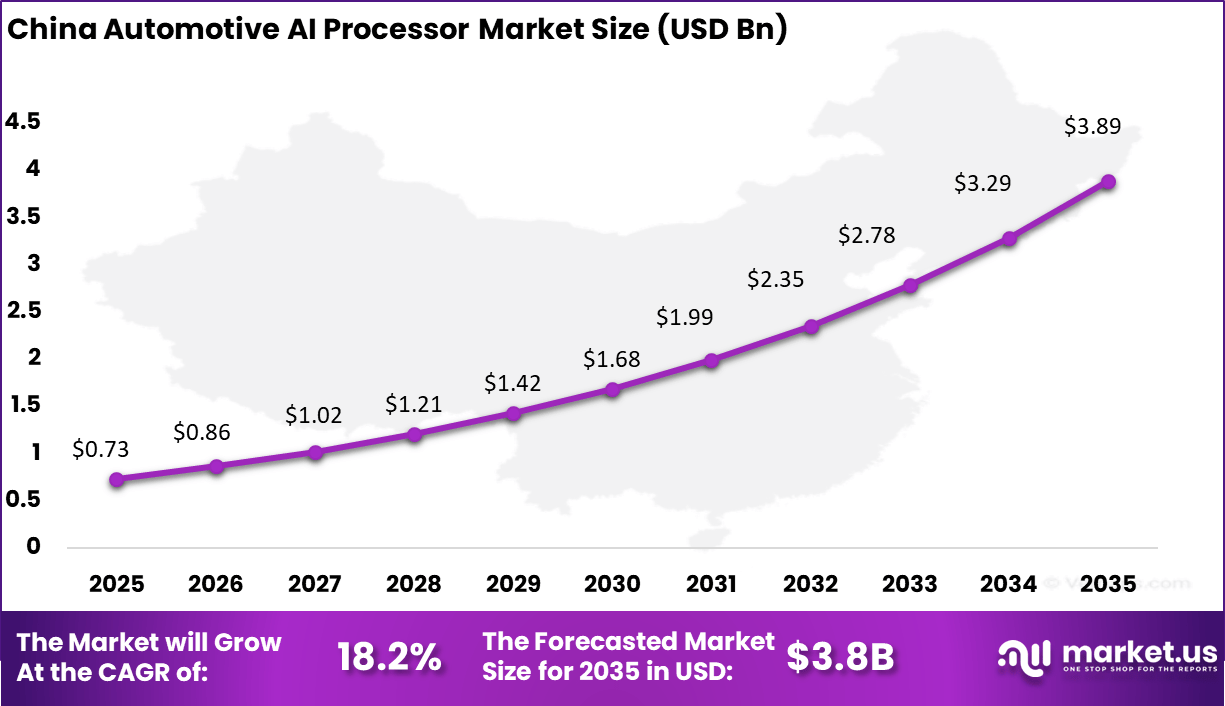

- The Asia-Pacific region held a 42.6% market share, with China contributing USD 0.73 billion, growing at a CAGR of 18.2%.

Key Insight Summary

- OEM Implementation: By 2026, around 43% of OEMs are implementing AI at scale or selectively within their operations.

- SDV Prioritization: About 45% of automotive OEMs and suppliers have identified the transition to software-defined vehicles (SDV) as their top strategic priority for 2026.

- ADAS Dominance: Advanced Driver Assistance Systems (ADAS) features, such as automatic braking and lane-keeping, hold the largest application share at approximately 58.7% to 59%.

- Telematics Growth: Telematics is the fastest-growing application segment, with a projected CAGR of 33.8%.

- Autonomy Levels:

- Level 2 (Partial Autonomy): Remains the most widely adopted tier, especially in mid-range and premium vehicles.

- Level 3 (Conditional Autonomy): Expected to be the fastest-growing autonomy segment from 2025 to 2030.

- Manufacturing Efficiency: OEMs utilizing AI for quality assurance and predictive maintenance have seen a 50% improvement in “first-time right” product yields.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growing demand for autonomous driving AI processors enabling vehicle autonomy ~7.3% Global Short Term Increase in ADAS adoption Enhanced vehicle safety and convenience ~6.1% North America, Europe Short Term Development of electric vehicles (EVs) AI processors integrating with EV systems ~5.5% Global Mid Term Advancements in deep learning High performance computing for driving assistance ~4.3% Global Mid Term Regulatory support for vehicle safety ADAS mandated by safety standards ~3.9% North America, Europe Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High cost of AI processors Premium pricing of advanced chips for vehicles ~5.0% Emerging Markets Short to Mid Term Data privacy concerns Use of AI processors for real time surveillance ~4.2% Europe, North America Short Term Integration complexity Aligning AI processors with existing vehicle architectures ~3.8% Global Mid Term Dependence on semiconductors Global semiconductor shortages affecting production ~2.7% Global Mid to Long Term Regulatory delays Inconsistent regulations across regions ~2.1% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High hardware cost Premium cost of AI processors for vehicles ~6.4% Emerging Markets Short to Mid Term Skill shortages Lack of expertise in AI chip design ~5.1% Global Mid Term Safety certification delays Long approval processes for new vehicle technologies ~4.3% North America, Europe Mid Term Limited availability of data Insufficient training data for deep learning models ~3.6% Global Long Term Complexity in integration Challenges in embedding AI into legacy vehicle systems ~2.8% Global Long Term Processor Type Analysis

System on Chip processors account for 40.7% of the automotive AI processor market, reflecting their importance in vehicle computing architectures. SoCs integrate multiple processing functions such as CPU, GPU, and AI accelerators onto a single chip. This integration supports compact design and efficient power consumption. Automotive manufacturers prefer SoCs for their ability to handle complex AI workloads within limited space.

These processors support real-time data processing from cameras, sensors, and radar systems. This improves responsiveness in safety-critical applications. As vehicle electronics become more centralized, SoC adoption continues to rise. Ongoing improvements in processing efficiency enhance performance. This keeps SoCs as a leading processor type in the market.

Application Analysis

ADAS accounts for 45.6% of application demand, making it the largest application segment. AI processors enable functions such as lane detection, adaptive cruise control, and collision avoidance. These features rely on fast and accurate data processing. AI-driven ADAS systems process sensor inputs in real time to support driving decisions.

Deep learning models enhance object recognition and environment understanding. This improves vehicle safety and driver assistance reliability. As safety regulations become stricter, ADAS adoption continues to grow. AI processors play a critical role in enabling these systems. This sustains strong demand in this application segment.

Vehicle Type Analysis

Passenger cars represent 70.3% of market demand, reflecting high production volumes and consumer demand for smart features. Automakers integrate AI processors to enhance safety, comfort, and infotainment. These processors support advanced driver assistance and in-cabin intelligence. The adoption of AI in passenger cars improves driving experience and operational safety.

Features such as driver monitoring and parking assistance rely on AI processing. This supports wider market penetration. As consumer expectations increase, automakers continue to add intelligent features. Passenger cars remain the primary vehicle type driving market growth.

Technology Analysis

Deep learning accounts for 52.5% of technology adoption, highlighting its importance in automotive AI systems. Deep neural networks enable accurate perception and decision making. These models are well suited for complex driving environments. AI processors optimized for deep learning handle large data volumes efficiently.

This supports object detection, classification, and predictive analysis. Improved model performance enhances driving safety. As model complexity increases, demand for deep learning acceleration grows. Automotive AI processors continue to evolve to support these workloads. This technology segment remains dominant.

End-User Analysis

OEMs represent 95.2% of end-user demand, indicating strong direct adoption by vehicle manufacturers. OEMs integrate AI processors during vehicle design and production stages. This ensures seamless system compatibility and performance optimization. Direct integration allows OEMs to control system architecture and functionality.

AI processors support brand-specific safety and automation features. This strengthens product differentiation. As automakers invest in intelligent vehicle platforms, OEM adoption remains high. Their influence shapes market direction. OEMs continue to dominate end-user demand.

Regional Analysis

Asia-Pacific holds a 42.6% share of the automotive AI processor market, supported by strong automotive manufacturing activity. The region benefits from rapid adoption of smart vehicle technologies. Government support for intelligent mobility also plays a role.

China contributes USD 0.73 billion in market value, driven by large-scale vehicle production and AI integration. Automakers in the country focus on advanced safety and automation features. AI processors support these initiatives. A CAGR of 18.2% reflects steady growth across the region. Rising demand for intelligent vehicles supports expansion. Asia-Pacific remains a key region for automotive AI processor development.

Driver Analysis

The automotive AI processor market is being driven by the widespread integration of artificial intelligence into vehicle systems that support advanced driver assistance, autonomous driving, in‑cab intelligence, and connectivity features. AI processors enable real‑time data processing from cameras, radar, lidar, and in‑vehicle sensors to support perception, decision making, and control functions with high reliability and low latency.

As vehicle architectures evolve toward software‑defined platforms and electrification, demand for high‑performance, energy‑efficient processing units that can handle complex AI workloads continues to increase. This trend is reinforced by consumer expectations for safer, more responsive, and personalised driving experiences.

Restraint Analysis

A significant restraint in the automotive AI processor market relates to stringent safety, reliability, and certification requirements that automotive applications demand. Processors deployed in safety‑critical functions such as collision avoidance and lane‑keeping assistance must meet rigorous automotive standards and undergo extensive validation, which can extend development cycles and increase costs.

In addition, automotive environments impose thermal, power, and longevity constraints that complicate the design and qualification of advanced AI silicon. These regulatory and engineering requirements can deter rapid integration of cutting‑edge processor technologies compared with consumer sectors.

Opportunity Analysis

Emerging opportunities in the automotive AI processor market are linked to the expanding ecosystem of software‑defined vehicles, cloud‑connected services, and personalised in‑vehicle experiences. AI processors that support natural language interaction, driver monitoring, adaptive cruise control, and predictive maintenance can unlock new value streams for vehicle manufacturers and mobility service providers.

There is also opportunity in zonal and distributed compute architectures that allocate specialised AI processing close to sensor inputs to improve response times and power efficiency. Segment‑specific solutions tailored for electric vehicles, autonomous shuttles, and fleet management systems further broaden addressable use cases.

Challenge Analysis

A central challenge confronting this market involves balancing peak performance with energy efficiency and cost effectiveness. High computational demands for perception and planning tasks can lead to elevated power consumption and heat generation, which are critical considerations in automotive platforms where energy budgets and thermal management are constrained.

Achieving optimal trade‑offs between processing throughput, silicon complexity, and vehicle design constraints requires deep co‑design of hardware, software, and system architecture. Additionally, ensuring consistent performance across varied operating conditions and software updates demands robust validation and lifecycle support.

Emerging Trends

Emerging trends in the automotive AI processor landscape include the adoption of heterogeneous computing architectures that combine central AI cores with specialised accelerators for vision, sensor fusion, and neural network inference.

Another trend is increased integration of edge AI capabilities that reduce dependence on external connectivity and support high‑assurance, low‑latency processing for safety‑critical functions. There is also growing momentum toward scalable compute platforms that can upgrade through software over time, enabling vehicles to support evolving AI models and expanded feature sets without hardware replacement.

Growth Factors

Growth in the automotive AI processor market is supported by advancements in sensor technologies, connectivity standards, and data analytics frameworks that generate richer real‑time inputs and drive computational demand. Expanding research and development in autonomous driving levels, from advanced driver assistance to conditional autonomy, reinforces investment in sophisticated AI silicon.

Consumer demand for intelligent in‑vehicle experiences, enhanced safety features, and seamless interaction models further amplifies the need for robust AI processing capabilities. As vehicles become increasingly software defined and data rich, AI processors remain central to delivering performance, reliability, and next‑generation mobility features.

Investment Opportunities

Investment opportunities in the automotive AI processor market exist in autonomous driving and advanced safety systems. As autonomous vehicle technology advances, automakers and tech companies are investing in AI processors that can handle the massive amounts of sensor data required for self-driving functions. AI processors optimized for autonomous driving are poised for growth as the industry moves closer to fully autonomous vehicles.

Another opportunity lies in the integration of AI processors in electric vehicles (EVs). As EV adoption grows, the need for AI-powered features such as energy management, autonomous charging, and smart routing increases. AI processors in EVs help optimize performance, reduce energy consumption, and improve battery management. This growing focus on smart, connected EVs offers a significant investment opportunity.

Business Benefits

Automotive AI processors improve operational efficiency by enabling faster and more accurate decision-making in vehicles. This enhances the functionality of advanced driver assistance systems (ADAS), reducing the likelihood of accidents and improving safety. Streamlining decision-making reduces reliance on manual control and allows for smoother, more autonomous vehicle operation.

These processors also enhance the overall customer experience by supporting smart features such as personalized driving preferences, in-vehicle entertainment, and predictive maintenance. AI processors help improve vehicle efficiency, reduce wear and tear, and provide real-time diagnostics. These features contribute to better user satisfaction, longer vehicle lifespans, and more seamless ownership experiences.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior OEMs Very High ~95.2% Safety, efficiency, and vehicle autonomy Long term contracts and R and D Tier 1 Suppliers High ~2.3% Integration of AI processors in vehicle systems Strategic partnerships Automotive startups Moderate ~1.5% New vehicle models with integrated AI Innovation driven funding Venture Capitalists Moderate ~1.0% Investment in emerging AI driven vehicle technologies Early stage investments Regulatory bodies Low ~0.5% Safety standards enforcement Policy formulation and oversight Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status AI and machine learning Real time decision making for vehicle assistance ~7.1% Growing Deep learning processors High performance neural networks for autonomous driving ~6.2% Growing System on Chip (SoC) solutions Compact and efficient AI chip designs for vehicles ~5.3% Mature Cloud computing for data storage Scalable infrastructure for vehicle data processing ~4.1% Mature LiDAR and sensor integration Enhanced situational awareness for ADAS ~3.5% Developing Key Market Segments

By Processor Type

- Graphics Processing Unit (GPU)

- Central Processing Unit (CPU)

- Application-specific Integrated Circuit (ASIC)

- Field Programmable Gate Array (FPGA)

- System on Chip (SoC)

- Others

By Application

- ADAS

- Autonomous Driving

- Infotainment Systems

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

By Technology

- Deep Learning

- Machine Learning

- Computer Vision

- Others

By End-User

- OEMs

- Aftermarket

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading technology and automotive suppliers such as NVIDIA Corporation, Mobileye, and Qualcomm Technologies Inc. dominate high-performance AI processors for ADAS and autonomous driving. Their processors support perception, sensor fusion, and real-time decision making. Strong software stacks and developer ecosystems enhance adoption. These players benefit from early partnerships with global automakers.

Traditional automotive Tier-1 suppliers such as Robert Bosch, Continental, and Aptiv integrate AI processors into complete vehicle platforms. Huawei Technologies and Baidu play a strong role in the China market. Their focus remains on system-level integration, safety certification, and scalability. These companies address OEM demand for reliable and regulation-ready AI hardware solutions.

Semiconductor focused players such as Intel Corporation, Renesas Electronics Corporation, NXP Semiconductors, and Texas Instruments Inc. support mid-range and safety-critical applications. Advanced Micro Devices Inc. and Arm Holdings Plc enable scalable AI architectures. Tesla Inc. advances in-house AI processors for full self-driving. Other players expand competition and regional innovation.

Top Key Players in the Market

- Aptiv

- Baidu

- Continental

- Horizon Robotics

- Huawei Technologies

- Mobileye (Intel)

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Robert Bosch

- Tesla Inc.

- Intel Corporation

- Renesas Electronics Corporation

- NXP Semiconductors

- Texas Instruments Inc.

- Advanced Micro Devices Inc.

- Arm Holdings Plc

- Others

Recent Developments

- In April 2025, Horizon Robotics and Bosch signed a Memorandum of Understanding (MOU) to advance their collaboration on smart driving technologies. The partnership aims to combine Horizon’s AI processors with Bosch’s automotive solutions, focusing on enhancing Advanced Driver Assistance Systems (ADAS) and autonomous driving features.

- In September 2025, Huawei introduced a new partnership model with automakers, offering them greater control over vehicle design and innovation. This strategy allows automakers to align their vehicle development with regulatory requirements while incorporating Huawei’s AI technologies to meet market demands and consumer expectations.

- Also in September 2025, Qualcomm partnered with Harman to integrate Qualcomm’s Snapdragon Cockpit Elite platforms into Harman’s automotive product line. This collaboration enhances AI functionality in vehicles, offering advanced in-car experiences.

Report Scope

Report Features Description Market Value (2025) USD 5.7 Bn Forecast Revenue (2035) USD 39.3 Bn CAGR(2026-2035) 21.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Processor Type (Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application-specific Integrated Circuit (ASIC), Field Programmable Gate Array (FPGA), System on Chip (SoC), Others), By Application (ADAS, Autonomous Driving, Infotainment Systems, Telematics, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), By Technology (Deep Learning, Machine Learning, Computer Vision, Others), By End-User (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aptiv, Baidu, Continental, Horizon Robotics, Huawei Technologies, Mobileye (Intel), NVIDIA Corporation, Qualcomm Technologies Inc., Robert Bosch, Tesla Inc., Intel Corporation, Renesas Electronics Corporation, NXP Semiconductors, Texas Instruments Inc., Advanced Micro Devices Inc., Arm Holdings Plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive AI Processor MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive AI Processor MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Aptiv

- Baidu

- Continental

- Horizon Robotics

- Huawei Technologies

- Mobileye (Intel)

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Robert Bosch

- Tesla Inc.

- Intel Corporation

- Renesas Electronics Corporation

- NXP Semiconductors

- Texas Instruments Inc.

- Advanced Micro Devices Inc.

- Arm Holdings Plc

- Others