Global Automatic Emergency Braking Market by Product (Low-Speed AEBS and High-Speed AEBS), By Technology (Crash Imminent Braking, Dynamic Brake Support, and Forward Collision Warning), By Vehicle Type (Passenger Vehicle and Commercial Vehicle), By Brake(Disc,Drum), By Type(Low-Speed AEB System, High-speed AEB System, Pedestrians AEB Systems), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 104132

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

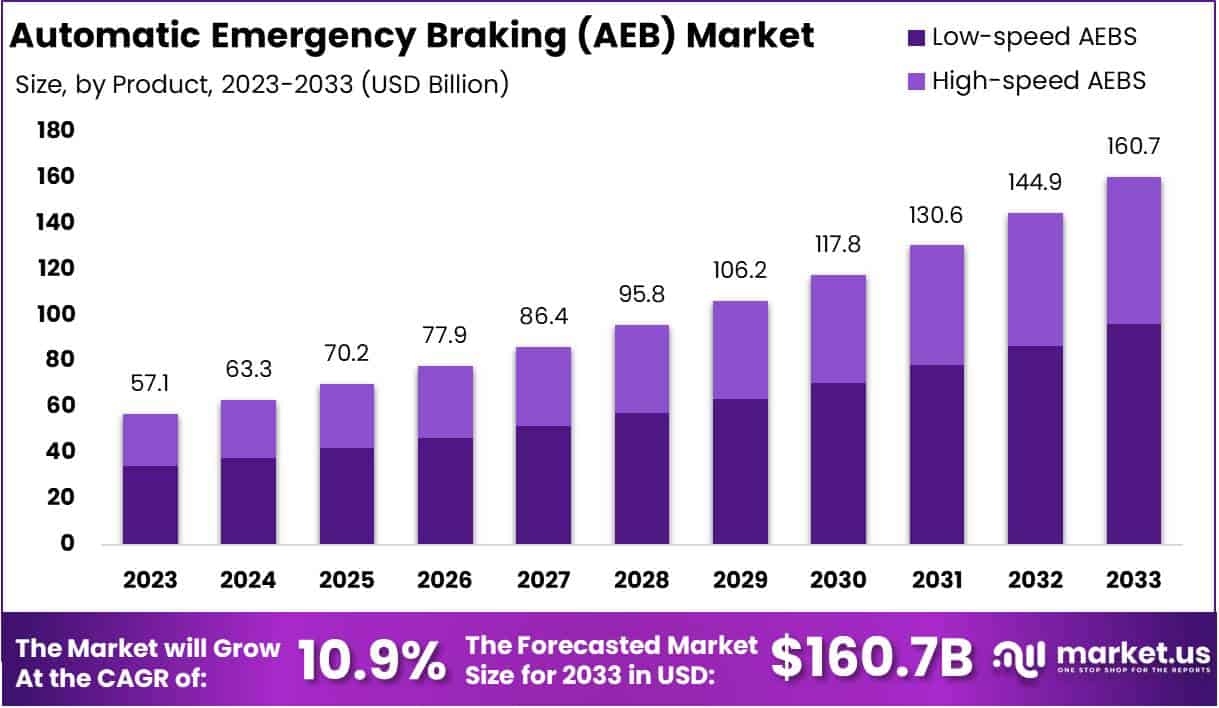

The Global Automatic Emergency Braking (AEB) Market size is expected to be worth around USD 160.7 Billion by 2033, From USD 57.1 Billion by 2023, growing at a CAGR of 10.9% during the forecast period from 2023 to 2033.

The Automatic Emergency Braking (AEB) market encompasses the development, manufacturing, and integration of braking systems designed to automatically apply brakes to prevent or mitigate collisions. These systems use sensors like radar, cameras, and lidar to detect obstacles and evaluate the risk of collisions, enabling vehicles to autonomously initiate braking actions.

AEB technology has become a critical component in advanced driver assistance systems (ADAS) and is increasingly being integrated into vehicles to enhance road safety. The market includes a wide range of stakeholders, from automotive OEMs to technology providers and regulatory bodies, all working towards the widespread adoption and enhancement of AEB capabilities.

Several key factors are driving the growth of the AEB market. A primary driver is the increasing emphasis on vehicle safety regulations by governments and safety organizations worldwide.

Many countries are mandating the integration of AEB systems in new vehicles, aiming to reduce traffic accidents and fatalities.Additionally, consumer demand for safer vehicles has pushed automotive manufacturers to incorporate AEB as a standard or optional feature.

Technological advancements in sensor technologies and artificial intelligence are further enabling more accurate and responsive AEB systems, which has led to greater adoption across different vehicle segments. The rise of electric and autonomous vehicles also complements the demand for AEB, as these vehicles rely heavily on advanced safety features to ensure seamless operation.

AEB systems is being driven by both regulatory pressures and shifting consumer preferences towards advanced safety features. In mature markets like North America and Europe, regulatory frameworks require new vehicles to include AEB systems, leading to widespread adoption.

In contrast, emerging markets such as Asia-Pacific are witnessing a gradual increase in AEB adoption, driven by rising awareness about road safety and increasing disposable incomes that allow consumers to invest in higher-end vehicle safety features.

The integration of AEB systems into a broader range of vehicles, from luxury models to mid-range and even entry-level cars, is further expanding the market’s reach.

The AEB market presents substantial growth opportunities, particularly in the development of next-generation AEB systems that integrate with other advanced driver-assistance systems (ADAS).

Enhanced systems that combine AEB with features like lane-keeping assist and adaptive cruise control can provide a more comprehensive safety solution, which is appealing to automakers and consumers alike.

There is also significant potential in the aftermarket sector, where retrofitting older vehicles with AEB capabilities can extend the benefits of this technology beyond new car buyers.

Moreover, partnerships between automotive OEMs and technology providers can accelerate innovation in AEB systems, especially in the areas of machine learning and sensor fusion.

As autonomous driving technology advances, the integration of AEB as a critical fail-safe mechanism further emphasizes its importance, positioning it as a key component in the future of mobility and transportation safety.

According to a 2023 study by the Partnership for Market Change (PMC), AEB technology demonstrates a significant potential to enhance vehicle safety by reducing the frequency of collisions.

Data indicates that AEB systems lower rear-end collision rates by approximately 43% . Additionally, the technology is shown to reduce front impact crash rates by 27% , underlining its value in preventing accidents during high-speed scenarios.

When it comes to mitigating risks involving pedestrians, AEB systems have been shown to decrease fatalities by 44% and injuries by 33%, positioning AEB as a critical technology in improving safety outcomes for vulnerable road users.

Furthermore, various studies corroborate that AEB can reduce rear-end collisions by a range of 25% to 50%, emphasizing its effectiveness in real-world driving environments.

According to research by AB Dynamics and the European Commission, vehicles equipped with AEB technology experienced about 38% fewer rear-end crashes . Moreover, the research highlighted that AEB systems with pedestrian detection capabilities are particularly impactful, reducing pedestrian fatalities by approximately 27% .

In the United States, the National Highway Traffic Safety Administration (NHTSA) estimates that AEB could prevent at least 24,000 injuries annually and save over 360 lives each year .

Given the high incidence of pedestrian accidents over 70,000 annually in the U.S. the adoption of AEB systems could play a pivotal role in enhancing road safety. NHTSA’s estimates appear conservative, allowing room for discussions and refinements to further optimize AEB’s integration into mainstream vehicle offerings.

According to a Spring 2023 survey by S&P Global Mobility, consumer acceptance of AEB and other Advanced Driver Assistance Systems (ADAS) remains mixed . While 83% of respondents expressed a preference for features like blind spot warning, over 80% also favored forward collision warning and rear-view cameras, reflecting a strong desire for safety-focused technology.

However, familiarity with fully autonomous driving remains low, with only 61% of global respondents showing interest in self-driving capabilities .This suggests that while consumers recognize the benefits of semi-automated systems like AEB, they remain hesitant toward fully autonomous driving solutions.

For automakers, this presents an opportunity to focus on educating consumers about AEB’s benefits and integrating user-friendly features that enhance trust and familiarity with these technologies. The adoption of AEB systems, coupled with strategic communication of their safety advantages, will be essential in driving market penetration and consumer acceptance.

Key Takeaways

- The Global Automatic Emergency Braking (AEB) Market is projected to expand from USD 57.1 billion in 2023 to approximately USD 160.7 billion by 2033, with a compound annual growth rate (CAGR) of 10.9%.

- Low-speed AEBS holds the largest market share within the product segment at 53.1%, owing to its effectiveness in urban driving conditions and popularity among automakers.

- Dynamic Brake Support dominates the technology segment with a 49% share, due to its capability to enhance braking efficiency during emergency stops.

- Passenger Vehicles lead the market in vehicle type, accounting for 71.1% of the market share, driven by high consumer demand for safety features in new cars.

- Disc brakes dominate the brake segment with a 79.3% share, preferred for their superior braking performance and heat dissipation capabilities.

- Asia-Pacific leads the AEB market with a 42.27% share, driven by the increasing adoption of ADAS technologies, vehicle production, and supportive regulations in China, Japan, and South Korea.

- Growth Opportunity: Technological advancements in radar, lidar, and AI-based systems present significant opportunities, enabling improved accuracy in AEB systems and expanding their adoption in both new and retrofitted vehicles.

- Restraining Factor: High costs of AEB systems remain a barrier, particularly in emerging markets, where price sensitivity and affordability issues limit widespread adoption despite safety benefits.

By Product Analysis

Low-Speed AEBS Segment Dominating The Automatic Emergency Braking (AEB) Market with 53.1% Largest Share

In 2023, Low-speed AEBS (Automatic Emergency Braking Systems) held a dominant market position within the Product segment of the Automatic Emergency Braking (AEB) Market, capturing more than a 53.1% share.

This significant market presence is largely attributed to its critical role in urban and city driving environments, where traffic congestion and lower-speed collision risks are more prevalent.

The system’s ability to prevent or mitigate minor collisions at lower speeds has made it highly desirable among vehicle manufacturers and consumers alike, driving its widespread adoption.

High-speed AEBS, while not leading the market, represents a key area of growth potential within the AEB market. Designed for enhanced safety at higher speeds, this segment caters to highway driving and long-distance travel, where the risks of severe accidents are higher.

Although it trails behind Low-speed AEBS in market share, its advanced capabilities for accident prevention in critical high-speed scenarios are likely to support steady growth in the coming years.

By Technology Analysis

Dynamic Brake Support Segment Dominating The Automatic Emergency Braking (AEB) Market with 49% Largest Share

In 2023, Dynamic Brake Support held a dominant market position in the Technology Analysis segment of the Automatic Emergency Braking (AEB) Market, capturing more than a 49% share.

This leadership position is driven by its ability to provide automatic braking assistance when the driver applies the brakes in emergency situations but does not apply enough force.

By enhancing braking efficiency, Dynamic Brake Support is particularly effective in reducing the severity of collisions and has become a preferred feature among automakers integrating AEB systems into their vehicles. Its widespread adoption has made it a critical component in improving road safety, leading to its significant market share.

Crash Imminent Braking, while not holding the top market share, represents a crucial segment within the AEB market, offering significant growth opportunities. This technology automatically applies the brakes when the system detects an imminent collision, even if the driver takes no action.

Its advanced functionality makes it particularly valuable in preventing severe accidents, thus gaining traction among premium vehicle manufacturers. As safety regulations become more stringent, the demand for such proactive braking technologies is expected to rise, contributing to steady market expansion.

Forward Collision Warning (FCW), although not a standalone braking technology, plays a key role in the broader AEB market by providing early alerts to drivers about potential collisions. This technology helps to reduce reaction times, giving drivers the opportunity to manually engage the brakes or take evasive action.

While its market share is lower compared to Dynamic Brake Support and Crash Imminent Braking, FCW remains a vital component in integrated safety systems, often bundled with other AEB technologies to enhance overall vehicle safety.

By Vehicle Type Analysis

Passenger Vehicle Segment Dominating The Automatic Emergency Braking (AEB) Market with 71.1 % Largest Share

In 2023, Passenger Vehicle support held a dominant market position in the Vehicle Type segment of the Automatic Emergency Braking (AEB) Market, capturing more than a 71.1% share.

This strong market presence is attributed to the widespread adoption of AEB systems in passenger cars, driven by increasing consumer demand for advanced safety features and stringent regulatory requirements.

As AEB systems have become standard in many new car models, manufacturers are focusing on integrating these technologies to enhance overall vehicle safety and compliance with safety standards. The preference for safer, technologically advanced vehicles has significantly contributed to the dominance of passenger vehicles in this segment.

Commercial Vehicles, while not leading in market share, represent a vital and steadily growing segment in the AEB market. The adoption of AEB systems in trucks, buses, and other commercial transport vehicles is gaining momentum, particularly in response to heightened safety regulations and the need to reduce accident risks in heavy-duty applications.

While currently trailing behind passenger vehicles, the potential for AEB systems to improve safety outcomes and lower operational risks for commercial fleets positions this segment for continuous growth. As logistics and transportation industries place more emphasis on safety, the demand for AEB in commercial vehicles is expected to increase over time.

By Brake Analysis

Disc Segment Dominating The Automatic Emergency Braking (AEB) Market with 79.3% Largest Share

In 2023, Disc brakes held a dominant market position in the Brake segment of the Automatic Emergency Braking (AEB) Market, capturing more than a 79.3% share. The extensive use of disc brakes in AEB systems is largely due to their superior performance in providing consistent and reliable braking power, especially during sudden stops and emergency situations.

Disc brakes offer better heat dissipation and less brake fade compared to drum brakes, making them a preferred choice among automakers for modern vehicles equipped with AEB technology. Their ability to enhance overall safety and vehicle control has been a key driver of their widespread adoption, cementing their leadership in this segment.

Drum brakes, while not leading the market, serve as a cost-effective alternative within the AEB market, particularly for certain budget-friendly or older vehicle models. Although they offer lower braking efficiency compared to disc brakes, drum brakes are valued for their durability and lower manufacturing costs.

This makes them a viable option for commercial vehicles and applications where cost constraints are critical. Despite their smaller market share, the steady demand for drum brakes in specific segments helps maintain their presence in the market, especially in regions where affordability is a key purchasing factor.

By Type Analysis

Low-Speed AEB System Segment Dominating The Automatic Emergency Braking (AEB) Market with 45.7% Largest Share

In 2023, Low-Speed AEB System held a dominant market position in the Type segment of the Automatic Emergency Braking (AEB) Market, capturing more than a 45.7% share. The widespread adoption of Low-Speed AEB systems is primarily driven by their effectiveness in urban driving conditions, where frequent stop-and-go traffic and close-range obstacles are common.

These systems are designed to detect vehicles and objects at lower speeds and automatically apply brakes to prevent or mitigate minor collisions, making them particularly popular in passenger vehicles. Their capability to enhance safety in congested city environments has made them the preferred choice among automakers, leading to their significant market share.

High-speed AEB Systems, while not the market leader, represent a key growth area within the AEB market. These systems are tailored for highway and long-distance driving scenarios, where they help prevent or reduce the severity of high-speed collisions.

As consumer awareness of vehicle safety features grows and regulations tighten, the demand for High-speed AEB systems is increasing, particularly among premium vehicle manufacturers. Although its market share trails behind Low-Speed AEB systems, the advanced capabilities of High-speed AEB in improving highway safety position it as a critical component of future vehicle safety systems.

Pedestrian AEB Systems, although a smaller segment compared to low and high-speed AEB systems, are experiencing expanding adoption due to their role in enhancing safety in urban environments. These systems are specifically designed to detect pedestrians and cyclists, automatically applying the brakes to avoid collisions.

As urbanization increases and the focus on vulnerable road users grows, pedestrian AEB systems are becoming more popular among car manufacturers, especially in regions with strict safety regulations. While they hold a niche market position, their importance in improving road safety and preventing pedestrian injuries is driving steady growth in this segment.

Key Market Segments

Based on Product

- Low-speed AEBS

- High-speed AEBS

Based on Technology

- Dynamic Brake Support

- Crash Imminent Braking

- Forward Collision Warning

Based on Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Based on Brake

- Disc

- Drum

Based on Type

- Low-Speed AEB System

- High-speed AEB System

- Pedestrians AEB Systems

Driver

Increasing Government Regulations and Safety Standards

The global Automatic Emergency Braking (AEB) market is being significantly driven by stringent government regulations and rising safety standards across regions. Governments worldwide have increasingly mandated the incorporation of AEB systems in new vehicles to reduce road accidents and enhance passenger safety.

For example, the European Union has implemented regulations requiring AEB systems in all new cars from 2022 onward, aiming to reduce collisions and fatalities on the road. Similarly, the National Highway Traffic Safety Administration (NHTSA) in the United States, alongside automakers, agreed to make AEB a standard feature in most passenger cars by 2023.

These regulations are compelling automakers to integrate AEB technology, thus driving demand across the market. Additionally, the focus on improving road safety aligns with broader goals like the United Nations’ Decade of Action for Road Safety, which further encourages global adoption of AEB systems.

The increasing consumer awareness of vehicle safety ratings, driven by programs such as Euro NCAP, is also pressuring manufacturers to include AEB systems to enhance their safety scores. This regulatory push, combined with consumer demand for safer vehicles, is expected to continue driving the adoption of AEB systems, thus ensuring a robust growth trajectory for the market through 2024.

Restraint

High Costs of AEB Systems Limit Market

While the Automatic Emergency Braking (AEB) market is experiencing significant growth, high costs associated with AEB systems remain a key barrier to widespread adoption, particularly in emerging markets. AEB systems involve advanced sensors, radar, and camera technologies that increase the overall cost of vehicles.

This cost increment is a concern for price-sensitive markets in regions such as Latin America, Africa, and parts of Asia-Pacific. Even though the long-term benefits of AEB systems include reduced accident-related costs, the upfront expense can deter manufacturers and consumers in markets where affordability is a major purchase consideration.

Moreover, automakers operating in developing economies often face challenges in balancing cost constraints with the integration of advanced safety technologies like AEB. Many consumers prioritize basic transportation needs over advanced safety features, making it difficult for manufacturers to justify the added expense of AEB.

This has led to a slower uptake in these regions compared to more affluent markets like North America and Europe. As a result, the high costs of AEB systems are constraining overall market growth by limiting their penetration in markets that are otherwise experiencing rapid automotive growth, thus affecting the global expansion of AEB technologies.

Opportunity

Technological Advancements in Sensor Technology

Technological advancements in sensor technology present a significant opportunity for the expansion of the Automatic Emergency Braking (AEB) market. Innovations in radar, lidar, and camera systems have enhanced the accuracy and reliability of AEB systems, making them more effective at detecting obstacles and preventing collisions.

For instance, the integration of 3D sensing and AI-based image recognition technologies has enabled AEB systems to differentiate between various types of obstacles, including pedestrians, cyclists, and other vehicles, thereby improving their functionality.

These advancements make AEB systems not only safer but also more appealing to automakers and consumers, thus boosting market adoption. Furthermore, as the automotive industry moves toward higher levels of automation and advanced driver-assistance systems (ADAS), AEB is becoming a critical component of semi-autonomous and autonomous driving platforms.

These advancements create opportunities for new market entrants and partnerships between automotive companies and tech firms. This trend is particularly evident in regions like North America and Asia-Pacific, where automotive innovation is accelerating.

As a result, continuous improvements in sensor technologies are expected to play a crucial role in broadening the application scope of AEB systems, enhancing their appeal and driving market growth through 2024 and beyond.

Trends

Rising Demand for Electric Vehicles (EVs)

The growing demand for electric vehicles (EVs) is a major trend that is positively influencing the Automatic Emergency Braking (AEB) market. With EVs becoming increasingly popular due to their environmental benefits and support from government incentives, automakers are leveraging AEB as a key differentiator to enhance vehicle safety and appeal.

Electric vehicle manufacturers such as Tesla, Nissan, and BYD are incorporating AEB systems as standard or optional features to meet consumer expectations for advanced safety. The integration of AEB in EVs aligns with the broader industry trend towards advanced driver-assistance systems (ADAS), positioning EVs as technologically advanced and safe options for buyers.

Moreover, the push for EV adoption in markets like Europe, China, and the United States is expected to contribute to the increased integration of AEB systems. In 2023, global EV sales reached nearly 14 million units, with estimates suggesting further growth in 2024.

As EV manufacturers focus on differentiating their products with state-of-the-art safety features, AEB is becoming a crucial part of their offerings.

This trend is not only contributing to a rise in the adoption of AEB technology in new vehicle models but is also helping to drive overall market growth, as AEB becomes synonymous with the safety and innovation that consumers expect from next-generation vehicles.

Regional Analysis

Asia-Pacific Leads the Automatic Emergency Braking (AEB) Market with 42.27% Largest Share

In 2023, Asia-Pacific emerged as the dominant region in the global Automatic Emergency Braking (AEB) market, holding a substantial market share of 42.27%. This leadership position is driven by factors such as the rising adoption of advanced driver-assistance systems (ADAS), increasing vehicle production, and supportive regulatory frameworks in countries like China, Japan, and South Korea.

Asia-Pacific region’s market value reached USD 21.7 billion, reflecting strong demand for enhanced vehicle safety technologies. China, the largest automotive market globally, has been a key contributor, with growing consumer demand for advanced safety features and government initiatives to mandate AEB systems in new vehicles.

Japan and South Korea further bolster the regional market through their robust automotive manufacturing capabilities and focus on exporting vehicles equipped with AEB technology.

North America is expected to be the fastest-growing region in the global AEB market, with a projected compound annual growth rate (CAGR) of 6.16%.

This growth is driven by increased regulatory pressure, such as agreements with the National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS), which have pushed for AEB as a standard feature in new vehicles.

The presence of major automotive players and technology companies, particularly in the United States, further supports this rapid growth.

Additionally, heightened consumer awareness and demand for advanced safety features are contributing to the uptake of AEB systems, with automakers aiming to enhance vehicle safety ratings.

Europe holds a significant position in the global AEB market, characterized by rigorous safety regulations and a strong automotive industry. The European Union’s mandates for AEB systems in new passenger cars have spurred market adoption across the region, making AEB integration a standard for many automakers.

Key automotive markets such as Germany, France, and the United Kingdom have driven this growth through their emphasis on vehicle safety and innovation.

European car manufacturers, including Volkswagen, BMW, and Daimler, continue to invest in AEB technologies to comply with stringent safety standards, which enhances their global competitiveness.

The Middle East & Africa region exhibits gradual adoption of AEB technology, primarily driven by the increasing presence of premium vehicle manufacturers and the growing emphasis on road safety.

While the overall market size is smaller compared to other regions, countries like the UAE and Saudi Arabia are witnessing a shift towards enhanced vehicle safety features, including AEB.

The market growth in these regions is supported by rising disposable incomes and a preference for luxury cars, which often include advanced safety systems as standard. However, economic challenges and varying regulatory standards across the continent continue to limit broader adoption.

Latin America represents an emerging market for AEB systems, driven by increasing safety awareness and gradual improvements in regulatory frameworks. While the adoption rate is currently lower compared to regions like North America and Europe, Brazil and Mexico are key contributors to market growth due to their large automotive manufacturing bases.

Local regulations and safety assessments are slowly aligning with international standards, encouraging the inclusion of AEB systems in newer vehicle models. However, the region faces challenges such as economic instability and price sensitivity among consumers, which may temper the speed of market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Automatic Emergency Braking (AEB) market in 2024 is shaped by the strategic activities of leading players such as Robert Bosch GmbH, Continental AG, Delphi Automotive LLP, ZF Friedrichshafen AG, and Mobileye. These companies leverage advanced technologies, extensive R&D, and strategic partnerships to maintain their competitive edge.

Robert Bosch GmbH and Continental AG, in particular, are at the forefront due to their expertise in sensor technologies and integrated safety systems, making them key suppliers for various automotive manufacturers worldwide.

Mobileye, a subsidiary of Intel, is a significant player in the AEB market, known for its advanced vision-based driver-assistance systems. Mobileye’s emphasis on AI and computer vision has allowed it to cater to the growing demand for precision and accuracy in AEB systems, especially in semi-autonomous vehicles.

Similarly, ZF Friedrichshafen AG and Delphi Automotive LLP (now Aptiv) are leveraging their capabilities in advanced driver-assistance systems (ADAS) to support the integration of AEB into next-generation vehicles.

Asian players like Hyundai Mobis, Aisin Seiki Co. Ltd., and Hitachi Automotive Systems Ltd. contribute to the market with their focus on cost-effective solutions and their strong presence in rapidly growing markets like South Korea, Japan, and China. Companies such as Autoliv Inc. and HL Mando Corporation further intensify competition by providing specialized safety components.

These key players, alongside other regional and niche manufacturers, are fostering innovation and scaling production capacities, collectively driving the global AEB market’s growth and pushing the boundaries of automotive safety.

Top Key Players in the Market

- Robert Bosch GmbH

- Continental Ag

- Delphi Automotive LLP

- ZF Friedrichshafen AG

- Mobileye

- Autoliv Inc.

- Hyundai Mobis

- Aisin Seiki Co. Ltd.

- Hitachi Automotive Systems Ltd.

- HL Mando Corporation

- Other Key Players

Recent Developments

- In April 29, 2024 NHTSA announced that nearly all new passenger cars and trucks sold in the United States will need to have automatic emergency braking (AEB) systems by September 2029. The agency highlighted that this mandate could save at least 360 lives each year and prevent approximately 24,000 injuries annually. This regulation aims to enhance road safety and reduce accidents caused by rear-end collisions.

- In May 9, 2024 , NHTSA published a final rule requiring automatic emergency braking systems in U.S. light vehicles and trucks by September 2029, under a new Federal Motor Vehicle Safety Standard (FMVSS). This mandate is part of the Bipartisan Infrastructure Law (BIL) of 2021, where Congress directed NHTSA to establish safety standards not only for AEB systems but also for other Level 2 advanced driver assistance systems (ADAS). These include lane departure warnings, lane-keeping assist, and forward collision warnings (FCW).

- In June 24, 2024 – A coalition of major automakers, including General Motors, Toyota Motor, and Volkswagen, urged NHTSA to reconsider the new rule from April that requires all new cars and trucks to have advanced AEB systems by 2029. The group argued that meeting the requirement for vehicles to stop and avoid collisions at speeds of up to 62 miles per hour is “practically impossible with available technology,” emphasizing the challenges of achieving this standard with current advancements in automotive technology.

Report Scope

Report Features Description Market Value (2023) US$ 57.1 Bn Forecast Revenue (2033) US$ 160.7 Bn CAGR (2024-2033) 10.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Low-speed AEBS, High-speed AEBS), By Technology (Crash Imminent Braking, Dynamic Brake Support, Forward Collision Warning), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Brake (Disc, Drum), By Type (Low-Speed AEB System, High-speed AEB System, Pedestrians AEB Systems) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Robert Bosch GmbH, Continental Ag, Delphi Automotive LLP, ZF Friedrichshafen AG, Mobileye, Autoliv Inc., Hyundai Mobis, Aisin Seiki Co. Ltd., Hitachi Automotive Systems Ltd., HL Mando Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic Emergency Braking MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Automatic Emergency Braking MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental Ag

- Delphi Automotive LLP

- ZF Friedrichshafen AG

- Mobileye

- Autoliv Inc.

- Hyundai Mobis

- Aisin Seiki Co. Ltd.

- Hitachi Automotive Systems Ltd.

- HL Mando Corporation

- Other Key Players