Global Automated Truck Loading System Market Size, Share, Growth Analysis By Automation Level (Semi-Automated Systems, Fully Automated Systems), By Component (Hardware, Software, Services), By Loading Dock Type (Flush Dock, Enclosed Dock, Sawtooth Dock, Climate Controlled Dock, Others), By System Type (Chain Conveyor System, Slat Conveyor System, Roller Track System, Belt Conveyor System, Skate Conveyor System, Automated Guided Vehicles (AGVs), Robotic Arm-Based System, Others), By Truck Type (Standard Trailer Trucks, Refrigerated/Cold Chain Trucks, Containerized Trucks, Flatbed Trucks, Special Purpose Trucks, Others), By Loading Dock Design (Flush Docks, Enclosed Docks, Open Docks, Sawtooth Docks, Others), By End-use (Automotive, FMCG & Retail, E-commerce & Logistics, Pharmaceuticals & Healthcare, Food & Beverage, Chemicals, Postal & Courier, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157642

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Automation Level Analysis

- Component Analysis

- Loading Dock Type Analysis

- System Type Analysis

- Truck Type Analysis

- Loading Dock Design Analysis

- End-use Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automated Truck Loading System Company Insights

- Recent Developments

- Report Scope

Report Overview

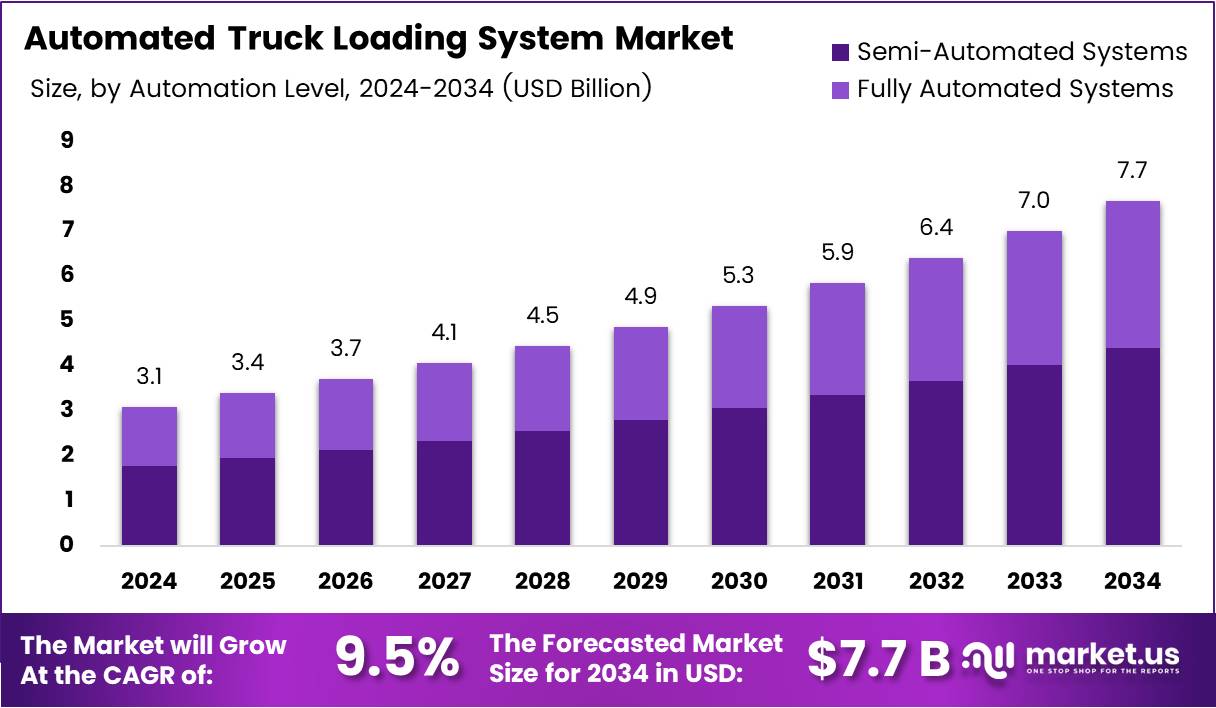

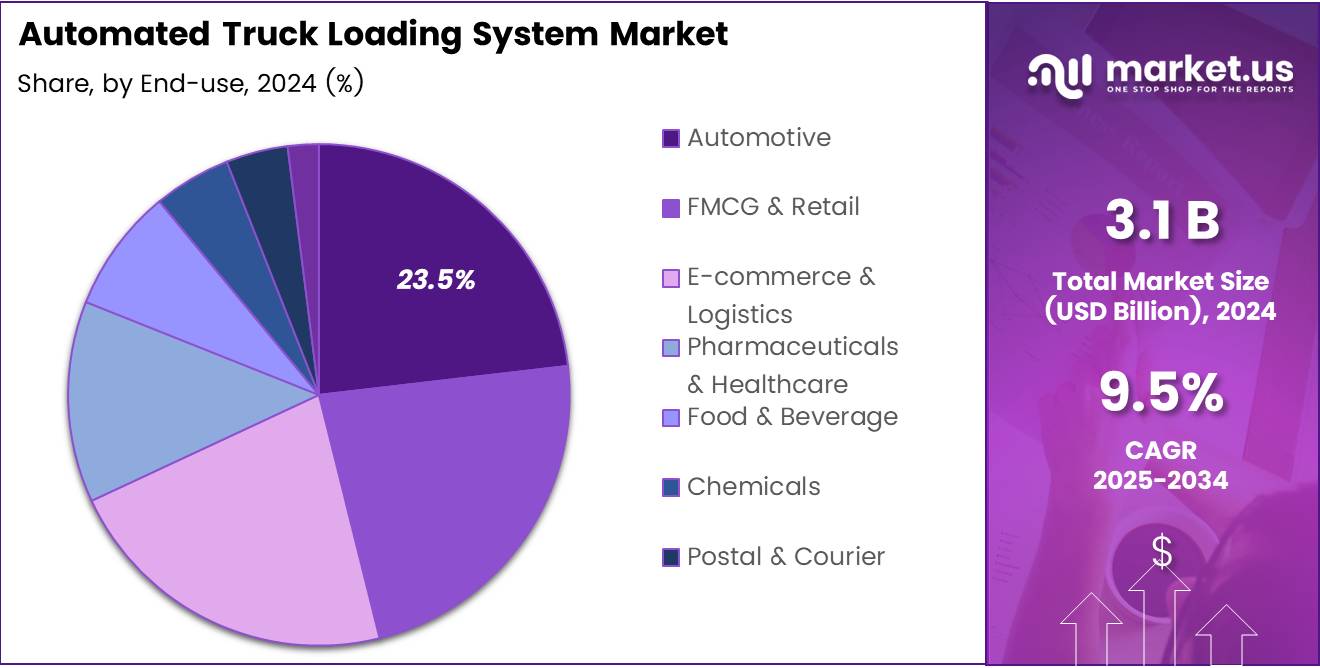

The Global Automated Truck Loading System Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034.

The Automated Truck Loading System (ATLS) market is rapidly evolving, driven by the growing need for efficiency in logistics and distribution. These systems automate the loading and unloading processes, reducing human labor and increasing throughput. As industries seek to improve operational efficiency, the demand for automated solutions is accelerating globally.

The key drivers of growth in the ATLS market include the increasing need for faster delivery times and enhanced supply chain management. Automation enables faster truck turnovers, which translates into reduced waiting times and optimized scheduling. For instance, systems that handle 2–3 trucks per hour ensure rapid processing, which is crucial for industries like e-commerce and manufacturing.

The market also benefits from the expanding e-commerce sector, which demands quick and reliable delivery solutions. Automated truck loading systems play a critical role in this space, allowing businesses to scale up operations while maintaining cost-effective practices. Additionally, the growing trend of digital transformation in supply chains is further propelling the adoption of automated solutions.

In terms of opportunities, the ATLS market is poised for substantial growth due to advancements in artificial intelligence (AI) and the Internet of Things (IoT). These technologies enable smart tracking, predictive maintenance, and seamless integration with warehouse management systems, enhancing operational efficiency. Furthermore, as industries look for sustainable solutions, automation offers a greener alternative to traditional manual processes, reducing energy consumption and emissions.

Government investments and regulations are shaping the market’s trajectory. Many governments are introducing policies to promote automation in industries such as transportation and logistics. For example, regulations that encourage workplace safety and efficiency are pushing companies to invest in automated systems that minimize human error and enhance safety.

According to industry sources, the demand for Automated Truck Loading Systems is expected to rise sharply in the coming years. This growth is driven by the adoption of smart technologies and the push for faster, more reliable delivery networks. The market is projected to expand with increasing investments in automation from both the private and public sectors.

Key Takeaways

- The Global Automated Truck Loading System Market is projected to reach USD 7.7 Billion by 2034, growing at a CAGR of 9.5% from 2025 to 2034.

- Semi-Automated Systems held a dominant market position in the By Automation Level Analysis segment in 2024, with a 57.3% share.

- Hardware dominated the By Component Analysis segment in 2024, holding a 67.4% share.

- Flush Docks led the By Loading Dock Type Analysis segment in 2024, with a 37.6% share.

- The Chain Conveyor System was the leading system type in 2024, holding a 23.5% share.

- Standard Trailer Trucks held a 35.8% share in the By Truck Type Analysis segment in 2024.

- Flush Docks dominated the By Loading Dock Design Analysis segment in 2024, with a 44.1% share.

- The Automotive sector led the By End-use Analysis segment in 2024, with a 23.2% share.

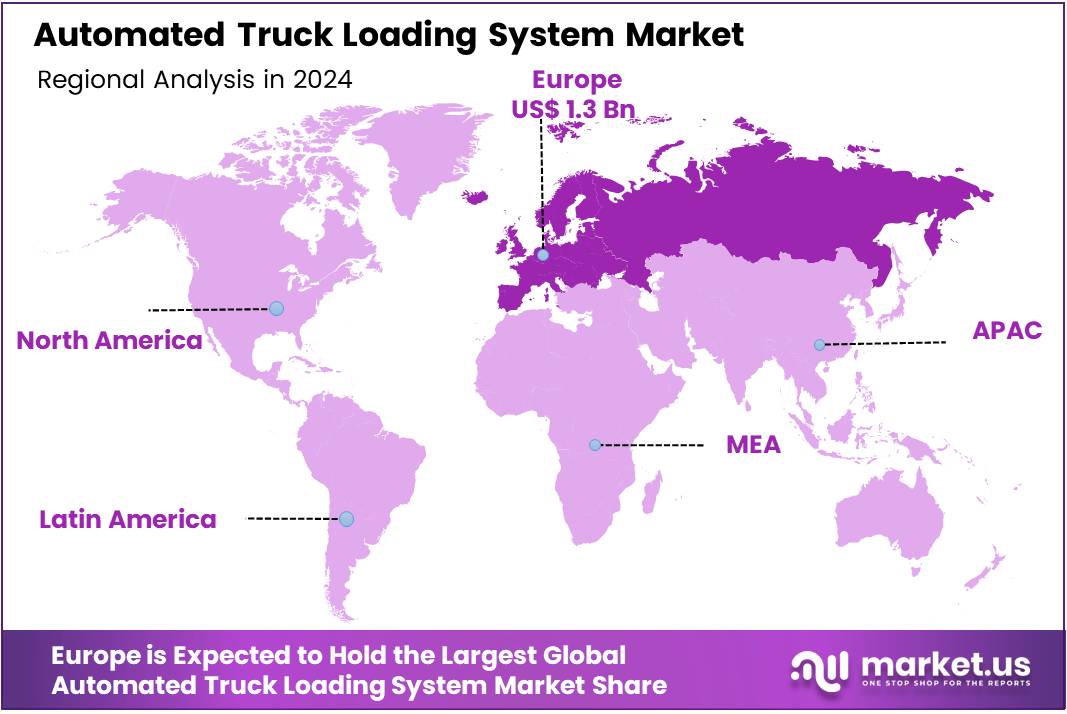

- Europe held the largest share of the Automated Truck Loading System market in 2024, with 43.6% of the global market, valued at USD 1.3 billion.

Automation Level Analysis

Semi-Automated Systems dominates with 57.3% due to its balanced approach between automation and human oversight.

In 2024, Semi-Automated Systems held a dominant market position in By Automation Level Analysis segment of Automated Truck Loading System Market, with a 57.3% share. This segment’s leadership reflects the industry’s preference for systems that combine automated efficiency with human control and flexibility.

Semi-Automated Systems continue to attract businesses seeking to modernize their loading operations while maintaining operational control. These systems offer significant productivity improvements over manual processes while requiring lower initial investments compared to fully automated alternatives. The technology provides operators with enhanced safety features and reduced physical strain, making it an attractive solution for companies transitioning from traditional loading methods.

Fully Automated Systems represent the remaining market share, appealing primarily to high-volume operations where maximum efficiency and minimal human intervention are priorities. While these systems offer superior speed and consistency, their higher implementation costs and complexity requirements limit adoption to larger enterprises with substantial loading volumes and technical capabilities.

Component Analysis

Hardware dominates with 67.4% due to its essential role in system infrastructure and mechanical operations.

In 2024, Hardware held a dominant market position in By Component Analysis segment of Automated Truck Loading System Market, with a 67.4% share. This dominance reflects the critical importance of physical infrastructure in automated loading systems, including conveyor mechanisms, robotic arms, sensors, and control panels.

Hardware components form the backbone of automated truck loading systems, encompassing all mechanical, electrical, and structural elements necessary for operation. The significant investment in hardware reflects the complexity and durability requirements of these systems, which must withstand continuous industrial use while maintaining precision and reliability.

Software represents a smaller but growing segment, focusing on control systems, user interfaces, and integration capabilities. As systems become more sophisticated, software’s role in optimizing performance and enabling remote monitoring continues to expand.

Services constitute the remaining market share, encompassing installation, maintenance, training, and support activities. While smaller in monetary value, services are crucial for ensuring optimal system performance and customer satisfaction throughout the equipment lifecycle.

Loading Dock Type Analysis

Flush Dock dominates with 37.6% due to its versatility and compatibility with various truck configurations.

In 2024, Flush Dock held a dominant market position in By Loading Dock Type Analysis segment of Automated Truck Loading System Market, with a 37.6% share. This dock type’s popularity stems from its ability to accommodate diverse truck sizes and loading requirements while providing efficient cargo transfer capabilities.

Flush Docks offer superior accessibility and safety features, making them ideal for facilities handling varied freight types and truck configurations. Their design allows for seamless integration with automated loading systems while maintaining operational flexibility for different cargo handling scenarios.

Enclosed Docks represent a significant portion of the market, appealing to facilities requiring weather protection and climate control during loading operations. These docks are particularly popular in regions with extreme weather conditions and for temperature-sensitive cargo handling.

Sawtooth Docks cater to specialized applications where multiple trucks need simultaneous access, optimizing space utilization in large distribution centers. Climate Controlled Docks serve niche markets requiring precise environmental conditions, while the Others category encompasses specialized dock configurations for unique operational requirements.

System Type Analysis

Chain Conveyor System dominates with 23.5% due to its reliability and proven performance in heavy-duty applications.

In 2024, Chain Conveyor System held a dominant market position in By System Type Analysis segment of Automated Truck Loading System Market, with a 23.5% share. This system type’s leadership reflects its robust construction and ability to handle heavy loads consistently across diverse industrial applications.

Chain Conveyor Systems excel in durability and load-bearing capacity, making them preferred choices for facilities handling heavy or irregularly shaped cargo. Their mechanical simplicity and proven reliability contribute to lower maintenance requirements and extended operational life, providing excellent return on investment for users.

The market shows healthy diversification across multiple system types, with Slat Conveyor Systems, Roller Track Systems, and Belt Conveyor Systems each serving specific operational needs. Automated Guided Vehicles (AGVs) and Robotic Arm-Based Systems represent advanced automation technologies gaining traction in high-tech facilities.

This fragmented distribution indicates a mature market where different technologies serve distinct operational requirements, allowing customers to select systems optimized for their specific cargo types, volume requirements, and facility constraints.

Truck Type Analysis

Standard Trailer Trucks dominates with 35.8% due to their widespread use in general freight transportation.

In 2024, Standard Trailer Trucks held a dominant market position in By Truck Type Analysis segment of Automated Truck Loading System Market, with a 35.8% share. This dominance reflects the prevalence of standard trailer configurations in commercial freight transportation and their compatibility with automated loading systems.

Standard Trailer Trucks represent the most common vehicle type in logistics operations, making them a natural focus for automated loading system development. Their standardized dimensions and loading configurations enable efficient system design and widespread applicability across diverse industries and cargo types.

Refrigerated/Cold Chain Trucks constitute a significant segment, driven by growing demand for temperature-controlled logistics in food, pharmaceutical, and healthcare sectors. These specialized vehicles require compatible loading systems that maintain cold chain integrity during cargo transfer operations.

Containerized Trucks, Flatbed Trucks, and Special Purpose Trucks serve specialized transportation needs, each requiring tailored loading solutions. The Others category encompasses emerging vehicle configurations and niche applications, indicating continued market evolution and adaptation to changing transportation requirements.

Loading Dock Design Analysis

Flush Docks dominates with 44.1% due to their operational flexibility and universal truck compatibility.

In 2024, Flush Docks held a dominant market position in By Loading Dock Design Analysis segment of Automated Truck Loading System Market, with a 44.1% share. This design type’s leadership position reflects its versatility in accommodating various truck heights and loading requirements while facilitating efficient automated operations.

Flush Docks provide optimal accessibility for automated loading equipment, enabling seamless cargo transfer while maintaining safety standards. Their design allows for easy integration of conveyor systems and robotic equipment, making them preferred choices for facilities implementing comprehensive automation strategies.

Enclosed Docks represent a substantial market segment, offering weather protection and security benefits that are particularly valuable for sensitive cargo handling operations. Open Docks serve cost-conscious applications where weather protection is less critical.

Sawtooth Docks cater to specialized high-volume operations requiring multiple simultaneous loading bays, optimizing facility throughput and space utilization. The Others category includes innovative dock designs addressing specific operational challenges and emerging market requirements.

End-use Analysis

Automotive dominates with 23.2% due to its high-volume manufacturing and complex supply chain requirements.

In 2024, Automotive held a dominant market position in By End-use Analysis segment of Automated Truck Loading System Market, with a 23.2% share. This sector’s leadership reflects its advanced manufacturing processes, high cargo volumes, and stringent efficiency requirements that align perfectly with automated loading capabilities.

The Automotive industry’s emphasis on lean manufacturing and just-in-time delivery creates strong demand for efficient, reliable loading systems. These operations require precise timing and minimal handling damage, making automated systems essential for maintaining production schedules and quality standards.

FMCG & Retail, along with E-commerce & Logistics, represent significant market segments driven by growing consumer demand and rapid delivery expectations. These sectors benefit from automated loading systems’ speed and consistency in high-volume operations.

Pharmaceuticals & Healthcare, Food & Beverage, and Chemicals sectors prioritize specialized handling requirements, including temperature control, contamination prevention, and regulatory compliance. Postal & Courier services and Others encompass diverse applications, indicating broad market adoption across industries seeking operational efficiency improvements.

Key Market Segments

By Automation Level

- Semi-Automated Systems

- Fully Automated Systems

By Component

- Hardware

- Software

- Services

By Loading Dock Type

- Flush Dock

- Enclosed Dock

- Sawtooth Dock

- Climate Controlled Dock

- Others

By System Type

- Chain Conveyor System

- Slat Conveyor System

- Roller Track System

- Belt Conveyor System

- Skate Conveyor System

- Automated Guided Vehicles (AGVs)

- Robotic Arm-Based System

- Others

By Truck Type

- Standard Trailer Trucks

- Refrigerated/Cold Chain Trucks

- Containerized Trucks

- Flatbed Trucks

- Special Purpose Trucks

- Others

By Loading Dock Design

- Flush Docks

- Enclosed Docks

- Open Docks

- Sawtooth Docks

- Others

By End-use

- Automotive

- FMCG & Retail

- E-commerce & Logistics

- Pharmaceuticals & Healthcare

- Food & Beverage

- Chemicals

- Postal & Courier

- Others

Drivers

Increasing Demand for Operational Efficiency Drives Automated Truck Loading System Market Growth

The rising demand for operational efficiency in logistics is one of the key drivers of the automated truck loading system market. Companies are increasingly seeking automation solutions to streamline their operations, reduce time spent on manual loading, and improve productivity. By minimizing human intervention, these systems allow for faster and more accurate loading, optimizing the overall supply chain process.

The growing adoption of automated solutions in supply chain management also plays a significant role in the market’s expansion. As businesses continue to prioritize automation to maintain competitiveness, automated truck loading systems become a crucial component for enhancing the efficiency and effectiveness of logistics operations. Automation reduces human error, increases throughput, and improves accuracy, all while keeping costs in check.

Another important factor driving the market is the need for reduced labor costs and minimized human error. Automated truck loading systems reduce reliance on manual labor, cutting down on the need for workers to handle heavy loads. By reducing human errors during loading processes, companies can prevent costly mistakes and improve overall safety in the workplace.

The rising focus on sustainability and reducing the carbon footprint is another critical driver. Automated systems enable more efficient operations, which help reduce energy consumption and emissions associated with logistics activities. Companies are increasingly aligning their logistics operations with sustainability goals, thus making automated solutions more attractive.

Restraints

Lack of Skilled Workforce and Limited Adaptability Restrain the Automated Truck Loading System Market

One of the key restraints in the automated truck loading system market is the lack of a skilled workforce for system maintenance. As these systems are complex and require technical expertise, companies face challenges in finding qualified personnel who can operate and maintain these systems efficiently. The shortage of skilled workers can result in operational disruptions and increased costs for training or outsourcing.

Another challenge is the limited adaptability of automated truck loading systems to different types of vehicles and cargos. These systems are often designed for specific types of trucks and cargo, making it difficult for businesses to use them across diverse fleets. This lack of versatility can limit the broader adoption of automated loading systems, especially for smaller businesses or those with varying logistics needs.

Growth Factors

Emerging Markets and Technological Integration Drive Growth Opportunities for Automated Truck Loading Systems

The expansion of e-commerce and last-mile delivery operations presents significant growth opportunities for the automated truck loading system market. As e-commerce continues to grow, the need for efficient and faster logistics solutions has increased, which directly drives demand for automation in the trucking and delivery sectors.

Integration with AI and IoT for real-time tracking is another promising opportunity. These technologies can enhance the capabilities of automated truck loading systems by providing real-time updates and predictive analytics for better decision-making. The ability to monitor operations remotely and in real time increases the efficiency of the entire logistics process.

Emerging markets, particularly those with expanding logistics sectors, present untapped growth potential. As infrastructure and logistics networks in developing regions improve, there will be an increasing demand for automated solutions to meet the rising logistical demands.

Additionally, government incentives for automation in logistics are expected to further fuel growth, as governments encourage the adoption of technologies that enhance supply chain efficiency and reduce operational costs.

Emerging Trends

Technological Advancements and Robotics Lead the Trend in Automated Truck Loading Systems

One of the major trends in the automated truck loading system market is the implementation of AI and robotics for smarter automation. AI-driven solutions can optimize the loading process by predicting the most efficient methods for loading different types of cargo, leading to enhanced operational efficiency and reduced loading times.

The integration of predictive maintenance is another growing trend. By using AI and IoT to monitor the health of automated systems, businesses can predict and address potential issues before they cause downtime. This ensures better system uptime and minimizes the cost of unexpected repairs.

Collaborative robots (cobots) are also gaining traction in automated loading systems. Cobots work alongside human operators, enhancing the flexibility and efficiency of operations. They are becoming increasingly popular in environments where human workers need support with physically demanding tasks, allowing for a safer and more productive workplace.

Regional Analysis

Europe Dominates the Automated Truck Loading System Market with a Market Share of 43.6%, Valued at USD 1.3 Billion

In 2024, Europe holds the largest share of the Automated Truck Loading System market, with 43.6% of the global market, valued at USD 1.3 billion. The region benefits from its advanced logistics infrastructure, a high level of industrial automation, and a focus on sustainability. Increased demand for operational efficiency and government incentives in the region are contributing to the robust growth of this market.

North America Automated Truck Loading System Market Trends

North America is a key player in the market, representing a significant portion of the global share. The market here is driven by the increasing demand for automation in industries such as automotive and e-commerce. With a focus on reducing labor costs and improving efficiency, North American companies are increasingly adopting automated truck loading systems.

Asia Pacific Automated Truck Loading System Market Trends

The Asia Pacific market is growing rapidly, driven by the region’s expanding manufacturing base and logistics sector. As industries in China and India increasingly modernize their supply chains, automated solutions like truck loading systems are becoming more prevalent. Technological advancements and lower operational costs make this region a key area of growth.

Middle East and Africa Automated Truck Loading System Market Trends

In the Middle East and Africa, the adoption of automated truck loading systems is still in the early stages but is projected to grow steadily. This growth is largely driven by infrastructure development and the region’s increasing push towards automation in the logistics and transportation sectors. Strategic investments in smart logistics are expected to propel market growth in the coming years.

Latin America Automated Truck Loading System Market Trends

Latin America’s market for automated truck loading systems is expected to expand moderately over the forecast period. Although the adoption rate is lower compared to other regions, increasing logistics demands and the growing e-commerce industry in countries like Brazil and Mexico will drive demand for automation solutions. Government efforts to modernize infrastructure are also contributing to the market’s growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automated Truck Loading System Company Insights

The global Automated Truck Loading System (ATLS) market in 2024 is characterized by significant advancements from key players, each contributing unique solutions to enhance logistics efficiency.

Joloda Hydraroll Ltd offers a comprehensive range of automated loading solutions, including the LoadMatic and LoadPlate systems, designed to expedite the loading process without requiring modifications to existing trailers. Their systems are particularly beneficial for industries aiming to streamline operations while maintaining existing infrastructure.

Actiw Oy, a subsidiary of Joloda Hydraroll, specializes in the LoadMatic system, a fully automated solution capable of loading both palletized and non-palletized goods into unmodified trucks and containers. This system is ideal for industries seeking to automate their loading processes without altering their current fleet.

Secon Components provides the NALON N8 system, which facilitates the automated loading and unloading of trucks and containers without the need for modifications. With a capacity of 150 pallets per hour, it enhances productivity by reducing manual labor and increasing throughput.

Beumer Group delivers specialized solutions like the BEUMER autopac®, designed for the efficient loading and palletizing of bagged materials such as cement and fertilizers. Their systems are tailored to handle specific bulk materials, ensuring optimized performance in specialized applications.

These companies are at the forefront of revolutionizing the logistics industry by providing automated solutions that improve efficiency, reduce labor costs, and enhance safety in loading operations.

Top Key Players in the Market

- Joloda Hydraroll Ltd

- Actiw Oy

- Secon Components

- Beumer Group

- Aebi Schmidt Group

- GEBHARDT Fördertechnik GmbH

- Siemens AG

- Daifuku Co., Ltd.

- Bastian Solutions

- Murata Machinery

Recent Developments

- In Jul 2025, Filics secures €13.5M in financing to expand and roll out its robotics platform, aiming to enhance its capabilities in automation and robotics for diverse industrial applications. This funding is expected to accelerate the development and deployment of their advanced technology solutions.

- In Dec 2024, Slip Robotics announces $28M Series B for automated truck-loading robots-as-a-service, reinforcing its position in the market with innovative, scalable solutions. The funding will support the company’s growth and expansion into new markets, further automating the logistics industry.

- In Jan 2024, Joloda Hydraroll announces the acquisition of Actiw Oy, a strategic move to enhance its automated truck loading systems portfolio. This acquisition will strengthen Joloda’s offerings, providing advanced technology to improve operational efficiency for their global customer base.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Automation Level (Semi-Automated Systems, Fully Automated Systems), By Component (Hardware, Software, Services), By Loading Dock Type (Flush Dock, Enclosed Dock, Sawtooth Dock, Climate Controlled Dock, Others), By System Type (Chain Conveyor System, Slat Conveyor System, Roller Track System, Belt Conveyor System, Skate Conveyor System, Automated Guided Vehicles (AGVs), Robotic Arm-Based System, Others), By Truck Type (Standard Trailer Trucks, Refrigerated/Cold Chain Trucks, Containerized Trucks, Flatbed Trucks, Special Purpose Trucks, Others), By Loading Dock Design (Flush Docks, Enclosed Docks, Open Docks, Sawtooth Docks, Others), By End-use (Automotive, FMCG & Retail, E-commerce & Logistics, Pharmaceuticals & Healthcare, Food & Beverage, Chemicals, Postal & Courier, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Joloda Hydraroll Ltd, Actiw Oy, Secon Components, Beumer Group, Aebi Schmidt Group, GEBHARDT Fördertechnik GmbH, Siemens AG, Daifuku Co., Ltd., Bastian Solutions, Murata Machinery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Truck Loading System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Automated Truck Loading System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Joloda Hydraroll Ltd

- Actiw Oy

- Secon Components

- Beumer Group

- Aebi Schmidt Group

- GEBHARDT Fördertechnik GmbH

- Siemens AG

- Daifuku Co., Ltd.

- Bastian Solutions

- Murata Machinery