Global Automated Sortation Systems Market Size, Share, Growth Analysis Report By Type (Linear Sortation, Loop Sortation), By Industry Vertical (Retail and E-commerce, Transportation and Logistics, Pharmaceuticals, Food & Beverage, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132922

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

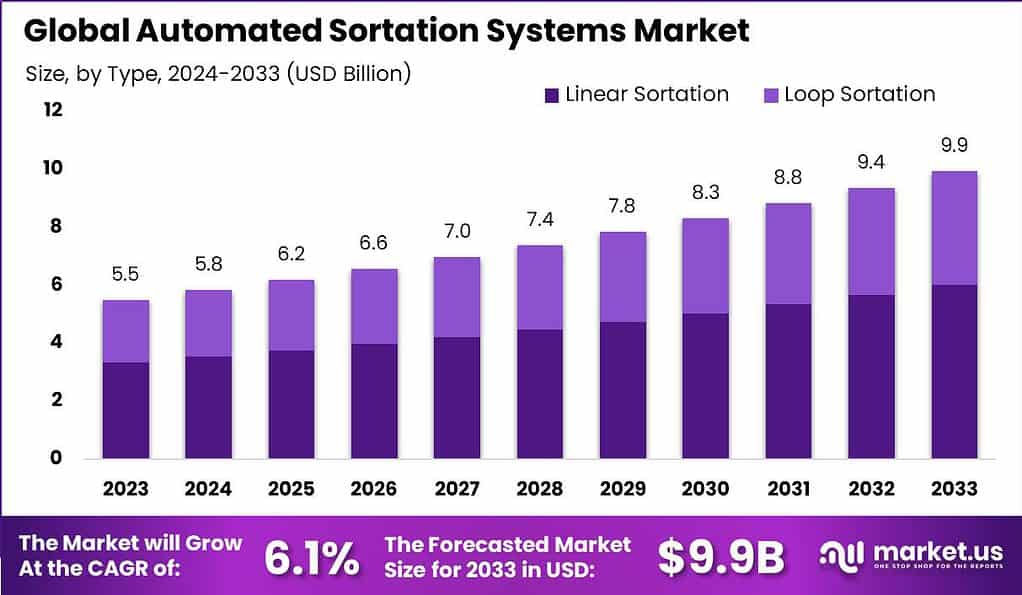

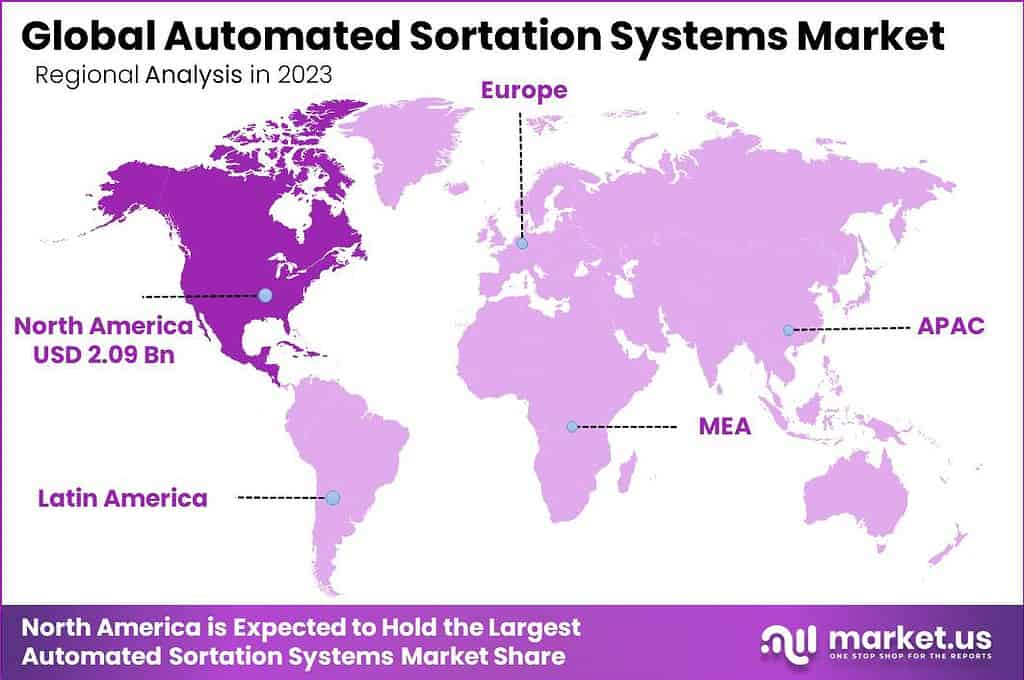

The Global Automated Sortation Systems Market size is expected to be worth around USD 9.9 Billion By 2033, from USD 5.5 Billion in 2023, growing at a CAGR of 6.10% during the forecast period from 2024 to 2033. In 2023, North America was the leading region in the automated sortation systems market, holding more than 38.0% of the market share and generating revenues of USD 2.09 billion.

Automated sortation systems are advanced logistics technologies designed to quickly and accurately sort and route items in various industries such as manufacturing, distribution, and e-commerce. These systems employ a range of mechanical components and intelligent software to categorize items based on size, weight, or destination, reducing the need for manual labor and increasing the efficiency of operations.

The market for automated sortation systems has seen significant growth due to the surge in online shopping and the increasing automation of supply chain processes. This market includes a wide variety of systems, such as belt sorters, roller sorters, and air sorters, tailored to different operational needs and industry requirements. Companies within this market continually innovate to offer more efficient, flexible, and scalable solutions, helping businesses optimize their sorting operations and reduce costs.

Several key factors drive the demand for automated sortation systems. The explosion of e-commerce has put immense pressure on logistics and distribution networks to deliver products rapidly and accurately, making efficient sortation systems indispensable. Additionally, the shift towards automation in manufacturing and the need for faster production cycles demand reliable and quick sorting solutions to keep up with market demands.

The demand for automated sortation systems continues to grow as companies seek to improve supply chain efficiency and cope with increasing volumes of goods. Opportunities in the market are abundant, particularly in emerging markets where retail and e-commerce sectors are expanding. The need for modernized and automated postal services also presents a significant opportunity for growth.

For instance, In July 2024, the BEUMER Group, based in Beckum, demonstrated its commitment to global growth and local investment by channeling over INR 2 billion into a new, cutting-edge production facility in Reliance MET City, Jhajjar. This strategic move not only amplifies BEUMER’s manufacturing capabilities on a global scale but also marks a significant step in the evolution of BEUMER India.

Technological advancements are shaping the future of the automated sortation systems market. Innovations in robotics, artificial intelligence, and machine learning have enhanced the capabilities of sortation systems, making them more adaptable and intelligent. For instance, the integration of AI allows systems to predict and manage the flow of items more efficiently, adapting to changes in real-time.

Key Takeaways

- The global Automated Sortation Systems market is projected to reach USD 9.9 billion by 2033, up from USD 5.5 billion in 2023, growing at a compound annual growth rate (CAGR) of 6.10% during the forecast period from 2024 to 2033.

- In 2023, the linear sortation segment held a dominant market position, capturing more than 60.5% of the share in the automated sortation systems market.

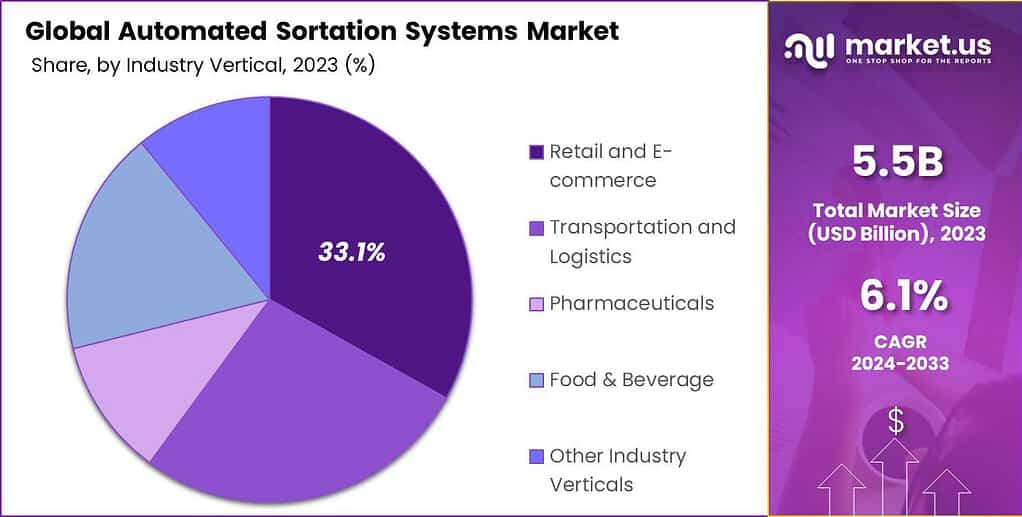

- In terms of industry verticals, the retail and e-commerce segment dominated the market in 2023, holding over 33.1% of the share within the automated sortation systems market.

- North America led the global market in 2023, accounting for more than 38.0% of the share, with revenues reaching USD 2.09 billion.

Type Analysis

In 2023, the Linear Sortation segment held a dominant market position, capturing more than a 60.5% share in the automated sortation systems market. This type of system is highly favored due to its efficiency and simplicity in design, which allows for easy integration into existing warehouse and distribution center infrastructures.

Linear sortation systems excel in environments where space is at a premium. Their design enables them to operate effectively in narrower spaces, which is particularly advantageous for smaller facilities that need to maximize their operational area.

Additionally, the versatility of linear sortation systems to handle a wide range of product sizes and types contributes to their leading position in the market. These systems can be customized with different types of diverts and belts to accommodate specific sorting needs, enhancing their appeal to companies with diverse product lines.

Advancements in sensor and control technologies have significantly boosted the efficiency of linear sortation systems. Modern systems are equipped with sophisticated sensors that ensure high accuracy in sorting, minimizing errors and improving overall throughput.

Industry Vertical Analysis

In 2023, the Retail and E-commerce segment held a dominant market position within the Automated Sortation Systems Market, capturing more than a 33.1% share. This leading role can be attributed to the segment’s pressing need to manage large volumes of goods and ensure timely and accurate delivery to consumers.

The adoption of these systems in retail and e-commerce not only enhances efficiency but also significantly reduces the potential for errors during sorting. By automating the sorting process, businesses can handle a larger volume of orders with greater accuracy, which is crucial in maintaining customer satisfaction.

Furthermore, automated sortation systems support the scalability of operations in the retail sector. They allow businesses to adjust their sorting operations quickly based on seasonal demand fluctuations, promotional campaigns, and other market dynamics.

The integration of advanced technologies such as AI and machine learning has further propelled the retail segment’s dominance in the automated sortation systems market. These technologies enable smarter, more adaptive sorting solutions that can continuously improve their sorting algorithms based on real-time data and feedback, optimizing the overall efficiency of the distribution process.

Key Market Segments

By Type

- Linear Sortation

- Loop Sortation

By Industry Vertical

- Retail and E-commerce

- Transportation and Logistics

- Pharmaceuticals

- Food & Beverage

- Other Industry Verticals

Driver

Increased Demand for E-Commerce Fulfillment

The explosive growth of e-commerce, fueled by shifting consumer shopping habits, has significantly driven the demand for automated sortation systems. E-commerce companies strive to meet consumers’ expectations for rapid delivery and seamless experiences, which has pushed logistics and warehousing operations to prioritize speed and accuracy.

Automated sortation systems address this by optimizing order fulfillment processes, reducing manual sorting, and enhancing throughput efficiency. These systems enable faster order picking and accurate deliveries, contributing to higher customer satisfaction. The growth of omnichannel retailing, which emphasizes quick in-store pick-ups and home deliveries, further accentuates the need for robust automation solutions.

Restraint

High Initial Capital Investment

Despite its benefits, the adoption of automated sortation systems often faces a major restraint in terms of high initial capital costs. Implementing these systems requires a substantial financial investment, which includes purchasing hardware, software, and integrating systems into existing operations.

Smaller businesses, particularly those with constrained budgets, may find it difficult to justify or afford such significant upfront costs. The complexity of installation and the requirement for maintenance and specialized expertise also add to the overall expenditure. This cost barrier can discourage businesses from adopting automated sortation, leading them to rely on less efficient manual processes.

Opportunity

Integration with Advanced Technologies

The integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) presents a significant opportunity for automated sortation systems. AI-powered algorithms can optimize sorting routes while IoT sensors facilitate real-time monitoring and maintenance.

This integration enables greater accuracy, efficiency, and flexibility in sorting operations, minimizing errors and reducing downtime. As more organizations embrace Industry 4.0 practices, the demand for highly automated, intelligent systems is poised to increase.

By adopting these cutting-edge technologies, businesses can gain a competitive edge, adapt to fluctuating demand patterns, and drive substantial improvements in supply chain efficiency. This potential to enhance operations through smart solutions makes integration a promising growth avenue for the sector.

Challenge

Adapting to Rapid Market Changes

One of the primary challenges for automated sortation systems is adapting to rapid changes in market demand and evolving product mixes. Consumer preferences and product portfolios can shift quickly, requiring supply chains to be highly flexible and responsive. Automated systems, however, are often designed with specific parameters and may lack the adaptability needed for handling sudden changes or new product types.

This rigidity can lead to operational inefficiencies, bottlenecks, and even potential downtime as companies reconfigure or upgrade their systems to match new requirements. Keeping up with fast-paced e-commerce trends and customer demands poses a persistent challenge, compelling manufacturers to develop modular and more easily reconfigurable systems that can seamlessly align with market fluctuations.

Emerging Trends

Automated sortation systems are transforming the logistics and warehousing sectors. Companies are increasingly adopting advanced technologies to enhance their sorting processes, aiming to meet customer expectations for faster deliveries.

A significant trend is the integration of robotics into sortation centers. For instance, Amazon introduced ‘Pegasus’ robots in its Denver facility, where human workers place packages on these robots, which then navigate to the appropriate chute for dispatch. This system has streamlined operations and increased productivity.

Another notable development is the shift towards modular and flexible sortation solutions. Tompkins Robotics’ t-Sort system employs autonomous mobile robots to sort items to various destinations, offering scalability and adaptability to changing operational needs.

Furthermore, the integration of advanced software systems, such as Warehouse Execution Systems (WES), is becoming more prevalent. These systems coordinate various warehouse processes in real-time, optimizing the flow of goods and resources.

Business Benefits

Implementing automated sortation systems offers numerous advantages for businesses aiming to optimize their warehouse operations. One of the primary benefits is increased efficiency and throughput. Automated systems can process high volumes of items swiftly and accurately, significantly reducing the time required for sorting and dispatching goods.

Another advantage is the reduction in labor costs. By automating repetitive and labor-intensive tasks, businesses can reallocate their workforce to more strategic roles, enhancing productivity. This shift not only lowers operational expenses but also improves employee satisfaction by reducing monotonous work.

Automated sortation systems also enhance accuracy in order fulfillment. The precision of these systems minimizes errors in sorting, leading to fewer mis-shipments and returns. This accuracy is vital for maintaining customer satisfaction and trust, as it ensures that orders are fulfilled correctly and promptly.

Regional Analysis

In 2023, North America held a dominant market position in the automated sortation systems market, capturing more than a 38.0% share with revenues amounting to USD 2.09 billion. This leading position is primarily attributed to the robust presence of major e-commerce and retail giants, which require sophisticated logistics and distribution networks to handle vast volumes of shipments efficiently.

The region’s commitment to technological innovation also plays a crucial role in its market dominance. North America is home to many leading companies specializing in automation techy, including those implementing sortation systems. The demand for automation to enhance operational efficiency and reduce labor costs in these sectors has significantly driven the adoption of automated sortation systems in this region.

These companies continuously invest in research and development to enhance the functionalities of sortation systems, making them more adaptable, faster, and reliable. This focus on innovation attracts businesses seeking advanced solutions to streamline their operations and improve throughput.

North America’s advanced logistics and supply chain infrastructure support the integration of automated sortation systems into various industries such as pharmaceuticals, automotive, and food and beverage. The ability of these systems to improve sorting accuracy and processing time is critical for industries where timing and precision are vital. Also, the rise of smart cities and digital transformation across industries in the region encourage the deployment of automated solutions like sortation systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Automated Sortation Systems market, several key players are leading the charge, with Daifuku Co., Ltd. standing out as a prominent figure. Daifuku is renowned for its innovation and reliability in providing advanced automation solutions. Their sortation systems are particularly favored for their precision and ability to handle high-volume sorting operations.

Another significant player in this market is SSI SCHAEFER Group. Known for their comprehensive approach to warehouse and logistics solutions, the company offers a range of automated sortation systems that cater to various industry needs. Their systems are designed to optimize space and increase efficiency, which is crucial for businesses looking to scale operations without compromising on speed or accuracy.

Honeywell International Inc. also plays a crucial role in shaping the automated sortation systems market. Their expertise in integrating Internet of Things (IoT) technology with sortation systems allows businesses to achieve enhanced operational insights and improved decision-making processes.

Top Key Players in the Market

- Daifuku Co., Ltd.

- SSI SCHAEFER Group

- Honeywell International Inc.

- KION Group

- Murata Machinery, Ltd.

- Interroll Group

- BEUMER Group

- KNAPP AG

- Equinox MHE

- Bastian Solutions

- Other Key Players

Recent Developments

- In June 2024, Honeywell, based in North Carolina, completed a significant acquisition of CAES Systems Holdings LLC from Advent International. The deal, valued at approximately USD 1.9 billion in cash, reflects a strategic valuation of 14 times the estimated 2024 EBITDA, adjusted for taxes. This acquisition underscores Honeywell’s commitment to expanding its technological capabilities and market reach.

- Simultaneously, in New Jersey, OPEX® Corporation received notable recognition from the SupplyTech Breakthrough Awards. OPEX® was honored with the 2024 Sortation System Innovation of the Year Award for its innovative OPEX Sure Sort® X and OPEX XtractTM systems. This award highlights OPEX’s dedication to advancing sorting technology, which is pivotal in enhancing operational efficiencies in supply chain management.

Report Scope

Report Features Description Market Value (2023) USD 5.5 Bn Forecast Revenue (2033) USD 9.9 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Linear Sortation, Loop Sortation), By Industry Vertical (Retail and E-commerce, Transportation and Logistics, Pharmaceuticals, Food & Beverage, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Daifuku Co., Ltd., SSI SCHAEFER Group, Honeywell International Inc., KION Group, Murata Machinery, Ltd., Interroll Group, BEUMER Group, KNAPP AG, Equinox MHE, Bastian Solutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Sortation Systems MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Sortation Systems MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Daifuku Co., Ltd.

- SSI SCHAEFER Group

- Honeywell International Inc.

- KION Group

- Murata Machinery, Ltd.

- Interroll Group

- BEUMER Group

- KNAPP AG

- Equinox MHE

- Bastian Solutions

- Other Key Players