Global Autogenous Vaccine for Aquaculture Market Analysis By Fish Species (Salmon, Tilapia, Bream, Labris Bergylta, Cyprinus Carpio, Other Fish Species), By Pathogen Type (Bacteria, Virus), By End-User (Aquatic Research Institutes, Fish Farming Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 74465

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Autogenous Vaccine for Aquaculture Market size is expected to be worth around USD 906.3 Million by 2033, from USD 404.6 Million in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

The market for custom vaccines in fish farming is expanding rapidly. These special vaccines are designed to fight the specific diseases found in fish and shellfish farms, offering a more effective disease prevention method compared to general vaccines. They help reduce the use of antibiotics and promote better health for aquatic animals.

A key driver of this market growth is the increasing demand for seafood, expected to rise by 30% by 2030, according to the Food and Agriculture Organization (FAO). Stronger rules on antibiotic use and a greater focus on preventing disease are also pushing the market forward. This growth is especially good for the farming of salmon, shrimp, and tilapia.

Organizations like the World Organisation for Animal Health (OIE) and national bodies are crucial in ensuring these vaccines are safe and effective. They set strict guidelines that vaccine makers must follow. A 2022 report shows that these standards are working, with a 75% success rate in meeting safety and effectiveness goals. Experts agree that these regulations help keep both people and animals safe, boosting confidence in vaccine quality.

However, there are challenges. The industry must deal with tough regulations, but some companies specialize in making and distributing these vaccines worldwide. With around 62,800 tons of antibiotics used in fish farming annually, custom vaccines offer a promising solution to reduce antibiotic use.

Organizations and governments are working to promote the use of these vaccines in sustainable fish farming, especially in countries with lower incomes. This effort is supported by significant funding, with over $200 million invested in research and development each year. This investment is sparking new innovations and leading to partnerships and business deals in the vaccine market.

Key Takeaways

- Market Growth: The market is set to reach USD 906.3 million by 2033, with a CAGR of 8.4% from 2024 to 2033.

- Segment Dominance: Salmon leads with over 28% market share in 2023, followed by tilapia and bream.

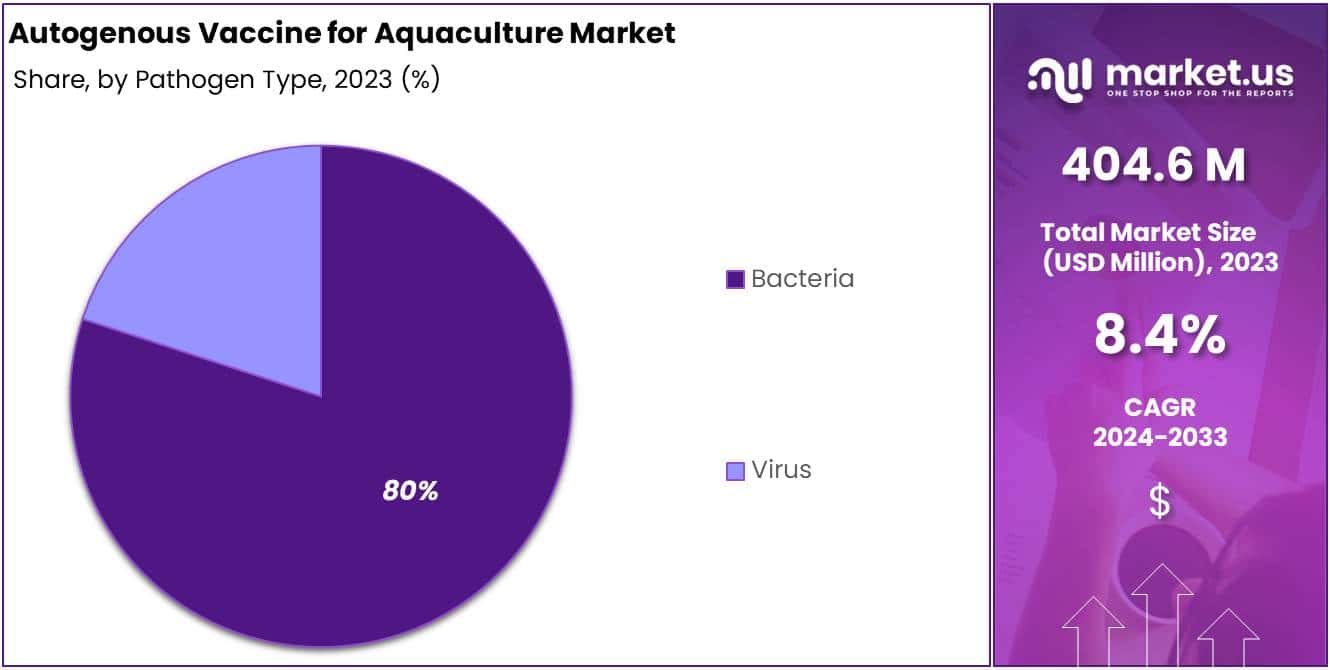

- Pathogen Focus: Bacterial infections hold over 80% market share, with viruses showing growth potential.

- Primary End-User: Fish farming companies account for 58% market share, prioritizing tailored vaccines for disease prevention.

- Driver: Concerns over disease outbreaks lead to increased autogenous vaccine adoption in fish farming.

- Challenge: Regulatory hurdles and approval processes hinder market growth, requiring long timelines and meeting varying regulations.

- Opportunity: Sustainable aquaculture practices drive market growth, aligning with environmental concerns and consumer preferences.

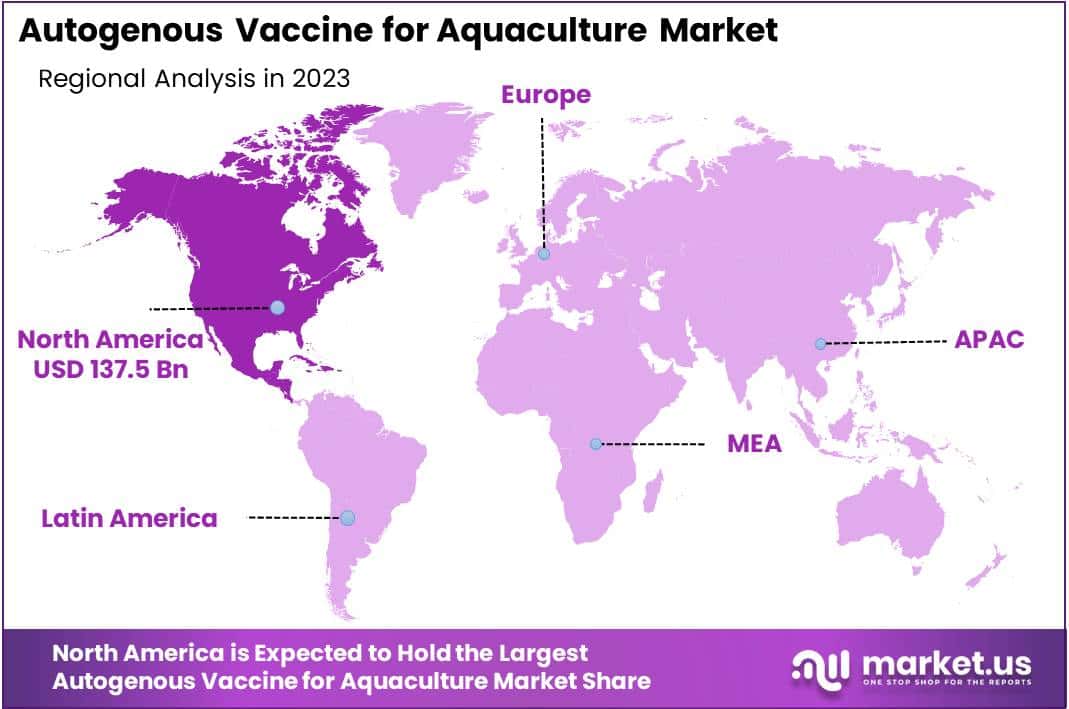

- Regional Leadership: North America dominates, holds 34% revenue share, with the United States and Canada leading due to strong aquaculture industries and advanced vaccine research.

Fish Species Analysis

In 2023, the Salmon segment was at the forefront of the Autogenous Vaccine market for Aquaculture, securing over 28% of the market. This leading position is due to the rising need to combat diseases in salmon farming and the recognition of autogenous vaccines’ effectiveness in disease prevention. Salmon’s high commercial value also drives the demand for these tailored vaccines to ensure healthy fish stocks and improve production.

The Tilapia and Bream segments followed closely, benefiting from the expansion of farming in warmer regions. Their versatility and increasing popularity as a protein source have led to a higher demand for vaccines customized for their specific health challenges.

The segments for Labris bergylta (Ballan wrasse) and Cyprinus carpio (Common carp) are smaller but growing. Ballan wrasse, used to control sea lice in salmon farms, and common carp, with a large farming industry in Asia and Europe, both require specific vaccines to manage diseases effectively.

The Other Fish Species segment covers a broad range of species with unique vaccine needs due to diverse pathogens. This segment’s growth is linked to the aquaculture industry’s expansion and the necessity for disease prevention tailored to various species and farming environments.

The autogenous vaccine market in aquaculture focuses on species-specific disease management. The shift towards sustainable and healthy farming practices is expected to boost the demand for these vaccines. This market’s growth highlights the essential role of customized vaccines in promoting fish health and increasing productivity.

Pathogen Type Analysis

In 2023, the bacteria part of the autogenous vaccine market for fish farming led the way, grabbing over 80% of the market. This big piece of the market is because bacterial infections are very common in fish farming. Bacteria like Vibrio, Aeromonas, and Streptococcus are often to blame for sickness, pushing the need for vaccines made just for these problems.

Autogenous vaccines are special because they are made to fight the exact germs found in a specific fish farm. This makes them very good at stopping diseases. The quick making and using of these vaccines have made them popular among fish farmers.

The virus part of the market is smaller but growing. As people become more aware of viral diseases in fish farming and better at finding these viruses, this area is expected to grow. New ways to make vaccines and find diseases quicker are helping this growth.

The whole market for autogenous vaccines in fish farming is getting bigger because of more investment in keeping fish healthy, better vaccine technology, and a push for farming fish in ways that are good for the environment. Moving towards preventing disease with vaccines, instead of treating them after they happen, fits with a global move to use fewer antibiotics in fish farming.

In short, the big lead of the bacteria part in the vaccine market for fish farming comes from the need to fight common bacterial diseases. But, the virus part is set to grow, helped by new technology and a focus on stopping viral diseases. Innovation in making vaccines and focusing on stopping diseases before they start will shape the future of this market.

End-User Analysis

In 2023, fish farming companies were the big players in the autogenous vaccine market for aquaculture, grabbing more than half of the market share at 58%. Why? Because they need to keep their fish healthy, and vaccines are a big part of that.

These companies face unique challenges with diseases in their fish farms. Autogenous vaccines are their go-to because they’re made specifically for the diseases found in their farms. This makes them more effective than one-size-fits-all vaccines.

Regular vaccines have some problems, like not always working against new strains of diseases. Autogenous vaccines solve this problem because they’re tailor-made for the specific diseases on a farm.

Fish farming companies are also investing more in research to make better vaccines and deal with new diseases. They’re teaming up with research institutes and biotech companies to improve vaccine technology.

As the demand for seafood grows, fish farming companies will keep leading the way in using autogenous vaccines to keep their fish healthy. This helps them stay ahead in the market and ensures a steady supply of fish for everyone.

Key Market Segments

Fish Species

- Salmon

- Tilapia

- Bream

- Labris Bergylta

- Cyprinus Carpio

- Other Fish Species

Pathogen Type

- Bacteria

- Virus

End-User

- Aquatic Research Institutes

- Fish Farming Companies

Drivers

Increased Concerns Over Disease Management

Concerns about diseases in fish farming are pushing more people to use autogenous vaccines. These vaccines are made to fight specific diseases that hurt fish. Disease outbreaks can cost fish farmers a lot of money.

The Food and Agriculture Organization says these outbreaks make farmers lose over $6 billion each year. Autogenous vaccines are like personalized medicine for fish. They protect them from getting sick. Because of this, fish farmers are starting to use autogenous vaccines more. This is helping the autogenous vaccine market grow.

Restraints

Regulatory Challenges and Approval Process

Regulatory hurdles and long approval processes are big challenges for the Autogenous Vaccine for Aquaculture Market. Making these vaccines is tough because they have to meet strict safety and quality rules.

According to the World Health Organization, it can take five to seven years to get approval for veterinary vaccines. This long wait means companies spend a lot of money, sometimes over $100 million, and delays getting their vaccines to market. It’s also tricky dealing with different rules in different places. This makes it hard for vaccine makers to sell their products quickly. So, it slows down how fast the autogenous vaccine market for aquaculture can grow.

Opportunities

Growing Adoption of Sustainable Aquaculture Practices

The Autogenous Vaccine for Aquaculture Market has a big chance to grow because more fish farms are trying to be eco-friendly. People want seafood that’s good for the environment. A report by the Food and Agriculture Organization (FAO) says fish farming is going up. In 2020, it was 114.5 million tonnes worldwide. This means more farms are looking for ways to be sustainable. Autogenous vaccines can help because they reduce the need for antibiotics and chemicals.

This is good for fish health and the environment. As fish farms focus more on being eco-friendly, they’ll likely want more autogenous vaccines. This is a big opportunity for companies in this market.

Trends

Rising Investment in Research and Development

In the world of aquaculture vaccines, there’s a big trend: more and more money is being put into research and development (R&D). This means companies and research groups are spending a lot of time and resources trying to come up with better vaccines. They want these vaccines to protect fish from a wider range of diseases.

According to the World Aquaculture Society, the amount of money invested in aquaculture R&D has been going up by more than 20% each year since 2018. By 2023, it’s estimated that this investment reached about $5.4 billion. This trend shows that people in the industry are really serious about making aquaculture better. They want to find new ways to keep fish healthy and safe from diseases, which is super important for the future of aquaculture.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 34% share and holds USD 137.5 Million market value for the year. This was because of its strong aquaculture industry, strict rules about keeping aquaculture healthy, and the rise in using advanced vaccines by aquaculture farmers.

The United States and Canada played a big role in North America’s success in this market. They have big aquaculture farms and their governments support sustainable aquaculture and animal health. Also, many big companies in North America keep working on new vaccines to fight aquaculture diseases. This helps keep North America ahead in the autogenous vaccine market.

In the future, North America will likely stay at the top in the Autogenous Vaccine for Aquaculture market. This is because of ongoing improvements in vaccine technology, more awareness about the benefits of autogenous vaccines, and increased investments in sustainable aquaculture. But we need to watch out for new trends and rules that could change things in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Autogenous Vaccine for Aquaculture Market key players play a vital role in driving innovation, expanding market reach, and advancing the development of autogenous vaccines tailored to the specific needs of the aquaculture industry. Their collaborative efforts contribute to the overall growth and sustainability of aquaculture production, ensuring the health and well-being of aquatic species worldwide.

IDT Biologika GmbH is recognized as a major player in the production of custom vaccines for fish farms. Their expertise lies in crafting vaccines tailored to the specific needs of aquaculture. They prioritize research and ensure their vaccines are safe and effective, earning trust from fish farmers globally.

MARINNOVAC Limited is acknowledged for its innovative approach to developing vaccines for fish. They specialize in creating vaccines that target specific fish diseases, constantly striving to improve their products through collaboration and research. Ceva Biovac is a notable company in the fish vaccine market, renowned for its tailored vaccine solutions. Their vaccines are designed to address specific diseases that affect fish, contributing to their global reputation for quality and effectiveness.

Zoetis Inc. stands out as a leading provider of animal health solutions, including vaccines for fish. They are committed to innovation and continually develop new vaccines to support the health and growth of fish farming. Alongside these major players, there are other important contributors in the fish vaccine market, each playing a unique role in ensuring the health and sustainability of aquaculture.

In addition to the aforementioned market leaders, several other key players contribute to the autogenous vaccine market for aquaculture. These players encompass a diverse range of companies, including biotechnology firms, pharmaceutical companies, and research institutions, each bringing unique capabilities and expertise to the sector.

Market Key Players

- IDT Biologika GmbH

- MARINNOVAC Limited

- Ceva Biovac

- Zoetis Inc.

- Barramundi Group

- HIPRA

- AniCon Labor GmbH

- Kennebec River Biosciences

- sanphar

Recent Developments

- In November 2023, HIPRA introduced a new line of DIVAVAC autogenous vaccines tailored specifically for shrimp aquaculture. These vaccines boast enhanced biosecurity measures and increased effectiveness against a range of bacterial and viral pathogens.

- In October 2023, Ceva Animal Health formed a strategic alliance with BlueNalu, delving into the burgeoning field of cell-based seafood. Together, they aim to pioneer autogenous vaccines for cultured yellowtail tuna, marking Ceva’s foray into this innovative market segment.

- In July 2023, AniCon Labor GmbH partnered with the University of Stirling to devise a groundbreaking diagnostic tool. This tool facilitates the swift identification of fish pathogens, streamlining the development process for targeted autogenous vaccines.

- In April 2023, Zoetis Inc. bolstered its AquaHealth division by acquiring FishVet Group, a prominent aquaculture diagnostics company. This acquisition enhances Zoetis’ capacity to diagnose and manage diseases in fish farms, opening up new avenues for autogenous vaccine advancement.

Report Scope

Report Features Description Market Value (2023) USD 404.6 Bn Forecast Revenue (2033) USD 906.3 Bn CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Fish Species (Salmon, Tilapia, Bream, Labris Bergylta, Cyprinus Carpio, Other Fish Species), By Pathogen Type (Bacteria, Virus), By End-User (Aquatic Research Institutes, Fish Farming Companies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IDT Biologika GmbH, MARINNOVAC Limited, Ceva Biovac, Zoetis Inc., Barramundi Group, HIPRA, AniCon Labor GmbH, Kennebec River Biosciences, sanphar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Autogenous Vaccine for Aquaculture market in 2023?The Autogenous Vaccine for Aquaculture market size is USD 404.6 million in 2023.

What is the projected CAGR at which the Autogenous Vaccine for Aquaculture market is expected to grow at?The Autogenous Vaccine for Aquaculture market is expected to grow at a CAGR of 8.4% (2024-2033).

List the segments encompassed in this report on the Autogenous Vaccine for Aquaculture market?Market.US has segmented the Autogenous Vaccine for Aquaculture market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Fish Species the market has been segmented into Salmon, Tilapia, Bream, Labris Bergylta, Cyprinus Carpio, Other Fish Species. By Pathogen Type the market has been segmented into Bacteria, Virus. By End-User the market has been segmented into Aquatic Research Institutes, Fish Farming Companies.

List the key industry players of the Autogenous Vaccine for Aquaculture market?IDT Biologika GmbH, MARINNOVAC Limited, Ceva Biovac, Zoetis Inc., Barramundi Group, HIPRA, AniCon Labor GmbH, Kennebec River Biosciences, sanphar

Which region is more appealing for vendors employed in the Autogenous Vaccine for Aquaculture market?North America is expected to account for the highest revenue share of 34% and boasting an impressive market value of USD 137.5 million. Therefore, the Autogenous Vaccine for Aquaculture industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Autogenous Vaccine for Aquaculture?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Autogenous Vaccine for Aquaculture Market.

Autogenous Vaccine for Aquaculture MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Autogenous Vaccine for Aquaculture MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IDT Biologika GmbH

- MARINNOVAC Limited

- Ceva Biovac

- Zoetis Inc.

- Barramundi Group

- HIPRA

- AniCon Labor GmbH

- Kennebec River Biosciences

- sanphar