Atopic Dermatitis Drugs Market Analysis By Drug Class (Biologics, PDE-4 Inhibitor, Corticosteroids, Calcineurin Inhibitors, and Other Drug Classes), By Route of Administration (Injectable, Topical, Oral), By End-User (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 65478

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

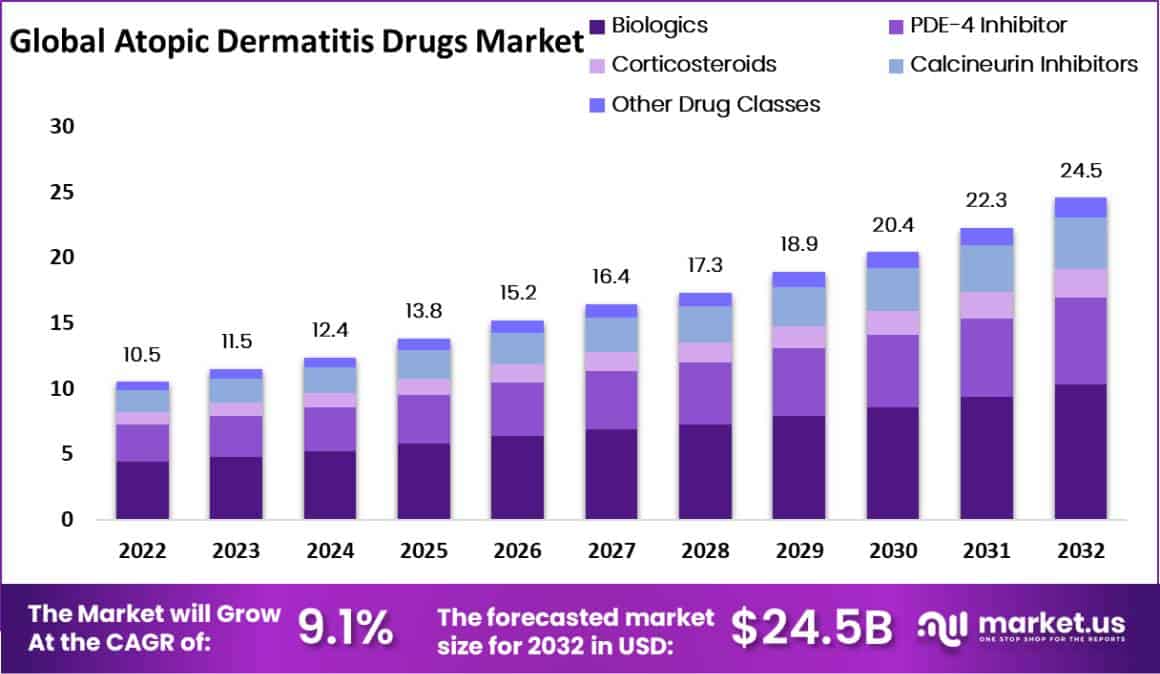

The Global Atopic Dermatitis Drugs Market size is expected to be worth around US$ 24.5 Billion by 2033, from US$ 10.5 Billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

Atopic dermatitis is a type of eczema. It is a condition in which skin becomes red, dry, bumpy, and itchy. Atopic dermatitis consists of allergic asthma, hay fever, food allergies, and anaphylaxis.

The increasing significance of atopic dermatitis, the emergence of biologics, untapped opportunities, and a strong pipeline are estimated to boost the growth of the market during the forecast period 2023-2032. The significance of atopic dermatitis is increasing steadily. According to the report in 2020, the significance of atopic dermatitis identified by the doctor in patients which were ranged between 10.2% in Asian and 17.1% in Europe adults moreover 22.6% and 0.96% in children.

The factors such as favorable reimbursement policies in developing countries, various initiatives taken by the government, increasing awareness about the availability of treatments for the disease, rapid technological advancement, and increase in funding with the government support for R&D were also projected to boost the growth of the market during the forecast period 2023-2032.

Key Takeaways

- The Atopic Dermatitis Drugs Market is projected to experience exponential growth between 2022-2032 with compound annual growth at 9.1%.

- Atopic Dermatitis (AD), or another form of Eczema, affects 10.2% to 17.1% of adult population worldwide while between 0.96% to 22.6% affect children globally.

- Biologics dominate with a 42% market share in 2022, attributed to government initiatives, a robust pipeline, and high efficacy in severe cases.

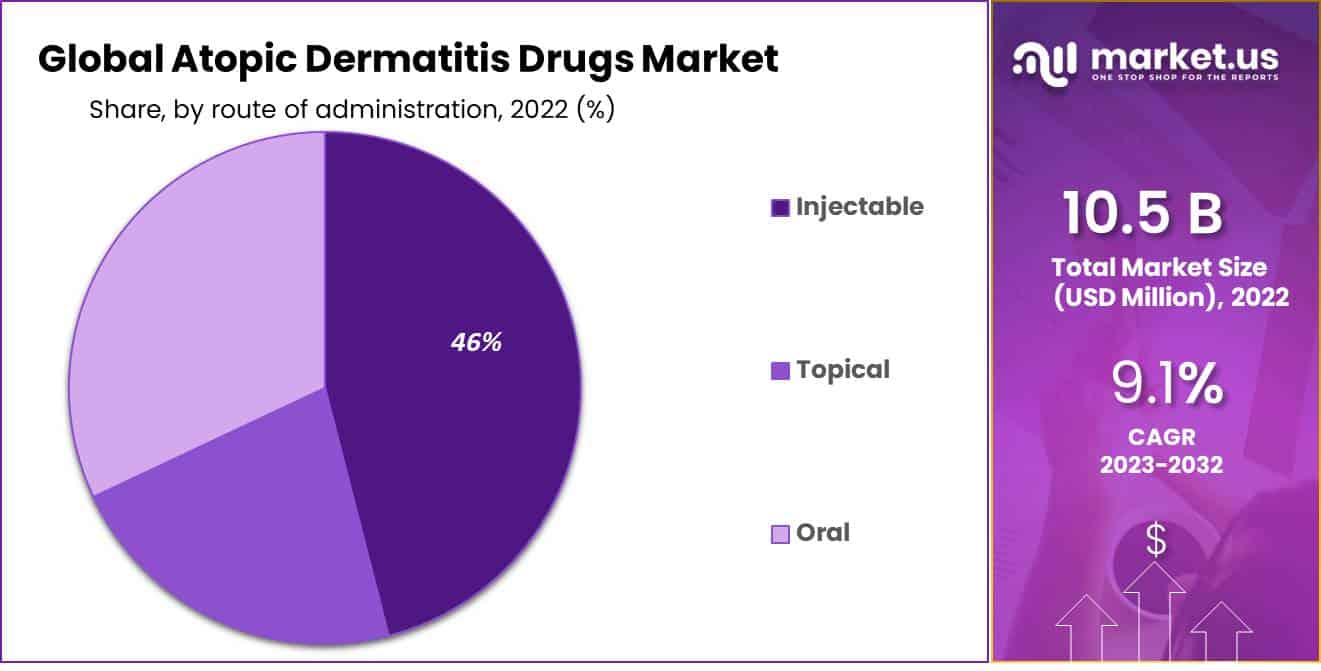

- Injectable drugs hold a 46% market share due to increased use, notably in pediatric patients.

- Hospital pharmacies lead distribution with various factors such as drug approvals and government support driving growth.

- Market drivers include the growing global significance of atopic dermatitis and the increasing demand for biologics in dermatology.

- Prolonged use of potent topical steroids can lead to side effects, acting as a potential market restraint.

- Opportunities arise from the development of novel pipeline drugs and favorable reimbursement policies, particularly in developing countries.

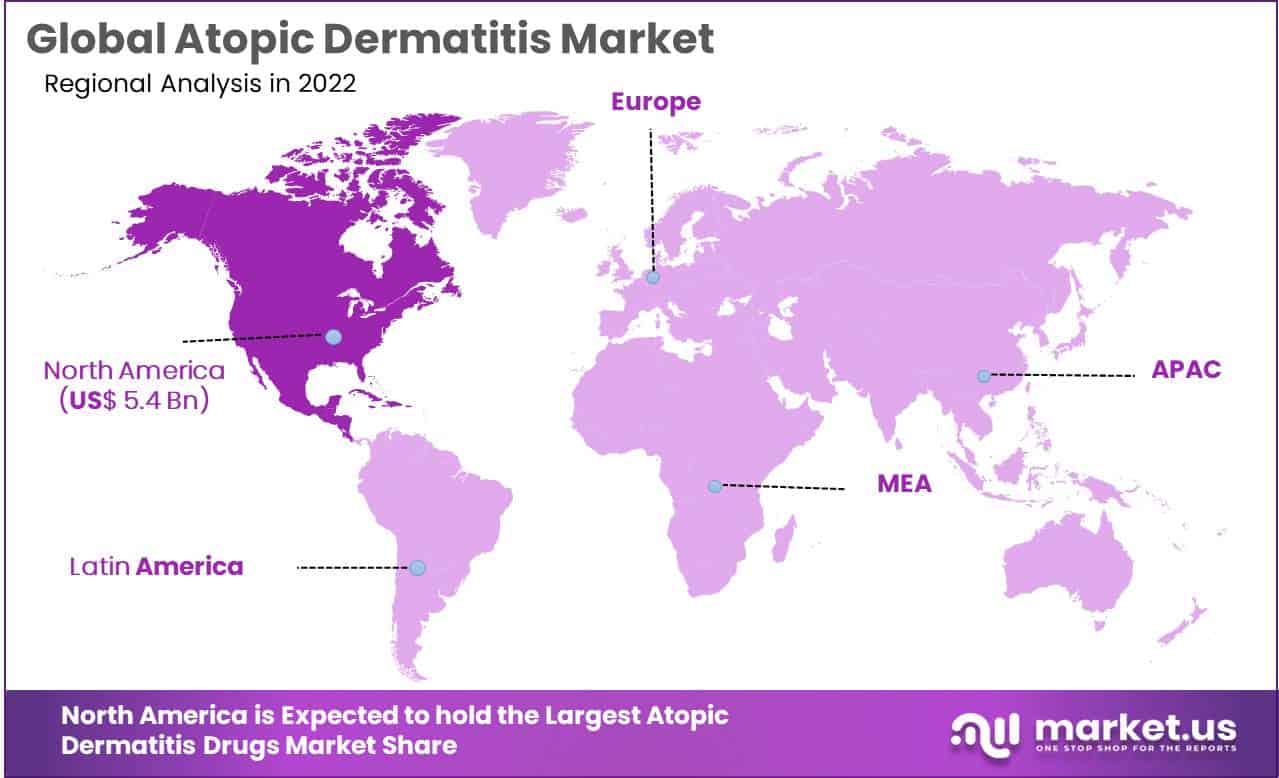

- North America dominates the market with a 52% revenue share, driven by favorable reimbursement policies and the impact of the COVID-19 pandemic on hand atopic dermatitis cases.

Drug Class Analysis

The biologics segment accounted for the largest revenue share of 42% in 2022. Over conventional topical treatments, biologics have huge clinical advantages. Biologics are mainly prescribed for severe cases when the patient is irresponsive to prior systemic therapies, mostly for second or third-line treatment.

The dominance of the segment is owing to the increase in various government initiatives, the availability of a robust pipeline of biologic drugs, new product launches, the availability of treatments for the disease, and the increasing demand for biologics due to high efficacy. For instance, a monoclonal antibody name nemolizumab is presently in the pipeline of Galderma Laboratories, L.P., and it is being investigated for its use in atopic dermatitis.

Route of Administration Analysis

The injectable segment dominates the market with the highest revenue share of 46% and will likely maintain its dominance over the forecast period. This is because of the increased use of injectable products like Dupilumab.

There will be a shift in the use of therapeutics for atopic dermatitis in the near future as the use of biologics is increasing gradually. There are only a few treatment options available for pediatric patients with atopic dermatitis. So, biologics are being investigated for the treatment of pediatric patients suffering from AD.

Distribution Channel Analysis

The hospital pharmacies segment dominated the market and is estimated to continue during the forecast period. The factors such as approval of drugs, the high significance of atopic dermatitis, increasing income levels of middle-class & poor families, and increase in prices of drugs.

Furthermore, an increasing number of initiatives from different government bodies in developing the infrastructures of hospitals as well as pharmacies are estimated to increase the growth of the segment.

Key Market Segments

Based on Drug Class

- Biologics

- PDE-4 Inhibitor

- Corticosteroids

- Calcineurin Inhibitors

- Other Drug Classes

Based on the Route of Administration

- Injectable

- Topical

- Oral

Based on Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Drivers

Increasing Significance of Atopic Dermatitis

The rising significance of atopic dermatitis medication globally is estimated to be the major factor boosting the growth of the market for atopic dermatitis medications. Several individuals are suffering from atopic dermatitis, which will results to propel the growth of the market over the forecast period. Climatic circumstances, geographical location, age, lifestyle, gender, socioeconomic level, individual behaviors, and inheritance all these factors impact the significance of dermatological problems globally.

Increasing Demand for Biologics

Due to the increase in the use of biologic drugs in dermatology, the treatment of dermatological disorders, mainly atopic dermatitis, has changed. By improving the overall quality of life biologics, a positive response to atopic dermatitis have verified. Thus, the demand for treatments for atopic dermatitis was increasing, and the pattern is likely to continue over the forecast period. Till now, only one biologics product was permitted to use for the treatment of AD; most of the other drugs were under phase II clinical studies and will likely be approved soon.

Restraints

Side-Effects of Topical Steroids

If the topical steroid treatments last for less than four weeks, then they will be trouble-free and risk-free. Frequent repetition of short doses of harsh steroids or long-term topical steroid use may cause side effects on the body. Mild topical steroids have fewer side effects. The major problem is the prolonged usage of potent steroids. The topical steroids have systemic as well as local side effects. Local side effects refer to a particular area of the skin, while systemic side effects refer to an issue that affects the entire individual body.

Opportunities

Rapid Development of Novel Pipeline Drugs

Rapid Development of Novel Pipeline Drugs, the High Significance of Atopic Dermatitis, and Other Factors Create Numerous Opportunities for the Market.

The atopic dermatitis market is estimated to experience significant growth during the forecast period. This is due to the rising number of AD industry, enhancement in demand for product approvals and new biologics, and rapid development of novel pipeline drugs. Moreover, different initiatives undertaken by governments with the aim of providing affordable and better treatment are estimated to accelerate the growth of the market.

Likewise, the high significance of atopic dermatitis and the favorable reimbursement policies in developing countries likely propel the market’s growth. Additionally, the increase in funding, along with the rise in government support and various technological advancements, is estimated to create different opportunities for the global atopic dermatitis drugs market during the forecast period 2023-2032.

Trends

Biologics is the New Class Treatment in the Market

The new class of treatment in the market is biologics. The crucial factor that contributes to the growth of the biologics segment is its targeted approach. The increasing rate of recurrence of disease was driving various companies to invest in the expansion of novel biologics with high effectiveness.

Biologics are not considered as first-line treatment, but it has safety, high efficacy, and a targeted approach to treating the disease. That’s why dermatologists believe that it should be considered the first choice for individuals who are suffering from atopic dermatitis.

Regional Analysis

North America Dominates the Global Atopic Dermatitis Drugs Market During the Forecast Period

North America dominated the market with the highest revenue share of 52%. The key factors that are responsible for the dominance of the region are the favorable reimbursement policies and the presence of well-established R&D infrastructures. Additionally, in this sector, the reimbursement and regulatory landscape is constantly developing to adapt to the fast research progress.

The COVID-19 pandemic is estimated to positively impact the growth of the market. The pandemic resulted in an increase in the frequency of hand-washing for the sanitation and safety measures of the population to prevent the infection of the virus. But, frequent exposure to water and soap has raised the cases of dry skin, which further results in the rise in cases of hand atopic dermatitis.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

During the forecast period, the competitive landscape in the market is estimated to stay high due to new product launches. To commercialize and develop new products, collaborations and partnerships are being formed between players.

The competition is increasing in the market due to the lucrative nature of the market. Because of this nature, it is attracting new players with innovative products in the market. For instance, for atopic dermatitis adult and adolescent patients, AbbVie declared the extension of sDNA for the review of RINVOQ in April 2021.

Market Key Players

- Sanofi SA

- Pfizer Inc.

- AbbVie Inc.

- Eli Lilly and Company

- LEO Pharma Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- Regeneron Pharmaceuticals Inc.

- Other Key Players

Recent Developments

- In September 2024: Eli Lilly announced the FDA approval of EBGLYSS (lebrikizumab-lbkz) for treating moderate-to-severe atopic dermatitis in adults and children aged 12 and older. This approval reflects the drug’s effectiveness, evidenced in Phase 3 studies where EBGLYSS helped patients achieve significant skin clearance and relief from itching symptoms. Following this regulatory nod, EBGLYSS will soon be available in the U.S. market.

- In June 2023: Sanofi reported positive Phase 2b trial results for amlitelimab, an investigational anti-OX40-ligand monoclonal antibody. The study showed statistically significant improvements in the Eczema Area and Severity Index (EASI) scores for patients with moderate-to-severe atopic dermatitis, compared to placebo. Results indicated a 61.5% reduction in EASI scores at week 16, which further improved to 64.4% at week 24 for the highest dose of amlitelimab. These findings support the potential of amlitelimab as a first and best-in-class treatment option for atopic dermatitis.

- In February 2023: Pfizer received U.S. FDA approval for the supplemental New Drug Application (sNDA) of Cibinqo (abrocitinib) to include treatment for adolescents aged 12 to 18 years with refractory, moderate-to-severe atopic dermatitis. This expansion is supported by results from the JADE TEEN clinical trial, which showed significant improvement in skin clearance and itch reduction compared to placebo.

Report Scope

Report Features Description Market Value (2022) US$ 10.5 Billion Forecast Revenue (2032) US$ 24.5 Billion CAGR (2023-2032) 9.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class- Biologics, PDE-4 Inhibitor, Corticosteroids, Calcineurin Inhibitors, and Other Drug Classes; By Application- Monitoring, Treatment, Research, Healthcare, and Other Applications; and y Distribution Channel- Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Sanofi SA, Pfizer Inc., AbbVie Inc., Eli Lilly and Company, LEO Pharma Inc., Novartis AG, Otsuka Pharmaceutical Co., Ltd., Regeneron Pharmaceuticals Inc., and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Atopic Dermatitis Drugs MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Atopic Dermatitis Drugs MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sanofi SA

- Pfizer Inc.

- AbbVie Inc.

- Eli Lilly and Company

- LEO Pharma Inc.

- Novartis AG